Visit: JAYANT BHANDARI https://jayantbhandari.com/

Vancouver, British Columbia–(Newsfile Corp. – February 12, 2024) – Dolly Varden Silver Corporation (TSXV: DV) (OTC: DOLLF) (the “Company” or “Dolly Varden“) is pleased to announce 2023 step-out drilling at the Homestake Ridge property intersected a new gold-rich zone, to the northwest from the Homestake Silver Deposit.

Highlights of Homestake Silver step-outs to the northwest include: (intervals shown are core length**)

Highlights from Homestake Main infill drilling below high-grade plunge include: (intervals shown are core length**)

*AuEq and AgEq are calculated using $US1650/oz Au, $US20/oz Ag

**Estimated true widths vary depending on intersection angles and range from 50% to 85% of core lengths.

***Determined using metallic screen fire assay on 1.0 kg split

“Whether we discover new zones of high-grade gold at Homestake Ridge or expand the large, wide and high-grade silver deposits at Wolf and Torbrit, drilling continues to deliver results from the premier, undeveloped gold-silver trend in Canada,” said Shawn Khunkhun, CEO of Dolly Varden Silver.

“The new high-grade gold and silver mineralization encountered in step out drilling to the northwest of Homestake Silver represents a significant breakthrough in further defining, upgrading and expanding the mineralization at Homestake Ridge,” said Rob van Egmond, Vice-President Exploration.” This new zone remains open to the northwest, projecting towards the Homestake Main Deposit.”

This release includes the remaining drill results from 48 drill holes from the 2023 drill program at the 100%-owned Kitsault Valley Project that includes the Homestake Ridge and Dolly Varden properties in BC’s Golden Triangle. Reporting 26 drill holes at Homestake Main (11,054.90m), four drill holes (2,478.00m) from the new gold-rich zone at the Homestake Silver northwestern extension, and six exploration drill holes on the Homestake Ridge property (1,627.00m). In addition, twelve holes (6,971.00m) from the Dolly Varden property including the North Star, Red Point and Wolf areas are reported in this release.

Homestake Silver Step-Out Drilling

The high-grade gold and silver intersections in holes HR23-389 and HR23-399 are horizontally separated by approximately 40m and are interpreted to be a new gold zone extending northwest, at depth towards the Homestake Main deposit. Deeper in these holes a second, targeted mineralized envelope was encountered (Figure 5). In longitudinal section, the new gold zone overlaps parallel with the known mineralized envelopes approximately 50 meters to the east. This zone remains open to the northwest below historic drilling. Drilling in 2024 will target a 350m long gap between the Homestake Silver and Homestake Main Deposits to expand this new zone (Figure 2).

Drill hole HR23-410 is a 75-meter step-out from previously released holes HR23-395 and 398 (January 4th, 2024 release) and represents an extension of the higher grade veins to depth and below the wide, higher grade plunge.

The dip of drill hole HR23-394 steepened due to hole deviation more than anticipated and remained in the footwall to mineralized zones.

Figure 1. Location in this release along Dolly Varden’s Kitsault Valley trend

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1728/197571_d1b03db9d4f00b27_002full.jpg

Homestake Main Drilling

The objective of drilling during 2023 at the Homestake Main and Homestake Silver deposits was to expanded multiple, subparallel mineralized zones and to upgrade Inferred Mineral Resources in the projected plunge of the wider, higher-grade zone. The drilling completed in 2023 at Homestake Main was primarily resource expansion drilling, targeting both down dip and along strike from current Mineral Resources.

At Homestake Main, the 2023 drilling tested the depth extent of the structural corridor that hosts the mineralization and infilled in areas of higher grades. Drill hole HR23-374 is located approximately 200m down dip from the modelled wide, high-grade plunge, planned as a depth test at the bottom edge of the known mineralized envelope.

Drilling along the northwest projection of the Homestake Main zone intersected the structural corridor and associated alteration but with a decrease in vein stockwork and vein breccias density.

Homestake Ridge Exploration Drilling

Four exploration drill holes (HR23-417, 420, 421 and 424) tested two parallel, northwest trending structures located 300 metres and 600 meters to the west of the Homestake Silver deposit. HR23-424 tested the Fox Reef, a parallel structure approximately 900 meters to the southwest. Numerous veins and breccias were intersected with lower grade gold values (Table 3). Another two drill holes (HR23-422 and 423) tested the Dilly – Rambler exploration target 1,500m to the south of Homestake Silver. Although zones of QSP alteration and structures of interest were intersected, no significant precious metal grades were returned from the samples in these holes.

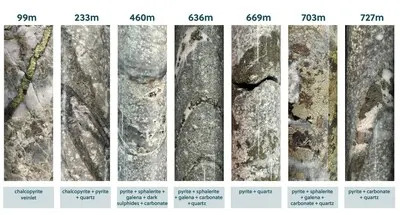

The Homestake Ridge deposits are interpreted as a structurally controlled, multi-phase epithermal vein stockwork and vein breccia system hosted in Jurassic Hazelton Volcanic rocks. Mineralization consists of pyrite and chalcopyrite in a breccia matrix within a silica breccia vein system and quart-carbonate veining (Figure 3). The northwest orientation of the main Homestake structural trend appears to have numerous subparallel internal structures that are interpreted to form the controls for higher grade gold and silver shoots within a broader low-grade (>0.1 g/t Au) zone at the Homestake Main deposit. The main structural corridor dips steeply to the northeast at Homestake Main and rolls to steeply Southwest at Homestake Silver (Figure 2 and 5).

Figure 2. Long Section of Homestake Silver and Main. Modelled mineralized envelope from resource in Red (looking southwest)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1728/197571_d1b03db9d4f00b27_003full.jpg

Figure 3. Drill hole HR23-389 at the gold zone from the Homestake Silver deposit hosting quartz carbonate vein and stockwork with high-grade gold and silver mineralization.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1728/197571_d1b03db9d4f00b27_004full.jpg

Figure 4. Location of 2023 Drill holes at Homestake Main and northwest step outs at Homestake Silver in this release. Plan View with Current Mineral Resource block model in grey, primarily of Inferred Classification

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1728/197571_d1b03db9d4f00b27_005full.jpg

Figure 5. Homestake Silver northwest extension Cross Section (A-B) with 2023 and previous drill holes

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1728/197571_d1b03db9d4f00b27_006full.jpg

Table 1. Completed Drill Hole Assays from the Homestake Silver Deposit Northern Extension drilling

| Hole ID | From (m) | To (m) | Length (m)** | Au (g/t) | Ag (g/t) | Cu (%) | AuEq* | AgEq* |

| HR23-389 | 329.50 | 369.93 | 40.43 | 0.11 | 67 | 0.00 | 0.91 | 76 |

| including | 366.00 | 368.00 | 2.00 | 0.52 | 559 | 0.03 | 7.26 | 602 |

| including | 367.00 | 368.00 | 1.00 | 0.99 | 996 | 0.04 | 13.00 | 1078 |

| New Au Zone | 377.50 | 444.00 | 66.50 | 15.26 | 20 | 0.01 | 15.50 | 1285 |

| including | 401.00 | 413.45 | 12.45 | 79.49 | 60 | 0.01 | 80.21 | 6649 |

| including | 409.90 | 410.58 | 0.68 | 1335*** | 781 | 0.01 | 1344.42 | 111440 |

| Lower Zone | 503.07 | 550.35 | 47.28 | 1.22 | 1 | 0.01 | 1.23 | 102 |

| including | 510.60 | 511.85 | 1.25 | 13.70 | 4 | 0.01 | 13.75 | 1140 |

| including | 522.77 | 523.37 | 0.60 | 8.53 | 4 | 0.01 | 8.57 | 711 |

| including | 525.79 | 526.81 | 1.02 | 13.65 | 6 | 0.01 | 13.72 | 1137 |

| HR23-394 | 416.50 | 421.50 | 5.00 | 0.52 | 14 | 0.02 | 0.69 | 57 |

| including | 416.50 | 417.50 | 1.00 | 2.10 | 26 | 0.03 | 2.42 | 200 |

| and | 484.00 | 486.00 | 2.00 | 2.20 | 50 | 0.02 | 2.79 | 231 |

| HR23-399 New Au Zone | 377.90 | 435.60 | 57.70 | 2.68 | 20 | 0.02 | 2.92 | 242 |

| including | 396.24 | 397.25 | 1.01 | 43.10 | 66 | 0.23 | 43.90 | 3639 |

| including | 413.00 | 414.75 | 1.75 | 40.33 | 418 | 0.13 | 45.37 | 3761 |

| and | 446.80 | 452.00 | 5.20 | 1.40 | 5 | 0.02 | 1.46 | 121 |

| Lower Zone | 545.10 | 570.00 | 24.90 | 0.36 | NSV | 0.36 | 30 | |

| HR23-410 | 329.35 | 329.85 | 0.50 | 0.12 | 1215 | 0.04 | 14.77 | 1225 |

| and | 329.85 | 330.35 | 0.50 | 0.06 | 192 | 0.41 | 2.37 | 197 |

| 75m Step out | 566.11 | 572.72 | 6.61 | 10.17 | 7 | 0.03 | 10.25 | 850 |

| including | 567.58 | 571.47 | 3.89 | 16.81 | 10 | 0.04 | 16.93 | 1403 |

| including | 567.58 | 568.20 | 0.62 | 50.70 | 26 | 0.08 | 51.01 | 4229 |

| including | 570.00 | 571.47 | 1.47 | 15.30 | 9 | 0.05 | 15.41 | 1277 |

Table 2. Completed Drill Hole Assays from the Homestake Main Deposit Area

| Hole ID | From (m) | To (m) | Length (m)** | Au (g/t) | Ag (g/t) | Cu (%) | AuEq* | AgEq* |

| HR23-367 | 295.75 | 304.80 | 9.05 | 1.66 | 1 | 0.01 | 1.68 | 139 |

| including | 299.96 | 300.80 | 0.84 | 3.16 | 2 | 0.03 | 3.19 | 264 |

| including | 301.32 | 301.82 | 0.50 | 19.80 | 11 | 0.06 | 19.94 | 1652 |

| HR23-368 | 186.90 | 188.90 | 2.00 | 0.18 | NSV | 0.18 | 15 | |

| and | 207.70 | 212.95 | 5.25 | 0.17 | NSV | 0.17 | 14 | |

| HR23-369 | 204.00 | 211.00 | 7.00 | 0.60 | NSV | 0.60 | 50 | |

| including | 231.07 | 231.62 | 0.55 | 0.83 | 4 | 0.01 | 0.88 | 73 |

| and | 294.50 | 317.34 | 22.84 | 0.37 | NSV | 0.37 | 31 | |

| including | 313.19 | 314.50 | 1.31 | 3.31 | 18 | 0.00 | 3.52 | 292 |

| HR23-370 | 288.00 | 295.00 | 7.00 | 1.65 | 2 | 0.01 | 1.67 | 139 |

| including | 293.00 | 295.00 | 2.00 | 4.83 | 5 | 0.01 | 4.89 | 405 |

| HR23-371 | 323.00 | 323.50 | 0.50 | 1.45 | NSV | 1.45 | 120 | |

| HR23-372 | 234.36 | 258.50 | 24.14 | 0.87 | 1 | 0.04 | 0.88 | 73 |

| including | 246.50 | 250.50 | 4.00 | 3.58 | 3 | 0.10 | 3.61 | 299 |

| including | 257.70 | 258.50 | 0.80 | 1.05 | 7 | 0.52 | 1.13 | 94 |

| HR23-373 | 341.00 | 343.00 | 2.00 | 0.45 | NSV | 0.45 | 37 | |

| HR23-374 | 261.03 | 344.54 | 83.51 | 1.22 | 2 | 0.04 | 1.24 | 103 |

| including | 268.48 | 269.15 | 0.67 | 22.60 | 10 | 0.17 | 22.72 | 1883 |

| including | 311.00 | 313.00 | 2.00 | 18.75 | 8 | 0.22 | 18.85 | 1562 |

| including | 321.00 | 322.00 | 1.00 | 10.15 | 9 | 0.09 | 10.26 | 850 |

| HR23-375 | 234.00 | 237.18 | 3.18 | 0.14 | 2 | 0.01 | 0.17 | 14 |

| HR23-376 | 402.09 | 409.13 | 7.04 | 0.97 | 1 | 0.05 | 0.98 | 81 |

| including | 408.32 | 409.13 | 0.81 | 5.29 | 5 | 0.32 | 5.35 | 444 |

| HR23-377 | 475.75 | 477.26 | 1.51 | 0.32 | 4 | 0.04 | 0.37 | 31 |

| HR23-378 | 523.55 | 526.00 | 2.45 | 0.36 | NSV | 0.36 | 30 | |

| and | 569.85 | 571.46 | 1.61 | 0.45 | NSV | 0.45 | 37 | |

| HR23-379 | 264.00 | 293.00 | 29.00 | 0.47 | 1 | 0.02 | 0.49 | 40 |

| including | 284.88 | 286.50 | 1.62 | 4.96 | 14 | 0.25 | 5.13 | 425 |

| and | 299.75 | 315.35 | 15.60 | 0.29 | NSV | 0.29 | 24 | |

| and | 387.00 | 416.00 | 29.00 | 0.38 | NSV | 0.38 | 31 | |

| including | 395.00 | 399.50 | 4.50 | 0.80 | NSV | 0.80 | 66 | |

| including | 403.00 | 406.00 | 3.00 | 0.92 | NSV | 0.92 | 76 | |

| HR23-380 | 420.44 | 446.00 | 25.56 | 0.25 | 0 | 0.00 | 0.25 | 21 |

| HR23-381 | 259.97 | 277.00 | 17.03 | 0.56 | 12 | 0.03 | 0.71 | 59 |

| including | 265.24 | 265.89 | 0.65 | 3.38 | 111 | 0.41 | 4.72 | 391 |

| including | 268.02 | 268.61 | 0.59 | 1.30 | 4 | 0.00 | 1.35 | 112 |

| HR23-382 | 312.00 | 394.41 | 82.41 | 0.26 | NSV | 0.02 | 0.26 | 22 |

| including | 324.60 | 325.12 | 0.52 | 3.33 | 4 | 0.44 | 3.38 | 280 |

| including | 359.50 | 360.22 | 0.72 | 1.95 | 13 | 0.48 | 2.11 | 175 |

| and | 404.00 | 434.00 | 30.00 | 0.38 | NSV | 0.01 | 0.38 | 31 |

| including | 426.30 | 427.12 | 0.82 | 4.86 | 21 | 0.32 | 5.11 | 424 |

Table 2 con’t. Completed Drill Hole Assays from the Homestake Main Deposit Area

| Hole ID | From (m) | To (m) | Length (m)** | Au (g/t) | Ag (g/t) | Cu (%) | AuEq* | AgEq* |

| HR23-383 | 166.08 | 168.00 | 1.92 | 0.86 | 39 | 0.00 | 1.33 | 110 |

| HR23-384 | 338.12 | 371.10 | 32.98 | 0.31 | 1 | 0.01 | 0.33 | 27 |

| and | 391.00 | 444.00 | 53.00 | 0.30 | 1 | 0.00 | 0.31 | 26 |

| HR23-385 | 485.67 | 515.05 | 29.38 | 0.25 | 2 | 0.07 | 0.27 | 22 |

| and | 510.00 | 510.70 | 0.70 | 0.93 | 15 | 0.63 | 1.11 | 92 |

| HR23-386 | 156.69 | 208.95 | 52.26 | 1.47 | 25 | 0.13 | 1.78 | 147 |

| including | 159.00 | 160.00 | 1.00 | 1.35 | 969 | 0.09 | 13.04 | 1081 |

| including | 161.00 | 163.50 | 2.50 | 18.14 | 30 | 0.24 | 18.51 | 1534 |

| including | 161.00 | 161.50 | 0.50 | 69.90 | 42 | 0.18 | 70.41 | 5836 |

| including | 183.90 | 190.00 | 6.10 | 2.19 | 16 | 0.91 | 2.39 | 198 |

| HR23-387 | 146.84 | 190.10 | 43.26 | 0.62 | 6 | 0.13 | 0.69 | 57 |

| including | 150.00 | 150.50 | 0.50 | 6.18 | 10 | 0.16 | 6.31 | 523 |

| including | 166.00 | 168.65 | 2.65 | 2.54 | 35 | 1.68 | 2.96 | 246 |

| including | 189.10 | 189.60 | 0.50 | 2.62 | 1 | 0.11 | 2.64 | 219 |

| HR23-388 | 211.90 | 229.50 | 17.60 | 1.00 | 4 | 0.14 | 1.04 | 86 |

| including | 213.86 | 215.00 | 1.14 | 1.90 | 17 | 0.93 | 2.10 | 174 |

| including | 219.48 | 220.20 | 0.72 | 7.80 | 8 | 0.13 | 7.90 | 655 |

| including | 221.50 | 222.00 | 0.50 | 1.03 | 9 | 0.16 | 1.14 | 94 |

| including | 225.60 | 228.40 | 2.80 | 2.05 | 4 | 0.14 | 2.10 | 174 |

| and | 372.50 | 381.50 | 9.00 | 1.76 | 3 | 0.13 | 1.80 | 149 |

| including | 373.38 | 373.88 | 0.50 | 28.80 | 47 | 2.23 | 29.37 | 2434 |

| HR23-390 | 167.70 | 218.00 | 50.30 | 1.92 | 4 | 0.03 | 1.96 | 162 |

| including | 169.68 | 170.18 | 0.50 | 129.00 | 218 | 1.09 | 131.63 | 10911 |

| including | 173.95 | 174.45 | 0.50 | 5.59 | 8 | 0.13 | 5.68 | 471 |

| including | 206.00 | 207.00 | 1.00 | 2.72 | 1 | 0.00 | 2.73 | 227 |

| including | 216.00 | 218.00 | 2.00 | 2.12 | 5 | 0.03 | 2.18 | 180 |

| HR23-391 | 159.00 | 167.50 | 8.50 | 0.12 | NSV | 0.12 | 10 | |

| and | 232.00 | 239.55 | 7.55 | 1.22 | 5 | 0.14 | 1.28 | 106 |

| including | 234.00 | 236.55 | 2.55 | 3.29 | 11 | 0.36 | 3.43 | 284 |

| and | 246.04 | 306.90 | 60.86 | 0.72 | 3 | 0.09 | 0.76 | 63 |

| including | 246.04 | 246.61 | 0.57 | 3.56 | 40 | 0.12 | 4.04 | 335 |

| including | 254.48 | 273.30 | 18.82 | 1.52 | 4 | 0.14 | 1.56 | 130 |

| including | 304.70 | 305.20 | 0.50 | 13.55 | 50 | 0.27 | 14.15 | 1173 |

| and | 324.00 | 346.20 | 22.20 | 0.26 | 0 | 0.02 | 0.27 | 22 |

| including | 331.80 | 332.30 | 0.50 | 3.96 | 5 | 0.84 | 4.03 | 334 |

| HR23-392 | 113.00 | 119.00 | 6.00 | 0.45 | 47 | 0.02 | 1.01 | 84 |

Table 3. Completed Drill Hole Assays from the Homestake Ridge Property Exploration

| Hole ID | From (m) | To (m) | Length (m)** | Au (g/t) | Ag (g/t) | Cu (%) | AuEq* | AgEq* |

| HR23-422 | 193.00 | 194.17 | 1.17 | 0.36 | 24 | 0.13 | 0.65 | 54 |

| HR23-424 | 10.00 | 17.00 | 7.00 | 0.27 | NSV | |||

| HR23-424 | 12.00 | 13.16 | 1.16 | 1.06 | 9 | 1.17 | 97 | |

| and | 23.25 | 23.75 | 0.50 | 5.72 | 22 | 0.40 | 5.98 | 496 |

| and | 95.20 | 95.70 | 0.50 | 0.54 | 20 | 0.79 | 65 | |

| and | 196.05 | 196.66 | 0.61 | 1.76 | 2 | 1.79 | 148 | |

| and | 199.35 | 199.85 | 0.50 | 1.97 | 3 | 2.00 | 166 | |

| and | 249.35 | 249.93 | 0.58 | 1.84 | 2 | 1.86 | 154 | |

| HR23-423 | 168.60 | 169.70 | 1.10 | 1.52 | 1 | 1.53 | 127 | |

| and | 246.75 | 247.75 | 1.00 | 0.78 | NSV | 0.78 | 65 | |

| HR23-420 | NSV | |||||||

| HR23-421 | 97.60 | 206.00 | 108.40 | 0.11 | NSV | 0.112 | 9 | |

| HR23-417 | 156.20 | 161.20 | 5.00 | 0.98 | NSV | 0.978 | 81 | |

| including | 158.20 | 159.20 | 1.00 | 2.09 | NSV | 2.09 | 173 |

*AuEq and AgEq are calculated using $US1650/oz Au, $US20/oz Ag.

**Estimated true widths vary depending on intersection angles and range from 50% to 90% of core lengths

***Determined using metallic screen fire assay on 1.0kg

Table 4. Drill Hole Collar Locations for 2023 Homestake Ridge drill holes in this release

| Hole ID | Easting UTM83 (m) | Northing UTM83 (m) | Elev. (m) | Azimuth | Dip | Length (m) |

| HR23-367 | 462840 | 6179693 | 952 | 211 | -58 | 351.00 |

| HR23-368 | 462840 | 6179693 | 952 | 202 | -68 | 402.00 |

| HR23-369 | 463071 | 6179531 | 927 | 237 | -55 | 414.00 |

| HR23-370 | 462840 | 6179693 | 952 | 226 | -56 | 324.90 |

| HR23-371 | 462771 | 6179849 | 1091 | 200 | -75 | 589.00 |

| HR23-372 | 463071 | 6179531 | 927 | 235 | -62 | 390.00 |

| HR23-373 | 462840 | 6179693 | 952 | 230 | -68 | 450.00 |

| HR23-374 | 463166 | 6179562 | 895 | 232 | -53 | 441.00 |

| HR23-375 | 462771 | 6179849 | 1091 | 200 | -62 | 582.00 |

| HR23-376 | 462897 | 6179729 | 964 | 140 | -65 | 609.00 |

| HR23-377 | 463166 | 6179562 | 895 | 232 | -71 | 552.00 |

| HR23-378 | 462771 | 6179849 | 1091 | 200 | -73 | 609.00 |

| HR23-379 | 463015 | 6179634 | 918 | 210 | -59 | 450.00 |

| HR23-380 | 463132 | 6179539 | 914 | 221 | -70 | 501.00 |

| HR23-381 | 462794 | 6179271 | 1116 | 106 | -45 | 402.00 |

| HR23-382 | 463075 | 6179672 | 902 | 212 | -55 | 450.00 |

| HR23-383 | 463129 | 6179330 | 986 | 220 | -53 | 285.00 |

| HR23-384 | 463132 | 6179539 | 914 | 205 | -66 | 501.00 |

| HR23-385 | 462897 | 6179729 | 964 | 240 | -74 | 600.00 |

| HR23-386 | 463120 | 6179391 | 969 | 223 | -57 | 300.00 |

| HR23-387 | 463120 | 6179391 | 969 | 231 | -52 | 306.00 |

| HR23-388 | 463133 | 6179500 | 925 | 223 | -47 | 399.00 |

| HR23-390 | 463120 | 6179391 | 969 | 205 | -62 | 354.00 |

| HR23-391 | 463133 | 6179500 | 925 | 218 | -61 | 439.00 |

| HR23-392 | 462794 | 6179271 | 1116 | 116 | -45 | 354.00 |

| HR23-389 | 463590 | 6179193 | 825 | 228 | -46 | 603.00 |

| HR23-394 | 463590 | 6179193 | 825 | 228 | -53 | 654.00 |

| HR23-399 | 463590 | 6179193 | 825 | 232 | -48 | 621.00 |

| HR23-410 | 463560 | 6179124 | 834 | 220 | -50 | 600.00 |

| HR23-417exp | 463182 | 6178630 | 1070 | 240 | -50 | 283.00 |

| HR23-420exp | 463482 | 6178246 | 1014 | 240 | -50 | 279.00 |

| HR23-421exp | 463295 | 6177829 | 1200 | 282 | -46 | 222.00 |

| HR23-422exp | 463305 | 6177143 | 1117 | 166 | -46 | 261.00 |

| HR23-423exp | 463713 | 6176389 | 1038 | 315 | -50 | 255.00 |

| HR23-424exp | 463318 | 6178059 | 1169 | 230 | -46 | 327.00 |

Dolly Varden Exploration Drilling

Result for twelve drill holes competed at the end of the 2023 season on the Dolly Varden property come from three main areas: Red Point, North Star and Wolf (Figure 6).

Red Point Drilling

Three holes were drilled in the Red Point area, located at the southern end of the western gold belt, approximately 10 kilometers southeast along the trend from the Homestake Ridge deposits. Styles of mineralization encountered including varying degrees of quartz and quartz-carbonate veining in a QSP alteration halo, similar to what is seen at the Homestake Ridge deposits. Highlights from the 2023 exploration drilling include: (intervals shown are core length**)

**Estimated true widths vary depending on intersection angles and range from 70% to 90% of core lengths.

North Star Drilling

Two drill holes intersected the stratabound mineralization of the North Star deposit, part of the Torbrit Horizon, approximately 50 meters down dip from historic underground drilling in the 1960s. The surface drill holes collars were moved further back to intercept the horizon at a better angle and test for continuity. The North Star deposit has higher lead (Pb) and zinc (Zn) values than the Torbrit deposit located across the Kitsault Valley. The Current Mineral Resource Estimate for North Star does not include any credits for the significant base metals in the mineralized horizon.

Highlights from North Star Area include: (intervals shown are core length**)

**Estimated true widths vary depending on intersection angles and range from 80% to 95% of core lengths.

The North Star deposit (along the Torbrit Horizon) remains open to the west down dip along the Torbrit Horizon for follow up in the 2024 drill program.

Wolf Drilling

The five drill holes reported in this release for Wolf were part of an end of season follow up to test below the plunge of the wide, higher-grade zone. The Wolf structure was intersected with low silver grades and increased lead and zinc values, typical of below and outside of the plunge of high-grade silver zone (Figure 8).

Figure 6. Drill hole location map for Dolly Varden Property holes reported in this release.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1728/197571_d1b03db9d4f00b27_007full.jpg

Figure 7. Wolf Long Section with 2023 drill holes in this release highlighted in white. The 2023 result highlights shown from step-outs along the wide, high-grade plunge are from previous releases (Sept 11th and Nov 06th, 2023).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1728/197571_d1b03db9d4f00b27_008full.jpg

Table 5. Completed Drill Hole Assays from the Dolly Varden Property Exploration Drilling in this release.

| Hole ID | From (m) | To (m) | Length (m)** | Ag (g/t) | Au (g/t) | Pb (%) | Zn (%) | AgEq (g/t) |

| DV23-353 North Star | 251.05 | 254.50 | 3.45 | 138 | 0.07 | 3.50 | 7.69 | 543 |

| including | 252.50 | 254.50 | 2.00 | 211 | 0.10 | 5.74 | 9.82 | 769 |

| and | 266.45 | 267.10 | 0.65 | 426 | 0.39 | 0.59 | 0.24 | 485 |

| and | 291.50 | 292.50 | 1.00 | 219 | 0.47 | 0.05 | 1.29 | 308 |

| DV23-358 North Star | 278.96 | 280.80 | 1.84 | 52 | 0.03 | 0.80 | 11.10 | 500 |

| and | 293.32 | 311.42 | 18.10 | 199 | 0.08 | 1.28 | 1.21 | 292 |

| including | 293.32 | 300.75 | 7.43 | 345 | 5.92 | 2.75 | 1.6 | 491 |

| including | 293.32 | 293.90 | 0.58 | 1510 | 0.06 | 1.23 | 5.34 | 1755 |

| including | 296.00 | 297.00 | 1.00 | 753 | 0.51 | 15.20 | 4.32 | 1430 |

| DV23-360 Red Point | 1.85 | 122.47 | 120.62 | 3 | 0.44 | 0.02 | 0.05 | 42 |

| including | 34.90 | 48.00 | 13.10 | 6 | 1.92 | 0.03 | 0.08 | 169 |

| including | 44.00 | 46.30 | 2.30 | 15 | 7.25 | 0.03 | 0.07 | 619 |

| DV23-363 Red Point | 29.00 | 109.00 | 80.00 | NSV | 0.38 | |||

| including | 51.00 | 54.10 | 3.10 | 12 | 3.45 | 298 | ||

| DV23-384 Red Point | 724.20 | 783.00 | 58.80 | 1 | 0.28 | 0.01 | 0.03 | 26 |

| including | 737.50 | 761.81 | 24.31 | 1 | 0.45 | 0.00 | 0.02 | 39 |

| DV23-377 Surprise | NSV | |||||||

| DV23-378 Surprise | NSV | |||||||

| DV23-380 Wolf | 575.60 | 584.28 | 8.68 | 2 | NSV | 0.12 | 0.55 | 26 |

| DV23-381 Wolf | 593.13 | 594.10 | 0.97 | 115 | 0.03 | 1.60 | 1.73 | 233 |

| and | 669.20 | 670.20 | 1.00 | 184 | 0.04 | 0.52 | 2.44 | 295 |

| and | 671.92 | 673.90 | 1.98 | 215 | 0.01 | 0.23 | 3.17 | 343 |

| and | 675.40 | 676.40 | 1.00 | 138 | 0.03 | 15.04 | 3.12 | 725 |

| DV23-382 Wolf | 549.83 | 570.70 | 20.87 | 39 | 0.18 | 1.25 | 0.70 | 119 |

| including | 551.00 | 552.30 | 1.30 | 250 | 0.28 | 15.38 | 3.80 | 895 |

| DV23-383 Wolf | 274.00 | 276.72 | 2.72 | 6 | 0.03 | 0.06 | 1.14 | 53 |

| DV23-385 Wolf | 369.02 | 384.62 | 15.60 | 21 | 0.05 | 0.77 | 0.61 | 72 |

| including | 372.10 | 372.92 | 0.82 | 131 | 0.28 | 0.34 | 0.55 | 185 |

*AgEq is calculated using $US20/oz Ag, $US0.90/lb Pb and $US1.10/lb Zn

**Estimated true widths vary depending on intersection angles and range from 70% to 95% of core lengths

Table 6. Drill Hole Collar Locations for 2023 Dolly Varden Property drill holes in this release.

| Hole ID | Easting UTM83 (m) | Northing UTM83 (m) | Elev. (m) | Azimuth | Dip | Length (m) |

| DV23-353 North Star | 467575 | 6171329 | 533 | 115 | -60 | 431.00 |

| DV23-358 North Star | 467575 | 6171329 | 533 | 155 | -58 | 413.00 |

| DV23-360 Red Point | 467026 | 6172064 | 618 | 205 | -50 | 384.00 |

| DV23-363 Red Point | 466782 | 6172288 | 707 | 220 | -63 | 378.00 |

| DV23-384 Red Point | 466500 | 6171968 | 759 | 260 | -60 | 912.00 |

| DV23-377 Surprise | 466815 | 6173693 | 446 | 232 | -46 | 300.00 |

| DV23-378 Surprise | 466815 | 6173693 | 446 | 340 | -60 | 618.00 |

| DV23-380 Wolf | 467013 | 6173643 | 383 | 140 | -71 | 803.00 |

| DV23-381 Wolf | 467013 | 6173643 | 383 | 140 | -74 | 824.00 |

| DV23-382 Wolf | 467013 | 6173643 | 383 | 142 | -65 | 648.00 |

| DV23-383 Wolf | 467265 | 6172994 | 372 | 305 | -55 | 762.00 |

| DV23-385 Wolf | 467127 | 6173757 | 364 | 138 | -57 | 498.00 |

Quality Assurance and Quality Control

The Company adheres to CIM Best Practices Guidelines for exploration related activities conducted on its property. Quality Assurance and Quality Control (QA/QC) procedures are overseen by the Qualified Person.

Dolly Varden QA/QC protocols are maintained through the insertion of certified reference material (standards), blanks and field duplicates within the sample stream. Drill core is cut in-half with a diamond saw, with one-half placed in sealed bags and shipped to the laboratory and the other half retained on site. Third party laboratory checks on 5% of the samples are carried out as well. Chain of custody is maintained from the drill to the submittal into the laboratory preparation facility.

Analytical testing was performed by ALS Canada Ltd. in North Vancouver, British Columbia. The entire sample is crushed to 70% minus 2mm (10 mesh), of which a 500 gram split is pulverized to minus 200 mesh. Multi-element analyses were determined by Inductively Coupled Plasma Mass Spectrometry (ICP-MS) for 48 elements following a 4-acid digestion process. High grade silver testing was determined by Fire Assay with either an atomic absorption, or a gravimetric finish, depending on grade range. Gold is determined by Fire Assay on a 30g split with and AA finish and over limits determined by Fire Assay with a gravimetric finish. Metallic screen fire assay analysis on 1kg sample +106umis carried out when determined to be necessary on higher grade samples.

Qualified Person

Rob van Egmond, P.Geo., Vice-President Exploration for Dolly Varden Silver, the “Qualified Person” as defined by NI43-101 has reviewed, validated and approved the scientific and technical information contained in this news release and supervises the ongoing exploration program at the Dolly Varden Project.

About Dolly Varden Silver Corporation

Dolly Varden Silver Corporation is a mineral exploration company focused on advancing its 100% held Kitsault Valley Project (which combines the Dolly Varden Project and the Homestake Ridge Project) located in the Golden Triangle of British Columbia, Canada, 25kms by road to tide water. The 163 sq. km. project hosts the high-grade silver and gold resources of Dolly Varden and Homestake Ridge along with the past producing Dolly Varden and Torbrit silver mines. It is considered to be prospective for hosting further precious metal deposits, being on the same structural and stratigraphic belts that host numerous other, on-trend, high-grade deposits, such as Eskay Creek and Brucejack. The Kitsault Valley Project also contains the Big Bulk property which is prospective for porphyry and skarn style copper and gold mineralization, similar to other such deposits in the region (Red Mountain, KSM, Red Chris).

Forward-Looking Statements

This release may contain forward-looking statements or forward-looking information under applicable Canadian securities legislation that may not be based on historical fact, including, without limitation, statements containing the words “believe”, “may”, “plan”, “will”, “estimate”, “continue”, “anticipate”, “intend”, “expect”, “potential”, and similar expressions. Forward-looking statements involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of Dolly Varden to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. Forward-looking statements or information in this release relates to, among other things, the 2022 drill program at the Kitsault Valley Project, the results of previous field work and programs and the continued operations of the current exploration program, interpretation of the nature of the mineralization at the project and that that the mineralization on the project is similar to Eskay and Brucejack, results of the mineral resource estimate on the project, the potential to grow the project, the potential to expand the mineralization and our beliefs about the unexplored portion of the property.

These forward-looking statements are based on management’s current expectations and beliefs and assume, among other things, the ability of the Company to successfully pursue its current development plans, that future sources of funding will be available to the company, that relevant commodity prices will remain at levels that are economically viable for the Company and that the Company will receive relevant permits in a timely manner in order to enable its operations, but given the uncertainties, assumptions and risks, readers are cautioned not to place undue reliance on such forward-looking statements or information. The Company disclaims any obligation to update, or to publicly announce, any such statements, events or developments except as required by law.

For additional information on risks and uncertainties, see the Company’s most recently filed annual management discussion & analysis (“MD&A“) and management information circular dated January 21, 2022 (the “Circular“), both of which are available on SEDAR at www.sedar.com. The risk factors identified in the MD&A and the Circular are not intended to represent a complete list of factors that could affect the Company.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this news release.

For further information: Shawn Khunkhun, CEO & Director, 1-604-609-5137, www.dollyvardensilver.com.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/197571

Kelowna, British Columbia–(Newsfile Corp. – February 12, 2024) – F3 Uranium Corp (TSXV: FUU) (OTCQB: FUUFF) (“F3” or “the Company“) is pleased to announce final assay results from the fall 2023 drill program, including PLN23-110 (see NR dated December 18, 2023) which returned 2.0m of 42.4% U3O8 from 226.0m to 228.0m, including 1.5m averaging 55.4% U3O8 with a highest grade of 66.8% U3O8 in a single 0.5m sample. PLN23-112, drilled from line 060S returned 11.5m averaging 2.00% U3O8 from 229.0m to 240.5m including 3.5m averaging 4.24% U3O8.

Sam Hartmann, VP Exploration, commented:

“PLN23-110 returned ultra-high grade assays, including the highest assay to date – 66.8% U3O8 on section 015S, which remains open in the up-dip direction. At the B1 area, where we initially targeted the B1 EM conductor, significant alteration in sandstone and basement rocks was encountered (see NR dated December 18, 2023) and we are pleased to receive final geochemistry supporting our decision to drill a wide fence with 4 drill holes across approximately 250m of geology. Anomalous basement uranium values were intersected, notably in PLN23-105 with up to 137 ppm uranium; values of greater than 100 ppm uranium have previously only been encountered in PLN14-019 and immediately surrounding holes, as well as within the JR Zone itself.”

The Company is also pleased to announce that it has completed a technical report for its Patterson Lake North (PLN) Project, including the PLN, Broach and Minto properties, pursuant to National Instrument 43-101 “Standards of Disclosure for Mineral Projects” (“NI 43-101”). The report was completed by lead consultant SLR International Corporation (“SLR”) with an effective date of November 20, 2023, prepared for F3 Uranium Corp. and dated January 25, 2024. The report will be filed on SEDAR within 45 days.

Assay Highlight:

PLN23-110 (line 015S): mineralized intervals

Main JR Zone Intercepts:

PLN23-101 (line 015S): mineralized intervals

PLN23-106 (line 120S): mineralized interval

PLN23-108 (line 030S): mineralized intervals

PLN23-109 (line 015S): mineralized interval

PLN23-112 (line 060S): mineralized intervals

PLN23-114 (line 030S): mineralized intervals

Exploration Drilling Highlights:

PLN23-102 (line 3450S), B1 Area:

PLN23-105 (line 3450S), B1 Area:

PLN23-111 (line 3450S), B1 Area:

Table 1. Drill Hole Summary and Uranium Assay Results

| Collar Information | Assay Results | |||||||||

| Hole ID | Grid Line | Easting | Northing | Elevation | Az | Dip | From (m) | To (m) | Interval (m) | U3O8 weight % |

| PLN23-101 | 015S | 587732.5 | 6410748.2 | 545.3 | 54.6 | -64.9 | 218.50 | 222.50 | 4.00 | 0.22 |

| 222.50 | 224.00 | 1.50 | 1.77 | |||||||

| 224.00 | 227.50 | 3.50 | 0.28 | |||||||

| 227.50 | 229.00 | 1.50 | 2.64 | |||||||

| 229.00 | 230.00 | 1.00 | 0.26 | |||||||

| PLN23-102 | 3450S | 589712.2 | 6407939.1 | 540.0 | 53.1 | -65.6 | B1 exploration; no mineralization >0.05 | |||

| PLN23-103 | 045S | 587780.7 | 6410746.1 | 545.7 | 54.5 | -60.3 | no mineralization >0.05 | |||

| PLN23-104 | 105S | 587729.0 | 6410634.5 | 545.2 | 54.4 | -60.6 | no mineralization >0.05 | |||

| PLN23-105 | 3450S | 589764.9 | 6407978.1 | 540.4 | 53.3 | -65.0 | B1 exploration; no mineralization >0.05 | |||

| PLN23-106 | 120S | 587761.4 | 6410639.4 | 544.4 | 54.3 | -64.1 | 240.50 | 241.00 | 0.50 | 0.07 |

| PLN23-107 | 3450S | 589673.7 | 6407913.1 | 539.9 | 55.0 | -65.2 | B1 exploration; no mineralization >0.05 | |||

| PLN23-108 | 030S | 587682.1 | 6410692.8 | 545.1 | 53.6 | -60.3 | 256.50 | 257.00 | 0.50 | 0.24 |

| 260.50 | 261.00 | 0.50 | 0.67 | |||||||

| PLN23-109 | 015S | 587739.0 | 6410762.5 | 545.5 | 54.7 | -74.9 | 221.00 | 223.50 | 2.50 | 0.33 |

| PLN23-110 | 015S | 587733.4 | 6410749.2 | 545.5 | 53.3 | -61.8 | 217.00 | 219.50 | 2.50 | 0.23 |

| 226.00 | 228.00 | 2.00 | 42.4 | |||||||

| incl | 226.00 | 227.50 | 1.50 | 55.4 | ||||||

| PLN23-111 | 3240S | 589638.6 | 6408148.6 | 535.5 | 55.2 | -65.2 | B1 exploration; no mineralization >0.05 | |||

| PLN23-112 | 060S | 587748.7 | 6410702.1 | 545.7 | 53.3 | -65.5 | 229.00 | 232.00 | 3.00 | 0.33 |

| 232.00 | 232.50 | 0.50 | 13.2 | |||||||

| 232.50 | 237.00 | 4.50 | 0.14 | |||||||

| 237.00 | 240.50 | 3.50 | 4.24 | |||||||

| incl | 238.00 | 238.50 | 0.50 | 20.0 | ||||||

| 244.50 | 245.00 | 0.50 | 0.05 | |||||||

| PLN23-113 | 930S | 588352.9 | 6410068.3 | 532.9 | 52.8 | -65.0 | A1 exploration; no mineralization >0.05 | |||

| PLN23-114 | 030S | 587736.8 | 6410733.3 | 545.5 | 54.8 | -58.1 | 219.50 | 222.50 | 3.00 | 0.05 |

| 230.50 | 232.00 | 1.50 | 0.64 | |||||||

| 235.50 | 236.00 | 0.50 | 0.11 | |||||||

| PLN23-115 | 2955S | 589548.1 | 6408433.1 | 530.8 | 42.9 | -67.9 | B1 exploration; no mineralization >0.05 | |||

Assay composite parameters:

Composited weight % U3O8 mineralized intervals are summarized in Table 1. Samples from the drill core are split in half sections on site. Where possible, samples are standardized at 0.5m down-hole intervals. One-half of the split sample is sent to SRC Geoanalytical Laboratories (an SCC ISO/IEC 17025: 2005 Accredited Facility) in Saskatoon, SK while the other half remains on site for reference. Analysis includes a 63 element suite including boron by ICP-OES, uranium by ICP-MS and gold analysis by ICP-OES and/or AAS.

The Company considers uranium mineralization with assay results of greater than 1.0 weight % U3O8 as “high grade” and results greater than 20.0 weight % U3O8 as “ultra-high grade”.

All depth measurements reported are down-hole and true thickness are yet to be determined.

About Patterson Lake North:

The Company’s 4,078-hectare 100% owned Patterson Lake North property (PLN) is located just within the south-western edge of the Athabasca Basin in proximity to Fission Uranium’s Triple R and NexGen Energy’s Arrow high-grade world class uranium deposits which is poised to become the next major area of development for new uranium operations in northern Saskatchewan. PLN is accessed by Provincial Highway 955, which transects the property, and the new JR Zone uranium discovery is located 23km northwest of Fission Uranium’s Triple R deposit. The PLN property is part of the PLN Project which also includes the Minto and Broach properties.

Qualified Person:

The technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 and approved on behalf of the company by Raymond Ashley, P.Geo., President & COO of F3 Uranium Corp, a Qualified Person. Mr. Ashley has verified the data disclosed.

About F3 Uranium Corp.:

F3 Uranium is a uranium project generator and exploration company, focusing on projects in the Athabasca Basin, home to some of the world’s largest high grade uranium discovery. F3 Uranium currently has 18 projects in the Athabasca Basin. Several of F3’s projects are near large uranium discoveries including Triple R, Arrow and Hurricane.

Forward Looking Statements

This news release contains certain forward-looking statements within the meaning of applicable securities laws. All statements that are not historical facts, including without limitation, statements regarding future estimates, plans, programs, forecasts, projections, objectives, assumptions, expectations or beliefs of future performance, including statements regarding the suitability of the Properties for mining exploration, future payments, issuance of shares and work commitment funds, entry into of a definitive option agreement respecting the Properties, are “forward-looking statements.” These forward-looking statements reflect the expectations or beliefs of management of the Company based on information currently available to it. Forward-looking statements are subject to a number of risks and uncertainties, including those detailed from time to time in filings made by the Company with securities regulatory authorities, which may cause actual outcomes to differ materially from those discussed in the forward-looking statements. These factors should be considered carefully and readers are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements and information contained in this news release are made as of the date hereof and the Company undertakes no obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws.

The TSX Venture Exchange and the Canadian Securities Exchange have not reviewed, approved or disapproved the contents of this press release, and do not accept responsibility for the adequacy or accuracy of this release.

F3 Uranium Corp.

750-1620 Dickson Avenue

Kelowna, BC V1Y9Y2

Contact Information

Investor Relations

Telephone: 778 484 8030

Email: ir@f3uranium.com

ON BEHALF OF THE BOARD

“Dev Randhawa”

Dev Randhawa, CEO

See plan maps below and cross sections at PLN JR Zone| F3 Uranium Corp. under Sections.

Figure 1 – Patterson Lake North Fall 2023 Drill Program Update: Assay Results

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8110/197577_f8732418c479aa79_003full.jpg

Figure 2 – Patterson Lake North Fall 2023 Drill Program Update: JR Zone Assay Results

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8110/197577_f8732418c479aa79_004full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/197577

Kelowna, British Columbia–(Newsfile Corp. – February 6, 2024) – Strathmore Plus Uranium Corporation (TSXV: SUU) (OTCQB: SUUFF) (“Strathmore Plus” or “the Company“) is pleased to announce the initiation of a non-brokered private placement (the “Offering”) to raise minimum gross proceeds of $1,500,000 from the sale of 3,000,000 units of the Company (each, a “Unit”) at a price of C$0.50 per Unit (the “Offering Price”), and maximum gross proceeds of $2,000,000 from the sale of up to 4,000,000 Units, at the Offering Price. Red Cloud Securities Inc. will be acting as a finder in connection with the Offering.

Each Unit consists of one common share of the Company (each, a “Common Share”) and one-half Common Share purchase warrant (each, a “Warrant”). Each full Warrant entitles the holder to purchase one Common Share at a price of $0.70 per share for a period of 24 months following the issue date of the Units.

Proceeds from the Offering will be used for working capital and further exploration of the Company’s Wyoming properties.

The closing of the Offering is subject to receipt of all necessary regulatory approvals, including the approval of the listing of the Common Shares issuable from the sale of the Units on the TSX Venture Exchange. The Common Shares issuable from the sale of the Units and upon the exercise of the Warrants will be subject to a hold period ending on the date that is four months and one day from the issue date of the Unit in accordance with applicable securities laws. A finder’s fee may be paid on a portion of the proceeds from the Offering.

This news release does not constitute an offer to sell or a solicitation of an offer to sell any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

About Strathmore Plus Uranium Corp.

Strathmore has three fully permitted uranium projects in Wyoming, including Agate, Beaver Rim, and Night Owl. The Agate and Beaver Rim properties contain uranium in typical Wyoming-type roll front deposits based on historical drilling data. The Night Owl property is a former producing surface mine that was in production in the early 1960s.

Strathmore Plus Uranium Corp.

Contact Information:

Investor Relations

Telephone: 1 888 882 8177

Email: info@strathmoreplus.com

Jamie Bannerman jamie@rdcapital.com

250-868-6553

ON BEHALF OF THE BOARD

“Dev Randhawa”

Dev Randhawa, CEO

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/197051

YERINGTON, Nev., Feb. 08, 2024 (GLOBE NEWSWIRE) — Nevada Copper Corp. (TSX: NCU) (OTC: NEVDF) (FSE: ZYTA) (“Nevada Copper” or the “Company”) provides updates on restart activities at its Pumpkin Hollow underground mine (the “Underground Mine”).

Randy Buffington, President and CEO of Nevada Copper, stated, “Since restarting mining and milling operations, we’ve made progress in a number of areas, including completion of life of mine projects such as the Geho dewatering system and phase two of the underground crushing and ore handling system, development of significant stope inventory underground and realignment of the site operations team, under the leadership of Chuck Pollard as Assistant General Manager. However, several unforeseen setbacks impacted our progress on meeting operational targets. We took critical steps and refocused resources to mitigate and address these issues. The hoisting and ore handling system has returned to full capacity and mill operations continue to incrementally improve with over two months of mill feed stockpiled on surface. While I am disappointed that these challenges have negatively impacted our ability to meet hoisting and processing targets, we continue to ramp-up toward steady state operations.”

Recent Operating Developments

Operational Status

As noted above, several key milestones have been achieved across many aspects of the mine, including completion of critical LOM projects and restart of all significant operations, however, key fourth quarter operational targets were not met. The following challenges impacted our progress in the fourth quarter:

Life of Mine Infrastructure

In addition to the completion and commissioning of the Geho dewatering system and the second phase of the ore handling system, other LOM infrastructure improvements include the drilling of a new fuel delivery hole, drilling of a second paste hole that will provide life-of-mine paste delivery for EN Zone stopes and improvements to the water infiltration system on surface to handle excess surge capacity. A scope of work is being issued to potential contractors for the final phase of the ore handling system, which includes installation and commissioning of the crushing system.

Financing Matters

Considering the unexpected challenges described above, the Company has generated lower sales through the ramp-up process than previously anticipated, negatively impacting financing requirements. As previously disclosed, the Company has fully drawn US$25 million of debt pursuant to a deferred funding agreement with its two largest shareholders, Pala Investments Limited (“Pala”) and Mercuria Holdings (Singapore) Pte Ltd. Pala has since been providing sole funding for the Company’s operating needs in the form of debt on similar terms to the Company’s October 2022 credit facility with Pala, except such debt is unsecured and not guaranteed by the Company’s subsidiaries and the interest rate on the debt is SOFR + 10% and it matures in December 2024.

The Company requires additional financing in order to complete the ramp-up of the Underground Mine. While Pala has continued to support the Company, it is under no obligation to do so. The Company is also in discussions with other third parties. There is no assurance that additional financing will be obtained in a sufficient amount, or at all. In the absence of securing sufficient funding from Pala or other third parties, the Company will not be able to continue carrying on business.

Exploration Opportunities

As previously reported, the Company completed its 2023 drill program with a total of 11 holes (3,305 feet) drilled on the Copper Ridge target and 9 holes (1,653 feet) on the Dimples target. Preliminary assays continue to be received and analyzed by the Company and indicate that mineralization and alteration found at surface has been intersected in the drill holes. Further updates will be made once the final assays and QA/QC samples are expected to be received in the first quarter of 2024.

Qualified Person

The technical information and data in this news release has been reviewed by Steven Newman, Registered Member – SME, Vice President, Technical Services for Nevada Copper and Greg French, C.P.G., VP Exploration for Nevada Copper, who are non-independent Qualified Persons within the meaning of NI 43-101.

About Nevada Copper

Nevada Copper (TSX: NCU) is the owner of the Pumpkin Hollow copper project located in Nevada, USA with substantial reserves and resources including copper, gold and silver. Its two fully permitted projects include the high-grade Underground Mine and processing facility, which was recently restarted and is undergoing a ramp up of operations to nameplate capacity, and a large-scale open pit PFS stage project.

Randy Buffington

President & CEO

For additional information, please see the Company’s website at www.nevadacopper.com, or contact:

Tracey Thom | Vice President, IR and Community Relations

tthom@nevadacopper.com

+1 775 391 9029

Cautionary Language on Forward Looking Statements

This news release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian securities laws. All statements in this news release, other than statements of historical facts, are forward-looking statements. Such forward-looking information and forward-looking statements specifically include, but are not limited to, statements that relate to the ramp-up and restart of operations at the Underground Mine and the resolution of unexpected challenges and future financing needs. There can be no assurance that the ramp-up of the Underground Mine will be completed. Additional financing will be required to complete the ramp-up of the Underground Mine and there can be no assurance that any such additional financing will be available on terms that are favourable to the Company or at all.

Forward-looking statements and information include statements regarding the expectations and beliefs of management. Often, but not always, forward-looking statements and forward-looking information can be identified by the use of words such as “plans”, “expects”, “potential”, “is expected”, “anticipated”, “is targeted”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the negatives thereof or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements or information should not be read as guarantees of future performance and results. They are subject to known and unknown risks, uncertainties and other factors which may cause the actual results and events to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information.

Such risks and uncertainties include, without limitation, those relating to: the need for additional capital and no assurance can be given regarding the availability thereof; the ability of the Company to complete the restart and ramp-up of the Underground Mine within the expected cost estimates and timeframe; results of exploration programs; the impact of the effects of COVID-19 on the business and operations of the Company; the state of financial markets; history of losses; dilution; adverse events relating to milling operations, construction, development and restart and ramp-up, including the ability of the Company to address unexpected challenges; ground conditions; cost overruns relating to development, construction and restart and ramp-up of the Underground Mine; loss of material properties; interest rate increases; global economy; limited history of production; future metals price fluctuations; speculative nature of exploration activities; periodic interruptions to exploration, development and mining activities; environmental hazards and liability; industrial accidents; failure of processing and mining equipment to perform as expected; labour disputes; supply problems; uncertainty of production and cost estimates; the interpretation of drill results and the estimation of mineral resources and reserves; changes in project parameters as plans continue to be refined; possible variations in ore reserves, grade of mineralization or recovery rates from management’s expectations and the difference may be material; legal and regulatory proceedings and community actions; accidents; title matters; regulatory approvals and restrictions; increased costs and physical risks relating to climate change, including extreme weather events, and new or revised regulations relating to climate change; permitting and licensing; dependence on management information systems and cyber security risks; volatility of the market price of the Company’s securities; insurance; competition; hedging activities; currency fluctuations; loss of key employees; other risks of the mining industry as well as those risks discussed in the Company’s Management’s Discussion and Analysis in respect of the year ended December 31, 2022 and in the section entitled “Risk Factors” in the Company’s Annual Information Form dated March 20, 2023. The forward-looking statements and information contained in this news release are based upon assumptions management believes to be reasonable, including, without limitation: no adverse developments in respect of the property or operations at the project; no material changes to applicable laws; the restart and ramp-up of operations at the Underground Mine in accordance with management’s plans and expectations; no material adverse impacts from the effects of COVID-19 going forward; the Company will be able to obtain sufficient additional funding to complete the restart and ramp-up of the Underground Mine, no material adverse change to the price of copper from current levels; and the absence of any other factors that could cause actions, events or results to differ from those anticipated, estimated or intended.

The forward-looking information and statements are stated as of the date hereof. The Company disclaims any intent or obligation to update forward-looking statements or information except as required by law. Although the Company has attempted to identify important factors that could cause actual actions, events, or results to differ materially from those described in forward-looking information and statements, there may be other factors that could cause actions, events or results not to be as anticipated, estimated or intended. Specific reference is made to “Risks and Uncertainties” in the Company’s Management’s Discussion and Analysis in respect of the year ended December 31, 2022 and “Risk Factors” in the Company’s Annual Information Form dated March 20, 2023, for a discussion of factors that may affect forward-looking statements and information. Should one or more of these risks or uncertainties materialize, should other risks or uncertainties materialize or should underlying assumptions prove incorrect, actual results and events may vary materially from those described in forward-looking statements and information. For more information on the Company and the risks and challenges of its business, investors should review the Company’s filings that are available at www.sedarplus.com.

The Company provides no assurance that forward-looking statements and information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements or information. Accordingly, readers should not place undue reliance on forward-looking statements or information.

Vancouver, British Columbia, February 7, 2024 (NYSE American: EMX; TSX Venture: EMX; Frankfurt: 6E9) — EMX Royalty Corporation (the “Company” or “EMX”) is pleased to announce that it has received approval from the TSX Venture Exchange (“TSXV”) of its Notice of Intention to Make a Normal Course Issuer Bid (the “NCIB”).

Under the NCIB, the Company may purchase for cancellation up to 5,000,000 common shares (the “Shares”) (representing approximately 4.45% of its issued and outstanding Shares, being 112,234,040 Shares, as of January 24, 2024) over a twelve-month period commencing on February 13, 2024. The NCIB will expire no later than February 12, 2025.

EMX believes that from time to time, the market price of its Shares may not reflect their underlying value and that the purchase of its Shares will enhance shareholder value and increase liquidity of the Shares. The Company intends to fund the purchases out of available cash.

All purchases made pursuant to the NCIB will be made through the facilities of the TSXV, NYSE American Stock Exchange (“NYSE American”), other designated exchanges and/or alternative Canadian trading systems or by such other means as may be permitted by applicable securities laws. The NCIB will be made in accordance with the applicable rules and policies of the TSXV, NYSE American and applicable Canadian and United States securities laws. The price that EMX will pay for Shares in open market transactions will be the market price at the time of purchase. Any Shares that are purchased under the NCIB will be cancelled. The actual number of Shares that may be purchased and the timing of such purchases will be determined by the Company. Decisions regarding purchases will be based on market conditions, share price, best use of available cash, and other factors. The Company is not obligated to purchase any particular number of Shares under the NCIB and the NCIB may be modified or suspended at the Company’s discretion.

EMX has appointed National Bank Financial Inc. to make purchases under the NCIB on its own behalf.

About EMX. EMX is a precious, base and battery metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the TSXV and the NYSE American under the symbol “EMX”, and also trade on the Frankfurt exchange under the symbol “6E9”. Please see www.EMXroyalty.com for more information.

For further information contact:

| David M. Cole President and CEO Phone: (303) 973-8585 Dave@EMXroyalty.com | Scott Close Director of Investor Relations Phone: (303) 973-8585 SClose@EMXroyalty.com | Isabel Belger Investor Relations (Europe) Phone: +49 178 4909039 IBelger@EMXroyalty.com |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility of the adequacy or accuracy of this release.

Forward-Looking Statements

This news release may contain “forward looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding EMX’s proposed normal course issuer bid and the timing, number and price of Shares that may be purchased under the normal course issuer bid, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to the market price of the Shares being too high to ensure that purchases benefit the Company and its shareholders, and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended September 30, 2023 (the “MD&A”), and the most recently filed Annual Information Form (“AIF”) for the year ended December 31, 2022, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedarplus.ca and on the SEC’s EDGAR website at www.sec.gov

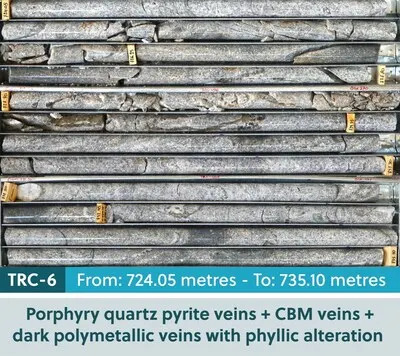

TORONTO, Feb. 6, 2024 /CNW/ – Collective Mining Ltd. (TSX: CNL) (OTCQX: CNLMF) (FWB: GG1) (“Collective” or the “Company”) is pleased to announce that a second rig has been mobilized to the Trap target (“Trap”) due to strong visual mineralization observed in follow up drilling currently underway. Trap is one of a series of porphyry targets within the Company’s Guayabales Project located in Caldas Colombia. The Company’s 2024 exploration plan includes up to 40,000 metres of diamond drilling with three rigs currently operating and a fourth rig anticipated to start drilling by the middle of February 2024.

Trap Highlights (see Figures 1-4)

David Reading, Special Advisor to the Company commented: “The current drill hole at Trap is very exciting as it highlights the presence of stockwork and sheeted porphyry veins which relates to pulses of mineralized fluids typical of large systems. Additionally, based on core inspection of this hole, there is a noticeable increase in total sulphide content relative to the discovery holes previously announced by the Company.”

Richard Tosdal, Special Advisor to the Company added: “The current drill hole appears to start at the margin of a porphyry system and then enters porphyry quartz diorite with sheeted quartz veins surrounded by pervasive phyllic alteration assemblages composed of sericite (probably muscovite), chlorite and sulphides typical of the upper parts of porphyry copper-gold systems.”

About Collective Mining Ltd.

To see our latest corporate presentation and related information, please visit www.collectivemining.com

Founded by the team that developed and sold Continental Gold Inc. to Zijin Mining for approximately $2 billion in enterprise value, Collective Mining is a copper, silver, gold and tungsten exploration company with projects in Caldas, Colombia. The Company has options to acquire 100% interests in two projects located directly within an established mining camp with ten fully permitted and operating mines.

The Company’s flagship project, Guayabales, is anchored by the Apollo system, which hosts the large-scale, bulk-tonnage and high-grade copper-silver-gold-tungsten Apollo porphyry system. The Company’s near-term objective is to drill the shallow portions of the Apollo system, continue to expand the overall dimensions of the system, which remains open in most directions and test newly generated grassroots targets.

Management, insiders and close family and friends own nearly 45% of the outstanding shares of the Company and as a result, are fully aligned with shareholders. The Company is listed on the TSX under the trading symbol “CNL”, on the OTCQX under the trading symbol “CNLMF” and on the FWB under the trading symbol “GG1”.

Qualified Person (QP) and NI43-101 Disclosure

David J Reading is the designated Qualified Person for this news release within the meaning of National Instrument 43-101 (“NI 43-101”) and has reviewed and verified that the technical information contained herein is accurate and approves of the written disclosure of same. Mr. Reading has an MSc in Economic Geology and is a Fellow of the Institute of Materials, Minerals and Mining and of the Society of Economic Geology (SEG).

Technical Information

Rock, soils and core samples have been prepared and analyzed at ALS laboratory facilities in Medellin, Colombia and Lima, Peru. Blanks, duplicates, and certified reference standards are inserted into the sample stream to monitor laboratory performance. Crush rejects and pulps are kept and stored in a secured storage facility for future assay verification. No capping has been applied to sample composites. The Company utilizes a rigorous, industry-standard QA/QC program.

Information Contact:

Follow Executive Chairman Ari Sussman (@Ariski73) on X

Follow Collective Mining (@CollectiveMini1) on X, (Collective Mining) on LinkedIn, and (@collectivemining) on Instagram

FORWARD-LOOKING STATEMENTS

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking information and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussion with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often, but not always using phrases such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking information. In this news release, forward-looking information relate, among other things, to: anticipated advancement of mineral properties or programs; future operations; future recovery metal recovery rates; future growth potential of Collective; and future development plans.

These forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business. Management believes that these assumptions are reasonable. Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include, among others: risks related to the speculative nature of the Company’s business; the Company’s formative stage of development; the Company’s financial position; possible variations in mineralization, grade or recovery rates; actual results of current exploration activities; conclusions of future economic evaluations; fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold, precious and base metals or certain other commodities; fluctuations in currency markets; change in national and local government, legislation, taxation, controls regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formation pressures, cave-ins and flooding); inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); and title to properties, as well as those risk factors discussed or referred to in the annual information form of the Company dated April 7, 2022. Forward-looking information contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements and there may be other factors that cause results not to be anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information.

SOURCE Collective Mining Ltd.

VANCOUVER, BC / ACCESSWIRE / February 5, 2024 / Rover Critical Minerals Corp. (TSXV:ROVR)(OTCQB:ROVMF)(FSE:4XO) (“Rover” or the “Company“) is pleased to announce the appointment of a new President and Director to the Company. Further to its release of July 10, 2023, Mr. Paddy J. Moylan has been promoted from Business Development Advisor, to both Director and President of the Company.

Judson Culter, CEO at Rover Metals, states “In 2023 we saw the expansion of Rover Metals into Australia as part of our strategic growth plans with the appointment of Mr. Paddy J. Moylan as our Business Development Advisor (Australasia). Now in 2024, I am thrilled to announce that Mr. Moylan has accepted the role as President and Director at Rover. Australians are world leaders in the mining of lithium and other critical minerals. The appointment of Mr. Moylan confirms that Rover intends to be a Lithium and Critical Minerals producer.”

Paddy Moylan, President, Director

Paddy Moylan holds combined Bachelor of Commerce and Law degrees and a graduate diploma in legal practice. He has been a lawyer for over 20 years. He is a significant investor in battery metals in Australia and internationally. Mr. Moylan has developed a large network in the battery metals space as an early investor in lithium. He has successfully advised companies on project acquisition, development, divestment and corporate advisory.

Mr. Moylan says “I have been impressed with the board and Judson’s leadership over the last seven months. The market has not been positive, but we have a developing project that we are working hard on. I am excited by this opportunity, and I look forward to working hard to grow the company’s value proposition to investors and partners. I will also be focused on the value-add to the Company in terms of our project line-up and investor base. Battery Metals and Critical Minerals are the future of the mining industry. Whilst we are at the lower end of the cycle, it is the time to ensure Rover is set for success and I will have a laser like focus on doing just that. I look forward to meeting with and talking to investors as we develop Rover as a leading critical minerals company.”

The appointment of Mr. Moylan as President and Director of the Company is subject to final approval by the Toronto Venture Exchange (the “TSXV”). An updating release will be provided once the TSXV provides their acceptance.

Rover is a publicly traded junior mining company that trades on the TSXV under symbol ROVR, on the OTCQB under symbol ROVMF, and on the FSE under symbol 4XO. The Company has a diverse portfolio of mining resource development projects with varying exploration timelines. Its critical mineral projects include lithium, zinc, and copper. Its precious metals projects include gold and silver. The Company is exclusive to the mining jurisdictions of the U.S. and Canada.

You can follow Rover on its social media channels:

Twitter: https://twitter.com/rovermetals

LinkedIn: https://www.linkedin.com/company/rover-metals/

Facebook: https://www.facebook.com/RoverMetals/

for daily company updates and industry news, and

YouTube: https://www.youtube.com/channel/UCJsHsfag1GFyp4aLW5Ye-YQ?view_as=subscriber

for corporate videos.

Website: https://www.rovermetals.com/

ON BEHALF OF THE BOARD OF DIRECTORS

“Judson Culter”

Chief Executive Officer and Director

For further information, please contact:

Email: info@rovermetals.com

Phone: +1 (778) 754-2617

Statement Regarding Forward-Looking Information

This news release contains statements that constitute “forward-looking statements.” Such forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause Rover’s actual results, performance, achievements, or developments in the industry to differ materially from the anticipated results, performance, or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur. There can be no assurance that such statements prove to be accurate. Actual results and future events could differ materially from those anticipated in such statements, and readers are cautioned not to place undue reliance on these forward-looking statements. Any factor could cause actual results to differ materially from Rover’s expectations. Rover undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates, opinions, or other factors, should change.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS NEWS RELEASE REPRESENTS THE EXPECTATIONS OF THE COMPANY AS OF THE DATE OF THIS NEWS RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER SUCH DATE. READERS SHOULD NOT PLACE UNDUE IMPORTANCE ON FORWARD-LOOKING INFORMATION AND SHOULD NOT RELY UPON THIS INFORMATION AS OF ANY OTHER DATE. WHILE THE COMPANY MAY ELECT TO, IT DOES NOT UNDERTAKE TO UPDATE THIS INFORMATION AT ANY PARTICULAR TIME EXCEPT AS REQUIRED IN ACCORDANCE WITH APPLICABLE LAWS.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OF THIS RELEASE.

SOURCE: Rover Critical Minerals Corp.

View the original press release on accesswire.com

VANCOUVER, BC / ACCESSWIRE / January 31, 2024 / Rover Metals Corp. (TSXV:ROVR)(OTCQB:ROVMF)(FSE:4XO) (“Rover” or the “Company“) is pleased to announce that it is changing its name to Rover Critical Minerals Corp. The name change marks the Company’s successful pivot into critical minerals exploration, a process which started in January 2022. Trading will commence under the new name on Monday February 5, 2024. The Company’s shares will continue to trade under the symbol ROVR on the TSXV; ROVMF on the OTCQB; and 4XO on the FSE.

New ISIN/CUSIP numbers reflecting the name change have been made eligible. The Company’s transfer agent, Computershare, can be contacted with any further questions. Effective Monday February 5, 2024, the Company’s will be launching a new website with a new URL of www.rovercriticalmierals.com. Officers and Directors of the Company will continue to use their existing emails and gradually migrate to new email domain over the coming months.

Judson Culter, CEO at Rover Metals, states “Management and Directors at Rover are doubling down on our pivot into critical minerals. We remain resolute in our focus on advancing the Let’s Go Lithium project in the Amargosa Valley of Nevada.”

The LGL project is a claystone sedimentary lithium project located in a flat playa in an ancient volcanic lakebed. The claim block, which is approximately 8,300 acres in size, includes several limestone-capped butte-like outcrop formations. As released on September 7, 2023, a successful Phase 1 surface sampling program has returned multiple high-grade surface lithium samples. The clay body, as it’s known today, is believed to have very little overburden, and at the southern boundary of the project the lithium rich clay is exposed at the surface, or above surface in butte outcrops. Project infrastructure includes hydro power lines on site, direct road access, access to the Union Pacific rail line, and the nearby town of Pahrump with a readily available work force.

Regional Geology

The project is located within the prolific southwest Nevada claystone lithium jurisdiction. LGL is located just 12 km away from the historic Franklin Wells hectorite (a rare lithium smectite mineral) deposit. Mining at Franklin Wells dates back to the 1920’s. The regional geology of the Amargosa Valley is a basin-and-range structure with the Greenwater Range and Funeral Mountains to the west and the Amargosa Desert to the east. The Greenwater/Funeral mountains are fault-controlled with narrow interior valleys and are bounded by broad, coalescing alluvial fans. The Greenwater/Funeral mountains are composed of lower Paleozoic marine and metamorphic rocks. LGL is located in a large basin of clay rich Tertiary lakebed sediments, the major host rock for the other lithium claystone deposits in the southwest Nevada lithium jurisdiction. Lhoist North America has been open pit mining the specialty clays in the area since 1974.

Later-stage company comparable claystone lithium projects in southwest Nevada include Century Lithium Corp.’s Clayton Valley project; American Lithium’s TLC project; Noram Lithium’s Zeus project, and Nevada Lithium’s Bonnie Claire project. All of the aforementioned companies are later-stage mining companies, with a NI 43-101 resource calculation.

Rover is a publicly traded junior mining company that trades on the TSXV under symbol ROVR, on the OTCQB under symbol ROVMF, and on the FSE under symbol 4XO. The Company has a diverse portfolio of mining resource development projects with varying exploration timelines. Its critical mineral projects include lithium, zinc, and copper. Its precious metals projects include gold and silver. The Company is exclusive to the mining jurisdictions of the U.S. and Canada.

Swiss Business Development Consultant

In May 2023, the Company hired a Switzerland, based consultant (the “Consultant”) to provide business development consulting services in the key mining markets of England, France, Germany, and Switzerland. The Consultant’s roles and responsibilities include traveling through-out central Europe representing the Company at mining events. Further to its release of May 26, 2023, the Company is issuing 150,000 common shares in the Company for services provided by the Consultant. The Consultant is independent (arm’s length) to the Company. The share-based payment is for the payment of consulting services for the period of October 1st to December 31st, 2023. The Company has received approval from the Toronto Venture Exchange to make the issuance, pursuant to the common shares bearing the standard four-month regulatory hold period from the date of issuance.

You can follow Rover on its social media channels:

Twitter: https://twitter.com/rovermetals

LinkedIn: https://www.linkedin.com/company/rover-metals/

Facebook: https://www.facebook.com/RoverMetals/

for daily company updates and industry news, and