This attractively designed book published by the world’s largest copper mining company describes and illustrates copper’s use and heritage from antiquity to the 21st century, all around the world. Learn how civilizations used copper to make jewelry, ornaments, utensils, weapons, religious objects, money, scientific and musical instruments, machinery and artwork – as well as myriad new uses for copper that are innovating our world today. Click the image to read 65 pages.

Category: Base Metals

The next couple of years were supposed to be a time of plenty for copper, thanks to a series of big new projects starting up around the world. The expectation across most of the industry was for a comfortable surplus before the market tightens again later this decade, when surging demand for electric vehicles and renewable energy infrastructure is expected to collide with a lack of new mines.

Instead, the mining industry has highlighted how vulnerable supply can be, whether due to political and social opposition, the difficulty of developing new operations or simply the day-to-day challenge of pulling rocks up from deep beneath the earth.

In the past two weeks, one of the world’s biggest copper mines was ordered to close in the face of fierce public protests, while a slew of operational setbacks has forced one of the leading miners to slash its production forecasts.

The sudden removal of around 600,000 tons of expected supply would move the market from a large expected surplus into balance, or even a deficit, analysts say. And it’s also a major warning for the future: copper is an essential metal needed to decarbonize the global economy, which means mining companies will play a key role in facilitating the shift to green energy.

While the price reaction to the supply disruptions has so far been muted — amidst ongoing worries about China’s property sector — any sign of demand recovery would hit a tight market.

Last week, Panama’s government formally ordered First Quantum Minerals Ltd. to end all operations at its US$10-billion copper mine in the country. The order followed weeks of protests and political wrangling that came to a head when the country’s Supreme Court invalidated the law that underpinned its mining licence. The giant Cobre Panama mine can produce about 400,000 tons of copper a year.

As the market was digesting the news that one of the biggest mines was closing (at least for now), Anglo American PLC delivered its own production bombshell on Dec. 8 by announcing it will slash production from its flagship copper business in South America.

Problems at its platinum and iron ore mines in South Africa were well publicized, but the copper cuts caught investors off guard, sending the company’s shares plunging by 19 per cent. Anglo has reduced its copper production target for next year by about 200,000 tons, essentially removing the equivalent of a large copper mine from global supply. Production will fall even further in 2025.

BMO Capital Markets Corp., which was forecasting a large surplus of refined copper next year, now sees a small deficit instead. Goldman Sachs Group Inc. — which has been much more bullish on copper and already forecast a deficit of refined metal for 2024, now sees that shortfall ballooning to more than half-a-million tons. Jefferies Financial Group Inc. also now expects a major deficit next year.

“The supply cuts reinforce our view that the copper market is entering a period of much clearer tightening,” Goldman analysts including Nicholas Snowdon said.

The expectation for a looser market in the near term has weighed on prices for much of this year, leaving copper drifting sideways. In early October, the International Copper Study Group said it expects a surplus of 467,000 tons next year — its largest forecast for a glut since 2014.

Live copper inventories on the London Metal Exchange had surged since mid-year to a two-year high, but have now retreated for three straight weeks.

“Disruptions have significantly increased, and a market deficit is now increasingly likely,” Jefferies said. “We could be at the foothills of the next copper cycle.”

Original Source: https://financialpost.com/commodities/mining/world-copper-supply-suddenly-looking-scarce

VANCOUVER, BC / ACCESSWIRE / January 10, 2024 / Metallic Minerals Corp. (TSXV:MMG)(OTCQB:MMNGF) (“Metallic Minerals” or the “Company”) is pleased to announce results from its fall 2023 exploration drilling campaign at the Company’s 100%-owned, 171 square kilometer (“km2″) Keno Silver project, adjacent to Hecla Mining (“Hecla”) in the high-grade Keno Hill silver district of Canada’s Yukon Territory. The 2023 exploration program included 1,112 meters (“m”) in four diamond drill holes focused on expansion of the Formo target in the West Keno area, which is on trend with the 100 million-ounce (“Moz”) historic Hector-Calumet mine controlled by Hecla.

Drill hole FOR23-03 represents one of the best intercepts to date for the Keno Silver project, returning grades of 256 grams per tonne (g/t) silver equivalent recovered (“Ag Eq”) over 46 m. This is also the deepest intercept to date on the Formo vein structure (only 275 m vertically from surface) and mineralization remains fully open down dip and along strike. Formo is anticipated to be one of the highest grade and largest contributors to the forthcoming inaugural NI-43-101 mineral resource estimate for the Keno Silver project, currently nearing completion by SGS Geological Services.

2023 West Keno Exploration Highlights

- High-grade silver (“Ag”), lead (“Pb”), zinc, (“Zn”) and significant gold (“Au”) mineralization was encountered in all four 2023 drill holes (See Table 1) which will contribute to the pending NI 43-101 Mineral Resource Estimate for the project.

- Both high-grade Ag-Au-Pb-Zn vein-style mineralization and broader zones of bulk tonnage Ag-Au-Pb-Zn mineralization comprised of high-grade vein intervals and associated stringers and stockwork veining were encountered.

- FOR23-03 returned 256.8 g/t Ag Eq (99.1 g/t Ag, 0.52 g/t Au, 0.65% Pb, 2.62% Zn) over 46.05 m with multiple internal higher-grade zones including, 3.3 m of 1,413.45 g/t Ag Eq (562.4 g/t Ag, 0.20 g/t Au, 2.35% Pb and 20.3% Zn). The bulk tonnage interval of this hole represents one of the highest gram-meter (g/t Ag Eq x interval thickness) intervals on the Keno Silver project to date, and extended mineralization by 140 m from the nearest 2022 and historic drill holes.

- FOR23-04, a large step-out hole, drilled nearly 250 m west of the nearest Formo vein drilling, returned four separate silver-dominant vein structures of considerable width providing additional confirmation of the potential for on-strike expansion of the Formo target.

- The Formo target remains open to further expansion, down-dip and on-trend, and shows potential for new discoveries within the Formo property footprint.

Metallic Minerals President, Scott Petsel, stated, “The Formo target is an exciting, advanced exploration stage “resource-ready” target with significant room to grow featuring both high-grade and bulk mineable widths that make it amenable to lower-cost mining methods. The Formo target is ideally located near infrastructure as it is adjacent to the Silver Trail highway (Highway 11) and power lines that feed the central Keno Hill mill. It also directly adjoins Hecla’s Keno Hill property, where Hecla is actively mining the nearby Bermingham mine. We are excited to be able to include these new drill results in our upcoming inaugural resource for the Keno Silver project as these results at Formo continue to demonstrate our ability to build a significant resource base for the project. The resource estimate is expected to be complete in Q1 2024.”

“In addition, the Company looks forward to meeting with interested investors at the upcoming Vancouver Resource Investment Conference, AMEBC Mineral Roundup and Prospectors and Developers annual conferences where Metallic Minerals has been invited to display drill core from its 2023 exploration programs at La Plata and Keno Silver. We anticipate reporting additional results from the Keno Silver project and La Plata projects over the next few weeks.”

Upcoming Events

Vancouver Resource Investment Conference (VRIC)

Metallic Minerals and fellow Metallic Group members, Granite Creek Copper and Stillwater Critical Minerals, in Booth #112 at the 2024 VRIC event, January 21 and 22, 2024. For more information click here.

AMEBC Mineral Roundup Core Shack

Metallic Minerals will be displaying core from the 2023 drill season at the upcoming AMEBC Mineral Roundup event held in Vancouver, BC January 22 to 25, 2024. For more information click here.

Prospectors and Developers Association of Canada Annual Convention (PDAC)

Metallic Minerals will be displaying core from the 2023 drill season at the La Plata project during the PDAC convention held in Toronto, March 3 to 6, 2024. For more information click here.

Table 1 – Highlights of 2023 Drill Results from the West Keno – Formo Target Area

| DDH Hole ID | From (m) | To (m) | Length (M) | Recovered Ag Eq (g/t) | Ag (g/t) | Au (g/t) | Pb (%) | Zn (%) |

| FOR23-001 | 148.74 | 149.43 | 0.69 | 499.23 | 3.6 | 6.20 | 0.00 | 0.01 |

| and | 196.95 | 215 | 18.05 | 234.45 | 121.4 | 0.05 | 1.22 | 2.06 |

| including | 196.95 | 198.9 | 1.95 | 513.39 | 300.3 | 0.07 | 2.71 | 3.74 |

| also incl | 208.4 | 214 | 5.6 | 478.25 | 241.0 | 0.10 | 2.41 | 4.43 |

| with | 208.4 | 211.2 | 2.8 | 687.57 | 367.9 | 0.18 | 4.02 | 5.37 |

| FOR23-002 | 172.3 | 173.35 | 1.05 | 67.04 | 3.5 | 0.79 | 0.01 | 0.01 |

| and | 218 | 221 | 3 | 131.42 | 51.9 | 0.38 | 0.35 | 1.07 |

| incl | 218.75 | 219.75 | 1 | 277.81 | 137.0 | 0.00 | 0.96 | 3.08 |

| FOR23-003 | 239.95 | 286 | 46.05 | 256.82 | 99.1 | 0.52 | 0.65 | 2.62 |

| including | 239.35 | 263.65 | 23.7 | 462.37 | 176.0 | 1.0 | 1.13 | 4.67 |

| with | 239.35 | 245.5 | 5.5 | 406.57 | 46.6 | 4.07 | 0.49 | 0.60 |

| and with | 255.8 | 263.65 | 7.85 | 899.27 | 392.4 | 0.13 | 2.06 | 11.68 |

| including | 260.35 | 263.65 | 3.3 | 1,413.45 | 562.4 | 0.20 | 2.35 | 20.30 |

| with | 260.75 | 261.5 | 0.75 | 1,411.76 | 994.0 | 0.03 | 3.01 | 7.36 |

| and with | 262.05 | 263.65 | 1.6 | 1,769.44 | 416.0 | 0.39 | 2.64 | 32.32 |

| and | 284 | 286 | 2 | 302.55 | 116.5 | 0.03 | 1.07 | 4.07 |

| FOR23-004 | 122 | 124.46 | 2.46 | 76.62 | 43.7 | 0.11 | 0.33 | 0.43 |

| and | 153.5 | 154.1 | 0.6 | 284.52 | 154.0 | 0.09 | 1.67 | 2.14 |

| and | 177.5 | 183 | 5.5 | 72.95 | 61.2 | 0.00 | 0.28 | 0.18 |

| including | 179 | 180.75 | 1.76 | 144.67 | 130.0 | 0.00 | 0.46 | 0.21 |

| and | 300.3 | 301 | 0.7 | 83.26 | 5.6 | 0.97 | 0.01 | 0.00 |

Notes to reported values:

- Ag equivalent is presented for comparative purposes using conservative long-term metal prices (all USD): $22.0/oz silver (Ag), $1,850/oz gold (Au), $1.00/lb lead (Pb), $1.40/lb zinc (Zn).

- Recovered Silver Equivalent in Table 1 is determined as follows: Ag Eq g/t = [Ag g/t x recovery] + [Au g/t x recovery x Au price/ Ag price] + [Pb % x 10,000 x recovery x Pb price / Ag price] + [Zn% x 10,000 x recovery x Zn price / Ag price].

- In the above calculations: 1% = 10,000 ppm = 10,000 g/t.

- The following recoveries have been assumed for purposes of the above equivalent calculations: 95% for precious metals (Ag/Au) and 90% for all other listed metals, based on recoveries at similar nearby operations.

- Intervals are reported as measured drill intersect lengths and do not represent true width.

Figure 1. Keno Silver District Geology and Deposits

West Keno and the Formo Target Area

The Western Keno Hill district is host to the largest historic production and current resources in the prolific Keno Hill silver district. The Formo target is located at the intersection of a north-easterly structural zone extending from the Hector-Calumet mine, which was the largest producer in the district producing nearly 100 million ounces of silver and the Elsa structural trend, which was the second largest silver producer in the district (see Figure 2).

The Formo property, which includes the historic Formo Mine, was acquired by Metallic Minerals in 2017. The historic Formo mine produced high-grade silver at various times since the 1930s from high-grade vein structures that graded over 1,000 g/t silver1. Significant underground exploration drifts were developed in the 1950s with most of the historic production from an open pit located alongside of the Silver Trail highway between the Elsa townsite and Keno City and last mined in the 1980s.

The primary Formo vein structure is exposed at surface in an open cut. Multiple veins have been encountered in the target area that demonstrate an association with Triassic greenstones in the Earn group schist, similar to the Sadie Ladue deposit which produced 12.7 Moz silver at a grade of 1,620 g/t Ag1. In addition to the mineralization at the known Formo target, two new surface targets have been identified through soil and rock sampling along the same structural corridors that show potential to host high-grade and bulk tonnage Keno-style Ag-Au-Pb-Zn veins on the Formo property (Figure 2).

Since 2020, Metallic Minerals has drilled 26 holes (4,419 m) at the Formo target building on the six core holes and 54 percussion holes drilled by previous owners between 1980 and 1981. The Formo target is open to significant expansion down dip and along trend with several newly identified targets for drill testing (Figure 2 and 3 below).

Figure 2 – West Keno and Formo Target Plan Map

Figure 3 – Formo Target Cross Section (Looking East)

Pending 43-101 Mineral Resource Estimate for Keno Silver Project

The upcoming inaugural independent 43-101 mineral resource estimate is focused on four initial deposits across the Keno Silver project, including: Formo, Caribou, Fox and Homestake. These four deposits are the most advanced of over 40 identified target areas, each of which is characterized by a kilometric scale Ag in soil anomaly, exposed outcropping high-grade veins, and varying levels of exploration activity or historic production. Metallic Minerals has completed 165 drill holes totalling 18,983 m of combined reverse circulation and diamond core drilling at the Keno Silver project since 2017 on a total of 11 targets, all of which have returned encouraging results. The four most advanced “resource-ready” targets will be part of the upcoming mineral resource estimate being completed by SGS Geological Services and include:

- Formo Target – In the West Keno District, it demonstrates potential for lower-cost bulk tonnage mining or high-grade selective methods with drill highlights including:

- Hole FOR22-04 – 20.87 m @ 220.5 g/t Ag Eq (144.6 g/t Ag, 0.70% Pb, 1.59% Zn), and 1.63 m @ 1,487.19 g/t Ag Eq (1,049 g/t Ag, 4.21% Pb, 9.45% Zn)

- Hole FOR21-05 – 19.8 m @ 216.26 g/t Ag Eq (70 g/t Ag, 0.41 g/t Au, 0.30% Pb, 2.07% Zn) and 0.7 m @ 1,405 g/t Ag Eq (421.0 g/t Ag, 0.15 g/t Au, 1.53% Pb, 24.2% Zn)

- Hole FOR20-003 – 3.0 m @ 2,954.52 g/t Ag (1,568 g/t Ag, 29.45% Pb, 1.35% Zn)

- Caribou Target – In the Central Keno target area the Caribou target historically produced very high-grade material from a shallow surface pit grading more than 6,000 g/t silver.

- Fox Target – Discovered by Metallic Minerals in 2020 in the East Keno target area, the Fox target is characterized as a newly recognized bulk tonnage style of mineralization with shallow-dipping sheeted vein sets up to 177 m in width. Drilling since 2020, has defined a bulk-tonnage mineralized block over 300 m along strike and 150 m down-dip from surface which is open in all directions.

- Homestake Target – A historic producer, the Homestake target in the Central Keno area is fractally spatial with the districts’ giant past producers and current resources (Silver King, Elsa, Bermingham, Hector Calumet, Flame & Moth and Bellekeno) near the contact of the Keno Hill Quartzite and Sourdough Hill formations. With only 88 drill holes (slightly over 5000 m of drilling), and a strike length over 2 km the Homestake target represents considerable resource opportunity and exploration potential.

Metallic Minerals sees considerable opportunity for resource growth from target expansion and new discovery with the further systematic application of exploration, including the expansion of detailed soil geochemical grids, “resource-ready” target expansion through drilling and reconnaissance drilling of early-stage targets.

About Metallic Minerals

Metallic Minerals Corp. is focused on copper, silver, gold, and other critical minerals in the La Plata mining district in Colorado, and silver and gold in the high-grade Keno Hill and Klondike districts of the Yukon. Our objective is to create shareholder value through a systematic, entrepreneurial approach to making exploration discoveries, growing resources, and advancing projects toward development.

At the Company’s La Plata project in southwestern Colorado, the new 2023 NI 43-101 mineral resource estimate identifies a significant porphyry copper-silver resource containing 1.21 Blbs copper and 17.6 Moz of silver3. The 2022 expansion drilling provided the basis for the updated resource, including the longest and highest-grade interval ever encountered at La Plata and one of the top intersections for any North American copper project in the past several years. In May 2023, the Company announced a 9.5% strategic investment by Newcrest Mining Limited (acquired by Newmont Mining in 2023) to accelerate the advancement of the Company’s La Plata project. In the 2023 Fraser Institute’s Annual Survey of Mining Companies, Colorado ranked 5th globally for investment attractiveness and 2nd in the USA.

In Canada’s Yukon Territory, Metallic Minerals has consolidated the second-largest land position in the historic high-grade Keno Hill silver district, directly adjacent to Hecla Mining Company’s (“Hecla”) operations, with more than 300 Moz of high-grade silver in past production and current M&I resources. Hecla, the largest primary silver producer in the USA and third largest in the world, is anticipating full production at its Keno Hill operations by the end of 2023. An inaugural mineral resource estimate on the project is expected in early 2024, with an 1,112-meter expansion drill program completed at the Formo target during fall of 2023.

The Company is also one of the largest holders of alluvial gold claims in the Yukon and is building a production royalty business by partnering with experienced mining operators, including Parker Schnabel of Little Flake Mining from the Discovery Channel television show, Gold Rush.

All of the districts in which Metallic Minerals operates have seen significant mineral production and have existing infrastructure, including power and road access. The Company is led by a team with a track record of discovery and exploration success on several major precious and base metal deposits in the region, as well as having large-scale development, permitting and project financing expertise. The Metallic Minerals team has been recognized for its environmental stewardship practices and is committed to responsible and sustainable resource development.

Footnotes:

- Cathro, R. J., Great Mining Camps of Canada 1. The History and Geology of the Keno Hill Silver Camp, Yukon Territory. Geoscience Canada, Sept. 2006. ISSN 1911-4850.

- Alexco Resource Corp Technical Report, titled “NI 43-101 Technical Report on Updated Mineral Resource and Reserve Estimate of the Keno Hill Silver District” with an effective date of April 1, 2021, and issue date of May 26, 2021.

- See news release dated July 31, 2023. The Mineral Resource has been estimated in conformity with CIM Estimation of Mineral Resource and Mineral Reserve Best Practices Guidelines (2019) and current CIM Definition Standards. The constrained Mineral Resources are reported at a base case cut-off grade of 0.25% Cu Eq, based on metal prices of $3.75/lb Cu and $22.50/oz Ag, assumed metal recoveries of 90% for Cu and 65% for Ag, a mining cost of US$5.30/t rock and processing and G&A cost of US$11.50/t mineralized material. The current Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability. The quantity and grade of reported Inferred Resources in this Mineral Resource Estimate are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as Indicated or Measured. However, based on the current knowledge of the deposits, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Website: www.mmgsilver.com Phone: 604-629-7800

Email: cackerman@mmgsilver.com Toll Free: 1-888-570-4420

Qualified Person

The disclosure in this news release of scientific and technical information regarding exploration projects on Metallic Minerals’ mineral properties has been reviewed and approved by Taylor Haid, P. Geo, Project Manager for TruePoint Exploration, who is a Qualified Person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

Quality Assurance / Quality Control

All samples were prepared by Bureau Veritas’ (BV) Whitehorse, Yukon facility and geochemically analyzed at the BV laboratory in Vancouver, British Columbia. All samples were prepared using BV code PRP70-250, which crushed, split, and pulverized 250 grams of core to 200 mesh pulps. These pulps were then analyzed by 37 Element 1:1:1 Aqua Regia Digestion followed by Inductively Coupled Plasma Mass Spectrometry (ICP-ES/MS) analyses (BV Code AQ202). Over-limit silver, lead, and zinc samples were further analyzed with multi-acid digestion and atomic absorption spectrometry (BV Code MA404). Samples with over-limit gold (and silver when over-limit was reached via multi-acid) were re-analyzed using a 30-gram fire assay fusion with gravimetric finish (BV Code FA530).

All results have passed the QAQC screening by the lab and the company utilizes a quality control and quality assurance protocol for the project, including insertion of blanks, duplicates, and certified reference materials approximately every tenth sample. Certified reference materials were acquired from OREAS North America Inc. of Sudbury, Ontario, and CDN Resource Laboratories Ltd. Of Langley, British Columbia for the 2023 drill program at the Keno Silver project.

Forward-Looking Statements

This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, statements about expected results of operations, royalties, cash flows, financial position and future dividends as well as financial position, prospects, and future plans and objectives of the Company are forward-looking statements that involve various risks and uncertainties. Although Metallic Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, unsuccessful operations, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration, development of mines and mining operations is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Metallic Minerals and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Metallic Minerals Corp.

View the original press release on accesswire.com

Vancouver, British Columbia–(Newsfile Corp. – January 9, 2024) – Dolly Varden Silver Corporation (TSXV: DV) (OTCQX: DOLLF) (the “Company” or “Dolly Varden“) is pleased to announce that, further to its news release dated December 20, 2023, it has completed the issuance of 275,000 common shares of the Company (the “Consideration Shares“) to Libero Copper & Gold Corporation (“Libero“) as consideration for the acquisition by Dolly Varden of an option agreement (the “Option Agreement“) from Libero entitling Dolly Varden to earn-in a 100% undivided interest in the property known to Libero as the Big Bulk Property, comprised of seven mineral claims in the Golden Triangle, British Columbia (the “Acquisition“). In connection with the issuance of the Consideration Shares to Libero, the Company has filed a prospectus supplement to its base shelf prospectus dated April 25, 2023 to qualify the distribution thereof.

In connection with the Acquisition, Dolly Varden also entered into a further amending agreement to the Option Agreement clarifying that Dolly Varden may only elect to issue common shares of the Company to satisfy any option payments under the Option Agreement so long as the deemed price of the common shares at the time is equal to or greater than $0.64, as required by the rules of the TSXV. Whether Dolly Varden chooses to make such payments is cash or common shares is otherwise at the discretion of Dolly Varden.

About Dolly Varden Silver Corporation

Dolly Varden Silver Corporation is a mineral exploration company focused on advancing its 100% held Kitsault Valley Project (which combines the Dolly Varden Project and the Homestake Ridge Project) located in the Golden Triangle of British Columbia, Canada, 25kms by road to tide water. The 163 sq. km. project hosts the high-grade silver and gold resources of Dolly Varden and Homestake Ridge along with the past producing Dolly Varden and Torbrit silver mines. It is considered to be prospective for hosting further precious metal deposits, being on the same structural and stratigraphic belts that host numerous other, high-grade deposits, such as Eskay Creek and Brucejack. The Kitsault Valley Project also contains the Big Bulk property which is prospective for porphyry and skarn style copper and gold mineralization, similar to other such deposits in the region (Red Mountain, KSM, Red Chris).

Forward-Looking Statements

This news release contains statements that constitute “forward-looking statements.” Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur.

Forward-looking statements in this news release include, among others, the potential future issuances of common shares of the Company and other statements that are not historical facts. These forward-looking statements are based on management’s current expectations and beliefs and assume, among other things, the receipt of final approval of the Acquisition from the TSXV, use of proceeds of the Acquisition, the adequacy of the Company’s current financial position, the ability of the Company to successfully pursue its current development plans, that future sources of funding will be available to the Company on desirable and permitted terms, that relevant commodity prices will remain at levels that are economically viable for the Company and that the Company will receive relevant permits in a timely manner in order to enable its operations, but given the uncertainties, assumptions and risks, readers are cautioned not to place undue reliance on such forward-looking statements or information.

By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors and risks include, among others: the risk that the Company may not be able to complete the Acquisition due to failure to receive regulatory approval; the Company may require additional financing from time to time in order to continue its operations which may not be available when needed or on acceptable terms and conditions acceptable; compliance with extensive government regulation; domestic and foreign laws and regulations could adversely affect the Company’s business and results of operations; and the stock markets have experienced volatility that often has been unrelated to the performance of companies and these fluctuations may adversely affect the price of the Company’s securities, regardless of its operating performance. The risk factors identified herein are not intended to represent a complete list of factors that could affect the Company. For additional information on risks and uncertainties, see the Company’s annual information form dated April 11, 2023 for the year ended December 31, 2022 and the Company’s base-shelf prospectus dated April 25, 2023, both available on SEDAR+ at www.sedarplus.ca.

The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

For further information: Shawn Khunkhun, CEO & Director, 1-604-609-5137, www.dollyvardensilver.com.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/193758

In the post-Christian world, the assumption is that prosperity and education must automatically lead to enlightenment. The results have, however, been quite the opposite, as these factors have instead provided leverage to the underlying irrational, amoral “system.” A foundation of rational, moral fabric must first be laid to have any hope of building a civilization. That is where attempts to enlighten the Third World have failed:

Here is a discussion on how Canada (and the rest of the West) did hara-kiri by bringing in so many Third World immigrants:

On Investments

92 Energy (ASX.92E; A$0.495) is being acquired. It owns uranium projects in the Athabasca region of Canada. The arbitrage is 30% based on a recent financing that the acquiree did. Based on the current share price of the acquiree, the upside is 60%. The merged entity will trade only in Canada. I understand some Australian shareholders are getting out because their brokers likely do not offer trading in Canada. The ideal choice to trade such stocks is brokers that offer trading on ASX and Canadian exchanges. I prefer Interactive Brokers. (This is a referal link).

Jayant Bhandari

Disclaimer: All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, or stock picks, expressed or implied herein, are for informational, entertainment, or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies. The sole purpose of these musings is to show my thinking process when analyzing a stock, not to provide any recommendations. I will not and cannot be held liable for any actions you take resulting from anything you read here. Conduct your due diligence, or consult a licensed financial advisor or broker before making any investment decisions. Any investments, trades, speculations, or decisions made based on any information found on this site, expressed or implied herein, are committed at your own risk, financial or otherwise.

A Virtual Event | JAN 6, 2024 – 8:00 AM – 4:00 PM (PST)

YOU WON’T FIND IT ANYWHERE ELSE

And certainly not at this price.

Right now, you can attend this exclusive event for 50% off the retail price, for just $99USD ($199 after January 6, 2024)

Dear Investor,

SOMETIMES BORING PAYS BIG BUCKS

A quiz for any of you football fans. Which position group in the National Football League earns the highest salary on average?

That’s easy you say — quarterback? Nope.

Wide receiver? Try again.

Running back? Not even close.

The answer is left tackle (one of the big boring guys up front). Surprised? It’s true. According to Spotrac, the average salary for an NFL left tackle in 2023 was $8,137,061. Quarterbacks, receivers, and running backs (the so-called skill positions) on average earned $5,767,724, $3,244,312, and $2,151,733, respectively.

It’s hard to believe but despite the headline-grabbing sums paid to quarterbacks such as Justin Herbert ($52.5 million per year), when all players, including back-ups and third stringers, are considered, the league paid more on average to left tackles than to quarterbacks. There’s a good reason for this.

Offensive tackles play a vital role; they protect the team’s quarterback from opposing attackers. One missed assignment can result in a negative play or worse — a season- or career-ending injury to a $50 million quarterback.

The risk is too high, so teams gladly pay up. Laremy Tunsil, the highest paid offensive tackle, takes home $20 million per year, which is more than most quarterbacks — and he rarely, if ever, touches the ball.

Sometimes, real value appears where you least expect it.

THE UNSUNG HEROES: FROM DISCOVERY TO MINE

A lot happens between mineral discovery and the first extraction of valuable ore (and the long-awaited cash flow). During this lengthy process, a number of factors, including changing risk factors and capital flows, alter the market value of the project.

Franco-Nevada co-founder Pierre Lassonde captured the general trend in his widely referenced Lassonde Curve.

Mining speculators are naturally drawn to the first hump of the Lassonde Curve, the discovery period, where exploration pays off and excitement reaches its peak. No doubt the profits here can be mind blowing, but speculators face another big opportunity to profit (the second hump), and that is the development / pre-production period.

Like our indispensable left tackle, development-stage companies are the unsung heroes of the game. They engage in what some dismiss as the “boring engineering phase” of development to production (the blocking and tackling, if you will): namely, the financing, engineering, permitting, and construction.

Are you still awake? Yes, it’s boring, yet critical. A misstep at this stage can nullify a decade or more of investment and hard work.

The good news is that at each successive stage, the odds of success improve. Only a small fraction of exploration companies make it this far. The end is in sight!

SURPRISINGLY REWARDING

While many early speculators prefer to cash out following the initial discovery boom, other investors join in. The maturing project, with risk and reward now clearly defined, attracts a different class of investor, including institutions.

These investors aim to profit from the difference between the market value and the net asset value (NAV) of the company. In the optimal case, the market value converges to near 100% of the NAV.

One might think that at this stage of the mineral discovery lifecycle, the prospect for large gains is slim. But that’s not the case according to Lobo Tiggre, founder of The Independent Speculator, and whose firm studied 124 cases going back to the 1980s.

According to Tiggre, these investments often double in value and in some cases deliver 600% returns or higher. Furthermore, 75.4% of all cases delivered positive gains.

At the same time, he is quick to point out that averages are just that — averages. They tell you little about the performance of individual companies. Despite the encouraging numbers, some companies still fail miserably.

His conclusion: Due diligence still matters.

DON’T GO AT IT ALONE — LET RICK BE YOUR GUIDE

Investing in development stage and pre-production companies can be extraordinarily rewarding, but there are risks.

That’s why I created the Rule Bootcamp Series with my partner, renowned natural resource investor Rick Rule.

When it comes to junior resource investing, Rick is the real deal with over 40 years of experience and hundreds of privately placed debt and equity deals under his belt. He has researched and funded companies around the world, including those domiciled in Australia, Canada, Chile, Great Britain, New Zealand, Switzerland, and the United States.

This bootcamp is your opportunity to capitalize on the lifetime’s worth of experience of a celebrated professional.

Among the topics we’ll discuss are:

- An overview of developers and pre-production companies

- Red flags to watch out for when evaluating potential investments

- How to read an NI 43-101 report on a developer or pre-producer

- The ‘ten disciplines’ that every investor must understand and review prior to investing

- How you can make impressive returns without taking excessive risk

- The questions you must ask development-stage mining CEOs before you invest

- How Rick Rule selects his own development-stage and pre-production investments

About your host, Rick Rule, and his company, Rule Investment Media. Rick Rule is a highly experienced investor and speculator who began his career in the securities business in 1974 and has been principally involved in natural resource security investments ever since. He has structured, led, and participated in hundreds of privately placed debt and equity issuances for resource companies operating globally. Rule Investment Media strives to produce the highest quality and most reliable market news and commentary in the natural resources sector. The goal: to connect scarce knowledge with the people who seek it and inspire intelligent investing decisions with insightful analysis and thought-provoking interviews. |

MEET OUR DISTINGUISHED SPEAKER LINEUP

Douglas Silver

Douglas Silver

CEO, Balfour Holdings, LLC

Douglas has had a diverse career in the mining industry ranging from prospecting geologists to being a founder and portfolio manager for the largest mining private equity fund. He is especially known for his work in mining royalties, having sold his company, International Royalty Corp, for C$745 million as well as a mineral royalty portfolio to Osisko Gold for C$1.1 billion. Mr. Silver is one of only three people to be inducted into both the U.S. and Canadian Mining Halls of Fame.

Nick Michael

VP Technical Services (retired), Orion Resource Partners

Recently retired from Orion Resource Partners where he held the position of VP Technical Services, Nick was involved in the design/construction process as well as technical diligence and independent engineer (for investors) of many mines throughout the globe. He has a working understanding in all disciplines related to mining, proficient in mining, metallurgy, and engineering. This skillset, developed over years of experience and provided insight to efficiently evaluate, engineer, and manage greenfield, brownfield, and operating mines.

Lobo Tiggre

Founder, Louis James, LLC

Lobo Tiggre is the founder, CEO, and principal analyst and editor of Louis James, LLC. He researched and recommended speculative opportunities in Casey Research publications from 2004 to 2018, writing under the name “Louis James” for privacy reasons. While at Casey Research, he learned about the newsletter business from Casey co-founder David Galland, and resource speculation from the legendary speculator Doug Casey himself.

Prior to his work at Casey Research, Mr. Tiggre was a writer and publisher involved in numerous ventures. In 1998, he published his first novel, Y2K: The Millennium Bug. In 2012, he co-authored Doug Casey’s first book in almost two decades, Totally Incorrect. This was followed by another book co-authored with Doug Casey in 2014, Right on the Money. Tiggre has plans for several new books going forward, both fiction and non-fiction.

Louis-Pierre Gignac

President & CEO, G Mining Ventures Corp.

Mr. Gignac has more than 20 years of experience in the mining industry. His expertise includes managing project development studies, providing open-pit expertise, financial modeling, and economic evaluation of projects. He has coordinated many mandates with numerous major mining companies ranging from early exploration evaluations to operations optimization involving all fields of mining and geology. He is a member of the Ordre des Ingénieurs du Québec (“OIQ”) and the Canadian Institute of Mining (“CIM”). He holds a Bachelor of Mining Engineering from McGill University and a Master’s degree of Applied Science in Industrial Engineering from the École Polytechnique de Montréal and is a CFA Charterholder. Mr. Gignac also serves as a director of Major Drilling Group International.

YOU WON’T FIND IT ANYWHERE ELSE

And certainly not at this price.

Right now, you can attend this exclusive event for 50% off the retail price, for just $99USD ($199 after January 6, 2024)

Vancouver, British Columbia–(Newsfile Corp. – January 3, 2024) – EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the “Company” or “EMX”) is pleased to announce the execution of an option agreement for EMX’s Sagvoll and Meråker projects in Norway (see Figure 1) with Lumira Energy Ltd. (“Lumira“), a private Australian Company. The agreement provides EMX with 2.5% Net Smelter Return (“NSR”) royalty interests, cash and equity payments, work commitments and other considerations. EMX has recently executed another agreement with Lumira for EMX’s Copperhole Creek project in Queensland Australia (see Company News Release dated September 13, 2023). In conjunction with these transactions, Lumira Energy intends to establish a public listing on the Australian Securities Exchange (ASX) in mid-year 2024 via an Initial Public Offering (“IPO”).

The polymetallic Sagvoll and Meråker projects in Norway are positioned along a prolific metallogenic belt in Norway that includes the historic Røros volcanogenic massive sulfide (“VMS”) district. The Meråker project hosts VMS styles of mineralization, while the Sagvoll project contains both VMS and magmatic nickel-copper sulfide targets. Prior to EMX’s involvement, little work had been done on the Meråker project in the past 50 years, and Sagvoll has not seen substantive exploration since Falconbridge Ltd. last conducted exploration there in the early 2000’s. Together with the Copperhole Creek project in Australia, these projects will form a strong “starter portfolio” for Lumira in support of their upcoming IPO.

Commercial Terms Overview: All terms in Australian Dollars (AUD) unless otherwise indicated. Upon execution, Lumira will make a cash payment of $50,000 to EMX. Lumira will vest a 100% interest in the Projects, by granting to EMX:

- A 2.5% NSR royalty interest on each project.

- Annual advance royalty (“AAR”) payments of $35,000 per project per year commencing upon the second anniversary of the IPO, with the AAR payments escalating by 15% per year until reaching a maximum of $100,000 per year.

- Equity payments of $150,000 in shares of Lumira upon completion of the IPO along with the same number of options exercisable at a 50% premium to the IPO price for two years and an additional same number of options exercisable at a 100% premium to the IPO price for three years.

- An additional 750,000 shares upon the first anniversary of the IPO.

- Milestone payments as follows:

- $250,000 in cash upon completion of a Preliminary Economic Assessment (or equivalent study)

- $500,000 in cash upon completion of a Prefeasibility Study

To maintain its interest in the projects, Lumira will also:

- Spend $150,000 in exploration expenditures per project by the first anniversary of execution.

- Commit to $650,000 in exploration expenditures by the first anniversary of the IPO with a minimum of $200,000 spent on each project (if both are maintained).

- Commit to $750,000 in exploration expenditures by the second anniversary of the IPO with a minimum of $250,000 spent on each project (if both are maintained).

- Complete a cumulative of $5,000,000 in exploration expenditures by the 5th anniversary of execution, with a minimum of $1,200,000 spent on each project (if both are maintained).

Within 72 months of executing the agreement, Lumira will have the right to re-purchase 0.5% of the NSR Royalty on each Project for $1,000,000.

Overviews of the projects. The Sagvoll and Meråker polymetallic projects in Norway are located in the early Paleozoic VMS belt in Norway, which saw numerous districts and mines in operation from the 1600’s through the 1990’s. This metallogenic region represents a tectonically displaced continuation of the Cambrian-Ordovician VMS belts in northeastern North America, which includes the Buchans and Bathurst VMS camps in eastern Canada, and also the Avoca VMS district in Ireland. As such, this represents one of the more prolific VMS belts in the world in terms of total production from its various mining districts, albeit now tectonically displaced and occurring along opposite sides of the Atlantic Ocean.

Sagvoll Project, Caledonian VMS Belt, Southern Norway: The Sagvoll project in southern Norway consists of both VMS and magmatic nickel-copper sulfide mineralization developed along the Caledonian mountain belt. At Sagvoll, mineralization and historic mining areas are positioned along a 13-kilometer trend (see Figure 2). Although multiple historic mines were developed in the area, only limited historical drilling has taken place, most of which were drilled over 100 years ago. Many prospects and mining areas remain untested. The most recent work conducted in the district took place in 2006, when Falconbridge Ltd (later Xstrata PLC) flew airborne geophysical surveys and identified five prioritized nickel-copper targets and 11 VMS targets for further exploration and drill testing. However, the follow-up exploration work was never completed.

EMX has identified several “walk-up” style drill targets based upon the historical and more recent Falconbridge/Xstrata data and will work closely with Lumira to systematically explore the area. EMX explored the Sagvoll project in 2022 and conducted extensive soil sampling campaigns over the VMS trend to identify the continuation of outcropping VMS mineralization at the Akervoll and Malså prospects. The company has further carried out reconnaissance field mapping, review of historical drill core, and lithogeochemical sampling to identify alteration and mineralization zoning patterns. In 2023 the Company focused on the Skjærkerdalen Nickel target and conducted field mapping campaigns to understand the distribution of mineralized mafic intrusions in the area.

Meråker, Caledonian VMS Belt, Southern Norway. Located near the Norwegian city of Trondheim, the 18,600 Ha Meråker project contains multiple historic mines and prospects developed on trends of polymetallic VMS style mineralization (see Figure 3). Copper was the chief product from many of the historic mines, but significant zinc mineralization is seen in the mine dumps and outcrops in the area. There are several parallel trends of mineralization within the project area, extending for nearly 30 kilometers along strike. Little modern exploration has taken place at Meråker.

The Company and its former partner Norra Metals together with the NGU (Geological Survey of Norway) jointly carried out an airborne EM survey over the Meråker project in 2021. In 2023 EMX carried out reconnaissance mapping and sampling covering various prospects in the Meråker license block with positive base metal results. An extensive soil sampling program, including 4750 samples covered the prospective Fonnfjell, Mannfjell and Lillefjell targets, which warrant follow-up work.

More information on the Project can be found at www.EMXroyalty.com.

Comments on Nearby and Adjacent Properties. The deposits, projects and mines discussed in this news release provide context for EMX’s Project, which occurs in a similar geologic setting, but this is not necessarily indicative that the Project hosts similar quantities, grades or styles of mineralization.

Dr. Eric P. Jensen, CPG, a Qualified Person as defined by National Instrument 43-101 and employee of the Company, has reviewed, verified and approved the disclosure of the technical information contained in this news release.

About EMX. EMX is a precious, base and battery metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and TSX Venture Exchange under the symbol “EMX”, and also trade on the Frankfurt exchange under the symbol “6E9”. Please see www.EMXroyalty.com for more information.

For further information contact:

David M. Cole

President and Chief Executive Officer

Phone: (303) 973-8585

Dave@emxroyalty.com

Scott Close

Director of Investor Relations Phone: (303) 973-8585

SClose@emxroyalty.com

Isabel Belger

Investor Relations (Europe)

Phone: +49 178 4909039

IBelger@EMXroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

Forward-Looking Statements

This news release may contain “forward-looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended September 30, 2023 (the “MD&A”), and the most recently filed Annual Information Form (“AIF”) for the year ended December 31, 2022, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedarplus.ca and on the SEC’s EDGAR website at www.sec.gov.

Figure 1. Location Maps of the Projects

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1508/192978_d114cad2e48ee9a7_002full.jpg

Figure 2. Exploration Targets on the Sagvoll Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1508/192978_d114cad2e48ee9a7_003full.jpg

Figure 3. Exploration Targets on the Meråker Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1508/192978_d114cad2e48ee9a7_004full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/192978

Vancouver, British Columbia–(Newsfile Corp. – December 28, 2023) – Goldshore Resources Inc. (TSXV: GSHR) (OTCQB: GSHRF) (FSE: 8X00) (“Goldshore” or the “Company“), is pleased to share a corporate update in regards to its ongoing activities.

Corporate Update Highlights:

- The Company is completing a Mineral Resource Estimate (“MRE”) update and expects the results of the study to be completed in January 2024.

- Goldshore continues to work with its metallurgical consultants on test work for heap leaching the low-grade material from the Moss Gold deposit, using various composites of ore size and grade. The result of the heap leach testing should be completed by the end of H1 2024.

- Once the new model, MRE and metallurgical testing are completed, the Company will commence Phase Two of the preliminary economic assessment (“PEA”), in scoping a project (size and scale) that deliver optimum economic results, appreciating the market’s discontent for large scale Cap-Ex projects. Completion of the PEA will be done by the end of August 2024.

- The Company hosted a Year in Review conference call with questions and answers from investors and can be viewed on: Media | Goldshore Resources.

Equity Grant to Management and Directors

Goldshore’s Board of Directors (“Board”) granted 3,569,333 incentive stock options (“Options”) and 2,095,332 restricted share units (“RSU”) to the directors, management, officers and consultants of the Company as part of its annual compensation plan. The Options are exercisable at $0.15 per share for a period of five (5) years and vest as follows: 1/3 on May 22, 2024, 1/3 on May 22, 2025 and 1/3 on May 22, 2026. The RSU’s vest 12 months from the date of grant as follows: 1,536,665 on December 11, 2024 and 558,667 on December 22, 2024.

About Goldshore

Goldshore is an emerging junior gold development company and owns 100% of the Moss Gold Project located in Ontario. The Company is well-financed and supported by an industry-leading management group and board of directors, and is well positioned to advance the Moss Gold Project through the next stages of exploration and development.

For More Information – Please Contact:

Brett A. Richards

President, Chief Executive Officer and Director

Goldshore Resources Inc.

P. +1 604 288 4416 M. +1 905 449 1500

E. brichards@goldshoreresources.com

W. www.goldshoreresources.com

Facebook: GoldShoreRes | Twitter: GoldShoreRes | LinkedIn: goldshoreres

This press release is not an offer to sell or the solicitation of an offer to buy the securities in the United States or in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to qualification or registration under the securities laws of such jurisdiction. The securities being offered have not been, nor will they be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act“) or any U.S. state securities laws, and such securities may not be offered or sold within the United States or to, or for the account or benefit of, U.S. persons absent registration or an applicable exemption from registration requirements of the U.S. Securities Act and applicable U.S. state securities laws.

THIS PRESS RELEASE, PROVIDED PURSUANT TO APPLICABLE CANADIAN REQUIREMENTS, IS NOT FOR DISTRIBUTION TO UNITED STATES NEWS SERVICES OR FOR DISSEMINATION IN THE UNITED STATES, AND DOES NOT CONSTITUTE AN OFFER OF THE SECURITIES DESCRIBED HEREIN. THE OFFERING IN QUESTION HAS NOT BEEN REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED, OR ANY STATE SECURITIES LAWS, AND THE SECURITIES SOLD IN SUCH OFFERING MAY NOT BE OFFERED OR SOLD IN THE UNITED STATES OR TO U.S. PERSONS ABSENT REGISTRATION OR APPLICABLE EXEMPTION FROM REGISTRATION REQUIREMENTS.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains statements that constitute “forward-looking statements.” Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects”, “plans”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, “potential” and similar expressions, or that events or conditions “will”, “would”, “may”, “could” or “should” occur.

Forward-looking statements in this news release include, among others, statements relating to expectations regarding the exploration and development of the Moss Gold Project, the release of an updated mineral resource estimate and preliminary economic assessment, and other statements that are not historical facts. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors and risks include, among others: the Company may require additional financing from time to time in order to continue its operations which may not be available when needed or on acceptable terms and conditions acceptable; compliance with extensive government regulation; domestic and foreign laws and regulations could adversely affect the Company’s business and results of operations; the stock markets have experienced volatility that often has been unrelated to the performance of companies and these fluctuations may adversely affect the price of the Company’s securities, regardless of its operating performance; and the impact of COVID-19.

The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/192532

💎 Diamcor Mining 💎: TSX.V: DMI

Website: https://diamcormining.com/

Corporate Deck: https://diamcormining.com/_resources/…

Contact:

Mr. Rich Matthews

rmatthews@integcom.us

+1 (604) 757-7179

Mr. Dean H. Taylor

deant@diamcor.com

1.250.864.3326

About Diamcor 💎: Diamcor Mining Inc. is a publicly traded Canadian company with a proven history of supplying rough diamonds to the world market. Diamcor has established a long-term strategic alliance with world famous luxury retailer Tiffany & Co. and is now in the final stages of developing the Krone-Endora at Venetia Project co-located with De Beer’s flagship Venetia mine.

Key Takeaways

- The U3O8 uranium spot price broke through $80 per pound, gaining 8.39% in November and is up 67.10% YTD; uranium stocks followed suit.

- Uranium continues to outperform other commodities and demonstrate its strong fundamentals.

- Both Western and Eastern nations made important geopolitical maneuvers in November to secure uranium supplies.

- Competition for uranium supply is rapidly intensifying, driven by the increasing importance of nuclear energy and the growing awareness of an impending supply-demand gap.

- COP28 was dubbed the “nuclear COP” as nuclear energy took center stage.

Performance as of November 30, 2023

| Asset | 1 MO* | 3 MO* | YTD* | 1 YR | 3 YR | 5 YR |

| U3O8 Uranium Spot Price 1 | 8.39% | 33.16% | 67.10% | 63.32% | 39.69% | 22.87% |

| Uranium Mining Equities (Northshore Global Uranium Mining Index) 2 | 6.31% | 26.90% | 54.22% | 46.74% | 54.38% | 27.87% |

| Uranium Junior Mining Equities (Nasdaq Sprott Junior Uranium Miners Index TR) 3 | 7.47% | 28.70% | 42.66% | 30.94% | 54.22% | N/A |

| Broad Commodities (BCOM Index) 4 | -2.69% | -3.98% | -9.75% | -12.28% | 11.04% | 4.28% |

| U.S. Equities (S&P 500 TR Index) 5 | 9.13% | 1.74% | 20.80% | 13.84% | 9.76% | 12.51% |

*Performance for periods under one year not annualized.

Sources: Bloomberg and Sprott Asset Management LP. Data as of 11/30/2023. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

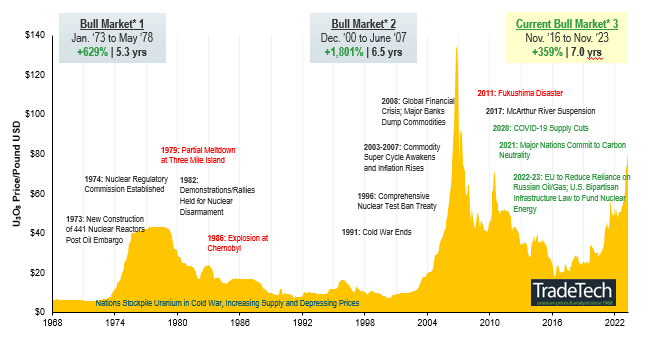

Uranium’s Resurgence to a 16-Year High

The U3O8 uranium spot price gained 8.39% in November, increasing from US$74.48 to $80.73 per pound as of November 30, 2023.1 Uranium has posted a stellar 67.10% year-to-date return as of November 30, 2023, and continued to show strength and diversification relative to other commodities, which declined 9.75% (as measured by the BCOM Index).

Breaking through the $80 per pound level represents a high price for the current uranium bull market and a price level not seen in almost 16 years. Uranium’s all time high of $136 was reached in 2007 at the end of the last commodity supercycle which ended due to the 2008 Global Financial Crisis. Following the GFC, the uranium price was in a state of decline through 2016, when it reached a month-end low of $17.75 on November 30, 2016. Although November was characterized by lower inflation and favorable 2024 interest rate change expectations, which provided many asset classes with a boost, energy and metals commodity markets were largely negative, with the notable exception of uranium. This trend continues to showcase the uranium market’s economic insensitivity and diversification to major asset classes.

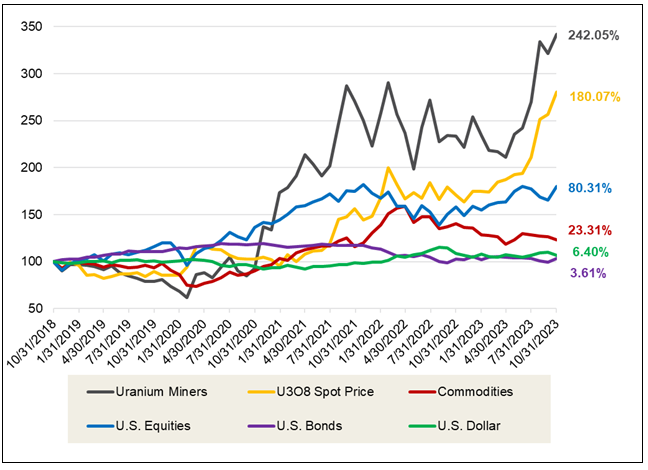

Over the longer term, physical uranium and uranium equities have demonstrated significant outperformance against broad asset classes, particularly other commodities. For the five years ended November 30, 2023, the U3O8 spot price has risen a cumulative 180.07% compared to 23.31% for the broader commodities index (BCOM), as shown in Figure 1.

Figure 1. Physical Uranium & Uranium Stocks Have Outperformed Other Asset Classes Over the Past Five Years (11/30/2018-11/30/2023)

Source: Bloomberg and Sprott Asset Management. Data as of 09/30/2023. Uranium miners are measured by the Northshore Global Uranium Mining Index (URNMX index); U.S. Equities are measured by the S&P 500 TR Index; the U308 spot price is from TradeTech; U.S. Bonds are measured by the Bloomberg Barclays US Aggregate Bond Index (LBUSTRUU); Commodities are measured by the Bloomberg Commodity Index (BCOM); and the U.S. Dollar is measured by DXY Curncy Index. Definitions of the indices are provided in the footnotes. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

The Urgency of the Uranium Supply Race

Geopolitical uncertainty and concerns about the security of uranium supply continue to be the driving forces behind the ongoing uranium rally. Notably, French President Emmanuel Macron’s November visit to Kazakhstan marked a pivotal event. During this visit, a significant joint declaration was made to enhance trade and cooperation in the fields of nuclear energy and strategic minerals. Additionally, a crucial agreement was signed, focusing on collaboration in the nuclear fuel cycle.6 These strengthened ties between France and Kazakhstan come at a critical juncture for France, especially in light of deteriorating relations with Niger following the July coup. Niger’s military junta has publicly accused France of attempting to destabilize the country, leading to the closure of borders and heightened uncertainty surrounding France’s uranium supply from Niger. It’s worth noting that France shares a deep historical connection with Niger, having maintained control until Niger gained independence in 1960. Over the past decade, France has relied heavily on Niger for almost 20% of its uranium imports, a substantial proportion considering that Niger’s contribution to global production stands at just 4%.7,8

France & the West Move to Secure Supply…

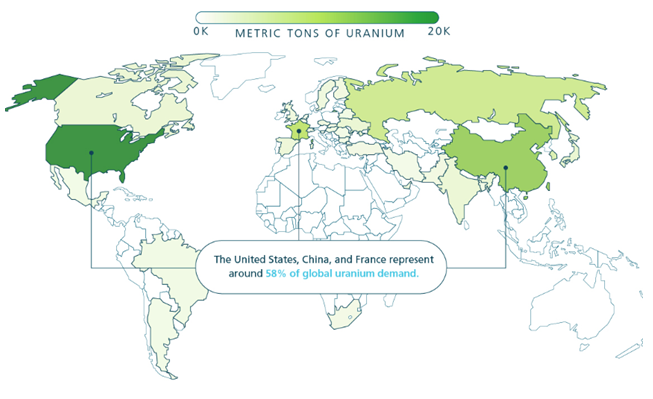

Kazakhstan and France play pivotal roles in the uranium markets, each contributing substantially to the industry. Kazakhstan, as the world’s leading uranium producer, accounts for an impressive 43% of the global mine production in 2022. On the other hand, France stands out not only as the world’s third-largest consumer of uranium, as illustrated in Figure 2, but also boasts a significant reliance on nuclear energy, which accounts for 63% of its total electricity generation. Given these vital positions, the evolving situation in Niger, coupled with an inherent supply-demand gap in the broader uranium market, has heightened the imperative for ensuring the security of supply, not just for France but for all nations reliant on uranium resources.

Western nations are particularly vulnerable due to their shift away from Russia for nuclear fuel supply services. While Russia contributed only 5% to the global uranium mine supply in 2022, it plays a more substantial role in uranium conversion and enrichment services. Consequently, Western utilities are still accepting deliveries of Russian-enriched uranium, but they are implementing self-sanctions by refraining from entering into new contracts. Moreover, legislative efforts are gaining momentum, aiming to restrict uranium imports into the United States. The Prohibiting Russian Uranium Imports Act has recently garnered approval in the U.S. House and now awaits consideration in the Senate (was passed on 12/11/2023 by U.S. House of Representatives). Time is limited for its passage within the current year. If the act is ratified, it will lead to a ban on Russian uranium imports 90 days after its enactment, while allowing for temporary waivers until 2028.9

…Along with Russia and China

Eastern nations are also actively pursuing the assurance of a stable uranium supply. While Russia does engage in uranium mining, its domestic production falls short of meeting its extensive demands to fuel both domestic and Russian-built reactors in various countries. Consequently, Russia also uses its southern neighbor, Kazakhstan, for access to uranium resources. In a reciprocal effort, following French President Emmanuel Macron’s visit to Kazakhstan, Russian President Vladimir Putin embarked on a visit to further strengthen Russian-Kazakh relations just one week later.10 These diplomatic overtures align with China’s President Xi Jinping’s visit to Kazakhstan in October, where he emphasized the need for increased cooperation.11

China stands out with the second-largest uranium reactor requirements globally and ambitious nuclear expansion plans, currently overseeing the construction and planning of 68 reactors, compared to the 55 already operational. Given the scale of both current and anticipated future demand, China is deeply committed to securing its uranium supply for the long term. Leveraging its historical capability to invest significantly in commodity supply chains well in advance of actual requirements, it is likely that a substantial portion of Kazakh supply, including the announced capacity increases to 100% by 2025, will primarily flow into China. As a notable illustration, the China National Uranium Corporation is presently expanding its storage capacity at its warehouse along the Kazakhstan-China border, increasing it from 3,000 tU to 20,000 tU—almost double China’s anticipated annual reactor requirements for 2023.12

The competition for uranium supply is rapidly intensifying, driven by the increasing importance of nuclear energy and the growing awareness of an impending supply-demand gap. This situation has been exacerbated by the fact that mine supply has consistently lagged behind reactor requirements for more than a decade. To bridge this gap, the industry has been compelled to depend on secondary sources, mainly utility inventories through either direct sales or, more notably, inventory drawdowns. We firmly believe that the era of destocking has come to an end, and the supply-demand deficit appears poised to endure. This scenario is likely to provide ample room for the uranium bull market to flourish.

Figure 2. Uranium Demand for Nuclear Power

Source: World Nuclear Association, November 2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

The “Nuclear COP”

Nuclear energy sentiment and international collaboration were abundant in the United Nations COP28 (Conference of the Parties). COP28 took place this month, eight years after the signing of the Paris Agreement, and saw world leaders convene to discuss their collective commitments to limit global warming to below 2, preferably to 1.5 degrees, Celsius compared to pre-industrial levels.

During COP28, more than 20 nations, including the United States, France, Japan and the UK, made a significant commitment to triple global nuclear energy generation by 2050.13 COP28 was held in the United Arab Emirates, and amidst reports of geopolitical disagreements affecting discussions on fossil fuels, nuclear energy took center stage as a pivotal point of collaboration during the conference. Some even referred to this event as the “nuclear COP,” underscoring its newfound prominence on the international stage. This represents a substantial acceleration in the global sentiment towards nuclear energy. In contrast, at COP27 the previous year, the most concrete nuclear-related developments were limited to altering the agreement’s language to prioritize “low-emission” energy sources rather than solely “renewables.” Additionally, it marked the first time nuclear energy was even considered in the conversation, a significant shift from its exclusion at COP26.

Nuclear energy has undeniably experienced a boost in favor, as governments worldwide come to recognize the imperative of dependable baseload power to counterbalance the intermittent nature of renewable energy sources. A noteworthy advantage of nuclear energy lies in its capacity factor, which stands at an impressive 93%. This metric represents the ratio of the total energy generated over a specific period to what the plant would have produced at full capacity. By comparison, renewables like solar and wind lag behind, with capacity factors of 25% and 36%, respectively.

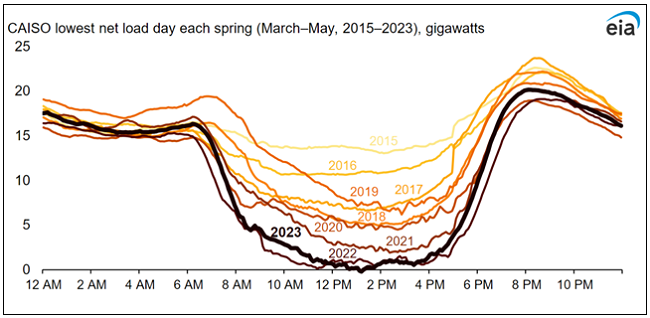

Moreover, the growing investment in solar energy by numerous nations has underscored the critical importance of reliable power supply. This need becomes even more pronounced when considering that peak electricity demand frequently occurs after sunset when solar power becomes unavailable. This phenomenon is exemplified by California’s duck curve, a graph depicting the growing gap between electricity supply and demand as the sun sets, emphasizing the urgency of securing stable energy sources.

Figure 3. California’s Duck Curve Is Getting Deeper

Source: EIA. As solar capacity grows, duck curves are getting deeper in California. Included for illustrative purposes only. Past performance is no guarantee of future results.

Uranium Miners Developments

Uranium miners ascended in tandem with the U3O8 uranium spot price, with the broad sector of uranium miners rising by 6.31%2 and junior uranium miners gaining 7.47%.3

As the price of uranium has increased significantly, uranium mine projects are starting to come online. Restarts, projects that had been producing uranium and then stopped and put on care and maintenance, have been the logical start to a supply response.

In November, enCore Energy Corp. (enCore) announced the successful startup of uranium production at its Rosita plant.14 enCore also plans to restart its Alta Mesa plant in early 2024. These restarts are both located in Texas and should help to start the revival of the U.S.’s domestic uranium production.

Though restarts such as enCore’s and Boss Energy Ltd.’s Honeymoon project (see last month’s commentary) are critical to helping address the uranium market’s supply-demand deficit, new builds will also be needed for this endeavor. New builds take many years to both develop and go through the permitting process, and total lead times can take 10 to 15 years.15

NexGen Energy Ltd. (Nexgen) is a uranium developer focused on the Rook 1 Project located in the Athabasca Basin of Saskatchewan, Canada. In November, Nexgen announced it had received a major milestone with Saskatchewan’s environmental approval for its Rook 1 project.16 The 98,739 tU indicated mineral resources Rook 1 Project next step in the permitting process is for federal approval. This marks a further significant development as even though the Athabasca Basin is a large source of high-grade uranium, this Rook 1 environmental approval is the first in more than 20 years.

Global Atomic Corporation (Global Atomic) released an update on its Dasa project in Niger. In August, the coup d’état in Niger forced Global Atomic to announce delays of 6-12 months in the first production at Dasa to end of 2025.17 In November, their update on the situation in Niger seemed to help soothe investor concerns as the stock jumped and outperformed peers. In this update, the Global Atomic President and CEO noted, “Further to our Q2 2023 update regarding the Republic of Niger, a transition government is in place and includes a new Prime Minister and Cabinet, as well as the previous experienced staff in the Government Ministries. The Government of Niger is a 20% owner of the Dasa Project and recognizes that the Dasa Mine will benefit the Republic of Niger by generating royalty and tax revenue, creating new jobs and opportunities for local business and revitalize the northern region of the country. The Government has offered its positive support for the development of the Dasa Project.” 18

A Concerning Supply Deficit

As global uranium mine production consistently falls short of the world’s burgeoning uranium reactor demands, a concerning supply deficit is projected to materialize over the next decade. This deficit is further exacerbated by a decade of insufficient investment in supply infrastructure. Additionally, the prospects for future supply are hindered by extended lead times and substantial capital requirements. Consequently, we deem the reactivation of dormant mines and the development of new ones as absolutely critical. The uranium price target as an incentive for reviving existing mines and initiating greenfield projects is a moving target. Our assessment suggests that achieving higher uranium prices will be necessary to stimulate sufficient production and bridge the forecasted deficits. Looking ahead, the persistent growth in demand amid an uncertain uranium supply landscape is expected to bolster a sustained bullish market trend, as depicted in Figure 4.

Figure 4. Uranium Bull Market Continues (1968-2023)

Note: A “bull market” refers to a condition of financial markets where prices are generally rising. A “bear market” refers to a condition of financial markets where prices are generally falling.