Vancouver, British Columbia–(Newsfile Corp. – January 4, 2022) – EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the “Company” or “EMX”) is pleased to announce results from recently completed geochemical surveys at EMX’s 100% owned Mt Steadman and Yarrol gold projects in central Queensland, Australia. Numerous gold-in-soil anomalies have been identified by surveys conducted on both projects, with several anomalies extending to the edges of the survey grids, meaning that they remain open for expansion. A total of 895 samples were collected, with results including 2.17 ppm gold in a new target area at Mt Steadman. Results from the Yarrol project also delineated several robust gold-in-soil anomalies, as well as a new target area with high levels of cobalt and nickel in rock chip samples. These results highlight the additional exploration potential of both projects.

EMX will continue executing exploration programs on both projects in the coming year, and both projects are currently available for partnership.

Mt Steadman Project. The 5,700 hectare Mt Steadman project is an intrusion-related gold system (“IRGS”) in the New England Orogenic Belt in Queensland, Australia, a province that hosts IRGS-type gold, porphyry and epithermal deposits. Mt Steadman is located along the Perry Fault system, a major structural feature in the area (see Figure 1). The Mt Steadman project was the focus of exploration in the 1990’s when shallow reconnaissance drilling programs led to the recognition and definition of historical gold resources. However little exploration has taken place since (see EMX News Release dated April 26, 2021).

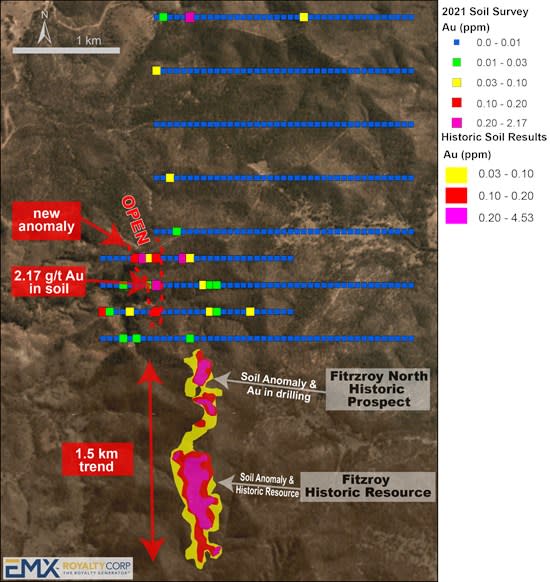

In Q3 and Q4 2021, EMX conducted a broad soil geochemical survey to the north of the Fitzroy historical resource (see Figure 2). A total of 351 samples were collected on 200 meter and 400 meter spaced traverses with samples collected every 50 meters along each line. This program resulted in the delineation of multiple anomalous gold-in-soil trends. The most prominent anomaly extends for 400 meters along trend and reaches a maximum width of 200 meters at its northern extent. The anomaly remains open to the north and includes a sample of 2.17 ppm gold. This new soil anomaly is similar in scale and tenor to those around the historic Fitzroy prospect located 1km to the southeast. This anomaly also exhibits coincident anomalous molybdenum and tellurium geochemistry, similar to geochemical signatures seen at Fitzroy, and closely correlates with the mapped extent of a zone of hydrothermal breccias, quartz veining and alteration.

Yarrol Project. The 17,500 hectare Yarrol project is located between EMX’s Queensland Gold royalty property and Evolution Mining’s Mt Rawdon gold mine, and is positioned along the regional scale Yarrol Fault. Several other historical mines and active exploration projects lie along the Yarrol Fault structural trend. EMX’s Yarrol Project was the site of historical mining activities from the late 1800’s through the 1930’s. Further exploration carried out in the 1980’s and 1990’s led to the definition of two historical gold resources on the Yarrol Project, but little exploration activity has taken place since that time (see EMX news release dated April 26, 2021).

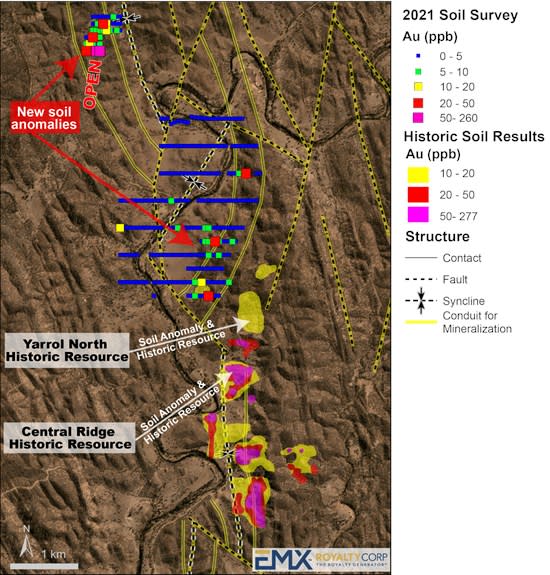

EMX’s 2021 programs at Yarrol included the collection of 544 soil samples, which identified two new gold-in-soil anomalies (see Figure 3). The northern anomaly, known as the Limestone Creek area, lies approximately five kilometers northwest of the historical Yarrol gold resources. This new anomaly has dimensions of 200 by 600 meters, with the strongest results along the southernmost line. The area was identified as a target by EMX on the basis of magnetic inversion geophysical models, previous geochemical results and the presence of numerous historical prospecting pits. The Limestone Creek anomaly also coincides with a zone of albite-silica-goethite alteration developed adjacent to a monzonite porphyry and remains open to the south. The anomaly has a scale and tenor that resembles those over the historical gold resources on the Yarrol Project.

Other gold-in-soil anomalies have been delineated immediately northwest of the historical Yarrol resources, along a contact zone between geological formations within folded and faulted sediments, which also merit follow-up exploration.

In the process of carrying out the sampling programs at the Yarrol Project, EMX geologists also noted boulders of dark manganiferous material in several drainages in the northern part of the exploration license. The boulders were traced back to an outcropping stratigraphic horizon of dark, manganiferous material that has the appearance of a conglomeratic unit.

Nine rock chip samples collected from various boulders, float materials and outcrop exposures averaged 1.1% cobalt, 0.15 % nickel and 10.0% manganese, with a high of 1.6% cobalt with 0.25% nickel. EMX considers this to be a significant discovery of additional mineral potential on the Yarrol Project, as previous efforts had strictly focused on Yarrol’s intrusion-related gold mineralization. Additional sampling programs are underway to better quantify the extent of this unit and its degrees of enrichment in cobalt, nickel and manganese. Barium is also enriched in this material, with eight of the nine samples submitted for analysis exceeding the upper analytical limit of 1% barium.

Upcoming Exploration Plans. Additional geochemical sampling programs will be carried out at both the Mt Steadman and Yarrol projects in the coming months with the goal of extending the soil anomalies and identifying additional drill targets. Drill programs are being planned for mid-2022.

EMX’s Australian Royalty Generation Program. EMX maintains an active royalty generation program and continues to review new project opportunities throughout Australia. The Company currently holds two royalty projects in Australia (Koonenberry and Queensland Gold) and has three exploration projects in Queensland that are available for partnership. More information on these projects can be found on the EMX website (www.EMXroyalty.com).

Comments on Sampling, Assaying, and Nearby Mines and Deposits. EMX’s exploration samples were collected in accordance with industry standard best practices. EMX conducts routine QA/QC analysis on its exploration samples, including the utilization of certified reference materials, blanks, and duplicate samples. All samples were submitted to ALS Brisbane for sample preparation and analysis (ISO 9001:2000 and 17025:2005 accredited).

The soil samples were analyzed using the AuME-TL-44 method which is a trace level gold and multi-element technique consisting of an aqua-regia digest and an ICP-MS finish.

The rock chip samples were analyzed with a four-acid super trace technique (ME-MS61) with an ICP-MS finish. The rock chip samples were also analyzed with a lithium borate fusion prior to acid dissolution (three-acid) and an ICP-MS finish (ME-MS81). Over limit cobalt and manganese samples were analyzed by a HF-HN03-HCL04 digest, HCL leach and ICP-AES (OG62) finish.

The nearby mines and deposits discussed in this news release provide context for EMX’s properties, which occur in a similar geologic setting, but this is not necessarily indicative that the properties host similar mineralization.

Dr. Eric P. Jensen, CPG, a Qualified Person as defined by National Instrument 43-101 and employee of the Company, has reviewed, verified and approved the disclosure of the technical information contained in this news release.

About EMX. EMX is a precious, base and battery metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and the TSX Venture Exchange under the symbol EMX, as well as on the Frankfurt Exchange under the symbol “6E9.” Please see www.EMXroyalty.com for more information.

For further information contact:

David M. Cole

President and Chief Executive Officer

Phone: (303) 973-8585

Dave@emxroyalty.com

Scott Close

Director of Investor Relations

Phone: (303) 973-8585

SClose@emxroyalty.com

Isabel Belger

Investor Relations (Europe)

Phone: +49 178 4909039

IBelger@EMXroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release may contain “forward-looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to: unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended September 30, 2021 and the year ended December 31, 2020 (the “MD&A”), and the most recently filed Revised Annual Information Form (the “AIF”) for the year ended December 31, 2020, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedar.com and on the SEC’s EDGAR website at www.sec.gov.

Figure 1. Location map for the Yarrol and Mt Steadman projects.

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/1508/108814_emxfigure1.jpg

The summary of historical production at Mt Rawdon is from the Evolution Mining website: https://evolutionmining.com.au/wp-content/uploads/2020/04/Mt-Rawdon-fact-sheet-2020_LR.pdf (2020).

The summary of historic production at Mt Morgan is cited from Mt. Morgan: A. Taube; The Mount Morgan gold-copper mine and environment, Queensland; a volcanogenic massive sulfide deposit associated with penecontemporaneous faulting. Economic Geology; 81 (6): 1322-1340.

Figure 2. 2021 Soil Results from the Mt Steadman Project.

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/1508/108814_e9855e3924041a44_004full.jpg

Figure 3. 2021 Soil Results from the Yarrol Project.

To view an enhanced version of Figure 3 please visit:

https://orders.newsfilecorp.com/files/1508/108814_e9855e3924041a44_005full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/108814