This attractively designed book published by the world’s largest copper mining company describes and illustrates copper’s use and heritage from antiquity to the 21st century, all around the world. Learn how civilizations used copper to make jewelry, ornaments, utensils, weapons, religious objects, money, scientific and musical instruments, machinery and artwork – as well as myriad new uses for copper that are innovating our world today. Click the image to read 65 pages.

Category: Energy

Vancouver, British Columbia–(Newsfile Corp. – January 10, 2024) – Emperor Metals Inc. (CSE: AUOZ) (OTCQB: EMAUF) (FSE: 9NH) (“Emperor“) is pleased to announce additional assay results from the summer 2023 drilling campaign at the Duquesne West Gold Project. Using Artificial Intelligence (A.I.) to model the deposit and plan our drill program, a total of 14 diamond drillholes have been completed which represents 8,579 meters.

Full results for DQ23-02 extension and DQ23-07 have been released from SGS Laboratories (see Table 1 intercept highlights). These results indicate the potential for resource expansion within and outside the open pit concept. Emperor is targeting a multi-million-ounce resource in a combination of conceptual open pit and underground mining scenarios.

Highlights

- DQ23-07 intersects 15.7 metres (m) of 0.8 grams per tonne (g/t) gold (Au) (including 7.0 m of 1.08 g/t Au) and 7.2 m of 2.8 g/t Au within the open pit concept (see Figure 1).

- Drilling adds incremental ounces outside known high-grade areas in the open pit scenario. These intercepts will reduce the stripping ratio; due to gold endowment in areas that were overlooked and historically unsampled.

- DQ23-02 intersected 3.65 m of 6.25 g/t Au (including 1.2 m of 12.2 g/t Au). Expanded mineralization in footwall zone.

CEO John Florek commented:

” Emperor is the first company to sample all intervals in our drilling to evaluate the additional potential for bulk tonnage open-pit mining at Duquesne West. We’re excited to see positive assay results for rocks within a conceptual open-pit domain that were not sampled by previous explorers who lacked an open-pit strategy on this property and did not examine the additional lower-grade bulk tonnage opportunity.

Historical sampling focused on the extensive underground potential for high-grade gold, so only 30% of the core from historical drilling was sampled by previous operators. Our discovery of these lower grade bulk tonnage ounces within our open-pit conceptual model is very significant for reducing strip ratio and for improving overall economics in a combination type open-pit and under-ground mining scenario.

Our vision to develop a multimillion-ounce deposit with multiple mining scenarios on the Duquesne West property continues to grow. Our use of A.I has enabled us to quickly process extensive historical data and integrate it with new information to model exploration targets with a high degree of confidence and success. The proximity to multiple mills and infrastructure in a Tier 1 mining district makes the production potential of this project highly valuable within the global junior mining space. The current price of gold certainly helps promote this vision.”

Image 1: Figure showing DQ23-07 intercept within the conceptual open pit model. Broad scale mineralization confirming incremental grade outside existing high-grade lenses in areas previously unsampled by historical workers. These intercepts may add ounces to the deposit.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8461/193768_ff2b77dc9406f97d_001full.jpg

Summary of Drill Results:

DQ23-02 was a step-out hole and originally drilled to test the eastern margin of a mineralized zone, with an intersection of 10.65 m of 3.97 g/t Au (see press release dated September 12, 2023) that is expected to extend the footprint of mineralization. The grades and thickness intersected were as expected. However, the hole was extended due to assays identifying a broad thickness of mineralization at the bottom of the hole; 25.0 m of 1.69 g/t Au (see press release dated September 12, 2023). This extension of DQ23-02 tested further into the footwall because of indications of mineralization by Emperor’s AI modeling; this extension encountered gold values and expanded the mineralized footprint of the deposit (3.65 m of 6.25 g/t Au); see Figure 2

DQ23-07 was designed to intersect mineralization in both the near-surface ultimate pit scenario and the underground mining scenario. Intersection within the open pit scenario contained 15.7 Metres of 0.8 g/t Au (including 7.0 m of 1.80 g/t Au) and 7.2 m of 2.8 g/t Au; additional broad scale mineralization was seen as well (21.5 m of 0.40 g/t Au). Mineralization deeper in the footwall and within the underground mining scenario intercepted a footwall zone containing 2.0 m of 2.42 g/t Au.

The open pit concept in Figure 1 shows an ultimate pit with a depth extent of 400 meters; the footprint is 1.8 km by 0.8 km. Initial exploration in 2024 will strategically focus on the area of the phase 1 pit design. This will allow us to determine the potential economics as we progress through the phases having the necessary assay results for resource evaluation and eventually for economic evaluations. Currently, Emperor is also sampling near-surface core from the historical core library that was not assayed by previous explorers. Up to 70% of this core has not been assayed. So far, over 3,000 meters have been sampled and will be sent to the laboratory for analysis.

In General, mineralization is within and proximal to a fertile, gold endowed, quartz-feldspar porphyry intrusion (QFP), which appears to enrich the greenstone belt along this structural corridor that hosts the Duquesne West Gold Deposit. Apophyses of this intrusion are more endowed and are close to the most highly replacement type mineralization. Competency contrasts between rock types within this mineralized corridor are good sites for additional mineralization.

High and low-grade mineralization are important in Open Pit Mining:

- Highest grade intercepts are within mafic (+/- ultramafic) breccia zone carapaces mantling the QFPs or highly deformed replacement style structural zones (in the mafic volcanics) that are highly strained and completely replaced by ankerite, sericite, and quartz.

- The broadest low-grade zones are located within the QFPs.

- Some lower-grade broad zones mantle higher-grade intercepts in the mafic volcanics. This usually occurs at the margin between mafic volcanics and QFP (low grade in both units surrounding a high-grade intercept.)

This mineralizing system is significantly large in length, width and depth. These broad zones will aid in lowering strip ratios when Emperor has enough data to support a new resource estimate for both open pit and underground conceptual mining scenarios.

Approximately 75% of the assays have been returned from the laboratory, Emperor is awaiting additional assays results.

Samples were sent to SGS Laboratories in Lakefield, ON.

Image 2: DQ23-02 intercept of 3.65 m of 6.25 g/t Au. Intercept expands footprint of the minable stope model in footwall zone; potential adding ounces to the deposit.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8461/193768_ff2b77dc9406f97d_002full.jpg

Quality Assurance and Control

The Quality Assurance and Quality Control (QAQC) was conducted by Technominex, a geological contractor hired by Emperor Metals, which adheres to CIM Best Practices Guidelines for exploration related activities conducted at its facility in Rouyn Noranda, Quebec. The QA/QC procedures are overseen by a Qualified Person on site.

Emperor Metals QA/QC protocols are maintained through the insertion of certified reference material (standards), blanks and lab duplicates within the sample stream totaling approximately one QA/QC sample per 7 samples. Drill core is cut in-half with a diamond saw, with one-half placed in sealed bags with appropriate tags and shipped to the SGS Lakefield laboratory and the other half retained on site in the original core box. A dispatch list consists of 88 or 176 samples along with their corresponding QA/QC samples for a single batch. This allows complete batches (88 samples) for fire assay. A file for sample tracking records tags used and weights of sample bags shipped to the SGS Lakefield. Shipment is done by Manitoulin Transport and coordination by Technominex staff in Rouyn-Noranda.

The third-party laboratory, SGS prep laboratory in Lakefield Ontario, processes the shipment of samples using standard sample preparation (code PRP91) and produces pulps from the specified samples. The pulps are then sent off to SGS Burnaby for analysis. Chain of custody is maintained from the drill to the submittal into the laboratory preparation facility all the way to analysis at the SGS Burnaby B.C. laboratory.

Analytical testing is performed by SGS laboratories in Burnaby, British Columbia. The entire sample is crushed to 75% passing 2mm, with a split of 500g pulverized to 85% passing 75 microns. Samples are then analyzed using Au – ore grade 50g Fire Assay, ICP-AES with reporting limits of 0.01 -100 part per million (ppm). High grade gold analysis based on the presence of visible gold or a fire assay result exceeding 100 ppm, are analyzed by Au – metallic screening, 1kg screened to 106μm, 50g fire assay, gravimetric, AAS or ICP-AES of entire plus fraction and duplicate analysis of minus fraction. Reporting limit 0.01ppm.

About the Duquesne West Gold Project

The Duquesne West Gold Property is located 32 km northwest of the city of Rouyn-Noranda and 10 km east of the town of Duparquet. The property lies within the historic Duparquet gold mining camp in the southern portion of the Abitibi Greenstone Belt in the Superior Province.

Under an Option Agreement, Emperor agreed to acquire a one hundred percent (100%) interest in a mineral claim package comprising 38 claims covering approximately 1,389 ha, located in the Duparquet Township of Quebec (the “Duquesne West Property”) from Duparquet Assets Ltd., a 50% owned subsidiary of Globex Mining Enterprises Inc. (GMX-TSX). For further information on the Duquesne West Property and Option Agreement, see Emperor’s press release dated October 12, 2022, available on SEDAR.

The Property hosts a historical inferred mineral resource estimate of 727,000 ounces of gold at a grade of 5.42 g/t Au.1,2 The mineral resource estimate predates modern CIM guidelines and a Qualified Person on behalf of Emperor has not reviewed or verified the mineral resource estimate, therefore it is considered historical in nature and is reported solely to provide an indication of the magnitude of mineralization that could be present on the property. The gold system remains open for resource identification and expansion.

Reinterpretation of the existing geological model was created using Artificial Intelligence (A.I) and Machine Learning. This model shows the opportunity for additional discovery of ounces by revealing gold trends unknown to previous workers and the potential to expand the resource along significant gold-endowed structural zones.

Multiple scenarios exist to expand additional resources which include:

- Underground High-Grade Gold

- Open Pit Bulk Tonnage Gold

- Underground Bulk Tonnage Gold.

1 Watts, Griffis, and McOuat Consulting Geologists and Engineers, Oct 20, 2011, Technical Report and Mineral Resource Estimate Update for the Duquesne-Ottoman Property, Quebec, Canada for XMet Inc.

2 Power-Fardy and Breede, 2011. The Mineral Resource Estimate (MRE) constructed in 2011 is considered historical in nature as it was constructed prior to the most recent Canadian Institute of Mining and Metallurgy (CIM) standards (2014) and guidelines (2019) for mineral resources. In addition, the economic factors used to demonstrate reasonable prospects of eventual economic extraction for the MRE have changed since 2011. A qualified person has not done sufficient work to consider the MRE as a current MRE. Emperor is not treating the historical MRE as a current mineral resource. The reader is cautioned not to treat it, or any part of it, as a current mineral resource.

Table of Significant Drilling Intercepts

| Hole No. | From (m) | To (m) | Interval (m) | Au (g/t Au) |

| 1DQ23-02 | 909.35 | 910.5 | 1.15 | 12.17 |

| 910.5 | 913 | 2.5 | 3.52 | |

| Wt. Avg. | 3.65 | 6.25 | ||

| Including: | 1.15 | 12.17 | ||

| 1DQ23-07 | 54 | 55 | 1 | 0.76 |

| 55 | 56 | 1 | 0.17 | |

| 56 | 57 | 1 | 0.02 | |

| 57 | 58 | 1 | 0.87 | |

| 58.0 | 58.8 | 0.75 | 0.35 | |

| 58.75 | 59.3 | 0.55 | 0.84 | |

| 59.3 | 60 | 0.7 | 1.23 | |

| 60 | 61 | 1 | 0.75 | |

| 61 | 62 | 1 | 1.17 | |

| 62 | 63 | 1 | 0.48 | |

| 63 | 64 | 1 | 2.16 | |

| 64 | 65 | 1 | 0.57 | |

| 65 | 66 | 1 | 1.09 | |

| 66 | 67 | 1 | 1.05 | |

| 67 | 68 | 1 | 1.01 | |

| 68 | 69 | 1 | 0.55 | |

| 69 | 69.7 | 0.7 | 1.00 | |

| Wt. Avg. | 15.7 | 0.82 | ||

| Including: | 7 | 1.08 | ||

| 228.1 | 229.1 | 1 | 3.33 | |

| 229.1 | 230.1 | 1 | 6.33 | |

| 230.1 | 231.2 | 1.1 | 5.70 | |

| 231.2 | 232.4 | 1.2 | 2.74 | |

| 232.4 | 233.85 | 1.45 | 0.26 | |

| 233.85 | 235.3 | 1.45 | 0.38 | |

| Wt. Avg. | 7.2 | 2.80 | ||

| Including: | 4.3 | 4.47 | ||

| Including: | 2.1 | 6.00 | ||

| 343.5 | 344.5 | 1 | 0.78 | |

| 344.5 | 346 | 1.5 | 0.5 | |

| 346 | 347 | 1 | 0.78 | |

| 347 | 348 | 1 | 0.18 | |

| 348 | 349 | 1 | 0.13 | |

| 349 | 350 | 1 | 0.39 | |

| 350 | 351 | 1 | 0.47 | |

| 351 | 352 | 1 | 0.36 | |

| 352 | 353 | 1 | 0.19 | |

| 353 | 354 | 1 | 0.02 | |

| 354 | 355 | 1 | 0.23 | |

| 355 | 356 | 1 | 0.32 | |

| 356 | 357 | 1 | 0.09 | |

| 357 | 358 | 1 | 0.01 | |

| 358 | 359 | 1 | 0.03 | |

| 359 | 360 | 1 | 0.13 | |

| 360 | 361 | 1 | 0.05 | |

| 361 | 362 | 1 | 0.04 | |

| 362 | 363 | 1 | 2.93 | |

| 363 | 364 | 1 | 0.005 | |

| 364 | 365 | 1 | 0.77 | |

| Wt. Avg. | 21.5 | 0.40 | ||

| 563.6 | 564.6 | 1 | 3.35 | |

| 564.6 | 565.6 | 1 | 1.48 | |

| Wt. Avg. | 2 | 2.42 | ||

| 1Host Structures are interpreted to be steeply dipping and true widths are generally estimated to 90%. | ||||

QP Disclosure

The technical content for the Duquesne West Project in this news release has been reviewed and approved by John Florek, M.Sc., P.Geol., a Qualified Person pursuant to CIM guidelines.

About Emperor Metals Inc.

Emperor Metals Inc. is an innovative Canadian mineral exploration company focused on developing high-quality gold properties situated in the Canadian Shield. For more information, please refer to SEDAR (www.sedarplus.ca), under the Company’s profile.

ON BEHALF OF THE BOARD OF DIRECTORS

s/ “John Florek”

John Florek, M.Sc., P.Geol

President, CEO and Director

Emperor Metals Inc.

For further information, please contact:

Mr. Alex Horsley, Director

Phone: 778-323-3058

Email: alexh@emperormetals.com

Website:www.emperormetals.com

THE CANADIAN SECURITIES EXCHANGE HAS NOT APPROVED NOR DISAPPROVED THE CONTENT OF THIS PRESS RELEASE

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

CERTAIN STATEMENTS MADE AND INFORMATION CONTAINED HEREIN MAY CONSTITUTE “FORWARD-LOOKING INFORMATION” AND “FORWARD-LOOKING STATEMENTS” WITHIN THE MEANING OF APPLICABLE CANADIAN AND UNITED STATES SECURITIES LEGISLATION. THESE STATEMENTS AND INFORMATION ARE BASED ON FACTS CURRENTLY AVAILABLE TO THE COMPANY AND THERE IS NO ASSURANCE THAT ACTUAL RESULTS WILL MEET MANAGEMENT’S EXPECTATIONS. FORWARD-LOOKING STATEMENTS AND INFORMATION MAY BE IDENTIFIED BY SUCH TERMS AS “ANTICIPATES”, “BELIEVES”, “TARGETS”, “ESTIMATES”, “PLANS”, “EXPECTS”, “MAY”, “WILL”, “COULD” OR “WOULD”.

FORWARD-LOOKING STATEMENTS AND INFORMATION CONTAINED HEREIN ARE BASED ON CERTAIN FACTORS AND ASSUMPTIONS REGARDING, AMONG OTHER THINGS, THE ESTIMATION OF MINERAL RESOURCES AND RESERVES, THE REALIZATION OF RESOURCE AND RESERVE ESTIMATES, METAL PRICES, TAXATION, THE ESTIMATION, TIMING AND AMOUNT OF FUTURE EXPLORATION AND DEVELOPMENT, CAPITAL AND OPERATING COSTS, THE AVAILABILITY OF FINANCING, THE RECEIPT OF REGULATORY APPROVALS, ENVIRONMENTAL RISKS, TITLE DISPUTES AND OTHER MATTERS. WHILE THE COMPANY CONSIDERS ITS ASSUMPTIONS TO BE REASONABLE AS OF THE DATE HEREOF, FORWARD-LOOKING STATEMENTS AND INFORMATION ARE NOT GUARANTEES OF FUTURE PERFORMANCE AND READERS SHOULD NOT PLACE UNDUE IMPORTANCE ON SUCH STATEMENTS AS ACTUAL EVENTS AND RESULTS MAY DIFFER MATERIALLY FROM THOSE DESCRIBED HEREIN. THE COMPANY DOES NOT UNDERTAKE TO UPDATE ANY FORWARD-LOOKING STATEMENTS OR INFORMATION EXCEPT AS MAY BE REQUIRED BY APPLICABLE SECURITIES LAWS.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/193768

KELOWNA, BC / ACCESSWIRE / January 10, 2024 / Diamcor Mining Inc. (TSXV.DMI)(OTCQB:DMIFF)(FRA:DC3A), (“Diamcor” or the “Company”), a well-established Canadian diamond mining company with a proven history in the mining, exploration, and sale of rough diamonds is pleased to provide a brief overview of the significant events which shaped the diamond industry in 2023, their implications for the sector, and the actions taken to allow the industry to move forward in 2024 with a sense of optimism. Additionally, we are pleased to provide an overview of the Company’s main operational focus for the coming year.

2023 Diamond Industry Overview

The year 2023 proved to be a year of adaptation and strategic realignment for the diamond industry as the world continued to emerge from the global COVID-19 pandemic. The significant events which shaped the year included:

- Changes in consumer spending habits and their allocation of funds as countries began to open up and the world entered a post-COVID 19 environment.

- The continued purchasing of rough diamonds at the previously elevated levels of 2022 by many in the industry despite changes in consumer spending, resulting in the short-term creation of excess rough diamond inventories and downward pressure on pricing.

- Significant reductions of new rough diamond sales by the world’s largest producers in the second half of 2023 to aid in rebalancing the above excess inventories and support price recovery.

- The decision by the world’s largest cutting and polishing country, India, to temporarily suspend the import of rough diamonds from October 15, 2023 to December 15, 2023.

- Continued geopolitical concerns surrounding the ongoing Russia/Ukraine conflict and recent Israeli-Palestinian conflict.

- Economic uncertainties which continued in the industry’s most important market of the USA, as well as slower than expected post-COVID-19 economic recovery in China.

- The initial G7 sanctions on rough diamonds originating in Russia proved largely ineffective throughout the year, however several revisions by the G7 to increase the effectiveness of these sanctions came into effect on January 1, 2024.

- Additional sanctions on rough diamonds originating in Russia were also announced by the European Union on January 3, 2024.

The industry demonstrated its ability to implement proactive changes in 2023 to strengthen itself for 2024, and the Company reaffirms its belief in the unique value proposition of its Krone-Endora at Venetia project given its ability to provide non-conflict natural rough diamonds to the world market moving forward. Unlike their lab-grown counterparts, natural diamonds are treasured for their rarity, provenance, and the timeless allure they hold, and with limited supplies of natural diamonds remaining, the revised sanctions on Russia (~30% of annual global production), many mines reaching the end of their lives, the general sentiment in the industry is that yearly production levels are expected to continue to drop in the years to come. The adjustments made by the industry in 2023 appear to have been effective, with price recoveries in various categories becoming apparent later in the year. The Company believes this trend of increasing prices will continue into 2024 and moving forward, with the level of increases ultimately being driven by combined elements such as: consumer spending, increased shortages due to revised sanctions on Russia, potential reductions in yearly production from existing mines, and increased demand due to the recovery and growth of emerging markets such as China and India.

2024 Operational Focus

After successfully navigating its way through various complex global and industry issues of recent years, the Company sees 2024 as a year of significant opportunity in which it can return its primary focus back to the advancement and growth of its Krone-Endora at Venetia project (the “Project”). The Project has always presented a compelling opportunity given its direct relationship with De Beers’ Venetia diamond mine, which is widely accepted as one of the most prolific diamond mines in the world. The Company’s primary areas of focus for 2024 will be:

- The continuation of trial-mining exercises and optimization of operational efficiencies, with ancillary diamond recoveries and sales revenue which will assist in supporting the advancement of the Project’s recommended work programs and continued advancement.

- The concurrent advancement of additional bulk sampling on key areas of interest within the remaining 85% of the property to determine the potential extent and location of the known displacement of material from Venetia into these areas.

- The finalization of planned additions to the Project’s processing plant and final recovery systems, as well as additional heavy equipment assets to support significant increases in processing volumes and the potential for increased ancillary revenues while reducing operating costs at the Project for the long-term.

- The continued identification and evaluation of opportunities which demonstrate the potential for additional near-term production of natural gem quality rough diamonds from non-conflict areas to support the Company’s future growth and shareholder value.

The Company has successfully advanced the Project from its inception into the fully permitted Project with significant infrastructure and the growth potential it represents today. We believe with the recent events of the past few years now largely behind us, we are well-positioned in 2024 to now take advantage of the compelling opportunity that companies such as Diamcor have with the ability to provide gem quality natural rough diamonds from non-conflict areas moving forward.

Results of the Annual General Meeting

The Company also announces that shareholders passed each of the resolutions described in the Company’s proxy materials by the required majority of voting at the Company’s Annual General Meeting (the “AGM”) held on December 20, 2023.

The total number of votes cast for each resolution is set out in the table below.

| MOTIONS | NUMBER OF SHARES | PERCENTAGE OF VOTES CAST | ||||||

| FOR | AGAINST | WITHHELD/ ABSTAIN | SPOILED | NON VOTE | FOR | AGAINST | WITHHELD/ ABSTAIN | |

| Number of Directors | 70,372,338 | 1,503,286 | 0 | 0 | 0 | 97.91% | 2.09% | 0.00% |

| Dean H. Taylor | 60,540,849 | 0 | 198,100 | 0 | 11,136,675 | 99.67% | 0.00% | 0.33% |

| Darren Vucurevich | 60,498,630 | 0 | 240,319 | 0 | 11,136,675 | 99.60% | 0.00% | 0.40% |

| Sheldon Nelson | 60,716,049 | 0 | 22,900 | 0 | 11,136,675 | 99.96% | 0.00% | 0.04% |

| Dr. Stephen Haggerty | 60,716,349 | 0 | 22,600 | 0 | 11,136,675 | 99.96% | 0.00% | 0.04% |

| Appointment of Auditors | 71,875,624 | 0 | 0 | 0 | 0 | 100.0% | 0.00% | 0.00% |

TOTAL SHAREHOLDERS VOTED BY PROXY: 56

TOTAL SHARES ISSUED & OUTSTANDING: 128,512,937

TOTAL SHARES VOTED: 71,875,624

TOTAL % OF SHARES VOTED: 55.93%

About Diamcor Mining Inc.

Diamcor Mining Inc. is a fully reporting publicly traded Canadian diamond mining company with a well-established proven history in the mining, exploration, and sale of rough diamonds. With a long-term strategic alliance with world famous Tiffany & Co, the Company’s primary focus is on the mining and development of its Krone-Endora at Venetia Project which is co-located and directly adjacent to De Beers’ Venetia Diamond Mine in South Africa. The Venetia diamond mine is recognized as one of the world’s top diamond-producing mines, and the deposits which occur on Krone-Endora have been identified as being the result of shift and subsequent erosion of an estimated 50M tonnes of material from the higher grounds of Venetia to the lower surrounding areas in the direction of Krone and Endora. The Company focuses on the acquisition and development of mid-tier projects with near-term production capabilities and growth potential and uses unique approaches to mining that involves the use of advanced technology and techniques to extract diamonds in a safe, efficient, and environmentally responsible manner. The Company has a strong commitment to social responsibility, including supporting local communities and protecting the environment.

About the Tiffany & Co. Alliance

The Company has established a long-term strategic alliance and first right of refusal with Tiffany & Co. Canada, a subsidiary of world-famous New York based Tiffany & Co., to purchase up to 100% of the future production of rough diamonds from the Krone-Endora at Venetia Project at market prices. In conjunction with this first right of refusal, Tiffany & Co. Canada also provided the Company with financing in an effort to advance the Project as quickly as possible. Tiffany & Co. is now owned by Moet Hennessy Louis Vuitton SE (LVMH), a publicly traded company which is listed on the Paris Stock Exchange (Euronext) under the symbol LVMH and on the OTC under the symbol LVMHF. For additional information on Tiffany & Co., please visit their website at www.tiffany.com.

About the Krone-Endora at Venetia Project

Diamcor acquired the Krone-Endora at Venetia Project from De Beers Consolidated Mines Limited, consisting of the prospecting rights over the farms Krone 104 and Endora 66, which represent a combined surface area of approximately 5,888 hectares directly adjacent to De Beers’ flagship Venetia Diamond Mine in South Africa. The Company subsequently announced that the South African Department of Mineral Resources had granted a Mining Right for the Krone-Endora at Venetia Project encompassing 657.71 hectares of the Project’s total area of 5,888 hectares. The Company has also submitted an application for a mining right over the remaining areas of the Project. The deposits which occur on the properties of Krone and Endora have been identified as a higher-grade “Alluvial” basal deposit which is covered by a lower-grade upper “Eluvial” deposit. These deposits are proposed to be the result of the direct-shift (in respect to the “Eluvial” deposit) and erosion (in respect to the “Alluvial” deposit) of an estimated 1,000 vertical meters of material from the higher grounds of the adjacent Venetia Kimberlite areas. The deposits on Krone-Endora occur with a maximum total depth of approximately 15.0 metres from surface to bedrock, allowing for a very low-cost mining operation to be employed with the potential for near-term diamond production from a known high-quality source. Krone-Endora also benefits from the significant development of infrastructure and services already in place due to its location directly adjacent to the Venetia Mine, which is widely recognised as one of the top producing diamond mines in the world.

Qualified Person Statement:

Mr. James P. Hawkins (B.Sc., P.Geo.), is Manager of Exploration & Special Projects for Diamcor Mining Inc., and the Qualified Person in accordance with National Instrument 43-101 responsible for overseeing the execution of Diamcor’s exploration programmes and a Member of the Association of Professional Engineers and Geoscientists of Alberta (“APEGA”). Mr. Hawkins has reviewed this press release and approved of its contents.

On behalf of the Board of Directors:

Mr. Dean H. Taylor

President & CEO

Diamcor Mining Inc.

www.diamcormining.com

For further information contact:

Mr. Dean H. Taylor

Diamcor Mining Inc

DeanT@Diamcor.com

+1 250 862-3212

For Investor Relations contact:

Mr. Rich Matthews

Integrous Communications

rmatthews@integcom.us

+1 (604) 355-7179 +1 (647) 258-3310

Mr. Neil Simon

Investor Cubed Inc

nsimon@investor3.ca

+1 (647) 258-3310

This press release contains certain forward-looking statements. While these forward-looking statements represent our best current judgement, they are subject to a variety of risks and uncertainties that are beyond the Company’s ability to control or predict and which could cause actual events or results to differ materially from those anticipated in such forward-looking statements. Further, the Company expressly disclaims any obligation to update any forward looking statements. Accordingly, readers should not place undue reliance on forward-looking statements.

WE SEEK SAFE HARBOUR

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Diamcor Mining Inc.

View the original press release on accesswire.com

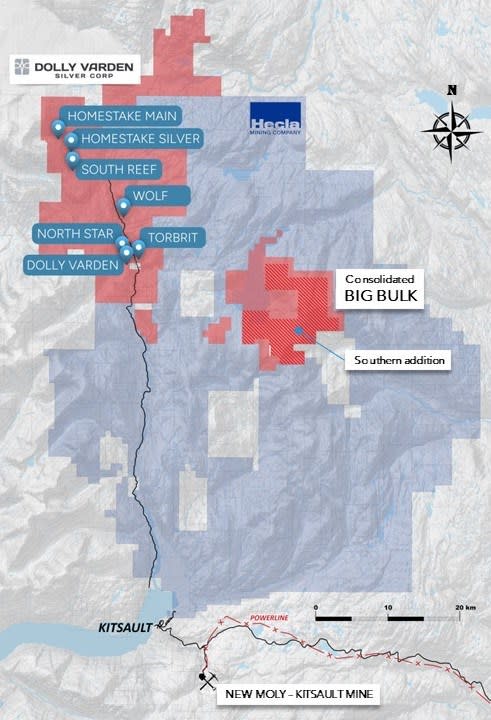

VANCOUVER, BC / ACCESSWIRE / January 10, 2024 / Metallic Minerals Corp. (TSXV:MMG)(OTCQB:MMNGF) (“Metallic Minerals” or the “Company”) is pleased to announce results from its fall 2023 exploration drilling campaign at the Company’s 100%-owned, 171 square kilometer (“km2″) Keno Silver project, adjacent to Hecla Mining (“Hecla”) in the high-grade Keno Hill silver district of Canada’s Yukon Territory. The 2023 exploration program included 1,112 meters (“m”) in four diamond drill holes focused on expansion of the Formo target in the West Keno area, which is on trend with the 100 million-ounce (“Moz”) historic Hector-Calumet mine controlled by Hecla.

Drill hole FOR23-03 represents one of the best intercepts to date for the Keno Silver project, returning grades of 256 grams per tonne (g/t) silver equivalent recovered (“Ag Eq”) over 46 m. This is also the deepest intercept to date on the Formo vein structure (only 275 m vertically from surface) and mineralization remains fully open down dip and along strike. Formo is anticipated to be one of the highest grade and largest contributors to the forthcoming inaugural NI-43-101 mineral resource estimate for the Keno Silver project, currently nearing completion by SGS Geological Services.

2023 West Keno Exploration Highlights

- High-grade silver (“Ag”), lead (“Pb”), zinc, (“Zn”) and significant gold (“Au”) mineralization was encountered in all four 2023 drill holes (See Table 1) which will contribute to the pending NI 43-101 Mineral Resource Estimate for the project.

- Both high-grade Ag-Au-Pb-Zn vein-style mineralization and broader zones of bulk tonnage Ag-Au-Pb-Zn mineralization comprised of high-grade vein intervals and associated stringers and stockwork veining were encountered.

- FOR23-03 returned 256.8 g/t Ag Eq (99.1 g/t Ag, 0.52 g/t Au, 0.65% Pb, 2.62% Zn) over 46.05 m with multiple internal higher-grade zones including, 3.3 m of 1,413.45 g/t Ag Eq (562.4 g/t Ag, 0.20 g/t Au, 2.35% Pb and 20.3% Zn). The bulk tonnage interval of this hole represents one of the highest gram-meter (g/t Ag Eq x interval thickness) intervals on the Keno Silver project to date, and extended mineralization by 140 m from the nearest 2022 and historic drill holes.

- FOR23-04, a large step-out hole, drilled nearly 250 m west of the nearest Formo vein drilling, returned four separate silver-dominant vein structures of considerable width providing additional confirmation of the potential for on-strike expansion of the Formo target.

- The Formo target remains open to further expansion, down-dip and on-trend, and shows potential for new discoveries within the Formo property footprint.

Metallic Minerals President, Scott Petsel, stated, “The Formo target is an exciting, advanced exploration stage “resource-ready” target with significant room to grow featuring both high-grade and bulk mineable widths that make it amenable to lower-cost mining methods. The Formo target is ideally located near infrastructure as it is adjacent to the Silver Trail highway (Highway 11) and power lines that feed the central Keno Hill mill. It also directly adjoins Hecla’s Keno Hill property, where Hecla is actively mining the nearby Bermingham mine. We are excited to be able to include these new drill results in our upcoming inaugural resource for the Keno Silver project as these results at Formo continue to demonstrate our ability to build a significant resource base for the project. The resource estimate is expected to be complete in Q1 2024.”

“In addition, the Company looks forward to meeting with interested investors at the upcoming Vancouver Resource Investment Conference, AMEBC Mineral Roundup and Prospectors and Developers annual conferences where Metallic Minerals has been invited to display drill core from its 2023 exploration programs at La Plata and Keno Silver. We anticipate reporting additional results from the Keno Silver project and La Plata projects over the next few weeks.”

Upcoming Events

Vancouver Resource Investment Conference (VRIC)

Metallic Minerals and fellow Metallic Group members, Granite Creek Copper and Stillwater Critical Minerals, in Booth #112 at the 2024 VRIC event, January 21 and 22, 2024. For more information click here.

AMEBC Mineral Roundup Core Shack

Metallic Minerals will be displaying core from the 2023 drill season at the upcoming AMEBC Mineral Roundup event held in Vancouver, BC January 22 to 25, 2024. For more information click here.

Prospectors and Developers Association of Canada Annual Convention (PDAC)

Metallic Minerals will be displaying core from the 2023 drill season at the La Plata project during the PDAC convention held in Toronto, March 3 to 6, 2024. For more information click here.

Table 1 – Highlights of 2023 Drill Results from the West Keno – Formo Target Area

| DDH Hole ID | From (m) | To (m) | Length (M) | Recovered Ag Eq (g/t) | Ag (g/t) | Au (g/t) | Pb (%) | Zn (%) |

| FOR23-001 | 148.74 | 149.43 | 0.69 | 499.23 | 3.6 | 6.20 | 0.00 | 0.01 |

| and | 196.95 | 215 | 18.05 | 234.45 | 121.4 | 0.05 | 1.22 | 2.06 |

| including | 196.95 | 198.9 | 1.95 | 513.39 | 300.3 | 0.07 | 2.71 | 3.74 |

| also incl | 208.4 | 214 | 5.6 | 478.25 | 241.0 | 0.10 | 2.41 | 4.43 |

| with | 208.4 | 211.2 | 2.8 | 687.57 | 367.9 | 0.18 | 4.02 | 5.37 |

| FOR23-002 | 172.3 | 173.35 | 1.05 | 67.04 | 3.5 | 0.79 | 0.01 | 0.01 |

| and | 218 | 221 | 3 | 131.42 | 51.9 | 0.38 | 0.35 | 1.07 |

| incl | 218.75 | 219.75 | 1 | 277.81 | 137.0 | 0.00 | 0.96 | 3.08 |

| FOR23-003 | 239.95 | 286 | 46.05 | 256.82 | 99.1 | 0.52 | 0.65 | 2.62 |

| including | 239.35 | 263.65 | 23.7 | 462.37 | 176.0 | 1.0 | 1.13 | 4.67 |

| with | 239.35 | 245.5 | 5.5 | 406.57 | 46.6 | 4.07 | 0.49 | 0.60 |

| and with | 255.8 | 263.65 | 7.85 | 899.27 | 392.4 | 0.13 | 2.06 | 11.68 |

| including | 260.35 | 263.65 | 3.3 | 1,413.45 | 562.4 | 0.20 | 2.35 | 20.30 |

| with | 260.75 | 261.5 | 0.75 | 1,411.76 | 994.0 | 0.03 | 3.01 | 7.36 |

| and with | 262.05 | 263.65 | 1.6 | 1,769.44 | 416.0 | 0.39 | 2.64 | 32.32 |

| and | 284 | 286 | 2 | 302.55 | 116.5 | 0.03 | 1.07 | 4.07 |

| FOR23-004 | 122 | 124.46 | 2.46 | 76.62 | 43.7 | 0.11 | 0.33 | 0.43 |

| and | 153.5 | 154.1 | 0.6 | 284.52 | 154.0 | 0.09 | 1.67 | 2.14 |

| and | 177.5 | 183 | 5.5 | 72.95 | 61.2 | 0.00 | 0.28 | 0.18 |

| including | 179 | 180.75 | 1.76 | 144.67 | 130.0 | 0.00 | 0.46 | 0.21 |

| and | 300.3 | 301 | 0.7 | 83.26 | 5.6 | 0.97 | 0.01 | 0.00 |

Notes to reported values:

- Ag equivalent is presented for comparative purposes using conservative long-term metal prices (all USD): $22.0/oz silver (Ag), $1,850/oz gold (Au), $1.00/lb lead (Pb), $1.40/lb zinc (Zn).

- Recovered Silver Equivalent in Table 1 is determined as follows: Ag Eq g/t = [Ag g/t x recovery] + [Au g/t x recovery x Au price/ Ag price] + [Pb % x 10,000 x recovery x Pb price / Ag price] + [Zn% x 10,000 x recovery x Zn price / Ag price].

- In the above calculations: 1% = 10,000 ppm = 10,000 g/t.

- The following recoveries have been assumed for purposes of the above equivalent calculations: 95% for precious metals (Ag/Au) and 90% for all other listed metals, based on recoveries at similar nearby operations.

- Intervals are reported as measured drill intersect lengths and do not represent true width.

Figure 1. Keno Silver District Geology and Deposits

West Keno and the Formo Target Area

The Western Keno Hill district is host to the largest historic production and current resources in the prolific Keno Hill silver district. The Formo target is located at the intersection of a north-easterly structural zone extending from the Hector-Calumet mine, which was the largest producer in the district producing nearly 100 million ounces of silver and the Elsa structural trend, which was the second largest silver producer in the district (see Figure 2).

The Formo property, which includes the historic Formo Mine, was acquired by Metallic Minerals in 2017. The historic Formo mine produced high-grade silver at various times since the 1930s from high-grade vein structures that graded over 1,000 g/t silver1. Significant underground exploration drifts were developed in the 1950s with most of the historic production from an open pit located alongside of the Silver Trail highway between the Elsa townsite and Keno City and last mined in the 1980s.

The primary Formo vein structure is exposed at surface in an open cut. Multiple veins have been encountered in the target area that demonstrate an association with Triassic greenstones in the Earn group schist, similar to the Sadie Ladue deposit which produced 12.7 Moz silver at a grade of 1,620 g/t Ag1. In addition to the mineralization at the known Formo target, two new surface targets have been identified through soil and rock sampling along the same structural corridors that show potential to host high-grade and bulk tonnage Keno-style Ag-Au-Pb-Zn veins on the Formo property (Figure 2).

Since 2020, Metallic Minerals has drilled 26 holes (4,419 m) at the Formo target building on the six core holes and 54 percussion holes drilled by previous owners between 1980 and 1981. The Formo target is open to significant expansion down dip and along trend with several newly identified targets for drill testing (Figure 2 and 3 below).

Figure 2 – West Keno and Formo Target Plan Map

Figure 3 – Formo Target Cross Section (Looking East)

Pending 43-101 Mineral Resource Estimate for Keno Silver Project

The upcoming inaugural independent 43-101 mineral resource estimate is focused on four initial deposits across the Keno Silver project, including: Formo, Caribou, Fox and Homestake. These four deposits are the most advanced of over 40 identified target areas, each of which is characterized by a kilometric scale Ag in soil anomaly, exposed outcropping high-grade veins, and varying levels of exploration activity or historic production. Metallic Minerals has completed 165 drill holes totalling 18,983 m of combined reverse circulation and diamond core drilling at the Keno Silver project since 2017 on a total of 11 targets, all of which have returned encouraging results. The four most advanced “resource-ready” targets will be part of the upcoming mineral resource estimate being completed by SGS Geological Services and include:

- Formo Target – In the West Keno District, it demonstrates potential for lower-cost bulk tonnage mining or high-grade selective methods with drill highlights including:

- Hole FOR22-04 – 20.87 m @ 220.5 g/t Ag Eq (144.6 g/t Ag, 0.70% Pb, 1.59% Zn), and 1.63 m @ 1,487.19 g/t Ag Eq (1,049 g/t Ag, 4.21% Pb, 9.45% Zn)

- Hole FOR21-05 – 19.8 m @ 216.26 g/t Ag Eq (70 g/t Ag, 0.41 g/t Au, 0.30% Pb, 2.07% Zn) and 0.7 m @ 1,405 g/t Ag Eq (421.0 g/t Ag, 0.15 g/t Au, 1.53% Pb, 24.2% Zn)

- Hole FOR20-003 – 3.0 m @ 2,954.52 g/t Ag (1,568 g/t Ag, 29.45% Pb, 1.35% Zn)

- Caribou Target – In the Central Keno target area the Caribou target historically produced very high-grade material from a shallow surface pit grading more than 6,000 g/t silver.

- Fox Target – Discovered by Metallic Minerals in 2020 in the East Keno target area, the Fox target is characterized as a newly recognized bulk tonnage style of mineralization with shallow-dipping sheeted vein sets up to 177 m in width. Drilling since 2020, has defined a bulk-tonnage mineralized block over 300 m along strike and 150 m down-dip from surface which is open in all directions.

- Homestake Target – A historic producer, the Homestake target in the Central Keno area is fractally spatial with the districts’ giant past producers and current resources (Silver King, Elsa, Bermingham, Hector Calumet, Flame & Moth and Bellekeno) near the contact of the Keno Hill Quartzite and Sourdough Hill formations. With only 88 drill holes (slightly over 5000 m of drilling), and a strike length over 2 km the Homestake target represents considerable resource opportunity and exploration potential.

Metallic Minerals sees considerable opportunity for resource growth from target expansion and new discovery with the further systematic application of exploration, including the expansion of detailed soil geochemical grids, “resource-ready” target expansion through drilling and reconnaissance drilling of early-stage targets.

About Metallic Minerals

Metallic Minerals Corp. is focused on copper, silver, gold, and other critical minerals in the La Plata mining district in Colorado, and silver and gold in the high-grade Keno Hill and Klondike districts of the Yukon. Our objective is to create shareholder value through a systematic, entrepreneurial approach to making exploration discoveries, growing resources, and advancing projects toward development.

At the Company’s La Plata project in southwestern Colorado, the new 2023 NI 43-101 mineral resource estimate identifies a significant porphyry copper-silver resource containing 1.21 Blbs copper and 17.6 Moz of silver3. The 2022 expansion drilling provided the basis for the updated resource, including the longest and highest-grade interval ever encountered at La Plata and one of the top intersections for any North American copper project in the past several years. In May 2023, the Company announced a 9.5% strategic investment by Newcrest Mining Limited (acquired by Newmont Mining in 2023) to accelerate the advancement of the Company’s La Plata project. In the 2023 Fraser Institute’s Annual Survey of Mining Companies, Colorado ranked 5th globally for investment attractiveness and 2nd in the USA.

In Canada’s Yukon Territory, Metallic Minerals has consolidated the second-largest land position in the historic high-grade Keno Hill silver district, directly adjacent to Hecla Mining Company’s (“Hecla”) operations, with more than 300 Moz of high-grade silver in past production and current M&I resources. Hecla, the largest primary silver producer in the USA and third largest in the world, is anticipating full production at its Keno Hill operations by the end of 2023. An inaugural mineral resource estimate on the project is expected in early 2024, with an 1,112-meter expansion drill program completed at the Formo target during fall of 2023.

The Company is also one of the largest holders of alluvial gold claims in the Yukon and is building a production royalty business by partnering with experienced mining operators, including Parker Schnabel of Little Flake Mining from the Discovery Channel television show, Gold Rush.

All of the districts in which Metallic Minerals operates have seen significant mineral production and have existing infrastructure, including power and road access. The Company is led by a team with a track record of discovery and exploration success on several major precious and base metal deposits in the region, as well as having large-scale development, permitting and project financing expertise. The Metallic Minerals team has been recognized for its environmental stewardship practices and is committed to responsible and sustainable resource development.

Footnotes:

- Cathro, R. J., Great Mining Camps of Canada 1. The History and Geology of the Keno Hill Silver Camp, Yukon Territory. Geoscience Canada, Sept. 2006. ISSN 1911-4850.

- Alexco Resource Corp Technical Report, titled “NI 43-101 Technical Report on Updated Mineral Resource and Reserve Estimate of the Keno Hill Silver District” with an effective date of April 1, 2021, and issue date of May 26, 2021.

- See news release dated July 31, 2023. The Mineral Resource has been estimated in conformity with CIM Estimation of Mineral Resource and Mineral Reserve Best Practices Guidelines (2019) and current CIM Definition Standards. The constrained Mineral Resources are reported at a base case cut-off grade of 0.25% Cu Eq, based on metal prices of $3.75/lb Cu and $22.50/oz Ag, assumed metal recoveries of 90% for Cu and 65% for Ag, a mining cost of US$5.30/t rock and processing and G&A cost of US$11.50/t mineralized material. The current Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability. The quantity and grade of reported Inferred Resources in this Mineral Resource Estimate are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as Indicated or Measured. However, based on the current knowledge of the deposits, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Website: www.mmgsilver.com Phone: 604-629-7800

Email: cackerman@mmgsilver.com Toll Free: 1-888-570-4420

Qualified Person

The disclosure in this news release of scientific and technical information regarding exploration projects on Metallic Minerals’ mineral properties has been reviewed and approved by Taylor Haid, P. Geo, Project Manager for TruePoint Exploration, who is a Qualified Person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

Quality Assurance / Quality Control

All samples were prepared by Bureau Veritas’ (BV) Whitehorse, Yukon facility and geochemically analyzed at the BV laboratory in Vancouver, British Columbia. All samples were prepared using BV code PRP70-250, which crushed, split, and pulverized 250 grams of core to 200 mesh pulps. These pulps were then analyzed by 37 Element 1:1:1 Aqua Regia Digestion followed by Inductively Coupled Plasma Mass Spectrometry (ICP-ES/MS) analyses (BV Code AQ202). Over-limit silver, lead, and zinc samples were further analyzed with multi-acid digestion and atomic absorption spectrometry (BV Code MA404). Samples with over-limit gold (and silver when over-limit was reached via multi-acid) were re-analyzed using a 30-gram fire assay fusion with gravimetric finish (BV Code FA530).

All results have passed the QAQC screening by the lab and the company utilizes a quality control and quality assurance protocol for the project, including insertion of blanks, duplicates, and certified reference materials approximately every tenth sample. Certified reference materials were acquired from OREAS North America Inc. of Sudbury, Ontario, and CDN Resource Laboratories Ltd. Of Langley, British Columbia for the 2023 drill program at the Keno Silver project.

Forward-Looking Statements

This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, statements about expected results of operations, royalties, cash flows, financial position and future dividends as well as financial position, prospects, and future plans and objectives of the Company are forward-looking statements that involve various risks and uncertainties. Although Metallic Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, unsuccessful operations, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration, development of mines and mining operations is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Metallic Minerals and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Metallic Minerals Corp.

View the original press release on accesswire.com

Vancouver, British Columbia–(Newsfile Corp. – January 3, 2024) – EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the “Company” or “EMX”) is pleased to announce the execution of an option agreement for EMX’s Sagvoll and Meråker projects in Norway (see Figure 1) with Lumira Energy Ltd. (“Lumira“), a private Australian Company. The agreement provides EMX with 2.5% Net Smelter Return (“NSR”) royalty interests, cash and equity payments, work commitments and other considerations. EMX has recently executed another agreement with Lumira for EMX’s Copperhole Creek project in Queensland Australia (see Company News Release dated September 13, 2023). In conjunction with these transactions, Lumira Energy intends to establish a public listing on the Australian Securities Exchange (ASX) in mid-year 2024 via an Initial Public Offering (“IPO”).

The polymetallic Sagvoll and Meråker projects in Norway are positioned along a prolific metallogenic belt in Norway that includes the historic Røros volcanogenic massive sulfide (“VMS”) district. The Meråker project hosts VMS styles of mineralization, while the Sagvoll project contains both VMS and magmatic nickel-copper sulfide targets. Prior to EMX’s involvement, little work had been done on the Meråker project in the past 50 years, and Sagvoll has not seen substantive exploration since Falconbridge Ltd. last conducted exploration there in the early 2000’s. Together with the Copperhole Creek project in Australia, these projects will form a strong “starter portfolio” for Lumira in support of their upcoming IPO.

Commercial Terms Overview: All terms in Australian Dollars (AUD) unless otherwise indicated. Upon execution, Lumira will make a cash payment of $50,000 to EMX. Lumira will vest a 100% interest in the Projects, by granting to EMX:

- A 2.5% NSR royalty interest on each project.

- Annual advance royalty (“AAR”) payments of $35,000 per project per year commencing upon the second anniversary of the IPO, with the AAR payments escalating by 15% per year until reaching a maximum of $100,000 per year.

- Equity payments of $150,000 in shares of Lumira upon completion of the IPO along with the same number of options exercisable at a 50% premium to the IPO price for two years and an additional same number of options exercisable at a 100% premium to the IPO price for three years.

- An additional 750,000 shares upon the first anniversary of the IPO.

- Milestone payments as follows:

- $250,000 in cash upon completion of a Preliminary Economic Assessment (or equivalent study)

- $500,000 in cash upon completion of a Prefeasibility Study

To maintain its interest in the projects, Lumira will also:

- Spend $150,000 in exploration expenditures per project by the first anniversary of execution.

- Commit to $650,000 in exploration expenditures by the first anniversary of the IPO with a minimum of $200,000 spent on each project (if both are maintained).

- Commit to $750,000 in exploration expenditures by the second anniversary of the IPO with a minimum of $250,000 spent on each project (if both are maintained).

- Complete a cumulative of $5,000,000 in exploration expenditures by the 5th anniversary of execution, with a minimum of $1,200,000 spent on each project (if both are maintained).

Within 72 months of executing the agreement, Lumira will have the right to re-purchase 0.5% of the NSR Royalty on each Project for $1,000,000.

Overviews of the projects. The Sagvoll and Meråker polymetallic projects in Norway are located in the early Paleozoic VMS belt in Norway, which saw numerous districts and mines in operation from the 1600’s through the 1990’s. This metallogenic region represents a tectonically displaced continuation of the Cambrian-Ordovician VMS belts in northeastern North America, which includes the Buchans and Bathurst VMS camps in eastern Canada, and also the Avoca VMS district in Ireland. As such, this represents one of the more prolific VMS belts in the world in terms of total production from its various mining districts, albeit now tectonically displaced and occurring along opposite sides of the Atlantic Ocean.

Sagvoll Project, Caledonian VMS Belt, Southern Norway: The Sagvoll project in southern Norway consists of both VMS and magmatic nickel-copper sulfide mineralization developed along the Caledonian mountain belt. At Sagvoll, mineralization and historic mining areas are positioned along a 13-kilometer trend (see Figure 2). Although multiple historic mines were developed in the area, only limited historical drilling has taken place, most of which were drilled over 100 years ago. Many prospects and mining areas remain untested. The most recent work conducted in the district took place in 2006, when Falconbridge Ltd (later Xstrata PLC) flew airborne geophysical surveys and identified five prioritized nickel-copper targets and 11 VMS targets for further exploration and drill testing. However, the follow-up exploration work was never completed.

EMX has identified several “walk-up” style drill targets based upon the historical and more recent Falconbridge/Xstrata data and will work closely with Lumira to systematically explore the area. EMX explored the Sagvoll project in 2022 and conducted extensive soil sampling campaigns over the VMS trend to identify the continuation of outcropping VMS mineralization at the Akervoll and Malså prospects. The company has further carried out reconnaissance field mapping, review of historical drill core, and lithogeochemical sampling to identify alteration and mineralization zoning patterns. In 2023 the Company focused on the Skjærkerdalen Nickel target and conducted field mapping campaigns to understand the distribution of mineralized mafic intrusions in the area.

Meråker, Caledonian VMS Belt, Southern Norway. Located near the Norwegian city of Trondheim, the 18,600 Ha Meråker project contains multiple historic mines and prospects developed on trends of polymetallic VMS style mineralization (see Figure 3). Copper was the chief product from many of the historic mines, but significant zinc mineralization is seen in the mine dumps and outcrops in the area. There are several parallel trends of mineralization within the project area, extending for nearly 30 kilometers along strike. Little modern exploration has taken place at Meråker.

The Company and its former partner Norra Metals together with the NGU (Geological Survey of Norway) jointly carried out an airborne EM survey over the Meråker project in 2021. In 2023 EMX carried out reconnaissance mapping and sampling covering various prospects in the Meråker license block with positive base metal results. An extensive soil sampling program, including 4750 samples covered the prospective Fonnfjell, Mannfjell and Lillefjell targets, which warrant follow-up work.

More information on the Project can be found at www.EMXroyalty.com.

Comments on Nearby and Adjacent Properties. The deposits, projects and mines discussed in this news release provide context for EMX’s Project, which occurs in a similar geologic setting, but this is not necessarily indicative that the Project hosts similar quantities, grades or styles of mineralization.

Dr. Eric P. Jensen, CPG, a Qualified Person as defined by National Instrument 43-101 and employee of the Company, has reviewed, verified and approved the disclosure of the technical information contained in this news release.

About EMX. EMX is a precious, base and battery metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and TSX Venture Exchange under the symbol “EMX”, and also trade on the Frankfurt exchange under the symbol “6E9”. Please see www.EMXroyalty.com for more information.

For further information contact:

David M. Cole

President and Chief Executive Officer

Phone: (303) 973-8585

Dave@emxroyalty.com

Scott Close

Director of Investor Relations Phone: (303) 973-8585

SClose@emxroyalty.com

Isabel Belger

Investor Relations (Europe)

Phone: +49 178 4909039

IBelger@EMXroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

Forward-Looking Statements

This news release may contain “forward-looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended September 30, 2023 (the “MD&A”), and the most recently filed Annual Information Form (“AIF”) for the year ended December 31, 2022, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedarplus.ca and on the SEC’s EDGAR website at www.sec.gov.

Figure 1. Location Maps of the Projects

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1508/192978_d114cad2e48ee9a7_002full.jpg

Figure 2. Exploration Targets on the Sagvoll Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1508/192978_d114cad2e48ee9a7_003full.jpg

Figure 3. Exploration Targets on the Meråker Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1508/192978_d114cad2e48ee9a7_004full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/192978

💎 Diamcor Mining 💎: TSX.V: DMI

Website: https://diamcormining.com/

Corporate Deck: https://diamcormining.com/_resources/…

Contact:

Mr. Rich Matthews

rmatthews@integcom.us

+1 (604) 757-7179

Mr. Dean H. Taylor

deant@diamcor.com

1.250.864.3326

About Diamcor 💎: Diamcor Mining Inc. is a publicly traded Canadian company with a proven history of supplying rough diamonds to the world market. Diamcor has established a long-term strategic alliance with world famous luxury retailer Tiffany & Co. and is now in the final stages of developing the Krone-Endora at Venetia Project co-located with De Beer’s flagship Venetia mine.

Key Takeaways

- The U3O8 uranium spot price broke through $80 per pound, gaining 8.39% in November and is up 67.10% YTD; uranium stocks followed suit.

- Uranium continues to outperform other commodities and demonstrate its strong fundamentals.

- Both Western and Eastern nations made important geopolitical maneuvers in November to secure uranium supplies.

- Competition for uranium supply is rapidly intensifying, driven by the increasing importance of nuclear energy and the growing awareness of an impending supply-demand gap.

- COP28 was dubbed the “nuclear COP” as nuclear energy took center stage.

Performance as of November 30, 2023

| Asset | 1 MO* | 3 MO* | YTD* | 1 YR | 3 YR | 5 YR |

| U3O8 Uranium Spot Price 1 | 8.39% | 33.16% | 67.10% | 63.32% | 39.69% | 22.87% |

| Uranium Mining Equities (Northshore Global Uranium Mining Index) 2 | 6.31% | 26.90% | 54.22% | 46.74% | 54.38% | 27.87% |

| Uranium Junior Mining Equities (Nasdaq Sprott Junior Uranium Miners Index TR) 3 | 7.47% | 28.70% | 42.66% | 30.94% | 54.22% | N/A |

| Broad Commodities (BCOM Index) 4 | -2.69% | -3.98% | -9.75% | -12.28% | 11.04% | 4.28% |

| U.S. Equities (S&P 500 TR Index) 5 | 9.13% | 1.74% | 20.80% | 13.84% | 9.76% | 12.51% |

*Performance for periods under one year not annualized.

Sources: Bloomberg and Sprott Asset Management LP. Data as of 11/30/2023. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

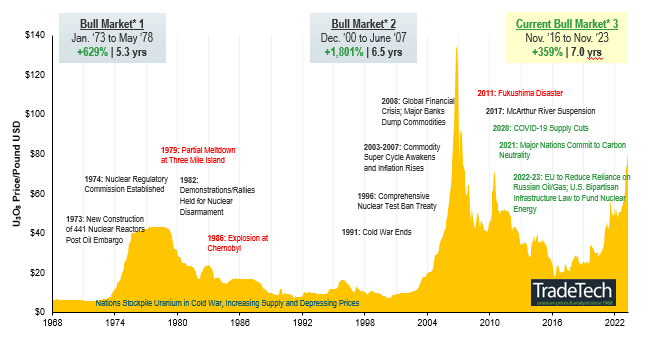

Uranium’s Resurgence to a 16-Year High

The U3O8 uranium spot price gained 8.39% in November, increasing from US$74.48 to $80.73 per pound as of November 30, 2023.1 Uranium has posted a stellar 67.10% year-to-date return as of November 30, 2023, and continued to show strength and diversification relative to other commodities, which declined 9.75% (as measured by the BCOM Index).

Breaking through the $80 per pound level represents a high price for the current uranium bull market and a price level not seen in almost 16 years. Uranium’s all time high of $136 was reached in 2007 at the end of the last commodity supercycle which ended due to the 2008 Global Financial Crisis. Following the GFC, the uranium price was in a state of decline through 2016, when it reached a month-end low of $17.75 on November 30, 2016. Although November was characterized by lower inflation and favorable 2024 interest rate change expectations, which provided many asset classes with a boost, energy and metals commodity markets were largely negative, with the notable exception of uranium. This trend continues to showcase the uranium market’s economic insensitivity and diversification to major asset classes.

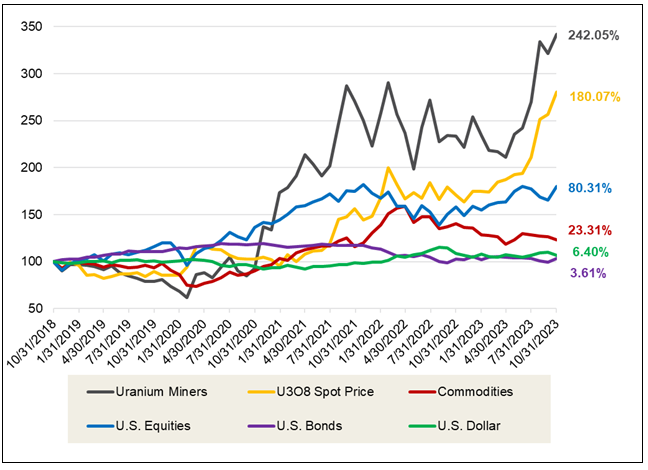

Over the longer term, physical uranium and uranium equities have demonstrated significant outperformance against broad asset classes, particularly other commodities. For the five years ended November 30, 2023, the U3O8 spot price has risen a cumulative 180.07% compared to 23.31% for the broader commodities index (BCOM), as shown in Figure 1.

Figure 1. Physical Uranium & Uranium Stocks Have Outperformed Other Asset Classes Over the Past Five Years (11/30/2018-11/30/2023)

Source: Bloomberg and Sprott Asset Management. Data as of 09/30/2023. Uranium miners are measured by the Northshore Global Uranium Mining Index (URNMX index); U.S. Equities are measured by the S&P 500 TR Index; the U308 spot price is from TradeTech; U.S. Bonds are measured by the Bloomberg Barclays US Aggregate Bond Index (LBUSTRUU); Commodities are measured by the Bloomberg Commodity Index (BCOM); and the U.S. Dollar is measured by DXY Curncy Index. Definitions of the indices are provided in the footnotes. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

The Urgency of the Uranium Supply Race

Geopolitical uncertainty and concerns about the security of uranium supply continue to be the driving forces behind the ongoing uranium rally. Notably, French President Emmanuel Macron’s November visit to Kazakhstan marked a pivotal event. During this visit, a significant joint declaration was made to enhance trade and cooperation in the fields of nuclear energy and strategic minerals. Additionally, a crucial agreement was signed, focusing on collaboration in the nuclear fuel cycle.6 These strengthened ties between France and Kazakhstan come at a critical juncture for France, especially in light of deteriorating relations with Niger following the July coup. Niger’s military junta has publicly accused France of attempting to destabilize the country, leading to the closure of borders and heightened uncertainty surrounding France’s uranium supply from Niger. It’s worth noting that France shares a deep historical connection with Niger, having maintained control until Niger gained independence in 1960. Over the past decade, France has relied heavily on Niger for almost 20% of its uranium imports, a substantial proportion considering that Niger’s contribution to global production stands at just 4%.7,8

France & the West Move to Secure Supply…

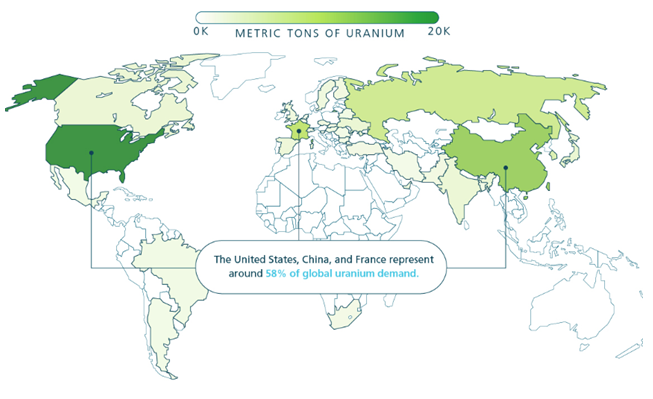

Kazakhstan and France play pivotal roles in the uranium markets, each contributing substantially to the industry. Kazakhstan, as the world’s leading uranium producer, accounts for an impressive 43% of the global mine production in 2022. On the other hand, France stands out not only as the world’s third-largest consumer of uranium, as illustrated in Figure 2, but also boasts a significant reliance on nuclear energy, which accounts for 63% of its total electricity generation. Given these vital positions, the evolving situation in Niger, coupled with an inherent supply-demand gap in the broader uranium market, has heightened the imperative for ensuring the security of supply, not just for France but for all nations reliant on uranium resources.

Western nations are particularly vulnerable due to their shift away from Russia for nuclear fuel supply services. While Russia contributed only 5% to the global uranium mine supply in 2022, it plays a more substantial role in uranium conversion and enrichment services. Consequently, Western utilities are still accepting deliveries of Russian-enriched uranium, but they are implementing self-sanctions by refraining from entering into new contracts. Moreover, legislative efforts are gaining momentum, aiming to restrict uranium imports into the United States. The Prohibiting Russian Uranium Imports Act has recently garnered approval in the U.S. House and now awaits consideration in the Senate (was passed on 12/11/2023 by U.S. House of Representatives). Time is limited for its passage within the current year. If the act is ratified, it will lead to a ban on Russian uranium imports 90 days after its enactment, while allowing for temporary waivers until 2028.9

…Along with Russia and China

Eastern nations are also actively pursuing the assurance of a stable uranium supply. While Russia does engage in uranium mining, its domestic production falls short of meeting its extensive demands to fuel both domestic and Russian-built reactors in various countries. Consequently, Russia also uses its southern neighbor, Kazakhstan, for access to uranium resources. In a reciprocal effort, following French President Emmanuel Macron’s visit to Kazakhstan, Russian President Vladimir Putin embarked on a visit to further strengthen Russian-Kazakh relations just one week later.10 These diplomatic overtures align with China’s President Xi Jinping’s visit to Kazakhstan in October, where he emphasized the need for increased cooperation.11

China stands out with the second-largest uranium reactor requirements globally and ambitious nuclear expansion plans, currently overseeing the construction and planning of 68 reactors, compared to the 55 already operational. Given the scale of both current and anticipated future demand, China is deeply committed to securing its uranium supply for the long term. Leveraging its historical capability to invest significantly in commodity supply chains well in advance of actual requirements, it is likely that a substantial portion of Kazakh supply, including the announced capacity increases to 100% by 2025, will primarily flow into China. As a notable illustration, the China National Uranium Corporation is presently expanding its storage capacity at its warehouse along the Kazakhstan-China border, increasing it from 3,000 tU to 20,000 tU—almost double China’s anticipated annual reactor requirements for 2023.12

The competition for uranium supply is rapidly intensifying, driven by the increasing importance of nuclear energy and the growing awareness of an impending supply-demand gap. This situation has been exacerbated by the fact that mine supply has consistently lagged behind reactor requirements for more than a decade. To bridge this gap, the industry has been compelled to depend on secondary sources, mainly utility inventories through either direct sales or, more notably, inventory drawdowns. We firmly believe that the era of destocking has come to an end, and the supply-demand deficit appears poised to endure. This scenario is likely to provide ample room for the uranium bull market to flourish.

Figure 2. Uranium Demand for Nuclear Power

Source: World Nuclear Association, November 2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

The “Nuclear COP”

Nuclear energy sentiment and international collaboration were abundant in the United Nations COP28 (Conference of the Parties). COP28 took place this month, eight years after the signing of the Paris Agreement, and saw world leaders convene to discuss their collective commitments to limit global warming to below 2, preferably to 1.5 degrees, Celsius compared to pre-industrial levels.

During COP28, more than 20 nations, including the United States, France, Japan and the UK, made a significant commitment to triple global nuclear energy generation by 2050.13 COP28 was held in the United Arab Emirates, and amidst reports of geopolitical disagreements affecting discussions on fossil fuels, nuclear energy took center stage as a pivotal point of collaboration during the conference. Some even referred to this event as the “nuclear COP,” underscoring its newfound prominence on the international stage. This represents a substantial acceleration in the global sentiment towards nuclear energy. In contrast, at COP27 the previous year, the most concrete nuclear-related developments were limited to altering the agreement’s language to prioritize “low-emission” energy sources rather than solely “renewables.” Additionally, it marked the first time nuclear energy was even considered in the conversation, a significant shift from its exclusion at COP26.

Nuclear energy has undeniably experienced a boost in favor, as governments worldwide come to recognize the imperative of dependable baseload power to counterbalance the intermittent nature of renewable energy sources. A noteworthy advantage of nuclear energy lies in its capacity factor, which stands at an impressive 93%. This metric represents the ratio of the total energy generated over a specific period to what the plant would have produced at full capacity. By comparison, renewables like solar and wind lag behind, with capacity factors of 25% and 36%, respectively.

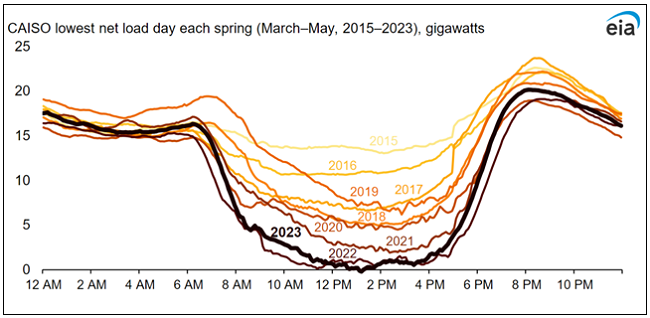

Moreover, the growing investment in solar energy by numerous nations has underscored the critical importance of reliable power supply. This need becomes even more pronounced when considering that peak electricity demand frequently occurs after sunset when solar power becomes unavailable. This phenomenon is exemplified by California’s duck curve, a graph depicting the growing gap between electricity supply and demand as the sun sets, emphasizing the urgency of securing stable energy sources.

Figure 3. California’s Duck Curve Is Getting Deeper

Source: EIA. As solar capacity grows, duck curves are getting deeper in California. Included for illustrative purposes only. Past performance is no guarantee of future results.

Uranium Miners Developments

Uranium miners ascended in tandem with the U3O8 uranium spot price, with the broad sector of uranium miners rising by 6.31%2 and junior uranium miners gaining 7.47%.3

As the price of uranium has increased significantly, uranium mine projects are starting to come online. Restarts, projects that had been producing uranium and then stopped and put on care and maintenance, have been the logical start to a supply response.

In November, enCore Energy Corp. (enCore) announced the successful startup of uranium production at its Rosita plant.14 enCore also plans to restart its Alta Mesa plant in early 2024. These restarts are both located in Texas and should help to start the revival of the U.S.’s domestic uranium production.

Though restarts such as enCore’s and Boss Energy Ltd.’s Honeymoon project (see last month’s commentary) are critical to helping address the uranium market’s supply-demand deficit, new builds will also be needed for this endeavor. New builds take many years to both develop and go through the permitting process, and total lead times can take 10 to 15 years.15

NexGen Energy Ltd. (Nexgen) is a uranium developer focused on the Rook 1 Project located in the Athabasca Basin of Saskatchewan, Canada. In November, Nexgen announced it had received a major milestone with Saskatchewan’s environmental approval for its Rook 1 project.16 The 98,739 tU indicated mineral resources Rook 1 Project next step in the permitting process is for federal approval. This marks a further significant development as even though the Athabasca Basin is a large source of high-grade uranium, this Rook 1 environmental approval is the first in more than 20 years.

Global Atomic Corporation (Global Atomic) released an update on its Dasa project in Niger. In August, the coup d’état in Niger forced Global Atomic to announce delays of 6-12 months in the first production at Dasa to end of 2025.17 In November, their update on the situation in Niger seemed to help soothe investor concerns as the stock jumped and outperformed peers. In this update, the Global Atomic President and CEO noted, “Further to our Q2 2023 update regarding the Republic of Niger, a transition government is in place and includes a new Prime Minister and Cabinet, as well as the previous experienced staff in the Government Ministries. The Government of Niger is a 20% owner of the Dasa Project and recognizes that the Dasa Mine will benefit the Republic of Niger by generating royalty and tax revenue, creating new jobs and opportunities for local business and revitalize the northern region of the country. The Government has offered its positive support for the development of the Dasa Project.” 18

A Concerning Supply Deficit