Vancouver, British Columbia–(Newsfile Corp. – September 6, 2022) – Riverside Resources Inc. (TSXV: RRI) (OTCQB: RVSDF) (FSE: 5YY) (“Riverside” or the “Company”), is pleased to report that the BHP – Riverside Exploration Funding Agreement (“EFA”) will be extended into a fourth year. Building on the past three years of BHP fully funded generative exploration work, the EFA will move into the next exploration phase focusing on five copper projects in Sonora, Mexico (see Figure 1) with a currently approved US$1,100,000 in exploration funding to work on the Llano de Nogal district and US$500,000 in ongoing High Value Work programs in the Sonora Projects for a total so far allocated budget of US$1,600,000 exploration work on the specified properties in the EFA.

The approved next phase of work focuses toward property specific funding to advance the current priority projects with derisking exploration, geophysics, geology, geochemistry, mineral titles, and other related mineral exploration aspects to progress towards drilling and drill decisions. Additional expanded budgets for drilling will be added as projects are moved forward to the Operational Phase for the BHP -Riverside EFA. To that effect, Riverside has experience in all aspects of the upcoming work, as Riverside has managed this successfully in earlier exploration alliances with Kinross Gold, Antofagasta, Cliffs, and Hochschild among others.

Riverside’s President and CEO, John-Mark Staude, commented: “We are pleased to see our partnership with BHP progress from the generative phase into more focused exploration work across the portfolio of projects we’ve acquired and advanced to-date. Now that our partnership with BHP is focusing on a priority group of copper projects, the extensive data, relationships and additional targets we’ve generated within the broader EFA area can also be leveraged and pursued by Riverside. The solid funding support by BHP builds beyond Riverside’s strong balance sheet and other projects. The Company owns and anticipates catalysts in the coming quarter.“

This exploration program is coordinating with the technical teams from BHP and Riverside Resources to work together towards programs which are jointly defined by both companies, while Riverside continues to be the EFA Operator. The five projects that are moving forward are called collectively the “Sonora Projects”. BHP and Riverside will progress the Sonora Projects exploration for large Tier 1 scale porphyry Cu targets and work toward drilling where the majority ownership and funds from BHP could earn a minimum of 80%. Once any of the Sonora Projects are named a Designated Project and moved to the Operational Phase, the partnership continues through a funding by BHP of at least $4M into each project, as outlined in earlier news releases, with Riverside retaining an NSR on projects, should BHP earn an interest and Riverside does not choose to continue as JV partner.

BHP and Riverside will now focus the EFA on Sonora Projects with additional funding to be fully funded by BHP for this fourth year, with emphasizing on drill targeting, permitting, preparation for future drill testing of identified assets and expand on the work programs of the five projects noted below.

The Technical Committee, comprised of both BHP and Riverside personnel, reviewed and visited prospective areas in Sonora, identified during the Generation Phase of the EFA, and singled out a portfolio of five priority copper projects, which are inside of two reduced focused zones and specific property boundaries.

Figure 1: Progressing five projects inside of two focused areas for the BHP – Riverside funded work extended EFA.

To view an enhanced version of Figure 1, please visit:

https://images.newsfilecorp.com/files/6101/136027_3ad3038cc48b5a6a_002full.jpg

Additionally, with the thorough evaluations completed by the BHP – Riverside EFA, the Company and BHP now hold a comprehensive and unique data set on Sonora’s porphyry copper potential. Certain prospective target areas were not selected within the EFA framework for various reasons but still have significant potential to host large copper deposits, and both parties can now pursue these opportunities themselves. Moreover, Riverside is also working up four Additional Properties that are mutually agreed for BHP to consider and could be added to the Sonora Projects. These additional properties have yet to reach an on-going funding decision and if not, then may become part of the going forward target ideas that Riverside could pursue as well as the larger exploration region in the coming months.

Options Grant

On September 2nd, 2022 the Company granted 1,000,000 incentive stock options (the “Options”) to Directors, Officers and Consultants of the Company. The Options are exercisable at $0.13 per share for a period of 5 years from the date of grant. Options granted to individuals in their capacity as a Director vest in 3 equal instalments over 18 months and Options granted to Officers and Consultants vest in 4 equal instalments over 12 months. The Options were granted pursuant to the Company’s shareholder-approved stock option plan and are subject to the policies of the TSX Venture Exchange and any applicable regulatory hold periods.

About Riverside Resources Inc.:

Riverside is a well-funded exploration company driven by value generation and discovery. The Company has over $4M in cash, no debt and less than 75M shares outstanding with a strong portfolio of gold-silver and copper assets and royalties in North America. Riverside has extensive experience and knowledge operating in Mexico and Canada and leverages its large database to generate a portfolio of prospective mineral properties. In addition to Riverside’s own exploration spending, the Company also strives to diversify risk by securing joint-venture and spin-out partnerships to advance multiple assets simultaneously and create more chances for discovery. Riverside has properties available for option, with information available on the Company’s website at www.rivres.com.

ON BEHALF OF RIVERSIDE RESOURCES INC.

“John-Mark Staude”

Dr. John-Mark Staude, President & CEO

For additional information contact:

John-Mark Staude

President, CEO

Riverside Resources Inc.

info@rivres.com

Phone: (778) 327-6671

Fax: (778) 327-6675

Web: www.rivres.com

Mehran Bagherzadeh

Corporate Communications

Riverside Resources Inc.

Mehran@rivres.com

Phone: (778) 327-6671

TF: (877) RIV-RES1

Web: www.rivres.com

Certain statements in this press release may be considered forward-looking information. These statements can be identified by the use of forward-looking terminology (e.g., “expect”,” estimates”, “intends”, “anticipates”, “believes”, “plans”). Such information involves known and unknown risks — including the availability of funds, the results of financing and exploration activities, the interpretation of exploration results and other geological data, or unanticipated costs and expenses and other risks identified by Riverside in its public securities filings that may cause actual events to differ materially from current expectations. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/136027

According to Goldman Sachs

By 2025, the metals could be priced at $15,000 a tonne (U$6.80 per pound), a rise of 66%. (current copper price is $9,300 per tonne (U$4.24 per pound)) Goldman said in a report titled “Copper is the new Oil”

The report also drills down into three drivers of green copper demand: electric vehicles (EVs); solar power and wind power. The bank estimates that 5.1 million EVs likely will be sold in 2021, rising to 31.51 million EVs in the year 2030. It also forecasts that 30 million charging units will be installed in 2030.

A rising tide of electrification, as many countries seek to lower their emissions through developing new technologies, promises robust demand for years to come. Global copper production would need to rise by between 3% and 6% per annum by 2030 for countries to meet the targets of the Paris Agreement on climate change, according to a Sept. 14 Bernstein Research note.

Joining us for a conversation is Judson Culter the CEO of Rover Metals to discuss the company’s newest project acquisition, the Indian Mountain Lake Project, representing approximately 30,000 acres of greenstone belt, that will offer shareholders exposure to critical minerals – Zinc, Lead, Silver, and Copper.

0:00 Introduction

0:35 Rover Metals Company Overview

1:00 Indian Mountain Lake – Critical Minerals Project (Brownfields)

3:13 (3%) Blue Sky Potential

4:07 New Flagship – Zinc, Lead, Silver, Copper

5:43 Genetic Model

7:46 Infrastructure

10:18 Goals this year on the Indian Mountain Lake Project

11:42 Exploration Work – Twin and or Step Out Drilling

12:57 News flow for the 2022

14:55 Capital Structure

15:23 Message for Shareholders

17:06 What did I forget to ask

Rover Metals has an option to own a 90% interest in the Indian Mountain Lake Volcanic Massive Sulphide project, NT, Canada. The Indian Mountain Lake Project is the Company’s first district scale land package, representing approximately 30,000 acres of greenstone belt. The project has a historical Zinc-Copper-Lead-Silver geological resource. The Indian Mountain Lake VMS Project has had exploration dating back to the 1940s and has a historical resource spread across four zones on the project. The BB Zone and Kennedy Lake Zone have a combined historic resource of 1,400,000 tons grading 10% combined zinc and lead with 3.5 OPT (ounces per ton) of silver. Approximately 900 metres west of the BB Zone, the Kennedy Lake West Zone has a historic resource of 610,000 tons grading 1.15% copper. About 8 km southeast of the BB Zone, the Susu Lake Zone, has a historical resource consisting of 142,500 tons grading 0.95% copper*.

The property is located approximately 195 km east-northeast of Yellowknife, NT, off the eastern arm of Great Slave Lake. Seasonal access relies upon fixed or rotor wing support. A right of way was cleared to the project from Thompson Landing in the 1970’s. If this right of way were to be brushed out it would provide barge access at Thompson Landing, from Yellowknife, with ground transportation, considerably lowering any logistical costs. Future Government of Canada federally funded hydro-energy infrastructure could come close to the project if the Taltson Hydro Dam expansion proceeds through the eastern arm of Great Slave Lake into Yellowknife. At the southwest-end of Great Slave Lake, Osisko Metals is gearing up to reopen the Pine Point Zinc-Lead Mine. At nearby Hay River, NT, there is a rail line to the Teck Resources Zinc Refinery in Trail, BC.

*These resources are historic in nature. Further drilling is needed to bring them up to CIM Definition Standards. The historic data has not been verified by Rover. The historic information is provided in the 2103 Assessment Report for Indian Mountain Lake which is in public record with the Government of the Northwest Territories. Technical information has been approved by Gary Vivian, M.Sc., P.Geo., QP for the purposes of NI 43-101.

The Company’s management believes that the Indian Mountain Lake VMS Project has the potential to be a Tier 1 Zinc and Copper project. The historical resource represents only 3% of the total land package. The blue sky on the remaining 97% of the greenstone belt is: (1) for additional zinc resources and (2) a significant new copper discovery. Historical workings also document the presence of copper-gold skarn systems. The historic zones are open along strike and below a vertical depth of 150 meters.

In Canada, Zinc and Copper are on the Federal Government’s Critical Minerals List, and part of the Canadian Government’s Critical Minerals Strategy. As a result, the project qualifies for the 30% critical mineral flow-through investor tax credit. Zinc-Copper-Lead-Silver are also on the U.S. Critical Minerals List.

Metals trades under the symbol “ROVR” on the TSXV. Rover also obtained a public co-listing of its securities on the OTCQB on January 17, 2019 (OTCQB: ROVMF), and on the Frankfurt Stock Exchange on February 1, 2021 (FRA: 4XO).

On August 9, 2018, Rover Metals acquired a 100% interest in the Cabin Lake Property completing its area play for the Cabin Lake Group of Gold Projects. The Cabin Lake Group of Gold Projects are located 110 km northwest of Yellowknife and 20 km southeast of Fortune Minerals’ NICO Project and close to the new Tlicho All Season Road. The properties hosts high-grade gold in iron formation in archean metasedimentary.

On September 9, 2016, Rover Metals Optioned up to a 100% interest in the Up Town Gold Property. The Up Town Gold Property is a high grade Archean lode gold prospect adjoining the Giant Mine in Yellowknife, Northwest Territories. The Property consists of 6 claims covering 3,227 hectares and borders the west side of the Giant Mine leases. The Property centre is approximately 6 km north from downtown Yellowknife, and adjoins Gold Terra’s Northbelt claims.

Website: https://rovermetals.com/index.html

Corporate Presentation: https://rovermetals.com/pitchdeck/ROVR-presentation.pdf

Fact Sheet: https://rovermetals.com/s/Rover_FactSheet_v07-letter_web.pdf

Website | https://www.provenandprobable.com

Contact: Contact@provenandprobable.com

PRECIOUS METALS:

Call me directly at 855.505.1900 or email: Maurice@MilesFranklin.com

Precious Metals FAQ – https://www.milesfranklin.com/faq-maurice/

Proven and Probable

Where we deliver Mining Insights & Bullion Sales. I’m a licensed broker for Miles Franklin Precious Metals Investments, where we provide unlimited options to expand your precious metals portfolio, from physical delivery, offshore depositories, and precious metals IRA’s. Call me directly at (855) 505-1900 or you may email maurice@milesfranklin.com.

Proven and Probable provides insights on mining companies, junior miners, gold mining stocks, uranium, silver, platinum, zinc & copper mining stocks, silver and gold bullion in Canada, the US, Australia, and beyond.

Vancouver, British Columbia–(Newsfile Corp. – September 2, 2022) – EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the “Company” or “EMX”) is pleased to announce it has executed a purchase and sale agreement (the “Agreement”) for a portfolio of royalties, with Pediment Gold LLC, a wholly-owned subsidiary of Nevada Exploration Inc. (“NGE”) for $500,000. The portfolio consists of a 2% NSR royalty on NGE’s Nevada gold exploration portfolio covering ~62.5 square miles in Nevada and includes four district-scale land positions as well as certain other interests. In addition, if NGE options, farms out, or sells a project, beginning on the first anniversary of the third-party agreement, EMX will receive annual advanced royalty payments (“AAR”) of $20,000 that escalate $10,000 per year and are capped at $50,000. NGE has the right to buy back half of EMX’s 2% NSR by purchasing a 0.5% NSR interest for $1,000,000 anytime prior to the 7th anniversary of the Agreement and then, if the first NSR interest is purchased, purchasing the second 0.5% NSR interest anytime prior to production for $1,500,000.

Discussion of the Portfolio. NGE’s portfolio covers approximately 62.5 square miles of prospective mineral rights in Nevada and targets both Carlin and epithermal precious metal mineralization. NGE has advanced these projects from initial targeting, using NGE’s in-house ground water sampling programs and databases, and property acquisition through the collection of various geophysical datasets, geologic mapping, further bore-hole ground water sampling and in several cases, drill defined geologic orientation studies to further refine targets undercover. The portfolio was built over a decade with more than $10,000,000 spent in exploration advancing the projects. EMX’s royalty footprints cover these key tracks of ground and provides exceptional exploration and royalty upside.

Qualified Person. Michael P. Sheehan, CPG, a Qualified Person as defined by NI 43-101 and employee of the Company, has reviewed, verified and approved the above technical disclosure.

About EMX. EMX is a precious, base and battery metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and TSX Venture Exchange under the symbol “EMX”, and also trade on the Frankfurt exchange under the symbol “6E9”. Please see www.EMXroyalty.com for more information.

For further information contact:

David M. Cole

President and CEO

Phone: (303) 973-8585

Dave@EMXroyalty.com

Scott Close

Director of Investor Relations

Phone: (303) 973-8585

SClose@EMXroyalty.com

Isabel Belger

Investor Relations (Europe)

Phone: +49 178 4909039

IBelger@EMXroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

Forward-Looking Statements

This news release may contain “forward-looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended June 30, 2022 (the “MD&A”), and the most recently filed Annual Information Form (“AIF”) for the year ended December 31, 2021, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedar.com and on the SEC’s EDGAR website at www.sec.gov.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/135861

TORONTO, Sept. 01, 2022 (GLOBE NEWSWIRE) — Collective Mining Ltd. (TSXV: CNL) (OTCQX: CNLMF) (“Collective” or the “Company”) is pleased to announce that Executive Chairman Ari Sussman will be participating at the upcoming 2022 Precious Metals Summit in Beaver Creek, Colorado taking place September 13-16, 2022.

The Company will be presenting on Tuesday, September 13th at 1:45pm in Room 1 and is also available for one-on-one meetings.

Management will be discussing its new Apollo discovery at its Guayabales project, which Executive Chairman Ari Sussman stated on August 29, 2022; “… the Apollo Main Breccia has all the right markers to evolve into a large-scale discovery.” Notable intercepts include:

The Company will further update investors on its ongoing 20,000 metre drill program where management expects to release new assay results over the short-term.

About Collective Mining Ltd.

To see our latest corporate presentation and related information, please visit www.collectivemining.com

Collective Mining is an exploration and development company focused on identifying and exploring prospective mineral projects in South America. Founded by the team that developed and sold Continental Gold Inc. to Zijin Mining for approximately $2 billion in enterprise value, the mission of the Company is to repeat its past success in Colombia by making significant new mineral discoveries and advance the projects to production. Management, insiders and close family and friends own nearly 45% of the outstanding shares of the Company and as a result, are fully aligned with shareholders.

The Company currently holds an option to earn up to a 100% interest in two projects located in Colombia. As a result of an aggressive exploration program on both the Guayabales and San Antonio projects, a total of eight major targets have been defined. The Company has made significant grassroot discoveries at both projects with near-surface discovery holes at the Guayabales project yielding 302 metres at 1.11 g/t AuEq at the Olympus target, 163 metres at 1.3 g/t AuEq at the Donut target and recently, at the Apollo target, 207.15 metres at 2.68 g/t AuEq, 89.4 metres at 2.46 g/t AuEg and 87.8 metres at 2.49 g/t AuEg. At the San Antonio project, the Company intersected, from surface, 710 metres at 0.53 AuEq. (See related press releases on our website for AuEq calculations)

Qualified Person (QP) and NI43-101 Disclosure

David J Reading is the designated Qualified Person for this news release within the meaning of National Instrument 43-101 (“NI 43-101”) and has reviewed and verified that the technical information contained herein is accurate and approves of the written disclosure of same. Mr. Reading has an MSc in Economic Geology and is a Fellow of the Institute of Materials, Minerals and Mining and of the Society of Economic Geology (SEG).

Technical Information

Rock and core samples have been prepared and analyzed at SGS laboratory facilities in Medellin, Colombia and Lima, Peru. Blanks, duplicates, and certified reference standards are inserted into the sample stream to monitor laboratory performance. Crush rejects and pulps are kept and stored in a secured storage facility for future assay verification. No capping has been applied to sample composites. The Company utilizes a rigorous, industry-standard QA/QC program.

Contact Information

Collective Mining Ltd.

Steven Gold, Vice President, Corporate Development and Investor Relations

Tel. (416) 648-4065

FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including, but not limited to, statements about the drill programs, including timing of results, and Collective’s future and intentions. Wherever possible, words such as “may”, “will”, “should”, “could”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict” or “potential” or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties, and assumptions. Many factors could cause actual results, performance, or achievements to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, Collective cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and Collective assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

Burlington, Ontario–(Newsfile Corp. – September 1, 2022) – Silver Bullet Mines Corp. (TSXV: SBMI) (OTCQB: SBMCF) (‘SBMI’ or ‘the Company’) is pleased to announce two major achievements. It has begun processing higher grade ore at its 100%-owned mill, and it has signed its first contract for the delivery of silver dore bars.

“These are major milestones in the Company’s growth,” said A. John Carter, SBMI’s CEO. “In less than a year after starting construction of our mill, we are processing the higher grade material extracted from our Buckeye Silver Mine and we have signed our first contract to deliver silver out of that mine. This is outstanding work from everyone on the team.”

First run of higher grade material at the mill

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8464/135625_6aaaddfe043ffb8f_001full.jpghttps://embed.fireplace.yahoo.com/embed?ctrl=Monalixa&m_id=monalixa&m_mode=document&site=sports&os=android&pageContext=%257B%2522ctopid%2522%253A%25221542500%253B1577000%2522%252C%2522hashtag%2522%253A%25221542500%253B1577000%2522%252C%2522wiki_topics%2522%253A%2522Company%253BProcessing_(programming_language)%253BSilver_mining%253BHigher_(Scottish)%2522%252C%2522lmsid%2522%253A%2522a0V0W00000HOPDcUAP%2522%252C%2522revsp%2522%253A%2522newsfile_64%2522%252C%2522lpstaid%2522%253A%25228c42cb15-a414-3839-976b-78db104ac8a6%2522%252C%2522pageContentType%2522%253A%2522story%2522%257D

The bars for the order will be poured at the Company’s mill site near Globe, Arizona, using a mixture of the lower and the higher grade ores taken from the Company’s Buckeye Silver Mine. Several of the bars have already been poured and are ready for shipping and it is intended that the others will be poured in the immediate future.

This first order is a sample run of 50 kilograms of dore silver. The identity of the counter-party to the agreement is confidential. That counter-party has expressed an intention after this sample run to purchase all available uncommitted silver product produced at the Company’s mill.

SBMI recently received a technical report (not NI43-101) from its third-party engineering firm with minor recommendations to increase efficiencies at the mill. SBMI has implemented such recommendations while running the lower grade material stockpiled at the mill. The successful processing of this ore has led to the decision to start processing the higher grade material. In management’s opinion the mill is now running at near-optimal efficiencies.

The grade of the ore and the dore bars will be disclosed in the normal course, as the ore is processed.

Please visit the Company’s website for videos of the higher grade material being processed.

For further information, please contact:

John Carter

Silver Bullet Mines Corp., CEO

cartera@sympatico.ca

+1 (905) 302-3843

Peter M. Clausi

Silver Bullet Mines Corp., VP Capital Markets

pclausi@brantcapital.ca

+1 (416) 890-1232

Cautionary and Forward-Looking Statements

This news release contains certain statements that constitute forward-looking statements as they relate to SBMI and its subsidiaries. Forward-looking statements are not historical facts but represent management’s current expectation of future events, and can be identified by words such as “believe”, “expects”, “will”, “intends”, “plans”, “projects”, “anticipates”, “estimates”, “continues” and similar expressions. Although management believes that the expectations represented in such forward-looking statements are reasonable, there can be no assurance that they will prove to be correct.

By their nature, forward-looking statements include assumptions, and are subject to inherent risks and uncertainties that could cause actual future results, conditions, actions or events to differ materially from those in the forward-looking statements. If and when forward-looking statements are set out in this new release, SBMI will also set out the material risk factors or assumptions used to develop the forward-looking statements. Except as expressly required by applicable securities laws, SBMI assumes no obligation to update or revise any forward-looking statements. The future outcomes that relate to forward-looking statements may be influenced by many factors, including but not limited to: the impact of SARS CoV-2 or any other global virus; reliance on key personnel; the thoroughness of its QA/QA procedures; the continuity of the global supply chain for materials for SBMI to use in the production and processing of ore; shareholder and regulatory approvals; activities and attitudes of communities local to the location of the SBMI’s properties; risks of future legal proceedings; income tax matters; fires, floods and other natural phenomena; the rate of inflation; availability and terms of financing; distribution of securities; commodities pricing; currency movements, especially as between the USD and CDN; effect of market interest rates on price of securities; and, potential dilution. SARS CoV-2 and other potential global viruses create risks that at this time are immeasurable and impossible to define.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/135625

VANCOUVER, BC / ACCESSWIRE / August 30, 2022 / Stillwater Critical Minerals (formerly Group Ten Metals) (TSXV:PGE)(OTCQB:PGEZF)(FSE:5D32) (the “Company” or “SWCM”) congratulates Heritage Mining Ltd. (“Heritage”) for completion of their Initial Public Offering (“IPO”) and commencement of trading on the Canadian Securities Exchange under the symbol HML.

Under an earn-in agreement with SWCM announced November 29, 2021 (“the Agreement”), Heritage can acquire up to a 90% interest in the Drayton-Black Lake gold project in Ontario by completing cash and share payments totaling $320,000 and 7,200,000, respectively, and completing exploration and development work totaling $5,000,000 by the fourth anniversary of the Agreement.

The Agreement also provides SWCM with a 10% carried interest through completion of a feasibility study and includes potential success-based discovery payments of $1.00 per ounce of gold or gold equivalent on mineral resource estimates as filed from time-to-time on Drayton-Black Lake. Success-based payments are capped at a maximum of $10,000,000 and may be paid in cash or shares at Heritage’s discretion. At SWCM’s discretion, Heritage may own 100% of the project, with SWCM retaining an NSR royalty interest. Heritage has confirmed that issuance of 2,800,000 shares, required as a first tranche per the Agreement, is in progress and acknowledges the requirement for a cash payment of $150,000 within 10 days of the one-year anniversary of the Agreement.

Michael Rowley, SWCM’s President and CEO, commented, “Our heartiest congratulations to Heritage Mining for completing their IPO. This achievement is not only an important milestone in our agreement with them but is also one that sets the stage for our mutual success as they advance the Drayton-Black Lake project as their flagship asset. Heritage is off to a great start with a large and highly prospective land package in a producing yet underexplored high-grade district and a team with strong local expertise. gold belt. We expect our agreement with Heritage to be the first in a series of deals whereby we realize significant value for our non-core assets as part of our focus on battery and precious metals at Stillwater West, in Montana’s Stillwater Igneous Complex.”

Heritage Mining’s CEO, Peter Schloo stated, “Completing the IPO is a pivotal moment for Heritage. District-scale exploration assets are very rare, and the project’s location in Ontario’s producing Rainy River district adjacent to Treasury Metals’ Goliath Gold Complex makes it even more compelling. We are well-capitalized and excited about the potential of the Drayton-Black Lake project, and we look forward to reporting on our progress and the targets we have developed there.”

About the Drayton-Black Lake Gold Project

The Drayton-Black Lake project consists of over 142 square kilometers in the Abrams‐Minnitaki Lake Archean greenstone belt, along the northern margin of the Wabigoon sub-province in Ontario, Canada. This emerging gold belt has already produced over one million ounces gold1 and currently hosts 6.6 million ounces of gold in Reserves and Measured and Indicated resources in total among New Gold’s Rainy River Mine, Treasury Metals’ Goliath Gold Complex, and First Mining’s Cameron gold project2. Drayton-Black Lake has significant exploration potential with demonstrated high-grade gold in drill results and bulk samples across more than 30 kilometers of underexplored strike in a geologic setting that is shared with Treasury Metals’ development-stage Goliath Gold Complex project. Access and infrastructure are excellent on the project, which features direct road access and proximity to rail and power. The project features well-defined, near-term drill targets over four zones, based on over 100 years of exploration data from 176 diamond drill holes totaling approximately 20km that had never been compiled until 2022.https://embed.fireplace.yahoo.com/embed?ctrl=Monalixa&m_id=monalixa&m_mode=document&site=sports&os=android&pageContext=%257B%2522ctopid%2522%253A%25221542500%253B1480989%253B1481489%253B1577000%2522%252C%2522hashtag%2522%253A%25221542500%253B1480989%253B1481489%253B1577000%2522%252C%2522wiki_topics%2522%253A%2522Mining_engineering%253BCanadian_Securities_Exchange%253BNatural_resource%253BExploration%253BInitial_public_offering%253BPrecious_metal%253BMineral%253BNew_Gold%2522%252C%2522lmsid%2522%253A%2522a077000000LnOyOAAV%2522%252C%2522revsp%2522%253A%2522accesswire.ca%2522%252C%2522lpstaid%2522%253A%2522f7bb1360-0dab-3a4d-8e1e-8e30f01e3037%2522%252C%2522pageContentType%2522%253A%2522story%2522%257D

About Stillwater Critical Minerals Corp.

Stillwater Critical Minerals (TSX.V: PGE | OTCQB: PGEZF) is a mineral exploration company focused on its flagship Stillwater West PGE-Ni-Cu-Co + Au project in the iconic and famously productive Stillwater mining district in Montana, USA. With the recent addition of two renowned Bushveld and Platreef geologists to the team, the Company is well-positioned to advance the next phase of large-scale critical mineral supply from this world-class American district, building on past production of nickel, copper, and chromium, and the on-going production of platinum group and other metals by neighbouring Sibanye-Stillwater. The Platreef-style nickel and copper sulphide deposits at Stillwater West contain a compelling suite of critical minerals and are open for expansion along trend and at depth, with an updated NI 43-101 mineral resource update expected in 2022.

Stillwater Critical Minerals also holds the high-grade Drayton-Black Lake gold project adjacent to Treasury Metals’ development-stage Goliath Gold Complex in northwest Ontario, which is currently under an earn-in agreement with an option to joint venture whereby Heritage Mining may earn up to a 90% interest in the project by completing payments and work on the project. The Company’s district-scale Kluane PGE-Ni-Cu-Co project is on trend with Nickel Creek Platinum‘s Wellgreen deposit in Canada‘s Yukon Territory.

About the Metallic Group of Companies

The Metallic Group is a collaboration of leading precious and base metals exploration companies, with a portfolio of large, brownfield assets in established mining districts adjacent to some of the industry’s highest-grade producers of silver and gold, platinum and palladium, and copper. Member companies include Metallic Minerals in the Yukon’s high-grade Keno Hill silver district and La Plata silver-gold-copper district of Colorado, Granite Creek Copper in the Yukon’s high-grade Minto copper district, and Stillwater Critical Minerals in the Stillwater PGM-nickel-copper district of Montana. The founders and team members of the Metallic Group include highly successful explorationists formerly with some of the industry’s leading explorers/developers and major producers. With this expertise, the companies are undertaking a systematic approach to exploration using new models and technologies to facilitate discoveries in these proven, but under-explored, mining districts. The Metallic Group is headquartered in Vancouver, BC, Canada, and its member companies are listed on the Toronto Venture, US OTC, and Frankfurt stock exchanges.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Michael Rowley, President, CEO & Director

Email: info@criticalminerals.com

Phone: (604) 357 4790

Toll Free: (888) 432 0075

Web: http://criticalminerals.com

Footnotes: 1 – New Gold company reports; 2 – Totals include Rainy River Mineral Reserves and Mineral Resources https://newgold.com/assets/reserves-and-resources/default.aspx, Goliath Gold Complex Mineral Resources Treasury Metals https://treasurymetals.com/site/assets/files/4272/goliath_gold_complex_ni_43-101_resource_estimate_f.pdf and First Mining’s Cameron project Mineral Resources https://www.firstmininggold.com/assets/other-wholly-owned/cameron-project/

References to adjoining properties are for illustrative purposes only and are not necessarily indicative of the exploration potential, extent or nature of mineralization or potential future results of the projects. Mineral resources that are not mineral reserves do not have demonstrated economic viability. There is currently insufficient exploration to define these Inferred mineral resources as Indicated or Measured mineral resources and it is uncertain if further exploration will result in upgrading them to an Indicated or Measured mineral resource category.

Forward-Looking Statements

Forward Looking Statements: This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Stillwater Critical Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Stillwater Critical Minerals and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Stillwater Critical Minerals

View source version on accesswire.com:

https://www.accesswire.com/713962/Stillwater-Critical-Minerals-Congratulates-Heritage-Mining-on-their-Initial-Public-Offering

VANCOUVER, British Columbia, Aug. 29, 2022 (GLOBE NEWSWIRE) — Millrock Resources Inc. (TSX-V: MRO, OTCQB: MLRKF) (“Millrock” or the “Company”) reports that it has sold a portfolio of royalties on exploration projects in British Columbia, Canada and Sonora State, Mexico to Osisko Gold Royalties Ltd (“Osisko”). Gross proceeds from the sale are $1.2 million.

Millrock President & CEO, Gregory Beischer, commented: “Prevailing market challenges make an equity financing difficult and raising capital in this manner would be highly dilutive to shareholders. Sale of non-core assets is the best way to bolster Millrock’s treasury for continued project generation activities, while we wait for assay results to roll out from two major Alaska gold drilling projects in which Millrock holds an interest.”

| PROJECT NAME | NSR% |

| Mexico Royalties | |

| Santa Rosalia | 0.5% |

| El Valle | 0.5% |

| El Pima | 0.5% |

| Violeta | 0.5% |

| Guadalcazar | 0.5% |

| British Columbia Royalties | |

| Todd Creek | 1.5% to 2.0% |

| Oweegee Dome | 1.5% to 2.0% |

| Willoughby | 1.5% to 2.0% |

Table 1. Royalties sold to Osisko for $1.2 million.

The right to any proceeds stemming from the exercise of any royalty buy backs pertaining to the British Columbia royalty properties has been assigned to Osisko. Additionally, Millrock has granted certain rights to Osisko in relation to royalties currently held, or that may be created, by Millrock during the next five years.

About Millrock Resources Inc.

Millrock Resources Inc. is a premier project generator to the mining industry. Millrock identifies, packages, and operates large-scale projects for joint venture, thereby exposing its shareholders to the benefits of mineral discovery without the usual financial risk taken on by most exploration companies. The company is recognized as the premier generative explorer in Alaska, holds royalty interests in British Columbia, Canada, and Sonora State, Mexico, is a significant shareholder of junior explorer ArcWest Exploration Inc., and owns a large shareholding in each of Resolution Minerals Limited and Felix Gold Limited. Funding for drilling at Millrock’s exploration projects is primarily provided by its joint venture partners. Business partners of Millrock have included some of the leading names in the mining industry: EMX Royalty, Coeur Explorations, Centerra Gold, First Quantum, Teck, Kinross, Vale, Inmet, and Altius, as well as junior explorers Resolution, Riverside, PolarX, Felix Gold and Tocvan.

ON BEHALF OF THE BOARD

“Gregory Beischer”

Gregory Beischer, President & CEO

FOR FURTHER INFORMATION, PLEASE CONTACT:

Melanee Henderson, Investor Relations

Toll-Free: 877-217-8978 | Local: 604-638-3164

Twitter | Facebook | LinkedIn

Some statements in this news release may contain forward-looking information (within the meaning of Canadian securities legislation), including but not limited to the receipt of drill results from Alaska drilling projects. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements.

Figure 1

Figure 2

Figure 3

Figure 4

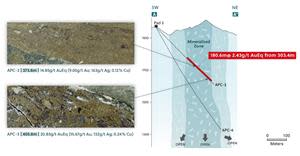

TORONTO, Aug. 29, 2022 (GLOBE NEWSWIRE) — Collective Mining Ltd. (TSXV: CNL) (OTCQX: CNLMF) (“Collective” or the “Company”) is pleased to announce assay results from two additional holes completed at the Apollo target (“Apollo”) at the Company’s Guayabales project located in Caldas, Colombia. Apollo is a newly discovered high-grade copper-gold-silver porphyry-related breccia and is one of eight porphyry-related targets situated within a three-by-four-kilometre cluster area generated by the Company through grassroots exploration at the project. As part of its fully funded 20,000+ metre drill program for 2022, there are currently three diamond drill rigs operating at the Apollo target with an additional rig drilling from underground at the Olympus target.

“These latest drill intercepts demonstrate the remarkably continuous nature of this mineralized breccia and overprinting CBM vein system which is now expanding with every drill hole that we complete. With multiple overprinting events depositing mineralization into the system, the Apollo main breccia has all the right markers to evolve into a large-scale discovery. We will remain aggressive with drilling for the balance of 2022,” commented Ari Sussman, Executive Chairman.

A short video presented by David Reading discussing the results can be seen by clicking here.

Details (See Table 1 and Figures 1 – 4)

Five diamond drill holes with accompanying assay results have now been announced at Apollo and resulted in expansion of this main breccia and overprinting vein system with dimensions of up to 300 metres along strike by 100 metres across by 400 metres vertical. The target remains open in all directions and has the potential to evolve into a significant high-grade, bulk tonnage mineralized system.

Drill holes APC-3 and APC-5 were drilled in opposite directions from two separate drill pads (Pads 2 and 3) to the northeast and southwest respectively to test continuity of the mineralized breccia previously intersected in holes APC-1, APC-1W and APC-2 and to test the early working model of the geometry of the main breccia (see press releases dated April 27, 2022, June 22 and July 6, 2022). The following results are highlighted:

APC-3 is the first hole drilled from a newly constructed pad (Pad 3) located approximately 400 metres to the south of Pad 1 (Holes APC-1 and 1W) and 300 metres to the southwest of Pad 2 (Hole APC-2 and APC-5).

APC-5 was drilled from Pad 2 to the SW with a steeper inclination and a 200-metre vertical difference from the previous intercept reported in APC-2.

Table 1: Assays Results

| HoleID | From (m) | To (m) | Intercept (m) | Au (g/t) | Ag (g/t) | Cu % | Zn % | Pb % | Mo % | AuEq (g/t)* |

| APC-3 | 303.40 | 484.00 | 180.60 | 1.52 | 39 | 0.16 | 0.13 | 0.11 | 0.001 | 2.43 |

| Incl | 304.90 | 326.00 | 21.10 | 2.86 | 24 | 0.04 | 0.28 | 0.28 | 0.001 | 3.47 |

| 363.10 | 409.70 | 46.60 | 3.78 | 58 | 0.20 | 0.33 | 0.27 | 0.001 | 5.13 | |

| APC-5 | 210.25 | 478.25 | 268.00 | 0.89 | 22 | 0.13 | 0.11 | 0.07 | 0.002 | 1.50 |

| Incl | 210.25 | 226.60 | 16.35 | 1.95 | 20 | 0.04 | 0.308 | 0.23 | 0.001 | 2.55 |

| 252.60 | 271.80 | 19.20 | 2.61 | 14 | 0.04 | 0.271 | 0.13 | 0.000 | 3.03 | |

| 456.00 | 478.25 | 22.25 | 2.30 | 21 | 0.04 | 0.332 | 0.24 | 0.002 | 2.92 | |

| and | 496.80 | 510.65 | 13.85 | 0.71 | 9 | 0.02 | 0.144 | 0.11 | 0.001 | 1.00 |

*AuEq (g/t) is calculated as follows: (Au (g/t) x 0.95) + (Ag g/t x 0.014 x 0.95) + (Cu (%) x 1.96 x 0.95) + (Mo (%) x 7.35 x 0.95)+(Zn(%)x 0.86 x 0.95)+ (Pb(%)x 0.44 x 0.95) utilizing metal prices of Cu – US$4.00/lb, Mo – US$15.00/lb, Zn – US$1.75/lb, Pb – US$0.9/lb, Ag – $20/oz and Au – US$1,400/oz and recovery rates of 95% for Au, Ag, Cu, Mo, Zn and Mo. Recovery rate assumptions are speculative as no metallurgical work has been completed to date.

** A 0.2 g/t AuEq cut-off grade was employed with no more than 15% internal dilution. True widths are unknown, and grades are uncut.

Figure 1: Plan View of the Guayabales Project Highlighting the Apollo Target

https://www.globenewswire.com/NewsRoom/AttachmentNg/eeb9e76f-a937-4682-a99b-ac6ab09f0c51

Figure 2: Plan View of the Apollo Target Area Outlining the Porphyry and Breccia Targets, their Related Soil Anomalies and Drill Holes Completed or Currently Underway

https://www.globenewswire.com/NewsRoom/AttachmentNg/7eca55ae-f68b-48d2-a2a9-cac7f26df452

Figure 3: Plan View with Traces of drill holes completed to date in the Main Breccia Discovery at Apollo

https://www.globenewswire.com/NewsRoom/AttachmentNg/b56c6abe-3941-438c-8374-c39142a568c3

Figure 4: Apollo Target Cross Section N-S with Core Photo Highlights for APC-5

https://www.globenewswire.com/NewsRoom/AttachmentNg/bb5d25f0-7fdc-4103-9370-fefd14b96872

Marketing Services Agreement

The Company is pleased to announce an agreement with Proven and Probable (“PP”) to provide investor relations services to the Company, subject to approval by the TSX Venture Exchange (the “TSX-V”). PP will provide investor relations services to increase exposure to and awareness of Collective. Services include, but not limited to:

The agreement with PP has a term of one year, for which they will be paid an annual fee of USD $72,000. PP currently owns 3,250 common shares of Collective.

About Collective Mining Ltd.

To see our latest corporate presentation and related information, please visit www.collectivemining.com

Collective Mining is an exploration and development company focused on identifying and exploring prospective mineral projects in South America. Founded by the team that developed and sold Continental Gold Inc. to Zijin Mining for approximately $2 billion in enterprise value, the mission of the Company is to repeat its past success in Colombia by making significant new mineral discoveries and advance the projects to production. Management, insiders and close family and friends own nearly 45% of the outstanding shares of the Company and as a result, are fully aligned with shareholders.

The Company currently holds an option to earn up to a 100% interest in two projects located in Colombia. As a result of an aggressive exploration program on both the Guayabales and San Antonio projects, a total of eight major targets have been defined. The Company has made significant grassroot discoveries at both projects with near-surface discovery holes at the Guayabales project yielding 302 metres at 1.11 g/t AuEq at the Olympus target, 163 metres at 1.3 g/t AuEq at the Donut target and recently, at the Apollo target, 207.15 metres at 2.68 g/t AuEq, 89.4 metres at 2.46 g/t AuEg and 87.8 metres at 2.49 g/t AuEg. At the San Antonio project, the Company intersected, from surface, 710 metres at 0.53 AuEq. (See related press releases on our website for AuEq calculations)

Qualified Person (QP) and NI43-101 Disclosure

David J Reading is the designated Qualified Person for this news release within the meaning of National Instrument 43-101 (“NI 43-101”) and has reviewed and verified that the technical information contained herein is accurate and approves of the written disclosure of same. Mr. Reading has an MSc in Economic Geology and is a Fellow of the Institute of Materials, Minerals and Mining and of the Society of Economic Geology (SEG).

Technical Information

Rock and core samples have been prepared and analyzed at SGS laboratory facilities in Medellin, Colombia and Lima, Peru. Blanks, duplicates, and certified reference standards are inserted into the sample stream to monitor laboratory performance. Crush rejects and pulps are kept and stored in a secured storage facility for future assay verification. No capping has been applied to sample composites. The Company utilizes a rigorous, industry-standard QA/QC program.

Contact Information

Collective Mining Ltd.

Steven Gold, Vice President, Corporate Development and Investor Relations

Tel. (416) 648-4065

FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including, but not limited to, statements about the drill programs, including timing of results, and Collective’s future and intentions. Wherever possible, words such as “may”, “will”, “should”, “could”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict” or “potential” or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties, and assumptions. Many factors could cause actual results, performance, or achievements to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, Collective cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and Collective assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.