Vancouver, British Columbia–(Newsfile Corp. – January 30, 2024) – EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the “Company” or “EMX”) is pleased to announce the execution of a purchase agreement with Aurora Exploration OY (“Aurora”), a private Finish company, for Aurora’s royalty interest covering the Mustajärvi gold project in Finland (the “Project”). The Mustajärvi project is located in the prolific Central Lapland Greenstone Belt in northern Finland, which hosts several recent gold discoveries as well as the Kittila Gold Mine, operated by Agnico Eagle Mines Ltd. The Mustajärvi project is currently being advanced by Firefox Gold Corporation (“Firefox”).

The Mustajärvi project was originally acquired by Aurora in 2017 and subsequently sold to Firefox. Further exploration and drilling by Firefox led to the discovery of significant gold mineralization within the Project area (see various news releases by Firefox between 2018 and 2023). As part of the transaction with Firefox, Aurora retained a 1% NSR royalty, to be acquired by EMX. Half of the NSR royalty (0.5%) can be repurchased by Firefox for US$500,000 upon receipt of a positive feasibility study. Further information on the project can be found at Firefox’s website (www.firefoxgold.com) and in the Project’s 2018 NI-43-101 Technical Report, which has been filed on SEDAR.

Firefox recently announced a partnership with Agnico Eagle Mines Ltd, including a private placement into Firefox (see Firefox News Release dated December 20, 2023). In its announcement, Firefox reported that proceeds from the private placement will be used to further advance and drill the Mustajärvi project.

Commercial Terms Overview: As consideration for the royalty interest, EMX has paid Aurora US$80,000 and will issue 30,000 common shares of the Company to Aurora, subject to receiving final acceptance from the TSX Venture Exchange. These are the sole considerations for the purchase of the royalty.

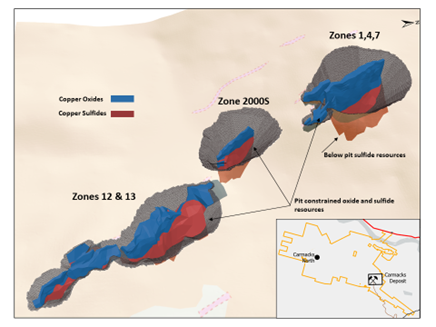

Overview of the Project. The Mustajärvi project is located in Northen Finland in the Central Lapland Greenstone Belt and is hosted within the Mustajärvi shear-zone (MSZ). The MSZ lies between the regional Venejoki and Sirkka shear zones, which host numerous gold occurrences and deposits including Rupert Resources’ recent Ikkari gold discovery.

Gold mineralization at Mustajärvi appears to be developed within “dilational jogs” along the MSZ. Drill defined zones of mineralization have now been reported over a 2.1km trend. The mineralization chiefly occurs as quartz-carbonate-tourmaline veins along contacts between intercalated siliciclastic meta-sediments and mafic-ultramafic volcanic rocks, a common control of gold mineralization in the region. The currently defined zones of mineralization remain open along strike at both ends of the trend as well as at depth.

Recent exploration activities concentrated on the “East Target”, where Firefox reported the discovery of a new zone of gold mineralization in 2022-2023. Drill intercepts in the East Target include hole 22MJ006 with 13.85 meters of 28.74 g/t Au from an in-hole depth of 24.15 meters, 22MJ021 with 15.5 meters of 13.09g/t Au from an in-hole depth of 11 meters and hole 23MJ004 with 20.45 meters of 5.14 g/t Au from an in-hole depth of 12 meters1. Elsewhere on the property, significant intercepts include drill hole 21MJ010 with 16.45 meters at 7.69 g/t Au from an in-hole depth of 154.15 meters1. Firefox and previous explorers have drilled a combined total of 14,158 meters on the property so far.

Comments on Nearby and Adjacent Properties. The deposits, projects and mines discussed in this news release provide context for the Project, which occurs in a similar geologic setting, but this is not necessarily indicative that the Project hosts similar quantities, grades or styles of mineralization.

Dr. Eric P. Jensen, CPG, a Qualified Person as defined by National Instrument 43-101 and employee of the Company, has reviewed, verified and approved the disclosure of the technical information contained in this news release.

About EMX. EMX is a precious, base and battery metals royalty company that specializes in generating and acquiring royalty interests. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and TSX Venture Exchange under the symbol “EMX”, and also trade on the Frankfurt exchange under the symbol “6E9”. Please see www.EMXroyalty.com for more information.

For further information contact:

David M. Cole

President and Chief Executive Officer

Phone: (303) 973-8585

Dave@emxroyalty.com

Scott Close

Director of Investor Relations

Phone: (303) 973-8585

SClose@emxroyalty.com

Isabel Belger

Investor Relations (Europe)

Phone: +49 178 4909039

IBelger@EMXroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

Forward-Looking Statements

This news release may contain “forward looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended September 30, 2023 (the “MD&A”), and the most recently filed Annual Information Form (“AIF”) for the year ended December 31, 2022, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedarplus.ca and on the SEC’s EDGAR website at www.sec.gov

Figure 1. Location of the Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1508/196134_652a150a5422085b_002full.jpg

1 In its news releases dated September 9, 2021, September 6, 2022, January 18, 2023 and July 18, 2023 Firefox has reported that “drilling is believed to be perpendicular to the dip of the mineralization, however true widths are not yet known and will be confirmed with additional drilling and geologic modelling.” Although these results were reported in compliance with NI43-101 protocols and are believed to be reliable and relevant, EMX has not performed sufficient work to verify the published assay results.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/196134