Vancouver, British Columbia–(Newsfile Corp. – February 29, 2024) – Riverside Resources Inc. (TSXV: RRI) (OTCQB: RVSDF) (FSE: 5YY) (“Riverside” or the “Company”), is pleased to announce it has located and sampled the PAT Vein showings inside its Pichette Project west of Geraldton, Ontario. As previously reported, P.A.T Mines drilled extensively a series of veins near the southern boundary in the 1950s. The company was also able to locate what it believes to be the PAT Veins where they outcrop on surface. Several samples were taken from the vein along a 50m exposed section that returned 1m chip samples of 13g/t and 21 g/t gold within banded iron formation units. These high-grade veins are similar to those mined at the Leitch and Sand River mines where the average grade was around 1 ounce/ton gold with silver.

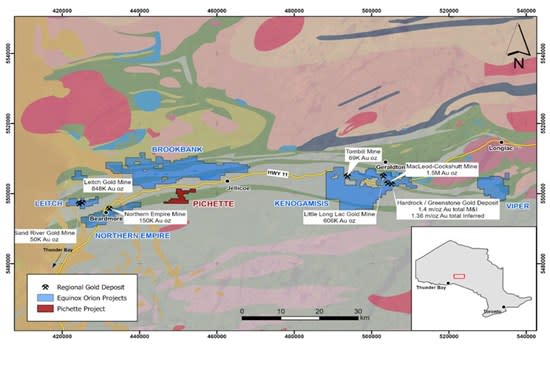

The Pichette Project has excellent road access and infrastructure being located immediately south of the Trans-Canada Highway. The project is underlain by an east-west trending panel of Archean-aged metavolcanic and metasedimentary rocks intruded by gabbros and latter porphyries. Metamorphism and tectonics have in most cases upgraded the tenor of gold mineralization in the belt between Beardmore and Geraldton.

In addition to the surface sampling Riverside completed a geological interpretation of the project to evaluate the timing and relationships of structural events and gold mineralization. As at the Greenstone Mine gold mineralization largely occurred in the first deformational events and was later remobilized or deformed by subsequent deformational events. The Greenstone Gold Mine has been studied by many experts and a complicated evolution of events has been documented as is common in Archean gold belts. The Greenstone Gold Mine will produce over 200,000 ounces of gold per year beginning this year.

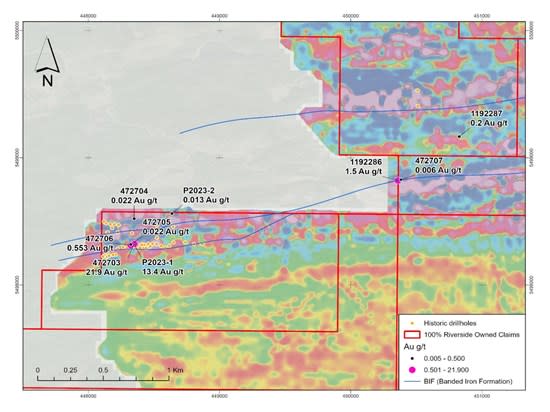

“Riverside is very excited to have found high grade gold on surface at the PAT Veins. While the veins are mostly covered by the forest organics, the banded iron formations associated with the veins and mineralized shears are easy to locate using the magnetic survey completed in 2022. The BIF unit extends across the project outlining a multi-kilometer” states Riverside’s President and CEO, John-Mark Staude.

Figure 1: Location of the Pichette Project within the Beardmore-Geraldton Greenstone Belt.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6101/199836_14c8ecfa84682bac_003full.jpg

This fall the Company completed a structural analysis of the geology and timing of mineralization at Pichette in order provide some context of the structures within the property and how they relate to the evolution of larger greenstone belt and nearby past producers and known gold occurrences. This analysis interprets the first phase of deformation resulted in folding of the Banded Iron Formations and north-south shortening of intrusions with most of the vein mineralization occurring during a second sinistral shearing event. These rocks were again subjected to a third dextral shearing event which resulted in some remobilization in metals.

Table 1: Selected prospecting samples from Riverside most recent field programs.

| Sample # | Au ppb | Sample type | Comments |

| 1192286 | 1,500 | grab | Cherty, Banded Iron Formation, weakly magnetic |

| 1192287 | 200 | grab | Rusty orange, quartz vein, with <1% pyrite in fractures |

| P2023-1 | 13,400 | chip | Rusty, quartz carbonate vein striking east-west, 1m continuous sampling across |

| P2023-2 | 13 | chip | Iron oxide-stained quartz vein material in road cut |

| 472703 | 21,900 | chip | 1.75m shear zone with rusty quartz-carbonate veins striking at 070, dipping at 80 N |

| 472704 | 22 | chip | Metasediments, shear zone, 1.5m continuous sampling across. |

| 472705 | 22 | chip | Narrow Quartz-carbonate vein, 12cm wide, no sulfides, following the structure |

| 472706 | 553 | chip | Fine grained Metaseds, sheared, siliceous, west of the 13 g/t sample |

Figure 2: Riverside bedrock sampling sites from recent site visits on Aeromagnetic map.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6101/199836_14c8ecfa84682bac_004full.jpg

On surface the mineralized zone consists of sugary and banded quartz with massive pyrrhotite and lesser arsenopyrite and pyrite with chlorite The average width of the altered and mineralized zone is 30m consisting primarily of pyritized and silicified mafic metavolcanics and BIF. Historical drill logs suggest a sharp contact between geological units that include mafic metavolcanics, metasediments, gabbros and quartz porphyries.

Gold is commonly enriched in intensely altered rocks adjacent to or within quartz-carbonate veins and veinlets as is found in orogenic deposits. Several of the historical drill logs document high grade intercepts similar to those documented at the Leitch Gold Mine to the west at Beardmore.

The alteration comprises a sequence of well fractured greenstone containing occasional small stringers of hard, reddish, siliceous material, with slight pyritization. The rock changes northward into a light green or tanned rock described in logs as “carbonate”. On surface more siliceous phases are noted with hard, black cherty material often found with the quartz veins. Moving further away from the zone a sericitic phase dominates.

Figure 3: Riverside Surface samples in relation to mineralized zones as defined by historical drilling.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6101/199836_14c8ecfa84682bac_007full.jpg

Rock samples from the exploration program discussed above at Pichette were driven from site to Activation Laboratories in Thunder Bay for analysis. Analysis was completed using total digestion and Multi-Element Analysis (40 element) via Inductively Coupled Plasma Atomic Emission Spectrometry and fire assay for gold. The QA/QC program implemented as part of the sampling procedures included inserting one standard and one blank inserted by Riverside every 20 batch of samples. Activation Laboratories is an ISO/IEC accredited laboratory.

Bonus Share Issuance:

On January 17, 2024, the Company issued 335,000 common shares to certain individuals in recognition of their contribution to the Company over the past year. The shares were issued pursuant to the Company’s shareholder-approved bonus share plan and are subject to the policies of the TSX Venture Exchange and will include a hold period expiring May 18th 2024.

Qualified Person:

This news release was reviewed and approved by Freeman Smith, P.Geo., a non-independent qualified person to Riverside Resources, who is responsible for ensuring that the geologic information provided within this news release is accurate and who acts as a “qualified person” under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

About Riverside Resources Inc.:

Riverside is a well-funded exploration company driven by value generation and discovery. The Company has over $6M in cash, no debt and less than 75M shares outstanding with a strong portfolio of gold-silver and copper assets and royalties in North America. Riverside has extensive experience and knowledge operating in Mexico and Canada and leverages its large database to generate a portfolio of prospective mineral properties. In addition to Riverside’s own exploration spending, the Company also strives to diversify risk by securing joint-venture and spin-out partnerships to advance multiple assets simultaneously and create more chances for discovery. Riverside has properties available for option, with information available on the Company’s website at www.rivres.com.

ON BEHALF OF RIVERSIDE RESOURCES INC.

“John-Mark Staude”

Dr. John-Mark Staude, President & CEO

For additional information contact:

John-Mark Staude

President, CEO

Riverside Resources Inc.

info@rivres.com

Phone: (778) 327-6671

Fax: (778) 327-6675

Web: www.rivres.com

Mehran Bagherzadeh

Corporate Communications

Riverside Resources Inc.

Phone: (778) 327-6671

TF: (877) RIV-RES1

Web: www.rivres.com

Certain statements in this press release may be considered forward-looking information. These statements can be identified by the use of forward-looking terminology (e.g., “expect”,” estimates”, “intends”, “anticipates”, “believes”, “plans”). Such information involves known and unknown risks — including the availability of funds, the results of financing and exploration activities, the interpretation of exploration results and other geological data, or unanticipated costs and expenses and other risks identified by Riverside in its public securities filings that may cause actual events to differ materially from current expectations. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/199836