Critical minerals, barite and zinc, added to expanded resource

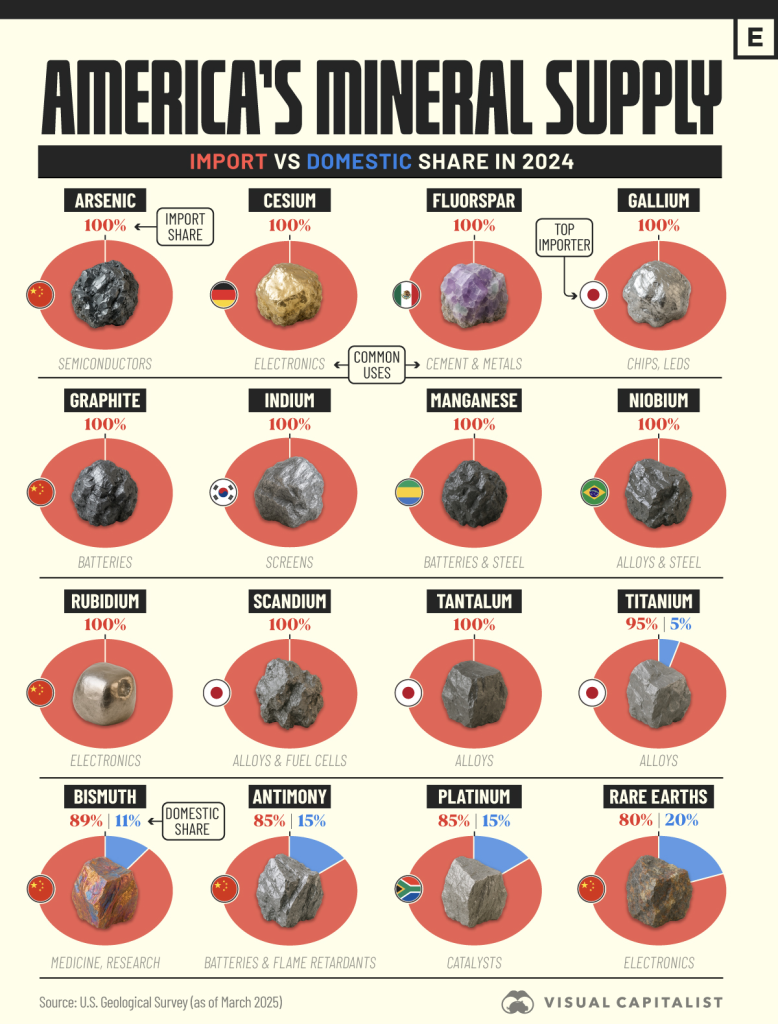

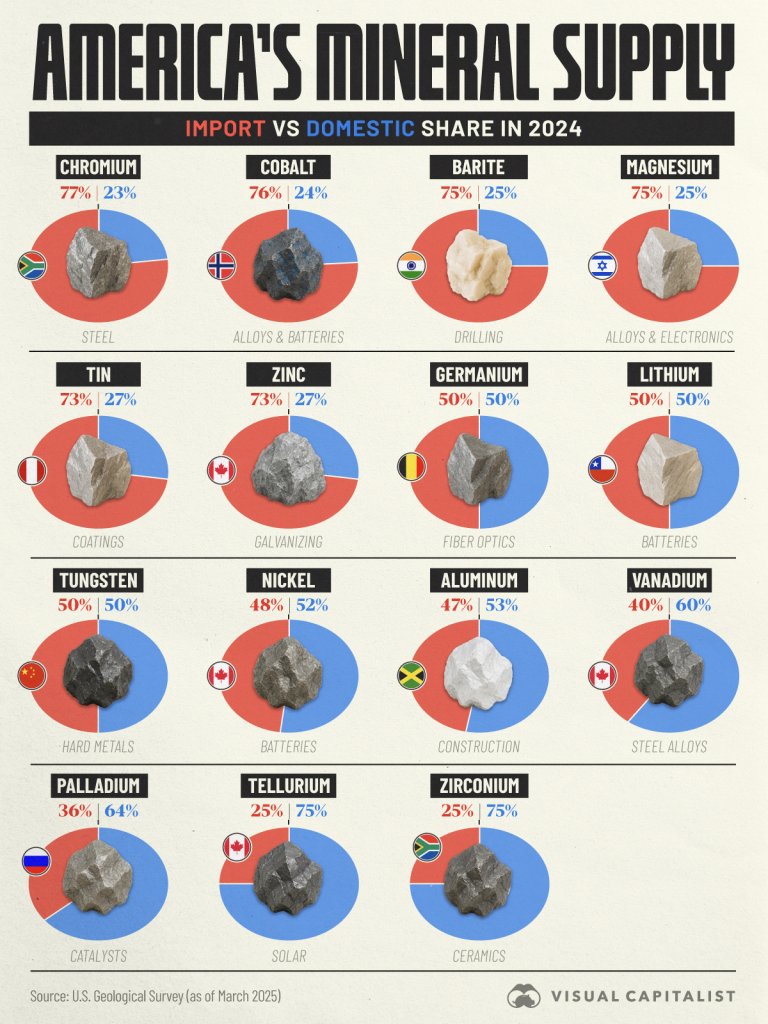

VANCOUVER, British Columbia, Sept. 04, 2025 (GLOBE NEWSWIRE) — Apollo Silver Corp. (“Apollo” or the “Company”) (TSX.V:APGO, OTCQB:APGOF, Frankfurt:6ZF0) is pleased to announce the results of an updated independent Mineral Resource estimate (“MRE”) for its Calico Silver Project (“Calico” or the “Calico Project”) located in San Bernardino County, California. Total silver (“Ag”) Measured & Indicated (“M&I”) tonnes at the Waterloo property have increased by 61% to a total of 55 million tonnes (“Mt”) at a grade of 71 grams per tonne (“g/t’) Ag for a total content of 125 million troy ounces (“Moz”). This represents a 14% increase in Ag ounces compared to the previous MRE (dated March 6, 2023). In addition to updating the gold resource at Waterloo, inaugural barite (“BaSO4”) and zinc (“Zn”) resources have been included in both the Indicated and Inferred categories.

News Highlights

- New combined Measured and Indicated total of 55 Mt at a grade of 71 g/t Ag for a total of 125 Moz Ag

- 61% increase in tonnage and a 14% increase in Ag ounces representing an increase of 15 Moz contained Ag

- Inferred total of 0.6 million tonnes at a grade of 26 g/t Ag for a total of 0.51 Moz contained Ag

- Sensitivity analyses show resiliency of the Ag resource to changes in metal price

- Inaugural BaSO4 and Zn resources are estimated as:

- Indicated: 36 Mt @ 7.4% BaSO4 and 0.45% Zn for a total content of 2.7 Mt BaSO4 and 354 million pounds (“Mlbs”) Zn

- Inferred: 17 Mt @ 3.9% BaSO4 and 0.71% Zn for a total content of 0.65 Mt BaSO4 and 258 Mlbs Zn

- Gold ounces have increased by 86% in the Inferred category for a new total of 17 Mt at a grade of 0.25 g/t Au and total Au content of 0.13 Moz

- One single pit for all metals at Waterloo deposit with a low strip ratio of 0.8:1

- The increased quantities of Ag and Au, the addition of two new critical minerals, and the larger single pit with low strip ratio has derisked the Calico Project

Further Growth Opportunities

- Silver: There remain further opportunities to expand the Ag mineralization below the base of the 2025 MRE in the northern region of the Waterloo deposit.

- Barite and Zinc: The indicated and inferred mineral resources for BaSO4 and Zn show clear potential to be upgraded into M&I via infill drilling and re-assays.

- Gold: Mineralization remains open along strike and at depth. Future work will target additional mineralization along strike with a particular focus on the high-grade structures.

- Langtry Property: Many areas under the Quaternary cover remain untested. In addition, the potential for BaSO4 and other metals have not yet been evaluated in detail at Langtry.

Ross McElroy, President and CEO for Apollo, commented: “The Calico Project continues to increase in value, scale and optionality. Already boasting one of the largest undeveloped silver deposits in the US, new data confirms the presence of additional minerals, such as barite and zinc, which are included on the US critical mineral list. These findings will contribute to our project development plans, including an upcoming Preliminary Economic Assessment (PEA). Notably, much of the mineralization occurs at shallow depths, resulting in a low economic strip rate. With a substantial land position, there is strong potential for further discoveries at Calico.”

CALICO PROJECT 2025 MINERAL RESOURCE ESTIMATE

The 2025 MRE focused on upgrading and expanding the Waterloo resource estimate from that declared in 2023 (see news release dated March 6, 2023). The most significant change in the 2025 MRE is the addition of BaSO4 and Zn to the Ag and Au mineral resources for the Waterloo deposit and updated mineral resource estimate cut-off (“COG”) grades for both the Waterloo and Langtry deposits. The Waterloo MRE now contains 125 Moz Ag in 55 Mt at an average grade of 71 g/t Ag in M&I categories, and 0.51 Moz Ag in 0.6 Mt at an average grade of 26 g/t Ag in the Inferred category. The Langtry MRE now contains 57 Moz Ag in 24 Mt at an average grade of 73 g/t Ag in the Inferred category.

In addition to its robust Ag resource, the Waterloo resource now contains 2.7 Mt BaSO4 and 354 Mlbs Zn in 36 Mt at an average grade of 7.4 % BaSO4 and 0.45 % Zn in the Indicated category, and 0.65 Mt BaSO4 and 258 Mlbs Zn in 17 Mt at an average grade of 3.9 % BaSO4 and 0.71 % Zn in the Inferred category. Also, 0.13 Moz oxide Au contained in 17 Mt at an average grade of 0.25 g/t Au in the Inferred category. Oxide Au mineralization has been drilled over 1,000 m strike length and remains open in multiple directions. Figures 1 and 2 present the mineral resource block model grade and classification for each of the metals, respectively.

Mineralization at Waterloo and Langtry is shallow and shows high continuity along the 1.8 km long strike length at Waterloo and 1.25 km at Langtry of the deposit. The 2025 MRE is calculated to a maximum open pit depth of approximately 192 m (630 ft) at Waterloo and approximately 149 m (490 ft) at Langtry for all metals. An open pit optimization is used to determine reasonable prospects for economic extraction, the calculated waste to mineralization tonnage ratio for the total resource at Waterloo is 0.8:1and 2.8:1 at Langtry.

Table 1: Calico Project 2025 MRE. Effective June 30, 2025.

| Precious Metals | ||||||||||

| Deposit | Metal | Class | Cutoff | Imperial Units | Metric Units | Contained Metal | ||||

| Grade | Volume (Myd3) | Tons | Grade | Volume (Mm3) | Tonnes | Grade | Moz | |||

| (g/t) | (Mst) | (oz/st) | (Mt) | (g/t) | ||||||

| Waterloo1 | Silver | Measured | AgEQ ≥ 47 | 23 | 48 | 2.2 | 18 | 43 | 75 | 104 |

| Indicated | 6.3 | 13 | 1.7 | 4.8 | 12 | 57 | 21 | |||

| Measured + Indicated | 29 | 61 | 2.1 | 22 | 55 | 71 | 125 | |||

| Inferred | 0.32 | 1.0 | 0.77 | 0.25 | 0.60 | 26 | 0.51 | |||

| Gold | Inferred | AgEQ ≥ 47 | 5.3 | 11 | 0.01 | 4.1 | 10 | 0.2 | 0.07 | |

| AgEQ < 47 and Au ≥ 0.17 | 3.6 | 7.5 | 0.01 | 2.8 | 6.8 | 0.3 | 0.06 | |||

| Inferred Total | 8.9 | 18.4 | 0.01 | 6.9 | 17 | 0.25 | 0.13 | |||

| Langtry2 | Silver | Inferred | Ag ≥ 43 | 13 | 27 | 2.1 | 9.9 | 24 | 73 | 57 |

| Base and Industrial Metals | |||||||||||

| Deposit | Metal | Class | Cutoff | Imperial Units | Metric Units | Contained Metal | |||||

| Grade | Volume (Myd3) | Tons | Grade | Volume (Mm3) | Tonnes | Grade | Mlbs | Mt | |||

| (g/t) | (Mst) | (%) | (Mt) | (%) | |||||||

| Waterloo1 | Barite | Indicated | AgEQ ≥ 47 | 19 | 40 | 7.4 | 15 | 36 | 7.4 | – | 2.7 |

| Inferred | 8.9 | 18 | 3.9 | 6.8 | 17 | 3.9 | – | 0.65 | |||

| Zinc | Indicated | AgEQ ≥ 47 | 19 | 40 | 0.45 | 15 | 36 | 0.45 | 354 | – | |

| Inferred | 8.9 | 18 | 0.71 | 6.8 | 17 | 0.71 | 258 | – | |||

- Ounces reported as troy ounces.

- Base-case resource estimate reported in Table 1 using 47 g/t Ag equivalent (“AgEQ”) and 0.17 g/t Au cut-off grades for Waterloo and 43 g/t Ag for Langtry.

- CIM definitions are followed for classification of the mineral resource.

- For the Waterloo Property, a AgEQ cut-off grade was calculated using the following variables: surface mining operating costs (US$2.8/st), processing costs plus general and administrative cost (US$26.5/st), Ag price (US$28/oz), BaSO4 price (US$120/t), Zn price (US$1.22/lb), Au price (US$2,451/oz), and metal recoveries (Ag 65%, Au 80%, BaSO4 85%, Zn 80%). For the Waterloo Property gold-only resources the Au cut-off grade was calculated using above Au price, Au recovery and gold-only processing costs plus general and administrative cost (US$8.2/st).

- For the Langtry Property, a silver-only equivalent cut-off grade was calculated using above Ag price, Ag recovery and silver-only processing costs plus general and administrative cost (US$24/st).

- Resources reported in Table 1 are constrained to within a conceptual economic pit shell targeting mineralized blocks within the specified cutoff grade limits shown in the table. Specific gravity for the mineralized zone is fixed at 2.44 t/m3 (13.13 ft3/st). For the Waterloo Property only the following drillhole grades were capped prior to estimation: Ag 450 g/t, Au 2 g/t, Ba 31% and Zn 7%.

- Totals may not represent the sum of the parts due to rounding.

- 1,2The 2025 MRE has been prepared by Derek Loveday, P. Geo., of Stantec Consulting Services Ltd., an independent Qualified Person, in co-operation with Mariea Kartick, P.Geo. (independent Qualified Person for drilling data QA/QC) and Johnny Marke P.G. (independent Qualified Person for resource estimation). The 2025 MRE was produced in conformance with NI 43-101. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that any mineral resource will be converted into a mineral reserve.

- No drilling was completed on the Waterloo Property and Langtry Property since the declaration of the 2023 MRE for Waterloo and 2022 MRE for Langtry. The 2025 MRE update accounts for changes in commodity prices, mining costs since 2022/2023, and barite testing of existing drill samples from the Waterloo Property.

Figure 1: Calico Project, 2025 Mineral Resource Block Model Grade

Figure 2: Calico Project, 2025 Mineral Resource Classification

Data Input

The 2025 MRE considered drilling information up to and including the most recently completed program in 2022, as well as geological information from Apollo’s 2021, 2022 and 2025 exploration activities. Drilling data supporting the 2025 MRE includes information from historic drilling data from 258 holes (18,679 m/61,282 ft), and 2022 drilling data from 85 holes (9,729 m/31,918 ft) for a total of 343 holes (28,407 m/93,199 ft). Nominal drill hole spacing is 30 x 46 m (100 x 150 ft) within the Measured portion of the 2025 MRE. Of the drill data set used, 332 holes are rotary or reverse circulation holes, and 11 holes are diamond drill holes.

For the 2025 MRE, additional re-assaying of 7,431 historical and recent drill pulps by X-Ray Fluorescence for barium (“Ba”) and barium oxide (“BaO)”) was completed or a total of 7,893 Ba samples used for estimation. The Ba as well as existing Zn assay (4-acid or aqua-regia) assay results were subject to a comprehensive quality assurance/quality control (“QAQC”) program that was reviewed by Mariea Kartick, P.Geo. (Stantec), an independent “Qualified Person” (or “QP”) as such term is defined within National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). In addition, detailed surface mapping and rock sampling were completed in the Burcham area of the Waterloo Property. The mapping and sampling provided a better understanding of the extent of the Au mineralization at surface and within the Pickhandle Formation as well as helped refine orientations of high-angle gold-bearing structures in the geologic model.

No additional Ag and Au assay data was used for the 2025 MRE from that acquired for the 2023 MRE. Material changes in Ag and Au resource in the 2025 MRE from the 2023 MRE are due to changing economics from 2023 to 2025 and inclusion of BaSO4 and Zn in the overall resource for the Waterloo deposit. Verification of drilling exploration data used for the 2025 MRE was performed by Mariea Kartick, P.Geo. (Stantec), an independent QP.

Cut-Off Grade and Reasonable Prospects for Eventual Economic Extraction

For the Waterloo MRE two base-case cut-off grades are used. A silver equivalent (“AgEQ”) cut-off grade of 47 g/t was calculated for a combined recovery of Ag, BaSO4, Zn and Au and where the combined mineralization of these metals was less than AgEQ COG, gold-only recovery were evaluated for a Au COG grade of 0.17 g/t. For Langtry silver-only recovery is considered for a lower Ag COG grade of 43 g/t. The above cut-off grades were determined using the following assumptions:

- Silver price of US$28 per troy ounce, gold price of US$2,451 per troy ounce, barite price of US$120 per mt and zinc price of US$ 1.22 per pound

- Combined metal (Ag, BaSO4, Zn, Au) processing costs of US$26.5 per short ton;

- Gold only processing cost of US$8.2 per short ton

- Silver only processing cost of US$24 per short ton

- Included in all processing costs are general and administrative costs of US$3 per short ton;

- Mining costs of US$2.8 per short ton; and

- Silver recovery of 65%, BaSO4 recovery of 85%, Zn recovery of 80% and Au recovery of 80%.

Metal recoveries are based on results from the 2022 Metallurgical Test Program (see news releases dated February 14, 2023, February 23, 2023 and May 2, 2023) and published recoveries for comparative operations. Silver, Zn and Au prices were calculated by averaging published monthly commodity prices from the last 24 months up to June 2025 based on data from the World Bank. Barite price was based on historical BaSO4 pricing trends from 2013 to 2023, the last year when publicly available barite pricing data was available. Changes in metal prices, optimized processing parameters and/or improved metal recoveries will all impact cut-off grade and any resultant MRE.

Reasonable prospects for eventual economic extraction were assessed by calculating recovered block revenues for silver grade blocks above cut-off grade, less surface mining costs, and generating an optimized Hexagon© MinePlan Pseudoflow economic pit shell at constant slope of 45 degrees that is constrained to within the property claim boundaries.

Sensitivity Analysis

A sensitivity analysis was undertaken to examine the impacts of varying the cut-off grades for AgEQ grades and tonnes for the Waterloo deposit within the base case economic pit shell and for Ag only grades and tonnes in the Langtry deposit. The available tonnes and average grade for each COG from within the 2025 MRE economic pit shell is shown in Table 2 for Waterloo and in Table 3 for Langtry.

Table 2: Sensitivity analysis of the grade and tonnage relationships at varying pit-constrained silver equivalent cut-off grades for the Waterloo Property. Effective June 30, 2025.

| Classification | AgEQ COG (g/t) | Tonnes (Mt) | Average Ag Grade (g/t) | Strip Ratio(t:t) | Contained Silver (Moz) |

| Measured | ≥ 35 | 49 | 67 | 0.6 | 109 |

| ≥ 40 | 47 | 71 | 0.6 | 107 | |

| ≥ 47 | 43 | 75 | 0.8 | 104 | |

| ≥ 50 | 42 | 77 | 0.8 | 103 | |

| ≥ 55 | 39 | 79 | 0.9 | 100 | |

| ≥ 60 | 36 | 83 | 1.1 | 97 | |

| Indicated | ≥ 35 | 14 | 52 | 0.6 | 23 |

| ≥ 40 | 13 | 54 | 0.6 | 22 | |

| ≥ 47 | 12 | 57 | 0.8 | 21 | |

| ≥ 50 | 11 | 58 | 0.8 | 21 | |

| ≥ 55 | 10 | 61 | 0.9 | 20 | |

| ≥ 60 | 9.3 | 64 | 1.1 | 19 | |

| Inferred | ≥ 35 | 0.8 | 23 | 0.6 | 0.6 |

| ≥ 40 | 0.7 | 25 | 0.6 | 0.6 | |

| ≥ 47 | 0.6 | 26 | 0.8 | 0.5 | |

| ≥ 50 | 0.6 | 26 | 0.8 | 0.5 | |

| ≥ 55 | 0.5 | 27 | 0.9 | 0.4 | |

| ≥ 60 | 0.4 | 29 | 1.1 | 0.4 |

Table 3: Sensitivity analysis of the grade and tonnage relationships at varying pit-constrained silver equivalent cut-off grades for the Langtry Property. Effective June 30, 2025.

| Classification | AgEQ | Tonnes (Mt) | Average Ag Grade (g/t) | Strip Ratio (t:t) | Contained Silver (Moz) |

| COG (g/t) | |||||

| Inferred | ≥ 35 | 29 | 68 | 2.1 | 63 |

| ≥ 40 | 26 | 71 | 2.5 | 59 | |

| ≥ 43 | 24 | 73 | 2.8 | 57 | |

| ≥ 50 | 19 | 81 | 4.1 | 49 | |

| ≥ 55 | 16 | 86 | 4.7 | 44 | |

| ≥ 60 | 13 | 92 | 5.8 | 39 |

Resource Estimation Methodology

The 2025 MRE was prepared in accordance with the requirements of NI 43-101 and applicable guidelines disseminated by CIM. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The quantity and grade of reported Inferred resources are uncertain in nature as there has been insufficient exploration to define these Inferred Resources as Indicated or Measured.

The 2025 MRE resource block model was oriented along regional strike of mineralization controlling range front fault (Calico fault) and bedding, at approximately 045 degrees. Metal grades were estimated using ordinary kriging into a 20 ft x 20 ft x 10 ft block model using 5 ft drill hole composites and a bulk density of 2.44 t/m3 (13.13 ft3/st). The block models are constrained to the west by the Calico range front fault and to the east by the contact between the mineralized Barstow formation sedimentary rocks and the Pickhandle formation rhyolitic rocks. Both structures are mineralization controlling features. A grade capping evaluation was performed, and for the Waterloo Property only the following drillhole grades were capped prior to estimation: Ag 450 g/t, Au 2 g/t, Ba 31% and Zn 7%. No grade capping was deemed necessary for the Langtry Property.

The MRE was internally audited, and peer reviewed by Stantec prior to being released to the Company and being declared final. Further, the Company completed an internal review of the 2025 MRE data supplied by Stantec. A full description of the data and the data verification process will be detailed in the technical report associated with the 2025 MRE, which will be prepared in accordance with NI 43-101 Standards of Disclosure for Mineral Projects and filed within 45 days of this news release on the Company’s website and on SEDAR+ at www.sedarplus.ca.

SAMPLING AND QUALITY ASSURANCE/QUALITY CONTROL

Additional sampling since the 2023 MRE and prior to the 2025 MRE included re-assaying of 7,797 drill pulps (primary plus QAQC) by X-Ray Fluorescence for Ba and BaO at ALS in Reno, Nevada and a metallurgical testing program for barite from five PQ drill core composites was completed at McClelland Laboratories Inc., in Sparks, Nevada. Results from the metallurgical test were presented in a prior News Release (May 2, 2023).

Pulps from historical and the 2022 drill program were submitted to ALS Reno for sample preparation and Ba analysis. Historical pulps were homogenized by light pulverizing (HOM-01) and the pulverisers were washed between samples (WSH22). After preparation, splits of prepared pulps are securely shipped to ALS Vancouver, British Columbia for analysis. Most of the pulps were analyzed using X-Ray Fluorescence Spectroscopy (“XRF”) methods ME-XRF10, with the exception of a few samples that were analysed with ME-XRF15c (samples with high sulphide content) or ME-XRF26 (selected samples for a more complete suite of elements). The detection limits for Ba with ME-XRF10 is between 0.01 and 45%, between 0.01 and 50% with ME-XRF15C and for BaO with ME-XRF26 0.01-66%. All analyses were completed at ALS Vancouver.

The Company maintains its own comprehensive quality assurance and quality control (QA/QC”) program to ensure best practices in sample preparation and analysis for samples. The QA/QC program includes the insertion and analysis of certified reference materials, commercial pulp blanks, preparation blanks, and field duplicates to the laboratories. Apollo’s QA/QC program includes ongoing auditing of all laboratory results from the laboratories. The Company’s Qualified Person is of the opinion that the sample preparation, analytical, and security procedures followed are sufficient and reliable. The Company is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data reported herein.

ABOUT THE PROJECT

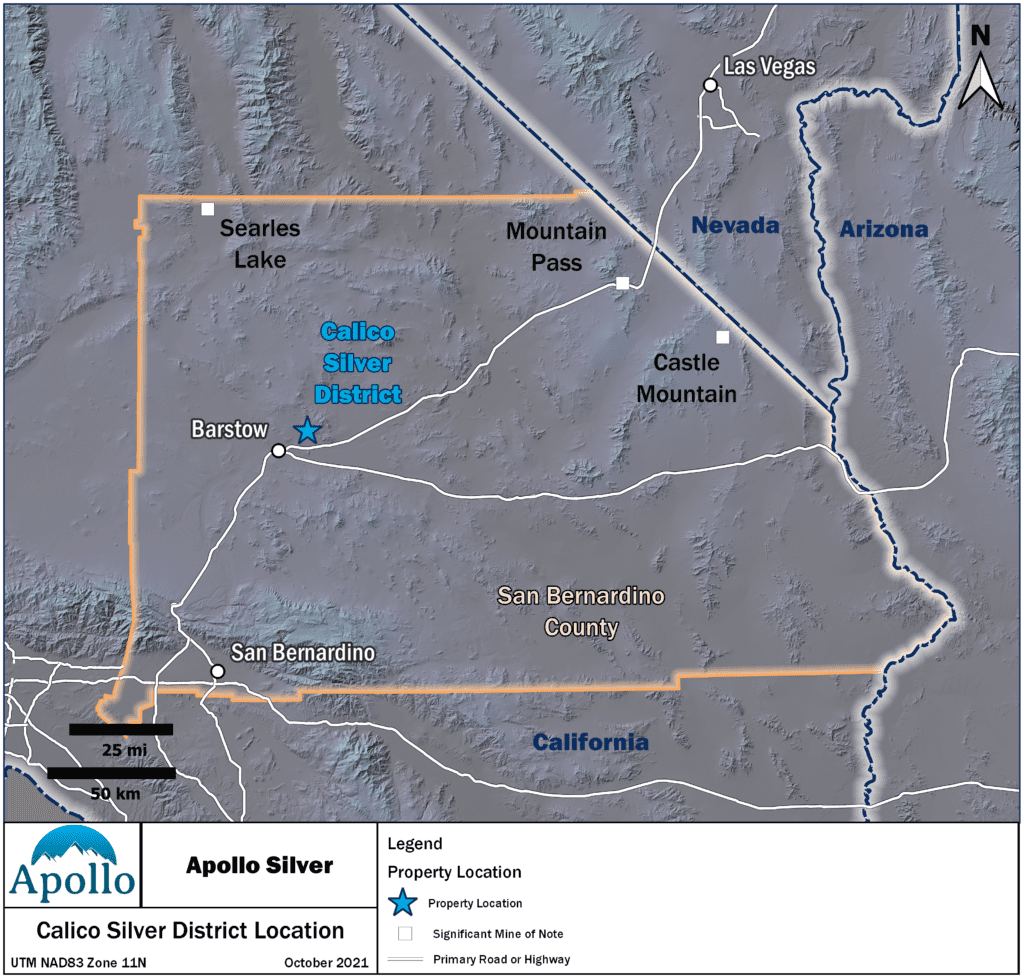

Location

The Calico Project is located in San Bernardino County, California and comprises the adjacent Waterloo, Langtry, and Mule properties which total 8,283 acres. The Calico Project is 15 km (9 miles) from the city of Barstow, 5 km (3 miles) from commercial electric power and has an extensive private gravel road network spanning the property.

Geology and Mineralization

The Calico Project is situated in the southern Calico Mountains of the Mojave Desert, in the south-western region of the Basin and Range tectonic province. This 15 km (9 mile) long northwest-southeast trending mountain range is dominantly composed of Tertiary (Miocene) volcanics, volcaniclastics, sedimentary rocks and dacitic intrusions. Mineralization at Calico comprises high-level low-sulfidation silver-dominant epithermal vein-type, stockwork-type and disseminated-style associated with northwest-trending faults and fracture zones and mid-Tertiary (~19-17 Ma) volcanic activity. Calico represents a district-scale mineral system endowment with approximately 6,000 m (19,685 ft) in mineralized strike length controlled by the Company. Silver and gold mineralization are oxidized and hosted within the sedimentary Barstow Formation and the upper volcaniclastic units of the Pickhandle formation along the contact between these units.

The 2025 MRE for Waterloo Property comprises 125 Moz Ag in 55 Mt at an average grade of 71 g/t Ag (M&I categories), 0.51 Moz Ag in 0.60 Mt at an average grade of 26 g/t Ag (Inferred category), 130,000 oz gold in 17 Mt at an average grade of 0.25 g/t gold (Inferred category), 2.7 Mt BaSO4 and 354 Mlbs Zn in 36 Mt at an average grade of 7.4 % BaSO4 and 0.45 % Zn (Indicated category), and 0.65 Mt BaSO4 and 258 Mlbs Zn in 17 Mt at an average grade of 3.9 % BaSO4 and 0.71 % Zn (Inferred category). The 2025 MRE for Langtry property comprises 57 Moz Ag in 24 Mt at an average grade of 73 g/t Ag (Inferred category).

QUALIFIED PERSONS

The scientific and technical data contained in this news release was reviewed, and approved by Derek Loveday, P. Geo., Johnny Marke P.G. and Mariea Kartick, P.Geo., from Stantec and are Qualified Persons independent of the Company. Mr. Loveday is a registered Professional Geoscientist in Alberta, Canada, and Mr. Marke is a registered Professional Geologist in Oregon, USA and both are responsible for the mineral resource estimation. Ms. Kartick is a registered Professional Geoscientist in Ontario, Canada and is responsible for data QA/QC.

This news release has also been reviewed and approved by Isabelle Lépine, M.Sc., P.Geo., Apollo’s Director of Mineral Resources. Ms. Lépine is a registered Professional Geoscientist in British Columbia, Canada and is not independent of the Company.

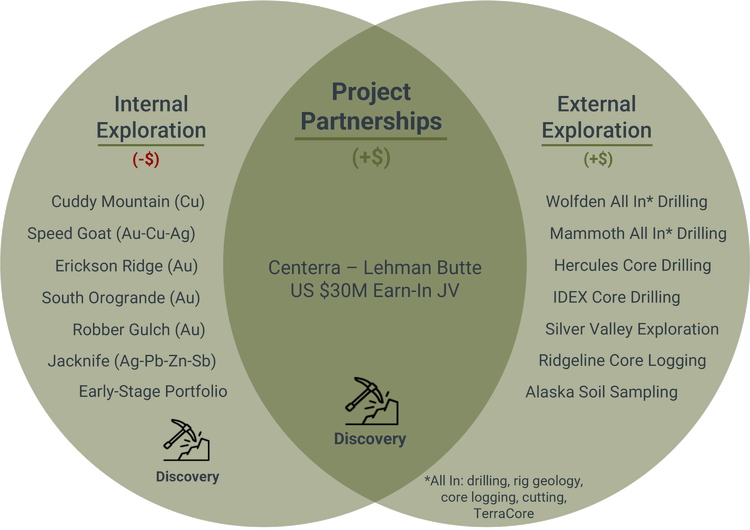

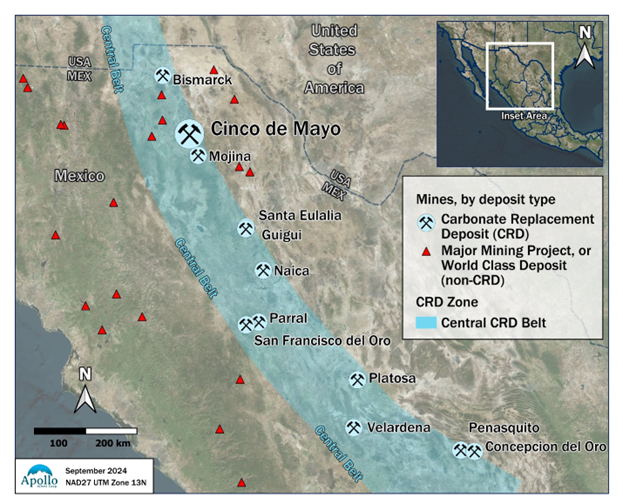

ABOUT APOLLO SILVER CORP.

Apollo Silver is advancing one of the largest undeveloped primary silver projects in the US. The Calico Project hosts a large, bulk minable silver deposit with significant barite credits – a critical mineral essential to the US energy and medical sectors. The Company also holds an option on the Cinco de Mayo Project in Chihuahua, Mexico, which is host to a major carbonate replacement (CRD) deposit that is both high-grade and large tonnage. Led by an experienced and award-winning management team, Apollo is well positioned to advance the assets and deliver value through exploration and development.

Please visit www.apollosilver.com for further information.

ON BEHALF OF THE BOARD OF DIRECTORS

Ross McElroy

President and CEO

For further information, please contact:

Email: info@apollosilver.com

Telephone: +1 (604) 428-6128

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release includes “forward-looking statements” and “forward-looking information” within the meaning of Canadian securities legislation. All statements included in this news release, other than statements of historical fact, are forward-looking statements including, without limitation, statements with respect to the potential of the Calico Project and its overall investment attractiveness; the expectation that the Calico Project will continue to increase in value, scale and optionality; the potential economic significance of the updated mineral resource estimate, including the newly defined barite and zinc resources in addition to silver and gold; the potential recovery rates; the potential to further expand the resource estimate and upgrade its confidence level, including prospective silver, gold, barite and zinc mineralization on strike and at depth; the potential impact of barite and zinc being designated as critical minerals in the United States; assumptions regarding mineralization at shallow depths and strip ratios; timing and execution of future planned drilling, exploration, preliminary engineering and additional metallurgical activities; timing of commencement and completion of a preliminary economic assessment or other technical studies; the potential for additional discoveries and overall project development; and the Company’s ability to advance, develop, and permit the Calico Project. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, “potential”, “target”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof.

Forward-looking statements are based on the reasonable assumptions, estimates, analysis, and opinions of the management of the Company made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management of the Company believes to be relevant and reasonable in the circumstances at the date that such statements are made. Forward-looking information is based on reasonable assumptions that have been made by the Company as at the date of such information and is subject to known and unknown risks, uncertainties and other factors that may have caused actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks associated with mineral exploration and development; metal and mineral prices; availability of capital; accuracy of the Company’s projections and estimates; realization of mineral resource estimates, interest and exchange rates; competition; stock price fluctuations; availability of drilling equipment and access; actual results of current exploration activities; government regulation; political or economic developments; environmental risks; insurance risks; capital expenditures; operating or technical difficulties in connection with development activities; personnel relations; and changes in Calico Project parameters as plans continue to be refined. Forward-looking statements are based on assumptions management believes to be reasonable, including but not limited to the price of silver, gold zinc and barite; the demand for silver, gold, zinc and barite; the ability to carry on exploration and development activities; the timely receipt of any required approvals; the ability to obtain qualified personnel, equipment and services in a timely and cost-efficient manner; the ability to operate in a safe, efficient and effective matter; and the regulatory framework regarding environmental matters, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward looking information contained herein, except in accordance with applicable securities laws. The forward-looking information contained herein is presented for the purpose of assisting investors in understanding the Company’s expected financial and operational performance and the Company’s plans and objectives and may not be appropriate for other purposes. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Photos accompanying this announcement are available at