VANCOUVER, BC / ACCESSWIRE / May 26, 2022 / Metallic Minerals (TSX.V:MMG)(OTCQB:MMNGF) (“Metallic Minerals“, or the “Company“) is pleased to report the final set of assay results from its 2021 drilling completed at the Company’s 100%-owned, 166-square-kilometer Keno Silver Project located within the historic, high-grade Keno Hill silver district in Canada’s Yukon Territory. These drill tests were targeted at extending high-grade silver-gold-lead-zinc mineralization at the Formo deposit in the West Keno target area, one of several advanced stage targets moving toward an initial NI 43-101 mineral resource estimate for the Keno Silver project.

Highlights

- Drilling in 2021 and 2020 by Metallic Minerals at the Formo deposit intercepted both high-grade Keno-style Ag-Au-Pb-Zn veins and broader zones of potentially bulk mineable mineralization.

- FOR21-05 returned three intervals at over 1,000 g/t silver equivalent (“Ag Eq”) from 92.7 m to 115.5 m for a total of 22.8 m grading 219.5 g/t Ag Eq including 0.5 m of 1,657.8 g/t Ag Eq with up to 17 g/t Au, 0.7 m of 1,408.8 g/t Ag Eq and 0.5 m of 1,649.9 g/t Ag Eq.

- FOR21-06 intercepted multiple zones of mineralization with 4.6 m of 938.3 g/t Ag Eq including 3,229.9 g/t Ag Eq over 1.0 m within a broader zone of 11.4 m grading 413.7 g/t Ag Eq.

The Formo target area hosts multiple parallel vein structures and mineralized zones within a broader structural envelope that remains open to expansion and shows excellent opportunities for resource delineation. Results from 2021 drilling intercepted extremely high grades, including FOR21-05 returning three intervals over 1,000 g/t silver Ag Eq and FOR21-06 with 3,229.9 g/t Ag Eq over 1.0 m within an interval of 4.6 m of 938.3 g/t Ag Eq (see Table 1 below). Both zones were encountered at shallow depths of less than 150 m down hole and these intersections extend high-grade silver mineralization below the 2020 drilling and the historically productive Formo mine. Geophysical and geochemical surveys, enhanced by the 2021 fieldwork, demonstrate significant resource potential opportunities in the Formo target area.

The Formo vein structure lies at the intersection of a north-easterly extension of the Bermingham-Calumet and the Elsa vein system, which are hosts to the some of the largest historic producing mines and current resources and reserves in the Keno Hill silver district (see Figure 1). The Formo Target remains open for expansion along trend and down dip and has several untested surface targets.

Metallic Minerals President, Scott Petsel, stated, “These exciting results from this most recent follow-up drilling program at the Formo target area in the western Keno Hill District, combined with the exceptional 2020 drill results, demonstrate the potential to delineate significant, high-grade resources at the Keno Silver project. Our team has done remarkable work to build on our understanding of the geology and the important controls to mineralization in the highly productive Keno Hill silver district.”

“As we prepare to embark on our upcoming exploration campaign, we recognize the importance of moving toward the definition of an inaugural resource estimates at Keno Silver, with Formo and Caribou being the two most advanced in that regard. We are also very focused on and enthusiastic about conducting robust follow-up work on our recent discoveries of both high-grade silver veins and bulk mineable mineralization in the East Keno area. We expect to provide updates with respect to planned programs at both Keno Silver and the La Plata project in Colorado over the coming weeks and look forward to meeting with investors during the upcoming Prospectors and Developers Conference in Toronto in mid-June.”

Upcoming Events

PDAC 2022 – Metallic will join fellow Metallic Group members at PDAC in Toronto, May 13-15 (Booth IE2851).

Yukon Property Tours & Conference – Metallic will be in Dawson City June 20-24 for the 2022 Yukon Property Tours

Figure 1. Keno Silver Project

West Keno Exploration Program and Formo Target

The Western Keno Hill district is host to the largest historic production and current resources in the prolific Keno Hill silver district. The Formo target is located at the intersection of a north-easterly structural zone extending from the Hector-Calumet mine, which was the largest producer in the district producing nearly 100 million ounces of silver and the Elsa structural trend, which was the second largest silver producer in the district (see Figure 2). The historic Formo mine produced silver at various times since the 1930s from high-grade vein structures that graded an average of over 5,000 g/t silver1. The majority of this historic production came from an open pit located alongside of the Silver Trail highway between the Elsa townsite and Keno City.

Metallic Minerals’ exploration efforts at the Formo target area have integrated recent drilling with surface and underground sampling into a 3D geologic model, along with multi-spectral studies and geophysical surveys covering the area (see Figure 3). In addition to the mineralization at the known Formo deposit, two new surface targets have been identified through surface soil and rock sampling along the same structural corridors that show potential to host high-grade and bulk tonnage Keno-style Ag-Au-Pb-Zn. The opportunity to significantly expand the known mineralization defined from underground sampling and surface drilling, as well as the potential to define new high-grade deposits along the main mineralized structural corridor, positions Formo as a top priority target for near-term resource definition at the Keno Silver project.

Table 1 – Significant Drill Results from 2020-2021 at the Formo Target Area

| DDH Hole ID | From (m) | To (m) | Width (m) | Ag Eq (g/t) | Ag (g/t) | Au (g/t) | Pb (%) | Zn (%) |

| FOR21-05 | 92.7 | 115.5 | 22.8 | 219.5 | 69 | 0.4 | 0.30 | 2.07 |

| 94.6 | 95.1 | 0.5 | 1,657.8 | 25 | 17.0 | 0.01 | 0.44 | |

| 98.8 | 108 | 9.2 | 430.5 | 164 | 0.1 | 0.69 | 4.85 | |

| 102.4 | 103.1 | 0.7 | 1,408.8 | 361 | 0.0 | 2.17 | 20.09 | |

| 107 | 107.5 | 0.5 | 1,649.9 | 421 | 0.1 | 1.53 | 24.20 | |

| FOR21-06 | 96 | 97 | 1.0 | 221.8 | 155 | 0.0 | 0.45 | 1.03 |

| 111.6 | 123 | 11.4 | 413.7 | 234 | 0.0 | 1.97 | 2.07 | |

| 114.4 | 119 | 4.6 | 938.3 | 528 | 0.1 | 4.48 | 4.82 | |

| 116 | 117 | 1.0 | 3,229.9 | 1,978 | 0.4 | 13.09 | 14.97 | |

| 121.2 | 123 | 1.8 | 202.8 | 128 | 0.0 | 1.00 | 0.76 | |

| FOR-20-001 | 50.9 | 57 | 6.1 | 284.5 | 218 | 0.0 | 0.3 | 1.14 |

| including | 50.9 | 53.95 | 3.05 | 447.5 | 369 | 0.0 | 0.11 | 1.52 |

| FOR-20-002 | 49.45 | 52.3 | 2.85 | 48 | 22 | 0.0 | 0.18 | 0.39 |

| FOR-20-003 | 96 | 100.1 | 4.1 | 2,536.0 | 1,165 | 0.0 | 21.74 | 11.32 |

| including | 96 | 99 | 3.0 | 3,425.9 | 1,568 | 0.0 | 29.45 | 15.35 |

| FOR-20-004 | 89.8 | 95.9 | 6.1 | 367.6 | 225 | 0.0 | 2.04 | 1.35 |

| including | 91.8 | 93.7 | 1.9 | 698.4 | 454 | 0.0 | 3.48 | 2.32 |

| including | 93.2 | 93.7 | 0.5 | 1,083.6 | 601 | 0.0 | 7.33 | 4.25 |

| FOR-20-005 | 104.76 | 105.45 | 0.69 | 365.0 | 146 | 0.0 | 1.32 | 3.52 |

| 152.17 | 152.67 | 0.5 | 85.5 | 6 | 0.4 | 0.01 | 0.76 | |

| FOR-20-006 | 137.63 | 139.78 | 2.15 | 740.6 | 332 | 0.0 | 3.06 | 6.04 |

| including | 139.13 | 139.78 | 0.65 | 2,255.9 | 1,001 | 0.1 | 8.92 | 18.92 |

| FOR-20-007 | 98.1 | 98.65 | 0.55 | 77 | 12 | 0.0 | 0.12 | 1.2 |

| 107.65 | 108.15 | 0.5 | 86.1 | 46 | 0.2 | 0.24 | 0.34 | |

| 125.55 | 126.05 | 0.5 | 75.5 | 1 | 0.2 | 0 | 1.23 | |

| FOR-20-008 | 116.45 | 116.95 | 0.5 | 289.2 | 178 | 0.1 | 2.2 | 0.42 |

| including | 168.6 | 169.6 | 1.0 | 79.2 | 57 | 0.0 | 0.25 | 0.25 |

| FOR-20-009 | 69.7 | 70.14 | 0.44 | 67.4 | 15 | 0.0 | 0.21 | 0.91 |

| 113.2 | 113.7 | 0.5 | 211.6 | 26 | 0.4 | 0.06 | 3 | |

| FOR-20-011 | 55.3 | 59.7 | 4.4 | 75.6 | 3 | 0.0 | 0.05 | 0.04 |

| including | 57.7 | 58.6 | 0.9 | 307.7 | 195 | 0.0 | 2.79 | 0.1 |

Silver equivalent (Ag Eq) values assume Ag $19/oz, Pb $1.05/lb, Zn $1.30/lb, Au $1,800/oz and 100% metallurgical recovery. Sample intervals are based on measured drill intersect lengths and are believed to be representative of true widths.

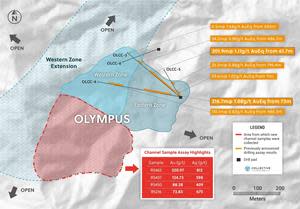

Figure 2 – West Keno Plan Map

Figure 3 – Formo Vein Long Section (Looking NW)

About Metallic Minerals

Metallic Minerals Corp. is a growth-stage exploration company, focused on high-grade silver and gold projects in underexplored, brownfields mining districts of North America. Our objective is to create shareholder value through a systematic, entrepreneurial approach to exploration in the Keno Hill silver district, La Plata silver-gold-copper district, and Klondike gold district through new discoveries and advancing resources to development. Metallic Minerals has consolidated the second-largest land position in the historic Keno Hill silver district of Canada’s Yukon Territory, directly adjacent to Alexco Resource Corp’s operations, with nearly 300 million ounces of high-grade silver in past production and current M&I resources. In addition, exploration at the recently acquired La Plata silver-gold-copper project in southwestern Colorado is targeting a silver and gold-enriched copper porphyry and adjacent high-grade silver and gold epithermal systems. The Company also continues to add new production royalty leases on its holdings in the Klondike gold district in the Yukon. All three districts have seen significant mineral production and have existing infrastructure, including power and road access. Metallic Minerals is led by a team with a track record of discovery and exploration success on several major precious and base metal deposits, as well as having large-scale development, permitting and project financing expertise.

About the Metallic Group of Companies

The Metallic Group is a collaboration of leading precious and base metals exploration and development companies, with a portfolio of large, brownfields assets in established mining districts adjacent to some of the industry’s highest-grade producers of silver and gold, platinum and palladium, and copper. Member companies include Metallic Minerals in the Yukon’s high-grade Keno Hill silver district and La Plata silver-gold-copper district of Colorado, Granite Creek Copper in the Yukon’s Minto copper district, and Group Ten Metals in the Stillwater PGM-nickel-copper district of Montana and Kluane district in the Yukon. The founders and team members of the Metallic Group include highly successful explorationists formerly with some of the industry’s leading explorer/developers and major producers. With this expertise, the companies are undertaking a systematic approach to exploration and development using new models and technologies to facilitate discoveries in these proven, but under-explored, mining districts. Members of the Metallic Group have been recognized as recipients of awards for excellence in environmental stewardship demonstrating commitment to responsible resource development and appropriate ESG practices. The Metallic Group is headquartered in Vancouver, BC, Canada, and its member companies are listed on the Toronto Venture, US OTCQB and Frankfurt stock exchanges.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Website: mmgsilver.com

Email: cackerman@mmgsilver.com

Phone: 604-629-7800

Toll Free: 1-888-570-4420

Qualified Person

The disclosure in this news release of scientific and technical information regarding exploration projects on Metallic Minerals’ mineral properties has been reviewed and approved by Scott Petsel, P.Geo., President, who is a Qualified Person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

Quality Assurance / Quality Control

All samples were assayed by 36 Element Aqua Regia Digestion ICP-MS methods at Bureau Veritas labs in Vancouver. with sample preparation in Whitehorse, Yukon and geochemical analysis in Vancouver, British Columbia. Samples with over limit silver and gold were re-analyzed using a 30-gram fire assay fusion with a gravimetric finish. Over-limit lead and zinc samples were analyzed by multi-acid digestion and atomic absorption spectrometry. All results have passed the QAQC screening by the lab and the company utilized a quality control and quality assurance protocol for the project, including blank, duplicate, and standard reference samples.

Forward-Looking Statements

Forward Looking Statements: This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Metallic Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Metallic Minerals and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Metallic Minerals Corp.