Website: https://www.grizzlydiscoveries.com/

Email: info@grizzlydiscoveries.com

Phone: 780-712-3559

Click Image to view file:

Website: https://www.grizzlydiscoveries.com/

Email: info@grizzlydiscoveries.com

Phone: 780-712-3559

Click Image to view file:

See visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Today, gold prices sit roughly 40% above their previous inflation-adjusted peak seen in 1980.

Despite tumbling 54% from the October 20th high of $4,380, gold remains at historically elevated levels, as investors rely on the metal as a reliable store of value. In total, the world’s above-ground gold stock would fit into a cube approximately 22.3 meters tall (73 feet).

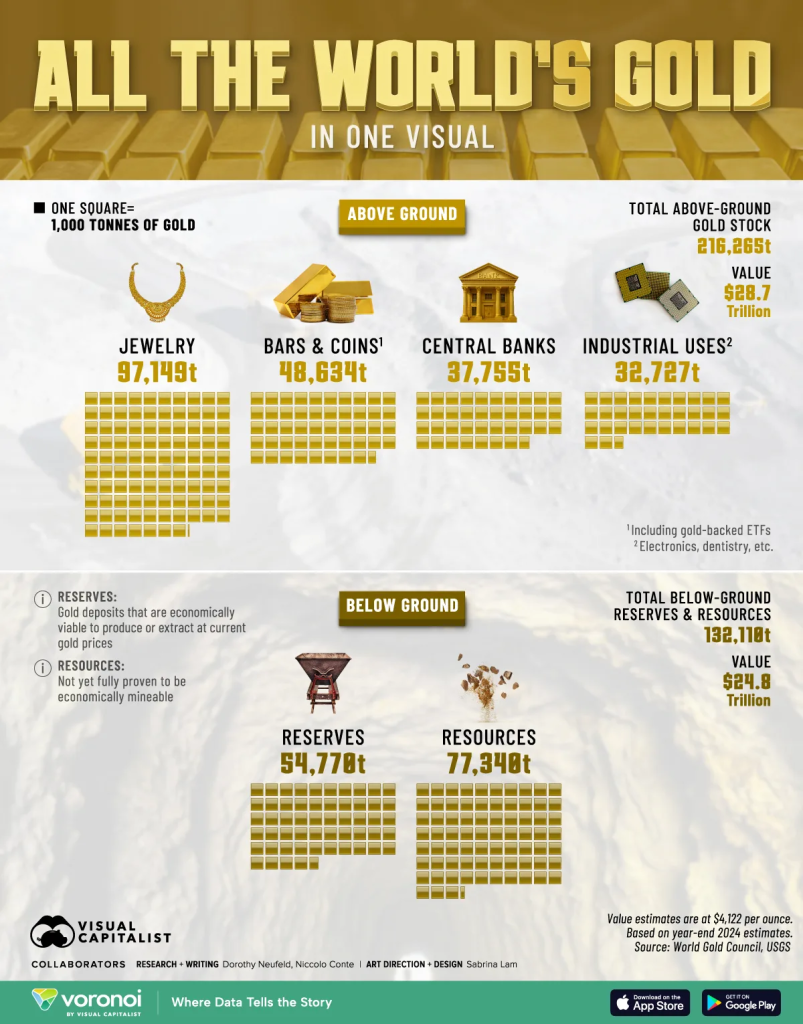

This graphic shows the global supply of gold as of year-end 2024, based on data from the World Gold Council.

Below, we show all the world’s gold, covering both above and below-ground stock:

| Category | Tonnes of Gold (t) |

|---|---|

| Jewelry | 97,149 |

| Bars and coins (including gold backed ETFs) | 48,634 |

| Central banks | 37,755 |

| Industrial uses (electronics, dentistry, etc.) | 32,727 |

| Reserves | 54,770 |

| Resources | 77,340 |

Jewelry is the largest category of above-ground gold, at 97,149 tonnes.

Last year, India was the largest buyer of gold jewelry globally, with 560 tonnes in purchases. China ranked second, with 510 tonnes. Across the region, gold is deeply intertwined with major life events such as weddings and cultural traditions.

Bars, coins, and gold-backed ETFs make up 48,634 tonnes of gold, exceeding central bank holdings (37,755 tonnes) by a substantial margin. Overall, the U.S., Germany, and Italy held the most gold in their central bank reserves as of year-end 2024.

Meanwhile, industrial uses such as electronics and dentistry make up 32,727 tonnes. Many semiconductor chips, for instance, use gold for coating or bonding wires thanks to its conductivity.

Source: https://www.visualcapitalist.com/all-of-the-worlds-gold-in-one-visual/

Vancouver, British Columbia–(Newsfile Corp. – December 4, 2025) – Elemental Royalty Corporation (TSXV: ELE) (NASDAQ: ELE) (“Elemental” or the “Company”) is pleased to announce that Bronco Creek Exploration Inc. (“BCE“), a wholly owned subsidiary of Elemental, has executed an option agreement (the “Agreement”) with First Quantum Minerals Limited (“First Quantum“), an Ontario, Canada, corporation (TSX: FM) for the Hachita project (the “Project“) in order to explore for porphyry copper-gold style mineralization in southwestern New Mexico, U.S.

The Agreement provides Elemental with an execution payment, staged option payments, and required work commitments on the Project during the earn-in period. Additionally, upon earn-in for the Project, Elemental will receive a 3% net smelter return (“NSR“) royalty interest, annual advanced royalty (“AAR“) and milestone payments, providing the Company with a strong foundation for future upside as the Project advances.

Highlights

The Project was acquired by staking of open ground after recognizing untested targets in the underexplored Sylvanite District during regional generative exploration efforts in the Laramide belt of southwestern U.S. The agreement serves as another example of generating compelling district-scale opportunities and organically growing the company’s royalty portfolio through its royalty generation efforts and technical expertise.

Commercial Terms Overview

Under the terms of the Agreements, First Quantum can earn 100% interest in the Project by providing: a) an execution payment totaling US$50,000, b) option payments totaling US$750,000, and c) cumulative exploration expenditures of US$6,000,000 over the five-year term of the option agreement.

Upon option exercise by First Quantum, Elemental will retain a 3% net smelter royalty on the Project; 1% of the royalty may be bought back for a total of US$5,000,000 on or before the fifth anniversary of a published resource. First Quantum will make Advanced Annual Royalty payments to Elemental of US$100,000 upon each anniversary of the closing date until the completion of either a Feasibility Study or a Development Decision. In addition, First Quantum will make Project milestone payments consisting of: a) US$500,000 upon completion of a Feasibility Study, and b) US$2,500,000 upon a development decision.

David M. Cole, Chief Executive Officer of Elemental, commented: “This transaction on the Hachita Project represents another excellent example of Elemental’s impressive technical expertise in identifying prospective targets in underexplored jurisdictions and thereby attracting world-class exploration partners. We look forward to working with First Quantum to advance Hachita and seeing the project progress further through a formal exploration campaign. Project generation remains a core tenet of our business model as we continue to build our portfolio of royalty interests.”

Hachita Project Overview

Hachita is located approximately 95 km SE of Lordsburg, New Mexico, in the Sylvanite Mining District. The Hachita project targets Laramide porphyry copper-gold and skarn mineralization in an underexplored district in the eastern portion of the Laramide Porphyry Belt. Multiple square kilometer overlapping alteration zones, robust geochemical anomalies, and coincident geophysical responses indicate the potential for two distinct targets on the Project: a porphyry copper-gold system at the Western Target and a copper-gold skarn system at the Copper Dick Extension (“CDE”) Target.

The Western Target is a porphyry copper-gold system exposed at surface with widespread sericite-pyrite alteration, locally abundant quartz veins, and copper oxide mineralization. Complex porphyry-style alteration zonation is exposed over a two by three square kilometer area, indicative of large-scale hydrothermal system. The system is faulted and rotated by post-mineral normal faults. The observations to-date are consistent with the shallower, upper pyrite halo portion of the porphyry system preserved in the northwest with portions of the deeper parts of the system outcropping to the southeast. The proximal, higher temperature and potentially higher-grade core of the system representing the primary target here has yet to be found. Airborne drone magnetics delineated a magnetic low which correlates well with the outcropping sericite-pyrite alteration zone. Additionally, historical induced polarization (“IP“) data displays a strong chargeability response within the target area, which may represent increasing sulfide content at depth.

The Copper Dick Extension Target is a copper-gold bearing garnet-pyroxene skarn target exposed at surface near the historical Copper Dick Mine. Mineralization at the mine is truncated to the north by a post-mineral normal fault, indicating the skarn mineralization and the Cretaceous carbonate host rocks that serve as an ideal host may be preserved at depth in the hanging wall. Historical IP data support this interpretation; a strong chargeability response over the Copper Dick Extension Target may represent the presence of sulfide mineralization at depth.

This transaction is an example of the execution of the royalty generation business model in providing turn-key and drill ready exploration projects to partner companies in exchange for royalty interests and pre-production cash flow.

David M. Cole

CEO and Director

For more information, please contact:

| David M. Cole | info@elementalroyalty.com |

| CEO | |

| Tara Vivian-Neal | info@elementalroyalty.com |

| Investor Relations |

TSXV: ELE | NASDAQ: ELE | ISIN: CA28619K1093 | CUSIP: 28619K109

About Elemental Royalty Corporation.

Elemental is a new mid-tier, gold-focused streaming and royalty company with a globally diversified portfolio of 16 producing assets and more than 200 royalties, anchored by cornerstone assets and operated by world-class mining partners. Formed through the merger of Elemental Altus and EMX, the Company combines Elemental Altus’s track record of accretive royalty acquisitions with EMX’s strengths in royalty generation and disciplined growth. This complementary strategy delivers both immediate cash flow and long-term value creation, supported by a best-in-class asset base, diversified production, and sector-leading management expertise.

Elemental Royalty trades on the TSX Venture Exchange and the Nasdaq under the ticker “ELE”.

Neither the TSX-V nor its Regulation Service Provider (as that term is defined in the policies of the TSX-V.) accepts responsibility for the adequacy or accuracy of this press release.

Qualified Person

Michael P. Sheehan, CPG, a Qualified Person as defined by National Instrument 43-101 and employee of the Company, has reviewed, verified and approved the disclosure of the technical information contained in this news release.

Cautionary note regarding forward-looking statements

This news release contains certain “forward looking statements” and certain “forward-looking information” as defined under applicable Canadian securities laws. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology.

Forward-looking statements and information are based on forecasts of future results, estimates of amounts not yet determinable and assumptions that, while believed by management to be reasonable, are inherently subject to significant business, economic and competitive uncertainties and contingencies.

Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of Elemental Royalty to control or predict, that may cause Elemental Royalty’ actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including but not limited to: the impact of general business and economic conditions, the absence of control over the mining operations from which Elemental Royalty will receive royalties, risks related to international operations, government relations and environmental regulation, the inherent risks involved in the exploration and development of mineral properties; the uncertainties involved in interpreting exploration data; the potential for delays in exploration or development activities; the geology, grade and continuity of mineral deposits; the possibility that future exploration, development or mining results will not be consistent with Elemental Royalty’ expectations; accidents, equipment breakdowns, title matters, labour disputes or other unanticipated difficulties or interruptions in operations; fluctuating metal prices; unanticipated costs and expenses; uncertainties relating to the availability and costs of financing needed in the future; the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses, commodity price fluctuations; currency fluctuations; regulatory restrictions, including environmental regulatory restrictions; liability, competition, loss of key employees and other related risks and uncertainties. For a discussion of important factors which could cause actual results to differ from forward-looking statements, refer to the annual information form of Elemental Altus for the year ended December 31, 2024. Elemental Altus undertakes no obligation to update forward-looking statements and information except as required by applicable law. Such forward-looking statements and information represent management’s best judgment based on information currently available. No forward-looking statement or information can be guaranteed, and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276952

Key Points

Silver, often nicknamed the ‘Devil’s metal’ because of its volatility, has reached record highs this year and still has further to run despite a supply crunch, according to experts.

The metal’s growth value has been running alongside gold’s, which has seen its own rally with the price surging past $4,000 an ounce this year.

Silver prices reached a historic peak of $54.47 per troy ounce in mid October, marking a 71% rise year-on-year. They’ve since pared back gains somewhat, but are now growing again, despite low supply levels.

“Some people were having to transport silver by plane rather than on cargo ships to meet delivery demand,” Paul Syms, head of EMEA ETF Fixed Income and commodity product management at Invesco, told CNBC.

“While we’ve seen the spike up, we’ve seen the price come down a little bit. Longer term, there’s a different dynamic this time that could keep silver at reasonably high prices and maybe continuing to go up for some time to come,” he added.

October was only the third time in the past 50 years where silver prices peaked. Other silver price highs include January 1980, when the Hunt brothers amassed a third of the world’s supply as they attempted to corner the market, as well as 2011, following the U.S. debt ceiling crisis when silver and gold were embraced as safe haven assets.

“Silver is only about a tenth the size of the gold market, and that short squeeze, obviously, sort of caught a few investors by surprise,” said Syms.

Unlike the previous investment waves, silver’s boom in 2025 relied on a mix of low supply and high demand from India as well as industrial needs and tariffs.

“After Liberation Day, the gold price spiked, but silver actually went down a little bit. And the gold-silver ratio spiked to above 100,” said Syms, referring to the gold-silver ratio which reflects how many ounces of silver are needed to buy one ounce of gold.

A low ratio means gold is relatively cheap, while a high ratio indicates silver is undervalued and likely to rise. In April, the ratio reached a historic high.

“The risk managers in financial and industrial entities did not want to let any metal go out of the States for fear that it might come back in at 35% higher for example,” said Rhona O’Connell, head of market analysis EMEA and Asia at Stone X.

Fast forward to the Autumn and silver entered its peak demand, especially as India’s monsoon and harvest seasons came to an end.

“Farmers don’t really like the banks very much, so gold and latterly, silver, tend to be the first port of call when they’ve got the harvest in,” said O’Connell.

India is also the world’s largest consumer of silver, with about 4,000 metric tons used every year, mostly for jewelry, utensils and ornaments.

The silver appeal this Autumn also coincided with Diwali, a five-day ‘Festival of Lights’ celebrating prosperity and good fortune and also India’s biggest public holiday.

While gold is traditionally a favorite, this year silver — an affordable investment option in a country where about 55% of the population depends on agriculture for their livelihood — outshined other metals.

On Oct. 17, the price of silver in India rose sharply, reaching a record high of 170,415 rupees a kilogram — an 85% rise since the start of the year.

However, 80% of India’s silver supply is imported. The UAE and China are increasingly supporting that demand, but the U.K. is traditionally India’s largest silver supplier.

Yet, London’s vaults have been emptying rapidly for the past few years. In June 2022, the London Bullion Market Association held 31,023 metric tons of silver. By March 2025, volumes had fallen by around a third to 22,126 metric tons — its lowest point in years.

“What isn’t necessarily so visible to people is what’s happening in the vaults,” said O’Connell. “And that had reached a point where there was basically there was no available metal left in London.”

In October, the squeeze was such that traders had to pay much higher borrowing costs – or lease rates – to close their positions.

“At one stage, to borrow overnight was costing 200% on an annualized basis, so a lot of people were very stressed to put it mildly,” said O’Connell.

Supply is a constant issue for silver, as for other precious and rare metals. The Silver Institute’s 2025′s World Silver Survey estimates that mine production has been decreasing over the past 10 years, especially in Central and South America.

“Over the course of the past twelve months or so, the underlying surplus has started to turn into a deficit for three reasons: the impact of the electrification of the vehicle fleet, artificial intelligence, and photovoltaics,” said O’Connell.

Vancouver, British Columbia–(Newsfile Corp. – November 26, 2025) – Elemental Royalty Corporation (TSXV: ELE) (NASDAQ: ELE) (“Elemental” or “the Company“) is pleased to announce that it has completed the previously announced acquisition of an existing uncapped 2% Gross Revenue Royalty (“GRR“) over Genesis Minerals’ (“Genesis“) (ASX: GMD) Focus Laverton Project in Western Australia (“Focus Laverton Royalty“), and an existing 2% GRR on Brightstar Resources’ (“Brightstar“) (ASX: BTR) producing Jasper Hills Project, with the consideration of A$80 million (c.US$52 million) now paid in full.

Highlights:

David M. Cole, Chief Executive Officer of Elemental Royalty Corporation commented: “We are delighted to have now completed the acquisition of the Laverton Royalty, an exceptional quality asset in a top-tier jurisdiction with a clear pathway to imminent production with a world-class operator. This acquisition cements an additional cornerstone royalty in our portfolio of outstanding, high-quality, producing and advanced development assets. The transaction also includes a royalty on the producing Jasper Hills Project which will immediately contribute to our Q4 and Full Year 2025 revenue.”

The Laverton Royalty

The Laverton Project covers several Archaean greenstone belts north-northeast of Kalgoorlie which host a range of orogenic lode gold deposits, typical of the Western Australian Yilgarn Eastern Goldfields. The Laverton district is one of the best endowed gold regions in Australia, hosting a number of major deposits, such as Gold Fields’ Granny Smith and AngloGold Ashanti’s Sunrise Dam.

Elemental Royalty now holds a total 4% GRR over 67km2 of the project, and a further 2% GRR over an additional 240km2, encompassing the following deposits:

The wider Laverton project has the following JORC 2012 compliant Mineral Resource and Ore Reserve Estimates, over which Elemental has significant coverage:

Including:

The newly acquired royalty area also includes an additional combined 240,000 ounces of historical gold resources2 at the Barnicoat Project and South Lancefield, reported to a JORC-2004 Compliant standard only.

David M. Cole

CEO and Director

For more information, please contact:

| David M. Cole | info@elementalroyalty.com |

| CEO | |

| Tara Vivian-Neal | info@elementalroyalty.com |

| Investor Relations | |

TSXV: ELE | NASDAQ: ELE | ISIN: CA28619K1093 | CUSIP: 28619K109

About Elemental Royalty Corporation.

Elemental Royalty is a new mid-tier, gold-focused streaming and royalty company with a globally diversified portfolio of 16 producing assets and more than 200 royalties, anchored by cornerstone assets and operated by world-class mining partners. Formed through the merger of Elemental Altus and EMX, the Company combines Elemental Altus’s track record of accretive royalty acquisitions with EMX’s strengths in royalty generation and disciplined growth. This complementary strategy delivers both immediate cash flow and long-term value creation, supported by a best-in-class asset base, diversified production, and sector-leading management expertise.

Elemental Royalty trades on the TSX Venture Exchange and on NASDAQ under the ticker Symbol “ELE”.

Neither the TSX-V nor its Regulation Service Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this press release.

Qualified Person

Michael P. Sheehan, CPG, a Qualified Person as defined by National Instrument 43-101 and employee of the Company, has reviewed, verified and approved the disclosure of the technical information contained in this news release.

1 Genesis Mineral Ltd., news release dated 26 May, 2025 – Mineral resource and reserve estimates were compiled by Mr. Alex Aaltonen, a Competent Person who is a Member of the Australasian Institute of Mining and Metallurgy (AusIMM). Mr. Aaltonen is an employee of Focus Minerals Limited.

2. A Qualified Person has not completed sufficient work to classify these historical estimates as current Mineral Resources in accordance with the JORC Code (2012), and it is uncertain whether further evaluation will result in the estimates being reported in accordance with the JORC Code (2012). The company is not treating these estimates as current, and further work, including data validation, QAQC review, and re-estimation, will be required to report updated resources.

Cautionary note regarding forward-looking statements

This news release contains certain “forward looking statements” and certain “forward-looking information” as defined under applicable Canadian securities laws. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology.

Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of Elemental Royalty to control or predict, that may cause Elemental Royalty’s actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including but not limited to: the impact of general business and economic conditions, the absence of control over the mining operations from which Elemental Royalty will receive royalties, risks related to international operations, government relations and environmental regulation, the inherent risks involved in the exploration and development of mineral properties; the uncertainties involved in interpreting exploration data; the potential for delays in exploration or development activities; the geology, grade and continuity of mineral deposits; the possibility that future exploration, development or mining results will not be consistent with Elemental Royalty’ expectations; accidents, equipment breakdowns, title matters, labour disputes or other unanticipated difficulties or interruptions in operations; fluctuating metal prices; unanticipated costs and expenses; uncertainties relating to the availability and costs of financing needed in the future; the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses, commodity price fluctuations; currency fluctuations; regulatory restrictions, including environmental regulatory restrictions; liability, competition, loss of key employees and other related risks and uncertainties. For a discussion of important factors which could cause actual results to differ from forward-looking statements, refer to the annual information form of Elemental Altus for the year ended December 31, 2024. Elemental Altus undertakes no obligation to update forward-looking statements and information except as required by applicable law. Such forward-looking statements and information represent management’s best judgment based on information currently available. No forward-looking statement or information can be guaranteed, and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276090

Vancouver, British Columbia–(Newsfile Corp. – November 24, 2025) – Elemental Royalty Corporation (TSXV: ELE) (Nasdaq: ELE) (“Elemental” or the “Company“) is pleased to announce that its common shares will commence trading on the Nasdaq Capital Market (“Nasdaq“) at market open tomorrow under the ticker symbol “ELE”. Elemental’s common shares will continue to trade on the TSX Venture Exchange under the ticker symbol “ELE”.

David M. Cole, Chief Executive Officer of Elemental, commented: “We are delighted that Elemental shares have been approved for trading on Nasdaq, an important milestone for our newly merged company. This listing will allow our shareholders to trade more easily and provide exposure to a significantly broader base of institutional and retail investors. We expect this listing to enhance trading liquidity, increase coverage from U.S. investment banks, and create opportunities for potential index inclusion.”

Concurrent with the commencement of trading on Nasdaq, Elemental’s common shares will cease to be quoted on the OTCQX Best Market. Shareholders are not required to take any action; however, shareholders who purchased shares on OTCQX are encouraged to monitor their brokerage accounts to ensure holdings are correctly reflected in respect of the Nasdaq listing.

The listing does not involve any concurrent financing, and no new shares were issued.

David M. Cole

CEO and Director

For more information, please contact:

| David M. Cole | info@elementalroyalty.com |

| CEO | |

| Tara Vivian-Neal | info@elementalroyalty.com |

| Investor Relations | |

TSXV: ELE | NASDAQ: ELE | ISIN: CA28619K1093 | CUSIP: 28619K109

About Elemental Royalty Corporation.

Elemental Royalty is a new mid-tier, gold-focused streaming and royalty company with a globally diversified portfolio of 16 producing assets and more than 200 royalties, anchored by cornerstone assets and operated by world-class mining partners. Formed through the merger of Elemental Altus and EMX, the Company combines Elemental Altus’s track record of accretive royalty acquisitions with EMX’s strengths in royalty generation and disciplined growth. This complementary strategy delivers both immediate cash flow and long-term value creation, supported by a best-in-class asset base, diversified production, and sector-leading management expertise.

Elemental Royalty trades on the TSX Venture Exchange and on Nasdaq under the ticker “ELE”.

Neither the TSXV nor its Regulation Service Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this press release.

Cautionary note regarding forward-looking statements

This news release contains certain “forward-looking statements” and certain “forward-looking information” as defined under applicable Canadian securities laws. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology.

Forward-looking statements and information include, but are not limited to, statements with respect to the expected benefits of the Nasdaq listing, the Company’s ability to execute its growth strategy, future revenue and cash-flow profile, and the acquisition of additional royalties and streams. Forward-looking statements and information are based on forecasts of future results, estimates of amounts not yet determinable, and assumptions that, while believed by management to be reasonable, are inherently subject to significant business, economic and competitive uncertainties and contingencies.

Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of Elemental to control or predict, that may cause Elemental’s actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including but not limited to: the impact of general business and economic conditions, the absence of control over the mining operations from which Elemental will receive royalties, risks related to international operations, government relations and environmental regulation, the inherent risks involved in the exploration and development of mineral properties; the uncertainties involved in interpreting exploration data; the potential for delays in exploration or development activities; the geology, grade and continuity of mineral deposits; the possibility that future exploration, development or mining results will not be consistent with Elemental’s expectations; accidents, equipment breakdowns, title matters, labour disputes or other unanticipated difficulties or interruptions in operations; fluctuating metal prices; unanticipated costs and expenses; uncertainties relating to the availability and costs of financing needed in the future; the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses, commodity price fluctuations; currency fluctuations; regulatory restrictions, including environmental regulatory restrictions; liability, competition, loss of key employees and other related risks and uncertainties. For a discussion of important factors which could cause actual results to differ from forward-looking statements, refer to the annual information form of Elemental for the year ended December 31, 2024. Elemental undertakes no obligation to update forward-looking statements and information except as required by applicable law. Such forward-looking statements and information represents management’s best judgment based on information currently available. No forward-looking statement or information can be guaranteed, and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/275754

Edmonton, Alberta–(Newsfile Corp. – November 25, 2025) – Grizzly Discoveries Inc. (TSXV: GZD) (FSE: G6H) (OTCQB: GZDIF) (“Grizzly” or the “Company”) is pleased to announce a private placement offering of Units and FT Units for gross proceeds of up to $1 Million if fully subscribed (the “Offering”).

Private Placement Offering

The Offering consists of up to 8,333,333 Units and up to 25,000,000 of any combination of Units and FT Units, each priced at $0.03 per Unit or FT Unit. Each Unit shall consist of one common share of the Company (“Common Share”) and one Common Share purchase warrant entitling the warrant holder to purchase an additional Common Share for $0.05 and expiring on the earlier of a) 30 days following written notice by the Company to the warrant holder that the volume-weighted average trading price of the Common Shares on the TSX Venture Exchange is at or greater than CA$0.10 per Common Share for 10 consecutive trading days; and (b) 24 months from the date of issuance (“Warrant”). Each FT Unit shall consist of one Common Share and one half of one Warrant, each of which shall be issued as a “flow through share” for the purposes of the Income Tax Act (Canada). The Offering is being offered to qualified subscribers in the Provinces of Alberta, British Columbia and Ontario and in other jurisdictions as the Company may in its discretion determine, in reliance upon exemptions from the registration and prospectus requirements of applicable securities legislation.

The Company intends to use the proceeds of the Offering, if fully subscribed with the maximum of 25,000,000 in FT Units and 8,333,333 Units, as follows:

| Mineral Property Exploration | $ | 750,000 | ||||||

| Mineral Rights and Exploration Permits | 35,000 | |||||||

| Working capital | Outstanding management fees to Officers | $ | 32,000 | |||||

| Other accounts payable | 47,000 | 79,000 | ||||||

| Corporate Overhead | Management fees to Officers | $ | 24,000 | |||||

| (Approx. 4 months) | Other Corporate Overhead | 112,000 | 136,000 | |||||

| Maximum proceeds | $ | 1,000,000 | ||||||

There is no minimum to the Offering. If the Company closes on less than the maximum proceeds, or if the proportion of Units and FT Units differs from the above, the use of proceeds will be adjusted.

In connection with the Offering, the Company may pay finders fees payable in any combination of cash, Units, and Warrants to registered broker dealers, limited market dealers or arm’s length persons in accordance with the policies of the TSX Venture Exchange (the “Exchange”) and applicable securities legislation and regulations. The Common Shares and any Common Shares issued on exercise of the Warrants are subject to restrictions on trading until four months and one day from the date of issuance in accordance with the policies of the Exchange.

The Offering is subject to acceptance of the TSX Venture Exchange.

ABOUT GRIZZLY DISCOVERIES INC.

Grizzly is a diversified Canadian mineral exploration company with its primary listing on the TSX Venture Exchange focused on developing its approximately 72,700 ha (approximately 180,000 acres) of precious and base metals properties in southeastern British Columbia. Grizzly is run by highly experienced junior resource sector management team, who have a track record of advancing exploration projects from early exploration stage through to feasibility stage.

On behalf of the Board,

GRIZZLY DISCOVERIES INC.

Brian Testo, CEO, President

Suite 363-9768 170 Street NW

Edmonton, Alberta T5T 5L4

For further information, please visit our website at www.grizzlydiscoveries.com or contact:

Nancy Massicotte

Corporate Development

Tel: 604-507-3377

Email: nancy@grizzlydiscoveries.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Caution concerning forward-looking information

This press release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable securities laws. This information and statements address future activities, events, plans, developments and projections. All statements, other than statements of historical fact, constitute forward-looking statements or forward-looking information. Such forward-looking information and statements are frequently identified by words such as “may,” “will,” “should,” “anticipate,” “plan,” “expect,” “believe,” “estimate,” “intend” and similar terminology, and reflect assumptions, estimates, opinions and analysis made by management of Grizzly in light of its experience, current conditions, expectations of future developments and other factors which it believes to be reasonable and relevant. Forward-looking information and statements involve known and unknown risks and uncertainties that may cause Grizzly’s actual results, performance and achievements to differ materially from those expressed or implied by the forward-looking information and statements and accordingly, undue reliance should not be placed thereon.

Risks and uncertainties that may cause actual results to vary include but are not limited to the availability of financing; fluctuations in commodity prices; changes to and compliance with applicable laws and regulations, including environmental laws and obtaining requisite permits; political, economic and other risks; as well as other risks and uncertainties which are more fully described in our annual and quarterly Management’s Discussion and Analysis and in other filings made by us with Canadian securities regulatory authorities and available at www.sedarplus.ca. Grizzly disclaims any obligation to update or revise any forward-looking information or statements except as may be required by law.

NOT FOR DISSEMINATION IN THE UNITED STATES OF AMERICA

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/275805

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

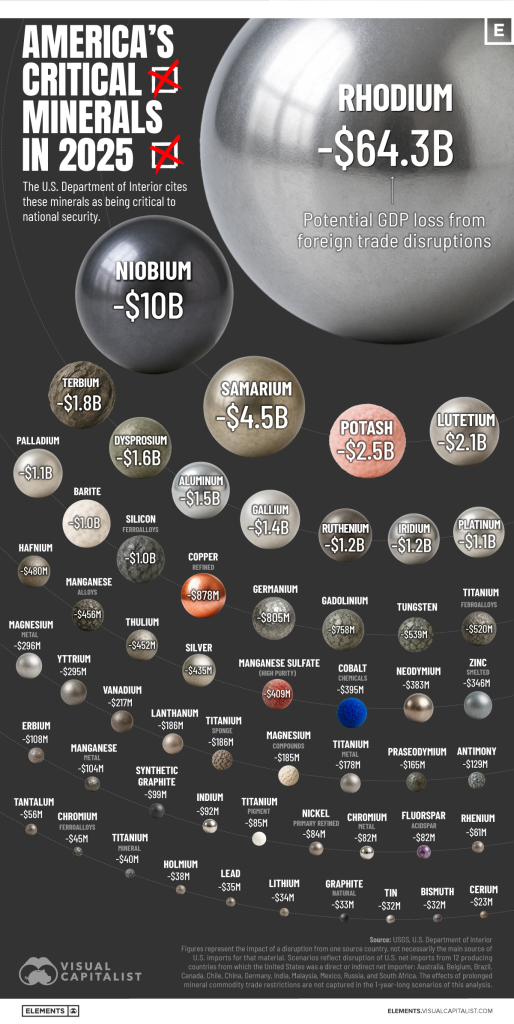

The U.S. relies heavily on imports for dozens of critical minerals used in everything from clean energy to defense. But what happens if those trade flows are disrupted?

This visualization ranks the most economically important critical minerals to the U.S. in 2025, based on potential GDP loss from foreign trade disruptions. The data comes from the U.S. Geological Survey (USGS), and includes 84 critical commodities.

A disruption in the supply of rhodium—primarily from South Africa—could slash over $64 billion from U.S. GDP in a single year. That’s more than six times the estimated impact of the next highest-risk mineral, niobium, which is mostly sourced from Brazil. Both materials are key to automotive and aerospace industries.

| Mineral commodity | Potential GDP loss ($M) | Example usages |

|---|---|---|

| Rhodium | 64,340 | Automotive catalytic converters; chemical catalysts |

| Niobium | 10,441 | High-strength steels; superconductors; jet engines |

| Samarium | 4,498 | Permanent magnets; nuclear reactor control rods |

| Potash | 2,541 | Fertilizer; chemicals; water treatment |

| Lutetium | 2,059 | Petroleum cracking catalysts; lasers |

| Terbium | 1,809 | Green phosphors; high-performance magnets |

| Dysprosium | 1,624 | High-temperature magnets (EV motors, wind turbines |

| Aluminum | 1,537 | Transportation; packaging; construction |

| Gallium | 1,418 | Semiconductors; LEDs; solar cells |

| Ruthenium | 1,249 | Electronics coatings; chip interconnects; catalysts |

‹123456›

Rare earth elements like samarium, terbium, and dysprosium rank high on the list. These are critical for magnets, motors, and high-tech applications like EVs and wind turbines. China dominates global supply of rare earths, accounting for over 69% of production. This dominance extends beyond mining, with China also processing nearly 90% of the world’s rare earth elements.

The USGS found that China contributes to the GDP risk of 46 of the 84 minerals studied.

Lithium, cobalt, and synthetic graphite—all crucial for battery production—appear lower in absolute dollar terms, but are still vital to long-term energy security. Magnesium, gallium, and germanium also raise red flags due to limited suppliers and essential applications in electronics, defense, and clean tech.

Edmonton, Alberta–(Newsfile Corp. – November 19, 2025) – Grizzly Discoveries Inc. (TSXV: GZD) (FSE: G6H) (OTCQB: GZDIF) (“Grizzly” or the “Company”) is pleased to announce that it has recently mobilized a crew from APEX Geoscience Ltd. (APEX) to conduct fieldwork at a number of targets prior to conducting trenching and drilling subject to financing. The targets are part of the Greenwood, BC Precious and Battery Metals Project (Figure 1).

In addition, the Company announces agreements with two arm’s length creditors to settle outstanding cash debt with common shares of the Company, including completing the Midway Mine Option and paying interest on the promissory note issued May 15, 2025. In aggregate, the Company intends to issue 541,667 common shares of Grizzly in settlement of an aggregate $16,250 in outstanding debt.

Midway Highlights

Brian Testo, President and CEO of Grizzly Discoveries, stated, “We are excited and are looking forward to pursuing a number of high grade gold – silver – copper – lead -zinc showings and historical mines with drilling in the fall of 2025 or early in 2026 along with additional exploration for significant battery metal prospects in our current 170,000+ acre land holdings in the Greenwood District. We have barely scratched the surface in terms of exploration!“

Figure 1: Land position and targets of interest for future exploration, Greenwood Project.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4488/275142_7f84f9a9f4ee6b25_002full.jpg

Figure 2. Midway geology and showings with gold in soils and rocks.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4488/275142_7f84f9a9f4ee6b25_003full.jpg

Figure 3. Midway Mine area proposed drilling with showings and gold in soils and rocks.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4488/275142_7f84f9a9f4ee6b25_004full.jpg

Plans for Fall 2025 Exploration at Greenwood:

Trenching, rock and soil sampling along with drilling at the Midway Target area is being planned for fall 2025 and early 2026. The amount of drilling will depend upon the financing efforts and weather.

Additional results should be forthcoming over the next coming months as work progresses and will be presented in additional news releases.

Midway Mine Option Payment Settlement

On October 11, 2022, the Company entered into an option agreement with an arm’s length individual (the “Optionor”) to purchase the mineral rights to 317 hectares in seven mineral claims in the Greenwood, BC area (the “Midway Mine Claims”). Completion of the Midway Mine Option pursuant to the 2022 option agreement requires the payment of $10,000 and the issuance of 100,000 common shares of the Company on the third anniversary of regulatory acceptance of the Midway Mine Option.

The Optionor has agreed to accept additional common shares of the Company in lieu of the cash payment of $10,000 at a deemed price of $0.03 per common share (the “Cash Option Payment Shares”), for a total payment of 433,334 common shares to complete the third anniversary payment under the Midway Mine Option Agreement, and thereby complete the option. Pursuant to the third anniversary payment, the Company will have a 100% interest in the Midway Mine Claims, subject to a 1% NSR royalty in favour of the Optionor, and the Optionor retaining the rights to quarriable industrial rocks.

Interest on Note Payable

On May 15, 2025, the Company, among other things, issued a promissory note (the “Note”) to an arm’s length corporation in partial settlement of outstanding debt to a creditor of the Company. The Note has a principal amount of $250,000 and bears simple interest of 5% p.a., payable every six months from the date of issue, and matures on May 15, 2027. Under the terms of the Debt Settlement Agreement, the Company may, at its option, pay the interest payments in Common Shares of the Company.

The Company has proposed to settle the semi-annual interest payment due November 2025 in common shares, at a deemed price of $0.03 per Common Share, for a total of 208,333 common shares of the Company (the “Note Interest Shares”) representing the interest payment of $6,250.

The issuance of the Cash Option Payment Shares and the Note Interest Shares are subject to acceptance by the TSX Venture Exchange and, upon issuance, will be subject to restrictions on trading until four months and one day from issuance.

Quality Assurance and Control

Rock and soil samples are being analyzed at ALS Global Laboratories (Geochemistry Division) in Vancouver, Canada (an ISO/IEC 17025:2017 accredited facility). Gold was assayed using a fire assay with atomic emission spectrometry and gravimetric finish when required (+10 g/t Au). Rock grab and rock chip samples from outcrop/bedrock are selective by nature and may not be representative of the mineralization hosted on the project.

The sampling program was undertaken by Company personnel under the direction of Michael B. Dufresne, M.Sc., P.Geol., P.Geo.. A secure chain of custody is maintained in transporting and storing of all samples.

The technical content of this news release and the Company’s technical disclosure has been reviewed and approved by Michael B. Dufresne, M. Sc., P. Geol., P.Geo., who is a non-independent Consultant and Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects.

ABOUT GRIZZLY DISCOVERIES INC.

Grizzly is a diversified Canadian mineral exploration company with its primary listing on the TSX Venture Exchange focused on developing its approximately 72,700 ha (approximately 180,000 acres) of precious and base metals properties in southeastern British Columbia. Grizzly is run by a highly experienced junior resource sector management team, who have a track record of advancing exploration projects from early exploration stage through to feasibility stage.

On behalf of the Board,

GRIZZLY DISCOVERIES INC.

Brian Testo, CEO, President

Suite 363-9768 170 Street NW

Edmonton, Alberta T5T 5L4

For further information, please visit our website at www.grizzlydiscoveries.com or contact:

Nancy Massicotte

Corporate Development

Tel: 604-507-3377

Email: nancy@grizzlydiscoveries.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Caution concerning forward-looking information

This press release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable securities laws. This information and statements address future activities, events, plans, developments and projections. All statements, other than statements of historical fact, constitute forward-looking statements or forward-looking information. Such forward-looking information and statements are frequently identified by words such as “may,” “will,” “should,” “anticipate,” “plan,” “expect,” “believe,” “estimate,” “intend” and similar terminology, and reflect assumptions, estimates, opinions and analysis made by management of Grizzly in light of its experience, current conditions, expectations of future developments and other factors which it believes to be reasonable and relevant. Forward-looking information and statements involve known and unknown risks and uncertainties that may cause Grizzly’s actual results, performance and achievements to differ materially from those expressed or implied by the forward-looking information and statements and accordingly, undue reliance should not be placed thereon.

Risks and uncertainties that may cause actual results to vary include but are not limited to the availability of financing; fluctuations in commodity prices; changes to and compliance with applicable laws and regulations, including environmental laws and obtaining requisite permits; political, economic and other risks; as well as other risks and uncertainties which are more fully described in our annual and quarterly Management’s Discussion and Analysis and in other filings made by us with Canadian securities regulatory authorities and available at www.sedarplus.ca Grizzly disclaims any obligation to update or revise any forward-looking information or statements except as may be required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/275142