Russia is warning that the United States will leverage stablecoins backed by Treasuries to offload $35T debt.

— Gold Telegraph ⚡ (@GoldTelegraph_) September 8, 2025

Pushing global adoption, then devaluing the dollar, leaving the world holding the bag.

I explained this “genius act” weeks ago.

Well…

pic.twitter.com/U0bRNDwfFq

Category: Junior Mining

Vancouver, British Columbia–(Newsfile Corp. – September 9, 2025) – EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (the “Company” or “EMX”) is pleased to provide an update with respect to the previously announced sale of its Nordic operational platform (the “Transaction“) to First Nordic Metals Corporation (TSXV: FNM) (“FNM”), a current partner and operator on multiple EMX royalty properties in Sweden and Finland (see the Company’s News Release dated June 2, 2025). This strategic divestment includes EMX’s regional infrastructure, exploration equipment, and employees across the Nordic countries.

The Transaction is a non-arm’s length transaction pursuant to the policies of the TSX Venture Exchange (“TSXV“) as a result of the parties having a director in common and is therefore subject to acceptance of the TSXV. The Transaction has been conditionally accepted by the TSXV and the Company is proceeding with the satisfaction of the conditions required for the final acceptance of the Transaction which are standard for a transaction of this nature. Additionally, completion of the Transaction remains subject to clearance pursuant to the Swedish Foreign Direct Investment Act, which process is expected to be completed prior to the end of October 2025.

About EMX. EMX is a precious and base metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and TSX Venture Exchange under the symbol “EMX”. Please see www.EMXroyalty.com for more information.

For further information, contact:

| David M. Cole President and CEO Phone: (303) 973-8585 Dave@EMXroyalty.com | Stefan Wenger Chief Financial Officer Phone: (303) 973-8585 SWenger@EMXroyalty.com | Isabel Belger Investor Relations Phone: +49 178 4909039 IBelger@EMXroyalty.com |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

Forward-Looking Statements

This news release may contain “forward-looking statements” and “forward-looking information” (together “forward-looking statements”) that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding receipt of final TSXV acceptance for the Transaction, timing and clearance of the Transaction pursuant to the Swedish Foreign Direct Investment Act, timing for completion of the Transaction or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include but are not limited to difficulties in obtaining required approvals for the Transaction, increased regulatory compliance costs and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended June 30, 2025 (the “MD&A”), and the most recently filed Annual Information Form (“AIF”) for the year ended December 31, 2024, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR+ at www.sedarplus.ca and on the SEC’s EDGAR website at www.sec.gov. EMX does not undertake to update any forward-looking statements, except in accordance with applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/265815

Thu, Sep 4, 2025, 3:00 PM 6 min read

Years ago, platinum’s nickname was “rich person’s gold,” as the rare precious metal commanded a premium to the yellow metal. I asked if platinum’s rally would continue and if it could become rich person’s gold again in a late-July Barchart article on the platinum market, when I concluded:

Platinum remains in a bullish trend, with plenty of upside room before it approaches the 2008 all-time high. Given gold’s ascent over the past years and platinum’s liquidity constraints, platinum could head back to its former position as “rich person’s gold.”

More News from Barchart

- Gold Rockets to Record Highs and Silver Takes Out 14-Year High: Where to From Here?

- Dollar Falters and Gold Soars as Fed Rate Cut Chances Increase

- Dollar Falls as Weak JOLTS Report Boosts Fed Rate Cut Chances

- Our exclusive Barchart Brief newsletter is your FREE midday guide to what’s moving stocks, sectors, and investor sentiment – delivered right when you need the info most. Subscribe today!

Nearby NYMEX platinum futures were trading at $1,422.90 on July 28. The $1460 level in early September could be a golden buying opportunity.

Platinum corrects lower

The quarterly chart highlights that after trading around a $1,000 per ounce pivot point for nearly a decade from Q3 2015 through Q1 2025, NYMEX platinum broke out to the upside.

Platinum futures eclipsed the critical technical resistance at the Q1 2021 high of $1,348.20 in Q2 2025. Moreover, the platinum futures formed a bullish key reversal pattern on the quarterly chart in Q2 2025, trading below the Q1 2025 low and closing above the high of the previous quarter. After trading to a peak of $1,440.50 in Q2 2025, platinum futures reached a higher high of $1,511.40 in Q3 where they ran out of upside steam, falling to the $1,270 level in August before recovering to around $1,460 in early September 2025.

The bullish trend remains intact

The shorter-term monthly continuous platinum futures chart highlights the bullish trend that has taken the rare precious metal to a new decade high.

The chart highlights the bullish trend, despite the pullback from the July high of over $1,500 per ounce.

The daily year-to-date chart displays an even more dramatically bullish picture for the platinum futures.

Even the most aggressive bull markets rarely move in straight lines

The nearby NYMEX platinum futures rallied 72%, moving from an April 7, 2025, low of $878.30 to a July 21, 2025, high of $1,511.40 per ounce. While the price has corrected, even the most aggressive trends can experience substantial corrections. Technical support for the NYMEX platinum futures remains far below the current $1,340 level, with the support at the late May 2025 high of just over $1,100 per ounce. Buying platinum during the current correction could be optimal as the precious metal remains in a compelling bullish trend.

Factors supporting higher platinum prices- The platinum-gold differential

The following factors support higher platinum prices:

- After consolidating around the $1,000 per ounce pivot point for nearly a decade, platinum futures broke out to the upside and remain in a bullish trend in early September 2025.

- Platinum is a rare metal, with only around seven million ounces or 218 metric tons of annual mine supply in 2025. South Africa is the leading producer, while Russia and Zimbabwe are second and third. The three countries accounted for approximately 75% of platinum output in 2023.

- In Q1 2025, the World Platinum Investment Council forecasted a third consecutive year for a substantial deficit in platinum’s supply-demand equation. The tight platinum market is a result of declining mine supplies.

- Gold has reached a record high over the past eight consecutive quarters, and silver prices have increased to the highest level since 2011. Platinum, like gold and silver, has industrial and financial applications, favoring higher platinum prices.

- Platinum is a far less liquid futures market than gold and silver. In early September, the open interest in NYMEX platinum futures was 88,805 contracts, representing 4.44 million ounces. At $1,460 per ounce, the total value of the platinum futures market was $6.483 billion. The total values of the gold and silver futures market were over $178.6 billion and over $33 billion, respectively. Platinum is a smaller and less liquid futures market than gold and silver. Lower liquidity tends to support higher volatility.

The case for higher platinum prices remains compelling in early September 2025. Buying during the current correction, leaving plenty of room to add on further declines, could be optimal.

The chart of the platinum-gold spread ({PLV25}-{GCZ25}) highlights that platinum had traded at a premium to gold in the 1990s, reaching an over $1,000 premium in 2008. Since 2015, platinum’s discount to gold has been increasing, reaching nearly $2,500 per ounce at the most recent April 2025 low. The bottom line is that platinum is historically inexpensive compared to gold.

Technical levels to watch in the futures- PPLT is a platinum ETF

The five-year monthly platinum futures chart highlights the critical technical levels in early September 2025.

As the chart highlights, support for platinum futures is at the March 2022 high of $1,197, the April 2023 high of $1,148.90, and the March 2024 high of $1,105 per ounce, as the prior technical resistance levels have become supports. The current upside target is the July 2025 $1,511.40 per ounce. Above there, platinum traded to a high of $1,523.80 in July 2014, $1,744.50 in February 2023, $1,918.50 in August 2011, and a record high in March 2008 of $2,308.80 per ounce. With gold trading over $1,300 above platinum’s March 2008 record peak, there is substantial upside potential in the platinum futures market.

The most direct route for a risk position in platinum is the physical market for platinum bars and coins. However, physical platinum often involves substantial premiums for purchases and discounts for sales. The futures market has a physical delivery mechanism, but it involves significant leverage with margin requirements. The most liquid platinum ETF, the Aberdeen Physical Platinum product (PPLT) makes a platinum investment available in standard equity accounts.

At $130.52 per share, PPLT had over $1.684 billion in assets under management. PPLT trades an average of 205,941 shares daily and charges a 0.60% management fee. PPLT is a highly liquid ETF product.

Platinum futures rallied 72% from the low on April 7, 2025, to the high on July 21, 2025.

As the chart shows, PPLT rose 61.6% from $82.79 to $133.80 per share from the low of April 7 to its high on July 18. While PPLT does a reasonable job tracking platinum prices, the expense ratio weighs on the performance. However, the management fee covers expenses, including storage and insurance. Moreover, since PPLT only trades during U.S. stock market hours and platinum futures trade around the clock, the ETF can miss highs or lows when the stock market is closed.

Time will tell if platinum catches and surpasses gold on the upside, but there is plenty of room for platinum to narrow the price gap. Platinum remains in a bullish trend in early September 2025, with lots of upside potential at the $1,460 per ounce level.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. This article was originally published on Barchart.com

Vancouver, British Columbia–(Newsfile Corp. – September 4, 2025) – Elemental Altus Royalties Corp. (TSXV: ELE) (OTCQX: ELEMF) (“Elemental Altus“) and EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (“EMX“, and together with Elemental Altus, the “Companies“) are pleased to announce that the Companies have entered into a definitive arrangement agreement dated September 4, 2025 (the “Arrangement Agreement“) whereby Elemental Altus will acquire all of the issued and outstanding common shares of EMX (the “EMX Shares“) pursuant to a court-approved plan of arrangement (the “Transaction“). The Merged Company (the “Merged Company“) will continue under the new name Elemental Royalty Corp.

Concurrently with and in support of the Transaction, Tether Investments S.A. de C.V. (“Tether“) and Elemental Altus have entered into a subscription agreement dated September 4, 2025 (the “Tether Subscription Agreement“) pursuant to which, among other things, Tether has agreed to purchase approximately 75 million Elemental Altus Shares at a price of C$1.84 per share for aggregate gross proceeds of US$1001 million (the “Tether Concurrent Financing“).

The Merged Company will have 16 producing royalties contributing to a projected approximate adjusted revenue2 of US$80 million in 2026, positioning the Merged Company as a new mid-tier streaming and royalty company.

Transaction Highlights and Strategic Rationale:

- Top Quality, Globally Diversified Portfolio:

- Creation of peer-leading revenue generating royalty company: combined revenue guidance of US$70 million in 2025 and analyst consensus revenue of US$80 million in 20263, underpinned by strong growth visibility;

- Gold focused portfolio: adjusted revenue relating to a commodity split of 67% precious metals and 33% base metals on a latest quarter revenue basis providing exposure to record gold prices;

- Strengthened asset portfolio: anchored by four cornerstone royalties with world-class operators;

- Enhanced portfolio diversification: exposure to 16 paying royalties and 200 total royalties providing a balanced foundation of immediate cash flow and long-term upside;

- Meaningful scale:

- Larger, well capitalized entity: with lower cost of capital, positioned to pursue further accretive royalty opportunities in the market;

- Graduating to the mid-tier: materially higher combined revenue than the junior royalty companies, filling a gap in the market left by recent industry consolidation;

- Increased trading liquidity: combined trading liquidity and expected indexation demand to help close valuation gap with peers;

- Poised for Future Growth:

- Complementary management expertise: unites Elemental Altus’ proven track record of accretive royalty acquisitions with EMX’s disciplined royalty generation and acquisition capabilities to create a best-in-class leadership team;

- Royalty generation business: a unique differentiator offering low cost, organic growth;

- Demonstrated shareholder support: Certain shareholders of EMX (including management) who hold approximately 23% of the outstanding EMX Shares have entered into voting support agreements and the Tether Concurrent Financing emphasizes strong confidence in the strategy and long-term vision of the Merged Company, and provides significant financial capacity to the Merged Company; and

- Clear path forward: the Merged Company will be listed on the TSX Venture Exchange (“TSX-V“) under the ticker “ELE” with plans to pursue a US listing prior to the closing of the Transaction.

Elemental Altus and EMX will hold a joint conference call and webcast for investors and analysts on September 5, 2025, at 8am PT/11 am ET to discuss the Transaction. Details are provided at the end of this press release.

Frederick Bell, CEO of Elemental Altus, commented:

“This transaction establishes one of the world’s premier gold focused emerging streaming and royalty companies, bringing together two complementary portfolios in a compelling combination. Elemental Altus’ portfolio, with a strategic emphasis on royalty acquisition, and with more than 75% of revenue associated with gold producing mines, is complemented by EMX’s revenue generating portfolio paired with their royalty generation business. The combination of two business that have each delivered over 17% compound annual growth rates in share price since their inception creates an enlarged company that is exceptionally well-placed to continue to grow in an accretive manner for shareholders. The support from Tether in the form of a US$100 million placement as well as the existing cashflow generation, provides the ability to pursue further valuable growth through acquisitions of the best opportunities in the sector. Both Elemental Altus’ and EMX’s shareholders will benefit from our cornerstone assets, greater scale, diversification, growth profile and trading liquidity.”

David Cole, CEO of EMX, commented:

“The merger of Elemental Altus and EMX represents a superb opportunity to combine two royalty companies with accelerating revenue streams and a shared mindset of financial discipline in the pursuit of growth. The ethos of EMX from the founding of the company has been to expose shareholders to the ever increasing value of mineral rights around the world. We believe that growing a diverse portfolio of royalties is the most effective way to accomplish this goal. Royalties are phenomenal financial instruments that leverage commodity price exposure and the asymmetric upside of exploration success. The integration of EMX and Elemental’s portfolios are expected to greatly enhance shareholder value through increased liquidity, capital availability and importantly, discovery optionality across an expanded portfolio.”

Juan Sartori, Executive Chairman of Elemental Altus, commented:

“Tether’s recent investment in Elemental Altus was based on its strategy of increasing gold exposure. We believed Elemental Altus was the ideal vehicle to execute on this strategy due to the company’s strong foundation of assets and disciplined approach to investments. We are even more excited about the Merged Company’s future following the combination with EMX, creating a platform for growth that is unmatched in the junior royalty space and allowing us to accelerate into the mid-tier royalty space. The Merged Company will have the cashflow generation and expertise to deploy capital on royalties and streams that continue to add value for all shareholders.”

Concurrently with the Transaction, Elemental Altus will complete the previously-approved consolidation of all of the issued and outstanding common shares of Elemental Altus (the “Elemental Altus Shares“) at a ratio of one (1) post-consolidation Elemental Altus Share for every 10 pre-consolidation Elemental Altus Shares (the “Consolidation“). Additional details of the timing for the Consolidation will be provided by Elemental Altus in a subsequent press release.

Under the terms of the Arrangement Agreement, shareholders of EMX will receive (a) 0.2822 Elemental Altus Shares for each EMX Share held immediately prior to the effective time of the Transaction (the “Effective Time“) if the Consolidation is completed prior to the Effective Time; or (b) 2.822 Elemental Altus Shares for each EMX Share, if the Consolidation is not completed prior to the Effective Time (the “Consideration“). Upon completion of the Transaction, including the Tether Concurrent Financing, existing Elemental Altus shareholders and former EMX shareholders will own approximately 51% and 49% of the outstanding common shares of the Merged Company, respectively, on a fully diluted basis. The implied market capitalization of the Merged Company is estimated at US$933m4.

Benefits for EMX Shareholders

- Immediate upfront premium to near all-time high closing share price of 21.5% based on 20-day volume-weighted average prices and 9.8% based on spot prices5

- Accretive to near term cash flow per share

- Offers material ownership in combined larger cash flowing company with near term cash contributions from Elemental Altus’ portfolio

- Diversification to Tier-1 Australian gold producing and near-producing assets

- Exposure to gold focused royalty revenue from cornerstone assets, including Karlawinda

- Optionality through Elemental Altus’ development royalty portfolio

- Continued financial support of Tether for further acquisitions

Benefits for Elemental Altus Shareholders

- Immediately accretive to net asset value (NAV) on a per share basis6

- Provides exposure to unique long-life Timok royalty

- Triples ownership of flagship Caserones royalty

- Diversifies risk profile adding cornerstone assets in North America, South America and Europe

- Combination with high-quality technical team will improve deal sourcing and organic origination of new royalties for low cost

- Enhanced trading liquidity and capital markets exposure through size and planned US listing, providing access to new investors including index inclusion

Transaction Details

Pursuant to the terms and conditions of the Arrangement Agreement, EMX shareholders will receive (a) 0.2822 Elemental Altus Shares for each EMX Share held immediately prior to the Effective Time if the Consolidation is completed prior to the Effective Time; or (b) 2.822 Elemental Altus Shares for each EMX Share, if the Consolidation is not completed prior to the Effective Time as the Consideration.

The Consideration implies a premium of 9.8% based on the closing prices of the Elemental Altus Shares and EMX Shares, respectively, on the TSX-V on September 4, 2025, and a premium of 21.5% based on the 20-day volume-weighted average price of the Elemental Altus Shares and EMX Shares, respectively, on the TSX-V and US Exchanges as of September 4, 2025. The Consideration implies a total equity value for EMX of US$4567 million on a basic basis.

The Transaction will be effected by way of a court-approved plan of arrangement under the Business Corporations Act (British Columbia). The Transaction will require the approval of at least (i) 66 2/3% of the votes cast at a special meeting of shareholders of EMX (the “EMX Special Meeting“); and (ii) if, and to the extent, required under applicable Canadian securities laws, a majority of the votes cast at a the EMX Special Meeting, excluding the votes attached to EMX Shares held by persons required to be excluded pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holder in Special Transactions (“MI 61-101“).

Upon completion of the Transaction, including the Tether Concurrent Financing, existing Elemental Altus and former EMX shareholders are expected to own approximately 51% and 49% of the Merged Company, respectively, on a basic basis.

Certain officers and directors and shareholders of EMX who hold approximately 23% of the outstanding EMX Shares have entered into voting support agreements pursuant to which they have agreed, among other things, to vote their EMX Shares in favour of the Transaction.

Upon completion of the Transaction, the Merged Company will be renamed Elemental Royalty Corp. and remain headquartered in Vancouver, British Columbia. The Board of Directors will be comprised of three representatives from Elemental Altus and two representatives from EMX. Juan Sartori will continue as Executive Chairman and David Cole will serve as CEO of the Merged Company, while Frederick Bell will assume the role of President and COO.

In addition to approval of the EMX shareholders, completion of the Transaction is subject to approval of the Elemental Altus shareholders for the Tether Concurrent Financing (as described below), TSX-V, regulatory and court approvals and other customary closing conditions for Transactions of this nature. Further, the completion of the Transaction is subject to the conditional approval of the listing of the Elemental Altus Shares on a US stock exchange and the completion of the Tether Concurrent Financing. Any such US listing of the common shares of the Merged Company is subject to the Merged Company meeting the quantitative and qualitative requirements to list on a US stock exchange. The Arrangement Agreement includes customary deal protection provisions, including reciprocal non-solicitation and right to match provisions, and an approximately C$15.8 million termination fee, payable under certain circumstances.

None of the securities to be issued pursuant to the Transaction have been or will be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws, and any securities issuable in the Transaction are anticipated to be issued in reliance upon available exemptions from such registration requirements pursuant to Section 3(a)(10) of the U.S. Securities Act or other available exemptions and applicable exemptions under state securities laws. This press release does not constitute an offer to sell or the solicitation of an offer to buy any securities.

The full details of the Transaction will be described in the Companies’ respective management information circulars to be prepared in accordance with applicable securities legislation and made available in connection with the special meetings.

Tether Concurrent Financing

Concurrently with and in support of the Transaction, Elemental Altus has entered into the Tether Subscription Agreement, pursuant to which, among other things, Elemental Altus and Tether have agreed to complete the Tether Concurrent Financing. Proceeds from the Tether Concurrent Financing will be used to repay EMX’s credit facility, fund royalty acquisitions (including to pay the purchase price for Elemental Altus’ two recently announced royalty acquisitions, or to repay its credit facility to the extent drawn for that purpose) and provide capital for the Merged Company so that it is fully unlevered post-completion.

Tether is an insider and control person of the Company, and therefore the Tether Concurrent Financing constitutes a related party transaction as defined under MI 61‐101. The shareholders of Elemental Altus must approve each of (a) the Tether Concurrent Financing pursuant to the requirements of MI 61-101 (the “Elemental Altus Financing Resolution“), (b) Tether as a “Control Person” of Elemental Altus pursuant to policies of the TSX-V (the “Elemental Altus Control Person Resolution“); and (c) the change of Elemental Altus’ name to Elemental Royalty Corp. (the “Elemental Altus Name Change Resolution” and collectively, the “Elemental Altus Resolutions“).

The Elemental Altus Financing Resolution will require the approval of at least a simple majority of the votes cast at a special meeting of shareholders of Elemental Altus (the “Elemental Altus Special Meeting“), excluding the votes attached to Elemental Altus Shares held by Tether and any other persons required to be excluded pursuant to MI 61-101. The Elemental Altus Control Person Resolution will require the approval of at least a simple majority of the votes cast at the Elemental Altus Special Meeting, excluding votes attached to Elemental Altus Shares held by the Tether and its associates and affiliates. The formal valuation requirement under MI 61-101 does not apply to the Tether Concurrent Financing as Elemental Altus has relied on the exemption therefrom contained at section 5.5(b) of MI 61-101.

Certain officers and directors and shareholders of Elemental Altus who hold approximately 40% of the outstanding Elemental Altus Shares have entered into voting support agreements pursuant to which they have agreed, among other things, to vote their Elemental Altus Shares in favour of the Elemental Altus Resolutions.

The Tether Concurrent Financing is conditional on the approval of the Transaction at the EMX Special Meeting. The Tether Concurrent Financing is also subject to approval of the TSX-V, including Elemental Altus fulfilling the requirements of the TSX-V. The Elemental Altus Shares issued under the Tether Concurrent Financing will be subject to a four month and one day hold period, pursuant to securities laws in Canada, and have not been and will not be registered under the U.S. Securities Act of 1933, as amended, or any applicable securities laws of any state of the United States and may not be offered or sold in the United States absent registration or an applicable exemption from such registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities of Elemental Altus, nor shall there be any offer or sale of any securities of Elemental Altus in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

The Tether Concurrent Financing will close concurrently with the closing of the Transaction, and such concurrent closing is a condition to the completion of closing the Transaction.

The full details of the Tether Concurrent Financing will be described in Elemental Altus’ management information circular to be prepared in accordance with applicable securities legislation and made available in connection with the special meeting.

The Elemental Altus Name Change Resolution will require the approval of at least 66 2/3% of the votes cast at the Elemental Altus Special Meeting. The Elemental Altus Name Change Resolution is not a condition to close the Transaction.

Timing

Subject to receiving the requisite court, regulatory and shareholder approvals as described above, the Transaction and the Tether Concurrent Financing are expected to close in the fourth quarter of 2025. In connection with and subject to closing of the Transaction and the Tether Concurrent Financing, it is expected that the EMX Shares will be delisted from the TSX-V and NYSE American, and that EMX will cease to be a reporting issuer under Canadian and U.S. securities laws.

Board of Directors Recommendations

The Board of Directors of Elemental Altus has unanimously approved the Transaction and (subject to the abstention of any conflicted director) the Tether Concurrent Financing and recommends that the shareholders of Elemental Altus vote in favour of the Elemental Altus Resolutions.

The Board of Directors of EMX (subject to the abstention of any conflicted director) and a special committee comprised solely of independent directors of EMX (the “EMX Special Committee“) have each unanimously determined that the Transaction is in the best interests of EMX and have approved the Transaction and recommend that the shareholders of EMX vote in favour of the Transaction.

Financial Advisors and Legal Counsel

National Bank Financial is acting as financial advisor to Elemental Altus. Fasken Martineau DuMoulin LLP is acting as legal advisor to Elemental Altus. Greenberg Traurig, LLP is acting as U.S. legal counsel to Elemental Altus. Bennett Jones LLP is acting as legal advisor to Tether.

GenCap Mining Advisory Ltd. has provided a fairness opinion to the Elemental Altus Board of Directors, stating that, as of the date of such opinion, and based upon and subject to the assumptions, limitations and qualifications stated in such opinion, the Consideration to be paid is fair, from a financial point of view, to Elemental Altus shareholders excluding Tether.

CIBC World Markets Inc. is acting as financial advisor to EMX. CIBC World Markets Inc. has provided a fairness opinion to the EMX Board of Directors, stating that, as of the date of such opinion, and based upon and subject to the assumptions, limitations and qualifications stated in such opinion, the Consideration under the Transaction is fair, from a financial point of view, to the shareholders of EMX.

Haywood Securities Inc. is acting as financial advisor to the EMX Special Committee. Haywood Securities Inc. has provided a fairness opinion to the EMX Special Committee, stating that, as of the date of such opinion, and based upon and subject to the assumptions, limitations and qualifications stated in such opinion, the Consideration to be received is fair, from a financial point of view, to the shareholders of EMX.

Cassels Brock & Blackwell LLP is acting as Canadian legal advisor to EMX. Crowell & Moring LLP is acting as U.S. legal advisor to EMX. Blake, Cassels & Graydon LLP is acting as legal advisor to the EMX Special Committee.

Conference Call and Webcast

Elemental Altus and EMX will hold a joint conference call and webcast for investors and analysts on September 5, 2025, at 8am PT/11 am ET to discuss the Transaction. Questions can be asked through a chat function.

Participants may join using the webcast link:

- Audience URL: https://my.demio.com/ref/qKUUovbX1KWgKjoT

The webcast will be archived on both the Elemental Altus and EMX websites until the Transaction closes.

On Behalf of Elemental Altus,

Frederick Bell

CEO

Corporate & Media Inquiries:

Tel: +1 604 646 4527

info@elementalaltus.com

www.elementalaltus.com

TSX-V: ELE | OTCQX: ELEMF | ISIN: CA28619K1093 | CUSIP: 28619K109

On Behalf of EMX,

David Cole

CEO

For further information, contact:

| David M. Cole President and CEO Phone: (303) 973-8585 Dave@EMXroyalty.com | Stefan Wenger Chief Financial Officer Phone: (303) 973-8585 SWenger@EMXroyalty.com | Isabel Belger Investor Relations Phone: +49 178 4909039 IBelger@EMXroyalty.com |

About Elemental Altus

Elemental Altus is an income generating precious metals royalty company with 10 producing royalties and a diversified portfolio of pre-production and discovery stage assets. The Company is focused on acquiring uncapped royalties and streams over producing, or near-producing, mines operated by established counterparties. The vision of Elemental Altus is to build a global gold royalty company, offering investors superior exposure to gold with reduced risk and a strong growth profile. The Elemental Altus Shares are listed on the TSX-V and OTCXQ under the symbol “ELE” and “ELEMF”, respectively. Please see www.elementalaltus.com for more information.

About EMX

EMX is a precious and base metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The EMX Shares are listed on the NYSE American Exchange and TSX-V under the symbol “EMX”. Please see www.EMXroyalty.com for more information.

Neither the TSX-V nor its Regulation Service Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this press release.

Cautionary note regarding forward-looking statements

This press release may contain “forward-looking information” within the meaning of applicable Canadian securities laws and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995, (collectively, “forward-looking statements”) that reflect the Companies’ current expectations and projections about their future results. These forward-looking statements may include statements regarding guidance and long-term outlook, including future revenue, which are based on public forecasts and other disclosure by the third-party owners and operators of our assets or on the ‘Elemental Altus’ or EMX’s assessments thereof, including certain estimates based on such information; expectations regarding financial strength, trading liquidity, and capital markets profile of the Merged Company; the completion of the Tether Concurrent Financing; the completion of the Transaction and the timing thereof; the realization of synergies and expected premiums in connection with the Transaction, the identification of future accretive opportunities, permitting requirements and timelines; the value the Transaction will add for shareholders of the Companies; the future price of the common shares of the Merged Company; the receipt of required approvals for the Transaction and the Tether Concurrent Financing; the completion of the name change of Elemental Altus; the completion of the Consolidation and the timing thereof; the benefits of the Transaction to shareholders of Elemental Altus; the benefits of the Transaction to shareholders of EMX; the availability of the exemption under Section 3(a)(10) of the U.S. Securities Act to the securities issuable pursuant to the Transaction; the listing of the Merged Company on a US stock exchange and the timing thereof; the timing and amount of estimated future royalty guidance; and the future price of gold. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, identified by words or phrases such as “expects,” “anticipates,” “believes,” “plans,” “projects,” “estimates,” “assumes,” “intends,” “strategy,” “goals,” “objectives,” “potential,” “possible” or variations thereof or stating that certain actions, events, conditions or results “may”, “could”, “would”, “should”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements are based on a number of material assumptions, including those listed below, which could prove to be significantly incorrect, including that no material disruption to production at any of the mineral properties in which the Companies’ have a royalty or other interest; that the Companies will receive all required approvals for the Transaction and the Tether Concurrent Financing in a timely manner; that synergies are realizable as between the Companies; estimated capital costs, operating costs, production and economic returns; estimated metal pricing; metallurgy, mineability, marketability and operating and capital costs; the expected ability of any of the properties in which the Companies hold a royalty, or other interest to develop adequate infrastructure at a reasonable cost; assumptions that all necessary permits and governmental approvals will remain in effect or be obtained as required to operate, develop or explore the various properties in which the Companies hold an interest; and the activities on any on the properties in which the Companies hold a royalty, or other interest will not be adversely disrupted or impeded by development, operating or regulatory risks or any other government actions.

Certain important factors that could cause actual results, performances or achievements to differ materially from those in the forward-looking statements include, amongst others, failure to obtain any required regulatory and shareholder approvals with respect to the Transaction and the Tether Concurrent Financing; the inability to satisfy the conditions to closing the Transaction and the Tether Concurrent Financing; the inability to satisfy the listing requirements to be listed on a US stock exchange; volatility in the price of gold or other minerals or metals, discrepancies between anticipated and actual production with respect to portfolio assets; the accuracy of the mineral reserves, mineral resources and recoveries set out in the technical data published by the owners of portfolio assets; the absence of control over mining operations from which the Companies receive royalties, and risks related to those mining operations, including risks related to international operations, government and environmental regulation, actual results of current exploration activities, conclusions of economic evaluations and changes in project parameters as plans continue to be refined, activities by governmental authorities (including changes in taxation); currency fluctuations; the global economic climate; dilution; share price volatility and competition.

Forward-looking statements are subject to known and unknown risks, uncertainties and other important factors that may cause the actual results, level of activity, performance or achievements of the Companies to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: the impact of general business and economic conditions, the absence of control over mining operations from which the Companies will receive royalties from, and risks related to those mining operations, including risks related to international operations, government and environmental regulation, actual results of current exploration activities, conclusions of economic evaluations and changes in project parameters as plans continue to be refined, risks in the marketability of minerals, fluctuations in the price of gold and other commodities, fluctuation in foreign exchange rates and interest rates, stock market volatility, as well as those factors discussed in (A) the Elemental Altus’ Annual Information Form dated August 18, 2025, filed under the Elemental Altus’ profile on SEDAR+ at www.sedarplus.ca; and (B) the EMX risk factors listed in EMX’s Management’s Discussion and Analysis for the six months ended June 30, 2025 and its Annual Information Form dated March 12, 2025 filed under EMX’s profile on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. Although the Companies have attempted to identify important factors that could cause actual results to differ materially from those Companies in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Companies do not undertake to update any forward-looking statements that are contained or incorporated by reference, except in accordance with applicable securities laws.

Cautionary Statements to U.S. Securityholders

The financial information included or incorporated by reference in this press release or the documents referenced herein has been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board, which differs from US generally accepted accounting principles (“US GAAP”) in certain material respects, and thus are not directly comparable to financial statements prepared in accordance with US GAAP.

This press release and the documents incorporated by reference herein, as applicable, have been prepared in accordance with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current standards of the United States securities laws. In particular, and without limiting the generality of the foregoing, the terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, “inferred mineral resources,”, “indicated mineral resources,” “measured mineral resources” and “mineral resources” used or referenced herein and the documents incorporated by reference herein, as applicable, are Canadian mineral disclosure terms as defined in accordance with Canadian National Instrument 43-101 — Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) — CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Definition Standards”).

The definitions of these terms, and other mining terms and disclosures, differ from the definitions of such terms, if any, for purposes of the United States Securities and Exchange Commission (“SEC”) disclosure rules for domestic United States Issuers (the “SEC Rules”), including the requirements of the SEC in Regulation S-K Subpart 1300 under the United States Securities Exchange Act of 1934, as amended. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multijurisdictional disclosure system, EMX is not required to provide disclosure on its mineral properties under the SEC Rules and provides disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information and other technical information contained or incorporated by reference herein or documents incorporated by reference may not be comparable to similar information disclosed by United States companies subject to the SEC’s reporting and disclosure requirements for domestic United States issuers. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Under Canadian rules, estimates of inferred mineral resources are considered too speculative geologically to have the economic considerations applied to them to enable them to be categorized as mineral reserves and, accordingly, may not form the basis of feasibility or pre-feasibility studies, or economic studies except for a preliminary economic assessment as defined under NI 43-101. Investors are cautioned not to assume that part or all of an inferred mineral resource exists or is economically or legally mineable. In addition, United States investors are cautioned not to assume that any part or all of the EMX’s measured, indicated or inferred mineral resources constitute or will be converted into mineral reserves or are or will be economically or legally mineable.

The Elemental Altus shares to be issued to EMX shareholders pursuant to the Transaction have not been or will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws, and such securities are anticipated to be issued in reliance upon the exemption from such registration requirements provided by Section 3(a)(10) of the U.S. Securities Act and similar exemptions under applicable U.S. state securities laws.

Non-IFRS Measures

Adjusted Revenue

Adjusted revenue is a non-IFRS financial measure, which is defined as including gross royalty revenue from associated entities holding royalty interests related to Elemental Altus’ and EMX’s effective royalty on the Caserones copper mine. Management uses adjusted revenue to evaluate the underlying operating performance of the Company for the reporting periods presented, to assist with the planning and forecasting of future operating results, and to supplement information in its financial statements. Management believes that in addition to measures prepared in accordance with IFRS such as revenue, investors may use adjusted revenue to evaluate the results of the underlying business, particularly as the adjusted revenue may not typically be included in operating results. Management believes that adjusted revenue is a useful measure of the Company performance because it adjusts for items which management believes reflect the Company’s core operating results from period to period. Adjusted revenue is intended to provide additional information to investors and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. It does not have any standardized meaning under IFRS and may not be comparable to similar measures presented by other issuers.

1 Exchange rate of C$1.00 = US$0.7231 (the “Exchange Rate“), being the indicative exchange rate for Canadian dollars in terms of the United States dollar, as quoted by the Bank of Canada on September 4, 2025.

2 Adjusted revenue is a non-IFRS measure. Please refer to the “Non-IFRS Measures” section of this press release and Elemental Altus’ discussion of non-IFRS performance measures in its Management’s Discussion and Analysis for the quarter ended June 30, 2025

3 Based on figures (i) with respect to EMX from National Bank Financial Inc. and as of August 12, 2025, and (ii) with respect to Elemental Altus from each of Raymond James Ltd. And National Bank Financial Inc. as of August 19, 2025 and from Canaccord Genuity Corp. as of May 26, 2025.

4 Assuming approximately 629.4 million outstanding common shares of the Merged Company on the completion of the Transaction and the Tether Concurrent Financing, and based on the closing price of the Elemental Altus Shares on September 4. 2025 of C$2.05 per share, converted to US$ at the Exchange Rate

5 As at September 4, 2025

6 Average of available consensus NAV estimates as of September 4, 2025.

7 Assuming approximately 108.9 million outstanding EMX Shares as of the Effective Time and based on the closing price of the Elemental Shares on September 4. 2025 of C$2.05 per share, converted to US$ at the Exchange Rate.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/265192

Scout Discoveries will be in Beaver Creek next week during the Precious Metals Summit. If you’ll be in the area and would like to connect, we’d love to hear from you!

Please feel free to reach out to Curtis Johnson at cjohnson@scoutdiscoveries.com or Amanda Irons at airons@scoutdiscoveries.com to coordinate.

Website: https://www.scoutdiscoveries.com/

Looking forward to seeing many of you there!

— The Scout Discoveries Team

Critical minerals, barite and zinc, added to expanded resource

VANCOUVER, British Columbia, Sept. 04, 2025 (GLOBE NEWSWIRE) — Apollo Silver Corp. (“Apollo” or the “Company”) (TSX.V:APGO, OTCQB:APGOF, Frankfurt:6ZF0) is pleased to announce the results of an updated independent Mineral Resource estimate (“MRE”) for its Calico Silver Project (“Calico” or the “Calico Project”) located in San Bernardino County, California. Total silver (“Ag”) Measured & Indicated (“M&I”) tonnes at the Waterloo property have increased by 61% to a total of 55 million tonnes (“Mt”) at a grade of 71 grams per tonne (“g/t’) Ag for a total content of 125 million troy ounces (“Moz”). This represents a 14% increase in Ag ounces compared to the previous MRE (dated March 6, 2023). In addition to updating the gold resource at Waterloo, inaugural barite (“BaSO4”) and zinc (“Zn”) resources have been included in both the Indicated and Inferred categories.

News Highlights

- New combined Measured and Indicated total of 55 Mt at a grade of 71 g/t Ag for a total of 125 Moz Ag

- 61% increase in tonnage and a 14% increase in Ag ounces representing an increase of 15 Moz contained Ag

- Inferred total of 0.6 million tonnes at a grade of 26 g/t Ag for a total of 0.51 Moz contained Ag

- Sensitivity analyses show resiliency of the Ag resource to changes in metal price

- Inaugural BaSO4 and Zn resources are estimated as:

- Indicated: 36 Mt @ 7.4% BaSO4 and 0.45% Zn for a total content of 2.7 Mt BaSO4 and 354 million pounds (“Mlbs”) Zn

- Inferred: 17 Mt @ 3.9% BaSO4 and 0.71% Zn for a total content of 0.65 Mt BaSO4 and 258 Mlbs Zn

- Gold ounces have increased by 86% in the Inferred category for a new total of 17 Mt at a grade of 0.25 g/t Au and total Au content of 0.13 Moz

- One single pit for all metals at Waterloo deposit with a low strip ratio of 0.8:1

- The increased quantities of Ag and Au, the addition of two new critical minerals, and the larger single pit with low strip ratio has derisked the Calico Project

Further Growth Opportunities

- Silver: There remain further opportunities to expand the Ag mineralization below the base of the 2025 MRE in the northern region of the Waterloo deposit.

- Barite and Zinc: The indicated and inferred mineral resources for BaSO4 and Zn show clear potential to be upgraded into M&I via infill drilling and re-assays.

- Gold: Mineralization remains open along strike and at depth. Future work will target additional mineralization along strike with a particular focus on the high-grade structures.

- Langtry Property: Many areas under the Quaternary cover remain untested. In addition, the potential for BaSO4 and other metals have not yet been evaluated in detail at Langtry.

Ross McElroy, President and CEO for Apollo, commented: “The Calico Project continues to increase in value, scale and optionality. Already boasting one of the largest undeveloped silver deposits in the US, new data confirms the presence of additional minerals, such as barite and zinc, which are included on the US critical mineral list. These findings will contribute to our project development plans, including an upcoming Preliminary Economic Assessment (PEA). Notably, much of the mineralization occurs at shallow depths, resulting in a low economic strip rate. With a substantial land position, there is strong potential for further discoveries at Calico.”

CALICO PROJECT 2025 MINERAL RESOURCE ESTIMATE

The 2025 MRE focused on upgrading and expanding the Waterloo resource estimate from that declared in 2023 (see news release dated March 6, 2023). The most significant change in the 2025 MRE is the addition of BaSO4 and Zn to the Ag and Au mineral resources for the Waterloo deposit and updated mineral resource estimate cut-off (“COG”) grades for both the Waterloo and Langtry deposits. The Waterloo MRE now contains 125 Moz Ag in 55 Mt at an average grade of 71 g/t Ag in M&I categories, and 0.51 Moz Ag in 0.6 Mt at an average grade of 26 g/t Ag in the Inferred category. The Langtry MRE now contains 57 Moz Ag in 24 Mt at an average grade of 73 g/t Ag in the Inferred category.

In addition to its robust Ag resource, the Waterloo resource now contains 2.7 Mt BaSO4 and 354 Mlbs Zn in 36 Mt at an average grade of 7.4 % BaSO4 and 0.45 % Zn in the Indicated category, and 0.65 Mt BaSO4 and 258 Mlbs Zn in 17 Mt at an average grade of 3.9 % BaSO4 and 0.71 % Zn in the Inferred category. Also, 0.13 Moz oxide Au contained in 17 Mt at an average grade of 0.25 g/t Au in the Inferred category. Oxide Au mineralization has been drilled over 1,000 m strike length and remains open in multiple directions. Figures 1 and 2 present the mineral resource block model grade and classification for each of the metals, respectively.

Mineralization at Waterloo and Langtry is shallow and shows high continuity along the 1.8 km long strike length at Waterloo and 1.25 km at Langtry of the deposit. The 2025 MRE is calculated to a maximum open pit depth of approximately 192 m (630 ft) at Waterloo and approximately 149 m (490 ft) at Langtry for all metals. An open pit optimization is used to determine reasonable prospects for economic extraction, the calculated waste to mineralization tonnage ratio for the total resource at Waterloo is 0.8:1and 2.8:1 at Langtry.

Table 1: Calico Project 2025 MRE. Effective June 30, 2025.

| Precious Metals | ||||||||||

| Deposit | Metal | Class | Cutoff | Imperial Units | Metric Units | Contained Metal | ||||

| Grade | Volume (Myd3) | Tons | Grade | Volume (Mm3) | Tonnes | Grade | Moz | |||

| (g/t) | (Mst) | (oz/st) | (Mt) | (g/t) | ||||||

| Waterloo1 | Silver | Measured | AgEQ ≥ 47 | 23 | 48 | 2.2 | 18 | 43 | 75 | 104 |

| Indicated | 6.3 | 13 | 1.7 | 4.8 | 12 | 57 | 21 | |||

| Measured + Indicated | 29 | 61 | 2.1 | 22 | 55 | 71 | 125 | |||

| Inferred | 0.32 | 1.0 | 0.77 | 0.25 | 0.60 | 26 | 0.51 | |||

| Gold | Inferred | AgEQ ≥ 47 | 5.3 | 11 | 0.01 | 4.1 | 10 | 0.2 | 0.07 | |

| AgEQ < 47 and Au ≥ 0.17 | 3.6 | 7.5 | 0.01 | 2.8 | 6.8 | 0.3 | 0.06 | |||

| Inferred Total | 8.9 | 18.4 | 0.01 | 6.9 | 17 | 0.25 | 0.13 | |||

| Langtry2 | Silver | Inferred | Ag ≥ 43 | 13 | 27 | 2.1 | 9.9 | 24 | 73 | 57 |

| Base and Industrial Metals | |||||||||||

| Deposit | Metal | Class | Cutoff | Imperial Units | Metric Units | Contained Metal | |||||

| Grade | Volume (Myd3) | Tons | Grade | Volume (Mm3) | Tonnes | Grade | Mlbs | Mt | |||

| (g/t) | (Mst) | (%) | (Mt) | (%) | |||||||

| Waterloo1 | Barite | Indicated | AgEQ ≥ 47 | 19 | 40 | 7.4 | 15 | 36 | 7.4 | – | 2.7 |

| Inferred | 8.9 | 18 | 3.9 | 6.8 | 17 | 3.9 | – | 0.65 | |||

| Zinc | Indicated | AgEQ ≥ 47 | 19 | 40 | 0.45 | 15 | 36 | 0.45 | 354 | – | |

| Inferred | 8.9 | 18 | 0.71 | 6.8 | 17 | 0.71 | 258 | – | |||

- Ounces reported as troy ounces.

- Base-case resource estimate reported in Table 1 using 47 g/t Ag equivalent (“AgEQ”) and 0.17 g/t Au cut-off grades for Waterloo and 43 g/t Ag for Langtry.

- CIM definitions are followed for classification of the mineral resource.

- For the Waterloo Property, a AgEQ cut-off grade was calculated using the following variables: surface mining operating costs (US$2.8/st), processing costs plus general and administrative cost (US$26.5/st), Ag price (US$28/oz), BaSO4 price (US$120/t), Zn price (US$1.22/lb), Au price (US$2,451/oz), and metal recoveries (Ag 65%, Au 80%, BaSO4 85%, Zn 80%). For the Waterloo Property gold-only resources the Au cut-off grade was calculated using above Au price, Au recovery and gold-only processing costs plus general and administrative cost (US$8.2/st).

- For the Langtry Property, a silver-only equivalent cut-off grade was calculated using above Ag price, Ag recovery and silver-only processing costs plus general and administrative cost (US$24/st).

- Resources reported in Table 1 are constrained to within a conceptual economic pit shell targeting mineralized blocks within the specified cutoff grade limits shown in the table. Specific gravity for the mineralized zone is fixed at 2.44 t/m3 (13.13 ft3/st). For the Waterloo Property only the following drillhole grades were capped prior to estimation: Ag 450 g/t, Au 2 g/t, Ba 31% and Zn 7%.

- Totals may not represent the sum of the parts due to rounding.

- 1,2The 2025 MRE has been prepared by Derek Loveday, P. Geo., of Stantec Consulting Services Ltd., an independent Qualified Person, in co-operation with Mariea Kartick, P.Geo. (independent Qualified Person for drilling data QA/QC) and Johnny Marke P.G. (independent Qualified Person for resource estimation). The 2025 MRE was produced in conformance with NI 43-101. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that any mineral resource will be converted into a mineral reserve.

- No drilling was completed on the Waterloo Property and Langtry Property since the declaration of the 2023 MRE for Waterloo and 2022 MRE for Langtry. The 2025 MRE update accounts for changes in commodity prices, mining costs since 2022/2023, and barite testing of existing drill samples from the Waterloo Property.

Figure 1: Calico Project, 2025 Mineral Resource Block Model Grade

Figure 2: Calico Project, 2025 Mineral Resource Classification

Data Input

The 2025 MRE considered drilling information up to and including the most recently completed program in 2022, as well as geological information from Apollo’s 2021, 2022 and 2025 exploration activities. Drilling data supporting the 2025 MRE includes information from historic drilling data from 258 holes (18,679 m/61,282 ft), and 2022 drilling data from 85 holes (9,729 m/31,918 ft) for a total of 343 holes (28,407 m/93,199 ft). Nominal drill hole spacing is 30 x 46 m (100 x 150 ft) within the Measured portion of the 2025 MRE. Of the drill data set used, 332 holes are rotary or reverse circulation holes, and 11 holes are diamond drill holes.

For the 2025 MRE, additional re-assaying of 7,431 historical and recent drill pulps by X-Ray Fluorescence for barium (“Ba”) and barium oxide (“BaO)”) was completed or a total of 7,893 Ba samples used for estimation. The Ba as well as existing Zn assay (4-acid or aqua-regia) assay results were subject to a comprehensive quality assurance/quality control (“QAQC”) program that was reviewed by Mariea Kartick, P.Geo. (Stantec), an independent “Qualified Person” (or “QP”) as such term is defined within National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). In addition, detailed surface mapping and rock sampling were completed in the Burcham area of the Waterloo Property. The mapping and sampling provided a better understanding of the extent of the Au mineralization at surface and within the Pickhandle Formation as well as helped refine orientations of high-angle gold-bearing structures in the geologic model.

No additional Ag and Au assay data was used for the 2025 MRE from that acquired for the 2023 MRE. Material changes in Ag and Au resource in the 2025 MRE from the 2023 MRE are due to changing economics from 2023 to 2025 and inclusion of BaSO4 and Zn in the overall resource for the Waterloo deposit. Verification of drilling exploration data used for the 2025 MRE was performed by Mariea Kartick, P.Geo. (Stantec), an independent QP.

Cut-Off Grade and Reasonable Prospects for Eventual Economic Extraction

For the Waterloo MRE two base-case cut-off grades are used. A silver equivalent (“AgEQ”) cut-off grade of 47 g/t was calculated for a combined recovery of Ag, BaSO4, Zn and Au and where the combined mineralization of these metals was less than AgEQ COG, gold-only recovery were evaluated for a Au COG grade of 0.17 g/t. For Langtry silver-only recovery is considered for a lower Ag COG grade of 43 g/t. The above cut-off grades were determined using the following assumptions:

- Silver price of US$28 per troy ounce, gold price of US$2,451 per troy ounce, barite price of US$120 per mt and zinc price of US$ 1.22 per pound

- Combined metal (Ag, BaSO4, Zn, Au) processing costs of US$26.5 per short ton;

- Gold only processing cost of US$8.2 per short ton

- Silver only processing cost of US$24 per short ton

- Included in all processing costs are general and administrative costs of US$3 per short ton;

- Mining costs of US$2.8 per short ton; and

- Silver recovery of 65%, BaSO4 recovery of 85%, Zn recovery of 80% and Au recovery of 80%.

Metal recoveries are based on results from the 2022 Metallurgical Test Program (see news releases dated February 14, 2023, February 23, 2023 and May 2, 2023) and published recoveries for comparative operations. Silver, Zn and Au prices were calculated by averaging published monthly commodity prices from the last 24 months up to June 2025 based on data from the World Bank. Barite price was based on historical BaSO4 pricing trends from 2013 to 2023, the last year when publicly available barite pricing data was available. Changes in metal prices, optimized processing parameters and/or improved metal recoveries will all impact cut-off grade and any resultant MRE.

Reasonable prospects for eventual economic extraction were assessed by calculating recovered block revenues for silver grade blocks above cut-off grade, less surface mining costs, and generating an optimized Hexagon© MinePlan Pseudoflow economic pit shell at constant slope of 45 degrees that is constrained to within the property claim boundaries.

Sensitivity Analysis

A sensitivity analysis was undertaken to examine the impacts of varying the cut-off grades for AgEQ grades and tonnes for the Waterloo deposit within the base case economic pit shell and for Ag only grades and tonnes in the Langtry deposit. The available tonnes and average grade for each COG from within the 2025 MRE economic pit shell is shown in Table 2 for Waterloo and in Table 3 for Langtry.

Table 2: Sensitivity analysis of the grade and tonnage relationships at varying pit-constrained silver equivalent cut-off grades for the Waterloo Property. Effective June 30, 2025.

| Classification | AgEQ COG (g/t) | Tonnes (Mt) | Average Ag Grade (g/t) | Strip Ratio(t:t) | Contained Silver (Moz) |

| Measured | ≥ 35 | 49 | 67 | 0.6 | 109 |

| ≥ 40 | 47 | 71 | 0.6 | 107 | |

| ≥ 47 | 43 | 75 | 0.8 | 104 | |

| ≥ 50 | 42 | 77 | 0.8 | 103 | |

| ≥ 55 | 39 | 79 | 0.9 | 100 | |

| ≥ 60 | 36 | 83 | 1.1 | 97 | |

| Indicated | ≥ 35 | 14 | 52 | 0.6 | 23 |

| ≥ 40 | 13 | 54 | 0.6 | 22 | |

| ≥ 47 | 12 | 57 | 0.8 | 21 | |

| ≥ 50 | 11 | 58 | 0.8 | 21 | |

| ≥ 55 | 10 | 61 | 0.9 | 20 | |

| ≥ 60 | 9.3 | 64 | 1.1 | 19 | |

| Inferred | ≥ 35 | 0.8 | 23 | 0.6 | 0.6 |

| ≥ 40 | 0.7 | 25 | 0.6 | 0.6 | |

| ≥ 47 | 0.6 | 26 | 0.8 | 0.5 | |

| ≥ 50 | 0.6 | 26 | 0.8 | 0.5 | |

| ≥ 55 | 0.5 | 27 | 0.9 | 0.4 | |

| ≥ 60 | 0.4 | 29 | 1.1 | 0.4 |

Table 3: Sensitivity analysis of the grade and tonnage relationships at varying pit-constrained silver equivalent cut-off grades for the Langtry Property. Effective June 30, 2025.

| Classification | AgEQ | Tonnes (Mt) | Average Ag Grade (g/t) | Strip Ratio (t:t) | Contained Silver (Moz) |

| COG (g/t) | |||||

| Inferred | ≥ 35 | 29 | 68 | 2.1 | 63 |

| ≥ 40 | 26 | 71 | 2.5 | 59 | |

| ≥ 43 | 24 | 73 | 2.8 | 57 | |

| ≥ 50 | 19 | 81 | 4.1 | 49 | |

| ≥ 55 | 16 | 86 | 4.7 | 44 | |

| ≥ 60 | 13 | 92 | 5.8 | 39 |

Resource Estimation Methodology

The 2025 MRE was prepared in accordance with the requirements of NI 43-101 and applicable guidelines disseminated by CIM. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The quantity and grade of reported Inferred resources are uncertain in nature as there has been insufficient exploration to define these Inferred Resources as Indicated or Measured.

The 2025 MRE resource block model was oriented along regional strike of mineralization controlling range front fault (Calico fault) and bedding, at approximately 045 degrees. Metal grades were estimated using ordinary kriging into a 20 ft x 20 ft x 10 ft block model using 5 ft drill hole composites and a bulk density of 2.44 t/m3 (13.13 ft3/st). The block models are constrained to the west by the Calico range front fault and to the east by the contact between the mineralized Barstow formation sedimentary rocks and the Pickhandle formation rhyolitic rocks. Both structures are mineralization controlling features. A grade capping evaluation was performed, and for the Waterloo Property only the following drillhole grades were capped prior to estimation: Ag 450 g/t, Au 2 g/t, Ba 31% and Zn 7%. No grade capping was deemed necessary for the Langtry Property.

The MRE was internally audited, and peer reviewed by Stantec prior to being released to the Company and being declared final. Further, the Company completed an internal review of the 2025 MRE data supplied by Stantec. A full description of the data and the data verification process will be detailed in the technical report associated with the 2025 MRE, which will be prepared in accordance with NI 43-101 Standards of Disclosure for Mineral Projects and filed within 45 days of this news release on the Company’s website and on SEDAR+ at www.sedarplus.ca.

SAMPLING AND QUALITY ASSURANCE/QUALITY CONTROL

Additional sampling since the 2023 MRE and prior to the 2025 MRE included re-assaying of 7,797 drill pulps (primary plus QAQC) by X-Ray Fluorescence for Ba and BaO at ALS in Reno, Nevada and a metallurgical testing program for barite from five PQ drill core composites was completed at McClelland Laboratories Inc., in Sparks, Nevada. Results from the metallurgical test were presented in a prior News Release (May 2, 2023).

Pulps from historical and the 2022 drill program were submitted to ALS Reno for sample preparation and Ba analysis. Historical pulps were homogenized by light pulverizing (HOM-01) and the pulverisers were washed between samples (WSH22). After preparation, splits of prepared pulps are securely shipped to ALS Vancouver, British Columbia for analysis. Most of the pulps were analyzed using X-Ray Fluorescence Spectroscopy (“XRF”) methods ME-XRF10, with the exception of a few samples that were analysed with ME-XRF15c (samples with high sulphide content) or ME-XRF26 (selected samples for a more complete suite of elements). The detection limits for Ba with ME-XRF10 is between 0.01 and 45%, between 0.01 and 50% with ME-XRF15C and for BaO with ME-XRF26 0.01-66%. All analyses were completed at ALS Vancouver.

The Company maintains its own comprehensive quality assurance and quality control (QA/QC”) program to ensure best practices in sample preparation and analysis for samples. The QA/QC program includes the insertion and analysis of certified reference materials, commercial pulp blanks, preparation blanks, and field duplicates to the laboratories. Apollo’s QA/QC program includes ongoing auditing of all laboratory results from the laboratories. The Company’s Qualified Person is of the opinion that the sample preparation, analytical, and security procedures followed are sufficient and reliable. The Company is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data reported herein.

ABOUT THE PROJECT

Location

The Calico Project is located in San Bernardino County, California and comprises the adjacent Waterloo, Langtry, and Mule properties which total 8,283 acres. The Calico Project is 15 km (9 miles) from the city of Barstow, 5 km (3 miles) from commercial electric power and has an extensive private gravel road network spanning the property.

Geology and Mineralization

The Calico Project is situated in the southern Calico Mountains of the Mojave Desert, in the south-western region of the Basin and Range tectonic province. This 15 km (9 mile) long northwest-southeast trending mountain range is dominantly composed of Tertiary (Miocene) volcanics, volcaniclastics, sedimentary rocks and dacitic intrusions. Mineralization at Calico comprises high-level low-sulfidation silver-dominant epithermal vein-type, stockwork-type and disseminated-style associated with northwest-trending faults and fracture zones and mid-Tertiary (~19-17 Ma) volcanic activity. Calico represents a district-scale mineral system endowment with approximately 6,000 m (19,685 ft) in mineralized strike length controlled by the Company. Silver and gold mineralization are oxidized and hosted within the sedimentary Barstow Formation and the upper volcaniclastic units of the Pickhandle formation along the contact between these units.

The 2025 MRE for Waterloo Property comprises 125 Moz Ag in 55 Mt at an average grade of 71 g/t Ag (M&I categories), 0.51 Moz Ag in 0.60 Mt at an average grade of 26 g/t Ag (Inferred category), 130,000 oz gold in 17 Mt at an average grade of 0.25 g/t gold (Inferred category), 2.7 Mt BaSO4 and 354 Mlbs Zn in 36 Mt at an average grade of 7.4 % BaSO4 and 0.45 % Zn (Indicated category), and 0.65 Mt BaSO4 and 258 Mlbs Zn in 17 Mt at an average grade of 3.9 % BaSO4 and 0.71 % Zn (Inferred category). The 2025 MRE for Langtry property comprises 57 Moz Ag in 24 Mt at an average grade of 73 g/t Ag (Inferred category).

QUALIFIED PERSONS

The scientific and technical data contained in this news release was reviewed, and approved by Derek Loveday, P. Geo., Johnny Marke P.G. and Mariea Kartick, P.Geo., from Stantec and are Qualified Persons independent of the Company. Mr. Loveday is a registered Professional Geoscientist in Alberta, Canada, and Mr. Marke is a registered Professional Geologist in Oregon, USA and both are responsible for the mineral resource estimation. Ms. Kartick is a registered Professional Geoscientist in Ontario, Canada and is responsible for data QA/QC.

This news release has also been reviewed and approved by Isabelle Lépine, M.Sc., P.Geo., Apollo’s Director of Mineral Resources. Ms. Lépine is a registered Professional Geoscientist in British Columbia, Canada and is not independent of the Company.

ABOUT APOLLO SILVER CORP.

Apollo Silver is advancing one of the largest undeveloped primary silver projects in the US. The Calico Project hosts a large, bulk minable silver deposit with significant barite credits – a critical mineral essential to the US energy and medical sectors. The Company also holds an option on the Cinco de Mayo Project in Chihuahua, Mexico, which is host to a major carbonate replacement (CRD) deposit that is both high-grade and large tonnage. Led by an experienced and award-winning management team, Apollo is well positioned to advance the assets and deliver value through exploration and development.

Please visit www.apollosilver.com for further information.

ON BEHALF OF THE BOARD OF DIRECTORS

Ross McElroy

President and CEO

For further information, please contact:

Email: info@apollosilver.com

Telephone: +1 (604) 428-6128

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release includes “forward-looking statements” and “forward-looking information” within the meaning of Canadian securities legislation. All statements included in this news release, other than statements of historical fact, are forward-looking statements including, without limitation, statements with respect to the potential of the Calico Project and its overall investment attractiveness; the expectation that the Calico Project will continue to increase in value, scale and optionality; the potential economic significance of the updated mineral resource estimate, including the newly defined barite and zinc resources in addition to silver and gold; the potential recovery rates; the potential to further expand the resource estimate and upgrade its confidence level, including prospective silver, gold, barite and zinc mineralization on strike and at depth; the potential impact of barite and zinc being designated as critical minerals in the United States; assumptions regarding mineralization at shallow depths and strip ratios; timing and execution of future planned drilling, exploration, preliminary engineering and additional metallurgical activities; timing of commencement and completion of a preliminary economic assessment or other technical studies; the potential for additional discoveries and overall project development; and the Company’s ability to advance, develop, and permit the Calico Project. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, “potential”, “target”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof.

Forward-looking statements are based on the reasonable assumptions, estimates, analysis, and opinions of the management of the Company made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management of the Company believes to be relevant and reasonable in the circumstances at the date that such statements are made. Forward-looking information is based on reasonable assumptions that have been made by the Company as at the date of such information and is subject to known and unknown risks, uncertainties and other factors that may have caused actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks associated with mineral exploration and development; metal and mineral prices; availability of capital; accuracy of the Company’s projections and estimates; realization of mineral resource estimates, interest and exchange rates; competition; stock price fluctuations; availability of drilling equipment and access; actual results of current exploration activities; government regulation; political or economic developments; environmental risks; insurance risks; capital expenditures; operating or technical difficulties in connection with development activities; personnel relations; and changes in Calico Project parameters as plans continue to be refined. Forward-looking statements are based on assumptions management believes to be reasonable, including but not limited to the price of silver, gold zinc and barite; the demand for silver, gold, zinc and barite; the ability to carry on exploration and development activities; the timely receipt of any required approvals; the ability to obtain qualified personnel, equipment and services in a timely and cost-efficient manner; the ability to operate in a safe, efficient and effective matter; and the regulatory framework regarding environmental matters, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward looking information contained herein, except in accordance with applicable securities laws. The forward-looking information contained herein is presented for the purpose of assisting investors in understanding the Company’s expected financial and operational performance and the Company’s plans and objectives and may not be appropriate for other purposes. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Photos accompanying this announcement are available at

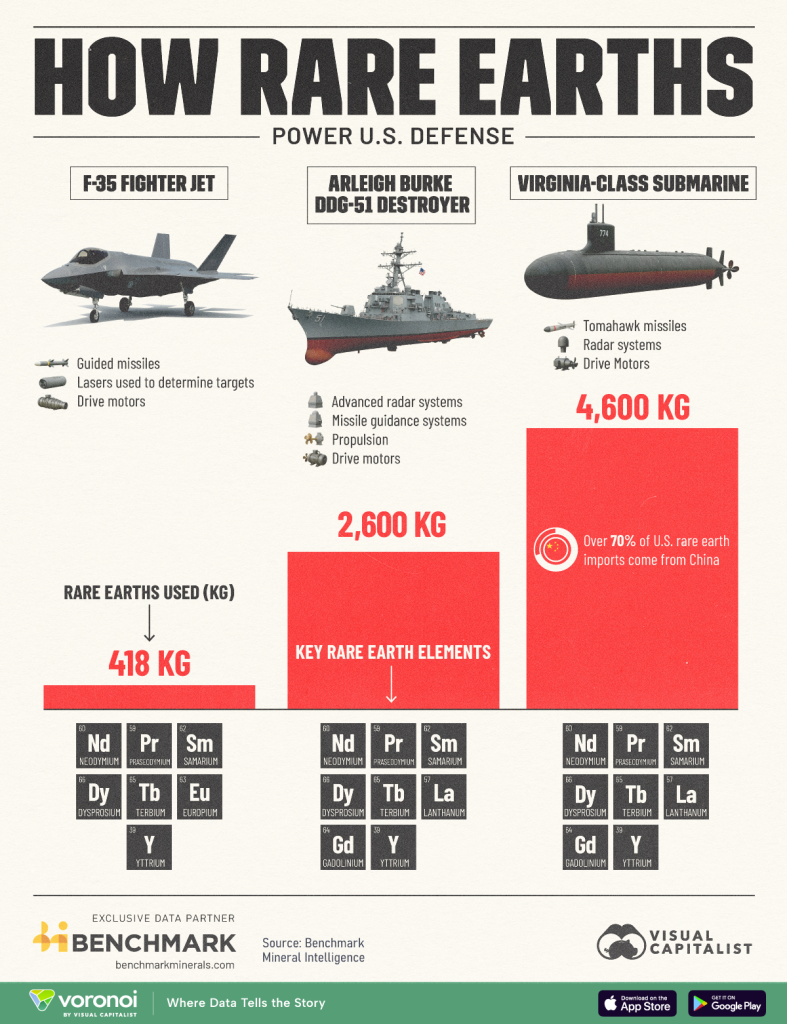

How Rare Earths Power U.S. Defense

Rare earth elements (REEs) are essential components of advanced military technology. From fighter jets to submarines, these critical minerals power key systems that give the U.S. military a strategic edge.

This infographic explores the quantities of REEs used in major U.S. defense platforms and highlights their specific applications in modern warfare.

It reveals how different military equipment relies on rare earths not just in bulk, but for highly specialized roles, from laser-guided weapons to stealth capabilities.

Key Takeaways

- U.S. military platforms like the Virginia-class submarine and Arleigh Burke destroyer require thousands of kilograms of rare earth elements (REEs).