Category: Exclusive Interviews

Maurice:

Joining us for a conversation is Greg Johnson, the CEO of Metallic Minerals. It’s a great time to be speaking with you as Metallic Minerals has some exciting news for shareholders. Before we begin, Mr. Johnson, please introduce us to Metallic Minerals and the opportunity the company presents to shareholders.

Greg Johnson:

Metallic Minerals is a silver-focused, exploration development stage company. The flagship asset is in the Keno silver district, one of the world’s highest-grade producing silver districts. A second asset in the high-grade silver-gold La Plata district, and our last asset, which is our Klondike alluvial gold project. We are headed up by a group of experienced explorer developers with a track record of successful discovery and project advancement.

Maurice:

Mr. Johnson, Metallic Minerals has some great news to provide shareholders on three fronts. First on the flagship Keno silver project, as well as updates from the La Plata and the Klondike alluvial projects. Beginning in the Yukon, sir, take us onsite to the high-grade Keno silver project, which has just announced the completion of what was the most expansive exploration program to date. First off, congratulations, sir.

Greg Johnson:

The Keno silver project is our flagship. We’re a couple of years into the acquisitions and initial development of the targets, and this was one of our biggest programs to date in 2021.

Maurice:

Mr. Johnson, the Keno silver project has three main areas within the west, central, and eastern parts of the high-grade silver producing district. Beginning at the central Keno, Mr. Johnson, walk us through the 2021 exploration program, which is a multiphase program of RC and diamond core drilling. What is Metallic Minerals looking for and what are you seeing?

Greg Johnson:

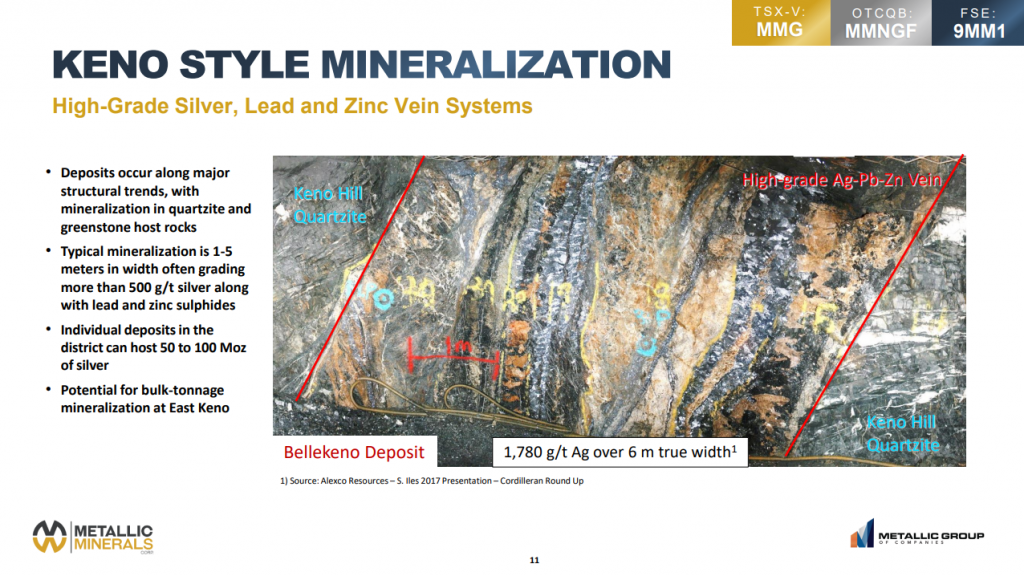

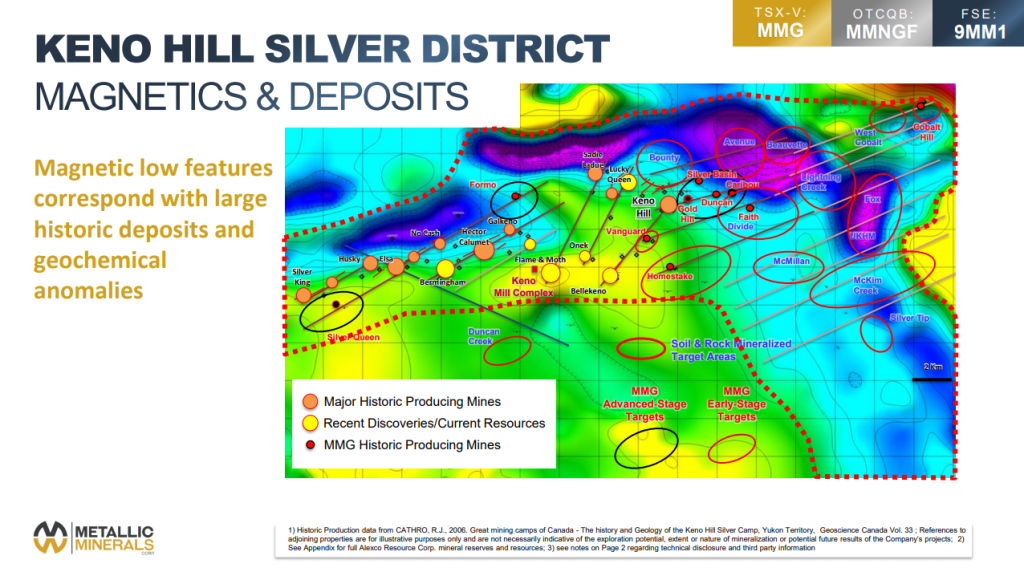

Allow me to me set the stage here. The district itself is about 35 kilometers wide, and we break it into three sectors or target areas, as you said, the west, central, and eastern parts. And each one of them is about 10 to 12 kilometers long. It’s a really big area, and we see the continuity of similar styles of mineralization from one side of the district to the other. Most of the production historically has been on that western half of the district where we’ve seen over 300 million ounces of past production plus current resources. And it’s one of the world’s highest grade 43-101 resources.

Greg Johnson:

Starting in the central part of the district this year, we kicked off a program looking at our advanced target areas. This is specifically in the Caribou and Homestake areas where we targeted stepping out along the already defined structures there, where we’ve hit ore grades over minable widths. We’re stepping out, we’re building tonnage. The drilling indicates that we’ve had some really good successful hits there, some big step by outs that we’re waiting to see results come back from the assay lab, but we’re quite pleased with the ability to be able to extend those advanced stage targets in the central part district.

Maurice:

Moving on to the west Keno, what can you share with us?

Greg Johnson:

So west Keno is focused in that area of significant historic production. This is nearby Alexco, who’s going back, has just recently gone back into production, and where they’ve got several major discoveries. So our targets there, west Keno, are right on these known very high-production areas. The Formo, Silver Queen are the two main targets here. Core drilling, to again step out along areas of known mineralization that have already been intercepted and being able to continue to build on those towards a first mineral resource, both central and the western parts of the district for Metallic Minerals.

Maurice:

Let’s move on to the emerging heavyweight, which is the east Keno, where it appears to have both the Keno style mineralization of ultra high-grade veins and bulk tonnage silver mineralization, which is now new in the district. To set the stage on this unique value proposition, in 2020 Metallic Minerals previously released significant bulk tonnage style intercepts on the east Keno. Do you mind sharing those numbers with us and how it fits in with your neighbor, Alexco, which has recently gone into full production?

Greg Johnson:

Yeah, this is pretty exciting. Metallic Minerals came into the district recognizing that you’ve got all this production on the western half of the district. The geology doesn’t stop at the claim boundary. It continues onto our ground, the same geologic setting. We started to collect samples, geophysics, and soils, and rocks, and mapping and started putting this together. Last year we’d identified 12 separate multi-kilometer-scale targets. These are big targets, both soil anomalies, and geophysical anomalies. And we put the first reconnaissance holes in 2020. We hit in 26 out of 30 holes. That’s an amazing track record for a first-phase reconnaissance drill program. A big part of this year’s program was coming back in and starting to step off from those hits last year, moving laterally, moving down dip, and we’re starting to put together an understanding of the scale of mineralization in this area.

Greg Johnson:

We also drilled the first core holes in this area this year. Deeper holes targeted at both geophysics and offsetting the reverse circulation drilling. So we’re pretty excited about what’s coming together here. The significance of what we’re seeing in the east is that not only are we seeing classic high-grade Keno style veins, which is what Alexco and most of the historic production has been based on, but we’re seeing zones up to a hundred meters or more of continuous disseminated silver mineralization. And this holds out the potential for bulk tonnage for something that could be much larger than anything that’s been seen in the district before.

Maurice:

Now along with the drilling, Metallic Minerals also completed an extensive Induced Polarization survey, and I noticed in the latest press release that Metallic Minerals made the following reference about six times: “Regional thrust vaults and associated epithermal style mineralization”. Now, as a shareholder, I’m keen to find out more. Any nuggets that you can share with us regarding the IP survey?

Greg Johnson:

Yeah, so this is an example of our effort to try to take a known productive district to extrapolate into the areas that have been less explored, and then to bring in new exploration targets, target types, models, and new modern exploration techniques. This is the first time we’ve ever applied what’s called induced polarization geophysics. This is where you put a charge in the ground, these were multi-kilometer-long lines, they allow you to sense as deep as 800 or a 1,000 meters from the surface, and this allows us to be able to start to map the subsurface even before we start drilling.

Greg Johnson:

And what’s exciting about this, is that that work over the east Keno targets was demonstrating that we’re getting conductors in the subsurface rocks that are correlating spatially with these big soil and magnetic features. The significant reason is if we’re hitting silver mineralization in the shallow drilling, and we’ve got a geophysical target that continues to 800 meters or more, and we’ve got multiple targets in the kilometric scale, it’s starting to suggest we’ve got a very strong plumbing system and that this could be a target that could really have the scale to it and potentially build this out to something significant.

Maurice:

Now that the exploration is complete this year at the Keno silver project, when can we expect to see results, and what determines success?

Greg Johnson:

We started in the central part of the district, that’ll be the first area that we’ll start to see numbers. Then on the Eastern side of the district with both RC and Diamon Core. And then last we wrapped up with the western part of the district with core drilling. We’re right now finalizing our interpretation on the IPE geophysics, so that’ll be integrated, and I could see us seeing numbers starting here really any time and continuing early into the new year. It’s going to be an exciting period. We’re starting to see a turnaround in the market and the interest over in gold, again, after more than a year of corrupt consolidation and correction. So this will be a great time in terms of catalyst from the news coming from the Keno silver project.

Maurice:

Let’s move south to Colorado, to the La Plata silver gold-copper project, where the season is just about wrapped up, and this is an emerging asset for Metallic Minerals. It has all the merits and hallmarks of a flagship project in its own right. Now Metallic Minerals just completed its first drilling in decades on the La Plata to bring up the La Plata up to NI 43-101 standards. It’s a project that was recognized and worked on by some of the majors in the past. Please tell us a bit about the project and the 2021 program and when we might expect to see results.

Greg Johnson:

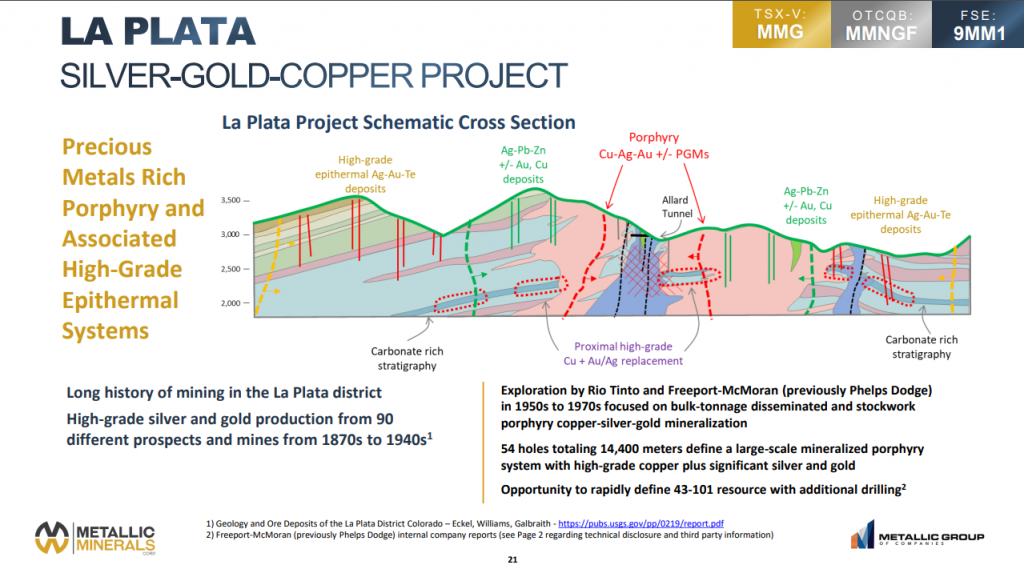

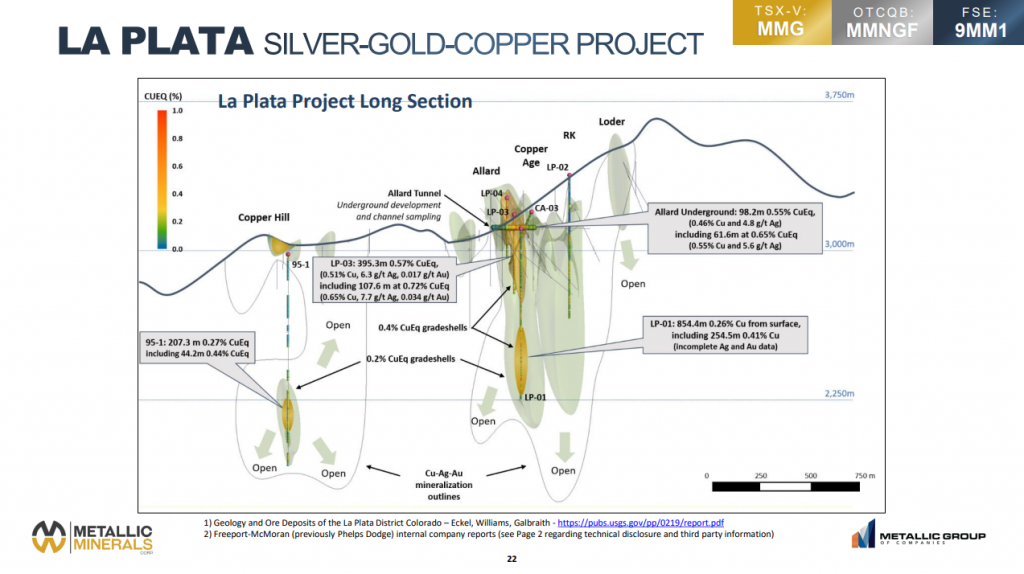

I’m excited about the La Plata Project. This was an opportunity that came in through our network. It’s a project area that, very similar to Keno Hill, had a history of high-grade silver and gold production from these high-grade veins, much like Keno. Located in the Southwestern part of the US, in Southwestern Colorado. That mining on the high-grade veins occurred from the 1800s to the 1940s. Then after World War II, we didn’t see the small miners come back, but we saw first Rio Tinto’s exploration group come into the district, recognizing that not only was there this high-grade production and occurrences, but that there was potential for bulk tonnage silver, gold, and copper. And they drilled several holes that really started to define that there was a porphyry system that sent in the center of this epithermal vein district.

Greg Johnson:

Following on that work, we had Phelps Dodge, which is now Freeport McMoRan coming to the district, and they continued to drill through the early 70s. And then Phelps Dodge sat on the project until 2002. The low in the last commodity price cycle, the group that we opted it from has held it for over 20 years. We’re the first to have an opportunity to take a look at this exciting project. We’re taking a very holistic approach. We’re going to be focused on both the bulk tonnage part of the system that’s related to these porphyries, as well as the high-grade silver and gold component. We’re bringing all the layers of modern geology and techniques for exploration to the table.

Greg Johnson:

This year’s program was focused on continuing to collect geophysics and soils and a very first confirmatory drilling and sampling that’s been done on the project in decades. We are just wrapping up that program now. I would expect to see results starting to come out fairly soon to move this quite rapidly to take the historic resource on the project and advance it with sufficient work to a modern 43-101. Again, this is going to be a project that’s going to have a series of news events in the relatively near future that are quite significant in advancing that into 2022.

Maurice:

Finally, let’s discuss the big year that Metallic Minerals has had on the Klondike alluvial gold royalty portfolio.

Greg Johnson:

This is an interesting one. It’s not the main focus of the company, but we had an opportunity a couple of years ago to pick up a portfolio of unmined Klondike alluvial ground. This is upstream from some of the biggest open-pit operations in the Klondike, in the Yukon, that produce over 50% of the Yukon’s gold from those mines each year. We’ve invited experienced operators on the ground. We’ve got three license areas currently that is fully permitted for production, two operators that have done significant work drilling, bulk sample testing. They are rapidly advancing this towards first production, and Metallic Minerals would take a production royalty. Anywhere from a 10% to a 15% royalty, depending on the stage of those license areas. We’re excited to see this advancement over this year’s work, and we’re anticipating very high potential that we’ll see these move into first production in 2022 for next season, and that’ll move to cash flow for Metallic Minerals on those properties.

Maurice:

Leaving the property bank, let’s look at some numbers. Sir, please provide the capital structure for Metallic Minerals.

Greg Johnson:

Metallic Minerals has about 136 million shares out, roughly a $65 million market cap. So we’re now out of that micro-cap area where we’re starting to get attention from some of the big investors. We’re well funded well into 2022 with the current treasury. We have no debt, so we’re in great shape to have been able to have an aggressive program on all three projects this year and moving into next year to continue our business model, which is one to define resources, grow resources, and advance those and de-risk them, creating value along the way. Very similar to what the team did with Novagold in the last metal price cycle.

Maurice:

Speaking of big investors, you have a great shareholder list. Could you comment on that, and the recent ownership by Eric Sprott?

Greg Johnson:

Yeah, we’re in this period now where the company is moving from a very early stage, exploration stage, to resource stage. And with that, we’re seeing interest from some of the bigger investors. We’ve got US Global, we’ve got Crescat, we’ve got OTP Funds. These are all specialist funds that understand this part of the business for mining exploration and have taken significant stakes. In addition, Eric Sprott is our largest individual shareholder. He’s one of the largest holders in Novagold as well, so we’re really happy to have him in as an investor. And he just increased his ownership by exercising all of his warrants in the company, bringing in over CAD $1.5 million dollars. We’re pleased with that continued support from Eric. He is very bullish long-term on silver, and his investment in the company was focused on our exposure to silver in the Keno silver district, and a potential upside from our other assets.

Maurice:

Now I’m no Eric Sprott, but I am proud to share that I did exercise my warrants as well.

Greg Johnson:

I believe all those that participated in the financing exercised their warrants as well. Metallic Minerals is pleased to see that continued support from shareholders, and I’m pleased to see the market starting to come back alive for silver and gold. It’s been a bit of a painful 14 month plus period here with the market last peaking back in August of 2020. But I think we’ve turned the corner, and I’m quite bullish that we’ve put this consolidation behind us. It’s a great time for investors to be looking at high-quality names and silver in particular. And I think we’ve got real promise with a strong fundamental backing for Metallic Minerals in terms of the work we’re going to be undertaking to create value, and I think with our leverage to silver, gold, and potentially to copper as well here shortly.

Maurice:

I was going to ask you if you have any comments for shareholders, but I think that may just suffice. How about this, sir, any question that I forgot to ask you today, sir?

Greg Johnson:

No, I think we covered the gamut here, Maurice. It was great to be able to speak with you. I think that it’s an exciting time for investors and for those who are new to Metallic Minerals, we would invite people to contact us through our website.

Maurice:

Please share that website for Metallic Minerals.

Greg Johnson:

The website is MMGsilver.com.

Maurice:

sir. Mr. Johnson, it’s been a pleasure speaking with you. Wishing you and Metallic Minerals the absolute best, sir.

Before you make your next bullion purchase, contact me at 855.505.1900 or email maurice@milesfranklin.com. I’m a licensed representative for Miles Franklin Precious Metals Investments, where we provide a number of options to expand your precious metals portfolio from physical delivery to offshore depositories and precious metal IRAs. Finally, we invite you to subscribe to www.ProvenandProbable.com, where we provide Mining Insights and Bullion Sales.

The information presented on Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The information is not intended to be and does not constitute financial investment or trading advice, or any other advice. You should not make any financial investment or trading decision based on any of the information presented without first undertaking independent due diligence and consultation with a professional broker or competent financial advisor.

Maurice Jackson:

Joining us for a conversation is Spencer Cole, the Chief Investment Officer of Vox Royalty. Mr. Cole, great time to be speaking with you as Vox Royalty continues to provide shareholders with a smart way to invest in commodities. Before we begin, Mr. Cole, please introduce us to Vox Royalty and the opportunity the company presents to shareholders.

Spencer Cole:

Vox Royalty is a high-growth, precious metals-focused, mining royalty investment company. The company’s been around for eight years, and over those eight years, we’ve built what we believe is the most unique mining royalty investment company in our entire $70 billion industry. We’re consistently delivering the highest rate of return on invested capital at what we believe is the lowest potential portfolio risk level. Particularly for some of your listeners who are concerned about inflation levels at the moment, we think Vox is a really attractive inflation hedge that offers investors high-organic growth with very low risk.

Maurice Jackson:

Last month, Vox Royalty announced some exciting news for shareholders regarding development and exploration updates from your royalty operating partners. This month appears equally exciting, as Vox Royalty has just announced additional key developments which look to strengthen your royalty portfolio. Beginning in Nevada, take us onto the Gold Standard Ventures South Railroad Gold Project, and provide us with an update on the feasibility study, permitting, and construction financing.

Spencer Cole:

The South Railroad Project is a rapidly advancing gold project in Nevada, which is obviously arguably one of the most pro-mining, particularly pro-gold mining jurisdictions on the planet. The operator just provided an update to the market that they’re rapidly approaching completion of the feasibility study, which is targeted for the first quarter of 20222. Upon the completion that feasibility study, they’re going to move straight into construction financing.

Spencer Cole:

Gold Standard Ventures already has one of the world’s largest mining private equity funds, Orion, who’s given them a $200 million term sheet to fund the construction of the mine. They’ll be looking to go back to other investment groups to see where the best source of financing is so going into early 2022, we expect a huge amount of exciting news flow as to how this project is going to be constructed, and then their management has also provided an update that they expect to receive their final permits to start construction of this project within 18 months, so a really exciting gold project that’s rapidly moving towards production over the coming years.

Maurice Jackson:

Speaking of exciting news for next year, let’s go to Black Cat’s Bulong Gold Project, where they’re looking at a first production guidance in 2022. What can you share with us?

Spencer Cole:

This is an exciting royalty within our portfolio for a few reasons, as you mentioned, the Black Cat Syndicate, which is the operator of this Bulong Gold Project, they just reiterated guidance. They’re expecting this gold mine to be in production in the second half of 2022, so investors can look forward to the royalty revenue possibly late next year. But a cherry on the cake, so to speak, with this royalty, is not only is the company actively moving this project forward towards production next year, but they’re aggressively drilling out the land package. On an annualized basis, they’re drilling over 80,000 meters on this land package. So not only are investors looking forward to, I guess, near-term royalty revenues on this property, but also, there’s likely to be a huge volume of discovery news flow over the coming months and quarters as they continue that drilling campaign.

Maurice Jackson:

We’ve covered gold. Let’s discuss silver and platinum group metals, beginning with silver at the Bowdens Silver Project by Silver Mines. How’s their drilling and development campaign coming along?

Spencer Cole:

It’s coming along extremely well. For readers who aren’t aware of the Bowdens Project, it’s the largest primary silver project in all of Australia. On a silver equivalent basis, there are approximately 275 million ounces of silver equivalent resources in the ground here, so just an extremely large ore body. The operator, Silver Mines, is working through final permitting at the moment. They’re also progressing an expansion case, looking at a high-grade underground that would go on top of the open pit operation. We expect that this project is rapidly heading towards a construction decision with final permits in hand next year. The managing director of the operator was recently quoted on Bloomberg as saying he personally believes there’s potential for this ore body to triple in size. So what is already a monstrously large silver deposit, the managing director of the operator thinks there’s a multiple of this potential in the ground, which is even more exciting for our investors.

Maurice Jackson:

Finally, my favorite metals, the Platinum Group Metals. What are the latest developments coming from ValOre?

Spencer Cole:

This is another exciting royalty within our portfolio of 54 royalties, The Pedra Branca Project, is ValOre’s flagship asset, it’s also the largest Platinum Group’s metal project and deposit in all of South America. ValOre has been aggressively drilling this property out, so they’ve been doing approximately a 10,000-meter drilling program this year, and our expectation from management is that they’re preparing for a resource update in the coming months. We look forward to seeing the size of this resource grow, and then for this project to continue to move along down the development pathway towards production over the coming years. So all eyes are on the resource update that we expect in the next few months.

Maurice Jackson:

Mr. Cole, as you look back at 2021 and then forward onto 2022, Vox Royalty, in many regards, has exceeded expectations in terms of your development, discovery drilling, and bolstering your royalty portfolio. Vox Royalty is on track for a record year on moving projects into production. Can you comment further on that?

Spencer Cole:

2021 has been a transformational year in Vox’s eight-year history. We’ve increased the number of producing royalty assets that we have in our portfolio to five. We’ve had record volumes of partner-funded drilling on our royalty properties. We’ve had a record number of projects, I guess, moving forward into sort of development stage as well, supporting the near-term growth potential as well. But then importantly for investors, as we look ahead towards next year, 2022, we expect that a lot of that key organic growth is even going to be outpaced and set to continue going into next year.

Spencer Cole:

Just by way of example, there are three additional projects that we expect to commence production next year that are in varying stages of construction currently. There are four separate feasibility studies that we expect to be released next year. The volume of drilling on our royalty properties, we expect that will achieve a new record in 2022 as well. So for Vox shareholders, they can look forward to a huge volume of organic growth in revenue and underlying development within our royalty properties without any additional capital required to acquire those royalties.

Maurice Jackson:

Now, before we leave the property bank, what is the next unanswered question for Vox Royalty? When can we expect a response and what determines success?

Spencer Cole:

I think as we touched on in our last interview, I think the main catalysts that investors continue to be excited about in Vox is just the organic growth within our portfolio and what that means for our revenue projections. As I touched on, we’ve seen a huge volume of growth on a number of our producing royalties. When we went public last year, we only had one producing royalty asset. And look, that was one criticism of the company, that people wanted us to have more producing assets, and where we stand today, we’ve now got five producing royalty assets. Organically, without spending any additional capital on new royalties, we expect that will increase from five producing royalty assets to 10, and north of 10 by late 2023.

Spencer Cole:

What is the unanswered question is how soon will those new royalty assets come into production and what does that mean for revenue, which has already been growing at quite a substantial rate? I think the great news for our investors is they don’t need to wait a very long time. This is a matter of months and quarters as they continue to see that growth organically within the portfolio, the incremental revenue that’s going to come from those producing operations.

Maurice Jackson:

Let’s look at some numbers. Sir, please provide us with the capital structure for Vox Royalty.

Spencer Cole:

We have a very tight capital structure at Vox. with less than 40 million shares on issue. We are in a net cash position on our balance sheet. Our total working capital is approximately nine million on the balance sheet between cash and listed investments. Vox has very strong balance sheet and we are very, very careful about not issuing stock. We, as management, own about 15 percent of the company, and our family members own additional stock on top of that, so this is very much an investor-led and managed business, where management is fully aligned with our investor group.

Maurice Jackson:

In closing, Mr. Cole, what would you like to say to shareholders?

Spencer Cole:

Thanks for the shareholders’ and listeners’ time today. I’d strongly encourage you to have a look at the Vox Royalty website. We’re on the cusp and continuing to deliver on a strategy that is high growth but low capital intensity, where we’re offering incredible returns at very disciplined prices. Particularly in this inflationary environment that we find ourselves in today, getting exposure to a portfolio of base and precious metal assets, such as Vox has in its portfolio, is a really smart way to hedge inflation risk. So I strongly encourage investors, particularly those that are worried about inflation, to seriously consider having a look at Vox Royalty in more detail.

Maurice Jackson:

Last question, sir. What did I forget to ask?

Spencer Cole:

I believe we’ve covered it all today.

Maurice Jackson:

Mr. Cole, for readers that wish to learn more about Vox Royalty, please share the contact details.

Spencer Cole:

Please visit our website www.voxroyalty.com.

Maurice Jackson:

Mr. Cole, it’s been a pleasure speaking with you. Wishing you and Vox Royalty the absolute best, sir.

Before you make your next bullion purchase, contact me at 855.505.1900 or email maurice@milesfranklin.com. I’m a licensed representative for Miles Franklin Precious Metals Investments, where we provide a number of options to expand your precious metals portfolio from physical delivery to offshore depositories and precious metal IRAs. Finally, we invite you to subscribe to www.ProvenandProbable.com, where we provide Mining Insights and Bullion Sales.

The information presented on Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The information is not intended to be and does not constitute financial, investment or trading advice, or any other advice. You should not make any financial investment or trading decision based on any of the information presented without first undertaking independent due diligence and consultation with a professional broker or competent financial advisor.

- Battery metal demand is rising, and the trend will continue

- New properties are in demand- Producers provide leverage to the metal prices, and exploration companies turbocharge the gearing- Location is critical

- Lithium Americas (LAC) looks to pick up a property

- Nevada Copper (NEVDF)- The trend is your friend, and increasing demand for EVs supports a continuation of the rally

Noram Lithium (NRVTF)- An undervalued battery metal play in Nevada, a desirable jurisdiction

In real estate, a property’s value always reflects its location. Any real estate professional understands that the three leading value factors are location-location-location.

Commodity producers face many regional issues. Raw materials can occur in local regions where political or economic forces make extraction challenging. The cost of production reflects local tax, royalty, logistical, and other factors.

Over the past year, the ascent of metals prices has caused many of the world’s leading producers to scramble to find new mining projects to meet the growing demand. One of the world’s leading diversified commodity producers, BHP is currently in talks with Ivanhoe Mines to acquire part of the Western Foreland exploration area in the Democratic Republic of the Congo (DRC). While DRC is the largest copper producer in Africa with the most substantial reserves, the country has a long history of corruption that has impeded its growth. The DRC is not an ideal location for mining companies, but the growing need for new output has put BHP in a position to consider the project. It takes up to ten years to bring a new copper mine into production, and producers are scouring the earth for projects that will meet the increasing demand.

Goldman Sachs called copper “the new oil” because of its role in decarbonization. Three-month LME copper was trading at the $9,518 per ton level on November 5, with the December COMEX copper futures at the $4.3430 per pound level. Goldman projects that copper prices could rise to the $15,000 per ton level by 2025, putting COMEX copper futures north of the $6.80 per pound level.

Meanwhile, lithium is another commodity that is experiencing growing demand. The success of addressing climate change through decarbonization relies on ample supplies of battery metals that can replace fossil fuels.

While BHP is looking to the DRC for new copper deposits, other mining and exploration companies are developing battery metal deposits. Friendlier and less challenging jurisdictions are likely to attract significant premiums over the coming months and years.

In the US, Nevada, the silver state, has a long history as one of the most favorable mining jurisdictions on the earth. When it comes to location, it does not get much better than Nevada.

Battery metal demand is rising, and the trend will continue

Climate change is not a US issue; it is a worldwide trend. Addressing climate change involves replacing the hydrocarbons that currently power the world with alternative, renewable energy sources. While batteries power only around one percent of the cars on roads today, the demand for EVs is growing by leaps and bounds. Hertz recently announced they are purchasing 100,000 Tesla model-3 EVs in a $4.2 billion deal. EVs will make up 20% of the Hertz fleet by the end of 2022. Hertz will also install thousands of charging stations in its locations in the US and Europe.

EV’s require twice the copper as internal combustion engines. The batteries require other metals and minerals including, lithium, nickel, cobalt, zinc, aluminum, manganese, graphite, and potassium. Tesla’s batteries currently use lithium-nickel-cobalt-aluminum chemistry. However, the company is working on a set of cobalt-free or reduced batteries drawing on lithium-iron-phosphate technology and chemistries that rely more heavily on nickel. The three-month nickel price on the London Metals Exchange closed 2020 at the $16,600 per ton level. As of November 4, the price was over $19,400 after reaching over $20,500 during the year. Copper futures on COMEX may have corrected from the May 2021 all-time high at nearly $4.90 per pound, but they remain appreciably higher than at the end of 2020.

Source: CQG

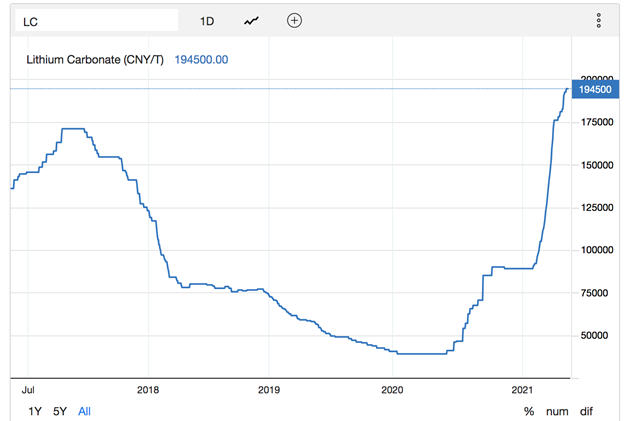

The monthly chart shows that copper closed 2020 at the $3.52 level. At the $4.3430 per pound level in early November 2021, copper futures were over 23% higher. The price action in the lithium carbonate market has been even more bullish.

Source: Trading Economics

The chart shows the rise from below $33,000 per ton in 2020 to the current price at the $194,500 level, an increase of nearly six times. Lithium’s ascent is more like a cryptocurrency than a commodity as the demand for the metal for EV production grows.

New properties are in demand- Producers provide leverage to the metal prices, and exploration companies turbocharge the gearing- Location is critical

Mining companies make substantial capital investments to extract raw materials from the earth’s crust. The leading mining companies profit handsomely when market prices exceed production costs, creating leverage. Mining companies often outperform the commodities they produce on the upside but underperform when prices decline.

Meanwhile, exploration companies provide even more leverage. Since rewards are always a function of the risks, companies that search for commodities tend to experience incredible gains when they find them and begin production or sell the properties to the more established mining companies that can take projects to the next production and processing levels.

The mining industry reflects economies of scale. The leading companies like BHP, Rio Tinto, Anglo American, Glencore, and others have made significant capital investments and spread production risks over a diversified portfolio of mining properties. They tend to allow exploration companies to make the finds and then take the mining properties to the next steps.

When it comes to investing, exploration companies can offer attractive returns that often outpace the underlying commodity and the established miners on a percentage basis. If the BHP’s offer leverage, exploration companies turbocharge that gearing.

Lithium Americas (LAC) looks to pick up a property

Lithium Americas Corporation (LAC) operates as a resource company in the United States. The company explores for lithium deposits. LAC owns interests in the Cauchari-Olaroz Project in the Jujuy province of Argentina and the Thacker Pass project in north-western Humboldt County, Nevada. Thacker Pass recently increased its Phase 1 capacity to target 40,000 tpa lithium carbonate.

LAC announced it submitted an unconditional offer to Millennial Lithium Corporation to acquire all of the outstanding shares for approximately $400 million.

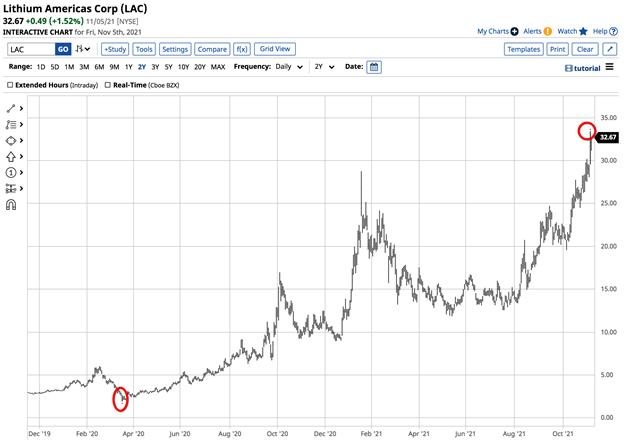

Source: Barchart

The chart shows LAC’s ascent from a low of $1.92 per share in March 2020 to its most recent high of $33.42 on November 4. At the $32.67 per share level, LAC’s market cap was over $3.919 billion. An average of over five million shares changes hands each day. Lithium has been a hot commodity that has moved nearly six times since 2020. LAC shares have moved over seventeen times higher over the period as the successful mining company turbocharged the commodity’s percentage gain.

Nevada Copper (NEVDF)- The trend is your friend, and increasing demand for EVs supports a continuation of the rally

Nevada Copper is an exploration company in the silver state of Nevada. The company owns a 100% interest in the Pumpkin Hollow property that contains copper, gold, and silver reserves. The most recent operations update highlighted accelerated stope turnover rates, management team changes that strengthened the company, productivity improvements, and processing of ore averaging approximately 1.5% copper delivered to the mill. Since the May high, copper’s price has dropped at nearly $4.90 per pound on the nearby COMEX futures contract. NEVDF is an exploration company, so its share performance tends to outperform the commodity on the upside and underperform on the downside. Copper rose from $3.52 per pound at the end of 2020 to a high of $4.8985 in May or 39.2%. On November 5, the price was at the $4.3430 level, 11.3% below the May peak. NEVDF shares closed 2020 at the $1.14 level.

Source: Barchart

The chart highlights that NEVDF shares reached a high of $2.71 when copper peaked and traded at 67.00 cents per share on November 5. NEVDF shares rallied by 137.7% and from the end of 2020 to the May 2021 high and were 75.3% lower than the peak as of November 5. Like many exploration companies, NEVDF turbocharged the price action in copper, outperforming the metal on the upside and underperforming on the downside.

As the demand for copper will rise over the coming years, and Goldman Sachs expects the price to increase dramatically, now could be the perfect time to consider this exploration company.

Noram Lithium (NRVTF)- Another battery metal play in Nevada, a desirable jurisdiction

Norman Lithium (NRVTF) is an exploration company that develops mineral properties in the United States.

The company owns interests in the Zeus Lithium Project in Clayton Valley, Nevada. Noram’s property is next door to Albemarle Corporation’s (ALB) Silver Peak Lithium Mine in Nevada.

Noram’s latest highlights include:

- A 70% increase in measured and indicated resources

- A 369% increase in inferred resources

- Deposits near the surface, reducing production costs

- The potential to increase the deposit size via deeper drilling

- An environmentally friendly footprint

- A Preliminary Economic Assessment (PEA) in the coming weeks – Advancing the project closer to its’ production target

At the 67.15 cents per share level, NRVTF has a market cap at the $50.701 million level. An average of 56,780 shares changes hands each day.

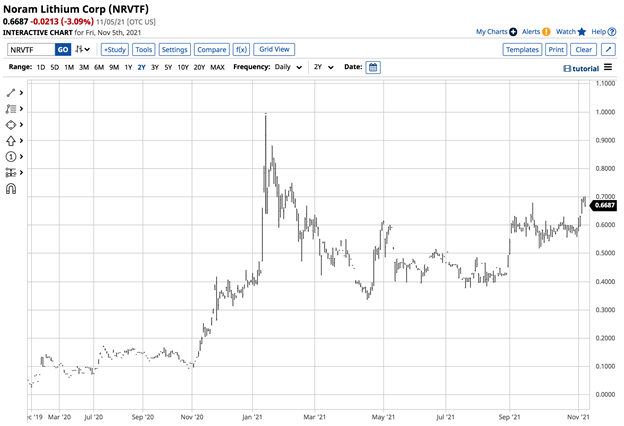

Source: Barchart

The chart shows NRVTF shares closed at the 40.26 cents level on December 31, 2020. At 66.87 on November 5, they were 66.1% higher. NRVTF shares reached a high of 98.78 cents on January 14, 2021, which is the stock’s current technical target. The shares have traded in a bullish trend since mid-April 2021.

With the spotlight on lithium, Norman could be an excellent exploration company to consider. Success in the Zeus project could attract interest from companies like Lithium Americas Corporation (LAC) that is currently buying Millennial Lithium Corporation’s shares for $400 million, nearly eight times higher than NRVTF’s current market cap.

Exploration companies are risky, but the potential for substantial rewards always involves an elevated risk level. Meanwhile, Nevada Copper and Noram Lithium have location on their sides as Nevada is a highly desirable mining jurisdiction in a world hungry for copper and lithium supplies.

Written By: Andrew Hecht, on behalf of Maurice Jackson of Proven and Probable.

Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein, or any security in any jurisdiction in which such an offer would be unlawful under the securities laws of such jurisdiction.

Silver Hammer Mining Corp. Stakes Additional Claims at Eliza Project in Nevada and Reports Initial Sampling Results from the Past-Producing Silverton Mine

Lakewood Exploration Inc.Thu, October 7, 2021, 7:30 AM·3 min readIn this article:

Figure 1

Eliza silver complex, Hamilton, Nevada, included previously reported surface samples. (See September 9, 2021 News Release for comprehensive sampling data).

Figure 2

Silverton claim layout with northeast sampling showing 6.1 g/t gold from a surface sample

VANCOUVER, British Columbia, Oct. 07, 2021 (GLOBE NEWSWIRE) — Silver Hammer Mining Corp. (CSE: HAMR / OTC: HAMRF) (“Silver Hammer” or the “Company”) is pleased to report that it has staked an additional 52 new claims at its Eliza Silver Project in the historic Hamilton District of Nevada, more than doubling its land package.

The Eliza Silver Project is located along the south side of the Eberhardt fault, opposite the past-producing Treasure Hill Mine in the Hamilton Mining District, Nevada’s highest-grade silver district producing 40 million (M) ounces (oz) silver with historic mined ore grades of up to 18,700 grams per tonne (g/t) between 1860-1872. Surface samples as high as 25,000 g/t were collected in the 1960s.1

With the addition of these new claims, the Eliza land package now comprises 88 claims totaling 5.52 square kilometres, (see Figure 1).

Figure 1. Eliza silver complex, Hamilton, Nevada, included previously reported surface samples. (See September 9, 2021 News Release for comprehensive sampling data).

https://www.globenewswire.com/NewsRoom/AttachmentNg/ad83cc3a-bd7d-4ffb-bf0e-d12dcced842c

“Our initial exploration work has identified mineralization that extends onto these newly acquired claims along the lower half of the Eliza project,” stated President Morgan Lekstrom. “We are currently conducting a mapping and geochemistry program on the property where we see significant potential for discovery in areas that have never been explored using modern exploration techniques. We will use this data to plan an extensive initial exploration program targeted for early 2022.”

Additionally, initial results from a sampling program at the Company’s Silverton Mine, a project sharing similar geology and Aster signature to Kinross Gold’s Round Mountain project located approximately 108 kilometres to the west, have confirmed surface gold mineralization on the east side of the property. A sample of 6.1 g/t gold was taken from the silicified tuff (see Figure 2).

Figure 2. Silverton claim layout with northeast sampling showing 6.1 g/t gold from a surface sample

https://www.globenewswire.com/NewsRoom/AttachmentNg/eaf7fb83-8d84-4822-a69f-d1849f27a85f

The Company also announces that David Grandy has stepped down as a director of the Company in order to pursue other opportunities. The Company thanks Mr. Grandy for his services, including helping take the company public, and wishes him the best in his future endeavours.

Qualified Person

Technical aspects of this press release have been reviewed and approved under the supervision of Philip Mulholland, P.Geo. Mr. Mulholland is a Qualified Person (QP) under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

About Silver Hammer Mining Corp.

Silver Hammer Mining Corp. is a junior resource company advancing the past-producing Silver Strand Mine in the Coeur d’Alene Mining District in Idaho, USA, both the Eliza Silver Project and the Silverton Silver Mine in one of the world’s most prolific mining jurisdictions in Nevada and the Lacy Gold Project in British Columbia, Canada. The Company has commenced an initial drill program at Silver Strand that will test for silver and gold mineralization immediately below the mine’s lowest level extending only 90 metres below surface. Lakewood strives to become a multimine silver producer and will focus near-term exploration and drilling plans at the Company’s Idaho and Nevada silver-gold assets.

*Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

On Behalf of the Board of Silver Hammer Mining Corp.

Morgan Lekstrom, President

Corporate Office: 551 Howe Street, Vancouver, British Columbia V6C 2C2, Canada

Contact: Kristina Pillon, President, High Tide Consulting Corp.

604.908.1695 / investors@silverhammermining.com

The CSE does not accept responsibility for the adequacy or accuracy of this release.

The Canadian Securities Exchange has neither approved nor disapproved the contents of this press release.

1 Nevada Bureau Mines report 52900017

Vancouver, British Columbia–(Newsfile Corp. – October 6, 2021) – Riverside Resources Inc. (TSXV: RRI) (OTCQB: RVSDF) (FSE: 5YY) (“Riverside” or the “Company”) is pleased to report the mineral tenure consolidation and expansion of La Union Polymetallic Project in Sonora, Mexico. The acquisition of these additional concessions provides Riverside with an expanded land position and further control of the historical mines and old workings across the district. This consolidation through the acquisition of small internal concessions provides Riverside an option on the high-grade, previous small scale mine properties, internal to the larger surrounding 100% Riverside owned mineral concessions and increases the property total area to over 26 km2 (2,604 hectares). This transaction expands upon the original property acquired from Millrock’s Mexico portfolio in 2019 (see press release of June 26, 2019).

La Union is located in western Sonora and is part of the orogenic gold trend. The old mining areas at La Union have seen very little drill testing and the broader structures are wide open for further regional exploration. Riverside is in contact with the local surface owners and knows the region from previous work with partner Hochschild Mining which allows Riverside to initiate exploration immediately.

Riverside’s initial field work included selective rock sampling from abandoned mine workings and dumps with results returning up to 59.4 g/t Au and 833 g/t Ag (see Table 1). Further exploration work will begin shortly as the Company is pleased to have completed this expansion step, opening the door to follow up work.https://s.yimg.com/rq/darla/4-9-0/html/r-sf-flx.html

La Union Polymetallic Project has been previously defined as a manto-chimney style deposit. The ongoing work has been demonstrating significantly high-grades in gold, silver, lead and zinc across mineralized areas identified. Near surface, the oxide gossan cap and carbonate replacement are particularly extensive with strong similarities with the Leadville polymetallic system in Colorado, USA. At La Union the Paleozoic carbonate stratigraphic section is a composite of over 1,000 m thick regionally and the mineralization of chimneys and mantos is open in multiple directions.

Table 1: Sample Results from La Union Polymetallic Project

| Sample ID | Au (g/t) | Ag (g/t) | Pb (%) | Zn (%) | Cu (%) | Type | Description |

| RRI7891 | 59.4 | 833 | 5.76 | 4.16 | 0.3 | rock chip | massive sulfide – dolomitic breccia |

| RRI7895 | 40 | 3.3 | 0.13 | mine dump | massive sulfide and jasperoid | ||

| RRI7894 | 8.3 | 239 | 0.17 | mine dump | jasperoid | ||

| RRI7890 | 1.367 | 50 | 1.63 | 1.43 | mine dump | sulfide-oxide bearing breccia | |

| RRI7893 | 0.473 | 12.4 | rock chip | brecciated contact – dolomite/quartzite | |||

| RRI7889 | 0.072 | 76.4 | rock chip | brecciated contact – dolomite/limestone |

Note: Six of the higher-grade due diligence samples out of eight total are shown in Table 1.

Figure 1: Photo of sample RRI7891 from La Famosa Mine and RRI7895 from Plomito Mine

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/6101/98673_78761357c45a0b0c_003full.jpg

Figure 2: Map of Riverside’s La Union Polymetallic Project, Sonora, Mexico. Highlights of the most recent results from rock sampling from Riverside (see Table 1)

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/6101/98673_78761357c45a0b0c_004full.jpg

Riverside’s President and CEO, John-Mark Staude: “We are excited to complete the acquisition of multiple key pieces of the project area at La Union, including the historic mines of Famosa and Plomito. Riverside is moving forward with growing projects, and generating exploration results at our properties, which continue to demonstrate the value of applying the Riverside property database and local team knowledge to capture and progress excellent mineral projects. The next steps for the La Union district will consist of field work and geophysics, which are expected to refine drilling targets.”

Transaction Details for the Acquisition:

Riverside has optioned over a 4-year term the properties with staged cash payments without any retained NSR. The terms for each respective property (La Famosa and Plomito) are presented below:

| YEAR | PAYMENTS | LA FAMOSA | PLOMITO | ||||

| 0 | On Signing | $ | – | $ | – | ||

| 1 | 12 months | $ | 10,000.00 | $ | 10,000.00 | ||

| 2 | 24 months | $ | 15,000.00 | $ | 15,000.00 | ||

| 3 | 36 months | $ | 25,000.00 | $ | 25,000.00 | ||

| 4 | 48 months | $ | 50,000.00 | $ | 40,000.00 | ||

| 5 | 60 months | $ | 75,000.00 | $ | 75,000.00 | ||

| TOTAL | $ | 175,000.00 | $ | 165,000.00 |

Geology and previous work at La Union Polymetallic Project:

Mineralization is primarily located within the Paleozoic sedimentary sequence, known in this area for reaching up to 1,000 m in thickness and hosting multiple historical workings. The mountain range is characterized with alternating limestone, dolomite and quartzite, at which contact mineralization has been observed to grow into a manto-chimney style deposit. These types of deposits tend to have higher metal grades, making this style of deposition attractive for exploration.

Local historical productions in the 1950’s mined high-grades averaging 7-20 g/t Au, 300 g/t Ag, 10-20% Pb and 5% Zn, for which mineralized bodies were traced for at least 80 m depth within oxides (Yantis, 1957). Since then, only small exploration programs followed and including Paget Mineral Exploration Company and Millrock with sampling programs yielding up to 22.5 g/t Au and multiple high-grade polymetallic samples over the project area. The presence of many high-grade areas, the thickness of the host rock and extent of the system across multiple known historic mines are favorable evidence for an extensive system.

Figure 3: Map representing historical samples including rock chip, and mine dump as stated above and part of the Millrock and Paget database acquired from 2012 to 2019

To view an enhanced version of Figure 3, please visit:

https://orders.newsfilecorp.com/files/6101/98673_78761357c45a0b0c_005full.jpg

Figure 4: Photo (left) of the mineralization as seen at La Union, showing quartzite bed bounded by oxide horizons. La Famosa (right) shows the old working from 1980s

To view an enhanced version of Figure 4, please visit:

https://orders.newsfilecorp.com/files/6101/98673_78761357c45a0b0c_006full.jpg

Geophysics and sampling will be additional tools deployed by Riverside in advancing the knowledge of this project, with a view to initiating a drill program that will allow the Project to extend high-grade at depth and define the limit of the oxide cap.

Qualified Person & QA/QC:

The scientific and technical data contained in this news release pertaining to La Union Project was reviewed and approved by Freeman Smith, P.Geo, a non-independent qualified person to Riverside Resources, who is responsible for ensuring that the geologic information provided in this news release is accurate and who acts as a “qualified person” under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

Rock samples from the exploration program discussed above at La Union were taken to the Bureau Veritas Laboratories in Hermosillo, Mexico for fire assaying for gold. The rejects remained with Bureau Veritas in Mexico while the pulps were transported to Bureau Veritas laboratory in Vancouver, BC, Canada for 45 element ICP/ES-MS analysis. A QA/QC program was implemented as part of the sampling procedures for the exploration program. Standard samples were randomly inserted into the sample stream prior to being sent to the laboratory.

About Riverside Resources Inc.:

Riverside is a well-funded exploration company driven by value generation and discovery. The Company has no debt and approximately 71M shares outstanding with a strong portfolio of gold-silver and copper assets in North America. Riverside has extensive experience and knowledge operating in Mexico and Canada and leverages its large database to generate a portfolio of prospective mineral properties. In addition to Riverside’s own exploration spending, the Company also strives to diversify risk by securing joint-venture and spin-out partnerships to advance multiple assets simultaneously and create more chances for discovery. Riverside has additional properties available for option, with more information available on the Company’s website at www.rivres.com.

ON BEHALF OF RIVERSIDE RESOURCES INC.

“John-Mark Staude”

Dr. John-Mark Staude, President & CEO

For additional information contact:

John-Mark Staude

President, CEO

Riverside Resources Inc.

info@rivres.com

Phone: (778) 327-6671

Fax: (778) 327-6675

Web: www.rivres.com

Raffi Elmajian

Corporate Communications

Riverside Resources Inc.

relmajian@rivres.com

Phone: (778) 327-6671 x312

TF: (877) RIV-RES1

Web: www.rivres.com

Certain statements in this press release may be considered forward-looking information. These statements can be identified by the use of forward-looking terminology (e.g., “expect”,” estimates”, “intends”, “anticipates”, “believes”, “plans”). Such information involves known and unknown risks — including the availability of funds, the results of financing and exploration activities, the interpretation of exploration results and other geological data, or unanticipated costs and expenses and other risks identified by Riverside in its public securities filings that may cause actual events to differ materially from current expectations. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/98673https://s.yimg.com/rq/darla/4-9-0/html/r-sf-flx.htmlhttps://jac.yahoosandbox.com/0.7.0/safeframe.html