Metallic Minerals

Joining us for a conversation is Ari Sussman of Collective Mining, Colombia’s Newest Exploration Company. Collective Mining has just announced another significant development coming from the flagship Guayabales Project. Today’s discussion will focus on the Main Breccia at the Apollo Target which is delivering High Grade along with some remarkable continuity with a new Strike of 385 Meters, Width at 350 Meters, and Vertical 825 Meters!

Collective Mining: Rapidly advancing, large-scale gold-copper-silver-moly porphyry and breccia targets with related high-grade vein systems in the mining-friendly department of Caldas in Colombia

Collective Mining’s two projects the Guayabales (Flagship) and the San Antonio (Secondary) are situated in Marmato, an underexplored yet multi-million ounce, high-grade gold and silver district located in the Middle Cauca belt in Colombia. With six out of eleven targets drilled, the Company has made three promising grassroot discoveries to date and is awaiting assay results on a potential fourth discovery. Drilling activity continues at a brisk pace with a 20,000+ metre drill program in 2022.

Website: https://www.collectivemining.com/

Listing:(TSX.V: CNL | OTCQX: CNLMF)

Corporate Presentation: https://www.collectivemining.com/investors/presentations/

Facebook: https://www.facebook.com/CollectiveMiningCol

Twitter: https://twitter.com/CollectiveMini1

LinkedIn: https://www.linkedin.com/company/collectivemining/?originalSubdomain=co

Instagram: https://www.instagram.com/collectivemining/

Youtube: https://www.youtube.com/channel/UC0J8zpCq0TNhJQePKdCrJag

Proven and Probable

Where we deliver Mining Insights & Bullion Sales. I’m a licensed broker for Miles Franklin Precious Metals Investments, The Only Online Dealer that is Licensed and Bonded (Period)! Where we provide unlimited options to expand your precious metals portfolio, from

Website| www.provenandprobable.com

Call me directly at 855.505.1900 or email: Maurice@MilesFranklin.com

Precious Metals FAQ – https://www.milesfranklin.com/faq-maurice/

Where there is will there is way

Western investors are dumping gold in response to rising rates.

CREDIT: DAVID PAGE

By

October 9, 2022 at 4:00 AM EDT

Follow the authors@Edspencive+ Get alerts forEddie Spence+ Get alerts forSing Yee

There’s a global migration underway in the gold market, as western investors dump bullion while Asian buyers take advantage of a tumbling price to snap up cheap jewelry and bars.

Rising rates that make gold less attractive as an investment mean that large volumes of metal are being drawn out of vaults in financial centers like New York and heading east to meet demand in Shanghai’s gold market or Istanbul’s Grand Bazaar.

In fact, it can’t move fast enough.

Logistical issues combined with quirks of the market are making it difficult for traders to get enough bullion where it’s wanted. As a result, gold and silver are selling at unusually large premiums over the global benchmark price in some Asian markets.

“The incentive to hold gold is a lot lower. It’s going from west to east now,” said Joseph Stefans, head of trading at MKS PAMP SA, a gold refining and trading firm. “We are trying to keep up as best we can.”

The rotation of metal around the world is part of a gold-market cycle that has repeated for decades: when investors retreat and prices drop, Asian buying picks up and precious metals flow east — helping to put a floor on the gold price during times of weakness.Sponsored ContentWomen are Finding Their Voices in Financial PlanningFirst Horizon Bank

Then, when gold eventually rallies again, much of it returns to sit in bank vaults beneath the streets of New York, London and Zurich.

Since peaking in March, gold prices have tumbled 18% as the Federal Reserve’s aggressive rate hikes caused mass liquidation by financial investors.

More than 527 tons of gold has poured out of New York and London vaults that back the two biggest Western markets since the end of April, according to data from the CME Group Inc. and London Bullion Market Association.

At the same time, shipments are rising into big Asian gold consumers like China, whose imports hit a four-year high in August.

Asia has net-imported gold from the West since Aprilhttps://www.bloomberg.com/toaster/v2/charts/8e101e907831c2855279f794770d9a13.html?brand=business&webTheme=default&web=true&hideTitles=true

Source: Swiss Federal Customs Administration

Note: Data shows net-imports from Switzerland from May to August

While plenty of gold is heading east, it’s still not enough to meet demand. Gold in Dubai and Istanbul or on the Shanghai Gold Exchange has traded at multi-year premiums to the London benchmark in recent weeks, according to MKS PAMP — a sign that buying is outstripping imports.

Read: China Gold Prices Surge to Huge Premium as Demand Swamps Imports

“Demand typically picks up when prices fall,” said Philip Klapwijk, managing director of Hong Kong-based consultant Precious Metals Insights Ltd. “Buyers want to source metal at the lower price and in the local physical market in question there may not be sufficient metal available when the price falls, so the local premium increases.”

Gold in Thailand is also trading at a premium to London prices, due to a lack of supply and weakness in the local currency, according to Jitti Tangsithpakdi, the president of Thailand’s Gold Traders Association.

In India, it is silver that is seeing big premiums. The differential has soared recently to $1, more than triple the usual level, according to consultancy Metals Focus Ltd.

“Right now the demand for silver is huge as traders restock,” said Chirag Sheth, the firm’s principal consultant in Mumbai. “Premiums could remain elevated during the festival season that concludes with Diwali.”

Analysts say that much of the precious metals feeding Asia’s appetite is coming out of vaults run by CME Group, which back the Comex futures market in New York.

Market dislocations early in the pandemic drove a massive surge in prices there, forcing banks to build large stockpiles to cover their futures positions. In recent months gold has traded at a discount on the Comex compared to London, and those inventories are now being drawn down to meet Asian demand.

However, it can be slow going, partly because Asian buyers tend to prefer one-kilogram bars over larger sizes. To fill a standard shipment box of 25 kg of gold, physical traders must take delivery of multiple Comex gold futures, often backed by bullion in different warehouses.

Traders say they are facing other logistical challenges as well, which are contributing to the high Asian premiums.

“Getting stuff on boats or on planes is a bit harder than it used to be,” said MKS PAMP’s Stefans. “It’s really just a classic example of demand far out-pacing supply.”

— With assistance by Swansy Afonso, Suttinee Yuvejwattana and Masumi Suga

TORONTO, Oct. 6, 2022 /CNW/ – Collective Mining Ltd. (TSXV: CNL) (OTCQX: CNLMF) (“Collective” or the “Company”) is pleased to announce assay results from four additional holes completed at the Apollo target (“Apollo”) within the Company’s Guayabales project located in Caldas, Colombia. The Main Breccia discovery at Apollo is a high-grade, bulk tonnage copper-gold-silver porphyry-related breccia target with previously announced intercepts including hole APC-2, which intersected 207.15 metres @ 2.68 g/t AuEq and APC-8, which intersected 265.75 metres @ 2.44 g/t gold equivalent (See press releases dated August 10th and September 13th respectively). As part of its fully funded 20,000+ metre drill program for 2022, there are currently three diamond drill rigs operating at the Apollo target.

“The Main Breccia discovery at the Apollo target continues to deliver robust results demonstrating remarkable continuity and grade over significant drilling widths. Drill-hole APC-14 is a very important hole as it not only confirmed that the Main Breccia comes directly to surface in the southern portion of the system but also extended the size (width) of the system to the south and to the north. Subsequent step out drill holes either recently completed or currently underway appear to have intersected significant extensions to the size of the system in the north. Once logging has been completed and interpreted by our team, a further update will be provided in the near term on this exciting development,” commented Ari Sussman, Executive Chairman.

Details (See Table 1 and Figures 1– 5)

Eleven diamond drill holes with accompanying assay results have now been announced at Apollo and based on results, the Main Breccia at Apollo continues to grow and now measures up to 385 metres along strike by 190 metres in width by 500 metres vertical. The target remains open in all directions and continues to develop into a significant bulk tonnage mineralized system.

Assay results have been received for four new sequential drill holes APC-11 through APC-14. Drill holes APC-12 and APC-14 intersected the Main Breccia and were drilled in different directions from two separate drill pads. APC-14 was drilled to the north from Pad 3 to a final depth of 407.5 metres and APC-12 was drilled eastwards to a final depth of 474.4 metres from the newly constructed Pad 4, which is located 300 metres to the north of Pad 3. Drill holes APC-11 and 13 were collared from Pad 2 and were drilled to the south and east to final depths of 243.75 metres and 313.20 metres respectively.https://embed.fireplace.yahoo.com/embed?ctrl=Monalixa&m_id=monalixa&m_mode=document&site=sports&os=android&pageContext=%257B%2522ctopid%2522%253A%25221542500%253B1577000%2522%252C%2522hashtag%2522%253A%25221542500%253B1577000%2522%252C%2522wiki_topics%2522%253A%2522Target_Corporation%253BMetre%253BBreccia%2522%252C%2522lmsid%2522%253A%2522a0770000002lA5sAAE%2522%252C%2522revsp%2522%253A%2522cnwgroup.com%2522%252C%2522lpstaid%2522%253A%25226ced45bf-fe56-3155-9ef3-33846db874a1%2522%252C%2522pageContentType%2522%253A%2522story%2522%257D

Assay results and related details are listed below:

Table 1: Apollo Target Assays Results

| HoleID | From (m) | To (m) | Intercept (m) | Au (g/t) | Ag (g/t) | Cu % | Zn % | Pb % | Mo % | AuEq (g/t)* |

| APC-11 | 55.00 | 55.60 | 0.60 | 7.73 | 28 | 0.02 | 0.07 | 0.47 | 0.001 | 8.02 |

| 157.55 | 158.10 | 0.55 | 1.88 | 61 | 0.06 | 0.58 | 0.68 | 0.001 | 3.48 | |

| 160.00 | 161.20 | 1.20 | 2.89 | 113 | 0.07 | 0.74 | 1.49 | 0.001 | 5.64 | |

| 173.60 | 174.25 | 0.65 | 5.95 | 18 | 0.02 | 0.14 | 0.17 | 0.002 | 6.13 | |

| 231.00 | 231.65 | 0.65 | 11.80 | 12 | 0.01 | 0.54 | 0.13 | 0.001 | 11.90 | |

| 234.70 | 235.45 | 0.75 | 2.42 | 50 | 0.02 | 0.14 | 0.89 | 0.001 | 3.51 | |

| 237.10 | 238.45 | 1.35 | 4.22 | 11 | 0.02 | 0.08 | 0.08 | 0.001 | 4.30 | |

| APC-12 | 191.35 | 429.05 | 237.70 | 1.15 | 72 | 0.38 | 0.08 | 0.07 | 0.001 | 2.88 |

| Incl | 209.70 | 224.00 | 14.30 | 4.01 | 77 | 0.21 | 0.27 | 0.26 | 0.001 | 5.58 |

| 339.55 | 361.30 | 21.75 | 3.84 | 210 | 0.68 | 0.37 | 0.45 | 0.001 | 8.27 | |

| 416.90 | 429.05 | 12.15 | 3.64 | 84 | 0.22 | 0.04 | 0.06 | 0.001 | 5.09 | |

| APC-13 | 126.40 | 143.20 | 16.80 | 4.24 | 19 | 0.01 | 0.24 | 0.21 | 0.001 | 4.60 |

| Incl | 128.95 | 132.85 | 3.90 | 9.73 | 34 | 0.02 | 0.46 | 0.32 | 0.000 | 10.25 |

| 141.20 | 143.20 | 2.00 | 15.54 | 65 | 0.02 | 1.03 | 1.10 | 0.001 | 16.99 | |

| 242.10 | 242.80 | 0.70 | 3.63 | 24 | 0.02 | 0.12 | 0.10 | 0.000 | 3.97 | |

| 343.60 | 353.70 | 10.10 | 1.15 | 16 | 0.01 | 0.05 | 0.05 | 0.000 | 1.39 | |

| and | 343.60 | 345.60 | 2.00 | 2.77 | 25 | 0.01 | 0.10 | 0.05 | 0.000 | 3.09 |

| APC-14 | 84.25 | 131.70 | 47.45 | 0.81 | 13 | 0.20 | 0.01 | 0.00 | 0.003 | 1.36 |

| 197.00 | 391.30 | 194.30 | 0.39 | 56 | 0.44 | 0.03 | 0.01 | 0.002 | 2.00 |

| *AuEq (g/t) is calculated as follows: (Au (g/t) x 0.95) + (Ag g/t x 0.014 x 0.95) + (Cu (%) x 1.96 x 0.95) + (Mo (%) x 7.35 x 0.95)+(Zn(%)x 0.86 x 0.95)+ (Pb(%)x 0.44 x 0.95) utilizing metal prices of Cu – US$4.00/lb, Mo – US$15.00/lb, Zn – US$1.75/lb, Pb – US$0.9/lb, Ag – $20/oz and Au – US$1,400/oz and recovery rates of 95% for Au, Ag, Cu, Mo, Zn and Mo. Recovery rate assumptions are speculative as no metallurgical work has been completed to date. |

| ** A 0.2 g/t AuEq cut-off grade was employed with no more than 15% internal dilution. True widths are unknown, and grades are uncut. |

About Collective Mining Ltd.

To see our latest corporate presentation and related information, please visit www.collectivemining.com

Collective Mining is an exploration and development company focused on identifying and exploring prospective mineral projects in South America. Founded by the team that developed and sold Continental Gold Inc. to Zijin Mining for approximately $2 billion in enterprise value, the mission of the Company is to repeat its past success in Colombia by making significant new mineral discoveries and advance the projects to production. Management, insiders and close family and friends own nearly 45% of the outstanding shares of the Company and as a result, are fully aligned with shareholders.

The Company currently holds an option to earn up to a 100% interest in two projects located in Colombia. As a result of an aggressive exploration program at both the Guayabales and San Antonio projects, a total of seven major targets have been defined at Guayabales as well as another three at San Antonio. The Company has made a total of five significant grassroot discoveries at both projects with near-surface discovery holes at the Guayabales project yielding 301.9 metres at 1.11 g/t AuEq at the Olympus target, 163 metres at 1.33 g/t AuEq at the Donut target, 207.15 metres at 2.68 g/t AuEq, 180.6 metres at 2.43 g/t AuEg and 87.8 metres at 2.49 g/t AuEg at the Apollo target and most recently, 102.2m @ 1.53 g/t AuEq at the Trap target. At the San Antonio project, the Company intersected, from surface, 710 metres at 0.53 AuEq. (See related press releases on our website for AuEq calculations)

Qualified Person (QP) and NI43-101 Disclosure

David J Reading is the designated Qualified Person for this news release within the meaning of National Instrument 43-101 (“NI 43-101”) and has reviewed and verified that the technical information contained herein is accurate and approves of the written disclosure of same. Mr. Reading has an MSc in Economic Geology and is a Fellow of the Institute of Materials, Minerals and Mining and of the Society of Economic Geology (SEG).

Technical Information

Rock and core samples have been prepared and analyzed at SGS laboratory facilities in Medellin, Colombia and Lima, Peru. Blanks, duplicates, and certified reference standards are inserted into the sample stream to monitor laboratory performance. Crush rejects and pulps are kept and stored in a secured storage facility for future assay verification. No capping has been applied to sample composites. The Company utilizes a rigorous, industry-standard QA/QC program.

FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including, but not limited to, statements about the drill programs, including timing of results, and Collective’s future and intentions. Wherever possible, words such as “may”, “will”, “should”, “could”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict” or “potential” or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties, and assumptions. Many factors could cause actual results, performance, or achievements to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, Collective cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and Collective assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

SOURCE Collective Mining Ltd.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2022/06/c4683.html

Figure 1

Figure 2

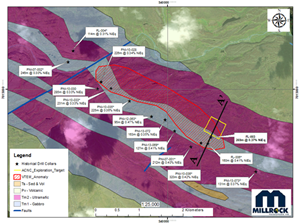

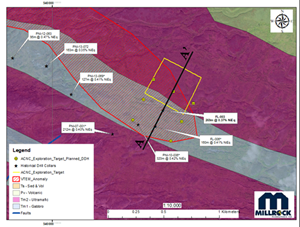

VANCOUVER, British Columbia, Oct. 05, 2022 (GLOBE NEWSWIRE) — Millrock Resources Inc. (TSX-V: MRO) (“Millrock”) is pleased to report that a significant exploration target of Ni-Cu-Co-PGE mineralization has been identified at Millrock’s 100% owned Nikolai Project. The Nikolai Project is located within Alaska’s Delta Mining District, approximately 130 kilometers by road south of Delta Junction and approximately 280 kilometers southeast of Fairbanks. The Eureka zone consists of disseminated Ni-Cu-Co-PGE mineralization initially discovered by a subsidiary of INCO and further expanded by Pure Nickel Inc., as reported in their press releases released between 2007-2014.

https://embed.fireplace.yahoo.com/embed?ctrl=Monalixa&m_id=monalixa&m_mode=document&site=sports&os=android&pageContext=%257B%2522ctopid%2522%253A%25221542500%253B1480989%253B1481489%2522%252C%2522hashtag%2522%253A%25221542500%253B1480989%253B1481489%2522%252C%2522wiki_topics%2522%253A%2522Target_Corporation%253B%25C3%2589cu%253BNio%253BExploration%2522%252C%2522lmsid%2522%253A%2522a0770000002m0AbAAI%2522%252C%2522revsp%2522%253A%2522globenewswire.com%2522%252C%2522lpstaid%2522%253A%2522c5ed4c96-c955-3257-9e0b-95a99f98e1d5%2522%252C%2522pageContentType%2522%253A%2522story%2522%257D

Millrock President and CEO Gregory Beischer commented: “Our exploration geologists have outlined a block of mineralized rock that could likely be converted to a NI43-101 compliant Inferred Resource with a single drill program estimated to cost approximately $2 million. If successful, Millrock estimates the resulting Inferred Resource may comprise a deposit with approximately 400,000 metric tonnes of contained nickel metal, plus copper, cobalt, and platinum group metals. Other companies exploring similar deposits have significantly higher market capitalization than Millrock. Establishing an Inferred Resource at Nikolai could substantially increase the value of the Company. The planned drilling program would delineate an Inferred Resource over a 400-meter-long strike length. However, indications from sparse drilling along strike in both directions indicate the suspected deposit may be in excess of five kilometers long and contain a very large, albeit low-grade metal endowment.”

Based on historical INCO Ltd. drill hole assay data available to Millrock, newly received assays reported on September 26, 2022, and positive mineralogy results reported on September 29, 2022, Millrock has established a clear exploration target. From the data, a block of mineralized rock measuring 400 meters by 300 meters by 400 meters has been outlined. Drill density is not presently sufficient to calculate an Inferred Resource. However, it is estimated that the exploration target contains between 140 million tonnes and 211 million tonnes, with grades ranging from 0.28% nickel equivalent (“NiEq”*) to 0.42% NiEq*. The target has been developed and modeled in 3D using the average thickness and grade from historical drill holes FL-003 and FL-006 of the Upper Eureka Zone, Central Eureka Zone and Lower Eureka Zone (Figure 1). Historical density studies of the Nikolai ultramafic sequence have returned an average density of 2.83 g/cm3, which was used in the tonnage calculation for this exploration target.

This target is based on two drill hole intersections, extrapolated along strike ~400-meter distance, with the base of the target as the lower mineralized elevation of FL-003. Additional drill holes reported by Pure Nickel are present in the area but were not used in exploration targeting as Millrock does not have access to the full dataset.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/1dce184f-2cd1-41b0-8904-44781c2965a2

Table 1 below details the exploration target’s potential grade and tonnage, with the potential tonnage and grade using a maximum and minimum increase/decrease of 20% to allow for uncertainty.

Table 1. Exploration Target potential grade and tonnages.

| Nikolai Ni-Cu-Co-PGE Exploration Target (NiEq & CuEq = $7.00, Cu = $3.50, Co = $25.00, Pt = $900, Pd = $1800, Au = $1600) | |||||||||||

| Zone | Metric Tonnage Range | Base & Battery Metals | Platinum Group and Precious Metals | Total NiEq2 Range | Total CuEq3 Range | ||||||

| Ni Range | Cu Range | Co Range | NiEq Range1 | Pt Range | Pd Range | Au Range | |||||

| % | % | % | % | g/t | g/t | g/t | % | % | |||

| Upper Eureka Zone | 48-73 | 0.16-0.24 | 0.04-0.06 | 0.013-0.019 | 0.23-0.34 | 0.037-0.055 | 0.078-0.117 | 0.005-0.007 | 0.26-0.39 | 0.53-0.79 | |

| Core Eureka Zone | 39-58 | 0.19-0.29 | 0.10-0.15 | 0.016-0.023 | 0.30-0.45 | 0.053-0.080 | 0.113-0.170 | 0.017-0.025 | 0.36-0.53 | 0.66-1.07 | |

| Lower Eureka Zone | 53-80 | 0.16-0.24 | 0.04-0.06 | 0.013-0.019 | 0.23-0.34 | 0.021-0.031 | 0.050-0.074 | 0.011-0.016 | 0.25-0.38 | 0.51-0.75 | |

| Total Eureka Zone | 140-211 | 0.16-0.25 | 0.06-0.08 | 0.014-0.020 | 0.25-0.37 | 0.035-0.053 | 0.077-0.115 | 0.010-0.015 | 0.28-0.42 | 0.55-0.85 | |

| 1. NiEq calculated as Ni+(Cu% x $3.50/$7.00)+(Co% x $25.00/$7.00) | |||||||||||

| 2. Total NiEq calculated as Ni + Cu% x $3.50/$7.00 + Co% x $25.00/$7.00 + Pt(g/t)/31.103 x $900/$7.00/22.04 + Pd(g/t)/31.103 x $1800/$7.00/22.04 + Au(g/t)/31.103 x $1600/$7.00/22.04 | |||||||||||

| 3. Total CuEq calculated as Cu + Ni% x $7.00/$3.50 + Co% x $25.00/$3.50 + Pt(g/t)/31.103 x $900/$3.50/22.04 + Pd(g/t)/31.103 x $1800/$3.50/22.04 + Au(g/t)/31.103 x $1600/$3.50/22.04 |

The potential quantity and grade is conceptual in nature. There has not been sufficient exploration drilling to estimate a Mineral Resource, and it is uncertain if further exploration will result in the estimation of a Mineral Resource.

Additionally, significant upside potential exists, as historical geophysical reports indicated a VTEM anomaly ~3.5 kilometer in length and 400 to 600 meters in width in this part of the Eureka Zone. The developed exploration target accounts for only 12% of the length of the VTEM anomaly (Figure 1). Historical drill hole assay results in this VTEM anomaly, reported by Pure Nickel Inc. (Pure Nickel Inc., News Release, October 29th, 2013), indicate an area of mineralization with an estimated true width ranging from 94.8 meters to 320 meters, and grades ranging from 0.20% to 0.25% nickel, 0.05% to 0.15% copper, 0.016% to 0.019% cobalt, 39 ppb to 96 ppb platinum, 62 ppb to 156 ppb palladium and 11 ppb to 31 ppb Au, with a calculated nickel equivalent (NiEq) ranging from 0.33% to 0.47%.

As reported previously, the Millrock Qualified Person (QP) does not have access to all the Pure Nickel Inc. drill logs, assay results, and geophysical data and has no way to verify the results that were published. The Millrock QP has access to the drill logs and assay certificates for the INCO holes that are designated with the “FL” prefix.

Exploration Target Drill Testing

A drill program consisting of seven holes totaling approximately 2,750 meters has been recommended. If successful, the program would, along with historical drill hole information, provide a drill density on 200 meters centers. This drill hole density is believed to be adequate to allow a calculation of an Inferred Resource, given the apparent relative continuity and homogeneity of the mineralized zone. Figure 2 depicts the approximate surface locations of the recommended drill collars for the intial test. Millrock anticipates that the recommended program will prove the exploration target holds significant mineralization and could be expanded along the VTEM anomaly.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/724ca567-1772-4801-8ad9-16070cd78ffd

Qualified Person

The technical information within this document has been reviewed and approved by Gregory A. Beischer, President, CEO, and a director of Millrock. Mr. Beischer is a Qualified Person as defined in NI 43-101.

About Millrock Resources Inc.

Millrock Resources Inc. is a premier project generator to the mining industry. Millrock identifies, packages, and operates large-scale projects for joint venture, thereby exposing its shareholders to the benefits of mineral discovery without the usual financial risk taken on by most exploration companies. The company is recognized as the premier generative explorer in Alaska and is a significant shareholder of junior explorers ArcWest Exploration Inc. (TSXV : AWX), Resolution Minerals Limited (ASX : RML), and Felix Gold (ASX: FXG). Funding for drilling at Millrock’s exploration projects is primarily provided by its joint venture partners. Business partners of Millrock have included some of the leading names in the mining industry: EMX Royalty, Coeur Explorations, Centerra Gold, First Quantum, Teck, Kinross, Vale, Inmet and, Altius as well as junior explorers Resolution, Riverside, PolarX, Felix Gold, and Tocvan.

ON BEHALF OF THE BOARD

“Gregory Beischer”

Gregory Beischer, President & CEO

FOR FURTHER INFORMATION, PLEASE CONTACT:

Melanee Henderson, Investor Relations

Toll-Free: 877-217-8978 | Local: 604-638-3164

Twitter | Facebook | LinkedIn

Some statements in this news release contain forward-looking information, including but not limited to execution of deportment studies. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include without limitation the completion of planned expenditures, the ability to complete exploration programs on schedule and the success of exploration programs.

“NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.”

VANCOUVER, British Columbia, Oct. 05, 2022 (GLOBE NEWSWIRE) — Rover Metals Corp. (TSXV: ROVR) (OTCQB: ROVMF) (FSE:4XO) (“Rover” or the “Company”) is pleased to announce that its new corporate presentation is now available on its website. The Company is also featuring a recently recorded interview with its CEO, Judson Culter, who has provided a corporate update and plans for Q4 of this year.

About Rover Metals

Rover is a publicly traded junior mining company that trades on the TSXV under symbol ROVR, on the OTCQB under symbol ROVMF, and on the FSE under symbol 4XO. The Company is now developing a diverse portfolio of mineral resource projects: (1) Nevada Claystone Lithium; (2) Zinc-Copper-Lead-Silver in NT, Canada; as well as (3) Gold in NT, Canada. The Company is exclusive to the mining jurisdictions of Canada and the U.S.https://embed.fireplace.yahoo.com/embed?ctrl=Monalixa&m_id=monalixa&m_mode=document&site=sports&os=android&pageContext=%257B%2522ctopid%2522%253A%25221542500%253B1577000%2522%252C%2522hashtag%2522%253A%25221542500%253B1577000%2522%252C%2522wiki_topics%2522%253A%2522Vancouver%253BRover_(marque)%253BTSX_Venture_Exchange%2522%252C%2522lmsid%2522%253A%2522a0770000002m0AbAAI%2522%252C%2522revsp%2522%253A%2522globenewswire.com%2522%252C%2522lpstaid%2522%253A%2522b243763e-490c-3642-8311-1f09ba99905e%2522%252C%2522pageContentType%2522%253A%2522story%2522%257D

You can follow Rover on its social media channels:

Twitter: https://twitter.com/rovermetals

LinkedIn: https://www.linkedin.com/company/rover-metals/

Facebook: https://www.facebook.com/RoverMetals/

for daily company updates and industry news, and

YouTube: https://www.youtube.com/channel/UCJsHsfag1GFyp4aLW5Ye-YQ?view_as=subscriber

for corporate videos.

Website: https://www.rovermetals.com/

ON BEHALF OF THE BOARD OF DIRECTORS

“Judson Culter”

Chief Executive Officer and Director

For further information, please contact:

Email: info@rovermetals.com

Phone: +1 (778) 754-2617

Statement Regarding Forward-Looking Information

This news release contains statements that constitute “forward-looking statements.” Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Rover’s actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur. There can be no assurance that such statements prove to be accurate. Actual results and future events could differ materially from those anticipated in such statements, and readers are cautioned not to place undue reliance on these forward-looking statements. Any factor could cause actual results to differ materially from Rover’s expectations. Rover undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS NEWS RELEASE REPRESENTS THE EXPECTATIONS OF THE COMPANY AS OF THE DATE OF THIS NEWS RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER SUCH DATE. READERS SHOULD NOT PLACE UNDUE IMPORTANCE ON FORWARD-LOOKING INFORMATION AND SHOULD NOT RELY UPON THIS INFORMATION AS OF ANY OTHER DATE. WHILE THE COMPANY MAY ELECT TO, IT DOES NOT UNDERTAKE TO UPDATE THIS INFORMATION AT ANY PARTICULAR TIME EXCEPT AS REQUIRED IN ACCORDANCE WITH APPLICABLE LAWS.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OF THIS RELEASE.