Upcoming exploration to focus on new magnetic anomaly.

Vancouver, British Columbia–(Newsfile Corp. – August 7, 2024) – Riverside Resources Inc. (TSXV: RRI) (OTCQB: RVSDF) (FSE: 5YY) (“Riverside” or the “Company”), is pleased to update progress on the Cecilia project where Riverside is working with Fortuna Mining Corp (TSX: FVI) (see March 13, 2024 press release). The Company has completed detailed magnetic susceptibility data acquisition for the entire project area and identified a new magnetic anomaly area of 6 x 2 km² in the southwest part of the project. The company believes this area displays many classic structural controls similar to the mineralization found at the main Cerro Magallanes target area of the project and can become an additional focus of the upcoming exploration activities as well as the already permitted and planned upcoming drill program that is fully funded and scheduled to start in early Q4, 2024.

The current technical work program is completing now as the project moves next to drill testing. The work that has been completed for evaluating and improving drill targets includes geophysics, geochemistry and geology being integrated. The Cecilia Project has good road access with the project located 40 km southwest of Agua Prieta (Mexico-USA border) and 250 km northeast of the capital city of Hermosillo. The project is a titled and 100% Riverside-owned, with drill permits and the ability to progress the drilling in the coming months. The property is a district-scale gold and silver, low-sulfidation epithermal system and is currently optioned with Fortuna Mining earning an initial ownership position through a series of payments and work commitments where Riverside remains as the operator of the exploration program as disclosed in March. The project covers over 60 km² and has over 10 different exploration targets, with at least two nested dome complexes similar to those in Peru at the Yanacocha Mining District and in Bolivia at the Korri Kollo Mine, which have produced well over 25M and 5M oz of gold respectively. The use of aeromagnetics helps further distinguish these targets.

John-Mark Staude, CEO of Riverside, states, “We are delighted to receive this excellent and detailed aeromagnetic survey for the entire 60 km² area from our work with Fortuna Mining on the Cecilia district exploration. We had full access to the surface for conducting field follow-up allowing the project to progress significantly over the past 6 months. Further, the discovery of a new anomaly is an exciting development and we look forward to undertaking additional exploration work on this discovery over the coming months as well as the fully funded drilling. Having the drill permit, mineral title and funding with a partner aligned in our exploration creates the platform for potential success with drilling activities proceeding in the near term. We look forward to the drill turning and having results from this project as well as updates on other activities that are underway into the fourth quarter of 2024.”

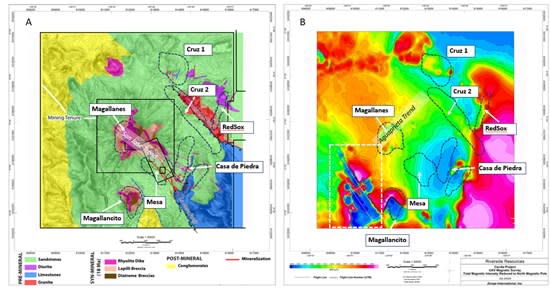

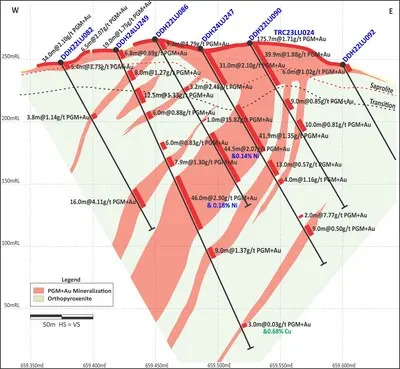

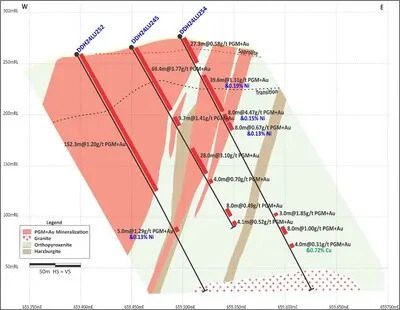

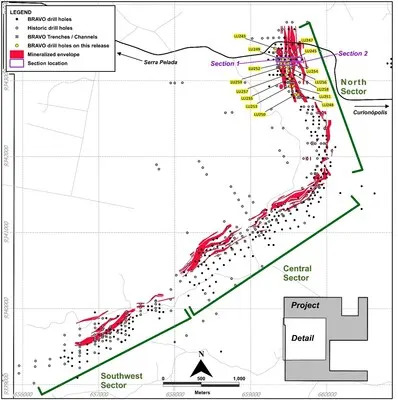

Riverside has completed the acquisition of aeromagnetic data expanding on an earlier and more focused survey where Riverside drilled and intersected gold mineralization. The new UAV magnetic data now covers the entire Cecilia project area of 60 km² with Riverside having full access to the entire property featuring a total flying of 658 line kilometers. Using this new, higher resolution magnetic data aids in interpreting and refining previous targets identified by Riverside. The results identified strong NW-trending magnetic lineaments in the southwestern corner of the project area (Figure 1). This data was not available in earlier results whereby the Company now has access to this region for the first time. This new magnetic anomalous area reflects a strong NW-trend which is similar to the main previously mined and drilled Au-mineralization structural trends like the San Jose Structural trend and Mesa Target (Figure 1A). Additionally, these lineaments bound the Magallancito dome and may be related to sharp contacts or fault-related contacts of intrusions around this target. Such strong structural features are typical of other major mining dome districts including Yanacocha, Peru and Mulatos, Sonora.

Some perpendicular magnetic lineaments in the project appear to define NE-trending zones along strike that generally serve as the main mineralization controls in the district and at surface have associated occurrences of Au-Ag mineralization (e.g. Agua Prieta Trend, Figure 1B). The new areas provide additional future focuses further expanding the planned program and continuing to grow the targeting of the project. Structural intersections in the mineralized dome districts of Mexico and other countries such as in Peru, Bolivia and USA often define focused locations of geologic faults which can provide fluid pathways for higher grade hydrothermal breccias and mineralization.

The acquisition and processing of the magnetic data were completed by Zonge International, Inc. This resulted in the merging and leveling of the historic UAV databases acquired recently by Riverside in the Magallanes Target, producing various merged data interpretations including; total magnetic intensity, reduction to the pole, 1st vertical derivative, and tilt derivative of the reduction to the pole processing’s. The updated 3D inversion model helps delineate the targets at depth and is being used for modeling drill collars and plans for upcoming drilling. This drilling is expected to start in the fourth quarter of 2024, with Fortuna Mining as the funding partner.

Figure 1.

A. Updated 1:10.000 geological map of the Cecilia project.

B. New target area at Magallancito over Total Magnetic Intensity (TMI) Reduced to North Pole map. The target areas dashed with scales of multiple kilometers.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6101/219104_17c80cf5a451ea58_002full.jpg

About the Cecilia Project:

Riverside Resources owns the project and has undertaken comprehensive exploration efforts at the property, including drilling activities that have yielded significant gold intercepts. Notably, drill results have intersected near surface promising intercepts such as 24.2 meters at 1.51 grams per ton of gold (April 15, 2021 press release) within the rhyodacite dome, showcasing the property’s gold at shallow depths which also has been mined in over a dozen locations including some substantial small scale underground prospect mining. The project has potential to follow these intercepts and go for larger targets at depth is the next planned drilling activity.

One distinguishing aspect of this project is the potential to preserve a fertile dome system. The Magallanes Target, situated at the central part of the project, exhibits interaction within extensive NE and NW structures, presenting a compelling opportunity for the discovery of epithermal gold-silver style mineralization. This geological scheme of the Cecilia Project resembles the Tertiary-age rhyolite systems, like the La Pitarrilla Ag-Pb-Zn project (~800M oz AgEq*) and Fresnillo’s San Julian Ag-Au Mine (~350M oz AgEq**), both situated in Durango, Mexico in the similar Sierra Madre Volcanic Province to Cecilia.

*Mineral Resource estimate for the Pitarrilla Ag Pb Zn Project, Durango, Mexico, SSR Mining, March, 2023.

**Obtained from Fresnillo public presentation, Hermosillo, October, 2016

Qualified Person & QA/QC:

The scientific and technical data contained in this news release pertaining to the Cecilia Project was reviewed and approved by Julian Manco, P.Geo, a non-independent qualified person to Riverside Resources focusing on the work in Sonora, Mexico, who is responsible for ensuring that the information provided in this news release is accurate and who acts as a “qualified person” under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

About Riverside Resources Inc.:

Riverside is a well-funded exploration company driven by value generation and discovery. The Company has over $5M in cash, no debt and less than 75M shares outstanding with a strong portfolio of gold-silver and copper assets and royalties in North America. Riverside has extensive experience and knowledge operating in Mexico and Canada and leverages its large database to generate a portfolio of prospective mineral properties. In addition to Riverside’s own exploration spending, the Company also strives to diversify risk by securing joint-venture and spin-out partnerships to advance multiple assets simultaneously and create more chances for discovery. Riverside has properties available for option, with information available on the Company’s website at www.rivres.com.

ON BEHALF OF RIVERSIDE RESOURCES INC.

“John-Mark Staude”

Dr. John-Mark Staude, President & CEO

For additional information contact:

John-Mark Staude

President, CEO

Riverside Resources Inc.

info@rivres.com

Phone: (778) 327-6671

Fax: (778) 327-6675

Web: www.rivres.com

Eric Negraeff

Investor Relations

Riverside Resources Inc.

Phone: (778) 327-6671

TF: (877) RIV-RES1

Web: www.rivres.com

Certain statements in this press release may be considered forward-looking information. These statements can be identified by the use of forward-looking terminology (e.g., “expect”,” estimates”, “intends”, “anticipates”, “believes”, “plans”). Such information involves known and unknown risks — including the availability of funds, the results of financing and exploration activities, the interpretation of exploration results and other geological data, or unanticipated costs and expenses and other risks identified by Riverside in its public securities filings that may cause actual events to differ materially from current expectations. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/219104