- Copper corrected from the May record high and made higher lows

- Four reasons the copper bull will take the price to new highs

- Impressive price action in the face of Chinese selling

- Nevada Copper- Three reasons why NEVDF is could outperform percentage gains in the nonferrous metal

- Bull markets rarely move in straight lines- The next leg for the copper bull has begun

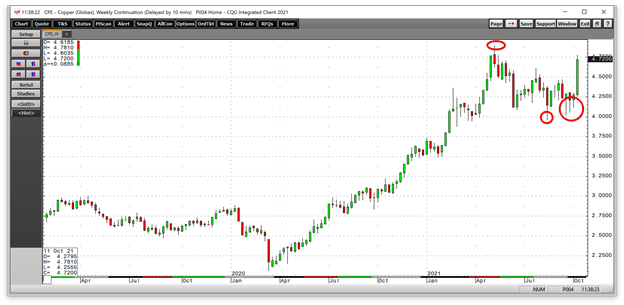

When Goldman Sachs called copper “the new oil” in April 2021, the price was on its way to a new record high at nearly $4.90 on the nearby COMEX futures contract. The world’s most active and liquid copper market on the London Metals Exchange reached a peak at over $10,700 per ton in May. Copper blew through the 2011 $4.6495 previous all-time peak as a hot knife goes through butter.

Even the most aggressive bull markets rarely move in straight lines. Corrections can be brutal when prices accelerate on the upside, reaching unsustainable short-term peaks.

Copper ran out of upside steam before touching the $4.90 per pound level on futures and $10,750 per ton level on LME forwards. The price fell just below the $4 level in August, three months after reaching the high. Copper was still “the new oil” when the price dropped, and the world’s leading copper consumer was hoping it would continue to fall. China has done everything to push copper’s price lower, but the red metal has exhibited remarkable resilience.

Meanwhile, Nevada Copper Corporation (NEVDF) has been working day and night to ramp up production and transform its balance sheet. The market has rewarded the company as the share price has been steadily increasing since the beginning of October.

Mining companies provide investors with leveraged exposure to a commodity as they tend to outperform the price action on the upside and underperform during corrections. Junior mining companies can magnify the leverage. Copper’s recent explosive move suggests that new highs are on the horizon. NEVDF has the potential to do even better on a percentage basis as the company ramps up its production of the red industrial metal.

Copper corrected from the May record high and made higher lows Copper futures ran out of steam at just below the $4.90 level, with the LME forwards moving the $10,747.50 per ton level for the first time. The May highs led to a substantial correction that briefly took COMEX futures below $4 per pound in August.

Source: CQG The chart shows the decline from $4.8985 in May to a low of $3.9615 in mid-August, a 19.1% correction. COMEX futures made higher lows of $4.0220, $4.0545, and $4.1140 in late September and early October before blasting off on the upside to over the $4.70 level as of October 15.

Source: Barchart

The chart illustrates the decline from $10,747.50 on May 10 to a low of $ 8,740 per ton on August 19 as copper forwards corrected by 18.7%. Copper then made higher lows at $8,810 on September 21 and $8,876.50 on October 1 before exploding higher to the $10,281 level on October 15.

Four reasons the copper bull will take the price to new highs

The four leading factors supporting a continuation of new and higher highs in the copper market are:

- Rising inflation– CPI rose by 5.4% in September, once again exceeding expectations. While the Fed will likely begin tapering quantitative easing, tapering is not tightening. Moreover, fiscal stimulus continues as the multi-trillion budget will pump more inflationary stimulus into the economy.

- Building demand– The infrastructure rebuilding package in the US will increase copper requirements for construction projects to rebuild the crumbling roads, bridges, tunnels, airports, schools, and government buildings over the coming years. Moreover, China’s copper requirements will continue to increase as the world’s most populous country builds infrastructure.

- Decarbonization– Addressing climate change boosts copper demand. As Goldman Sachs said in April, decarbonization does not occur without copper, making the metal “the new oil.” Copper requirements for EVs, wind turbines, and other clean energy projects is a multi-decade affair for the red metal.

- Supply shortages– Copper mining companies are scrambling to find new supply sources. Production can’t keep pace with demand- It takes eight to ten years to bring new copper mining projects on stream. BHP, a leading global mining company, is in talks with Ivanhoe Mines for participation in the Western Foreland exploration area in the politically dicey Democratic Republic of the Congo.

Bull markets tend to experience severe selloffs. China has attempted to cool off the bullish copper and other nonferrous metals markets. The world’s leading copper consumer has the most to lose from runaway prices on the upside.

Impressive price action in the face of Chinese selling

On September 1, China auctioned 150,000 tons of copper, aluminum, and zinc from strategic stockpiles, which was the third auction sale since early July, attempting to temper the market’s bullish price action. The market had expected the sales. Copper rallied to the highest level since early August on September 13, with many other base metals following the red metal higher. The price then retreated, but copper made a higher low on September 21. The Chinese auction to cool off the rally put 80,000 tons of copper, 210,00 tons of aluminum, and 130,000 tons of zinc into the market since early July. Since the day of the first auction, copper, aluminum, and zinc prices all posted gains. Imagine where prices might be if China did not sell from its strategic stocks.

In early October, China auctioned the fourth round of base metals, lifting the total sales to 570,000 metric tons. Copper and all the base metals posted explosive gains after the latest auction. China is selling copper, aluminum, and zinc from its strategic stockpiles. The attempt to stem price appreciation makes the Chinese a buyer of the metals on price weakness to replace its stocks. However, the auctions have not had the desired impact on price. The price action has been more than impressive in the face of the sales.

While BHP looks towards the DRC and other regions for new copper supplies, Nevada Copper is making significant headway on its production project in a highly stable political and economic environment in the United States. Moreover, Nevada is a state that continues to encourage mining activity and is rich in red metal reserves.

Nevada Copper- Three reasons why NEVDF has the potential to outperform percentage gains in the nonferrous metal

Nevada Copper (NEVDF) has made great strides over the past weeks and months. A successful junior mining company is positioned best to profit during a bull market in the commodity it extracts from the earth’s crust. Three factors support the price of NEVDF shares as copper has taken off on the upside again:

Factor one: Turing the corner on operations in Q3- On October 6, NEVDF provided an update on operational performance at the company’s underground mine at its Pumpkin Hollow project, noting:

- Copper in concentrate produced during September increased by 265% compared to August, driven by higher stope production. Approximately 30,386 tons of ore processing yielded 682 tons of copper concentrate at an average grade of 22%, reflecting 150 tons of copper output.

- Stoping is the process of extracting the desired ore or mineral from an underground mine, leaving open space called a stope. Stoping at Pumpkin Hollow significantly accelerated since mid-August, with the second and third stope panels fully mined and a fourth stope panel currently being mined. Further stopes are planned for October and November, and the high-grade Sugar Cube zone to be mined during the final months of 2021.

- NEVDF experienced the highest monthly development footage achieved since April 2021 in September, with a 12% increase over August. Approximately 750 lateral equivalent feet were advanced in September.

Outgoing Interim CEO Mike Brown said, “I am very pleased to see the improved trajectory in our production ramp-up and a recovery in productivities. The increased ore production was a key objective for September, and together with the improving productivities on-site, along with the ongoing management strengthening, provide further confidence in the mine ramp-up.”

Randy Buffington, a veteran mining executive with previous management experience at Barrick, Placer Dome, and Cominco, is taking over as President and CEO at Nevada Copper.

Factor two: On October 12, NEVDF announced it had agreed with its senior project lender and concluded a non-binding term sheet with its largest shareholder to provide additional financing and a significant deferral and extension of its debt facilities. The move offers Nevada Copper greater balance sheet flexibility and support for the ramp-up of its underground mining operations and advancement of its open-pit project and broader property exploration targets. The highlights of the more flexible financing arrangement include:

- Two-year deferral of first loan repayments scheduled to begin in July 2025.

- Extension of loan amortization with the final maturity pushed to July 2029.

- Deferral of the formal long stop date for the project as the completion test was deferred to June 2023.

- All outstanding shareholder loans were consolidated under an amended existing shareholder credit facility.

- A two-year extension to maturity data until 2026 with no scheduled payments before final maturity.

- An increase of $41 million in additional liquidity under the amended credit facility.

Randy Buffington, NEVDF’s new CEO, said, “These combined balance sheet improvements provide significant additional runway for the Company as we move forward to complete the ramp-up of our underground operations. The ongoing support of two of our major stakeholders provides further validation of the significant inherent value of our copper operations in Nevada and allows us to continue to pursue the growth potential embedded within our asset base.”

Factor three: NEVDF’s value proposition is compelling when compared to peers. The chart shows NEVDF’s market cap versus its enterprise value compared to other diversified metals and mining companies with similar market caps:

Source: Seeking Alpha

As the chart highlights, the enterprise value is over 2.2 times the current $173.53 million market cap, leading to plenty of upside room for NEVDF shares. There is plenty of room for growth as the enterprise value will rise with output from the underground and open-pit mining operations over the coming months and years. According to data from Seeking Alpha, at 97 cents per share on October 15, NEVDF had a $173.53 million market cap. The average daily volume in the past 15 trading days from all exchanges stood at just over 2,500,000 shares.

Source: Barchart

The chart shows the rise from 38.78 cents on October 1 to a high of 99.2 cents per share on October 14. NEVDF shares closed not far from the high at 96.56 cents on Friday, October 15.

The trend in copper and NEVDF is bullish, and the trend is always your best friend in markets.

Bull markets rarely move in straight lines- The next leg for the copper bull has begun

Bull markets can be bucking broncos as corrections are often downdrafts in prices. Copper’s decline from nearly $4.90 to below $4 and recovery to over $4.70 on October 15 is a bullish sign for the red metal.

Copper’s strength, along with the other base metals in the face of Chinese stockpiling selling, has been more than impressive and is a testament to the bullish factors that are likely to push the price higher. Goldman Sachs expects LME copper forwards to reach the $15,000 per ton level by 2025, putting COMEX futures over $6.80 per pound. Other analysts see the price rising to as high as $20,000 per ton as decarbonization will keep demand outpacing supplies.

Bull markets often take prices far higher than analysts believe possible before they peak. As the world searches for more copper to meet the rising demand, Nevada Copper’s mines are in the most economically and politically stable region of the world. NEVDF shares may have just begun to rally as the price threatens to move over the $1 per share level.