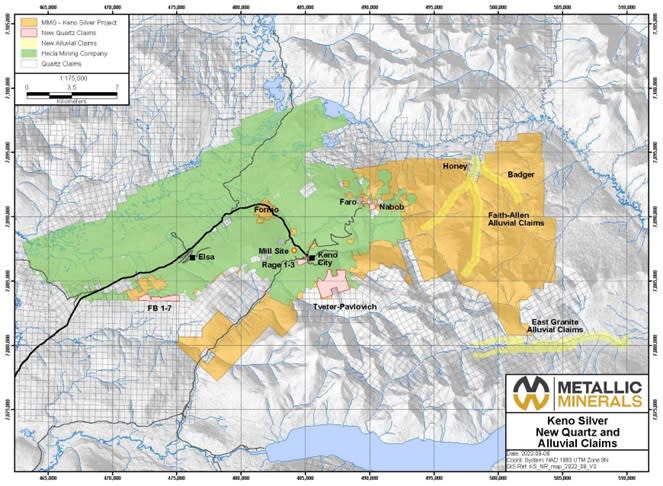

VANCOUVER, BC / ACCESSWIRE / September 7, 2022 / Metallic Minerals (TSX.V:MMG)(OTCQB:MMNGF) (“Metallic Minerals“, or the “Company“) is pleased to announce that it has acquired 100% interest in 5 square kilometres (“km2“) of new mineral properties in the Keno Hill silver district of Canada’s Yukon Territory, bringing the Company’s total district hard-rock land position to 171 km2. Each of these newly acquired properties have demonstrated the presence of high-grade Keno-style silver-lead-zinc mineralization and are adjacent to, or contiguous with, Metallic Minerals’ Keno Silver property and the Keno Hill properties now owned by Hecla Mining following the completion of the acquisition of Alexco Resources (see Figure 1).

Acquisition Highlights

- Nabob and Faro Claims – In the Keno Summit area, the Nabob claim hosts the Keno Hill “Main” vein and its numerous offshoots where drilling in 2012 returned impressive results (NA-12-02, 0.4 meters (m) of 4,090.6 grams per ton (g/t) Silver Equivalent (Ag Eq) (3,140 g/t Ag, 0.86 g/t Au, 22.37% Pb and 0.25% Cu), that led to high-grade surface mining of 65 tons of ore material over 4,200 g/t Ag (see Table 1)1. The Nabob Main vein was successfully targeted by two Metallic Minerals drill holes in its 2022 field program and assay results are pending.

- Rage 1-3 Claims – The Rage claims cover the Rain and Shine target area where a typical Keno-style Ag-Pb-Zn vein has been sampled at surface and returned grades to 889.1 g/t Ag Eq in grab samples from the vein. The Rain and Shine mineralization appears to occur at the intersection of the Flame & Moth and Onek trends, which host 41.5 million ounces of silver (“Moz Ag”) and 4.3 Moz Ag respectively, in mineral reserves and M&I resources2. Well located regarding infrastructure, the Rage claims are crossed by the Bellekeno mine-to-mill haul road, only 600 meters from the Hecla Mill.

- The Tveter-Pavlovich claims on the south side of Sourdough Hill, 500 meters from Hecla’s Bellekeno mine, is associated with extension of structures from the Bellekeno deposit which has produced 7.9 Moz Ag5 and hosts 4.75 Moz Ag in current reserves and M&I resources2. These potential extensions were tested by drilling at the Tveter-Pavlovich claim boundary in 2018 returning 3.3 m of 469.3 g/t Ag Eq (63.1 g/t Ag, 0.93% Pb, 0.92% Zn) including 0.2 m of 1,120.5 g/t Ag Eq (832.0 g/t Ag, 3.34%1)4. In addition to the Bellekeno vein extensions, historic exploration identified and exposed two additional vein occurrences with high-grade Ag-Pb-Zn and gold potential called the Mo vein showings on the property3.

Metallic Minerals President, Scott Petsel, stated, “We are very pleased to have been able to add these significant and very prospective properties in the high-grade Keno Hill silver district, and to immediately initiate drill testing of the Nabob vein as a historically drilled, potentially ‘resource-ready’ target.”

“Additionally, Metallic’s 171 km2 land position is the second largest in the prolific Keno Hill camp and now contains five ‘resource-ready’ advanced-stage targets, 11 ‘growth-stage’ targets with initial positive drilling and over 20 early-stage drill-ready targets with numerous additional untested soil anomalies of greater than 6.0 g/t Ag Eq., all in a district with over 100 years of mining history and over 300 million ounces of past silver production and current resources5. We are currently wrapping up our exploration program at the Keno Silver Project and we anticipate receiving initial results over the coming months from our core drilling and surface sampling programs including results from the Nabob target drilling.”

Keno District Alluvial Claims

In addition to the recently acquired hard-rock properties mentioned above, Metallic Minerals has been assembling, through acquisition and staking, a significant package of alluvial claims and leases in prospective areas in the Keno District. These claim groupings, including the Granite Creek East claims, the Allen/Faith Creek Claims and the Badger and Honey claims total over 20 miles of prospective alluvial deposits to explore and develop. Claims in the Granite Creek area have produced over 16,000 ounces of gold between 2015 and 2020 and gold production continues in multiple operations6. Metallic intends to pursue royalty agreements with known operators interested in alluvial claim development and production. A further update on Metallic’s alluvial claim and activities at both Keno and in the Klondike is expected in the coming weeks.

Upcoming Events

Metals Investor Forum – Metallic Minerals will be participating in the upcoming Metals Investor Forum in Vancouver on September 9-10, during which the Company will provide a live presentation with Q&A. For more information and to register click here.

Precious Metals Summit – Metallic Minerals will be attending the 2022 Precious Metals Summit in Beaver Creek, Colorado, where the Company will participate in 1-on-1 meetings with institutional investors and deliver a live presentation update. For more information and to register, click here.

Figure 1 – Keno Silver District Map Highlighting Metallic Minerals Property and New Acquisitions

Table 1 – Highlight Assay Results from Historic Drilling and Sampling at Recent Acquisition Targets

| Target Area | DDH or Sample ID | Sample Type | From (m) | To (m) | Width (m) | Ag Eq (g/t)1 | Ag (g/t) | Au (g/t) | Pb (%) | Zn (%) | Cu (%) |

| Rage | 113362 | Grab | – | – | – | 565.3 | 56.8 | 0.03 | 0.22 | 10.54 | 0.03 |

| Rage | 113363 | Grab | – | – | – | 193.0 | 26.0 | 0.31 | 0.07 | 2.80 | 0.03 |

| Rage | 113364 | Grab | – | – | – | 660.4 | 198.0 | 4.51 | 0.40 | 0.10 | 0.14 |

| Rage | 10-06-LB | Grab | – | – | – | 889.1 | 36.0 | 1.41 | 0.05 | 14.42 | 0.38 |

| Rage | 11-06-LB | Grab | – | – | – | 301.5 | 263.0 | 0.22 | 0.38 | 0.07 | Nil |

| Rage | RS-01-06 | Grab | – | – | – | 326.7 | 275.0 | 0.25 | 0.59 | 0.12 | Nil |

| Rage | RS-02-06 | Chip | – | – | – | 259.3 | 28.0 | 0.01 | 0.05 | 4.87 | Nil |

| Nabob2 | NA-12-02 | Core | 21.24 | 24.64 | 3.4 | 637.5 | 466.5 | 0.12 | 4.06 | 0.08 | 0.01 |

| Nabob2 | Incl. | Core | 21.24 | 21.64 | 0.4 | 4090.6 | 3140.0 | 0.86 | 22.37 | 0.25 | 0.09 |

| Nabob2 | NA-12-03 | Core | 22.5 | 23.7 | 1.2 | 292.5 | 169.7 | 0.13 | 2.69 | 0.15 | 0.01 |

| Nabob2 | NA-12-04 | Core | 16.76 | 17.76 | 1 | 236.7 | 122.0 | 0.07 | 2.33 | 0.40 | 0.01 |

| Nabob2 | NA-12-06 | Core | 20 | 20.75 | 0.75 | 240.4 | 200.0 | 0.13 | 0.60 | 0.09 | 0.01 |

| Nabob2 | NA-12-11 | Core | 4.75 | 5.55 | 0.8 | 1202.0 | 1019.0 | 0.29 | 3.60 | 0.28 | 0.05 |

| Nabob2 | NA-12-11 | Core | 16.1 | 16.7 | 0.6 | 251.6 | 172.0 | 0.05 | 1.56 | 0.27 | 0.03 |

| Nabob2 | NA-12-12 | Core | 7.05 | 8.25 | 1.2 | 1125.4 | 798.7 | 0.41 | 7.10 | 0.36 | 0.02 |

| Nabob2 | Incl. | Core | 7.05 | 7.45 | 0.4 | 2951.9 | 2142.0 | 0.71 | 18.63 | 0.67 | 0.04 |

| Nabob2 | NA-12-13 | Core | 8.6 | 10.1 | 1.5 | 211.5 | 119.2 | 0.44 | 0.58 | 0.60 | 0.01 |

| Nabob2 | NA-12-14 | Core | 5.2 | 6.1 | 0.9 | 779.8 | 655.0 | 0.44 | 1.56 | 0.34 | 0.08 |

| Nabob2 | NA-12-15 | Core | 11.35 | 13.00 | 1.65 | 455.3 | 394.0 | 0.15 | 0.40 | 0.65 | 0.01 |

| Tveter -Pavlovich3 | K-18-0695 | Core | 285.3 | 289.5 | 4.15 | 83.8 | 33.9 | 0.01 | 0.82 | 0.38 | – |

| incl. | Core | 287.65 | 288 | 0.35 | 724.2 | 354.0 | 0.01 | 8.99 | 0.61 | – | |

| Tveter -Pavlovich3 | K-18-0697 | Core | 230.5 | 233.8 | 3.3 | 469.3 | 63.1 | 0.01 | 0.93 | 0.92 | – |

| Incl. | Core | 230.5 | 230.7 | 0.2 | 1120.5 | 832.0 | 0.14 | 3.34 | 3.17 | – |

Table Notes: 1 – Silver equivalent (Ag Eq) values assume Ag $19/oz, Pb $1.05/lb, Zn $1.30/lb, Au $1,800/oz, Cu $3.00/lb and 100% metallurgical recovery. Sample intervals are based on measured drill intercept lengths. 2 – Historic Nabob drill samples were subject to highly selective sampling procedures for the purpose of evaluating high-grade mining opportunities and may not be representative of the entire mineralized widths of the Nabob vein system. 3 – Drilled by Alexco Resources at the Tveter-Pavlovich property boundary while the property was under option to Alexco Resources.

Nabob Target Area

The Nabob target, located in the Keno Summit target area, directly adjoins other holdings for Metallic. It was one of the original four claims filed on the Keno Summit discovery in 1919. The fact that it still has exposed high-grade Ag-Pb-Zn vein material, and in the 2010s saw 65 tons of very-high-grade silver production, emphasizes the overall prospectivity of this under-explored part of the district.

Hosted by the Nabob claim the “Main” vein and its transverse offshoots are exposed for 250 m on strike. Work completed in 2012 included rock sampling, trenching, geophysics and the drilling of 17 holes (490.7 m). As reported from the 2012 work, a bulk sample ran 1,618 g/t Ag, 18.5% Pb and 0.51 g/t Au underscoring the high-grade nature of the Nabob target1. After review of the available drill data and surface exposures, Metallic Minerals chose to drill two holes at the Nabob target in 2022 which have successfully encountered the vein structure and assay results are pending. The Nabob claim acquisition is accompanied by the equally prospective but undrilled Faro claim, also in the Keno Summit area. Together the claims enhance and expand Metallic’s holdings at the Keno Summit and add to the potential to rapidly develop a resource for the target area.

Rain and Shine (Rage 1-3) Target Area

The Rage claims, vended with the Nabob and Faro claims, host the Rain and Shine Ag-Pb-Zn-Au vein target. Mineralization at Rain and Shine is exposed at surface and has been sampled by Metallic Minerals returning substantial grades in grab sampling (see Table 1). The proximity of the Rain and Shine target to existing infrastructure, including Hecla’s operating mill and the Bellekeno haul road as well as being 750 m from underground developments at Hecla’s Flame & Moth mine (41.5 million silver ounces of combined reserves and M&I resources2), bode well for its exploration and development prospects. Mineralization at Rain and Shine is known to have occasional high grade gold numbers associated with the typical Ag-Pb-Zn mineralization and the exposed vein system is parallel to, and similar in style and mineralogy to the vein system being mined at the Flame & Moth. The Rain and Shine is a drill-ready target that Metallic will evaluate for drilling in 2023.

Tveter-Pavlovich Target Area

Consisting of 23 quartz mineral claims (Mo 1-8, Caroline 1-2, Rex 1-2, Boso 1-5, Casy 1-3, Bonny, Chrissie G and the Windy 1), the Tveter-Pavlovich claim block was optioned by Alexco Resources in 2017 with four holes drilled to test the extension of veins in the hanging wall of the Bellekeno 48 vein in the Bellekeno mine. Two of these drill holes encountered significant mineralization up to 1,120.5 g/t Ag Eq (see Table 1) with mineralization open to expansion with follow-up drilling.

Mineralization also outcrops on the Tveter-Pavlovich claims at the Mo target where historic trenching, dozing, shafting and the driving of an adit have exposed two parallel veins with select high-grade sample assays up to 9,771 g/t Ag, 80.5% Pb and 1.7 g/t Au3. Additionally, trenching in 1980 is reported to have exposed a segment of the Mo vein which ran up to 13,719 g/t Ag.

About Metallic Minerals

Metallic Minerals Corp. is an exploration and development stage company, focused on silver, gold and copper in the high-grade Keno Hill and La Plata mining districts of North America. Our objective is to create shareholder value through a systematic, entrepreneurial approach to making exploration discoveries, growing resources and advancing projects toward development. Metallic Minerals has consolidated the second-largest land position in the historic Keno Hill silver district of Canada’s Yukon Territory, directly adjacent Hecla Mining’s operations, with more than 300 million ounces of high-grade silver in past production and current M&I resources. Hecla Mining Company, the largest primary silver producer in the USA and third largest in the world, completed the acquisition of Alexco in September 2022. Metallic recently announced the inaugural NI 43-101 mineral resource estimate for its La Plata silver-gold-copper project in southwestern Colorado. The Company also continues to add new production royalty leases on its holdings in the Klondike gold district in the Yukon. All three districts have seen significant mineral production and have existing infrastructure, including power and road access. Metallic Minerals is led by a team with a track record of discovery and exploration success on several major precious and base metal deposits, as well as having large-scale development, permitting and project financing expertise.

About the Metallic Group of Companies

The Metallic Group is a collaboration of leading precious and base metals exploration and development companies, with a portfolio of large, brownfields assets in established mining districts adjacent to some of the industry’s highest-grade producers of silver and gold, platinum and palladium, and copper. Member companies include Metallic Minerals in the Yukon’s high-grade Keno Hill silver district and La Plata silver-gold-copper district of Colorado, Granite Creek Copper in the Yukon’s Minto copper district, and Stillwater Critical Minerals in the Stillwater PGE-nickel-copper district of Montana and Kluane district in the Yukon. The founders and team members of the Metallic Group include highly successful explorationists formerly with some of the industry’s leading explorer/developers and major producers. With this expertise, the companies are undertaking a systematic approach to exploration and development using new models and technologies to facilitate discoveries in these proven, but under-explored, mining districts. Members of the Metallic Group have been recognized as recipients of awards for excellence in environmental stewardship demonstrating commitment to responsible resource development and appropriate ESG practices. The Metallic Group is headquartered in Vancouver, BC, Canada, and its member companies are listed on the Toronto Venture, US OTCQB and Frankfurt stock exchanges.

Footnotes

- Blackburn, L. R., Assessment Report, Nabob Project, Keno Hill Yukon Territory, Canada, Keno Hill Exploration Corp., Yukon, 2014

- Alexco Resource Corp Technical Report, titled “NI 43-101 Technical Report on Updated Mineral Resource and Reserve Estimate of the Keno Hill Silver District” with an effective date of April 1, 2021 and issue date of May 26, 2021.

- Yukon MINFILE – Mineral Occurrence 105M 013 – Version 2004-1. Yukon Geological Survey, Energy, Mines and Resources, Yukon Government, 2004.

- Stammers, et al., Assessment Report, 2018 Pavlovich Option Sourdough Hill, Alexco Resources, Yukon, 2019.

- Cathro, R. J., Great Mining Camps of Canada 1. The History and Geology of the Keno Hill Silver Camp, Yukon Territory. Geoscience Canada, Sept. 2006. ISSN 1911-4850.

- Steinke, et al., Public Presentation, Placer Gold Settings in an Alpine Glaciated Environment, Granite Creek, Yukon, Placer Forum 2022.

References to adjoining properties are for illustrative purposes only and are not necessarily indicative of the exploration potential, extent or nature of mineralization or potential future results of the Company’s projects.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Website: www.mmgsilver.com Phone: 604-629-7800

Email: cackerman@mmgsilver.com Toll Free: 1-888-570-4420

Qualified Person

The disclosure in this news release of scientific and technical information regarding exploration projects on Metallic Minerals’ mineral properties has been reviewed and approved by Scott Petsel, P.Geo., President, who is a Qualified Person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

Forward-Looking Statements

This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Metallic Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Group Ten and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Metallic Minerals Corp.

View source version on accesswire.com:

https://www.accesswire.com/714932/Metallic-Minerals-Announces-Acquisition-of-Additional-High-Grade-Claims-in-the-Keno-Hill-Silver-District