Vancouver, British Columbia–(Newsfile Corp. – January 26, 2022) – EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the “Company” or “EMX”) is pleased to announce the execution, by its wholly-owned subsidiary Bronco Creek Exploration Inc., of an exploration and option agreement (the “Agreement”) for the sale of the Robber Gulch gold project (“Project”) in Idaho to Ridgeline Exploration Corporation, a wholly-owned subsidiary of Ridgeline Minerals Corp. (TSX-V: RDG) (“Ridgeline”). The Agreement provides EMX with cash payments, share payments, and work commitments during Ridgeline’s earn-in period, and upon earn-in a retained 3.25% net smelter return (“NSR”) royalty interest, annual advance royalty payments, and certain milestone payments.

Robber Gulch is a Carlin-style gold property acquired by EMX in 2019 and then optioned to a third party in 2020 that completed work programs consisting of geological mapping, soil and rock chip geochemical sampling, trenching, and a reconnaissance drill program. This previous work confirmed several key gold zones that were delineated by coincident geochemical anomalies and prospective geology. The drill testing was limited in scope and in EMX’s judgement did not adequately test the target zones. The Project reverted back to 100% EMX control in Q3, 2021.

The Robber Gulch Agreement with Ridgeline represents EMX’s execution of the seventh option agreement for Idaho gold projects since 2020. Ridgeline is also advancing the Company’s Swift and Selena royalty properties in Nevada. Robber Gulch is a key example of the royalty generation aspect of EMX’s business model, whereby prospective ground was identified, acquired inexpensively via staking open ground, and then partnered for exploration advancement at no additional cost to EMX.

Commercial Terms Overview. Pursuant to the Agreement, Ridgeline can earn 100% interest in the Project by (all dollar amounts in USD): (a) making execution and option payments totaling $750,000 over a five year option period, (b) delivering 150,000 shares of Ridgeline Minerals Corp. to EMX by the second anniversary of the Agreement, and (c) completing $650,000 in exploration expenditures before the fifth anniversary of the Agreement.

Upon Ridgeline’s option exercise and earn-in, EMX will retain a 3.25% NSR royalty interest on the Project. Ridgeline may buy back up to a total of one percent (1%) of the royalty by first completing an initial half-percent (0.5%) royalty buyback for a payment of $1,500,000 to the Company prior to the third anniversary of the option exercise. If the first buyback is completed, then the remaining half-percent (0.5%) of the royalty buyback can be purchased anytime thereafter for a payment of $2,000,000 to the Company. Ridgeline will also make annual advance royalty (“AAR”) payments of $50,000 that increase to $75,000 upon completion of a Preliminary Economic Assessment (“PEA”) or internal study termed an Order of Magnitude Study (“OMS”), the details of which are defined in the terms of the Agreement. The AAR payments cease upon commencement of commercial production. In addition, Ridgeline will make Project milestone payments consisting of: (a) $250,000 upon completion of a PEA, (b) $500,000 upon completion of the earlier of a Prefeasibility or Feasibility Study, and (c) $1,000,000 upon a positive Development Decision.

Robber Gulch Overview. The Robber Gulch Project is located 30 kilometers south of Burley, Idaho and consists of 117 unpatented lode mining claims covering approximately 9.3 square kilometers. Carlin-style mineralization is hosted in Pennsylvanian to Permian age silty limestones and calcareous siliciclastics that are exposed within erosional windows beneath post-mineralization volcanic rocks. The Robber Gulch geological environment is similar to that at the Black Pine project ~90 kilometers to the southeast.

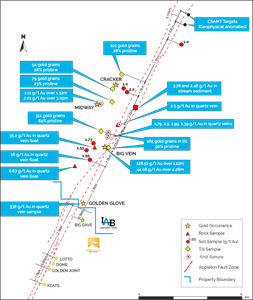

Previous work on the Project defined two main corridors of gold mineralization along the crest of a gently sloping ridge where prospective Paleozoic host rocks outcrop. Much of the remainder of the property is covered by shallow soil. A 2020 geochemical sampling program (conducted by previous partner Gold Lion Resources) identified robust 1,000 by 550 meter and 850 by 600 meter gold-in-soil anomalies1. Numerous lower level gold-in-soil anomalies are scattered across the property within an overlying sequence of less prospective host rocks.

Trenching across portions of the soil anomalies further defined priority oxide gold targets, including a trench interval of 189 meters averaging 0.43 g/t gold, with a higher grade sub-interval of 0.88 g/t gold over 45 meters. Historical drilling intercepted 57.9 meters (from 21.3 to 79.2 m) averaging 0.34 g/t gold, including 12.2 meters averaging 0.90 g/t gold (hole bottomed in 0.32 g/t gold)2. The last hole of Gold Lion’s 2021 program terminated prematurely in bedrock at 6.1 meters depth, and averaged 1.46 g/t gold across the drilled interval. True widths from the trenching and drilling are unknown.

EMX regards Robber Gulch as a highly prospective gold property within an emerging Carlin-style gold region in southern Idaho. The Company looks forward to the Ridgeline team advancing the Project with the knowledge gained from successfully exploring Carlin-style gold systems in Nevada.

More information on the Project can be found at www.EMXroyalty.com.

Comments on Sampling, Assaying and Adjacent Properties. EMX has not performed sufficient work to verify the Project’s historical drill results, but considers this information as reliable and relevant based upon the Company’s independent field work and reviews of data from multiple sources.

The geochemical and trench results in this news release from previous partner Gold Lion Resources were sampled and assayed according to industry standard procedures, and reported according to NI 43-101 requirements. EMX believes that these results are reliable and relevant. All trench samples were logged and sampled by Gold Lion personnel. Certified reference material standards, blanks and pulp duplicates were inserted at a ratio of approximately two in every 10 trench samples. Rock samples were collected as continuous 2 to 3-metre-long chip samples along the entire length of the trenches. An effort was made to collect an even volume of bedrock along each interval in order to minimize bias in the chip sampling.

All rock samples were sealed in poly bags and were transported to MS Analytical’s laboratory in Langley, B.C., by Gold Lion personnel for preparation and analysis. Sample preparation was completed by crushing the entire sample to 70% passing -2mm, riffle splitting off 1 kilogram and pulverizing the split to better than 85% passing 75 microns. Using a 30 gram sub-sample, the gold values are determined by the fire assay method, with atomic absorption finish (code FAS-111), which reports results in parts per million (ppm) (equivalent to grams per tonne (g/t)). Using a 0.5 grab sub-sample, the remaining analytes were determined by multi-element ICP-AES with an aqua regia digest (code ICP-130). Representative samples from RG-TR-20-03 were re-analyzed by Cyanide Leach (code AU-CN00) with a AAS finish. A range of samples from low (0.149g/t) to high grade gold (1.502g/t Au; determined by FAS-111) were selected to represent a range of mineralized samples from the trenching program for reanalysis by Cyanide Leach. All analytical results are verified with the application of industry standard Quality Control and Quality Assurance (QA-QC) procedures.

The Black Pine project referenced in this news release provides context for EMX’s Project, which occurs in a similar geologic setting, but this is not necessarily indicative that the Company’s Project hosts similar tonnages or grades of mineralization.

Michael P. Sheehan, CPG, a Qualified Person as defined by National Instrument 43-101 and employee of the Company, has reviewed, verified and approved the disclosure of the technical information contained in this news release.

About EMX. EMX is a precious, base and battery metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and the TSX Venture Exchange under the symbol EMX, as well as on the Frankfurt Exchange under the symbol “6E9.” Please see www.EMXroyalty.com for more information.

For further information contact:

David M. Cole

President and Chief Executive Officer

Phone: (303) 973-8585

Dave@emxroyalty.com

Scott Close

Director of Investor Relations

Phone: (303) 973-8585

SClose@emxroyalty.com

Isabel Belger

Investor Relations (Europe)

Phone: +49 178 4909039

IBelger@EMXroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release may contain “forward-looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserve and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to: unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended September 30, 2021 and the year ended December 31, 2020 (the “MD&A”), and the most recently filed Revised Annual Information Form (the “AIF”) for the year ended December 31, 2020, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedar.com and on the SEC’s EDGAR website at www.sec.gov.

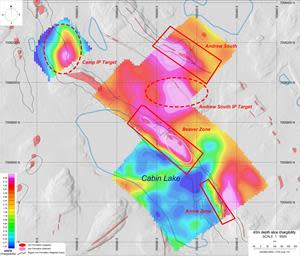

Figure 1. Location map of the Robber Gulch Project, Idaho.

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/1508/111649_0c1a673a64a1593a_002full.jpg

Figure 2: Robber Gulch Project Geology

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/1508/111649_0c1a673a64a1593a_003full.jpg

Note: Soil, rock chip and trench results are from Gold Lion Resources. Annotated drill hole intercepts are historical. True widths for trench and drill results are unknown.

1See Gold Lion Resources news releases dated June 16, and August 11, 2020.

2 Exvenco Resources Inc., 1986, Internal Report on Artesian City Project, Cassia County, Idaho.