Highlights

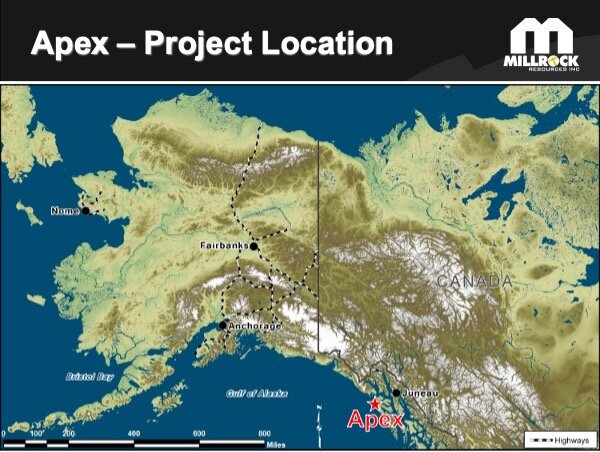

- Millrock has executed an agreement with Coeur Explorations, Inc., a wholly-owned subsidiary of Coeur Mining, Inc. concerning claims controlled by Millrock at the Apex gold project, located approximately 70 kilometers from Juneau in Southeast Alaska.

- Coeur Explorations may exercise an option to earn a 100% interest in the claims through staged payments and exploration expenditures.

- Upon earning 100% interest, a Net Smelter Returns royalty with an advanced minimum royalty provision and buyback option will be granted to Millrock.

- Initial exploration is underway; drill permits have been approved.

VANCOUVER, BRITISH COLUMBIA, August 12, 2021 – Millrock Resources Inc. (TSX-V: MRO, OTCQB: MLRKF) (“Millrock” or the “Company”) is pleased to announce that it has entered into an agreement with Coeur Explorations, Inc., a wholly-owned subsidiary of Coeur Mining, Inc. (“Coeur”), concerning the Apex gold project in Southeast Alaska. The project is located on Chichagoff Island, three kilometers north of the village of Pelican and 70 kilometers southwest of Juneau, Alaska.

Millrock President & CEO Gregory Beischer commented: “We are pleased to enter into this agreement with Coeur Explorations and will work diligently with their exploration team to explore the claims. From historic documents, we know that high-grade gold ore was previously mined, but there has never been a single exploratory hole drilled. It seems likely that the known high-grade gold-bearing quartz veins will continue along strike and in the down-dip direction. The claims have been completely dormant since the 1980s. We’ll start with surface geochemical sampling and detailed structural mapping this year and look to drill in 2022.”

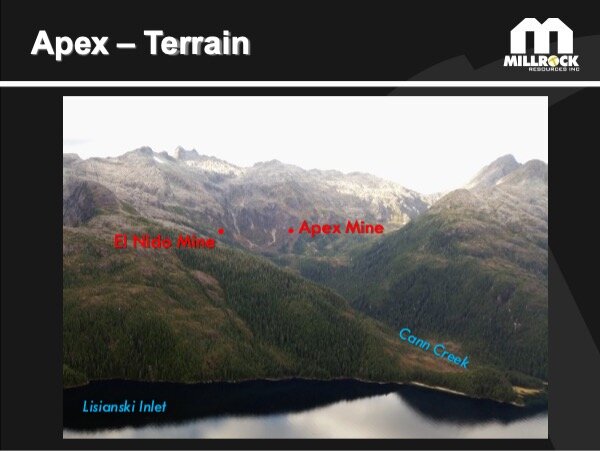

The Apex project targets high-grade, mesothermal, gold-bearing quartz vein deposits. The claims cover the former-producing Apex and El Nido gold mines which operated intermittently from the 1920s through to the 1940s and reportedly produced approximately 34,000 ounces of gold by underground mining methods. Nearly 1,200 meters of workings on four levels were used to extract ore (United States Geological Survey Alaska Resource Data File). Ore was hand-cobbed and milled on site. Surface exploration was done by WGM Inc. in the 1980s, but no drilling was done and the property has been dormant since. Millrock secured an option on the core claim group in 2016 from Apex El Nido Gold Mines Inc. Subsequently, Millrock staked surrounding lands, compiled information, and secured drilling permits. At surface, above the caved portal to the Apex Mine, a swarm of quartz veins can be observed over a width of more than 200 meters. Within the swarm, four thicker veins were the subject of the historic mining efforts. Geological and geochemical features suggest the vein system has continuity along strike to the northeast beneath Cann Creek, toward the tidewater of Lisianski Inlet, two kilometers away. The gold-bearing vein system has never been drill tested along strike or below the historic workings.

Under the agreement, Millrock will assign its rights under the existing option agreement with Apex El Nido Gold Mines to Coeur Explorations. Coeur Explorations will be responsible for making cash payments and funding exploration expenditures to keep the option agreement with Apex El Nido Gold Mines in good standing. Millrock will execute exploration under a services agreement on behalf of Coeur. Coeur Explorations may determine not to proceed to exercise the option at any time, but if it makes all the payments and expenditures, it will vest with a 100% interest in the underlying claims. Upon exercising the option to purchase the Apex El Nido Gold Mine claims, Millrock will also transfer the claims it owns outright to Coeur Explorations, and the entire project will become subject to a net smelter returns (“NSR”) royalty in favour of Millrock. The royalty payable is a 2.5% NSR with an advanced minimum royalty (“AMR”) provision. Coeur Explorations may reduce the NSR to 1.0% by paying Millrock US$3.0 million. The initial AMR payment will be US$50,000 and will increase by US$50,000 annually until production occurs. AMR payments are deductible from NSR payments. The property will revert to Millrock in the event that Coeur elects to discontinue AMR payments.

Typical of Southeast Alaska, the terrain is steep and challenging, as pictured in Figure 2. The former producing Apex and El Nido mine entries are at tree level, approximately 360 meters above sea level. A soil sampling crew has been mobilized to the project and is presently working out of accommodations in Pelican, using boat access. The goal of the program is to trace the mineralized structure and refine vein locations in anticipation of a 2022 drilling program.

Qualified Person

The scientific and technical information disclosed within this document has been prepared, reviewed, and approved by Gregory A. Beischer, President, CEO, and a director of Millrock Resources. Mr. Beischer is a qualified person as defined in NI 43-101.

About Millrock Resources Inc.

Millrock Resources Inc. is a premier project generator to the mining industry. Millrock identifies, packages, and operates large-scale projects for joint venture, thereby exposing its shareholders to the benefits of mineral discovery without the usual financial risk taken on by most exploration companies. The company is recognized as the premier generative explorer in Alaska, holds royalty interests in British Columbia, Canada, and Sonora State, Mexico, is a significant shareholder of junior explorer ArcWest Exploration Inc. and owns a large shareholding in Resolution Minerals Limited. Funding for drilling at Millrock’s exploration projects is primarily provided by its joint venture partners. Business partners of Millrock have included some of the leading names in the mining industry: Coeur Explorations, EMX Royalty, Centerra Gold, First Quantum, Teck, Kinross, Vale, Inmet and, Altius as well as junior explorers Resolution, Riverside, PolarX, and Felix Gold.

ON BEHALF OF THE BOARD

“Gregory Beischer”

Gregory Beischer, President & CEO

FOR FURTHER INFORMATION, PLEASE CONTACT:

Melanee Henderson, Investor Relations

Toll-Free: 877-217-8978 | Local: 604-638-3164

Twitter | Facebook | LinkedIn

Some statements in this news release may contain forward-looking information (within the meaning of Canadian securities legislation) including without limitation the intention to mount further exploration including drilling in 2022. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements.