Playfair Mining (TSX.V: PLY)

Press Release

Corporate Presentation

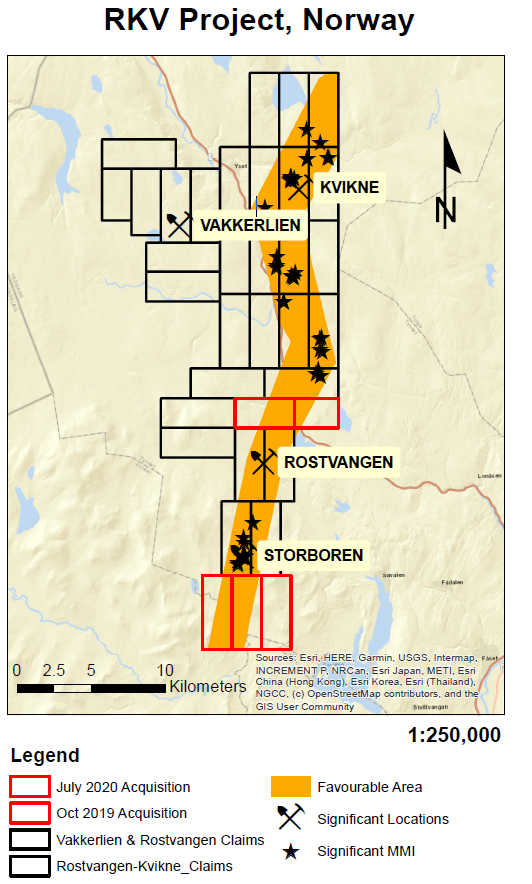

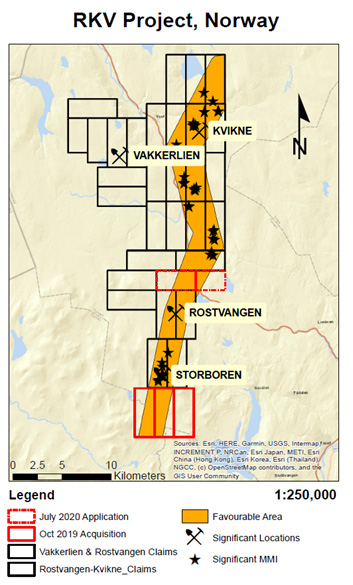

Playfair has acquired additional mineral rights and now owns 100% of a continuous 40 km long highly prospective trend characterized by historic mines, numerous mineral showings, favorable geology, geophysical anomalies, Windfall Geotek CARDS targets and high MMI geochemical responses.

For further information visit www.playfairmining.com or contact:

Donald G. Moore

CEO and Director

Phone: 604-377-9220

Email: dmoore@wascomgt.comD. Neil Briggs

Director

Phone: 604-562-2578

Email: nbriggs@wascomgt.com

Delivered to You

855.505.1900 | Maurice@MilesFranklin.com

Click Here