Casa Grande, AZ and Toronto, ON, July 16, 2024 – Arizona Sonoran Copper Company Inc. (TSX:ASCU) (“ASCU” or the “Company”), releases its updated Mineral Resource Estimate (“MRE”) for the Cactus brownfield copper project, located 45 miles south of Phoenix, Arizona (see FIGURES 1-3). The updated and expanded MRE is inclusive of a seven-month drilling program targeting the MainSpring property, which was completed in April 2024. The Cactus Project is wholly owned and located on private land in Arizona with direct road and rail access, infrastructure onsite, is at an advanced permitting stage, and has permitted access to onsite water wells. Highlights and key changes from the updated MRE are listed below.

Highlights:

- Updated total Cactus Project Mineral Resource Estimate (“MRE”) including Primary Mineral Resources:

- Measured and Indicated (“M&I”) 632.6 million short tons @ 0.58% Total Copper (“CuT”) for 7.3 billion pounds (“lbs”) of copper

- Inferred 474.0 million short tons @ 0.41% CuT for 3.8 billion lbs of copper

- Key Changes:

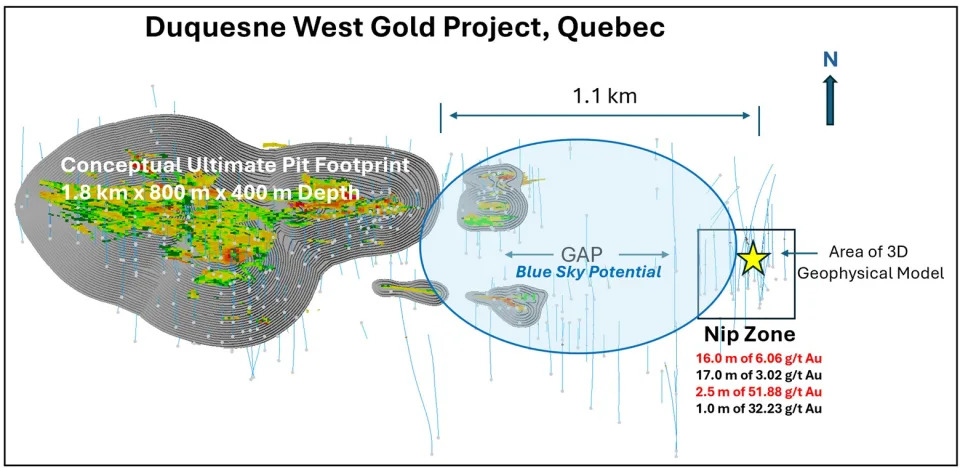

- Confirms Parks/Salyer and MainSpring as one deposit, renamed to “Parks/Salyer”

- Parks/Salyer mineral resource contains 339.0 million short tons @ 0.71% CuT for 4.8 billion lbs of copper in the M&I category and 299.3 million short tons @ 0.43% CuT for 2.6 billion lbs of copper in the Inferred category

- Parks/Salyer amenable as an open pit within the pending Preliminary Economic Assessment

- New Parks/Salyer mineral resource dimensions are 6,400 feet (“ft”)(1,950 meters (“m”) by 3,000 ft (915 m) to a maximum depth of 2,350 ft (716 m) below surface

- 1,904% increase to the Measured Category with inclusion of initial Measured mineral resources at Parks/Salyer, 26% increase to the total M&I and a 60% increase in total Inferred resource, with no change to cut-off grade criteria or underlying price and cost assumptions

- 42% increase of M&I mineral resources at Parks/Salyer attributed to success of measured infill drilling program, reporting of open pit resources, and reporting based on total copper pounds

- Parks/Salyer infill drilling (56,907 ft | 17,345 m) converted 55.9 M short tons @ 1.03% CuT for 1.2 billion lbs of copper reported to the measured category

- 60% increase to the Inferred mineral resources attributed to expansion of Parks/Salyer mineral resource onto the MainSpring property and reporting based on total copper pounds

- 7-month drilling program at MainSpring (49,193 ft | 14,994 m) delivered 244.9 M short tons @ 0.39% CuT for 1.9 Billion lbs of copper reported to the Inferred mineral resource

- Confirms Parks/Salyer and MainSpring as one deposit, renamed to “Parks/Salyer”

Table 1 below reports the July 11, 2024, Cactus Project MRE, containing the combined Parks/Salyer, Cactus West, Cactus East, and Stockpile mineral resource areas. Each mineral resource area is broken out individually in Table 4. Mineral resources defined within this July 11, 2024, the Cactus Project MRE will be used to form the basis of the ASCU Preliminary Economic Assessment (“PEA”), on track for release in early Q3 2024.

TABLE 1: Cactus Project MRE, Contained Copper Separated into Total Copper and Soluble Copper

| Material Type | Tons kt | Grade CuT % | Grade Cu Tsol % | Contained Total Cu (k lbs) | Contained Cu Tsol (k lbs) |

| Measured | |||||

| Total Leachable | 55,200 | 0.94 | 0.79 | 1,032,200 | 873,800 |

| Total Primary | 12,300 | 0.51 | 0.05 | 124,400 | 13,400 |

| Total Measured | 67,500 | 0.86 | 0.66 | 1,156,500 | 887,200 |

| Indicated | |||||

| Total Leachable | 414,800 | 0.60 | 0.53 | 4,965,000 | 4,365,700 |

| Total Primary | 150,400 | 0.39 | 0.04 | 1,173,300 | 126,000 |

| Total Indicated | 565,200 | 0.54 | 0.40 | 6,138,200 | 4,491,700 |

| M&I | |||||

| Total Leachable | 470,000 | 0.64 | 0.56 | 5.997,200 | 5,239,500 |

| Total Primary | 162,700 | 0.40 | 0.04 | 1,297,600 | 139,400 |

| Total M&I | 632,600 | 0.58 | 0.43 | 7,294,800 | 5,378,900 |

| Inferred | |||||

| Total Leachable | 299,600 | 0.43 | 0.38 | 2,572,400 | 2,262,800 |

| Total Primary | 174,500 | 0.36 | 0.04 | 1,267,500 | 124,700 |

| Total Inferred | 474,000 | 0.41 | 0.25 | 3,839,900 | 2,387,500 |

NOTES:

1. Total soluble copper grades (Cu TSol) are reported using sequential assaying to calculate the soluble copper grade. Tons are reported as short tons.

2. Stockpile resource estimates have an effective date of 1st March, 2022, Cactus mineral resource estimates have an effective date of 29th April, 2022, Parks/Salyer-MainSpring mineral resource estimates have an effective date of 11th July, 2024. All mineral resources use a copper price of US$3.75/lb.

3. Technical and economic parameters defining mineral resource pit shells: mining cost US$2.43/t; G&A US$0.55/t, 10% dilution, and 44°-46° pit slope angle.

4. Technical and economic parameters defining underground mineral resource: mining cost US$27.62/t, G&A US$0.55/t, and 5% dilution. Underground mineral resources are only reported for material located outside of the open pit mineral resource shells. Designation as open pit or underground mineral resources are not confirmatory of the mining method that may be employed at the mine design stage.

5. Technical and economic parameters defining processing: Oxide heap leach (HL) processing cost of US$2.24/t assuming 86.3% recoveries, enriched HL processing cost of US$2.13/t assuming 90.5% recoveries, sulphide mill processing cost of US$8.50/t assuming 92% recoveries. HL selling cost of US$0.27/lb; Mill selling cost of US$0.62/lb.

6. Royalties of 3.18% and 2.5% apply to the ASCU properties and state land respectively. No royalties apply to the MainSpring property.

7. Variable cut-off grades were reported depending on material type, potential mining method, potential processing method, and applicable royalties. For ASCU properties – Oxide open pit or underground material = 0.099% or 0.549% TSol respectively; enriched open pit or underground material = 0.092% or 0.522% TSol respectively; primary open pit or underground material = 0.226% or 0.691% CuT respectively.For state land property – Oxide open pit or underground material = 0.098 % or 0.545% TSol respectively; enriched open pit or underground material = 0.092% or 0.518% TSol respectively; primary openpit or underground material = 0.225% or 0.686% CuT respectively.For MainSpring properties – Oxide openpit or underground material = 0.096% or 0.532% TSol respectively; enriched open pit or underground material = 0.089% or 0.505% TSol respectively; primary open pit or underground material = 0.219% or 0.669% CuT respectively. Stockpile cutoff = 0.095% TSol.

8. Mineral resources, which are not mineral reserves, do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, sociopolitical, marketing, or other relevant factors.

9. The quantity and grade of reported inferred mineral resources in this estimation are uncertain in nature and there is insufficient exploration to define these inferred mineral resources as an indicated or measured mineral resource; it is uncertain if further exploration will result in upgrading them to an indicated or measured classification.

10. Totals may not add up due to rounding.

George Ogilvie, Arizona Sonoran Copper Company President and CEO commented, “The new Parks/Salyer deposit, inclusive of MainSpring could be transformational for the Company as we foresee the opportunity to right size a larger operation and rescope Parks/Salyer to an open pit mine. The pending result would lead to reduced mining execution risks and lowered operating costs which could manifest themselves in improved Project economics. The key difference in the larger mineral resource used for the pending PEA, relates to the MainSpring property acquisition and subsequent inferred drilling program identifying the continuation of near surface mineralization south of Parks/Salyer.”

Doug Bowden, Arizona Sonoran Copper Company VP Exploration stated, “Our Cactus Project is a successful copper porphyry growth story resulting from an aggressive exploration program. Our mineral resource journey began with our initial PEA in 2021, and continuously expanded outward from the Cactus Pit area to include Parks/Salyer and most recently MainSpring within the 5.5 km mine trend. The Parks/Salyer discovery includes significant quantities of high-grade (+1.00% CuT) copper, similar to the grades in Cactus East (as shown in FIGURES 2 and 3). Through systematic step out and infill drilling following our first mineral resource in 2021 to today’s update, our Cactus Project MRE indicates an increase to the M&I by an impressive 353%, from 1.61 Billion lbs to 7.29 Billion lbs of copper, while the inferred mineral resources increased 94%, from 1.98 Billion lbs to 3.84 Billion lbs. Lastly, these mineral resource areas have responded favorably and impressively to infill drilling with a consistently high conversion rate into higher resource classifications and will look forward to future infill programs as we move through the technical studies.”

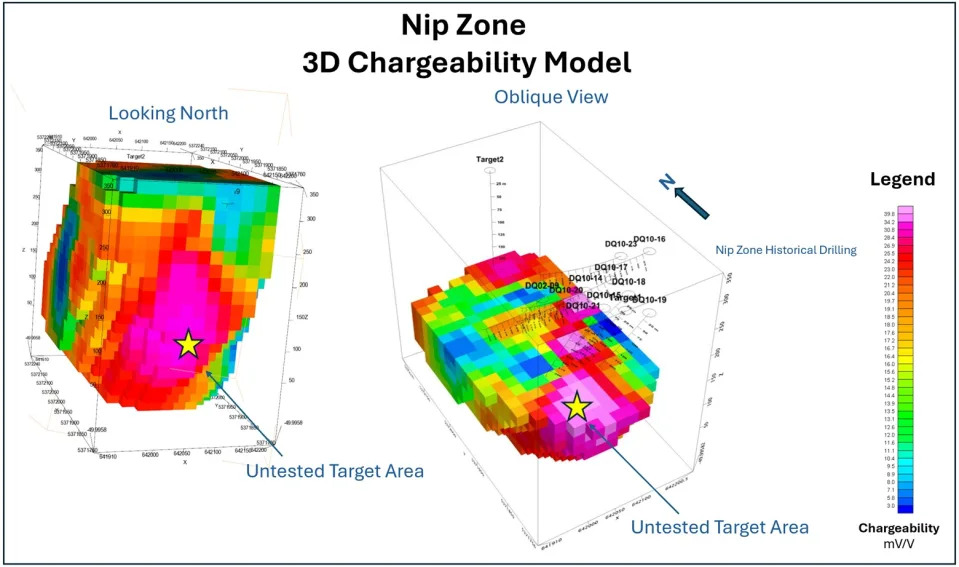

Cactus Mineral Resources Estimate

The Parks/Salyer mineral resources as shown in FIGURE 3, inclusive of MainSpring, indicate 339.0 M short tons @ 0.71% CuT in the M&I category and 299.2 M short tons @ 0.43% CuT in the Inferred Category. Notably, Parks/Salyer is mostly contained within an optimized resource open pit shell indicating the rescoped potential of open pit mining of the deposit with the inclusion of shallower mineralization located on the MainSpring property. Parks/Salyer mineral resources were calculated with a cutoff date of March 31, 2024. There are no material changes to the Cactus East, West and Stockpile deposits as reported within the FEB 21, 2024 PFS.

For the purposes of the MRE, Cactus East reports as open pit mineral resources in compliance with Reasonable Prospects for Eventual Economic Extraction (“RPEEE”). For the purposes of the pending PEA, Cactus East is expected to be exploited as an underground operation.

Table 2 below reports a direct like–for-like comparison of the updated July 11, 2024, MRE, to the MRE comprising the Prefeasibility Study (“PFS”) MRE and illustrates a significant change to the Measured (+1,900%) and Inferred (+60%) categories, as it relates to successful expansion and infill programs at Parks/Salyer, including the MainSpring Property. The Table below calculates a combination of the Soluble Copper grades and Total Copper grades based on the leachable (oxides and enriched) zones, and the primary sulphides, respectively, going forward, mineral resources will calculate both the contained Total Copper and Soluble Copper inventory. Table 2 uses the same notes and assumptions as Table 1.

Table 2: The Cactus Project Mineral Resource Estimate, as of July 11, 2024, as Compared to August 31, 2023

| PREVIOUS MINERAL RESOURCE (As of August 31, 2023) | UPDATED MINERAL RESOURCE (As of July 11, 2024) | VARIANCE | |||||

| Material Type | Tons kt | Grade Cu%¹ | Contained Cu k lbs | Tons kt | Grade Cu%¹ | Contained Cu k lbs | Cu Content % |

| Leachable | 9,100 | 0.23¹ | 41,900 | 55,200 | 0.79¹ | 873,800 | 1,985% |

| Primary | 1,300 | 0.32 | 8,000 | 12,300 | 0.51 | 124,400 | 1,455% |

| Total Measured | 10,400 | 0.24 | 49,800 | 67,500 | 0.74 | 998,200 | 1,904% |

| Leachable | 348,500 | 0.63¹ | 4,387,200 | 414,800 | 0.53¹ | 4,365,700 | 0% |

| Primary | 86,800 | 0.43 | 737,000 | 150,400 | 0.39 | 1,173,300 | 59% |

| Total Indicated | 435,300 | 0.59 | 5,124,200 | 565,200 | 0.49 | 5,539,000 | 8% |

| Leachable | 357,600 | 0.62¹ | 4,429,000 | 470,000 | 0.56¹ | 5,239,500 | 18% |

| Primary | 88,000 | 0.42 | 745,000 | 162,700 | 0.40 | 1,297,600 | 74% |

| Total M&I | 445,700 | 0.58 | 5,174,000 | 632,600 | 0.52 | 6,537,100 | 26% |

| Leachable | 107,700 | 0.61¹ | 1,307,900 | 299,600 | 0.38¹ | 2,262,800 | 73% |

| Primary | 126,200 | 0.36 | 900,000 | 174,500 | 0.36 | 1,267,500 | 41% |

| Total Inferred | 233,800 | 0.47 | 2,207,900 | 474,000 | 0.37 | 3,530,300 | 60% |

NOTES: refer to TABLE 1

1 Grade shown is Soluble Copper (Cu TSol)

Drilling programs

The updated Cactus Project MRE is supported by a systematic drilling program targeting MainSpring, the near surface southern extension of the Parks/Salyer deposit, and infill to measured drilling at Parks/Salyer, within the 5.5 kilometre (“km”) (~3.5 mile (“mi”)) mine trend. Mineral resources were classified using data of 125 ft (38 m) drill spacing for Measured, 250 ft (76 m) drill spacing for Indicated and 500 ft (~152 m) drill spacing for Inferred. The in-ground mineral resources were calculated using 435 total drillholes including 161 new holes drilled into the Cactus West and East deposits since 2019 and 159 new holes drilled into the Parks/Salyer deposits since 2020. The Stockpile mineral resource was calculated using 514 new holes drilled into the stockpile on a regular grid since 2021. The isolated MainSpring mineral resource estimate containing 244.9 M short tons @ 0.39% CuT, is shown in TABLE 3 below, while each deposit is broken out separately within TABLE 4.

TABLE 3: MainSpring Property Resource contained within New Parks/Salyer Mineral Resource

| Material Type | Tons kt | Grade CuT % | Grade Cu Tsol % | Contained Total Cu (k lbs) | Contained Cu Tsol (k lbs) |

| Inferred | |||||

| Total Leachable | 200,100 | 0.39 | 0.34 | 1,562,700 | 1,370,300 |

| Total Primary | 44,800 | 0.38 | 0.04 | 344,000 | 33,100 |

| Total Inferred | 244,900 | 0.39 | 0.29 | 1,906,700 | 1,403,500 |

NOTES: refer to TABLE 1

TABLE 4: Cactus Project Mineral Resources by Resource Area

| Material Type | Tons kt | Grade CuT % | Grade Cu Tsol % | Contained Total Cu (k lbs) | Contained Cu Tsol (k lbs) | |

| Measured | ||||||

| Leachable | Parks Salyer O/P | 45,000 | 1.09 | 0.92 | 981,200 | 828,700 |

| Parks Salyer U/G | 5 | 1.30 | 0.92 | 100 | 100 | |

| Cactus O/P | 10,200 | 0.25 | 0.22 | 50,800 | 45,000 | |

| Cactus U/G | n/a | |||||

| Stockpile | n/a | |||||

| Total Leachable | 55,200 | 0.93 | 0.79 | 1,032,100 | 873,800 | |

| Primary | Parks Salyer O/P | 10,900 | 0.53 | 0.06 | 115,500 | 12,200 |

| Parks Salyer U/G | 40 | 0.77 | 0.07 | 700 | 100 | |

| Cactus O/P | 1,300 | 0.32 | 0.04 | 8,200 | 1,100 | |

| Cactus U/G | n/a | |||||

| Stockpile | n/a | |||||

| Total Primary | 12,300 | 0.51 | 0.05 | 124,400 | 13,400 | |

| Total Measured | 67,500 | 0.86 | 0.66 | 1,156,500 | 887,200 | |

| Indicated | ||||||

| Leachable | Parks Salyer O/P | 201,300 | 0.75 | 0.66 | 3,027,000 | 2,671,100 |

| Parks Salyer U/G | 1,100 | 0.96 | 0.85 | 21,400 | 18,900 | |

| Cactus O/P | 131,000 | 0.55 | 0.49 | 1,446,100 | 1,277,000 | |

| Cactus U/G | 10,200 | 1.04 | 0.89 | 213,100 | 181,100 | |

| Stockpile | 71,100 | 0.18 | 0.15 | 257,400 | 217,600 | |

| Total Leachable | 414,800 | 0.60 | 0.53 | 4,965,000 | 4,365,700 | |

| Primary | Parks Salyer O/P | 80,400 | 0.42 | 0.04 | 680,600 | 69,200 |

| Parks Salyer U/G | 100 | 0.77 | 0.12 | 1,200 | 200 | |

| Cactus O/P | 68,300 | 0.34 | 0.03 | 465,800 | 45,100 | |

| Cactus U/G | 1,600 | 0.81 | 0.36 | 25,700 | 11,500 | |

| Stockpile | n/a | |||||

| Total Primary | 150,400 | 0.39 | 0.04 | 1,173,300 | 126,000 | |

| Total Indicated | 565,200 | 0.54 | 0.40 | 6,138,200 | 4,491,700 | |

| Measured & Indicated | ||||||

| Leachable | Parks Salyer O/P | 246,300 | 0.81 | 0.71 | 4,008,200 | 3,499,800 |

| Parks Salyer U/G | 1,100 | 0.98 | 0.86 | 21,500 | 19,000 | |

| Cactus O/P | 141,200 | 0.53 | 0.47 | 1,496,900 | 1,322,000 | |

| Cactus U/G | 10,200 | 1.04 | 0.89 | 213,100 | 181,100 | |

| Stockpile | 71,100 | 0.18 | 0.15 | 257,400 | 217,600 | |

| Total Leachable | 470,000 | 0.64 | 0.56 | 5,997,200 | 5,239,500 | |

| Primary | Parks Salyer O/P | 91,300 | 0.44 | 0.04 | 796,100 | 81,400 |

| Parks Salyer U/G | 100 | 0.95 | 0.15 | 1,900 | 300 | |

| Cactus O/P | 69,600 | 0.34 | 0.03 | 474,000 | 46,200 | |

| Cactus U/G | 1,600 | 0.80 | 0.36 | 25,700 | 11,500 | |

| Stockpile | n/a | |||||

| Total Primary | 162,700 | 0.40 | 0.04 | 1,297,600 | 139,400 | |

| Total M&I | 632,600 | 0.58 | 0.43 | 7,294,800 | 5,378,900 | |

| Inferred | ||||||

| Leachable | Parks Salyer O/P | 234,500 | 0.42 | 0.38 | 1,990,200 | 1,767,500 |

| Parks Salyer U/G | 9,600 | 0.84 | 0.76 | 161,200 | 146,300 | |

| Cactus O/P | 50,400 | 0.34 | 0.28 | 344,600 | 286,900 | |

| Cactus U/G | 3,900 | 0.94 | 0.77 | 72,800 | 59,100 | |

| Stockpile | 1,200 | 0.15 | 0.13 | 3,600 | 3,000 | |

| Total Leachable | 299,600 | 0.43 | 0.38 | 2,572,400 | 2,262,800 | |

| Primary | Parks Salyer O/P | 54,100 | 0.39 | 0.04 | 427,300 | 41,000 |

| Parks Salyer U/G | 1,000 | 0.82 | 0.26 | 16,700 | 5,300 | |

| Cactus O/P | 117,800 | 0.34 | 0.03 | 798,700 | 68,300 | |

| Cactus U/G | 1,500 | 0.82 | 0.33 | 24,900 | 10,200 | |

| Stockpile | n/a | |||||

| Total Primary | 174,500 | 0.36 | 0.04 | 1,267,600 | 124,800 | |

| Total Inferred | 474,000 | 0.41 | 0.25 | 3,839,900 | 2,387,500 | |

NOTES: refer to TABLE 1

Cactus Project Mineral Resource Modelling

The geological modelling, statistical analysis, and resource estimation in respect of the Cactus Project MRE were prepared by the ASCU resource team and by Allan Schappert – CPG #11758, who is a qualified person as defined by National Instrument 43-101– Standards of Disclosure for Mineral Projects (“NI 43-101”).

The Cactus Project MRE updates are based upon updated drilling data and interpretations. The Cactus Mineral Resource model was developed in Vulcan. Drilling data is supported by industry standard quality assurance and quality control programs, with quality control sampling comprising preparation blanks, certified reference materials, and field and pulp duplicate analyses. Review of the QA/QC data indicates it is of a quality suitable for use in resource estimation.

The mineralized domains are consistent with domaining for porphyry copper systems. Mineralized domains represent combinations of rock type and copper mineral zonation associated with secondary copper enrichment weathering processes. The main mineral zones are leached, oxide, enriched, and primary. Mineral zones are determined by logging and the assay attributes of sequential copper analyses.

Physical density measurements have been undertaken across the deposits, both historically by ASARCO, and more recently by ASCU. Density measurements on inground deposits use the wet / dry weight method and comprise 3,372 samples for Cactus and 143 samples for Parks/Salyer. Due to the unconsolidated nature of the stockpile material, physical bulk density measurements were attained by weight and volume calculations. Four test holes were excavated from which the material removed was dried and weight and the volume of each hole calculated.

Copper grades were estimated using Ordinary Kriging, using 20 ft (6.1 m) composites and top cutting determined by log normal probability plots on a per domain basis. Grade estimates were validated using visual and statistical methods including statistical distribution comparisons, visual comparison against the drilling data on sections, swath plots comparing block grades trends against de-clustered composites, and by smoothing checks using change of support. The effective date of the Cactus Project MRE is July 11, 2024. The Cactus Project MRE will form the basis of a PEA technical report prepared in accordance with NI 43-101, and prepared by M3 Engineering, which will be filed on SEDAR+ under the Company’s issuer profile within 45 days of this news release and will also be available at such time on the Company’s website. The PFS will be superseded in all respects once the Company has publicly disclosed the PEA.

Quality Assurance / Quality Control

Drilling completed on the project between 2020 and 2024 was supervised by on-site ASCU personnel who prepared core samples for assay and implemented a full QA/QC program using blanks, standards, and duplicates to monitor analytical accuracy and precision. The samples were sealed on site and shipped to Skyline Laboratories in Tucson AZ for analysis. Skyline’s quality control system complies with global certifications for Quality ISO9001:2008.

Scientific and technical information contained in this news release have been reviewed and verified by Allan Schappert – CPG #11758, who is a qualified person as defined by NI 43-101.

Links from the Press Release

Figures: https://arizonasonoran.com/projects/cactus-mine-project/press-release-images/

February 21, 2024: https://arizonasonoran.com/news-releases/arizona-sonoran-announces-a-positive-pre-feasibility-study-for-the-cactus-mine-project-with-a-us-509m-post-tax-npv-and-55-kstpa/

Neither the TSX nor the regulating authority has approved or disproved the information contained in this news release.

About Arizona Sonoran Copper Company (www.arizonasonoran.com | www.cactusmine.com)

ASCU’s objective is to become a mid-tier copper producer with low operating costs and to develop the Cactus Project that could generate robust returns for investors and provide a long term sustainable and responsible operation for the community and all stakeholders. The Company’s principal asset is a 100% interest in the brownfield Cactus Project (former ASARCO, Sacaton mine) which is situated on private land in an infrastructure-rich area of Arizona. The Company is led by an executive management team and Board which have a long-standing track record of successful project delivery in North America complemented by global capital markets expertise.

For more information:

Alison Dwoskin, Director, Investor Relations

647-233-4348

adwoskin@arizonasonoran.com

George Ogilvie, President, CEO and Director

416-723-0458

gogilvie@arizonasonoran.com

Forward-Looking Statements

This news release contains certain information that may constitute “forward-looking information” under applicable Canadian securities legislation. All information, other than historical fact, are forward-looking information. Generally, statements containing forward-looking information or statements can be identified by the use of forward-looking terminology such as “plans”, “expect”, “is expected”, “in order to”, “is focused on” (a future event), “estimates”, “intends”, “anticipates”, “believes” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, or the negative connotation thereof. Forward looking information includes, but is not limited to, the Company’s future operations, future exploration and development activities or other development plans, the potential of the Cactus Project (including the Parks/Salyer deposit), timing of economic studies and mineral resource estimates including the filing of the technical report in respect of the Cactus Project MRE, the results (if any) of further exploration work to define and or upgrade mineral resources and reserves at the Company’s properties; the anticipated exploration, drilling, development, construction and other activities of ASCU and the result of such activities; the mineral resources and mineral reserves estimates of the Cactus Project including the Cactus Project MRE (and the assumptions underlying such estimates); the ability of exploration work (including drilling) to accurately predict mineralization; the ability of management to understand the geology and potential of the Cactus Project; the completion and timing for the filing of the technical report in respect of the Cactus Project MRE; the timing and ability of the Company to produce a preliminary economic assessment (if at all); the scope of any future technical reports and studies conducted by ASCU; the ability to realize upon mineralization in a manner that is economic; the impact of bringing the Parks/Salyer deposit including the MainSpring property into the mine plan; , and corporate and technical objectives. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of ASCU to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and uncertainties that could affect the outcome include, among others: future prices and the supply of metals; risks relating to fluctuations in the Canadian dollar and other currencies relative to the US dollar; the results of drilling; the ability to access capital on terms acceptable to the Company necessary to incur the expenditures required to retain and advance the properties; changes in exploration, development or mining plans due to exploration results and changing budget priorities of the Company or its joint venture partners; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs or further exploration work; the ability to continue exploration and development of the ASCU properties; changes in any of the assumptions underlying the Cactus Project MRE; accidents, labour disputes and other risks of the mining industry; political instability, terrorism, insurrection or war; or delays in obtaining governmental approvals, projected cash operating costs, failure to obtain any required consents, permits or approvals; and the additional risks described in ASCU’s most recently filed Annual Information Form, annual and interim management’s discussion and analysis, copies of which are available on SEDAR+ (www.sedarplus.ca) under ASCU’s issuer profile.

Although ASCU has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. The Company considers its assumptions to be reasonable based on information currently available but cautions the reader that their assumptions regarding future events, many of which may be beyond the control of the Company, may ultimately prove to be incorrect since they are subject to risks and uncertainties that affects the Company and its operations. Accordingly, readers should not place undue reliance on forward-looking information and are urged to carefully consider the foregoing factors as well as other uncertainties and risks outlined in the Company’s public disclosure record. Forward-looking statements contained herein are made as of the date of this news release and ASCU disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.