Good as gold: 12.5kg bars, worth a cool £880,000 each. Photograph: Chris Collins/Getty Images

The price of gold continues to rise, but who buys it, and where do they keep it? We head to Zurich’s secret vault and meet the dealers

Michael SegalovSun 19 Jan 2025 04.00 ESTShare

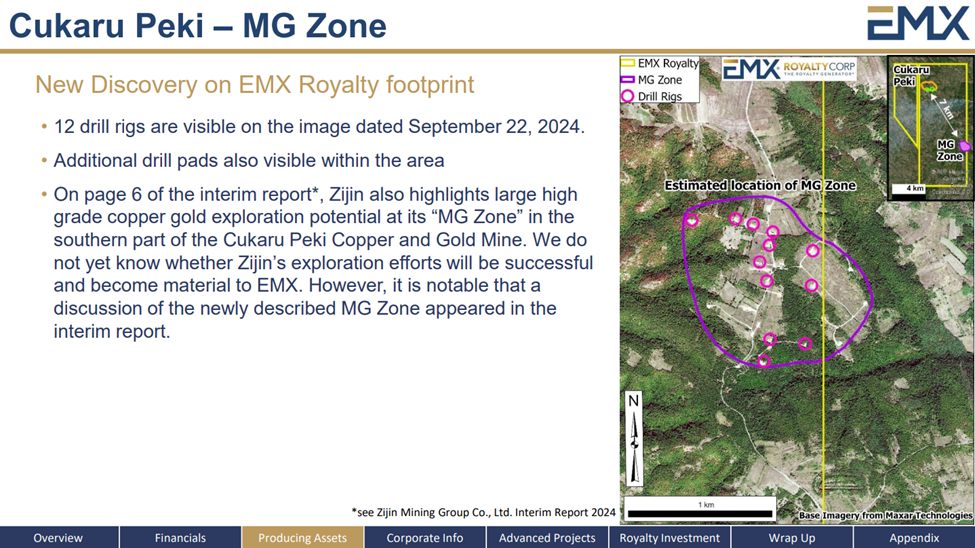

There’s a secrecy to the specifics of our planned rendezvous, when I meet a sharp-suited Egon von Greyerz in Zurich airport’s arrivals hall. Hands shaken, he guides us out of a side entrance towards a car park in a quiet corner of the sprawling complex. Roughly 30,000 people work in and around the site; annually, tens of millions of passengers pass through here. Scarce few are aware of the existence, let alone the precise location, of our intended destination: a high-security, 350sqm vault somewhere deep beneath us. Inside it, vast quantities of gold, much of it belonging to von Greyerz, and a roster of his company’s exceedingly wealthy international clientele.

For more than 25 years, von Greyerz has been in this business: buying, selling and storing precious metals for the super-rich, all the while preaching his golden gospel. “We set certain minimum levels,” he says, “to invest through us: $400,000 to store gold in this Zurich vault, or our similar one in Singapore. We use another deep in the Swiss Alps: you’ll need to invest $5m to have anything there.”

It’s not just the uber-wealthy who are turning to gold: more and more of us are at ie

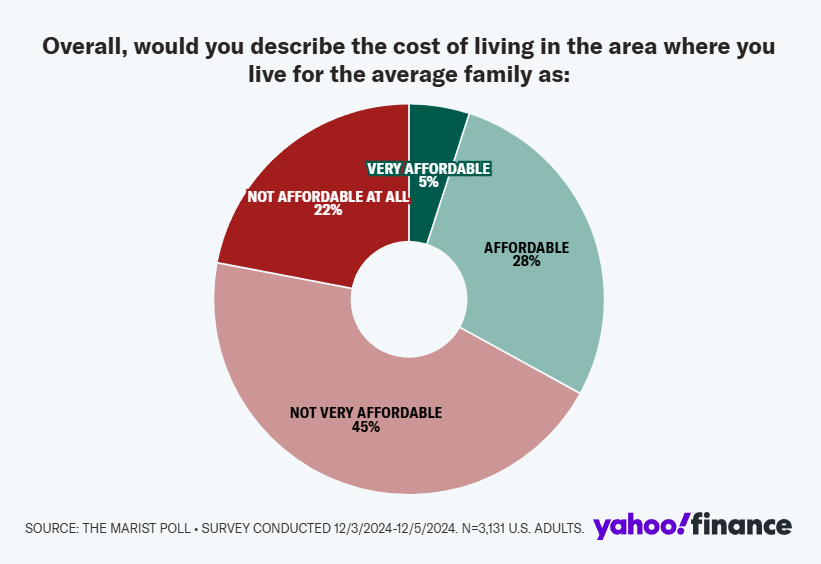

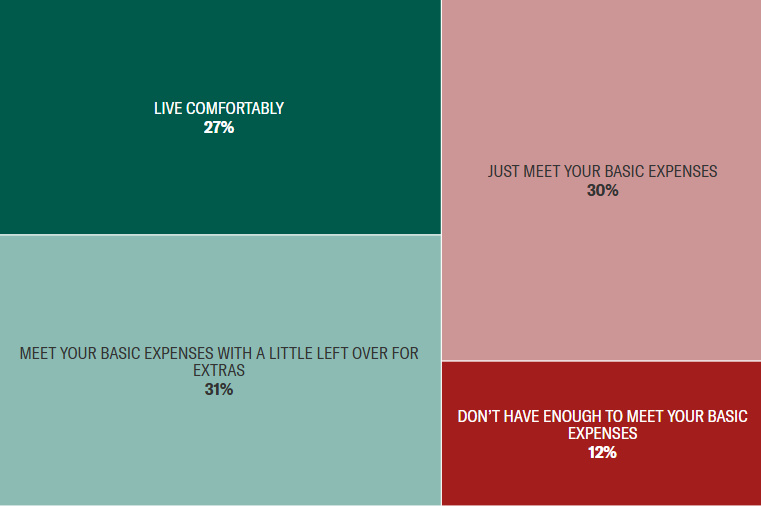

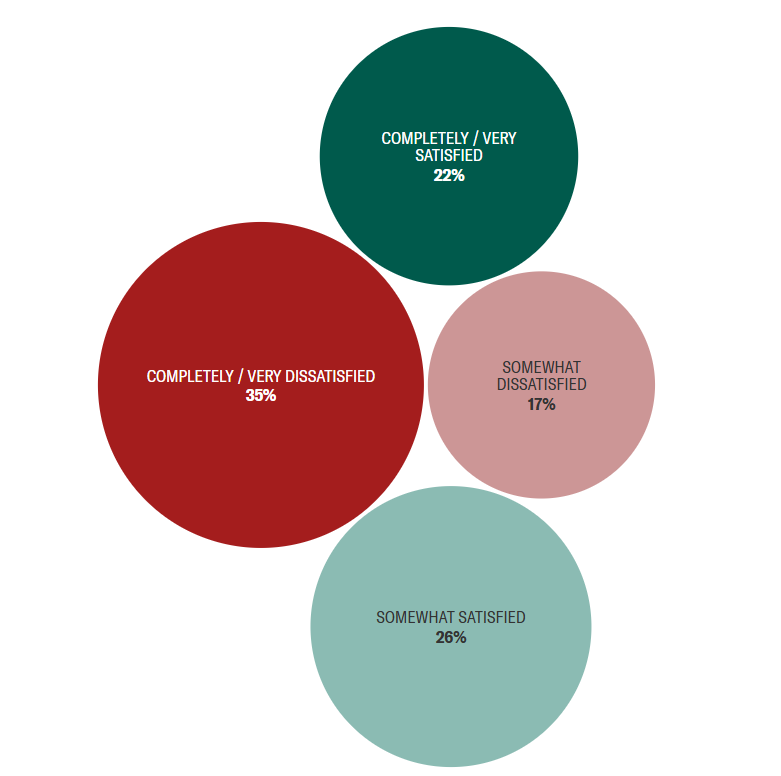

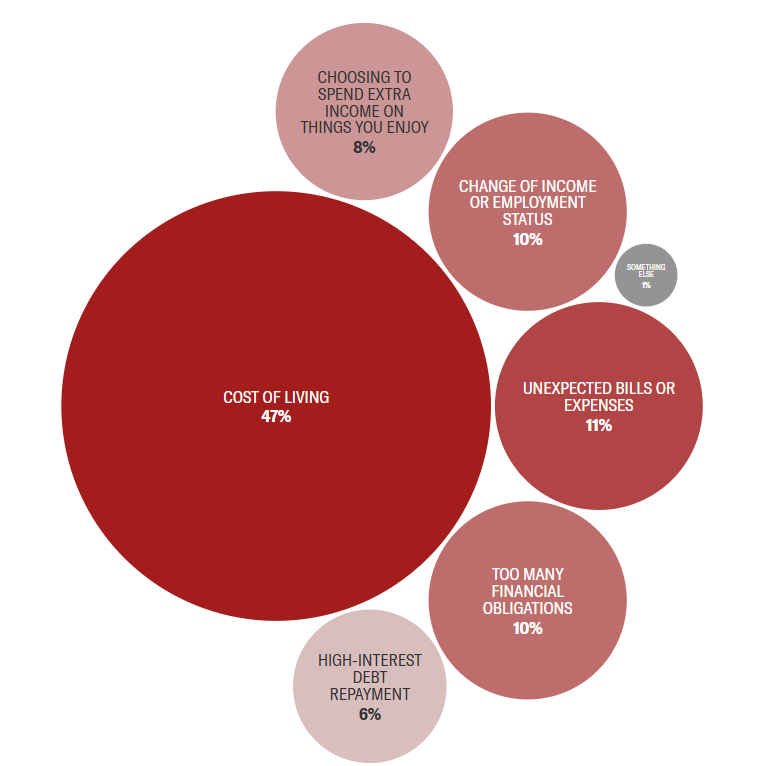

It’s not just the uber-wealthy who are turning to gold, as its price continues to soar. Whether going big on bullion or nabbing a gold sovereign for a few hundred pounds to pension-plan, more and more of us are at it. Welcome to a new gold rush. Last year, the Royal Mint, which buys and sells gold bars and coins, had a “record year” for customer purchases. Revenues from its gold bullion sales were up 153% year on year. It’s not hard to see why. In 2024, gold prices increased by 28%. From the climate crisis to Trump’s presidency, and increasing geopolitical instability, the world feels ever more uncertain. As we’ve done for millennia, many are turning to gold in search of safety and security.

For a tiny percentage of investors, this vault in Zurich offers gold-plated security and safety. We are buzzed into an unassuming office building – beyond the ground floor lobby, a cargo warehouse for customs checks. Up on the second floor, most doors are adorned with airline emblems, or those of international logistics firms. There’s little remarkable about the small, open-plan space I’m shown into, save for a large television screen in one corner displaying a series of neatly divided squares, each livestreaming one of the countless CCTV cameras in and around the vault below.

Once seated in the office’s neat meeting room, we get to it. Many vaults globally, von Greyerz begins, are in airports: high security, easy export. Geographically, Switzerland is convenient for storage: 50–70% of global gold is refined here. My passport is taken by a smartly dressed staffer for a final identity check. No photos allowed; I’m asked not to share certain security details. “Our business model is streamlined and simple,” von Greyerz says. “We buy gold for our clients direct from refineries, always freshly minted. We handle all the practicalities of storing it safely. It’s the same process in reverse if you want to sell. Gold has a global market value, known as its paper or spot price. The cost of physical gold is always a little higher, taking into account production costs. We add a small mark-up, too.” The vaults used aren’t owned by von Greyerz. “Given we buy and sell, an independent company storing is necessary: our clients, should they wish to, can come and inspect their assets entirely of their own accord.”

Once given the green light, we descend, beeped into the restricted customs area with its gun-wielding guards. Codes are entered; passes presented. Down a sterile staircase, along a dim, strip-lit tunnel and through a metal detector. Any issues, the alarm system immediately alerts nearby armed airport police. “We actively don’t have armed guards in the vault,” says von Greyerz, “because they can be a liability and turn on you. Few staff, who you know, are better than an army of people. Americans always expect men with machine guns to be stationed outside. That’s not our way.”

I ask the value of what’s stored ahead of us. It’s confidential. Are we talking millions? Tens of millions? Hundreds of millions? Von Greyerz smiles, but his lips won’t loosen. “All I can say is it’s more than whatever you think.” For context, a standard 12.5kg gold bar, the ones you’ll recognise from films, would set you back about £880,000.

Doors slam shut. I’m directed to remain behind a red line, as a heavy hatch is opened. Beyond a lattice of grills, a 130sqm cavern. Sandwiched between wooden crates are layers of large, exposed bars of silver. That’s standard in storage. The walls beyond are lined with shelves, upon which are piles of sealed grey-and-blue boxes: inside them, the gold. In an adjoining room, various treasures are brought out for our examination. First, britannias: 1oz gold coins stamped with a profile of King Charles. “In 2002,” says von Greyerz, “when we first invested in gold, these were worth £200. Now, it’s £1,850.” That was in June 2024, during my vault visit; as of early January 2025, a Britannia is worth over £2,200. Next, a box filled with 100g bars. Rectangular, with round edges. Finally, a pile of 1kg bars, circa £70,000 a piece.

Later, over lunch in Zurich’s old town, von Greyerz sets out his stall. “I’ve always been interested,” he says, “in understanding risk and protecting against downside.” He spent a few years working in the Swiss banking sector before joining a fledgling Dixons in 1972. In London, he was a company man for 17 years, latterly as a board member and finance director. “I resigned at 42, wanting to do my own thing.” He set up shop with a private asset and investment company, advising wealthy families and personal clients.

“Financial risk in the market, then and now, is too high for comfort,” he says. “Global debt today is $315trn; it’s an inescapable bubble. Since the early 1700s, 500 currencies have died, most through hyperinflation. Governments invariably destroy the finances of a country. Empires fall. Global powers change. Today, we’re seeing an acceleration in debts and decline. I think we’re close to another collapse.” He’s written about the subject extensively. A new era, he believes, will be based on commodities, not currency. “So, I turned to wealth preservation and came to the conclusion – obvious, in my opinion – that gold is its ultimate form. Simply put, it’s the only money that has survived through human history. Every other currency, without exception, has failed. In every situation of panic or crisis, people have always looked to gold.”

Convinced, in the late 1990s, von Greyerz took this analysis to a select group of clients. “In 2002, with gold dropping down a little in price, I put everything I had into gold, and suggested those I worked with do the same. It was never meant to become a company selling services or encouraging others to follow. But people kept asking…” Now he has clients in more than 90 countries. “With monetary currency,” he says, “you hold your wealth in something which, with inflation, has a constantly depreciating value. Even with low interest rates, the purchase power of your cash is always going down.”

There’s a distinction, von Greyerz clarifies, between gold and other investments. “I don’t see gold as speculation,” he says, “as something to buy and sell based on market changes. Prices fluctuate, but the trajectory is clear.” In essence, for those he advises – and von Greyerz himself – gold is a hedge; insurance for if and when their other financial assets implode. If the banking system and international order collapses, – say, amid a climate catastrophe – bullion remains tangible when the numbers disappear from our screens. “Our clients are prepared, worried about the world. Entrepreneurs, freethinkers.” Mavericks, maybe. “But they’re not strange people, they’re thinking smartly. Few of our clients invest less than 20% of their wealth in gold. Many invest more, up to 50% even.” Globally, only 0.5% of wealth is stored in gold. “If that goes up to 1.5% even, its value will go up vastly.” Just 3,000 or so tonnes of gold are mined each year; it’s a finite resource, you can’t just, on tap, produce it. Some predict reserves in the ground will run out as soon as 2050. There are other reasons to halt mining before then: emissions and water footprint; and regular reports of the global mining industry’s human rights abuses.

Most of us, von Greyerz concedes, could never dream of purchasing quantities that would qualify for his services. “Still,” he argues, “anything is worth investing. I believe for wealth preservation purposes you should buy gold at any level you can afford. Plus, in the UK, there’s no capital gains tax on any profits made on gold coins that are British legal tender, such as britannias and sovereigns.” In January 1970, 1oz of gold was worth about £14. Today, it’s up more than 15,000%.

Talk of brass tacks alone fails to capture the reality of gold’s enigmatic and enduring allure. Piles of cash, stocks and shares, or say, a lump of copper, would struggle to similarly stir the senses. Other metals are shiny; so why gold? Andrea Ferrero has been a professor of economics at Trinity College, Oxford, for a decade. Previously, he was an economist at the New York Federal Bank. “The starting point of gold’s role,” Ferrero says, “isn’t obvious. Its universal value can be put down to gold having a role in producing luxury goods and other commodities.” Traditionally, gold had few practical applications, its purpose purely cosmetic. “There’s its relative scarcity – we’ve discovered most of the gold, even with active searches. Plus, there are recent commentaries about the role of gold in industry, processors or other chips and technology. Industrial application might be another reason its value is going up.”

We should also look, Ferrero continues, to economic history. For centuries, gold played a major role in both domestic and international monetary systems: the first gold coins were struck on the order of King Croesus of Lydia (today part of Turkey), around 550BC. By the late 19th century, many of the world’s major currencies were fixed to gold at a set price per ounce: the gold standard. “This anchoring allowed for exchange rate stability. Today,” says Ferrero, “we live in the legacy of that system: the main role of gold is still hedging, a safe haven commodity.”

Contemporary political developments have only compounded gold’s current cachet. “Since the Russian invasion of Ukraine,” he says, “and with developments in the Middle East, there has been a big rise in geopolitical uncertainty. It’s one of the hottest topics in economics. Institutional and international investors are looking to diversify portfolios and allocate bigger shares to safe assets. In that respect, gold feels secure. It’s very libertarian – independent from governments. For states, like individuals, gold is like building a nuclear bunker,” says Ferrero, “preparing for a scenario you hope never materialises, but you’re ready, just in case.” According to the World Gold Council, latest data shows that central banks globally bought 53 tonnes of gold in November.

Just as important, feels historian Dr Stephen Tuffnell, is gold’s place in our cultural psyche. Much of his research has focused on the 19th-century gold rushes, at which stage, he says, gold cements itself as an almost mythical metal. “It’s then,” he says, “that miners see gold as a way to escape the drudgery of waged labour. It’s a bit like gambling, but in nature’s lottery.” In truth, many prospectors found small amounts. “Still, there’s an addiction to chasing gold rushes around the world. Yes, the age of gold underpins a wave of globalisation, but there’s more… There was a narrative then, maybe false, that with hard labour you could secure your own future. The excitement around gold, to this day, remains embedded in Anglo-American culture. It quickens the pulse in a way other metals don’t. There’s an idea that gold is wealth in its purest form.”

Just off the main thoroughfare of London’s Hatton Garden is Zoe Lyons’s family firm, Hatton Garden Metals. Their four-storey building is in the heart of the capital’s jewellery, precious-metal and diamond district, dating back centuries. Downstairs is a shopfront: two counters, a private inspection room and a waiting area, this morning – as on most days – filled with queueing customers. Above it, administrative offices, a boardroom I’m soon shown into and, on the top floor, a smelting lab, where purchased precious metals are melted down.

Lyons has been in the trade for 15 years, following in the footsteps of her South-Manchester pawnbroker and jeweller parents. Her sister also works in the business, as do various cousins. There are no minimums here. “Customers coming to the counter,” says Lyons, “generally have maybe up to £1,000-worth of gold on them. That figure can increase substantially: our trade customers come in with multiples and multiples of that to sell. We actively encourage customers not to make appointments. For the security of our clientele, it’s best that nobody knows who is coming in with what or when.”

A team of four experts buy and sell gold from the counters, each having undertaken six months of intricate training. “They know how to identify hallmarks, how to use acids to ascertain carats. They can identify plated items, strip items from core and base metal, assess if something needs smelting…” The list goes on. “In this industry, a typo or mistake can prove very expensive.” In essence, Hatton Garden Metals operates with the logic of a bureau de change. “There’s a lot of information online for buyers,” Lyons says. “Different companies flog different stocks: collectibles, commemorative items, the gift market. We publicly display our premiums over the spot price – the price we’ll buy, and that we’ll sell for. That changes on our website every 30 seconds. Once the deal is done, the price is locked.”

More collectible gold coins might be retained by the business for resale, but most of what Lyons and her team purchase is smelted down and sold back to the market at a price fixed twice-daily globally; in the UK, overseen by the London Bullion Market Association (LBMA). “We roughly know the volume we have coming in, and so book in a trade with the bank, either morning or afternoon. It means if the market dropped by 50% tomorrow, it doesn’t affect anything we’ve done today.” No risks can be taken. “I can’t hold on to gold in the hope the price goes up later. If the market went the other way, you’d have a problem on your hands.”

They provide a service to “a really eclectic mix of clients,” Lyons says. “Customers who buy a little every month for a pension or rainy day; those selling gold they’ve inherited, or owned for a long time; traders on Hatton Garden; preppers and end-of-worlders. Lots of our customers don’t feel totally secure about their money in the bank. They don’t want cash, not that banks make it easy to access it.”

Presumably, her own savings are converted into gold? “When I first started,” she replies, “I did buy some sovereigns. Then the market jumped up like, £10, and I sold.” Today, Lyons now refrains from purchasing her own product. “Well, I have a little bit, but nothing significant. It’s something I yell at my parents about still: why didn’t you buy when gold was so cheap? Half-sovereigns were £20 when my parents started. Today, they’re £250. I’m sure my kids and grandkids will say the same. But gold is a long-term investment: you want to buy it and then not look at the prices regularly as it fluctuates. You want to forget about it and live your life.” Difficult, for someone in her line of work. “I don’t have a choice but to constantly monitor the market. If I had any substantial money there, I’d always be obsessing about the ups and downs, and really, I don’t have the time or nerve.”

Each gold-getter I speak to has their own logic: an older, Jewish Londoner who prefers to keep his assets close, a response to a prosecution-filled history. A twentysomething who turned to gold after getting into crypto. Many just see gold as an alternative to traditional ways of saving.

Andy Reid is a regular buyer. A former soldier, today he’s Merseyside-based. He runs a local café, and works as a motivational speaker. For a long time, any spare cash went on premium bonds: a few hundred quid, a few times a year, most often. He’d been watching the Discovery reality show Gold Rush on TV, following gold miners across North America. “I read about how there’s less and less of it left in the ground and the demand for it in modern technology.” Then, a trip to Costco. “I’d been going for years, always noticing the fact they sell gold bars in-store from a glass kiosk…” Yes, really… “It never crossed my mind to buy gold with my scones, then a year or two ago, I started thinking…”

He’s been buying from Hatton Garden Metals ever since. A gold coin each month, if there’s enough cash left in the bank at the end of it. “It’s something you have in your hand. I can go into my safe and hold it. You can also pass it on tax-free.” Britannias and Sovereigns are legal tender, exempt from capital gains tax.

Reid’s children are six and 11. “I want to give them the coins when they’re in their 20s or 30s. I don’t even look at the price, really, when I buy. I’m thinking about the long term. If it goes up by a few quid next year, I’m not going to sell it. I show them what I’ve got so far, sometimes, so they see the results of saving. And it feels real in a way money in an account doesn’t.” He’s aware it’s not a failsafe. Prices do go up and down; no investment is foolproof. “Of course the market could crash,” he says. “I bought a house just before the 2008 financial crisis, and lost £30,000 overnight. I’m not too concerned. It’ll go back up again: just look at history.” And for Reid, at least, it’s about more than a sound investment. “I’m a normal lad from up north,” he says, “who joined the army as a teen with no qualifications. Now I’ve got gold coins in my safe. There’s something special about that you can’t really explain.”

This article was amended on 20 January 2025 because an earlier version mistakenly referred to Geneva, rather than to Zurich, in the subheading and a picture caption.