Lots Of Potential for Nevada Copper In 2021

- Copper is on a bullish tear- More upside in 2021 in all metals

- China is a massive buyer- A reason the US is next

- Nevada Copper- A strong management team with solid financing

- Proven and probable reserves in the US with the potential for more

- An emerging producer- Risk-reward and the value proposition favors lots of upside

Finding value in the stock market is a challenge these days. At the end of 2019, Tesla shares were trading at a split-adjust level of below $90 per share. On December 18, they were at $695. Returns like that are hard to come by; they require taking a fair amount of risk. Elon Musk had more than his share of detractors in late 2019. In 2020, they became very quiet.

As we move into 2021, we are hopeful the global pandemic will fade into our rearview mirror. Vaccines that create herd immunity to the virus are already becoming available. However, the economic legacy of a tidal wave of liquidity and tsunami of stimulus will remain a reminder of the costly coronavirus.

The 2008 global financial crisis was a far different event than the 2020 pandemic. However, central banks and governments employed the same financial tools. The only difference was in 2020; the levels were much higher. In 2008, the US Treasury borrowed a record $530 billion to fund the stimulus. In May 2020, the Treasury borrowed $3 trillion. The inflationary liquidity and stimulus ignited a secular rally in the raw materials asset class.

From 2008 through 2011, copper’s price exploded from $1.2475 to $4.6495 per pound. The price rose by over 3.7 times. In March 2020, the price of copper dropped to a low of $2.0595. If history repeats, the target for the red metal could be much higher than the 2011 record peak.

Nevada Copper Corporation trades under the symbol NEVDF in the OTC market or NCU.TO on the Toronto Stock Exchange. Nevada Copper is an emerging mid-tier copper producer that could provide incredible returns in a rising copper market.

Copper is on a bullish tear- More upside in 2021 in all metals

In 1988, the copper price rose to a record high of $1.6085 per pound in the futures market. It was not until 2005 that the red metal made a higher high.

Source: CQG

The long-term quarterly chart highlights the ascent of copper. The nonferrous metal has made higher lows since 2001. Technically, copper looks poised to reach a new all-time peak over the coming years. Price momentum and relative strength indicators point to a bullish trend as we move into 2021. After moving to a higher low in March, copper has posted gains over the past three consecutive quarters and has broken out to the upside.

Source: CQG

The monthly chart illustrates price gains in nine of the past ten months. The next level of technical resistance stands at the 2012 peak at just below $4 per pound, a gateway to the record high at $4.6495 from 2011. Central bank and government monetary and fiscal policies are rocket fuel for the red metal and many other commodities as they weigh on fiat currencies’ purchasing power. The London Metals Exchange is the leading trading venue for copper and other base metals.

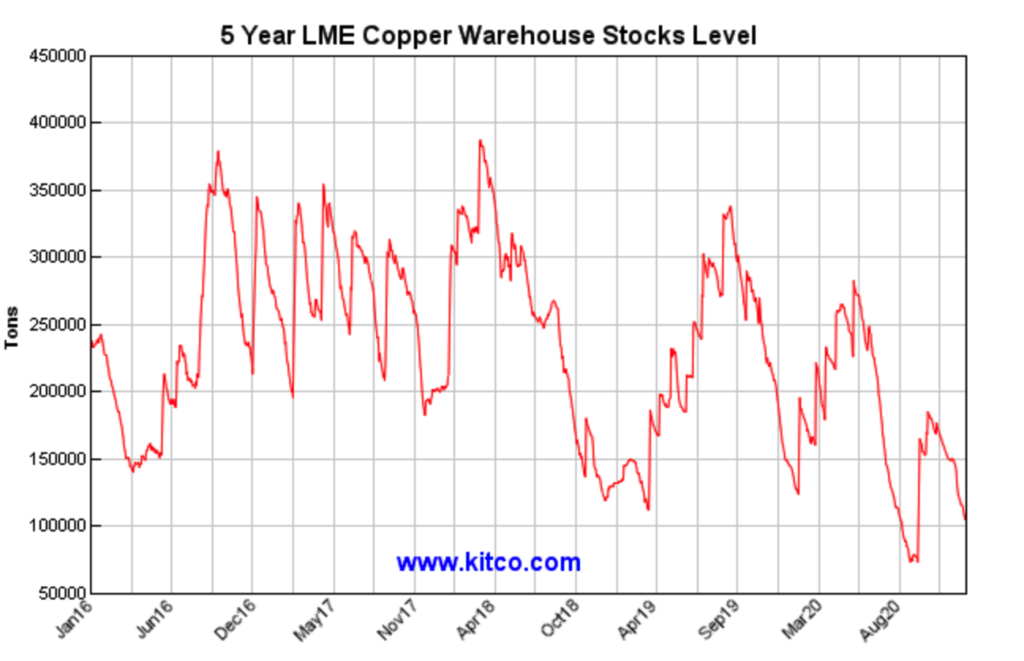

Source: LME/Kitco

The chart shows that copper inventories on the LME are closer to the lows than the highs over the past five years. At below 106,000 tons as of January 6, the low level of stockpiles is an indication that the fundamental equation is tight and favors the upside for the red metal.

China is a massive buyer- A reason the US is next

China is the demand side of the equation for copper and many other commodities. With 1.4 billion people and the world’s second-leading economy, the Chinese require massive copper inflows for infrastructure building each year.

The global pandemic has caused the US economy to falter. The high level of unemployment is a substantial challenge for the incoming Biden administration. Meanwhile, there is bipartisan support for an infrastructure rebuilding program that would make jobs available and repair the crumbling roads, bridges, tunnels, airports, government buildings, schools, and other infrastructure parts over the coming years. An infrastructure package would increase US demand for copper and other construction materials.

Meanwhile, we are likely to see demand for copper increase at a time when the expanding money supply is already pushing the price higher, creating an almost perfect bullish storm for the base metal.

Nevada Copper- A strong management team with solid financing

In the mining business, experienced management is critical for success. Glencore is one of the leading commodity producers and trading companies in the world. Nevada Copper’s CEO, Mike Ciricillo, was the former head of global copper assets at Glencore.

Pala Investments is a company dedicated to value creation in the mining sector. Nevada Copper’s Chairman Stephen Gill is a managing partner at Pala.

Tom Albanese, the company’s leading independent director, is the former CEO of Vedanta Resources, one of the world’s leading diversified natural resource companies with operations in India, South Africa, Namibia, and Australia. The company is a producer of oil, gas, zinc, lead, silver, copper, iron ore, steel, and aluminum. He was also Rio Tinto’s CEO. Rio Tinto is a global leader in raw materials production with a market cap of over $95 billion.

Nevada Copper has an all-star team at its helm. The company can finance through a senior debt facility at a low rate of interest backed by the German government. Management has arranged for off-take agreements for its copper concentrates.

Proven and probable reserves in the US with the potential for more

Nevada Copper owns mining properties and rights in the US in a region ranked in the top three in mining jurisdictions by the Fraser Institute in 2019. The Canadian Institute is a think tank that researches natural resources and other areas that impact Canadians’ quality of life.

The company has mineral resources of six and one-half billion pounds of copper, including underground and open pit measured and indicated resources.

The desert climate and local typography in Nevada are optimal for efficient and eco-friendly mining. The company uses a dry-stack method for tailings, which achieves a high percentage of recycled water and no tailings dam requirement.

Nevada Copper has strong support from the local community and all levels of Nevada’s state government for its projects and is fully permitted. It is the first producer in the area since 1978 with a large copper inventory in the earth’s crust. And, Nevada Copper has the only processing permit in the district.

Meanwhile, the underground mine is currently in production, with commercial output targeted mid-year of 2021. The company has a net present value of $421 million in post-tax revenues at $3.50 per pound, which does not include the pre-production open pit project. The copper price is already above that level. With over 13 years of remaining mine life, the project has another 680 million pounds of inferred resource available.

The next phase of projected output will come from the open pit, fully permitted for production with five billion pounds of copper, measured and indicated. The net present value of this reserve is approximately $1.2 billion, post-tax at $3.50 per pound.

Additionally, Nevada Copper is exploring for metals on over 16,000 acres in the region. The company’s current market cap of $150 million makes for a compelling value proposition.

On January 6, the company announced a steady increase in performance from its Pumpkin Hollow underground project. The CEO, Mike Ciricillo, commented:

“The team continues to improve the performance both at the mine and processing plant, evidenced by the operational metrics for December. Most importantly, they have done it safely. In addition, the commissioning of the main hoist system is progressing well, with the shaft reaching its full production speed further enabling the ramp-up to our goal of 5,000 tpd of hoisted material. We are well on our way to show the potential of the Pumpkin Hollow Underground Project.”

The company also announced it closed the previous announcement amendment to its existing senior credit facility on December 30, 2020. The amendment included a $15 million increase in the loan amount and a deferral of $26 million of planned debt service until 2023. Nevada Copper drew down the fill $15 million on December 30, 2020. The full details of the latest new can be accessed via this link.

An emerging producer- Risk-reward and the value proposition favors lots of upside

Emerging producers carry lots of risk in the world of commodities. However, the reward is always a function of risk in all markets. An experienced management team with a top-notch pedigree, production permits in a copper-rich area in Nevada, in the politically stable United States, and the prospects for a rising copper price make Nevada Copper a company to put on your investment radar. Nevada Copper trades on the Toronto Exchange under the symbol NCU.TO

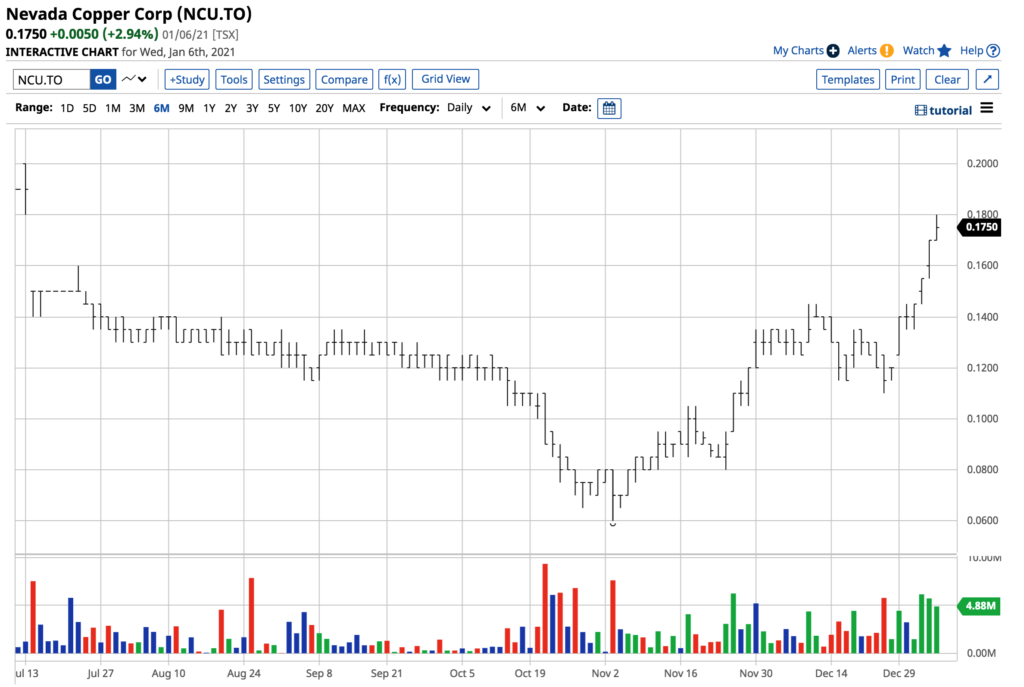

Source: Barchart

Since November 2, the stock has traded from a low of 5.0 cents to a high of 13.3 cents per share on January 6. NEVDF, the US OTC shares, has a market cap of $192.14 million and trades an average of over one million shares each day. At 13.30 cents on January 6, NEVDF is a company that could offer incredible growth over the coming years. A rising copper price in a world where demand is increasing will support more production. There is always lots of risk in stocks that trade for pennies. However, NEVDF/NCU.TO is a company that could be trading for dollars as the prospects for the red metal look bright.

It is always challenging to identify companies that can experience explosive growth. A reward is always a function of risk. Nevada Copper could be one of those diamonds in the rough in the mining business for 2021 and beyond.

Written By: Andrew Hecht, on behalf of Maurice Jackson of Proven and Probable.

Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein, or any security in any jurisdiction in which such an offer would be unlawful under the securities laws of such jurisdiction.