- Battery metal demand is rising, and the trend will continue

- New properties are in demand- Producers provide leverage to the metal prices, and exploration companies turbocharge the gearing- Location is critical

- Lithium Americas (LAC) looks to pick up a property

- Nevada Copper (NEVDF)- The trend is your friend, and increasing demand for EVs supports a continuation of the rally

Noram Lithium (NRVTF)- An undervalued battery metal play in Nevada, a desirable jurisdiction

In real estate, a property’s value always reflects its location. Any real estate professional understands that the three leading value factors are location-location-location.

Commodity producers face many regional issues. Raw materials can occur in local regions where political or economic forces make extraction challenging. The cost of production reflects local tax, royalty, logistical, and other factors.

Over the past year, the ascent of metals prices has caused many of the world’s leading producers to scramble to find new mining projects to meet the growing demand. One of the world’s leading diversified commodity producers, BHP is currently in talks with Ivanhoe Mines to acquire part of the Western Foreland exploration area in the Democratic Republic of the Congo (DRC). While DRC is the largest copper producer in Africa with the most substantial reserves, the country has a long history of corruption that has impeded its growth. The DRC is not an ideal location for mining companies, but the growing need for new output has put BHP in a position to consider the project. It takes up to ten years to bring a new copper mine into production, and producers are scouring the earth for projects that will meet the increasing demand.

Goldman Sachs called copper “the new oil” because of its role in decarbonization. Three-month LME copper was trading at the $9,518 per ton level on November 5, with the December COMEX copper futures at the $4.3430 per pound level. Goldman projects that copper prices could rise to the $15,000 per ton level by 2025, putting COMEX copper futures north of the $6.80 per pound level.

Meanwhile, lithium is another commodity that is experiencing growing demand. The success of addressing climate change through decarbonization relies on ample supplies of battery metals that can replace fossil fuels.

While BHP is looking to the DRC for new copper deposits, other mining and exploration companies are developing battery metal deposits. Friendlier and less challenging jurisdictions are likely to attract significant premiums over the coming months and years.

In the US, Nevada, the silver state, has a long history as one of the most favorable mining jurisdictions on the earth. When it comes to location, it does not get much better than Nevada.

Battery metal demand is rising, and the trend will continue

Climate change is not a US issue; it is a worldwide trend. Addressing climate change involves replacing the hydrocarbons that currently power the world with alternative, renewable energy sources. While batteries power only around one percent of the cars on roads today, the demand for EVs is growing by leaps and bounds. Hertz recently announced they are purchasing 100,000 Tesla model-3 EVs in a $4.2 billion deal. EVs will make up 20% of the Hertz fleet by the end of 2022. Hertz will also install thousands of charging stations in its locations in the US and Europe.

EV’s require twice the copper as internal combustion engines. The batteries require other metals and minerals including, lithium, nickel, cobalt, zinc, aluminum, manganese, graphite, and potassium. Tesla’s batteries currently use lithium-nickel-cobalt-aluminum chemistry. However, the company is working on a set of cobalt-free or reduced batteries drawing on lithium-iron-phosphate technology and chemistries that rely more heavily on nickel. The three-month nickel price on the London Metals Exchange closed 2020 at the $16,600 per ton level. As of November 4, the price was over $19,400 after reaching over $20,500 during the year. Copper futures on COMEX may have corrected from the May 2021 all-time high at nearly $4.90 per pound, but they remain appreciably higher than at the end of 2020.

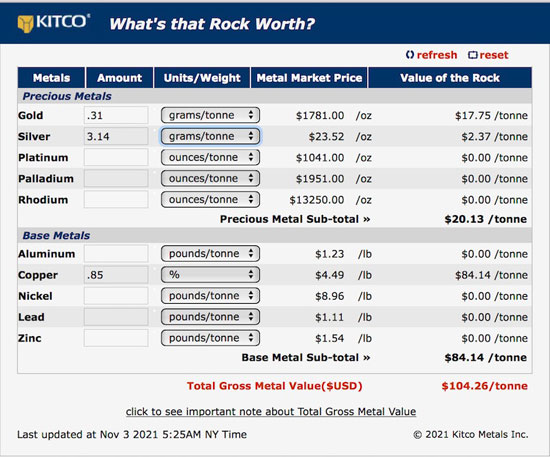

Source: CQG

The monthly chart shows that copper closed 2020 at the $3.52 level. At the $4.3430 per pound level in early November 2021, copper futures were over 23% higher. The price action in the lithium carbonate market has been even more bullish.

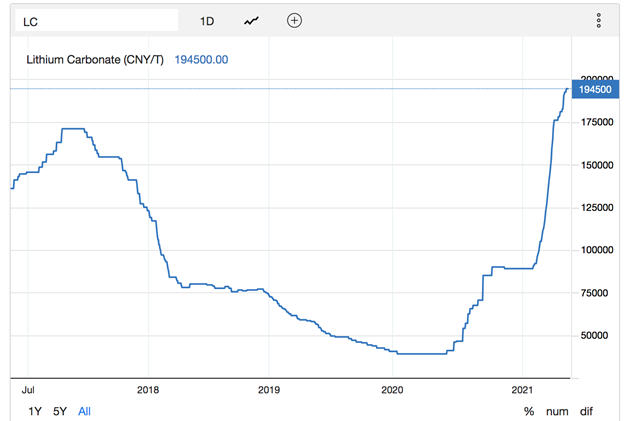

Source: Trading Economics

The chart shows the rise from below $33,000 per ton in 2020 to the current price at the $194,500 level, an increase of nearly six times. Lithium’s ascent is more like a cryptocurrency than a commodity as the demand for the metal for EV production grows.

New properties are in demand- Producers provide leverage to the metal prices, and exploration companies turbocharge the gearing- Location is critical

Mining companies make substantial capital investments to extract raw materials from the earth’s crust. The leading mining companies profit handsomely when market prices exceed production costs, creating leverage. Mining companies often outperform the commodities they produce on the upside but underperform when prices decline.

Meanwhile, exploration companies provide even more leverage. Since rewards are always a function of the risks, companies that search for commodities tend to experience incredible gains when they find them and begin production or sell the properties to the more established mining companies that can take projects to the next production and processing levels.

The mining industry reflects economies of scale. The leading companies like BHP, Rio Tinto, Anglo American, Glencore, and others have made significant capital investments and spread production risks over a diversified portfolio of mining properties. They tend to allow exploration companies to make the finds and then take the mining properties to the next steps.

When it comes to investing, exploration companies can offer attractive returns that often outpace the underlying commodity and the established miners on a percentage basis. If the BHP’s offer leverage, exploration companies turbocharge that gearing.

Lithium Americas (LAC) looks to pick up a property

Lithium Americas Corporation (LAC) operates as a resource company in the United States. The company explores for lithium deposits. LAC owns interests in the Cauchari-Olaroz Project in the Jujuy province of Argentina and the Thacker Pass project in north-western Humboldt County, Nevada. Thacker Pass recently increased its Phase 1 capacity to target 40,000 tpa lithium carbonate.

LAC announced it submitted an unconditional offer to Millennial Lithium Corporation to acquire all of the outstanding shares for approximately $400 million.

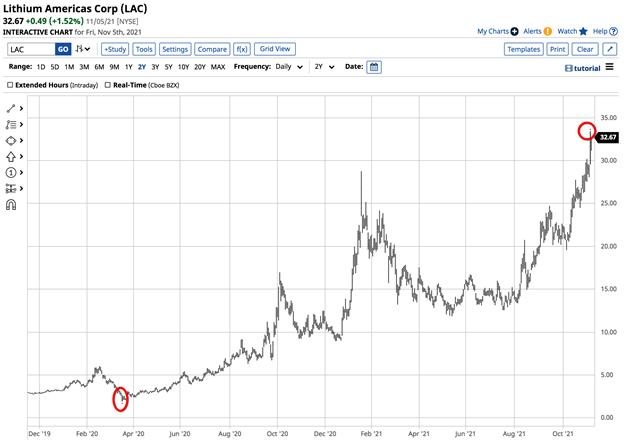

Source: Barchart

The chart shows LAC’s ascent from a low of $1.92 per share in March 2020 to its most recent high of $33.42 on November 4. At the $32.67 per share level, LAC’s market cap was over $3.919 billion. An average of over five million shares changes hands each day. Lithium has been a hot commodity that has moved nearly six times since 2020. LAC shares have moved over seventeen times higher over the period as the successful mining company turbocharged the commodity’s percentage gain.

Nevada Copper (NEVDF)- The trend is your friend, and increasing demand for EVs supports a continuation of the rally

Nevada Copper is an exploration company in the silver state of Nevada. The company owns a 100% interest in the Pumpkin Hollow property that contains copper, gold, and silver reserves. The most recent operations update highlighted accelerated stope turnover rates, management team changes that strengthened the company, productivity improvements, and processing of ore averaging approximately 1.5% copper delivered to the mill. Since the May high, copper’s price has dropped at nearly $4.90 per pound on the nearby COMEX futures contract. NEVDF is an exploration company, so its share performance tends to outperform the commodity on the upside and underperform on the downside. Copper rose from $3.52 per pound at the end of 2020 to a high of $4.8985 in May or 39.2%. On November 5, the price was at the $4.3430 level, 11.3% below the May peak. NEVDF shares closed 2020 at the $1.14 level.

Source: Barchart

The chart highlights that NEVDF shares reached a high of $2.71 when copper peaked and traded at 67.00 cents per share on November 5. NEVDF shares rallied by 137.7% and from the end of 2020 to the May 2021 high and were 75.3% lower than the peak as of November 5. Like many exploration companies, NEVDF turbocharged the price action in copper, outperforming the metal on the upside and underperforming on the downside.

As the demand for copper will rise over the coming years, and Goldman Sachs expects the price to increase dramatically, now could be the perfect time to consider this exploration company.

Noram Lithium (NRVTF)- Another battery metal play in Nevada, a desirable jurisdiction

Norman Lithium (NRVTF) is an exploration company that develops mineral properties in the United States.

The company owns interests in the Zeus Lithium Project in Clayton Valley, Nevada. Noram’s property is next door to Albemarle Corporation’s (ALB) Silver Peak Lithium Mine in Nevada.

Noram’s latest highlights include:

- A 70% increase in measured and indicated resources

- A 369% increase in inferred resources

- Deposits near the surface, reducing production costs

- The potential to increase the deposit size via deeper drilling

- An environmentally friendly footprint

- A Preliminary Economic Assessment (PEA) in the coming weeks – Advancing the project closer to its’ production target

At the 67.15 cents per share level, NRVTF has a market cap at the $50.701 million level. An average of 56,780 shares changes hands each day.

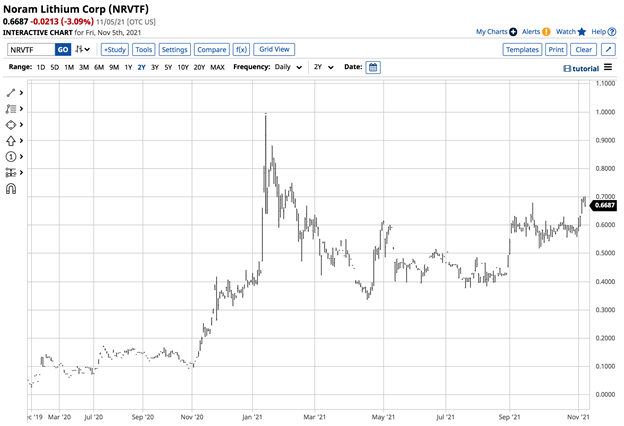

Source: Barchart

The chart shows NRVTF shares closed at the 40.26 cents level on December 31, 2020. At 66.87 on November 5, they were 66.1% higher. NRVTF shares reached a high of 98.78 cents on January 14, 2021, which is the stock’s current technical target. The shares have traded in a bullish trend since mid-April 2021.

With the spotlight on lithium, Norman could be an excellent exploration company to consider. Success in the Zeus project could attract interest from companies like Lithium Americas Corporation (LAC) that is currently buying Millennial Lithium Corporation’s shares for $400 million, nearly eight times higher than NRVTF’s current market cap.

Exploration companies are risky, but the potential for substantial rewards always involves an elevated risk level. Meanwhile, Nevada Copper and Noram Lithium have location on their sides as Nevada is a highly desirable mining jurisdiction in a world hungry for copper and lithium supplies.

Written By: Andrew Hecht, on behalf of Maurice Jackson of Proven and Probable.

Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein, or any security in any jurisdiction in which such an offer would be unlawful under the securities laws of such jurisdiction.