VANCOUVER, British Columbia, Feb. 18, 2026 (GLOBE NEWSWIRE) — Apollo Silver Corp. (“Apollo Silver” or the “Company”) (TSX.V:APGO; OTCQB:APGOF; Frankfurt:6ZF) is pleased to announce that it has been recognized as a 2026 Top 50 Company by the TSX Venture Exchange (“TSXV”).

The TSX Venture 50™ is an annual ranking of the top performing companies from the past year on TSXV based on three equally weighted criteria: market capitalization growth, share price appreciation and trading value. The TSX Venture 50™ showcases the top 50 of the over 1,600 TSXV issuers.

“We are honoured to be recognized as a member of the 2026 TSX Venture 50™,” said Ross McElroy, President and CEO of Apollo Silver. “This recognition reflects the strong performance of our shares over the past year, including 383% share price appreciation, a 484% growth in market capitalization and a 460% increase in total trading value in Canada. We thank our shareholders for their ongoing support.”

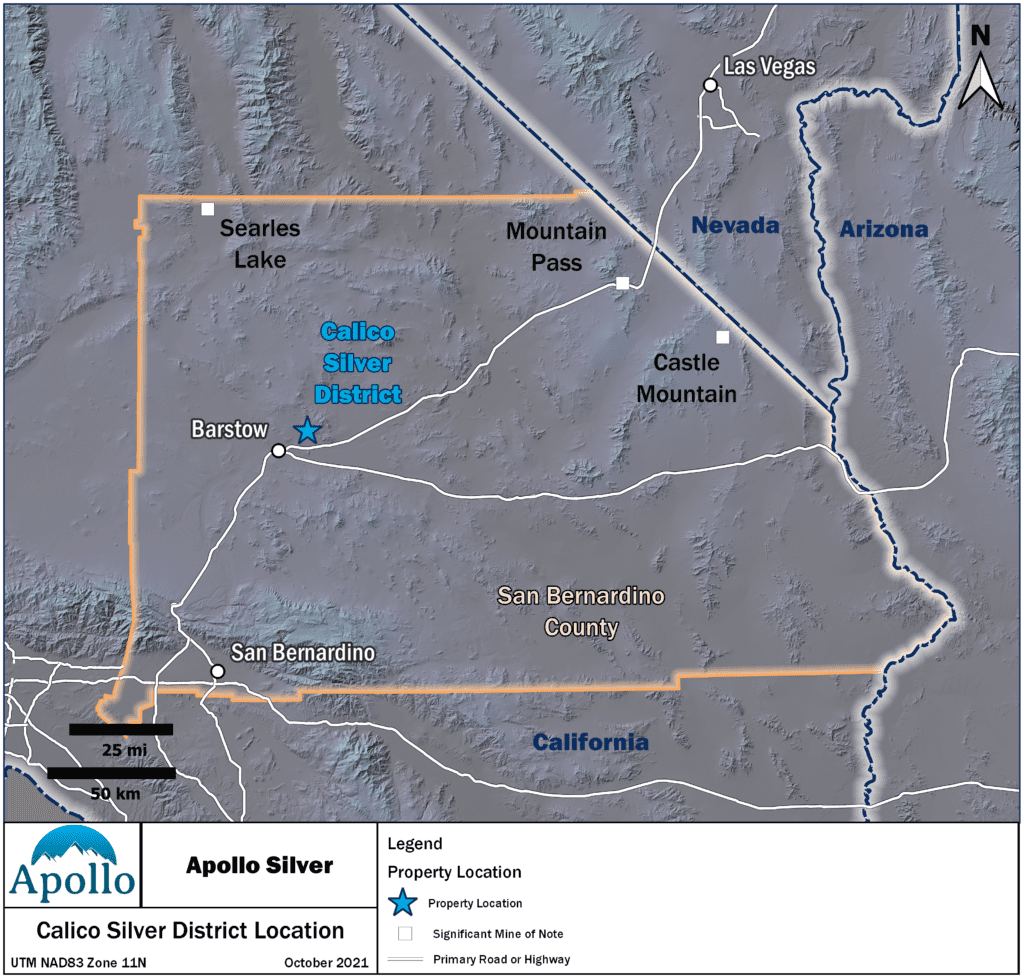

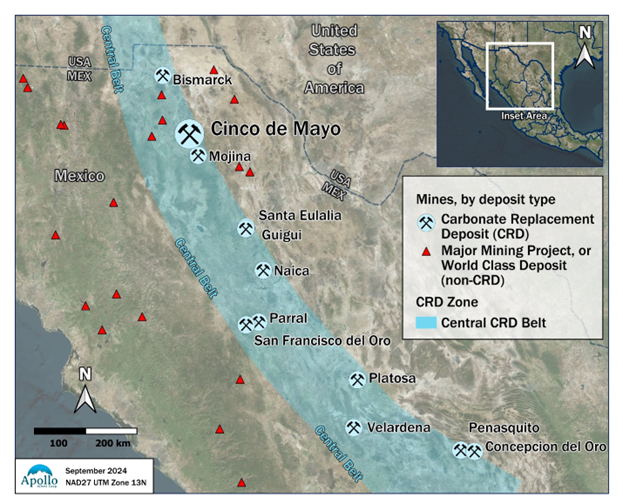

Over the past year, Apollo Silver has advanced exploration and technical programs at its flagship Calico Project in California and continued community engagement efforts and social-licence initiatives at its Cinco de Mayo Project in Mexico. With silver increasingly recognized as a critical mineral and growing industrial demand supporting a constructive market environment, Apollo Silver remains focused on disciplined execution and long-term value creation for shareholders.

ABOUT APOLLO SILVER CORP.

Apollo Silver is advancing the second largest undeveloped primary silver project in the US. The Calico Project hosts a large, bulk minable silver deposit with significant barite and zinc credits – recognized as critical minerals essential to the U.S. energy, industrial and medical sectors. The Company also holds an option on the Cinco de Mayo Project in Chihuahua, Mexico, which is host to a major carbonate replacement (CRD) deposit that is both high-grade and large tonnage. Led by an experienced and award-winning management team, Apollo is well positioned to advance the assets and deliver value through exploration and development.

Please visit www.apollosilver.com for further information.

ON BEHALF OF THE BOARD OF DIRECTORS

Ross McElroy

President and CEO

For further information, please contact:

Email: info@apollosilver.com

Telephone: +1 (604) 428-6128

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding “Forward-Looking” Information

This news release includes “forward-looking statements” and “forward-looking information” within the meaning of Canadian securities legislation. All statements included in this news release, other than statements of historical fact, are forward-looking statements including, without limitation, statements with respect to the continued advancement and development potential of the Company’s projects, including the Calico Project and the Cinco de Mayo Project and the Company’s future plans, objectives and expectations. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, “potential”, “target”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof.

Forward-looking statements are based on the reasonable assumptions, estimates, analysis, and opinions of the management of the Company made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management of the Company believes to be relevant and reasonable in the circumstances at the date that such statements are made. Forward-looking information is based on reasonable assumptions that have been made by the Company as at the date of such information and is subject to known and unknown risks, uncertainties and other factors that may have caused actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks associated with mineral exploration and development; metal and mineral prices; availability of capital; accuracy of the Company’s projections and estimates; realization of mineral resource estimates, interest and exchange rates; competition; stock price fluctuations; availability of drilling equipment and access; actual results of current exploration activities; government regulation; political or economic developments; environmental risks; insurance risks; capital expenditures; operating or technical difficulties in connection with development activities; personnel relations; and changes in project parameters as plans continue to be refined. Forward-looking statements are based on assumptions management believes to be reasonable, including but not limited to the price of silver, gold and barite; the demand for silver, gold and barite; the ability to carry on exploration and development activities; the timely receipt of any required approvals; the ability to obtain qualified personnel, equipment and services in a timely and cost-efficient manner; the ability to operate in a safe, efficient and effective matter; and the regulatory framework regarding environmental matters, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward looking information contained herein, except in accordance with applicable securities laws. The forward-looking information contained herein is presented for the purpose of assisting investors in understanding the Company’s expected financial and operational performance and the Company’s plans and objectives and may not be appropriate for other purposes. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.