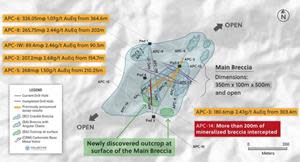

Figure 1

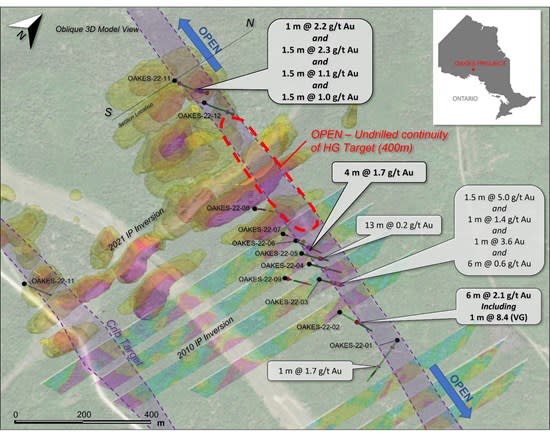

Figure 2

VANCOUVER, British Columbia, Sept. 26, 2022 (GLOBE NEWSWIRE) — Millrock Resources Inc. (TSX-V: MRO) (“Millrock”) is pleased to report additional assay results from the sampling of historical core from the Eureka Zone at its 100% owned Nikolai Project, which hosts nickel (Ni) – copper (Cu) – cobalt (Co) – platinum group elements (PGE) prospects.

The Nikolai Project is located within Alaska’s Delta Mining District, approximately 130 kilometers by road south of Delta Junction and approximately 280 kilometers southeast of Fairbanks. The Eureka zone consists of disseminated Ni-Cu-Co-PGE mineralization initially discovered by a subsidiary of INCO, and further expanded by Pure Nickel Inc., as reported in their press releases ranging between 2007-2014 (see Figure 1).

The new assay results confirm the existence of low-grade Ni-Cu-Co-PGE mineralization immediately below and adjacent to the Core Eureka Zone (“CEZ”). The new zone is named the Lower Eureka Zone (“LEZ”). Along with the Upper Eureka Zone (“UEZ”), hole FL-003, drilled by INCO in 1997, intersected 346 meters of nickel mineralization, representing an approximate true width of 275 meters (Figure 2).

Millrock President and CEO Gregory Beischer commented: “From historical drilling, it is clear that a large volume of mineralized rock is present in the Eureka Zone. We believe the demand for nickel, cobalt, and other Critical and Strategic Metals will be exceptionally strong in the coming decades, making low-grade mineralization such as at Eureka of interest.”

Figure 1. View looking east along the Eureka Zone within a large mafic-ultramafic magmatic complex. Note: Outline of the Ultramafic complex and Eureka zone are approximate.

https://www.globenewswire.com/NewsRoom/AttachmentNg/5acad3e2-2e55-4a93-b702-d81009a2ae43

Figure 2. Cross section view of Eureka Zone looking west, showing trace of holes FL-003 and FL-006 drilled by INCO in 1997.

https://www.globenewswire.com/NewsRoom/AttachmentNg/3fd1b98e-77c8-481c-bd68-484ec28815d0

About Eureka Zone:

Based on historical drill hole results, Millrock identified a probable zone of mineralization measuring approximately 1,200 meters by 400 meters by 300 meters that contains low but potentially economic concentrations of nickel, copper, cobalt, platinum, palladium, and gold. Upon further review of the historical drill hole results, it was noted that only incomplete, non-continuous sampling was done in rocks intersected below the CEZ in hole FL-003. Drill core from this hole is preserved at the Geologic Materials Center in Anchorage, Alaska. Millrock collected and assayed samples from hole FL-003 in the suspected LEZ.

Highlights of the core sampling program include:

- FL-003: 100 samples were assayed between hole depths of 273.4 meters and 412.1 meters

- FL-003: mineralized interval of 135.6 meters grading 0.20% Ni, 0.05% Cu, 0.016% Co, 0.062 ppm Pd, 0.026 ppm Pt, and 0.014 ppm Au (including eight historical intervals).

Based on the newly received assays and historical assays from INCO holes FL-003 and FL-006, Millrock now interprets there to be three distinct domains (UEZ, CEZ, and LEZ) within the Eureka Zone, with an estimated true thickness at the drilled location of 275 meters (Figure 2).

These three domains consist of strongly serpentinized rocks:

1: Upper Eureka Zone (UEZ) – sulfur-poor peridotite, with disseminated sulfides.

| Drillhole | To (m) | From (m) | Interval (m) | Ni (%) | Cu (%) | Co (%) | Pd (ppm) | Pt (ppm) | Au (ppm) | NiEq% | CuEq% |

| FL-003 | 60.2 | 173.7 | 113.5 | 0.20 | 0.05 | 0.014 | 0.101 | 0.046 | 0.007 | 0.32 | 0.65 |

| FL-006 | 185.0 | 298.1 | 113.1 | 0.21 | 0.06 | 0.018 | 0.093 | 0.046 | 0.006 | 0.35 | 0.70 |

2: Core Eureka Zone (CEZ) – sulfur-rich peridotite and norite with disseminated sulfides.

| Drillhole | To (m) | From (m) | Interval (m) | Ni (%) | Cu (%) | Co (%) | Pd (ppm) | Pt (ppm) | Au (ppm) | NiEq% | CuEq% |

| FL-003 | 173.7 | 271.9 | 98.2 | 0.22 | 0.12 | 0.019 | 0.141 | 0.064 | 0.018 | 0.42 | 0.85 |

| FL-006 | 298.1 | 382.8 | 84.7 | 0.26 | 0.13 | 0.020 | 0.143 | 0.069 | 0.025 | 0.47 | 0.94 |

3: Lower Eureka Zone (LEZ) – sulfur-poor melanorite, with disseminated sulfides.

| Drillhole | To (m) | From (m) | Interval (m) | Ni (%) | Cu (%) | Co (%) | Pd (ppm) | Pt (ppm) | Au (ppm) | NiEq% | CuEq% |

| FL-003 | 271.9 | 407.5 | 135.6 | 0.20 | 0.05 | 0.016 | 0.062 | 0.027 | 0.014 | 0.32 | 0.64 |

| FL-006 | Hole was ended prior to the LEZ |

Note: NiEq% and CuEq% in this press release are calculated using the following metal prices:

Nickel = $7.00/lb., Copper = $3.50/lb., Cobalt = $25.00/lb., Palladium = $1800/oz., Platinum = $900/oz. and Gold = $1600/oz.

In order to determine the deportment of nickel, copper, cobalt, and the precious metals, Millrock has submitted samples for laboratory analysis to identify which minerals are host to the valuable metals. From this information, an idea of metal recoverability can be gleaned. This will be very important information to have for a project of this type and scale.

Quality Control – Quality Assurance

Millrock adheres to stringent Quality Assurance – Quality Control (“QA/QC”) standards. Core samples are kept in a secure location at all times. In this case, the samples were assayed at the Bureau Veritas laboratory in Vancouver, Canada. Preparation and analysis methods are described in further detail here. The sample preparation method code being utilized for the current sampling program was PRP70-250. Analysis methods used include MA370 – 4-acid digestion ICP-ES Finish and FA330 – Fire assay fusion Au, Pt, Pd by ICP-ES. For every 10 core samples, a blank, duplicate, or standard sample (Certified Reference Materials) of known copper, nickel, platinum, palladium, and gold concentration was analyzed. The Qualified Person is of the opinion that the results reported in this press release are reliable.

Historical assay results for core samples originally obtained by INCO in 1997 were used, in part, for the composite grade calculation for the LEZ in hole FL-003. Millrock has not independently verified the results. However, the drilling work completed in 1997 was done under the direct supervision of Gregory Beischer in his prior role as Exploration Manager for INCO. Mr. Beischer is the Qualified Person responsible for the contents of this disclosure. The historical samples were assayed at Chemex Lab, Inc. Appropriate quality control measures were in place.

Qualified Person

The technical information within this document has been reviewed and approved by Gregory A. Beischer, President, CEO, and a director of Millrock. Mr. Beischer is a Qualified Person as defined in NI 43-101.

About Millrock Resources Inc.

Millrock Resources Inc. is a premier project generator to the mining industry. Millrock identifies, packages, and operates large-scale projects for joint venture, thereby exposing its shareholders to the benefits of mineral discovery without the usual financial risk taken on by most exploration companies. The company is recognized as the premier generative explorer in Alaska, is a significant shareholder of junior explorer ArcWest Exploration Inc. and owns a large shareholding in Resolution Minerals Limited and Felix Gold. Funding for drilling at Millrock’s exploration projects is primarily provided by its joint venture partners. Business partners of Millrock have included some of the leading names in the mining industry: EMX Royalty, Centerra Gold, First Quantum, Teck, Kinross, Vale, Inmet and, Altius as well as junior explorers Resolution, Riverside, PolarX, Felix Gold, and Tocvan.

ON BEHALF OF THE BOARD

“Gregory Beischer”

Gregory Beischer, President & CEO

FOR FURTHER INFORMATION, PLEASE CONTACT:

Melanee Henderson, Investor Relations

Toll-Free: 877-217-8978 | Local: 604-638-3164

Twitter | Facebook | LinkedIn

Some statements in this news release contain forward-looking information. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include without limitation the completion of the ongoing metal deportment study, and the completion of planned expenditures, the ability to complete exploration programs on schedule and the success of exploration programs.

“NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.”