Tag: #ProvenAndProbable

Vancouver, British Columbia–(Newsfile Corp. – January 13, 2022) – Provenance Gold Corp. (CSE: PAU) (OTCQB: PVGDF) (the “Company” or “Provenance“) is pleased to announce the closing of a non-brokered private placement for 5,000,000 units (each, a “Unit“) at a price of $0.16 per Unit for gross proceeds of $800,000. Each Unit consists of one common share of the Issuer (each, a “Share“) and one common share purchase warrant (each, a “Warrant“) with each Warrant entitling the holder thereof to purchase one additional common share (each, a “Warrant Share“) of the Issuer at a price of $0.24 per Warrant Share until January 13, 2025.

Proceeds of this private placement are earmarked for the drilling and subsequent initial resource estimate on the Eldorado property in addition to advancing work on the Company’s Nevada properties, particularly the White Rock property as well as general working capital.

Provenance plans to generate resource estimates on both its White Rock property in Nevada and its Eldorado property in eastern Oregon during 2022, which will be detailed in technical reports prepared by the Company in accordance with National Instrument 43-101. The White Rock property will be a maiden resource calculation while the Eldorado property will begin to substantiate historical resource estimates.

As referenced in a previous news release, the Eldorado project hosts three different historical resource estimates done by reputable engineering firms based. The first was done by Billiton Minerals USA after 150 holes had been drilled. The second resource estimate was calculated by Ican Minerals after they completed an additional 49 drill holes in between the original 150. The final resource estimate which was inferred by Ican indicated an ore body approximately 762 meters wide (2500 feet) and 914 meters long (3000 feet). Provenance hopes to have a good portion of the historical resource qualified through data collection and drilling in 2022.

Historical Resource Estimates Completed on the Eldorado Property

| COMPANY | RESOURCE ESTIMATE | CONTAINED TONS | GRADE |

| Billiton Minerals USA | 776,000 Ounces Gold | 36,000,000 | 0.75 g/t Gold (0.0219 ounces per ton) |

| Ican Minerals | 1,860,000 Ounces Gold | 90,000,000 | 0.76 g/t Gold (0.022 ounces per ton) |

| Ican Minerals | 4,000,000 Ounces Gold (Inferred) | 200,000,000 | 0.76 g/t Gold (0.022 ounces per ton) |

The Company anticipates the maiden resource estimate on its White Rock property over the next few months and is actively in the data collection and planning stage in anticipation of its upcoming drill program at Eldorado following the winter thaw and necessary permitting. This drill program, along with detailed historical data collection, compilation and modeling will be a key driver in producing a current and comprehensive resource estimate for the Eldorado property.

Provenance’s CEO, Rauno Perttu states, “with this funding, the Company is in an excellent position to advance its projects without diluting any more than is necessary at this time. With two cornerstone projects we believe we are in a very enviable position as a junior exploration company to potentially have two significant gold discoveries. We are fortunate to have experienced and influential funding partners that believe in the long-term outlook for the Company.”

No finders’ fees or commissions were paid in connection with completion of the private placement. All securities issued in connection with the private placement are subject to restrictions on resale until May 14, 2022 in accordance with applicable securities laws.

Rauno Perttu, P. Geo., a Qualified Person (as defined by National Instrument 43-101), and the Chief Executive Officer of the Company, has reviewed and approved the technical contents of this News Release.

The above-referenced resource estimates are considered historical in nature and as such are based on prior data and reports prepared by previous property owners. A qualified person has not done sufficient work yet to classify the historical estimates as current resources in accordance with current CIM (Canadian Institute of Mining, Metallurgy and Petroleum) categories and the company is not treating the historical estimates as current resources. Significant data compilation, redrilling, resampling and data verification may be required by a qualified person before the historical estimates on the project can be classified as a current resource. There can be no assurance that any of the historical mineral resources, in whole or in part, will ever become economically viable. In addition, mineral resources are not mineral reserves and do not have demonstrated economic viability. Even if classified as a current resource, there is no certainty as to whether further exploration will result in any inferred mineral resources being upgraded to an indicated or measured resource category.

About Provenance Gold Corp.

Provenance Gold Corp. is a precious metals exploration company with a focus on gold and silver resources within North America. The Company currently holds interests in four properties, three in Nevada, and one in eastern Oregon, USA. For further information please visit the Company’s website at https://provenancegold.com or contact Rob Clark at rclark@provenancegold.com.

On behalf of the Board,

Provenance Gold Corp.

Rauno Perttu, Chief Executive Officer

Neither the Canadian Securities Exchange, nor its regulation services provider, accepts responsibility for the adequacy or accuracy of this press release. This news release may contain certain “Forward-Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. When or if used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target, “plan”, “forecast”, “may”, “schedule” and similar words or expressions identify forward-looking statements or information. Such statements represent the Company’s current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Many factors, both known and unknown, could cause results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements and information other than as required by applicable laws, rules and regulations.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/109979

Highlights:

· New drill results from the Cortadera copper-gold porphyry deposit in Chile confirm growth of shallow resources at both Cuerpo 1 and 2. These include:

CRP0148 – 156m grading 0.4% CuEq* (0.4% copper (Cu), 0.1g/t gold (Au)) from surface,

including 32m grading 0.6%CuEq* (0.5% copper (Cu), 0.2g/t gold (Au)) from 90m depth

CRP0183 – 80m grading 0.4% CuEq* (0.4% copper (Cu), 0.1g/t gold (Au)) from 10m depth

including 12m grading 0.6%CuEq* (0.6% copper (Cu), 0.1g/t gold (Au)) from 44m depth

CRP0178 – 72m grading 0.4% CuEq* (0.4% copper (Cu), 0.1g/t gold (Au)) from surface

including 28m grading 0.7%CuEq* (0.7% copper (Cu), 0.1g/t gold (Au)) from surface

CRP0176 – 114m grading 0.3% CuEq* (0.3% copper (Cu), 0.1g/t gold (Au)) from surface

including 24m grading 0.6%CuEq* (0.6% copper (Cu), 0.1g/t gold (Au)) from surface

CRP0158 – 62m grading 0.4% CuEq* (0.4% copper (Cu), 0.1g/t gold (Au)) from 4m depth

including 18m grading 0.7%CuEq (0.6% copper (Cu), 0.2g/t gold (Au)) from 26m depth

· Exploration drilling commenced across the Productora central porphyry target, immediately adjacent to the Productora Mineral Resource – several large copper-gold targets scheduled for testing this year

· Further assay results from Cortadera being compiled for release in advance of a major resource upgrade in Q1 this year, following over 46,000m of additional drilling completed in 2021

Hot Chili’s Managing Director, Christian Easterday, said 2022 is shaping up to be an exciting year following a very strong set of achievements in 2021.

“We commence the year with $34 million in treasury, 100 percent ownership of Cortadera, Glencore as a strategic investor and our Company now consolidated and dual-listed in Canada.”

To access the announcement please click on the link below.

Download full announcement here

Cortadera Copper Deposit

Cortadera’s maiden Mineral Resource positions Hot Chili with the largest copper Mineral Resource and one of the largest gold Mineral Resources for an ASX-listed emerging company.

The Cortadera maiden Mineral Resource of 451Mt at 0.46% copper equivalent (CuEq) takes the total Mineral Resource estimate for Costa Fuego (Cortadera, Productora & El Fuego) to 724Mt at 0.48% CuEq for 2.9Mt copper, 2.7Moz gold, 9.9Moz Silver and 64kt molybdenum. Cortadera also contains a higher grade component of 104Mt at 0.74% CuEq, and this has strong potential to continue growing rapidly with further drilling.View the Cortadera Copper Deposit

You are about to discover the best video on how to buy precious metals.

Please share this interview: https://provenandprobable.com/how-the-1-invest-in-precious-metals/

In this interview, I share the 3 groups of precious metals investors, their habits, and results. 1 of the 3 groups has results that are unmatched compared to the other 2. This is an absolute must watch before you invest in precious metals. Is silver investment the best move for you? Which type of precious metals investor are you?

Concerned about the effects of inflation? Want to learn about some of the biggest silver stacking mistakes? Are you interested in owning gold, silver, platinum, palladium, and or rhodium; and how to spot a buying opportunity and sell precious metals like the pro’s? At Miles Franklin we offer all of the above physical delivery directly to you, along with Precious Metals IRA’s, storage with BRINKS. To place an order: 855.505.1900 or email: maurice@milesfranklin.com

Contact me:

Maurice Jackson

855.505.1900

Maurice@MilesFranklin.com

Proven and Probable

Where we deliver Mining Insights & Bullion Sales. I’m a licensed broker for Miles Franklin Precious Metals Investments under our President Andy Schectman. Where we provide unlimited options to expand your precious metals portfolio, from physical deliver, offshore depositories, precious metals IRA’s, and private blockchain distributed ledger technology. Call me directly at (855) 505-1900 or you may email maurice@milesfranklin.com.

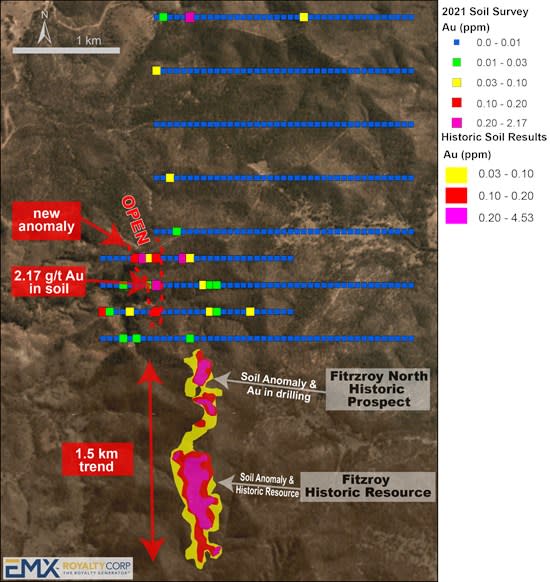

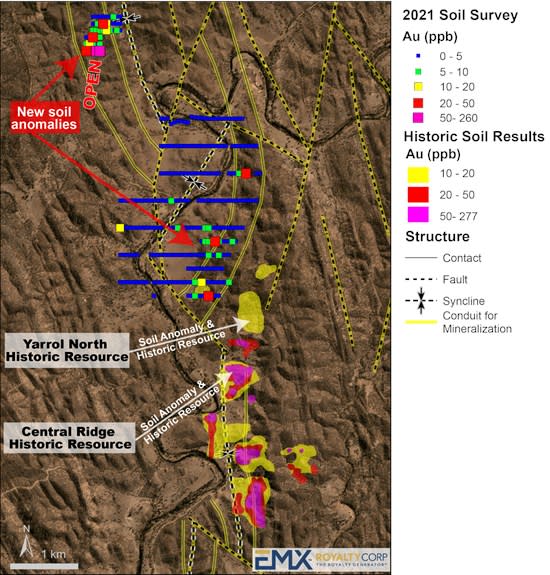

Vancouver, British Columbia–(Newsfile Corp. – January 4, 2022) – EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the “Company” or “EMX”) is pleased to announce results from recently completed geochemical surveys at EMX’s 100% owned Mt Steadman and Yarrol gold projects in central Queensland, Australia. Numerous gold-in-soil anomalies have been identified by surveys conducted on both projects, with several anomalies extending to the edges of the survey grids, meaning that they remain open for expansion. A total of 895 samples were collected, with results including 2.17 ppm gold in a new target area at Mt Steadman. Results from the Yarrol project also delineated several robust gold-in-soil anomalies, as well as a new target area with high levels of cobalt and nickel in rock chip samples. These results highlight the additional exploration potential of both projects.

EMX will continue executing exploration programs on both projects in the coming year, and both projects are currently available for partnership.

Mt Steadman Project. The 5,700 hectare Mt Steadman project is an intrusion-related gold system (“IRGS”) in the New England Orogenic Belt in Queensland, Australia, a province that hosts IRGS-type gold, porphyry and epithermal deposits. Mt Steadman is located along the Perry Fault system, a major structural feature in the area (see Figure 1). The Mt Steadman project was the focus of exploration in the 1990’s when shallow reconnaissance drilling programs led to the recognition and definition of historical gold resources. However little exploration has taken place since (see EMX News Release dated April 26, 2021).

In Q3 and Q4 2021, EMX conducted a broad soil geochemical survey to the north of the Fitzroy historical resource (see Figure 2). A total of 351 samples were collected on 200 meter and 400 meter spaced traverses with samples collected every 50 meters along each line. This program resulted in the delineation of multiple anomalous gold-in-soil trends. The most prominent anomaly extends for 400 meters along trend and reaches a maximum width of 200 meters at its northern extent. The anomaly remains open to the north and includes a sample of 2.17 ppm gold. This new soil anomaly is similar in scale and tenor to those around the historic Fitzroy prospect located 1km to the southeast. This anomaly also exhibits coincident anomalous molybdenum and tellurium geochemistry, similar to geochemical signatures seen at Fitzroy, and closely correlates with the mapped extent of a zone of hydrothermal breccias, quartz veining and alteration.

Yarrol Project. The 17,500 hectare Yarrol project is located between EMX’s Queensland Gold royalty property and Evolution Mining’s Mt Rawdon gold mine, and is positioned along the regional scale Yarrol Fault. Several other historical mines and active exploration projects lie along the Yarrol Fault structural trend. EMX’s Yarrol Project was the site of historical mining activities from the late 1800’s through the 1930’s. Further exploration carried out in the 1980’s and 1990’s led to the definition of two historical gold resources on the Yarrol Project, but little exploration activity has taken place since that time (see EMX news release dated April 26, 2021).

EMX’s 2021 programs at Yarrol included the collection of 544 soil samples, which identified two new gold-in-soil anomalies (see Figure 3). The northern anomaly, known as the Limestone Creek area, lies approximately five kilometers northwest of the historical Yarrol gold resources. This new anomaly has dimensions of 200 by 600 meters, with the strongest results along the southernmost line. The area was identified as a target by EMX on the basis of magnetic inversion geophysical models, previous geochemical results and the presence of numerous historical prospecting pits. The Limestone Creek anomaly also coincides with a zone of albite-silica-goethite alteration developed adjacent to a monzonite porphyry and remains open to the south. The anomaly has a scale and tenor that resembles those over the historical gold resources on the Yarrol Project.

Other gold-in-soil anomalies have been delineated immediately northwest of the historical Yarrol resources, along a contact zone between geological formations within folded and faulted sediments, which also merit follow-up exploration.

In the process of carrying out the sampling programs at the Yarrol Project, EMX geologists also noted boulders of dark manganiferous material in several drainages in the northern part of the exploration license. The boulders were traced back to an outcropping stratigraphic horizon of dark, manganiferous material that has the appearance of a conglomeratic unit.

Nine rock chip samples collected from various boulders, float materials and outcrop exposures averaged 1.1% cobalt, 0.15 % nickel and 10.0% manganese, with a high of 1.6% cobalt with 0.25% nickel. EMX considers this to be a significant discovery of additional mineral potential on the Yarrol Project, as previous efforts had strictly focused on Yarrol’s intrusion-related gold mineralization. Additional sampling programs are underway to better quantify the extent of this unit and its degrees of enrichment in cobalt, nickel and manganese. Barium is also enriched in this material, with eight of the nine samples submitted for analysis exceeding the upper analytical limit of 1% barium.

Upcoming Exploration Plans. Additional geochemical sampling programs will be carried out at both the Mt Steadman and Yarrol projects in the coming months with the goal of extending the soil anomalies and identifying additional drill targets. Drill programs are being planned for mid-2022.

EMX’s Australian Royalty Generation Program. EMX maintains an active royalty generation program and continues to review new project opportunities throughout Australia. The Company currently holds two royalty projects in Australia (Koonenberry and Queensland Gold) and has three exploration projects in Queensland that are available for partnership. More information on these projects can be found on the EMX website (www.EMXroyalty.com).

Comments on Sampling, Assaying, and Nearby Mines and Deposits. EMX’s exploration samples were collected in accordance with industry standard best practices. EMX conducts routine QA/QC analysis on its exploration samples, including the utilization of certified reference materials, blanks, and duplicate samples. All samples were submitted to ALS Brisbane for sample preparation and analysis (ISO 9001:2000 and 17025:2005 accredited).

The soil samples were analyzed using the AuME-TL-44 method which is a trace level gold and multi-element technique consisting of an aqua-regia digest and an ICP-MS finish.

The rock chip samples were analyzed with a four-acid super trace technique (ME-MS61) with an ICP-MS finish. The rock chip samples were also analyzed with a lithium borate fusion prior to acid dissolution (three-acid) and an ICP-MS finish (ME-MS81). Over limit cobalt and manganese samples were analyzed by a HF-HN03-HCL04 digest, HCL leach and ICP-AES (OG62) finish.

The nearby mines and deposits discussed in this news release provide context for EMX’s properties, which occur in a similar geologic setting, but this is not necessarily indicative that the properties host similar mineralization.

Dr. Eric P. Jensen, CPG, a Qualified Person as defined by National Instrument 43-101 and employee of the Company, has reviewed, verified and approved the disclosure of the technical information contained in this news release.

About EMX. EMX is a precious, base and battery metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and the TSX Venture Exchange under the symbol EMX, as well as on the Frankfurt Exchange under the symbol “6E9.” Please see www.EMXroyalty.com for more information.

For further information contact:

David M. Cole

President and Chief Executive Officer

Phone: (303) 973-8585

Dave@emxroyalty.com

Scott Close

Director of Investor Relations

Phone: (303) 973-8585

SClose@emxroyalty.com

Isabel Belger

Investor Relations (Europe)

Phone: +49 178 4909039

IBelger@EMXroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release may contain “forward-looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to: unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended September 30, 2021 and the year ended December 31, 2020 (the “MD&A”), and the most recently filed Revised Annual Information Form (the “AIF”) for the year ended December 31, 2020, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedar.com and on the SEC’s EDGAR website at www.sec.gov.

Figure 1. Location map for the Yarrol and Mt Steadman projects.

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/1508/108814_emxfigure1.jpg

The summary of historical production at Mt Rawdon is from the Evolution Mining website: https://evolutionmining.com.au/wp-content/uploads/2020/04/Mt-Rawdon-fact-sheet-2020_LR.pdf (2020).

The summary of historic production at Mt Morgan is cited from Mt. Morgan: A. Taube; The Mount Morgan gold-copper mine and environment, Queensland; a volcanogenic massive sulfide deposit associated with penecontemporaneous faulting. Economic Geology; 81 (6): 1322-1340.

Figure 2. 2021 Soil Results from the Mt Steadman Project.

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/1508/108814_e9855e3924041a44_004full.jpg

Figure 3. 2021 Soil Results from the Yarrol Project.

To view an enhanced version of Figure 3 please visit:

https://orders.newsfilecorp.com/files/1508/108814_e9855e3924041a44_005full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/108814

https://soundcloud.com/proven-and-probable/andrew-hecht-copper-fundamentals-and-stock-pick

Nevada Copper As We Head Into 2022

- Copper reached a new high in 2021

- Higher highs are on the horizon in 2022 for three critical reasons

- A favorable jurisdiction in Nevada- Momentum build and the value proposition is improving

- Two groups in the know have made significant investments

- The shares continue to offer value, risk-reward favors the upside for Nevada Copper

The leading stock market indices have been bumpy over the past weeks. The prospects for higher interest rates and taxes in 2022, new COVID-19 variants, inflation at the highest level in decades, and other factors have created uncertainty, which tends to cause indigestion in the stock market. However, many leading stocks remain near or at record highs.

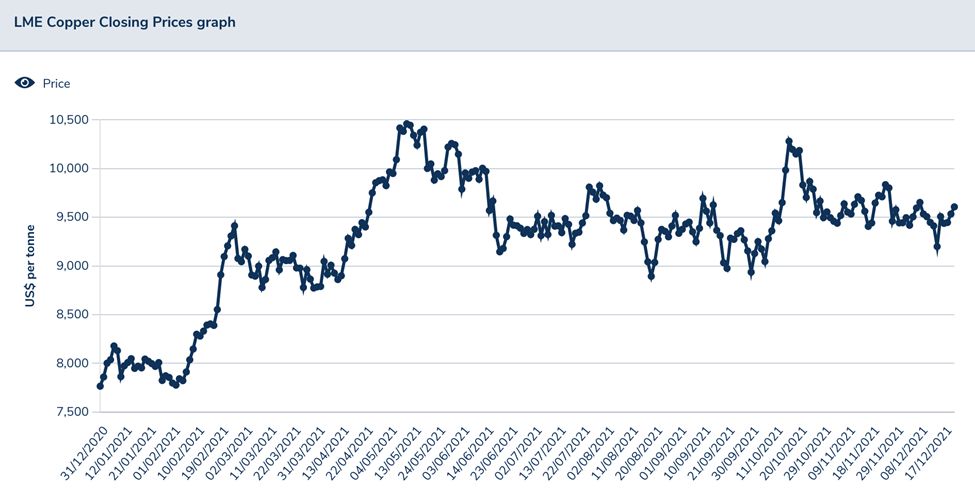

Copper is a bellwether commodity that many market participants look to for clues about the health and wellbeing of the global economy. Copper’s nickname is Dr. Copper because it tends to move higher during economic expansion and lower when the global economy contracts. In May 2021, copper rose to its highest price in history when nearby COMEX futures rose to just shy of $4.90 per pound, and LME forwards moved to over $10,700 per ton for the first time. Over the past year, copper has taken on a new role, increasing the demand side of its fundamental equation. The red nonferrous metal is a critical requirement for decarbonization, leading Goldman Sachs to call copper “the new oil.”

In the world of commodities, higher prices and growing demand lead to more production. However, the global copper market faces a challenge as it will take years for new supplies to come to market, creating deficits that push the price higher. While copper corrected since the May high, the price remained around $4.40 per pound level as of December 24.

Locating value in the US stock market is not easy these days. Nevada Copper Corp. (NEVDF) is a promising emerging US producer. Two seasoned commodity groups recently invested in NEVDF, seeing tremendous value in the burgeoning producer.

Copper reached a new high in 2021 Copper closed 2020 at the $3.52 per pound level on the nearby COMEX futures contract and $7,757 per ton on the three-month LME forwards.

Source: CQG

The chart highlights COMEX copper futures move to a high of $4.8985 in May. With the active month March contract at the $4.40 level on December 24, the price moved 25% higher in 2021 with only one week until 2022.

Source: LME

Three-month copper forwards rose to a high of $10,724.50 in 2021 and was at the $9,568 level on December 24, 23.35% higher than at the end of 2020.

While copper is closing 2021 below the year’s high, the trend remains bullish with impressive gains since the end of last year.

Higher highs are on the horizon in 2022 for three critical reasons

Three reasons support higher highs and new all-time peaks in the copper market in 2022 and beyond:

- Copper is critical for electric vehicles (EVs), wind turbines, and other clean energy initiatives. The red metal is a crucial ingredient for decarbonization, making the fundamental equation’s demand-side grow.

- It takes eight to ten years to bring new copper production online from exploration to output. Copper is still in the early phases of expanding global production, with the leading mining companies scrambling to find new ore deposits. As demand increases, supplies will struggle to keep pace over the coming years.

- Inflationary pressures will continue to rise, putting upward pressure on all commodities, and copper is no exception. At the latest December FOMC meeting, the US central bank forecast a 0.90% Fed funds rate for 2022 and a 1.60% rate for 2023. Even if inflationary pressures recede, real interest rates are likely to remain negative, which is bullish for raw material prices in the coming years.

Copper faces an almost perfect bullish storm for the coming years. Goldman Sachs’s forecast of $15,000 per ton by 2025 would put nearly COMEX futures over the $6.80 per pound level. While higher prices will encourage more production, existing mines cannot keep pace with the rising demand.

Chile is the world’s leading copper producer. The recent election of Gabriel Boric, a 35-year-old former student activist who carries a new generation’s socialist dreams to the presidential palace, threatens Chile’s capitalist economy fueled by copper output. Taxes are likely to rise along with wages and addressing climate change could cause a new wave of regulations that weigh on copper output over the coming years. Moreover, the new Chilean government could move to nationalize copper mines, which would impact output and efficiency. The bottom line is that a supply-demand deficit in the global copper market is likely to widen over the coming years, putting upward pressure on the red nonferrous metal’s price.

A favorable jurisdiction in Nevada- Momentum build and the value proposition is improving

The world’s leading copper producers are searching the globe for new reserves and output. Australian mining giant BHP recently said it is considering a challenging Democratic Republic of Congo copper project. The DRC is notorious for political and regulatory issues.

Meanwhile, the US remains a friendly mining environment, and Nevada is a state that supports the industry and is mineral-rich.

Nevada Copper (NEVDF) is an emerging producer with a lot going for it these days. The company mines copper in Nevada in the USA, and the Canadian Fraser Institute ranks the state as the world’s #1 mining jurisdiction. In 2021, momentum has been building for NEVDF:

- Underground mine operation improvements have resulted in 100% growth in development rates.

- New equipment in the second half of 2021 has accelerated development.

- An operational efficiency plan took effect in the second half of 2021 and is forecasted to increase output in H1, 2022.

To put more meat on the bone, in a December 21 press release, the company provided updates on its Pumpkin Hollow underground mine project:

- Nevada Copper is on track to advance over 1,100 lateral equivalent feet of development in December 2021.

- Development is running at the highest rate for 2021, with December nearly 50% higher than November and almost 100% above the level in August 2021.

- New equipment should enhance further development and growth in January 2022.

- Ventilation fan infrastructure should be completed in Q1 2022.

- Mining of the Sugar Cube, the first high-grade area in the East North Zone of the underground mine, is on schedule for Q1 2022.

In December, CEO Randy Buffington said, “We are on track to complete 1,100 feet of lateral development this month, which puts the Company in a position to mine the first stope of high-grade Sugar Cube as planned next month.”

Accelerated development increases NEVDF’s value proposition:

- The current enterprise value is less than the value of the company’s machinery and equipment.

- NPV at current prices is close to the US $3 billion level.

- The company will be cash-flow positive in 2022.

- Open-pit mining development will accelerate in 2022.

The company’s prospects are compelling, leading two influential groups to invest in NEVDF.

Two groups in the know have made significant investments

Solway Investment Group is a private international mining and metals group with headquarters in Switzerland. Solway specializes in nickel production with mines and smelting plants in Guatemala, Ukraine, Russia, Indonesia, and Macedonia. The group has over 5,000 employees, is expanding its focus in battery metals, and recently invested US$30 million for a 10% stake in Nevada Copper.

Mercuria Energy Group Ltd. is a multinational commodity trading company active in global energy, metals, and agricultural markets. The company dates back to 2004 when two ex-Phibro executives, Marco Dunard and Daniel Jaeggi departed after Citigroup sold Phibro to Occidental Petroleum. The company recently closed an oversubscribed $2.2 billion multi-year secured borrowing base credit facility with a collection of international financial institutions. Mercuria is one of the world’s leading and growing commodities trading companies, with core exposure in energy. Mercuria’s goal is a 50% portfolio in renewable energy over the coming five years and invested US$30 million for a 10% stake in Nevada Copper.

Solway and Mercuria are top organizations in the international commodities business, with tentacles reaching across the globe. Both companies put their capital up as they see the compelling potential for Nevada Copper’s properties and business plan.

The shares continue to offer value, risk-reward favors the upside for Nevada Copper

Nevada Copper shares remain inexpensive at the end of December 2021. Aside from the Solway and Mercuria investments, insider buying is another bullish sign for the company. After a recent blackout period, CEO Randy Buffington purchased 200,000 shares, and the company’s directors have been buyers of the shares. Nevada Copper shares (NEVDF) peaked at $2.40 value in May when copper prices reached the high at nearly $4.90 per pound. Copper closed around the $4.40 level on December 23, and NEVDF shares having fallen dramatically in early December hitting yearly lows, could be a golden opportunity for investors that see the same potential as Solway and Mercuria.

Source: Barchart

The chart shows that NEVDF shares corrected to a low of 38.78 cents on October 1 as nearby copper futures moved to test the $4 per pound level. At 53.0 cents per share on December 23, Nevada Copper had a $236.328 million market cap.

Development companies are risky businesses as their future depends on delivering from their mines. The backing of two well-established commodities trading and investment companies, insider buying, and accelerated progress are positive signs for the company as we head into 2022.

New copper production is scarce, and mining companies are scouring the globe for new reserves. Nevada copper’s location, proven and probable reserves, management, progress, and investors bode well for the company’s future. Further progress could transform NEVDF from an emerging producer to a takeover candidate or established producer as the world’s leading miners are hungry for output. Risk is always a function of reward with any investment. At 53.0 cents per share, NEVDF’s potential compensates for the risk.

Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein, or any security in any jurisdiction in which such an offer would be unlawful under the securities laws of such jurisdiction.

RooGold Year-End Review

VANCOUVER, BC / ACCESSWIRE / December 30, 2021 / RooGold Inc. (CSE:ROO)(OTC PINK:JNCCF)(Frankfurt:5VHA) (“RooGold” or the “Issuer“) is pleased to reflect on a very successful 2021.

RooGold spent 2021 amassing a portfolio of complementary properties located in New South Wales (NSW) Australia. NSW is one of the most prolific gold territories for exploration and production since the 1850s. It is the second largest gold producing area in Australia with a gold endowment exceeding 3,160 tonnes. The New South Wales resources sector is vibrant, with world class deposits, a highly skilled workforce and a well-earned reputation for safe, responsible and innovating mining practices.

KEY PROPERTY ACQUISITIONS

Southern Precious Metals Ltd. (SPML)

The Company acquired a 100% interest in SPML, and its subsidiary, which held 100% interests in the Malebo and Solomons Properties in NSW. Through this acquisition, the Company welcomed key shareholders Dr. Chris Wilson and Dr. Quinton Hennigh.

Dr Wilson is a commercially-driven exploration geologist with over 30 years of experience in area selection and prospect generation, target generation, and the design and management of large resource definition drilling and pre-feasibility programs. He has worked in over 75 countries, on most commodities and deposit styles from grassroots through resource definition to feasibility. He spent 10 years with Ivanhoe Mines (IVN), including being Exploration Manager for Mongolia where he was responsible for an exploration portfolio of over 127 licences, spanning 11 million hectares. More recently Dr. Wilson has been involved in resource to mine to production reconciliation studies, project valuation and fatal flaw analysis.

Dr. Hennigh has been an integral figure in Australian junior exploration for many years. His advisory role in Kirkland Lake Gold’s (KL) acquisition of the Fosterville gold mine in Victoria Australia lead to a dramatic increase in shareholder value as Kirkland Lake’s shares rose from $6/share in 2015 to over $75 in 2020. Dr. Hennigh’s Novo Resources (NVO) has also made a major discovery in the Pilbara region of Western Australia. As founder, then its CEO and currently Chairman, he has led them from a junior explorer to a producer. In addition, through his role as lead geo-technical advisor at Crescat Capital LLC, a Denver Colorado based hedge fund with a focus on junior precious metals investments, he consults for various prospective junior mining companies such as current high-flier, NewFound Gold Corp (NFG), of which Quinton is a Director.

RooGold Limited (Private Co.)

Through its acquisition of private company RooGold Ltd., RooGold Inc. (Public Co.) acquired nine (9) large resource exploration land packages in NSW, with the majority being past producing. The acquisition significantly added to the Company’s land position in NSW with an expanded array of potential targets in a proven mining friendly jurisdiction.

Properties being acquired from RooGold Ltd. have hosted historical high-grade gold and silver production, but have limited exploration work conducted on them in modern times. The Properties provide diversity in terms of the deposit types and are controlled by renowned regional structures and contacts. One of these structures is the well-recognized Peel-Manning fault system. The Properties have had a combined total of 93 historic precious metals mines and prospects. Highly lucrative production grades of up to 384 g/t Au and 1,200 g/t Ag have been recorded on these historical mines. The Properties represent a very unique proposition: they possess a rare combination of having large exploration potential along with strong indications pointing towards the presence of high-grade mineralization through the significant historical mines and prospects.

Aussie Precious Metals Corp. (APMC)

The Company acquired two large historically producing land packages in NSW. The addition of these properties complements one of the properties acquired from RooGold Ltd. which covers the northern portion of the Copeland goldfield, located approximately 65km south-east across the same mineralized system as the two APMC properties.

The first of the two properties is known as Trilby (ELA 6237) comprising of 215 km2 and is located in the western portion of the New England orogenic terrain. The area spans a 35km long section of the serpentanized Peel-Manning Fault system within the eastern boundary of the New England orogenic terrain. The area includes the Trilby historic gold mine, consisting of swarmed meta-hydrothermal quartz veins with visible gold noted. The geological setting is highly prospective for Listwanite associated gold mineralization. The Peel-Manning Fault zone is significantly gold endowed to the north (Bingara Alluvial field) and the south (Nundle gold field) of the application area. Hard rock gold lode deposits are also abundant across the fault site. Hence, the potential for significant listwanite associated orogenic precious metal deposits are considered viable exploration targets.

The second property is known as Lorne (ELA 6234) comprising of 102.5 km2, which is located in the western portion of the New England orogenic belt. The area spans 12 strike kilometres of the significantly gold mineralized regional Peel-Manning fault system. Mineralization is of an orogenic or lode gold type and is characterized by quartz veins which may host high grade gold shoots. The area includes twenty-eight past producing gold mines and prospects. Historical production and prospecting records define a 1 km wide, 7.5 km long gold trend. Historical hard-rock production grades of up to 15 g/t Au are cited on the NSW MinView website. The historic mines include the past producing Marquis of Lorne orogenic gold-antimony mine, with over 500 m of historical underground workings and historic estimated reserves of 50,000 oz Au. Historic drill hole intercepts of up to 5 g/t Au over 5m are recorded across this zone from 5 drill holes, according to NSW government archive records.

CONSOLIDATED PROPERTY PACKAGE

(13 CONCESSIONS-1,380KM2 -137 HISTORIC MINES & PROSPECTS)

With the culmination of these acquisitions, RooGold Inc. now has 9 highly prospective gold and silver properties (5 gold and 4 silver) from private company RooGold Ltd., 2 gold properties from Southern Precious Metals Limited (“SPML”) and 2 more gold properties from Aussie Precious Metals Corp (“APMC”). RooGold Inc. has a district scale land package in NSW composing of 13 concessions spanning ~1,380km2 and is home to 137 historic mines and prospects. NSW is prolifically mineralized with multiple metallogenic belts relative to other Australian regions and remains largely unexplored outside of the main camps. The region has a considerable gold endowment exceeding 100 Moz and silver endowment exceeding 1Boz.

CLOSING OF NON-BROKERED FINANCING

On October 4, 2021, the Company closed a non-brokered private placement of $2,632,500. One of the key investors in the round was Crescat Capital LLC. RooGold entered into a Strategic Shareholder Agreement with Crescat Capital LLC whereby Crescat’s Investment Team and its Geological and Technical Director, Quinton Hennigh, will act as advisors to RooGold management..

Proceeds of the Financing will be largely deployed towards the exploration work program on the Company’s NSW portfolio of properties. RooGold’s NSW exploration will be centered on highly focused and priority driven work programs. The initial focus will be on the three properties located on the Peel Manning Fault – Trilby, Lorne, and Gold Belt.

MARKET AWARENESS EFFORTS

On November 8, 2021, the Company announced the engagement of Cascade Ventures Ltd. (“Cascade“) for corporate consulting services for a term of 12 months. Cascade has been engaged to help coordinate a market awareness program for the Company through investor relations planning and budgeting, communications strategies, campaign development and management, and corporate positioning. To that end, as a result of comprehensive discussions through the later part of the year, it is the expectation of Cascade that multiple Investor Relations groups will be engaged in Janaury to collectively tell the RooGold Inc story as the company strives to increase shareholder value throughout 2022 and beyond.

PARTING THOUGHTS

“I firmly believe we are executing the necessary steps required for RooGold to become a successful and global exploration company. 2021 has been a year of transformational acquisitions and I am very excited to further explore these properties, while driving awareness to our story,” stated Mike Mulberry, CEO of RooGold. “Looking at 2022, our plan is to continue building out a best-in class management team to execute on our strategy and to engage proven resource story-tellers to help us tell our compelling story to the markets,” continued Mr. Mulberry.

About ROOGOLD

ROOGOLD is a Canadian based junior venture mineral exploration issuer which is uniquely positioned to be a dominant player in New South Wales, Australia, through a growth strategy focused on the consolidation and exploration of high potential, mineralized precious metals properties in this prolific region of Australia. Through its announced acquisitions of Southern Precious Metals Ltd., RooGold Ltd. and Aussie Precious Metals Corp. properties, RooGold commands a portfolio of 13 high-grade potential gold (9) and silver (4) concessions covering 1,380 km2 which have 137 historic mines and prospects.

For further information please contact:

Michael Mulberry

T: 778-855-5001

info@roogoldinc.com

Forward-Looking Statements

This press release may contain forward-looking statements within the meaning of applicable securities law. Forward-looking statements are frequently characterized by words such as “plan”,”expect”, “project”, “intend”,”believe”, “anticipate”, “estimate” and other similarwords, or statements that certain eventsor conditions “may” or “will” occur.

Although the Issuer believes that the expectations reflected in applicable forward-looking statements are reasonable, therecan be no assurance that such expectations will prove to be correct. Such forward-looking statements are subjectto risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in such statements.

NEITHER THE CANADIAN SECURITIES EXCHANGE NOR ITS REGULATION SERVICES PROVIDER ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

SOURCE: RooGold Inc.

View source version on accesswire.com:

https://www.accesswire.com/680197/RooGold-Year-End-Review

North Vancouver, British Columbia–(Newsfile Corp. – December 23, 2021) – Lion One Metals Limited (TSXV: LIO) (OTCQX: LOMLF) (ASX: LLO) (“Lion One” or the “Company”) is pleased to announce the results of its Annual General Meeting (“AGM“), held on December 16, 2021. According to the meeting Scrutineers report, 128 shareholders were represented at the meeting, in person or by proxy, representing 39,544,470 common shares or 25.29% of the 156,371,893 common shares outstanding on the October 27, 2021 record date for the Meeting.

All resolutions presented to the shareholders were approved with over 95% of votes cast being in favor of each resolution (see the SEDAR filing of the Company’s Information Circular, dated November 2, 2021). As a result,

- Davidson & Company LLP was re-appointed as the auditor of the Company

- The number of Directors was set at four with the following nominees elected as directors: Walter Berukoff, Richard Meli, Kevin Puil, and David Tretbar

- The Company’s Stock Option Plan was re-approved

Following the AGM, management gave a brief overview of the Company’s plans for the development of the Tuvatu gold processing plant in Fiji, including the award of the design and procurement work. The Company plans to provide additional information about its development plans in early 2022 along with further drilling results from its ongoing exploration programs.

The Circular is available on the Company website at www.liononemetals.com and under Lion One’s profile on SEDAR at www.sedar.com.

About Lion One Metals Limited

Lion One’s flagship asset is 100% owned, fully permitted high grade Tuvatu Alkaline Gold Project, located on the island of Viti Levu in Fiji. Lion One envisions a low-cost high-grade underground gold mining operation at Tuvatu coupled with exciting exploration upside inside its tenements covering the entire Navilawa Caldera, an underexplored yet highly prospective 7km diameter alkaline gold system. Lion One’s CEO Walter Berukoff leads an experienced team of explorers and mine builders and has owned or operated over 20 mines in 7 countries. As the founder and former CEO of Miramar Mines, Northern Orion, and La Mancha Resources, Walter is credited with building over $3 billion of value for shareholders.

On behalf of the Board of Directors of

Lion One Metals Limited

“Walter Berukoff“

Chairman and CEO

Investor Relations

Toll Free (North America) Tel: 1-855-805-1250

Email: info@liononemetals.com

Website: www.liononemetals.com

Neither the TSX Venture Exchange nor its Regulation Service Provider accepts responsibility for the adequacy or accuracy of this release.

This press release may contain statements that may be deemed to be “forward-looking statements” within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein are forward-looking information. Generally, forward-looking information may be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “proposed”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases, or by the use of words or phrases which state that certain actions, events or results may, could, would, or might occur or be achieved. This forward-looking information reflects Lion One Metals Limited’s current beliefs and is based on information currently available to Lion One Metals Limited and on assumptions Lion One Metals Limited believes are reasonable. These assumptions include, but are not limited to, the actual results of exploration projects being equivalent to or better than estimated results in technical reports, assessment reports, and other geological reports or prior exploration results. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Lion One Metals Limited or its subsidiaries to be materially different from those expressed or implied by such forward-looking information. Such risks and other factors may include, but are not limited to: the stage development of Lion One Metals Limited, general business, economic, competitive, political and social uncertainties; the actual results of current research and development or operational activities; competition; uncertainty as to patent applications and intellectual property rights; product liability and lack of insurance; delay or failure to receive board or regulatory approvals; changes in legislation, including environmental legislation, affecting mining, timing and availability of external financing on acceptable terms; not realizing on the potential benefits of technology; conclusions of economic evaluations; and lack of qualified, skilled labour or loss of key individuals. Although Lion One Metals Limited has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. Lion One Metals Limited does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/108450