Bob Moriarty

Archives

Feb 27, 2024

Newmont went down 7% for the same reason a dog walks into the middle of the road to lick its dick.

Because it can.

A number of other writers including John Hathaway are commenting on the disconnect between the cost of gold and silver compared to the price of resource stocks. While gold has pretty much held its own and silver is down but a tiny bit lately, the resource stocks have been hammered to all time lows lately seemingly without reason.

There is a reason.

Actually, there are two reasons.

It’s common for investors to focus on the price and action of the shares they own and what they might be interested in buying. But right now, those numbers are meaningless. Newmont didn’t have a pit collapse in Turkey. They didn’t have a copper mine seized in Panama or any abysmal drill results from an important project.

Newmont shares got sold because they could.

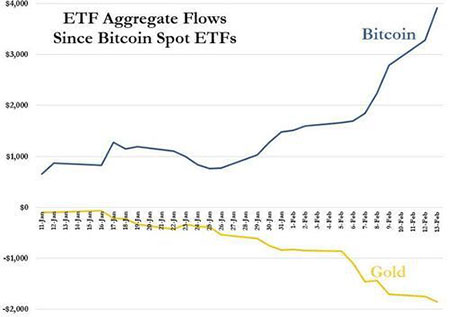

In the past six weeks as Bitcon soared higher, over four billion dollars of new money flowed into the speculation. The money had to come from somewhere. It came from gold and silver ETFs and it plunged out of resource funds at a historic rate. While four billion shot into Bitcon, two billion came out of gold and silver ETFs.

The money didn’t come out of the cheapest and worst resource stocks. They are the least liquid. It came out of the biggest and the best, the most liquid.

Because it could.

So, a lot of money left the tiny world of gold and silver stocks to enter the far bigger speculation we call Bitcon. But there was another giant factor pretty much ignored by everyone.

On April 25, 2011 I predicted silver was at a top. As a result, I was bombarded with hundreds of emails telling me I was a fool and a fraud. Here is what I said.

1. Silver is going parabolic.

According to Jim Rogers all parabolic moves end badly. I have seen similar charts in all kinds of commodities and they always correct. Parabolic charts mark tops. So, when silver bugs start suggesting, “This time it’s different” I know better.

Study the chart below. Ignore the commodity. When charts go parabolic, it ends badly. I was an investor in the 1970s in both gold and silver. I started buying gold at $35 and silver around $5 an ounce. I sold out all my silver in January of 1980 a week too early at $35 as it rocketed to $50.25 an ounce at the open on January 21, 1980. It went parabolic and basically that’s all you need to know.

Nvidia reported earnings last week and the shares continued their rocket launch. Here is a chart of the stock.

Compare the two charts. What I said in my piece from April 25th of 2011 is just as true today. All parabolic moves end badly. Nvidia shares are about to crash.

All those weak hands who were eager to see if they could sell at the very bottom of the gold/silver resource cycle are going to regret being part of the thundering herd.

When Nvidia crashes and Bitcon returns to earth, the direction of money flow will reverse. Bitcon is up 30% in just six weeks. There is nothing in economics that justifies that any more than Newmont dropping 7% in a day.

###

Bob Moriarty

President: 321gold

Archives