Tag: #InvestingInBatteryMetals

Transcript Pending

https://youtu.be/vIEmMHVZefA

Please Share This Video: https://youtu.be/vIEmMHVZefA

Joining us for a conversation is Mike Ciricillo the CEO of Nevada Copper. As we discuss the latest exciting developments from the flagship Pumpkin Hollow project located in Yerington, NV. Nevada Copper is in production and is on the path to becoming the next mid-tier copper producer in the world’s top-rated mining jurisdiction. The Pumpkin Hollow project host both an open-pit and underground mine. We get to discuss them both in today’s interview. Find out why the stock price has moved from .06 all the way to .32 in a 52 week period.

BUILDING THE NEXT MID-TIER COPPER PRODUCER Nevada Copper (TSX:NCU) is a US copper producer and owner of Pumpkin Hollow, which hosts an underground project that is now in production, and an open pit development. The property is located in Nevada (USA) – rated by The Fraser Institute as the World #1 mining jurisdiction. The processing facility commenced production in December, 2019, using development ore stockpiled during construction of the underground mine. The project benefits from a straightforward approach to production, together with a desert climate and local topography that facilitates efficient, eco-friendly mining techniques. In addition, the local district of Yerington is a former copper-producing region with superb infrastructure and a skilled workforce. The project’s substantial reserves and resources include copper, gold and silver and there is clear potential for deposit expansion and greenfield exploration.

Nevada Copper: (TSX: NCU | OTC: NEVDF) Website: www.nevadacopper.com Corporate Presentation: https://nevadacopper.com/investors/presentations/

Website| www.provenandprobable.com Call me directly at 855.505.1900 or email: Maurice@MilesFranklin.com Precious Metals FAQ – https://www.milesfranklin.com/faq-maurice/ Proven and Probable Where we deliver Mining Insights & Bullion Sales.

I’m a licensed broker for Miles Franklin Precious Metals Investments (https://www.milesfranklin.com/contact/) Where we provide unlimited options to expand your precious metals portfolio, from physical delivery, offshore depositories, and precious metals IRA’s. Call me directly at (855) 505-1900 or you may email maurice@milesfranklin.com

Press Relase

Corporate Presentation

“We are very pleased to have recently completed both commissioning of the Main Shaft and electrical system upgrades, two important steps towards achieving nameplate production. The remaining step, ventilation upgrades, is progressing well, and we remain on target for steady state production of 5,000 tons per day in Q3 this year,” stated Mike Ciricillo, Chief Executive Officer of Nevada Copper. “With the underground project expected to be ramped-up to full production in Q3, we look forward to advancing our other key growth opportunities, including our fully permitted Open Pit and property exploration targets.”

About Nevada Copper

Nevada Copper (TSX: NCU) is a copper producer and owner of the Pumpkin Hollow copper project. Located in Nevada, USA, Pumpkin Hollow has substantial reserves and resources including copper, gold and silver. Its two fully permitted projects include the high-grade underground mine and processing facility, which is now in the production stage, and a large-scale open pit project, which is advancing towards feasibility status.

NEVADA COPPER CORP.

www.nevadacopper.comMike Ciricillo, President and CEO

For further information contact:

Rich Matthews, Investor Relations

Integrous Communications

rmatthews@integcom.us

+1 604 757 7179

Press Release

Corporate Presentation

https://youtu.be/Jg47uOuWjNY

Jordan Trimble, President and CEO of Skyharbour Resources, states: “We have been very pleased with the results to date at the Maverick East Zone, and we will continue to focus on the expansion of this high grade mineralized zone. The uranium mineralization identified during previous drill programs illustrates the strong discovery potential at Moore and recent geophysical programs and new geological modeling have encouraged the Company to develop new regional drill targets in areas such as Grid Nineteen. Outside of our Moore Project, Skyharbour’s partner companies have been advancing some of our other projects. Azincourt is currently conducting a minimum 2,000 metre diamond drilling program at the East Preston Project and at our Hook Lake Project (previously called North Falcon Point), Valor Resources has begun planning for their upcoming exploration programs including airborne geophysics and ground-based exploration in the summer. The uranium market has shown notable signs of recovery with increasing equity valuations and improving sentiment, and this recovery appears to be accelerating.

For further information contact:

Spencer Coulter

Corporate Development and Communications

Skyharbour Resources Ltd.

Telephone: 604-687-3376

Email: info@skyharbourltd.com

The History of Nickel

RIU Explorers Conference Presentation Video

HCH Corporate Presentation Feb 2021

Cortadera Copper Project

Cortadera’s maiden Mineral Resource positions Hot Chili with the largest copper Mineral Resource and one of the largest gold Mineral Resources for an ASX-listed emerging company.

The Cortadera maiden Mineral Resource of 451Mt at 0.46% copper equivalent (CuEq) takes the total Mineral Resource estimate for Costa Fuego (Cortadera, Productora & El Fuego) to 724Mt at 0.48% CuEq for 2.9Mt copper, 2.7Moz gold, 9.9Moz Silver and 64kt molybdenum. Cortadera also contains a higher grade component of 104Mt at 0.74% CuEq, and this has strong potential to continue growing rapidly with further drilling.

Hot Chili Limited

ACN 130 955 725

ASX: HCH

Level 1, 768 Canning Highway, Applecross,

Western Australia 6153

P: +61 8 9315 9009

F: +61 8 9315 5004

www.hotchili.net.au

Hot Chili (ASX: HCH) is pleased to announce that it has been granted a VAT refund exporting benefit (VAT Refund Payment) from the Chilean Ministry of Economy, Development, and Tourism) for all expenditure associated with its 100% subsidiary Frontera SpA.

Frontera SpA controls the Cortadera copper-gold discovery, the centrepiece of Hot Chili’s Costa Fuego combined copper development, located along the Chilean coastal range 600km north of Santiago.

The VAT Refund Payment significantly strengthens the Company’s cash position in 2021 with an estimated refund of up to A$4 million expected to be paid to Hot Chili.

An initial VAT Refund Payment of A$1.8 to A$2 million (for previously accumulated VAT) is expected to be received in the coming months and further VAT Refund Payments will be received against all forthcoming

expenditure which attracts the 19% tax rate (drilling and assay costs etc).

The VAT Refund Payment relates to the future exporting capacity of Hot Chili’s Cortadera copper-gold project where Hot Chili is now able to claim VAT refund payments for ongoing expenditure up to US$258 million over

the course of its development activities.

Under the terms of the Vat Refund Payment, the Company has until the 1st January 2025 to commercialise production from Cortadera and meet certain export targets. Hot Chili also has the right to extend this term. In

the event that the term is not extended and Hot Chili does not meet certain export targets, Hot Chili will be required to re-pay the VAT Refund Payments to the Chilean Treasury subject to certain terms and conditions.

However, if Hot Chili achieves the export targets from Cortadera within that timeframe or its renewal, if required, any VAT Refund Payments will not be required to be re-paid.

Hot Chili had previously been granted a VAT Refund Payment for its Productora copper project in July 2014, which is active and also remains in-place until 1st January 2025.

This second VAT Refund Payment recognises the Company’s combined development approach for Costa Fuego and reinforces Chile’s proactive stance towards providing a stable and attractive destination for foreign

investment.

Further updates on multiple work streams across Costa Fuego are expected shortly.

This announcement is authorised by the Board of Directors for release to ASX.

For more information please contact:

Christian Easterday Tel: +61 8 9315 9009

Managing Director Email: christian@hotchili.net.au

or visit Hot Chili’s website at www.hotchili.net.au

Refer to ASX Announcement “Costa Fuego Becomes a Leading Global Copper Project” (12th October 2020) for JORC Table 1 information related to the Cortadera JORC compliant Mineral Resource estimate by Wood and the Productora re-stated JORC compliant Mineral Resource estimate by AMC ConsultantsCopper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price

1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. For Cortadera (Inferred + Indicated), the average Metallurgical

Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

** Reported on a 100% Basis – combining Cortadera and Productora Mineral Resources using a +0.25% CuEq reporting cut-off grade

Qualifying Statements

Independent JORC Code Costa Fuego Combined Mineral Resource (Reported 12th October 2020)

Reported at or above 0.25% CuEq*. Figures in the above table are rounded, reported to appropriate significant figures, and reported in accordance with the JORC Code – Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Metal rounded to nearest thousand, or if less, to the nearest hundred. * * Copper Equivalent (CuEq) reported for the resource were calculated using the following formula:: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1 % per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. For Cortadera (Inferred + Indicated), the

average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

** Note: Silver (Ag) is only present within the Cortadera Mineral Resource estimate

Competent Person’s Statement- Exploration Results

Exploration information in this Announcement is based upon work compiled by Mr Christian Easterday, the Managing Director and a fulltime employee of Hot Chili Limited whom is a Member of the Australasian Institute of Geoscientists (AIG). Mr Easterday has sufficient

experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is

undertaking to qualify as a ‘Com

petent Person’ as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves’ (JORC Code). Mr Easterday consents to the inclusion in the report of the matters based on

their information in the form and context in which it appears.

Competent Person’s Statement- Productora Mineral Resources

The information in this Announcement that relates to the Productora Project Mineral Resources, is based on information compiled by

Mr N Ingvar Kirchner. Mr Kirchner is employed by AMC Consultants (AMC). AMC has been engaged on a fee for service basis to provide

independent technical advice and final audit for the Productora Project Mineral Resource estimates. Mr Kirchner is a Fellow of the

Australasian Institute of Mining and Metallurgy (AusIMM) and is a Member of the Australian Institute of Geoscientists (AIG). Mr Kirchner

has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being

undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results,

Mineral Resources and Ore Reserves’ (the JORC Code 2012). Mr Kirchner consents to the inclusion in this report of the matters based on

the source information in the form and context in which it appears.

ears.

Competent Person’s Statement- Cortadera and Costa Fuego Mineral Resources

The information in this report that relates to Mineral Resources for the Cortadera and combined Costa Fuego Project is based on

information compiled by Elizabeth Haren, a Competent Person who is a Member and Chartered Professional of the Australasian Institute

of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Elizabeth Haren is employed as an associate Principal

Geologist of Wood, who was engaged by Hot Chili Limited. Elizabeth Haren has sufficient experience that is relevant to the style of

mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined

in the 2012 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”. Elizabeth Haren

consents to the inclusion in the report of the matters based on her information in the form and context in which it appears.

Reporting of Copper Equivalent

Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1 % per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. For Cortadera (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

Forward Looking Statements

This Announcement is provided on the basis that neither the Company nor its representatives make any warranty (express or implied) as to the accuracy, reliability, relevance or completeness of the material contained in the Announcement and nothing contained in the Announcement is, or may be relied upon as a promise, representation or warranty, whether as to the past or the future. The Company hereby excludes all warranties that can be excluded by law. The Announcement contains material which is predictive in nature and may be affected by inaccurate assumptions or by known and unknown risks and uncertainties and may differ materially from results ultimately achieved.

The Announcement contains “forward-looking statements”. All statements other than those of historical facts included in the Announcement are forward-looking statements including estimates of Mineral Resources. However, forward-looking statements are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future results expressed, projected or implied by such forward-looking statements. Such risks include, but are not limited to, copper, gold and other metals price volatility, currency fluctuations, increased production costs and variances in ore grade recovery rates from those assumed in mining

plans, as well as political and operational risks and governmental regulation and judicial outcomes. The Company does not undertake

any obligation to release publicly any revisions to any “forward-looking statement” to reflect events or circumstances after the date of the Announcement, or to reflect the occurrence of unanticipated events, except as may be required under applicable securities laws. All persons should consider seeking appropriate professional advice in reviewing the Announcement and all other information with respect to the Company and evaluating the business, financial performance and operations of the Company. Neither the provision of the Announcement nor any information contained in the Announcement or subsequently communicated to any person in connection with the Announcement is, or should be taken as, constituting the giving of investment advice to any person.

Transcript

https://youtu.be/rzeWjjffaH0

Join us as we sit down with Eric Jensen the general manager of exploration for EMX Royalty as we discuss the latest exciting press release detailing 5 option agreements on battery metal projects located in Scandinavia. The projects (Flåt Project, Bamble Project, Brattåssen Project, Mjövattnet Project, and the Njuggträskliden Project) are located in Norway and Sweden and host Nickel, Cobalt, Copper, and Platinum Group Elements. Plus, shareholders will find out the latest developments on the existing royalty projects, such as the Cukaru Peki Copper Project in Serbia, when EMX plans to pay a dividend?!? Find out why Rick Rule is a shareholder of EMX Royalty right here!

🕘TIMESTAMP🕒

EMX share price review – :36

Company Introduction – 1:26

Production & Consumption on Nickel & Cobalt – 3:16

Scandanavian Mining Jurisdiction – 5:31

Copper supply and demand fundamentals – 7:40

Platinum Group Elements (PGE’s) Outlook – 10:48

How is EMX positioning shareholders to take advantage of battery metals – 12:07

EMX Royalty Executes Option Agreement on 5 Battery Metal Projects – 14:00

Overview of Swedish Projects – 16:39

Overview of Norwegian Projects – 17:50

Exploration Plans for 2021 – 19:07

Assay Results – 20:00

Capital Structure – 20:56

When will EMX begin paying dividends – 22:05

What are the latest updates from Serbia on the Cukaru-Peki Project – 23:27

What is the next unanswered question for EMX – 25:34

What keeps you up at night – 27:03

What did I forget to ask – 27:51

EMX Royalty (TSX.V: EMX | NYSE: EMX)

Website: https://www.emxroyalty.com/

Press Release: https://bit.ly/3q2PXLl

Corporate Presentation: https://www.emxroyalty.com/investors/presentations/

Mr. Scott S. Close

Email: sclose@emxroyalty.com

Phone: +1 (303) 973-8585

About EMX Royalty:

EMX Royalty Corporation has a long-standing track record of success in exploration discovery, royalty generation, royalty acquisition, and strategic investments. Our diversified, three-pronged business approach provides exposure to multiple upside opportunities while minimizing the impact on EMX’s treasury.

EMX’s business model is designed to efficiently manage the risks inherent to the minerals exploration and mining industry. Key elements and resulting advantages of our unique approach are: We organically generate royalties through low-cost property acquisition and early-stage exploration to build value, and then develop partnerships with quality companies to advance the projects, with EMX retaining a royalty interest and receiving pre-production payments.

Our organic royalty growth is supplemented by purchases of royalties from other parties, as well as strategic investments. Cash flow from royalties, advance royalties, and other property payments are supplemented by returns from strategic investments, and provide “self-funding” operating capital for our ongoing business initiatives. Using this model, we sustainably grow the royalty portfolio, with minimal dilution to our shareholders. EMX’s royalty and property portfolio spans five continents and consists of a balanced mix of precious metal, base metal, and other assets.

HCH Equity Research

Discover the Value Proposition Here

About Us — Chilean Copper Company

Hot Chili is a copper company listed on the Australian Stock Exchange (HCH:ASX). Our focus is copper exploration and development in Chile’s Atacama Region, and we aim to be one of the largest copper companies operating in the area.

Our Mission

Hot Chili has three key high-grade copper projects—Cortadera, Productora, and El Fuego—all located in close proximity to one another. In developing these projects, our copper mining company seeks to create a new Chilean mining hub called Costa Fuego. We believe this kind of project portfolio is special among junior copper mining companies.

Current Projects

The centerpiece of our copper company’s ambitious discovery program is our Cortadera copper-gold project. In addition to Cortadera, our Productora copper-gold project entered production in 2020 through a partnership agreement with Chilean government-owned ENAMI, and our El Fuego project encompasses two historic high-grade copper mines.

Cortadera

Until February of 2019, when Hot Chili entered into an agreement to acquire a 100 percent interest, Cortadera was privately owned and little was publicly known about the discovery. Since acquiring Cortadera, our Chile copper company has engaged in an aggressive discovery program. Our drill results already include six world-class copper-gold intersections in a single zone of mineralization. We believe that Cortadera may be one of the most signficant copper discoveries of the last decade.

Cortadera’s Maiden Mineral Resource (+0.25% CuEq) of 451Mt at 0.46% copper equivalent (CuEq) takes the total Mineral Resource estimate for Costa Fuego to 724Mt at 0.48% CuEq for 2.9Mt copper, 2.7Moz gold, 9.9Moz Silver and 64kt molybdenum.The Cortadera Maiden Mineral Resource includes a higher grade component (+0.6% CuEq) of 104Mt at 0.74% CuEq.

Productora

Productora is a large-scale, advanced stage copper-gold project. To date, there has been approximately US$100 million of investment at Productora, and the project is estimated to have probable reserves of 166.9 million tonnes grading 0.43% Cu, 0.09g/t Au and 138 ppm Mo. With our ongoing development of Productora, along with Cortadera and El Fuego (discussed below), Hot Chili aims to be one of the top copper mining companies in the area.

El Fuego

Hot Chili has a majority interest in the El Fuego copper project. The property encompasses two historic underground mines—San Antonio and Valentina. At one time, these were two of the highest grade copper mines in the region. Both sites, however, were under private ownership for 50+ years, and modern exploration of these copper companies was minimal.

Our Team

Our executives, directors, and technical staff are based in Australia and Chile. Together, they have many decades of experience in the copper mining industry, particularly in Chile and Latin America. They are backed by the support of an impressive consulting and advisory team, which includes the likes of Dr. Steve Garwin, a copper and gold porphyry expert who played an instrumental role in identifying the potential for a major copper-gold discovery at Cortadera, and whom is leading the exploration efforts at our Chile copper projects.

About Hot Chili Limited

Hot Chili (HCH) is an ASX-listed Australian mineral exploration company, well advanced in developing its portfolio of copper projects on the coastal range in Region III, Chile.

Contact Hot Chili Limited

Australia

P: 08 9315 9009

F: 08 9315 5004

Press Release

Corporate Presentation

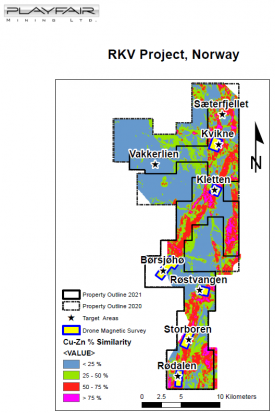

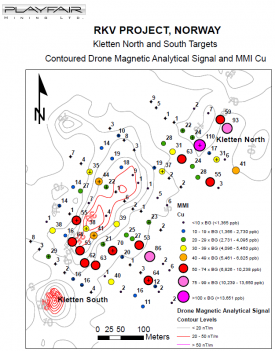

Don Moore, CEO of Playfair, comments “Playfair’s approach of applying modern technology to exploration of a historic mining district continues to discover compelling new drill targets in unexplored areas. We are confident that ongoing work will generate additional targets.”

Donald G. Moore

CEO and Director

Phone: 604-377-9220

Email: dmoore@wascomgt.com

D. Neil Briggs

Director

Phone: 604-562-2578

Email: nbriggs@wascomgt.com