VANCOUVER, BC / ACCESSWIRE / December 13, 2023 / Metallic Minerals Corp. (TSXV:MMG)(OTCQB:MMNGF) (“Metallic Minerals” or the “Company”) is pleased to announce the completion of 2023 field activities at the Company’s La Plata copper-silver-gold-PGE project in southwestern Colorado, USA. The 2023 exploration program included 4,530 meters in four diamond drill holes focused on expanding the current mineral resource and testing extensions of strong porphyry-style mineralization encountered in 2022 drill hole LAP22-04. LAP22-04 intercepted 816 meters of continuous mineralization grading 0.41% copper equivalent with significant intervals of higher-grade mineralization. Assays are pending with results expected in early 2024, which will provide the basis for an update to the current mineral resource estimate of 1.2 billion pounds copper and 17.6 million ounces of silver1 as announced in July 2023. Additional field activities included detailed geologic mapping, surface rock and soil sampling, airborne and drill core hyperspectral surveys.

The 2023 field campaign was funded by a strategic equity investment announced in May 2023 whereby Newmont Mining (previously Newcrest Mining Limited) acquired a 9.5% ownership position in Metallic Minerals with the goal of accelerating advancement of the La Plata project.

Highlights

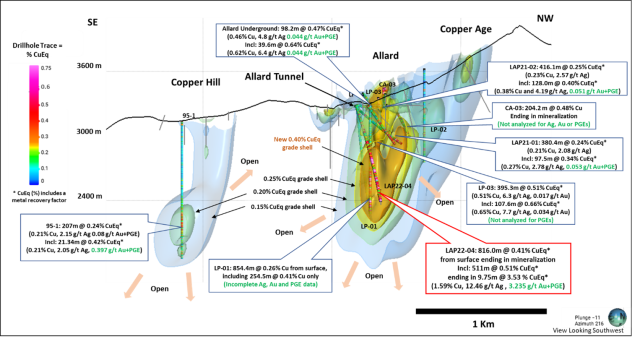

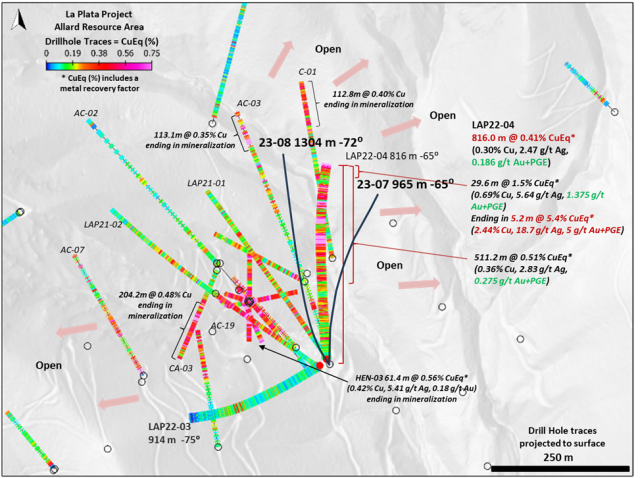

- Drilling totalled 4,530 meters in four resource expansion drill holes ranging from 965 meters in depth to 1,350 meters in hole LAP23-06, which is the deepest hole to date in the project.

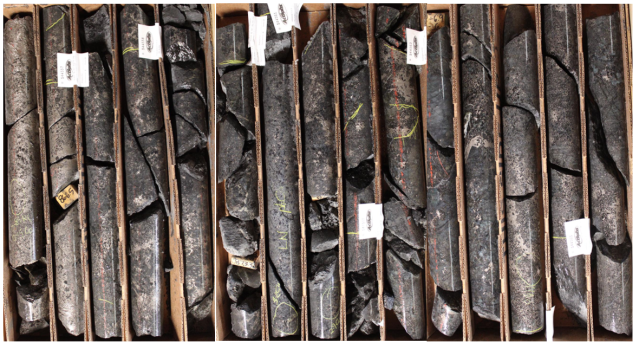

- All four drill holes intersected porphyry style mineralization over their entire lengths with varying levels of visible copper sulphides and vein density (see Figures below).

- Drilling in 2023 has extended mineralization to more than 1.5 kilometers vertically starting at surface and is anticipated to allow for inclusion of both gold and platinum group elements in future mineral resource estimates along with copper and silver.

- An advanced airborne hyperspectral survey covering 157 square kilometers (453-line km) was completed by SpecTIR in the visible (“VNIR”) to shortwave infrared (“SWIR”) and longwave infrared (“LWIR”) spectra (949 total bands) allowing for detailed mineral and alteration mapping across the entire district.

- Scanning of 3,848 meters of drill core was completed by GeologicAI providing hi-resolution RGB digital photography, laser profilometry using LIDAR, VNIR and SWIR hyperspectral imagery and x-ray fluorescence, allowing for detailed characterization of mineralization and alteration within the Allard deposit.

- Expansion of project surface sampling included 667 additional soil samples and 275 rock samples in conjunction with detailed geologic surface mapping both inside and outside of the Allard resource area. This work has identified a number of new high priority target areas for follow up exploration and has expanded the known surface footprint of the Allard mineral system.

Scott Petsel, Metallic Minerals’ President, stated, “We are excited to have completed our largest drill and field program to date at La Plata with the collaboration of our strategic investor, Colorado based Newmont Corporation (NYSE:NEM), which recently acquired Newcrest Mining. This year’s drilling was designed to expand the existing resource at the Allard deposit and to develop vectors towards the strongest mineralized parts in the system. Full results are pending, and the Company anticipates final assays to be reported in early 2024.

The Allard deposit remains open to significant expansion to the east, north and west and at depth. With the drilling this year, we anticipate adding gold, platinum and palladium to the current copper and silver resource. In addition, our work this season on the broader project has identified several new high-priority targets outside of the Allard resource area, highlighting the potential for new discoveries of both additional copper porphyry centers, as well as high-grade epithermal silver and gold systems.

With the projected strong and growing need for new copper production in the US and global markets over the coming decades, projects like La Plata that are located in stable geopolitical locations that can be developed responsibly to first-world standards, are going to be in very high-demand. It is still early days at La Plata, but we already see the potential for a leading, long-life opportunity in the production of copper, silver, gold and other critical minerals in the USA. We look forward to providing further updates on La Plata and our high-grade Keno Silver project in the Yukon and to displaying drill core at both the AMEBC Roundup and PDAC core shacks in Q1 2024.”

Upcoming Events

Vancouver Resource Investment Conference (VRIC)

Metallic Minerals and fellow Metallic Group members, Granite Creek Copper and Stillwater Critical Minerals, in Booth #112 at the 2024 VRIC event, January 21 and 22, 2024. For more information click here.

AMEBC Mineral Roundup Core Shack

Metallic Minerals will be displaying core from the 2023 drill season at the upcoming AMEBC Mineral Roundup event held in Vancouver, BC January 22 to 25, 2024. For more information click here.

Prospectors and Developers Association of Canada Annual Convention (PDAC)

Metallic Minerals will be displaying core from the 2023 drill season at the PDAC convention held in Toronto, March 3 to 6, 2024. For more information click here.

Figure 1 – Cross section through Allard Resource Area with new drill holes 23-05 and 23-06 (see Figure 2 for plan map)

Figure 2 – Plan map showing new drill holes 23-07 and 23-08.

Figure 3 – Core photos of Hole LAP23-05 from 425 m to 433 m showing an example of strong porphyry style mineralization including multi-phase veining and strongly disseminated copper sulphides.

Figure 4 – Core photo detail of from red outline above in Figure 3 showing the intensity of copper sulphides including chalcopyrite and bornite.

About Metallic Minerals

Metallic Minerals Corp. is focused on copper, silver, gold, and other critical minerals in the La Plata mining district in Colorado, and silver and gold in the high-grade Keno Hill and Klondike districts of the Yukon. Our objective is to create shareholder value through a systematic, entrepreneurial approach to making exploration discoveries, growing resources, and advancing projects toward development.

At the Company’s La Plata project in southwestern Colorado, the new 2023 NI 43-101 mineral resource estimate identifies a significant porphyry copper-silver resource containing 1.21 Blbs copper and 17.6 Moz of silver1. The 2022 expansion drilling provided the basis for the updated resource, including the longest and highest-grade interval ever encountered at La Plata and one of the top intersections for any North American copper project in the past several years. In May 2023, the Company announced a 9.5% strategic investment by Newcrest Mining Limited (acquired by Newmont Mining in 2023) to accelerate the advancement of the Company’s La Plata project. The 2023 Fraser Institute’s Annual Survey of Mining Companies, ranked Colorado 5th globally for investment attractiveness and 2nd in the USA.

In Canada’s Yukon Territory, Metallic Minerals has consolidated the second-largest land position in the historic high-grade Keno Hill silver district, directly adjacent to Hecla Mining Company’s (“Hecla”) operations, with more than 300 Moz of high-grade silver in past production and current M&I resources. Hecla, the largest primary silver producer in the USA and third largest in the world, is anticipating full production at its Keno Hill operations by the end of 2023. An inaugural mineral resource estimate on the project is expected in early 2024, with an 1,111-meter expansion drill program completed at the Formo target during fall of 2023.

The Company is also one of the largest holders of alluvial gold claims in the Yukon and is building a production royalty business by partnering with experienced mining operators, including Parker Schnabel of Little Flake Mining from the Discovery Channel television show, Gold Rush.

All of the districts in which Metallic Minerals operates have seen significant mineral production and have existing infrastructure, including power and road access. The Company is led by a team with a track record of discovery and exploration success on several major precious and base metal deposits in the region, as well as having large-scale development, permitting and project financing expertise. The Metallic Minerals team has been recognized for its environmental stewardship practices and is committed to responsible and sustainable resource development.

FOR FURTHER INFORMATION, PLEASE CONTACT:

| Website: www.mmgsilver.com Email: cackerman@mmgsilver.com | Phone: 604-629-7800 Toll Free: 1-888-570-4420 |

1) See news release dated July 31, 2023. The Mineral Resource has been estimated in conformity with CIM Estimation of Mineral Resource and Mineral Reserve Best Practices Guidelines (2019) and current CIM Definition Standards. The constrained Mineral Resources are reported at a base case cut-off grade of 0.25% copper equivalent, based on metal prices of $3.75/lb Cu and $22.50/oz Ag, assumed metal recoveries of 90% for Cu and 65% for Ag, a mining cost of US$5.30/t rock and processing and G&A cost of US$11.50/t mineralized material. The current Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability. The quantity and grade of reported Inferred Resources in this Mineral Resource Estimate are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as Indicated or Measured. However, based on the current knowledge of the deposits, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

Forward-Looking Statements

This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, statements about expected results of operations, royalties, cash flows, financial position and future dividends as well as financial position, prospects, and future plans and objectives of the Company are forward-looking statements that involve various risks and uncertainties. Although Metallic Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, unsuccessful operations, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration, development of mines and mining operations is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Metallic Minerals and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Metallic Minerals Corp.

View the original press release on accesswire.com