Vancouver, British Columbia–(Newsfile Corp. – April 25, 2023) – Goldshore Resources Inc. (TSXV: GSHR) (OTCQB: GSHRF) (FSE: 8X00) (“Goldshore” or the “Company“), is pleased to announce assay results from its 100,000-meter drill program at the Moss Gold Project in Northwest Ontario, Canada (the “Moss Gold Project” or “Moss Gold Deposit“).

Highlights:

- Results from nine holes drilled to infill poorly tested parts of the Southwest Zone have delineated multiple high-grade structures within the broader mineralized envelope with best intercepts of:

- Drill results prove that the Southwest Zone is a continuation of the Main Zone and not a fault offset as previously interpreted. Mapping and geophysical data, together with historical scout drilling, show that mineralization continues intermittently for another 3 kilometers to the southwest and that many of the better targets are yet to be drilled.

- With drilling recently completed, the Company is preparing an updated mineral resource expected in May (“May 2023 MRE“). The May 2023 MRE will use data from an additional 72 holes compared to the November 2022 mineral resource estimate (“November 2022 MRE“). Mineralization in the resource area remains open in multiple directions.

President and CEO Brett Richards stated: “These results continue to support our thesis that the size and scale of the Moss Gold Project will be large enough to support a material and meaningful update to the mineral resource estimate, which is expected in early May 2023.

“These additional results highlighting the mineralization in the south-west zone augment the press release of April 20, 2023, and continue to expand the zone well outside the historical resource, still open in several directions and at depth. In addition to the May 2023 MRE, we still have 30 quality drill targets to be tested. These include gold, coppercobalt, and polymetallic prospects. We have drilled less than 10% of the identified targets on our land package and are currently building a plan to drill test the better targets. It will be an exciting period when we are ready to evaluate the additional resource potential of the larger inventory of targets within our land package.

“We have focused on the currently defined portion of the Moss Gold Deposit as a meaningful Phase One Project that Goldshore itself can build. The Moss Gold Deposit remains open at depth and through several yet-to-be drilled parallel structures; and it is part of an overall 8-kilometer strike length of gold mineralization in drill holes. This strongly suggests that the Phase One Project is part of a much larger total project.”

Technical Overview

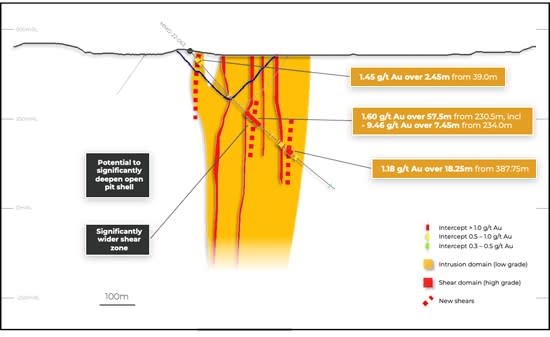

Figure 1 shows the location of the drill holes in this press release and Figure 2 shows a close up of the drilled area with significant intercepts. Figure 3 is a typical section through hole MMD-23-116, -118A. Table 1 shows the significant intercepts. Table 2 shows the drill hole locations.

Figure 1: Location of drill holes in this release relative to the November 2022 MRE and $1,500 open pit shell constraint.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8051/163605_14b848a0f4042ad4_002full.jpg

Figure 2: Close up of Southwest Zone with significant intercepts relative to the November 2022 MRE and $1,500 open pit shell constraint.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8051/163605_14b848a0f4042ad4_003full.jpg

Figure 3: Drill section through holes MMD-23-116 and -118A showing the significant expansion of the mineralized model beneath the November 2022 MRE and $1,500 open pit shell constraint, which should add to mineral resources in the May 2023 MRE.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8051/163605_14b848a0f4042ad4_004full.jpg

The Southwest Zone was previously considered to be a small fault-offset extension of the Main Zone. As a result, it was poorly drilled, which led to the definition of only a small open pit-constrained Mineral Resource (Figure 1 and 2).

Oriented core measurements from earlier drilling showed a significant change in strike of the Southwest Zone, revealing it to be 035º rather than the assumed 065º strike based on the known orientation of the Main and QES Zones. The nine holes reported herein were drilled perpendicular to the new strike to infill a poorly drilled volume in the center of the Southwest Zone at a closer spacing (30 meters) along each section to confirm the continuity of high-grade shears. This should enable greater confidence in the resource and an expansion of the open pit constraints at depth.

Holes MMD-22-111, MMD-23-116, -118A, and -119 intersected several high-grade shears (e.g., 0.65m @ 36.8 g/t Au in MMD-23-116) hosting quartz-carbonate veinlets with up to 3-5% pyritechalcopyrite within a strongly albite-hematite and silica-sericite-pyrite and carbonate altered diorite intrusion complex (Figure 4). The shears anastomose along the same orientation of the zone and trend beyond the area explored by historical drilling.

Holes MMD-22-107, -110, MMD-23-115, -117, -120 intersected wide intervals of low-grade mineralization within the altered intrusion containing localized narrow higher-grade shears. The results are similar to those encountered in the historic drilling and include:

- 0.58 g/t Au over 37.7m from 11.3m depth in MMD-22-107

- 0.41 g/t Au over 50.95m from 7.0m depth in MMD-22-110

- 0.38 g/t Au over 55.1m from 231.9m depth in MMD-23-116

- 0.43 g/t Au over 122.3 from 24.7m depth in MMD-23-117

- 0.58 g/t Au over 81.8 from 369.2m depth in MMD-23-118A

- 0.51 g/t Au over 122.8m from 116.0m depth in MMD-23-119 and

- 0.61 g/t Au over 33.2m from 447.85m depth

Hole MMD-22-107, -110, and -111 represent the most western holes drilled to date in the Southwest Zone, including historical drilling. They illustrate the continued potential to expand the Moss Gold Deposit beyond the original footprint with the newly understood orientation of the shear structures trending southwest of the historical exploration drilling. Gold has been intersected in scout drill holes over a further three kilometers along strike. Our airborne VTEM/magnetics data show that more favourable targets exist along this corridor in areas that have yet to be drilled.

Figure 4: Drill core from 416.4 – 417.05m (0.65 m @ 36.8 g/t Au) in MMD-23-116 highlighting a pyrite + chalcopyrite mineralized quartz-carbonate vein within the sheared, altered intrusion.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8051/163605_14b848a0f4042ad4_005full.jpg

Pete Flindell, VP Exploration for Goldshore, said, “These results show that the Southwest Zone is much better mineralized than historical drillholes suggested. They also show that the Moss Gold Deposit is yet to be closed off, confirming our belief that this is a much bigger mineralized system than is appreciated.”

Table 1: Significant downhole gold intercepts

| HOLE ID | FROM | TO | LENGTH (m) | TRUE WIDTH (m) | CUT GRADE (g/t Au) | UNCUT GRADE (g/t Au) |

| MMD-22-107 | 11.30 | 49.00 | 37.70 | 24.4 | 0.58 | 0.58 |

| including | 25.30 | 30.70 | 5.40 | 3.5 | 2.93 | 2.93 |

| 97.10 | 101.80 | 4.70 | 3.2 | 0.40 | 0.40 | |

| 113.20 | 122.45 | 9.25 | 6.3 | 0.35 | 0.35 | |

| 175.20 | 177.50 | 2.30 | 1.6 | 0.95 | 0.95 | |

| 193.60 | 201.50 | 7.90 | 5.5 | 0.33 | 0.33 | |

| 210.10 | 217.00 | 6.90 | 4.9 | 0.30 | 0.30 | |

| 222.05 | 225.50 | 3.45 | 2.4 | 0.43 | 0.43 | |

| 236.00 | 251.00 | 15.00 | 10.7 | 0.32 | 0.32 | |

| 334.00 | 344.00 | 10.00 | 7.5 | 0.65 | 0.65 | |

| including | 334.00 | 336.00 | 2.00 | 1.5 | 1.77 | 1.77 |

| MMD-22-110 | 7.00 | 57.95 | 50.95 | 33.3 | 0.41 | 0.41 |

| 73.05 | 83.55 | 10.50 | 7.0 | 0.35 | 0.35 | |

| 88.15 | 97.00 | 8.85 | 6.0 | 0.38 | 0.38 | |

| 104.45 | 112.00 | 7.55 | 5.2 | 0.53 | 0.53 | |

| 127.00 | 132.90 | 5.90 | 4.1 | 0.49 | 0.49 | |

| 166.00 | 169.00 | 3.00 | 2.1 | 0.39 | 0.39 | |

| 174.00 | 182.00 | 8.00 | 5.7 | 0.68 | 0.68 | |

| 202.95 | 208.00 | 5.05 | 3.6 | 0.35 | 0.35 | |

| 241.80 | 255.00 | 13.20 | 9.8 | 0.31 | 0.31 | |

| 273.60 | 277.00 | 3.40 | 2.5 | 0.82 | 0.82 | |

| 301.00 | 319.00 | 18.00 | 13.6 | 0.57 | 0.57 | |

| including | 315.05 | 319.00 | 3.95 | 3.0 | 1.83 | 1.83 |

| 336.00 | 342.00 | 6.00 | 4.6 | 0.34 | 0.34 | |

| 379.00 | 388.00 | 9.00 | 7.1 | 1.37 | 1.37 | |

| including | 379.00 | 381.00 | 2.00 | 1.6 | 4.02 | 4.02 |

| MMD-22-111 | 83.00 | 101.15 | 18.15 | 12.6 | 0.30 | 0.30 |

| 102.80 | 109.60 | 6.80 | 4.8 | 0.31 | 0.31 | |

| 115.40 | 122.90 | 7.50 | 5.3 | 0.60 | 0.60 | |

| 133.00 | 148.90 | 15.90 | 11.5 | 0.51 | 0.51 | |

| 161.70 | 166.00 | 4.30 | 3.1 | 0.32 | 0.32 | |

| 180.00 | 184.10 | 4.10 | 3.0 | 0.42 | 0.42 | |

| 231.00 | 240.85 | 9.85 | 7.4 | 0.30 | 0.30 | |

| 290.00 | 293.00 | 3.00 | 2.3 | 0.50 | 0.50 | |

| 375.30 | 392.20 | 16.90 | 13.5 | 1.47 | 1.47 | |

| including | 386.00 | 391.60 | 5.60 | 4.5 | 3.88 | 3.88 |

| including | 391.00 | 391.60 | 0.60 | 0.5 | 16.1 | 16.1 |

| 456.00 | 458.05 | 2.05 | 1.7 | 0.32 | 0.32 | |

| 487.90 | 490.00 | 2.10 | 1.7 | 0.36 | 0.36 | |

| MMD-23-115 | 56.00 | 77.60 | 21.60 | 15.2 | 0.48 | 0.48 |

| 88.40 | 97.35 | 8.95 | 6.3 | 0.69 | 0.69 | |

| including | 93.40 | 96.00 | 2.60 | 1.8 | 1.50 | 1.50 |

| 111.00 | 113.25 | 2.25 | 1.6 | 0.50 | 0.50 | |

| 120.30 | 132.60 | 12.30 | 8.7 | 0.53 | 0.53 | |

| 207.00 | 210.00 | 3.00 | 2.2 | 0.42 | 0.42 | |

| 215.00 | 219.00 | 4.00 | 2.9 | 0.66 | 0.66 | |

| 241.60 | 251.00 | 9.40 | 7.0 | 0.32 | 0.32 | |

| 257.00 | 259.55 | 2.55 | 1.9 | 0.33 | 0.33 | |

| 280.20 | 282.50 | 2.30 | 1.7 | 0.44 | 0.44 | |

| MMD-23-116 | 65.00 | 67.00 | 2.00 | 1.4 | 0.55 | 0.55 |

| 176.00 | 178.00 | 2.00 | 1.5 | 0.32 | 0.32 | |

| 221.15 | 226.70 | 5.55 | 4.2 | 0.33 | 0.33 | |

| 231.90 | 287.00 | 55.10 | 42.8 | 0.38 | 0.38 | |

| 297.30 | 307.00 | 9.70 | 7.6 | 0.44 | 0.44 | |

| 316.60 | 348.40 | 31.80 | 25.3 | 0.47 | 0.47 | |

| 359.00 | 377.00 | 18.00 | 14.4 | 0.58 | 0.58 | |

| including | 374.00 | 377.00 | 3.00 | 2.4 | 1.61 | 1.61 |

| 400.85 | 437.85 | 37.00 | 30.1 | 1.34 | 1.46 | |

| including | 405.55 | 418.60 | 13.05 | 10.6 | 3.25 | 3.59 |

| including | 416.40 | 417.05 | 0.65 | 0.5 | 30.0 | 36.8 |

| MMD-23-117 | 24.70 | 147.00 | 122.30 | 82.7 | 0.43 | 0.43 |

| including | 45.00 | 47.00 | 2.00 | 1.3 | 2.22 | 2.22 |

| and | 67.05 | 71.00 | 3.95 | 2.7 | 1.30 | 1.30 |

| and | 106.00 | 114.00 | 8.00 | 5.5 | 1.79 | 1.79 |

| 165.65 | 182.75 | 17.10 | 11.8 | 0.41 | 0.41 | |

| 217.35 | 258.00 | 40.65 | 28.5 | 0.35 | 0.35 | |

| including | 217.35 | 219.40 | 2.05 | 1.4 | 1.86 | 1.86 |

| 307.00 | 310.00 | 3.00 | 2.1 | 0.45 | 0.45 | |

| 353.00 | 388.00 | 35.00 | 25.3 | 0.31 | 0.31 | |

| 404.65 | 414.10 | 9.45 | 6.9 | 0.99 | 0.99 | |

| including | 404.65 | 412.90 | 8.25 | 6.0 | 1.03 | 1.03 |

| 446.00 | 448.00 | 2.00 | 1.5 | 0.62 | 0.62 | |

| MMD-23-118A | 35.85 | 45.00 | 9.15 | 5.5 | 0.88 | 0.88 |

| 101.00 | 109.00 | 8.00 | 5.1 | 0.96 | 0.96 | |

| 202.00 | 220.00 | 18.00 | 12.3 | 0.31 | 0.31 | |

| 241.30 | 249.10 | 7.80 | 5.4 | 0.30 | 0.30 | |

| 261.05 | 279.00 | 17.95 | 12.6 | 0.68 | 0.68 | |

| including | 271.55 | 274.10 | 2.55 | 1.8 | 3.66 | 3.66 |

| 290.20 | 310.00 | 19.80 | 14.1 | 0.67 | 0.67 | |

| including | 306.90 | 309.00 | 2.10 | 1.5 | 1.79 | 1.79 |

| 369.20 | 451.00 | 81.80 | 60.7 | 0.58 | 0.58 | |

| including | 374.80 | 379.00 | 4.20 | 3.1 | 1.03 | 1.03 |

| and | 389.45 | 391.90 | 2.45 | 1.8 | 1.45 | 1.45 |

| and | 409.00 | 423.00 | 14.00 | 10.4 | 1.63 | 1.63 |

| 461.95 | 467.10 | 5.15 | 3.9 | 0.59 | 0.59 | |

| 483.00 | 485.00 | 2.00 | 1.5 | 2.44 | 2.44 | |

| 495.05 | 516.55 | 21.50 | 16.4 | 0.37 | 0.37 | |

| MMD-23-119 | 84.75 | 96.00 | 11.25 | 7.8 | 0.30 | 0.30 |

| 116.00 | 238.80 | 122.80 | 87.8 | 0.51 | 0.51 | |

| including | 157.00 | 167.95 | 10.95 | 7.8 | 1.97 | 1.97 |

| including | 165.20 | 165.90 | 0.70 | 0.5 | 19.4 | 19.4 |

| and | 189.80 | 192.95 | 3.15 | 2.3 | 1.48 | 1.48 |

| 305.00 | 329.50 | 24.50 | 18.2 | 0.41 | 0.41 | |

| 362.00 | 365.05 | 3.05 | 2.3 | 0.51 | 0.51 | |

| 414.00 | 417.00 | 3.00 | 2.3 | 0.43 | 0.43 | |

| 431.20 | 437.20 | 6.00 | 4.6 | 0.31 | 0.31 | |

| 439.00 | 441.05 | 2.05 | 1.6 | 0.32 | 0.32 | |

| 447.85 | 481.05 | 33.20 | 25.6 | 0.61 | 0.61 | |

| including | 479.00 | 481.05 | 2.05 | 1.6 | 3.45 | 3.45 |

| 508.00 | 514.40 | 6.40 | 5.0 | 0.58 | 0.58 | |

| MMD-23-120 | 12.90 | 31.95 | 19.05 | 12.4 | 0.59 | 0.59 |

| 43.65 | 61.10 | 17.45 | 11.4 | 0.30 | 0.30 | |

| 63.00 | 125.00 | 62.00 | 40.9 | 0.32 | 0.32 | |

| 137.85 | 154.30 | 16.45 | 11.0 | 0.33 | 0.33 | |

| 165.90 | 170.00 | 4.10 | 2.7 | 0.37 | 0.37 | |

| 175.00 | 178.85 | 3.85 | 2.6 | 0.80 | 0.80 | |

| 208.20 | 211.55 | 3.35 | 2.3 | 0.43 | 0.43 | |

| 241.15 | 263.20 | 22.05 | 15.2 | 0.30 | 0.30 | |

| 276.00 | 282.10 | 6.10 | 4.2 | 0.61 | 0.61 | |

| 352.00 | 377.00 | 25.00 | 17.7 | 0.47 | 0.47 | |

| including | 368.00 | 370.05 | 2.05 | 1.5 | 1.15 | 1.15 |

Intersections calculated above a 0.3 g/t Au cut off with a top cut of 30 g/t Au and a maximum internal waste interval of 10 metres. Shaded intervals are intersections calculated above a 1.0 g/t Au cut off. Intervals in bold are those with a grade thickness factor exceeding 20 gram x metres / tonne gold. True widths are approximate and assume a subvertical body.

Table 2: Location of drill holes in this press release

| HOLE | EAST | NORTH | RL | AZIMUTH | DIP | EOH |

| MMD-22-107 | 668,208 | 5,378,030 | 442 | 127° | -50° | 450 |

| MMD-22-110 | 668,166 | 5,378,056 | 448 | 126° | -50° | 402 |

| MMD-22-111 | 668,147 | 5,378,114 | 445 | 143° | -50° | 552 |

| MMD-23-115 | 668,388 | 5,378,145 | 429 | 125° | -45° | 324 |

| MMD-23-116 | 668,387 | 5,378,392 | 446 | 124° | -49° | 525 |

| MMD-23-117 | 668,334 | 5,378,203 | 435 | 124° | -49° | 450 |

| MMD-23-118a | 668,375 | 5,378,401 | 444 | 126° | -54° | 552 |

| MMD-23-119 | 668,277 | 5,378,239 | 447 | 126° | -50° | 525 |

| MMD-23-120 | 668,255 | 5,378,123 | 436 | 125° | -49° | 450 |

Analytical and QA/QC Procedures

All samples were sent to ALS Geochemistry in Thunder Bay for preparation and analysis was performed in the ALS Vancouver analytical facility. ALS is accredited by the Standards Council of Canada (SCC) for the Accreditation of Mineral Analysis Testing Laboratories and CAN-P-4E ISO/IEC 17025. Samples were analyzed for gold via fire assay with an AA finish (“Au-AA23”) and 48 pathfinder elements via ICP-MS after four-acid digestion (“ME-MS61”). Samples that assayed over 10 ppm Au were re-run via fire assay with a gravimetric finish (“Au-GRA21”).

In addition to ALS quality assurance / quality control (“QA/QC”) protocols, Goldshore has implemented a quality control program for all samples collected through the drilling program. The quality control program was designed by a qualified and independent third party, with a focus on the quality of analytical results for gold. Analytical results are received, imported to our secure on-line database and evaluated to meet our established guidelines to ensure that all sample batches pass industry best practice for analytical quality control. Certified reference materials are considered acceptable if values returned are within three standard deviations of the certified value reported by the manufacture of the material. In addition to the certified reference material, certified blank material is included in the sample stream to monitor contamination during sample preparation. Blank material results are assessed based on the returned gold result being less than ten times the quoted lower detection limit of the analytical method. The results of the on-going analytical quality control program are evaluated and reported to Goldshore by Orix Geoscience Inc.

Grant of Stock Options and RSUs

In addition, the Company announces that it has granted a total of 4,100,000 stock options (“Options“) to purchase common shares of the Company to certain directors, officers, employees and consultants. Such Options are exercisable into common shares of the Company at an exercise price of $0.25 per common share for a period of five years from the date of grant. Of the Options, 3,900,000 will vest 1/3 on October 24, 2023, 1/3 on October 24, 2024, and 1/3 on October 24, 2025; and 200,000 will vest 1/3 immediately and 1/3 annually thereafter. All Options expire on April 24, 2028.

The Company has also issued a total of 1,673,968 restricted share units (“RSUs“) to certain directors and officers of the Company. The RSUs will fully vest on the date that is one year from the date of grant. Once vested, each RSU represents the right to receive one common share of the Company, the equivalent cash value thereof, or a combination of the two, at the Company’s discretion. The grant of Options and issuance of RSUs have been made in accordance with the Company’s Omnibus Incentive Plan (the “Plan“) that was approved by the Company’s directors on November 8, 2022. The Plan remains subject to the approval of the shareholders of the Company at its next Annual General and Special Meeting. Any grants of share-based compensation made under the Plan will also be subject to the approval of disinterested shareholders at the next Annual General and Special Meeting of the Company.

In addition, certain directors and officers of the Company have agreed to forgive an aggregate of $168,833 of debt, representing accrued consulting fees incurred during the period from January 2023 to March 2023 and directors’ fees incurred during the period from July 2022 to March 2023.

About Goldshore

Goldshore is an emerging junior gold development company and owns 100% of the Moss Gold Project located in Ontario, with Wesdome Gold Mines Ltd. being a large shareholder. Supported by an industry-leading management group, board of directors and advisory board, Goldshore is positioned to advance the Moss Gold Project through the next stages of exploration and development.

Peter Flindell, P.Geo., MAusIMM, MAIG, Vice President – Exploration of the Company, a qualified person under NI 43-101 has approved the scientific and technical information contained in this news release.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

For More Information – Please Contact:

Brett A. Richards

President, Chief Executive Officer and Director

Goldshore Resources Inc.

P. +1 604 288 4416 M. +1 905 449 1500

E. brichards@goldshoreresources.com

W. www.goldshoreresources.com

Facebook: GoldShoreRes | Twitter: GoldShoreRes | LinkedIn: goldshoreres

Cautionary Note Regarding Forward-Looking Statements

This news release contains statements that constitute “forward-looking statements.” Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur.

Forward-looking statements in this news release include, among others, statements relating to expectations regarding the exploration and development of the Moss Gold Project, the release of an updated mineral resource estimate and preliminary economic assessment, and other statements that are not historical facts. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors and risks include, among others: the Company may require additional financing from time to time in order to continue its operations which may not be available when needed or on acceptable terms and conditions acceptable; compliance with extensive government regulation; domestic and foreign laws and regulations could adversely affect the Company’s business and results of operations; the stock markets have experienced volatility that often has been unrelated to the performance of companies and these fluctuations may adversely affect the price of the Company’s securities, regardless of its operating performance; and the impact of COVID-19.

The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/163605