VANCOUVER, British Columbia, April 17, 2019 (GLOBE NEWSWIRE) — Novo Resources Corp. (“Novo” or the “Company”) (TSX-V: NVO; OTCQX: NSRPF) is pleased to provide an update regarding plans for the Company’s Beatons Creek conglomerate gold project and its broader East Pilbara projects (collectively the “East Pilbara gold assets”).

Novo recently announced a substantial resource upgrade (the “2019 Resource Estimate”) at Beatons Creek (for further details see the Company’s news release dated April 1, 2019). This increase in size and confidence of the 2019 Resource Estimate is important as it provides what the Company sees as critical mass to underpin an options study across the East Pilbara gold assets. Mr Paul Henharen of Acacia Management Consultancy P/L has considerable experience in this field and has been engaged to undertake the study in conjunction with Optiro P/L. The options study is expected to be completed during the third quarter of calendar 2019 and make recommendations on project development scenarios to take forward to more detailed economic studies.

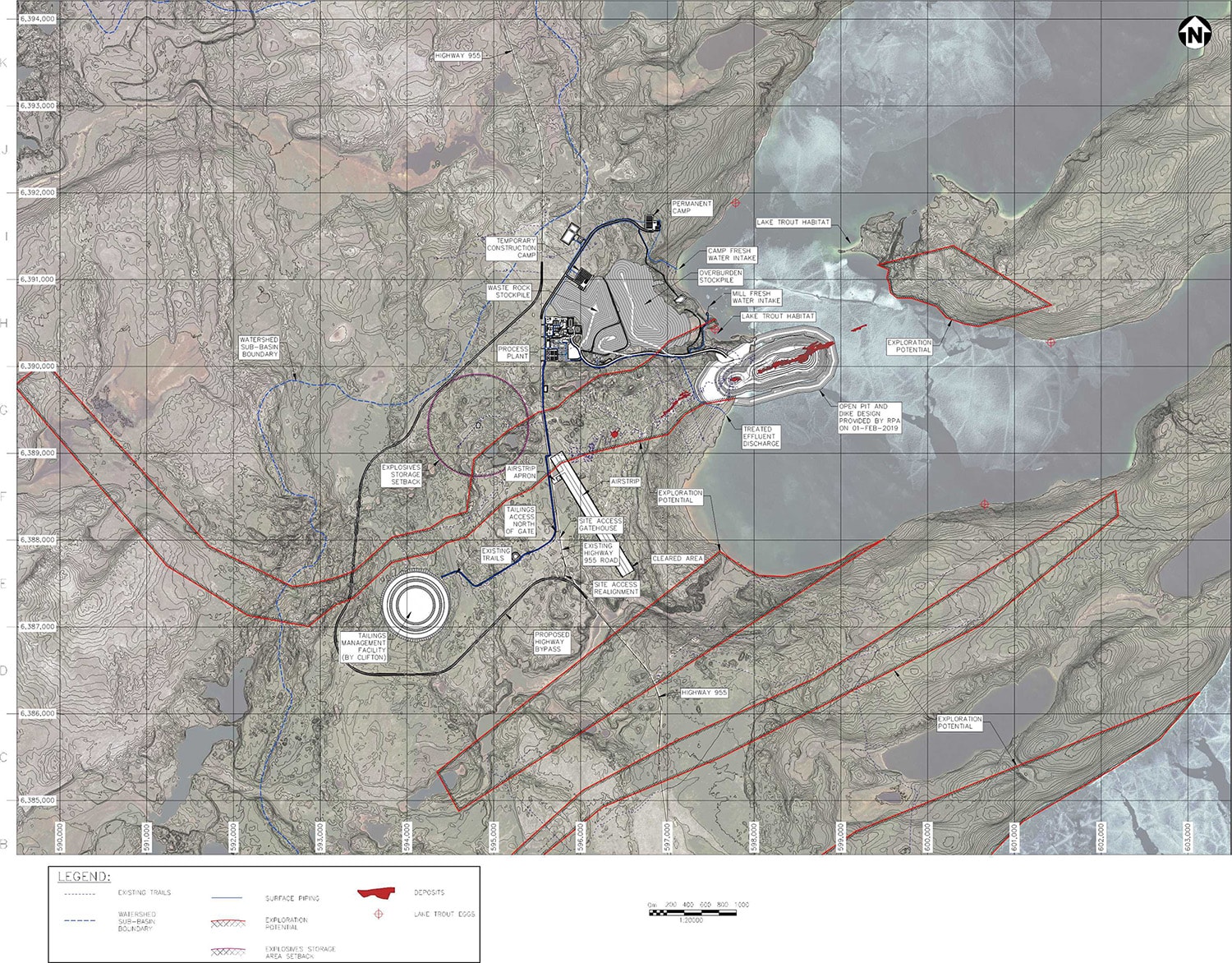

Novo’s East Pilbara gold assets extend beyond the Beatons Creek 2019 Resource Estimate. Other areas of interest include Novo’s 100%-controlled high grade Blue Spec gold-antimony deposit located 19km ENE of Nullagine (please refer to the Company’s news release dated August 17, 2015), the Talga Talga gold deposit 21km N of Marble Bar (please refer to the Company’s news release dated December 13, 2018) and an exploration pipeline of gold-bearing conglomerate prospects including Contact Creek and Virgin Creek, located 39 km NW and 27 km SW respectively from the town of Marble Bar (please refer to Figure 1 below – map of Novo’s East Pilbara prospects). Each of these prospects are earmarked for further exploration or project development expenditure during 2019.

In the Company’s January 7, 2019 news release, Novo outlined an extended and expanded non-binding memorandum of understanding with Sumitomo Corporation of Tokyo, Japan involving a pre-allocated commitment of 5,000,000,000 Japanese Yen. The objective of this commitment is to provide ongoing financial support and resources to progress economic studies and develop Novo’s Australian gold projects, subject to mutual agreement on project development plans and transaction structures.

Novo CEO and director Mr Rob Humphryson commented, “concurrently with our prospects at Egina and Comet Well / Purdy’s Reward around 300-400km to the west, exploration works at our East Pilbara gold assets have continued apace and have added significant value to Novo. The increase in both size and confidence of the Beatons Creek conglomerate gold resource has provided the impetus to aggressively pursue options for a standalone gold production centre in the East Pilbara. Novo remain committed to our goal of rapidly developing our gold projects and we are very excited at the prospect of returning Pilbara’s gold bearing conglomerates to production for the first time in almost 100 years”.

Dr. Quinton Hennigh (P.Geo.) is the qualified person pursuant to National Instrument 43-101 Standards of Disclosure for Mineral Projects responsible for, and having reviewed and approved, the technical information contained in this news release. Dr. Hennigh is President, Chairman, and a director of Novo.

About Novo Resources Corp.

Novo’s focus is to explore and develop gold projects in the Pilbara region of Western Australia, and Novo has built up a significant land package covering approximately 12,000 sq km. For more information, please contact Leo Karabelas at +1-416-543-3120 or e-mail leo@novoresources.com

On Behalf of the Board of Directors,

Novo Resources Corp.

“Quinton Hennigh”

Quinton Hennigh

Chairman and President

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward-looking information

Some statements in this news release contain forward-looking information (within the meaning of Canadian securities legislation) including, without limitation, the statements as to the Company’s planned exploration activities and the prospect of gold production from the Company’s East Pilbara gold assets. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, without limitation, customary risks of the resource industry, economic conditions and risks and uncertainties inherent to mineral resource estimates as well as the performance of services by third parties and the issuance of necessary approvals and permits by regulatory authorities.

A PDF accompanying this announcement is available at: http://ml.globenewswire.com/Resource/Download/94bef4a5-2742-4efb-a95d-5dfd1678d913

Category: Blog

Blog sub category

Conference Call and Webcast Details

Date: Wednesday, April 17, 2019

Time: 11:00 AM Eastern time (8:00 AM Pacific time)

Details to access the call live are as follows:

- Via telephone by calling 1 (888) 231-8191 in North America, or by calling +1 (647) 427-7450 outside of North America

- Via webcast at: https://event.on24.com/wcc/r/1976907/FB09C3DF44E955630E93DF32A19DD0C7

The webcast will be archived for 14 days following the call at the above-noted link. The conference call will also be recorded and available for replay until Wednesday, May 1, 2019. To access the replay, dial 1 (855) 859-2056 in North America or +1 (416) 849-0833 outside of North America and use playback passcode 7079595 to hear the recording.

Truth, Lies and Inflation

Miles Franklin sponsored this article by Gary Christenson. The opinions are his.

Christopher Whalen wrote “Trump is Right to Blow Up the Fed.” He stated:

“Anybody who cares to read the 1978 Humphrey Hawkins law will know that the Fed is directed by Congress to seek full employment and then zero inflation. Not 2 percent, but zero. Yet going back a decade or more, the Fed, led by luminaries such as Janet Yellen and Ben Bernanke, has advanced a policy of actively embracing inflation.”

From the Federal Reserve’s web site:

“The Congress established the statutory objectives for monetary policy—maximum employment, stable prices, and moderate long-term interest rates—in the Federal Reserve Act.”

*****

- Prices during ZERO inflation never double.

- Prices during 2% inflation double in 35 years.

- A new truck fifty years ago cost $2,500, and today it costs $50,000. This is a compound rate of inflation of 6.2% per year. Yes, the truck is better, but that doesn’t reduce the dollars you must pay.

- Motel Six rented no-frills rooms for $6 fifty years ago. Today they cost $50.00 plus higher taxes. The rate of inflation is 4.3%.

- A postage stamp fifty years ago cost $0.06. Today that stamp costs $0.55. The rate of inflation is 4.5%.

- Cigarettes in 1913 cost $0.10 per pack. Today the cost is $6.00 to $10.00, depending upon the tax load. The rate of inflation is about 4.4%.

- Gold in 1913 sold for $20.67 per ounce. Today gold sells for about $1,300. That rate of inflation is 4.0% per year for 105 years.

- A house in 1913 cost… you see the pattern. Except for televisions and computers, almost everything costs more than 10 years ago, considerably more than 20 years ago, far more than fifty years ago, and outrageously more than in 1913.

So What?

1) Prices were stable for the one hundred years before the Federal Reserve’s “takeover” of the money supply in the U.S. The rising prices problem occurs because of Fed policies, not time.

2) The above are examples of price inflation. You can add 999 more from your personal experience. The official numbers from the government are… well… untrustworthy.

3) Prices rise more rapidly than the Humphrey Hawkins law (zero percent) specifies.

4) Prices rise more rapidly than the 2% inflation target that the Fed endorses. [Why 2% instead of 3.96% or 0.22%?]

5) Congress could vote to audit the Fed. It does not.

6) Congress could demand the Fed follow law. It does not.

7) Congress could dissolve the Fed and return to a modified gold standard. This would encourage government accountability, stable prices, and decrease Wall Street’s influence over our lives and economy. For obvious reasons, it does not.

The Fed (and other central banks) engaged in massive Quantitative Easing—bond monetization or “printing currencies” for the past decade. Other central banks created currencies and bought bonds, stocks, ETFs, gold and politicians with their created “from thin air” currency units. QE works well for the financial and political elite, but not for “Main street” USA, the French “Yellow Vests” or most of the bottom 90%.

THE OFFICIAL NARRATIVE IS:

The Fed is necessary to manage the economy.

[The banking cartel owns the Fed to ensure the cartel’s profitability, influence and control over politicians.]

The Fed must remain independent.

[“Independent” is code for not controlled by Congress or the law. The Fed ensures transfer of wealth to the political and financial elite.]

The Fed should not be audited.

[What secrets would an audit discover?]

The Fed will create economic stimulus as needed.

[Yes, but what is the cost to the economy, pension plans, savers, and investors?]

Federal Reserve Notes (dollar bills) are “good” because they are debts issued by the Fed and backed by the full faith and credit of the United States.

[Debts of a corrupt central bank backed by the credit of an insolvent government are valuable only if we maintain confidence in both. But many of the stories about the Fed, dollars, unpayable debt and inflation statistics are lies… which will destroy confidence in both.]

TRUTH AND LIES?

In 1967 the Jefferson Airplane sang:

“When the truth is found to be lies,

All the joy within you dies.”

In 2019, regarding the dollar (and other debt-based fiat currencies), their lyrics could be:

“When the truth is found to be lies,

Confidence in currency dies.”

WHAT LIES?

- Per government statistics, there is very low inflation…

- Per Humphrey Hawkins, zero inflation is mandated…

- Per Federal Reserve policy, 2% inflation is good…

- Per President Johnson as he removed silver from coins in 1965…

“There will be no profit in holding them [silver coins] out of circulation for the value of their silver content.”

- Per President Nixon as he closed the “gold window” in 1971…

“… your dollar will be worth just as much tomorrow as it is today. The effect of this action, in other words, will be to stabilize the dollar.”

*****

“When the truth is found to be lies,

Confidence in currency dies.”

*****

When President Johnson lied about silver coins, $100 bought 77 ounces of silver. Today it buys about 7 ounces. In 2025 that $100 might purchase less than one ounce of silver.

When President Nixon lied about gold in 1971, $1,000 purchased 24 ounces of gold. Today $1,000 purchases about 0.75 ounce of gold. In 2025 that $1,000 might purchase less than one-tenth ounce of gold.

The Fed’s 2% inflation policy is nonsense. Their narrative pretends the Fed has a plan, stimulus is necessary, Federal Reserve Notes are a better currency than gold, and 999 other lies. They tell lies because the economic situation is SERIOUS.

As Jean-Claude Juncker (prominent EU Politician) noted,

“When it becomes serious you have to lie.”

How Do We Protect Our Assets and Retirement Income from Currency Collapse and Economic Lies?

- Act upon the truth, not the lies propagated because the economic situation is SERIOUS.

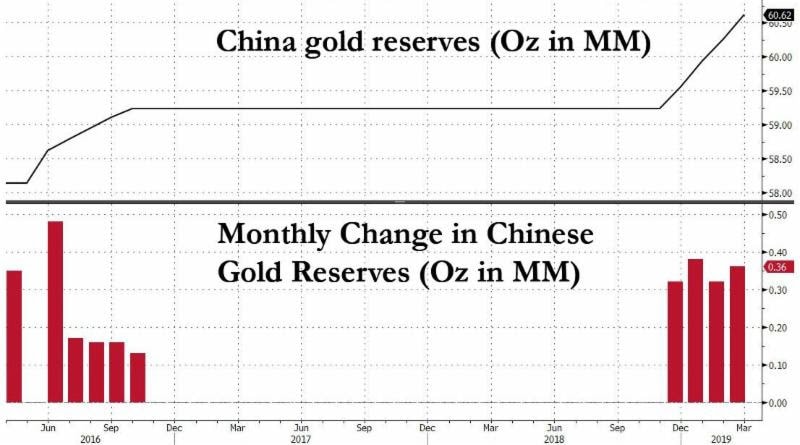

- Act like a central bank and buy gold and silver. Russia and China understood the lies long ago. That’s why they buy western gold every year and export no domestically mined gold.

- Governments have devalued currencies for 2,000 years. With $250 trillion in global debt that can never be paid, expect devaluation and inflation. That means higher prices are coming for food, energy, medical care, trucks, postage, cigarettes and hundreds of other items.

- Silver is inexpensive in 2019 compared to the S&P 500, national debt, and gold. Silver peaked eight years ago. Buy silver and wait. Another higher peak is coming… unless you trust central banks, politicians, governments and fiat currencies to act honestly and be trustworthy.

Miles Franklin sells silver and gold. Call 1-800-822-8080 and buy metals for insurance against the lies and devaluation necessary to support an unbacked fiat currency.

… or you can trust the political and financial elite to take care of your needs while they enrich themselves.

They might care about you, you might win the Powerball lottery, and extra-terrestrials might pay off our national debt with proceeds from asteroid mining…

Trusting the Fed less, and expecting a silver rally…

Gary Christenson

The Deviant Investor

Archived Newsletters

4/10 Watching Gold And Silver Is Like Watching The Grass Grow

4/8 Silver Now-Eight Years Later

4/5 Is This Patriotism? Is This How We Make America Great Again?

4/2 ZIRP and NIRP

4/1 How Many Times Have You Heard “You Can’t Eat Gold” As A Reason NOT To Own Gold?

International Storage

Private Safe Deposit Boxes

privatesafedepositboxes.net

Unencumbered / Segregated Storage

preciousmetalstorage.net

Private Safe Deposit Boxes – Frequently Asked Questions

About Miles Franklin

Miles Franklin was founded in January, 1990 by David MILES Schectman. David’s son, Andy Schectman, our CEO, joined Miles Franklin in 1991. Miles Franklin’s primary focus from 1990 through 1998 was the Swiss Annuity and we were one of the two top firms in the industry. In November, 2000, we decided to de-emphasize our focus on off-shore investing and moved primarily into gold and silver, which we felt were about to enter into a long-term bull market cycle. Our timing and our new direction proved to be the right thing to do.

We are rated A+ by the BBB with zero complaints on our record. We are recommended by many prominent newsletter writers including Doug Casey, Jim Sinclair, David Morgan, Future Money Trends and the SGT Report.

For your protection, we are licensed, regulated, bonded and background checked per Minnesota State law.

Miles Franklin

801 Twelve Oaks Center Drive

Suite 834

Wayzata, MN 55391

1-800-822-8080

www.milesfranklin.com

Copyright © 2019. All Rights Reserved.

From The Desk Of David Schectman

David’s Commentary (In Blue)

This is the third year in a row that Andy and Bill Holter met at the Masters for a three day mini vacation. Zhanna and Kathy stayed at home. This is a boy’s only affair. When Andy left Minneapolis on Tuesday morning the sun was out and it was in the 70s. And this is what it was like in Augusta.

When Andy left Minneapolis on Tuesday, it was 70 and I was sunning on the deck. Wednesday and Thursday, a snowstorm hit the Midwest. This is what my deck looked like below. Next year they will go to for the British Open.

They say that April is the cruelest month of them all. Last year we had a record 21” of snow in April. It’s almost as harsh as the gold and silver markets can be.

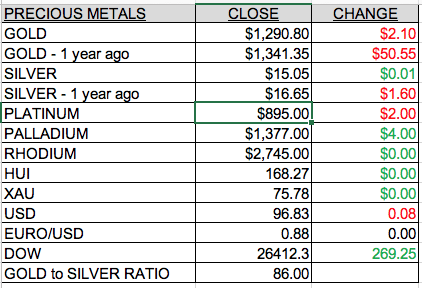

The Boyz never miss an opportunity to take advantage of a major moving average and once again, they pushed gold below the 50-day MA and below the key big number 1300 too. Silver was taken along for the ride and knocked below 15. But this will only last for a day or two, and just like the snow on my deck (above), it will not last – gold will move above 1300 and silver above 15. This is just the paper game, where they take their small profits and re-set to get ready to do it all over again. It’s like tennis or ping pong. Back and forth, back and forth, until finally there is a winner.

Here are Ed Steer’s comments on the price manipulation:

As Ted Butler always points out at times like this, except for the small amount of selling that the commercial traders do to get things started, plus maintain the downside price momentum, the are always, always, always the big buyers on engineered price declines like this…and never big sellers.

Gold was closed not only below $1,300 spot, but also back below its 50-day moving average — and silver was sold back below its 200-day moving average. It was all done for profit and price management purposes — and the Managed Money traders were the patsies once again. You’d think they’d learn after all these years, but they’re slaves to moving averages — and nothing else matters to them

So what have we learned in the last 10 years? We’ve learned that markets are cyclical. They have their peaks and their troughs. Most of our clients are contrarians. They understand that you have to buy low. Lord knows, we given lots of chances and this week is another one.

We have been bullish on silver for several years because the gold/silver ratio tells us that silver, relative to gold, is cheap. But it is not a good “predictive tool” because the ratio can tighten if gold falls and silver remains the same. That’s right, silver doesn’t have to rise for the ratio to fall; it only has to outperform gold. The most bullish case is for gold to rise, and for silver to rise faster. And we are bullish on gold. That is not contradictory, because where gold goes, silver will follow. Silver is more volatile, so if gold is going up, silver will go up more. One cannot be certain, but I do think that 2019 is the year that we finally break out of the trading range that we’ve been in, which in gold’s case is between $1,200 to $1,375. What we do know is that the silver/gold ratio has to normalize so if you are bullish on gold, be even more bullish on silver because it has to rise faster.

We are bullish on gold because gold is a necessary form of insurance versus the US dollar. If you believe that gold trades contra to the dollar, then that is reason enough to be bullish on gold. With $22 trillion in on-balance sheet liabilities and $120 trillion in off-balance sheet liabilities (Social Security, Medicare, etc.) this can only go one of two ways. You can default or you can deflate it away. The odds are that the Fed will continue to take the inflation route, rather than default on the debt, and the debt will be paid back, but with dollars that each year are worth less and less. It’s pretty basic stuff – keep increasing the money supply and watering down the purchasing power of the dollar and the “cost” to pay back the debt is easier to handle. Well, they will never pay back the debt. The struggle is to pay the interest on the debt. There is a saying: you are bankrupt when you can no longer afford to pay the interest on your debt. But since we have (for now) the world’s reserve currency, we can create the money to pay the interest out of thin air. In today’s daily one of the featured articles talks about how China and Russia are moving out of dollars and are the two largest buyers of gold on the planet now, in preparation to end the dollar’s long run as the world’s reserve currency.

Saudis Threaten to End Petrodollar — Jim Rickards

Investors have been speculating for years about the demise of the “petrodollar” deal struck by Henry Kissinger and Treasury Secretary William Simon in 1974.

It was first set up between the U.S. and Saudi princes to prop up the U.S. dollar. At the time, confidence in the dollar was on shaky ground because President Nixon had ended gold convertibility of dollars in 1971.

In 1974, the price of oil was skyrocketing, partly due to inflationary policies pursued by the Federal Reserve, and partly due to an Arab oil embargo in response to U.S. aid to Israel in the Arab-Israeli Yom Kippur War of 1973.

The world economy was under threat unless a way could be found to “recycle” the dollars the Arabs were receiving back into U.S. banks. President Nixon and Henry Kissinger asked Simon to negotiate with Saudi Arabia on this issue.

Kissinger and Simon worked out a plan. If the Saudis would price oil in dollars, U.S. banks would hold the dollar deposits for the Saudis.

Behind this “deal” was a not so subtle threat to invade Saudi Arabia and take the oil by force. I personally discussed these invasion plans in the White House with Kissinger’s deputy, Helmut Sonnenfeldt, at the time. But the petrodollar plan worked brilliantly and the invasion never happened.

The link to it is here.

One of our readers sent me an Email after reading my comments in our Wednesday newsletter. She said, “ I do not believe in coincidences. When I came across/read your article tonight I knew serendipity was afoot.”

The Most Interesting Financial Seminar I Ever Attended

I don’t believe in coincidences either. Let me tell you about “coincidence” – and the most interesting financial seminar I ever attended. Actually, I was one of the featured speakers at the seminar, not just an attendee.

32 years ago I traveled to a financial seminar in Hong Kong to discuss gold and the economy. These offshore events were very popular in the 80s. The conference boasted an impressive cast of speakers, including James Dale Davidson and Doug Casey. All of the speakers predicted that gold was going up – except for one – James Dale Davidson. He was very popular in those days, having just finished co-authoring a book on investing with Lord Reese-Moog in 1987 titled Blood in the Streets. Gold had been moving up for past two years and we all felt the fundamentals indicated that the move up would continue. Davidson emphatically said no, it’s not; it’s going down. At the end of the conference, the attendees are asked to fill out a form and rate the speakers, and Davidson got the lowest ratings! Davidson had the audacity to tell the audience of gold bugs that gold was going down. That’s like a preacher telling the choir that God doesn’t love them anymore. People only want to hear what they already believe. They want affirmation. Turns out that Davidson was right. Gold trended down for the next 13 years.

Outside the main hall, where the speeches are given, booths are set up to promote and sell investment products. In one of the booths something caught my attention. There was a black box that looked kind of like a big telephone sitting on the table. I decided to check it out. “What is this, I asked? It’s a FAX machine. What’s a FAX machine? You can send documents to other people with it”. I asked the salesman, since it’s a brand new technology and so few people have one, “who would you be able to send messages to?” You might say I was shortsighted. And this is how new technology begins.

Susan was with me. How could I even think of going to China and not bring her along. During our free time, we went shopping and one afternoon. We passed a large rather exclusive looking shopping mall. I told Susan that I want to go in. I had an overwhelming urge to go in. This is not at all like me. Shopping is not a big deal to me and never before, or since, did I ever feel such a need to check it out. I ignored Susan’s comment that “There was no reason for you to shop for clothes at a shopping center in Hong Kong”. But I had to do it. I literally grabbed Susan by the arm and pulled her up the stairs. And then, who do I see coming down the stairs directly at me but Morris Gindi. 15 years earlier, when I was a buyer for Target Stores, Morris was one of my suppliers. He sold me beach towels. Susan and I became very close friends with Morris and his wife Jill. We vacationed together and even stayed at their home in Brooklyn whenever I was in New York on a buying trip. After I left my job at Target, our friendship came to an abrupt and awkward end. We hadn’t spoken to the Morris for nearly 15 years. It had bothered me ever since. I hated the way things ended up between us. So here we were, half way around the world and suddenly we were, face to face. What are the odds of this happening? It could not have just been a “coincidence.” My urge to go up those stairs was overwhelming. I had to do it. And there is Morris. This was more like “fate” than a coincidence. I believe to this day that I needed to resolve the issues that ended our friendship and the fate presented me with an opportunity. This was indeed a memorable speaking engagement at a financial seminar.

Do You Believe In Psychics?

Yes, I believe in fate. And I believe that some people have special psychic gifts as well. Daryl Jason told Susan, “You are one of the most psychic people I have ever met.” But I am getting ahead of myself. When Susan was in her late 20s a friend of ours read her palm and told her, “You won’t live to be 30.” I know it is ridiculous, but it bothered her a lot. So on one of my buying trips to New York, I took Susan with me so she could get a second opinion. I mean I thought this was all pretty silly, but Susan didn’t and this was a perfect opportunity to put it all to rest. We stayed with a friend of mine who lived in the Village. He had a girlfriend, Sheri, who we had never met before. Susan asked her if she knew someone who could read her palm? Sheri said, “As a matter of fact, I do.” Sheri was the Director of Publicity for Simplicity Patterns and recently she sponsored an event for Simplicity Patterns for women in New York City who headed up clubs and organizations. After the presentation, as the women were leaving the auditorium, Sheri glanced down at the sheet that listed the attendees, and she came across the name Daryl Jason whose title was president of Taro Cards Of America. She thought to herself, this would be an interesting lady to talk to. Suddenly a woman stopped and said to her, “I am Daryl Jason, the person you wanted to talk to. You are living with a man of your same sign and the stomach problems you have been experiencing will go away. If you ever need me, here is my card.” Sheri was impressed. She is a Pisces and so is her boyfriend. What are the odds of knowing that? (144 to 1) and she was experiencing stomach problems, that no one knew about. So Sheri told Susan, “I’ve got the perfect person for you to see.” The next day Sheri and Susan left to see Daryl Jason, and my friend Dean and I spent the afternoon listening to Cheech and Chong records.

When the girls returned, Susan was pale. She proceeded to tell me about her visit with Daryl. First of all, she reassured Susan that she would live well past 30, which was a relief, and she also told her, “You are married to a Pisces who was born on March 11, and he has dark curly hair.” Correct! She told her, “Your mother died four years ago from cancer.” Correct! She told her, “Your husband is an old soul. He has been here many times before and his purpose in this life is to discover his emotions.” Now this really got my attention because this one sentence really gets to the core of who I am. How could she possibly know this? In fact, that went a long way toward explaining why I was so influenced by Camus’ Meursault (The Stranger) who led a life of “interested indifference.” That was how I led my life too, so if Daryl was correct, and I have been here many times before, then I could be indifferent, since I would have been there and done that countless times before. Well, that’s what I thought. Daryl also told Susan, “You are scheduled to go on a trip very soon, but you will not go.” Susan had won a scholarship to go to Cambridge for two weeks and was supposed to leave next month. Her passport didn’t show up and she never did make the trip. This was all very interesting, but I didn’t think much about it until – some six months later Susan and I were having a terrible fight (we never fight) and our marriage was about to break up. This is the only time that ever happened. Then the phone rang. I picked it up and the operator said, “Collect call for Susan from Daryl Jason.” I handed the phone to Susan, “I know what is going on there now. Stop it! Don’t you know that you and David are meant to be together forever?” This was the only time she ever called and the call came at the exact moment it was necessary. Daryl and Susan had a special psychic link and she understood what was happening at that very moment. She told Susan, “Your are one of the most psychic people I have ever met.” Susan was a sender, and Daryl was the receiver. That is the one phone call in my life I will never forget.

A week later a letter arrived from Daryl and in it she laid out our life for the next several years. The letter was placed on a drawer and forgotten. Three years later we moved, and while packing up, we found the letter….everything she wrote had come to pass, exactly as she said it would. We never spoke with Daryl again, but yes, there are some psychics who are the real deal. I have never forgotten her statement to Susan that life is eternal and we all come back to learn new lessons – until we no longer need to come back again.

Whether through religion or otherwise, it is comforting to think that life is immortal. After that phone call, everything that she told Susan took on an entirely new level of credibility.

This really did happen and I am not embellishing anything here. I wish she were here now to tell me where the precious metals markets are headed.

I have three interesting articles for you today. Check out Bill Bonner’s America’s Real National Emergency, and Egon von Greyerz’ The Biggest Short and The Spectacular Long, and SRSrocco’s Central Banks Buy Up Garbage Assets To Keep The Economy From Collapsing.

By Bill Bonner

America’s Real National Emergency

PARIS – Donald Trump thinks there’s a national emergency on America’s southern border.

Bridgewater’s Ray Dalio was on 60 Minutes over the weekend; he thinks American capitalism is such a mess – and that inequality of wealth is so skewed – that the president should call a national emergency to fix it.

But the real emergency lies elsewhere.

Egon von Greyerz

THE BIGGEST SHORT & THE SPECTACULAR LONG

The astonishing Fed again proved the consistency of its inconsistency.

Since its creation in 1913, and especially after WWII, the Fed has always been behind the curve. It is hard to believe that this is just incompetence. The recent change of policy hardly seems to be part of a plan but rather another reaction to events. Looking back at the Fed’s policy decisions, it is clear that virtually all are reactive rather than proactive.

Central banks have been totally detrimental to the world economy. They serve no constructive purpose whatsoever. As a matter of fact, they are a menace to the world and actually make things a lot worse than they would be if the laws of nature would rule. The natural rhythm of ebb and flow would regulate markets effortlessly without the need for artificial interference by central banks. If demand for credit is too high, the law of supply and demand would restrict the supply by interest rates going up. And if there was no demand for credit, loans would be cheap with rates going down.

SRSrocco

Central Banks Buy Up Garbage Assets To Keep The Economy From Collapsing

By purchasing increasingly worthless paper assets, we can thank the central banks for propping up the global economy for the past decade. Since the 2008 financial crisis, the top central bank’s have acquired $13 trillion worth of assets on their balance sheets. While the central banks label these balance sheet items as “Assets,” they are nothing more than glorified Paper IOU’s.

The Holter Report

China’s “Weight”.

A couple of topics for you today that are connected, obvious, yet not understood or even contemplated at this point. First, have you ever wondered why the names of many fiat currencies refer to “weight”? Such as the Peso, Peseta, Lira, or Pound amongst many others? This is similar to the names of various roads, like “Saw Mill Rd.”. It was named that because years ago there was actually a sawmill down the lane. These fiat currencies with “weighty” names started out as receipts for either gold or silver. They were convertible into a specific amount of metal when presented at a bank.

In essence these currencies were representations of physical metal since they were redeemable but far easier to carry around due to the lack of weight. In today’s jargon, paper currencies that were redeemable in specie were “derivatives” of the metals themselves. Then as time went on, the redeemability was cancelled and the currencies became true fiat, unbacked by anything except the credit worthiness of the issuer.

Over time, ALL currencies have become fiat and these currencies steadily devalued. I would ask, how can anyone have the thought these currencies can gain value versus gold or silver over a long period of time if they were originally spawned as derivatives? Can a derivative ever become more valuable than that it originated from? The answer of course is no and should be followed by another question; can a monetary guarantee from any government ever be more ironclad than that of physical metal itself?

Next, we know for a fact Russia, China and other nations have been accumulating gold for years now. Why? I can assure you it is not to “trade” for profit to accumulate more fiat. They fully understand their own issued fiats and those of other central banks were at best only derivatives historically and not even remotely a derivative of gold now. Now, they are only poor joking derivatives of the various central banks and in no way a store of value.

One of our readers passed this commentary regarding a Zerohedge article along yesterday to us;

“This graph is pure transparency to those who understand the Chinese. Whether in trade agreements, military power, or their economic goals, they never show their hand.

Some estimate they are holding 20,000+ tons of gold.

I believe they will shock the world with twice that (40,000 tons).

That will be the day everything changes and it will be by their design.

Does anyone truly believe Russia doesn’t know this ?”

Think about what is said here and truly what it means? When China does fully announce their gold holdings, they will most likely not make the yuan convertible into gold. Their gold holdings will simply act as a backstop for confidence in the currency. As Jim puts it, the gold hoard will act as the Hope Diamond around a woman’s neck as she walks into the room. No one will really look at the woman, so whether she is homely or not does not matter, only what is around her neck …and this would be China’s gold holdings and to a lesser degree Russia’s.

We are talking about “financial warfare” here. Russia and China fully understand the fraudulent nature of Western fractional reserve banking and finance. They understand how and why the West will fail and have been acting to accumulate gold as buffer against (or in place of) any dollar holdings. They have set up trade deals, lending/credit and clearing facilities, and treaty’s of all sorts with many nations. Put simply, they are making ready for the coming failure of the West!

Putting this together, China will be moving the currency pendulum back toward derivative status. As mentioned, I do not think the yuan will become convertible because if it was convertible …conversion is exactly what will happen. Instead, they will use their gold holdings as a sign of fiscal and monetary responsibility. Though not truly a derivative because no direct connection to their gold, the yuan will be favored versus other fiats because of the held gold. If you understand that we are currently at war, financial war, then you understand “why” foreign nations are accumulating gold. The old saying “he who owns the gold makes the rules” will apply here.

To finish, if you are waiting for gold to break out above the five+ year trading range before you position yourself, good luck! As a nation, we will be completely screwed without gold holdings because our dollar will be shunned internationally as one issued by a central bank with paltry if any actual gold holdings. China will mark up the price of gold making their hoard mighty …and making it very difficult for anyone ever to catch up if trying to pay with fiat and no Hope Diamond around their neck!

Standing watch,

Bill Holter

Holter-Sinclair collaboration

Archived Newsletters

4/10 Watching Gold And Silver Is Like Watching The Grass Grow

4/8 Silver Now-Eight Years Later

4/5 Is This Patriotism? Is This How We Make America Great Again?

4/1 How Many Times Have You Heard “You Can’t Eat Gold” As A Reason NOT To Own Gold?

Market Report April 12, 2019

International Storage

Private Safe Deposit Boxes

privatesafedepositboxes.net

Unencumbered / Segregated Storage

preciousmetalstorage.net

Private Safe Deposit Boxes – Frequently Asked Questions

About Miles Franklin

Miles Franklin was founded in January, 1990 by David MILES Schectman. David’s son, Andy Schectman, our CEO, joined Miles Franklin in 1991. Miles Franklin’s primary focus from 1990 through 1998 was the Swiss Annuity and we were one of the two top firms in the industry. In November, 2000, we decided to de-emphasize our focus on off-shore investing and moved primarily into gold and silver, which we felt were about to enter into a long-term bull market cycle. Our timing and our new direction proved to be the right thing to do.

We are rated A+ by the BBB with zero complaints on our record. We are recommended by many prominent newsletter writers including Doug Casey, Jim Sinclair, David Morgan, Future Money Trends and the SGT Report.

For your protection, we are licensed, regulated, bonded and background checked per Minnesota State law.

Miles Franklin

801 Twelve Oaks Center Drive

Suite 834

Wayzata, MN 55391

1-800-822-8080

www.milesfranklin.com

Copyright © 2019. All Rights Reserved.

April 15, 2019 – Nevada Copper Corp. (TSX:NCU) (“Nevada Copper” or the “Company”) is pleased to announce that it intends to release a new technical report for its 100% owned Pumpkin Hollow property, including the results of a new Preliminary Feasibility Study regarding the Open Pit Project on Tuesday, April 16, 2019 after the close of trading on the TSX. The press release summarizing the results of the Open Pit Prefeasibility Study and the accompanying Technical Report will be filed on SEDAR (www.sedar.com) and will also be available on the company’s website at www.nevadacopper.com. In conjunction with this, the Company has scheduled a conference call for analysts and investors which will be held on Wednesday, April 17, 2019 at 11:00 AM Eastern time (8:00 AM Pacific time).

Conference Call and Webcast Details

Details to access the call live are as follows:

- Via telephone by calling 1 (888) 231-8191 in North America, or by calling +1 (647) 427-7450 outside of North America

- Via webcast at: https://event.on24.com/wcc/r/1976907/FB09C3DF44E955630E93DF32A19DD0C7

The webcast will be archived for 14 days following the call at the above-noted link. The conference call will also be recorded and available for replay until Wednesday, May 1, 2019. To access the replay, dial 1 (855) 859-2056 in North America or +1 (416) 849-0833 outside of North America and use playback passcode 7079595 to hear the recording.

About Nevada Copper

Nevada Copper’s (TSX: NCU) Pumpkin Hollow underground project is in construction with a view to commencement of copper production in Q4, 2019. Located in Nevada, USA, Pumpkin Hollow has substantial reserves and resources including copper, gold and silver. Its two fully-permitted projects include a high-grade underground project (under construction) and a large-scale open pit project

Additional Information

For further information please visit the Nevada Copper corporate website (www.nevadacopper.com).

NEVADA COPPER CORP.

Matthew Gili, President and CEO

Further information call:

Rich Matthews

VP Marketing and Investor Relations

Nevada Copper Corp

rmatthews@nevadacopper.com

1 (877) 648-8266 – Work | (604) 355-7179 – Mobile

www.nevadacopper.com

It’s been an exciting April so far: we’ve announced plans for an exploration program, we’re expecting our PFS for the Open Pit any day now and, of course, we continue to make excellent progress on the underground mine. Construction is progressing in a strong, steady fashion and we remain on track to enter production in Q4 of this year. Below is an update of recent activity on site.

East Main Shaft

We are making very good progress with lateral development on the 2850 and 2770 levels and have advanced over 650 feet on both levels since the last update. Importantly, we now have fully-mechanized mining on the 2850 level and are now just a few hundred feet from reaching the bottom of EN vent shaft

1000KV transformers have now been installed on both levels and we have completed construction of all sumps on the shaft bottom, 2770 level and 2850 levels. We also have a modified sump in place on the 2940 level.

In addition, we have developed several utility bays on the 2850 level, including the temporary shop.

Up next: complete excavation to the bottom of the EN vent shaft, begin ramping to the east ore bodies and begin mechanized mining on the 2770 level.

Lateral development on the 2850 level of the East Main shaft

East-North Vent Shaft

Progress on the EN Vent Shaft has been particularly strong and we are now over 500 ft below surface.

Up next: continue sinking shaft and begin preparation to drive the Alimak from the 2850 level. The Alimak will be used to drive vertically up to intersect the East North Ventilation shaft and prepare the ore loading pocket.

Surface Works

The SAG mill pedestal is now complete and the Ball mill pedestal is almost finished. We have also finished pouring the Flotation foundation.

The foundations for the Thickener and fresh water areas have been completed and several pieces of critical components and equipment have arrived on site.

Dry stack tailings cell one is complete and is now in the process of being lined. The ore stockpile and surface water run off pond have been lined and completed.

Up next: Commence installation of equipment and start formwork for the ore stockpile loading hopper and for the filter press building

SAG Mill Discharge Pedestal Form Install – Cast In Steel Plate Install

Flotation Slab Final Inspections on Top Mat Rebar

SC2 Pond near Coarse Ore Stockpile Pad, prep for Liner Install

Thickener Tank mud slab forms

Please get in touch with any questions and be sure to subscribe to our mailing list to receive the latest news releases and updates as they are released.

David Swisher, SVP of Operations

For further information call:

Rich Matthews

VP Marketing and Investor Relations

Nevada Copper Corp

rmatthews@nevadacopper.com

1 (877) 648-8266 – Work | (604) 355-7179 – Mobile

www.nevadacopper.com

Results highlight increased indicated resources, the robust economics and long-term potential for the Triple R deposit

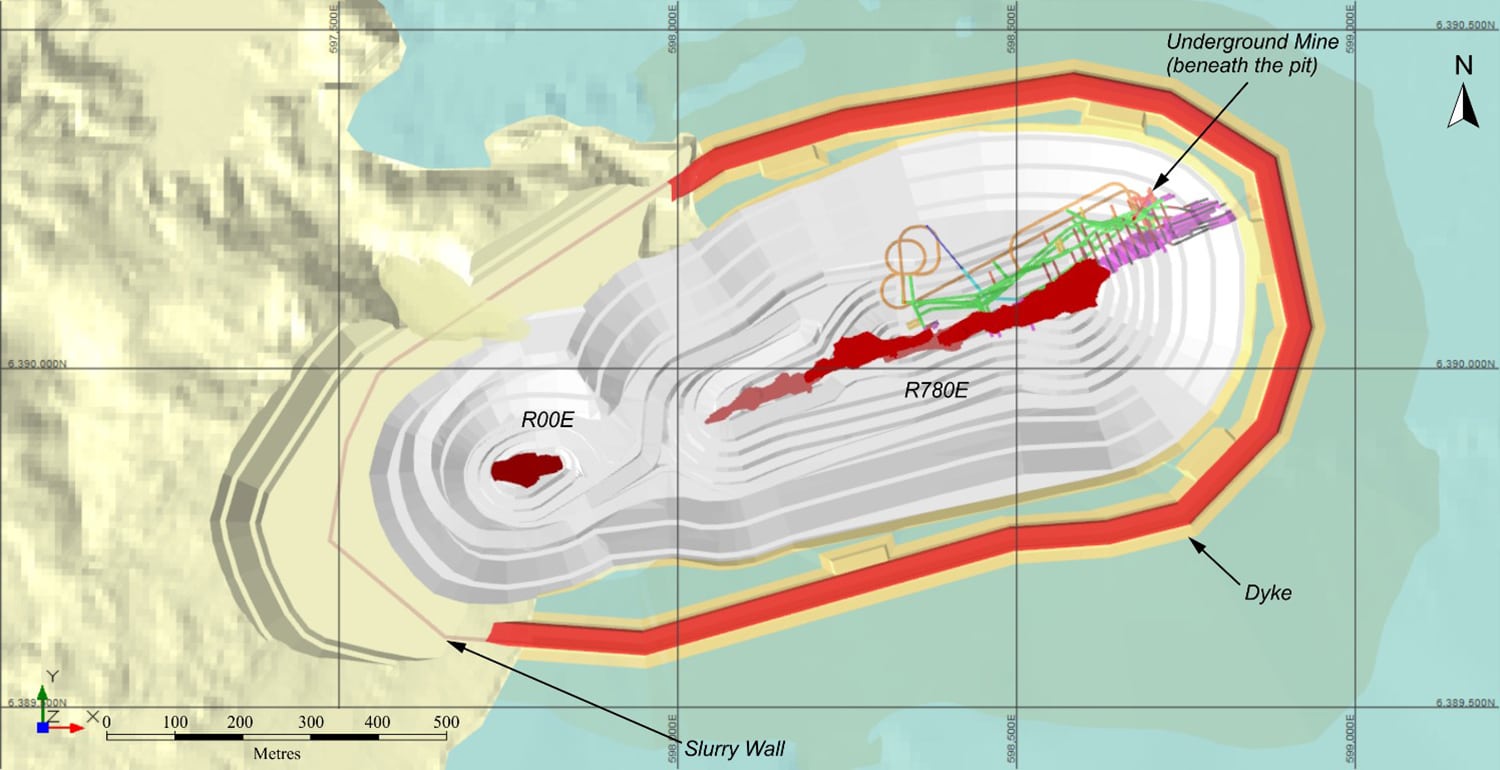

FISSION URANIUM CORP. (“Fission” or “the Company“) is pleased to announce the results of a Prefeasibility Study (the “PFS”), conducted by Roscoe Postle Associates Inc. (“RPA”) and first-time estimate of Mineral Reserves for its’ Patterson Lake South (“PLS”) property in Canada’s Athabasca Basin region. With an estimated OPEX of just US$6.77/lb U3O8 and an IRR (pre-tax) of 29%, the PFS further enhances the potential for highly-economic production at PLS. In addition, with the R780E zone still open at depth and along plunge to the east and the recently discovered high-grade mineralized zones along strike to the west and east (R1515W, R840W and R1620E zones) yet to be included in the reserve mine plan, there is clear upside for expanding the resource base and mine life and further improving the economics. The PFS is based on an open pit / underground hybrid operation and the Company is also progressing a PEA-level underground-only alternate scenario that indicates potential for improved economics.

PFS Highlights

Robust Economics including Very Low Operating Costs “OPEX”

- OPEX of US$6.77/lb U3O8. OPEX is substantially less than the 2015 PEA technical report for PLS which estimated US$12.38/lb

- Production averaging almost 15 million lbs U3O8 per year over the first five years from mineral reserves of 90.5 M lbs U3O8

- IRR (pre-tax) of 29%

- NPV (pre-tax), discounted at 8%, of C$1.32B

- Payback in 2 years (pre-tax)

- Initial CAPEX of C$1.49B, and sustaining capital (including reclamation and closure) of C$214M

- High processing recovery rate of 96.7%

- 4-year construction period and 8.2-year mine life

Increased Indicated Resource

Indicated Resources contain 103,768,000 lbs U3O8, an increase of 18% compared to the previous Mineral Resource estimate, reported February 20, 2018.

Demonstrated Scope for Substantial Growth

- Additional Zones: The PFS Mineral Reserves are based on the Indicated Resources of the R780E and R00E zones. There are three other mineralized zones along strike that do not yet have sufficient drilling to classify the majority of their resources to Indicated, and future programs will work to advance this. These include the R1515W, R845W and R1620E zones.

- Zone Expansion: The R780E zone is open at depth and along plunge to the east and further opportunity exists to continue to grow the resource in those directions, potentially extending the underground mine life.

- Mineralization Upgrade: The PFS mine plan does not include areas of Inferred Resources in the R00E and R780E zones. Additional drilling has the potential to convert these to Indicated.

Flexible Mining Approach

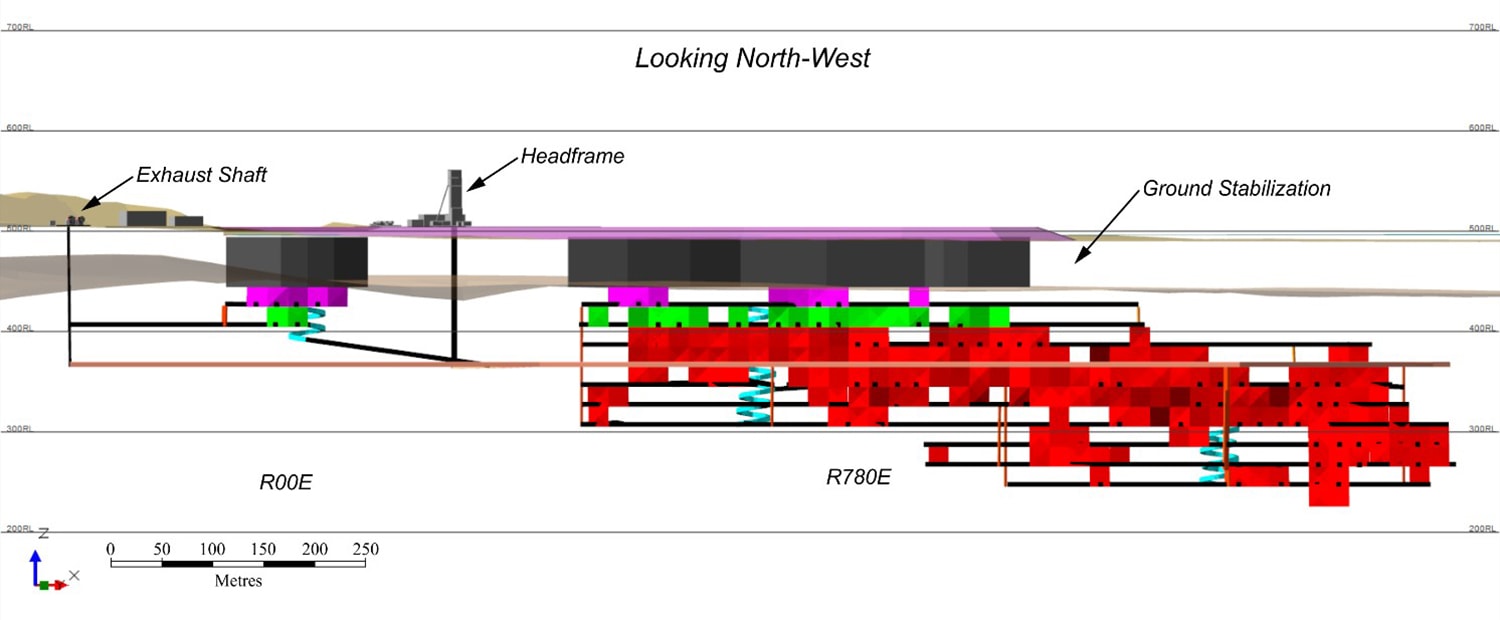

- The PFS base case for production at PLS is a hybrid operation (open pit and underground), aimed at maximizing extraction of R780E and R00E resources. However, it also has the potential to be mined as a purely underground operation.

- An on-going PEA-level underground-only scenario shows potential for improved economic results, including:

- 3-year construction period and 7.3 year operation (based on the same Indicated Resources as the PFS base case).

- Lower Initial CAPEX of C$1.19B

- All in OPEX of US$7.17 per pound

- Pre-tax IRR of 36%, NPV at 8% of C$1.31B, and a 1.9 year payback

- Reduced footprint and environmental impact

- This PEA-level scenario is preliminary in nature and is based on assumptions and estimates that are not at a PFS level of detail and therefore cannot be categorized as Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. There is no certainty that the PEA results will be realized.

Ross McElroy, President, COO, and Chief Geologist for Fission, commented, “This prefeasibility study presents a very strong base case for production at PLS and further improves the potential economics and de-risks the project. Particular highlights include very low operating costs, a high internal rate of return and broad scope for growth and optimization. It also includes the important milestone of estimating mineral reserves at PLS. The focus of the report is production from the R00E and R780E zones. Moving forward, we have the potential to add resources to these two zones, and from the three other known mineralized zones, which may increase mine life and improve economics. Overall, we are very pleased with the results of the report and we are continuing to advance PLS towards feasibility status.”

The PFS has an effective date of April 9, 2019 and supersedes all previously-filed technical reports for PLS.

Technical Summary

The PFS was prepared by independent consultants led by RPA, who carried out resource and reserve estimation and mining work, assisted by BGC Engineering Inc. (geotechnical aspects), BAUER Foundations Canada Inc. (dyke and slurry cut-off wall), Wood Canada Ltd. (process and infrastructure), Clifton Associates Ltd. (environmental and tailings) and Arcadis Canada Inc. (radiological considerations).

In addition to managing radiological issues common to high-grade uranium mining, a key technical challenge to developing the operation will be water control related to Patterson Lake and saturated sandy overburden. The PFS proposes a system of dykes and slurry cut-off walls – proven techniques successfully implemented at a number of Canadian mining operations, including the Diavik diamond mine and the Meadowbank gold mine. The development scenario does not require any new, untested, conceptual mining or construction methods. Since the PEA, extensive field programs have been carried out to confirm overburden characteristics, with these test results forming the basis of the PFS estimates.

Mineral Resources

Mineral Resources were updated for the PFS by RPA using data collected up to and including 2018 diamond drilling campaigns. Estimated block model grades are based on chemical assays only.

The Triple R deposit as defined in the Mineral Resource estimate is comprised of several nearly vertical stacked lenses across five mineralized zones that are generally oriented with an azimuth 66.2°. A set of cross-sections and level plans were interpreted to construct a total of 82 three-dimensional wireframe models (domains) for the mineralized zones at a minimum grade of 0.05% U3O8. Of the 82 wireframes, 16 are High Grade domains created at a minimum grade of approximately 5% U3O8, which are enveloped within the Low Grade domains.

Block model grades were interpolated by inverse distance cubed (ID3). Classification into the Indicated and Inferred categories was guided by the drill hole spacing and the continuity of the mineralized zones.

The updated resource estimate represents an 18% increase in pounds U3O8 classified as Indicated as compared to the previous Mineral Resource dated February 20, 2018. The increase in resource classified as Indicated is primarily due to infill drilling and conversion of Inferred Resources.

| Table 1 Mineral Resource Statement – October 23, 2018 | |||||

| Classification | Tonnes | Grade (%U3O8) |

Grade (Au g/t) |

Contained U3O8 (lb) |

Gold (oz) |

| Indicated | |||||

| Open Pit | 1,609,000 | 2.33 | 0.58 | 82,753,000 | 30,100 |

| Underground | 931,000 | 1.02 | 0.48 | 21,015,000 | 14,300 |

| Total Indicated | 2,540,000 | 1.85 | 0.49 | 103,768,000 | 44,400 |

| Inferred | |||||

| Open Pit | 40,000 | 0.62 | 0.24 | 551,000 | 300 |

| Underground | 1,198,000 | 1.23 | 0.50 | 32,334,000 | 19,300 |

| Total Inferred | 1,238,000 | 1.20 | 0.49 | 32,886,000 | 19,600 |

Notes:

- CIM definitions (2014) were followed for Mineral Resources.

- Mineral Resources are reported inclusive of Mineral Reserves.

- Mineral Resources are reported within an open pit design at a cut-off grade of 0.15% U3O8 and 0.25% U3O8 for resources outside the pit that are potentially mined by underground methods.

- The cut-off grades are based on price of US$50 per lb U3O8 and an exchange rate of 0.75 C$/US$.

- A minimum mining width of 1.0 m was used.

- Numbers may not add due to rounding.

Mineral Reserves

A first-time estimate of Mineral Reserves for the Project was carried out by RPA based on an open pit that captures all of the High Grade Indicated Resources in the R780E and R00E zones. Similar in concept to the 2015 PEA, the PFS Base Case design includes a sand dyke and plasticized cement slurry cut-off wall projecting into Patterson lake (Figure 1), and an onsite processing plant and associated infrastructure (Figure 2). Updates to the Mineral Resources and geotechnical understanding of the overburden and host rock are incorporated, based on field data collection programs and subsequent analysis.

Figure 1 – Dyke, Slurry Cut-Off Wall, and Open Pit Configuration

Figure 2 – Site Layout

Outside of the open pit, underground Mineral Reserves are based on designs for transverse and longitudinal longhole stoping, accessed via a portal located within the open pit, and two ventilation raises also located within the pit. Mineral Reserves are summarized in Table 2.

| Table 2 Mineral Reserve Statement – April 9, 2019 | |||

| Classification | Tonnes | Grade (%U3O8) |

Contained U3O8 (lb) |

| Probable | |||

| Open Pit | 2,296,000 | 1.62 | 82,262,000 |

| Underground | 592,000 | 0.63 | 8,236,000 |

| Total Probable | 2,888,000 | 1.42 | 90,500,000 |

Notes:

- CIM definitions (2014) were followed for Mineral Reserves.

- Open Pit Mineral Reserves are reported within mining shapes built within the open pit design at a cut-off grade of 0.15% U3O8

- Underground Mineral Reserves are reported using stope shapes generated with a 0.25% U3O8 minimum grade.

- The cut-off grades are based on price of US$50 per lb U3O8 and an exchange rate of 0.75 C$/US$.

- For underground mining, a minimum mining width of 3.0 m was used.

- Numbers may not add due to rounding.

Resource to reserve conversion was high, with modest mining losses (part of the “modifying factors” that differentiate reserves from resources) consisting of:

- Isolated resource blocks in the open pit that can’t be separated from waste

- Low-grade open pit resource blocks below cut-off after dilution

- Underground resource blocks not included in designed stopes

- 95% extraction factor on underground stopes.

PFS Base Case Life of Mine (LOM) Plan Summary

Physicals

- A four-year construction period, consisting of dyke building, slurry cut-off wall installation, dewatering, overburden removal, and plant and infrastructure construction.

- Six years of open pit operations at 1,000 tonnes per day (tpd) ore, 12,000 tpd moved.

- Followed by two years of underground operations at 1,000 tpd ore.

- 2.89 Mt processed over 8.2 years, grading 1.42% U3O8.

- Process recovery of 96.7%, based on updated metallurgical testwork.

- Production of 87.5 M lbs of U3O8, including an average of 14.35 Mlbs per year for the first five years.

Revenue

- Uranium price of US$50/lb U3O8, based on long-term consensus forecasts.

- Exchange rate of 0.75 US$ = C$1.00

- Gross revenue of C$5,837 million

- Less Saskatchewan Government Gross Revenue Royalties of C$423 million

- Net revenue of C$5,413 million

Operating Costs

- Average operating costs of C$9.03/lb U3O8 (US$6.77/lb U3O8)

- Unit operating costs of C$274 per tonne processed

- Mining C$ 89/t

- Processing C$115/t

- Surface and G&A C$ 71/t

- Total operating costs of C$790 million

- Operating cash flow of C$4,623 million

Capital Costs

- Pre-production capital costs of C$1,498 million

- Dyke & Slurry Cut-Off Wall C$ 371 million

- Open Pit Mining C$ 44 million

- Process Plant C$ 241 million

- Tailings Facility C$ 101 million

- Infrastructure C$ 114 million

- Indirects & Owner’s Costs C$ 376 million

- Contingency C$ 250 million

- Sustaining capital costs of C$137 million

- Reclamation and closure costs of C$77 million

Economic Results

- Pre-tax cash flow of C$2,910 million

- Income tax and Saskatchewan Profit Royalties of C$1,151 million

- After-tax cash flow of C$1,759 million

- Pre-tax NPV (at a discount rate of 8%) C$1,319 million

- Pre-tax IRR of 29%

- After-tax NPV (at a discount rate of 8%) C$693 million

- After-tax IRR of 21%

- Payback period of two years (pre-tax).

Underground Only PEA-Level Scenario

An alternative scenario involving sinking shafts on land and developing underground workings below Patterson Lake eliminates the need for the dyke and slurry cut-off wall construction prior to mining (Figure 3). Featuring a reduced footprint and environmental impact, this scenario results in some improved economic outcomes (such as reduced initial capital costs), despite the loss of some Indicated Mineral Resources to a crown pillar.

Figure 3 – Underground-Only Scenario

A comparison to the PFS Base Case is presented in Table 3.

| Table 3 Scenario Comparison | |||

| Item | Units | PFS Base Case | UG Only PEA Case |

| Construction Period | years | 4 | 3 |

| Mining | Mt | 2.89 | 2.25 |

| % U3O8 | 1.42 | 1.64 | |

| Mine Life | Years | 8.2 | 7.3 |

| Production | M lbs U3O8 | 90.5 | 81.4 |

| Operating Costs | C$/t | 274 | 335 |

| C$/lb U3O8 | 9.03 | 9.57 | |

| Initial Capital Cost | C$ M | 1,498 | 1,194 |

| Sustaining Capital Cost | C$ M | 137 | 258 |

| Pre-Tax Cash Flow | C$ M | 2,910 | 2,587 |

| After-Tax Cash Flow | C$ M | 1,759 | 1,533 |

| After-Tax NPV@8% | C$ M | 693 | 696 |

| After-Tax IRR | % | 21 | 26 |

This PEA-level scenario is preliminary in nature and is based on assumptions and estimates that are not at a PFS level of detail and therefore cannot be categorized as Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. There is no certainty that the PEA results will be realized.

Fission plans to advance the Underground Only Scenario to PFS level, for direct comparison to the Base Case, and decision-making going into FS.

Conclusion of Winter Program

The Company also announces it has completed the Winter 2019 work program at PLS. The final work elements included:

- Dual-purpose resource expansion and geotechnical rock-mechanic drilling (3 holes, see News Release Mar 19, 2019)

- Dyke cut-off drilling (16 holes)

- Water monitoring drilling (4 holes)

- Potential tailings management facility drilling (10 holes)

PLS Mineralized Trend & Triple R Deposit Summary

Uranium mineralization of the Triple R deposit at PLS occurs within the Patterson Lake Conductive Corridor and has been traced by core drilling over ~3.18 km of east-west strike length in five separated mineralized “zones” which collectively make up the Triple R deposit. From west to east, these zones are: R1515W, R840W, R00E, R780E and R1620E. Through successful exploration programs completed to date, Triple R has evolved into a large, near surface, basement hosted, structurally controlled high-grade uranium deposit. The discovery hole was announced on November 05, 2012 with drill hole PLS12-022, from what is now referred to as the R00E zone.

The R1515W, R840W and R00E zones make up the western region of the Triple R deposit and are located on land, where overburden thickness is generally between 55 m to 100 m. R1515W is the western-most of the zones and is drill defined to ~90 m in strike-length, ~68 m across strike and ~220 m vertical and where mineralization remains open in several directions. R840W is located ~515 m to the east along strike of R1515W and has a drill defined strike length of ~430 m. R00E is located ~485 m to the east along strike of R840W and is drill defined to ~115 m in strike length. The R780E zone and R1620E zones make up the eastern region of the Triple R deposit. Both zones are located beneath Patterson Lake where water depth is generally less than six metres and overburden thickness is generally about 50 m. R780E is located ~225 m to the east of R00E and has a drill defined strike length of ~945 m. R1620E is located ~210 m along strike to the east of R780E, and is drill defined to ~185 m in strike length.

Mineralization along the Patterson Lake Corridor trend remains prospective along strike in both the western and eastern directions. Basement rocks within the mineralized trend are identified primarily as mafic volcanic rocks with varying degrees of alteration. Mineralization is both located within and associated with mafic volcanic intrusives with varying degrees of silicification, metasomatic mineral assemblages and hydrothermal graphite. The graphitic sequences are associated with the PL-3B basement Electro-Magnetic (EM) conductor.

Patterson Lake South Property

The 31,039 hectare PLS project is 100% owned and operated by Fission Uranium Corp. PLS is accessible by road with primary access from all-weather Highway 955, which runs north to the former Cluff Lake mine and passes through the nearby UEX-Areva Shea Creek discoveries located 50km to the north, currently under active exploration and development.

Qualified Persons

This News Release describes an updated Mineral Resource estimate, a first-time Mineral Reserve estimate, and a PFS Life of Mine Plan and cash flow based upon geological, engineering, technical and cost inputs developed by RPA and other study participants. A National Instrument 43-101 Technical Report will be filed on SEDAR and made available on the Company’s website within 45 days. The technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 and reviewed and approved by Jason Cox, P.Eng. of RPA, an independent qualified person.

On behalf of the company, the technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 and reviewed on behalf of the company by Ross McElroy, P.Geol., President and COO for Fission Uranium Corp., a qualified person.

About Fission Uranium Corp.

Fission Uranium Corp. is a Canadian based resource company specializing in the strategic exploration and development of the Patterson Lake South uranium property – host to the class-leading Triple R uranium deposit – and is headquartered in Kelowna, British Columbia. Fission’s common shares are listed on the TSX Exchange under the symbol “FCU” and trade on the OTCQX marketplace in the U.S. under the symbol “FCUUF.”

ON BEHALF OF THE BOARD

Ross McElroy – Investor Relations

______________________________

877-868-814

ir@fissionuranium.com

Ross McElroy, President and COO

www.fissionuranium.com

Cautionary Statement:

Certain information contained in this press release constitutes “forward-looking information”, within the meaning of Canadian legislation. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur”, “be achieved” or “has the potential to”. Forward looking statements contained in this press release may include statements regarding the future operating or financial performance of Fission and Fission Uranium which involve known and unknown risks and uncertainties which may not prove to be accurate. Actual results and outcomes may differ materially from what is expressed or forecasted in these forward-looking statements. Such statements are qualified in their entirety by the inherent risks and uncertainties surrounding future expectations. Among those factors which could cause actual results to differ materially are the following: market conditions and other risk factors listed from time to time in our reports filed with Canadian securities regulators on SEDAR at www.sedar.com. The forward-looking statements included in this press release are made as of the date of this press release and the Company and Fission Uranium disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities legislation.

Vancouver, British Columbia–(Newsfile Corp. – April 12, 2019) – Miramont Resources Corp. (CSE: MONT) (OTCQB: MRRMF) (FSE: 6MR) (“Miramont” or the “Company“) is pleased to announce appointment of Dr. Quinton Hennigh as Executive Chairman of the Company. Dr. Hennigh has served as non-executive Chairman since November 2017. As Executive Chairman, Dr. Hennigh will be responsible for overseeing the control and direction of Miramont. Dr. Hennigh is an economic geologist with more than 25 years of exploration experience with major gold mining firms, including Homestake Mining, Newcrest Mining and Newmont Mining. Currently, Dr. Hennigh is President and Chairman of Novo Resources Corp and serves as a director for Irving Resources Inc., TriStar Gold Inc., Precipitate Gold Corp and NV Gold Corp.

Mr. Tyson King has been appointed as President and Chief Executive Officer of the Company. Mr. King is a co-founder of Miramont and has served in senior management roles since its inception, most recently as Vice-President. Mr. King will be responsible for the day-to-day operations and management of the Company and will report directly to Dr. Hennigh. Mr. King has over 10 years experience in the management of publicly trading and privately held companies in the commodities and natural resources sector. He has been actively engaged in overseeing the operations of numerous companies and has provided consulting services in connection with exploration activities. Mr. King holds a BA in Economics from the University of Calgary.

“I am very pleased to have the opportunity to take on a more active management role in the operations of Miramont” said Dr. Hennigh. “I also look forward to working more closely with Mr. King, who has been a driving force behind Miramont from the outset. Our plans moving forward include a continued assessment of all data from Cerro Hermoso and advancing the highly prospective Lukkacha project. The Company will also focus on identifying new exploration properties in Peru which could be acquired on reasonable terms.”

Miramont also announces that Mr. William Pincus will be leaving the Company and has tendered his resignation as President, Chief Executive Officer and a member of the Board of Directors of the Company. Quinton Hennigh, Chairman of the Board, noted: “The Board would like to thank Mr. Pincus for his service to the Company, especially helping establish Miramont as a Peruvian explorer. Mr. Pincus served with utmost integrity, candidness and forthrightness with all interactions with the board. We wish him well with his future endeavors.”

About Miramont Resources Corp.

Miramont is a Canadian-based exploration company with a focus on acquiring and developing mineral prospects within world-class belts of South America. Miramont’s key assets are located in southern Peru. The Cerro Hermoso property hosts a 1.4km diameter breccia pipe targeting gold – polymetallic mineralization, while the Lukkacha property is targeting porphyry copper mineralization.

On behalf of the Board of Directors,

MIRAMONT RESOURCES CORP.

Quinton Hennigh

Executive Chairman

For more information, please contact the Company at:

Telephone: (604) 398-4493

Facsimile: (604) 815-0770

info@miramontresources.com

www.miramontresources.com

Reader Advisory

This news release may contain statements which constitute “forward-looking information”, including statements regarding the plans, intentions, beliefs and current expectations of the Company, its directors, or its officers with respect to the future business activities of the Company. The words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” and similar expressions, as they relate to the Company, or its management, are intended to identify such forward-looking statements. Investors are cautioned that any such forward-looking statements are not guarantees of future business activities and involve risks and uncertainties, and that the Company’s future business activities may differ materially from those in the forward-looking statements as a result of various factors, including, but not limited to, fluctuations in market prices, successes of the operations of the Company, continued availability of capital and financing and general economic, market or business conditions. There can be no assurances that such information will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. The Company does not assume any obligation to update any forward-looking information except as required under the applicable securities laws.

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

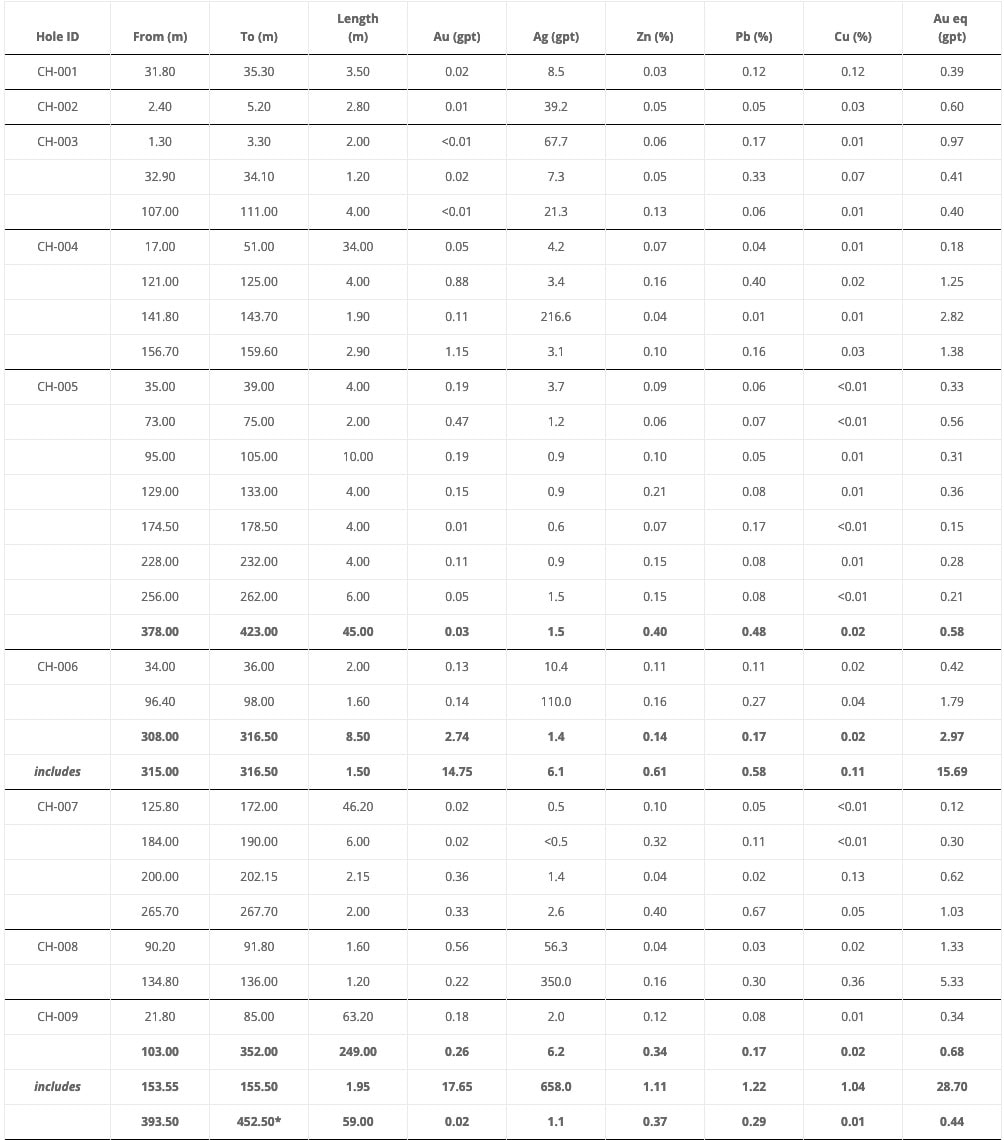

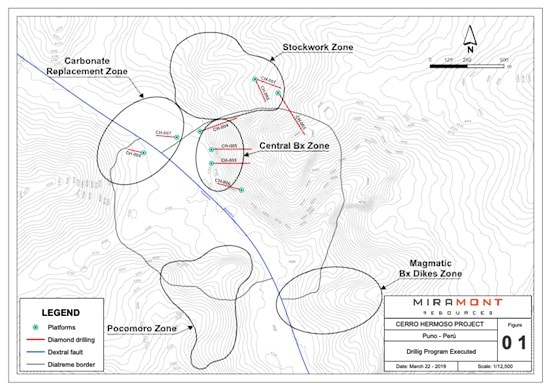

Vancouver, British Columbia–(Newsfile Corp. – April 12, 2019) – Miramont Resources Corp. (CSE: MONT) (OTCQB: MRRMF) (FSE: 6MR) (“Miramont” or the “Company“) is pleased to announce it has received final assays from its 3,679-meter diamond drill program at its Cerro Hermoso polymetallic project located in southern Peru. Results include 249 m of 0.68 gpt Au equivalent including 1.95 m of 28.4 gpt Au equivalent in hole CH-009 (please refer to a table of results below and a nearby plan map showing the location of drill holes).

Highlights:

- Drilling tested three principal targets, the Central Breccia Zone (holes CH-004, CH-005, CH-006 and CH-009), the Stockwork Zone (holes CH-001, CH-002 and CH-003) and the Carbonate Replacement Zone (holes CH-007 and CH-008).

- Significant mineralization was encountered in the Central Breccia Zone. Hole CH-009, drilled eastward, encountered 249 m of 0.68 gpt Au equivalent beginning at 103 m including 1.95 m of 28.4 gpt Au equivalent beginning at 153.55 m and a second interval of 59 m of 0.44 gpt Au equivalent beginning at 393.5 m and continuing to the end of the hole. Hole CH-005, situated approximately 100 m north of and parallel to CH-009, encountered 45 m of 0.58 gpt Au equivalent beginning at 378 m. Hole CH-006, situated approximately 250 m southeast of CH-009 and drilled westward, encountered 8.5 m of 2.97 gpt Au equivalent beginning at 308 m including 1.5 m of 15.69 gpt Au equivalent beginning at 315 m. Collectively, holes CH-009, CH-005 and CH-006 demonstrate the presence of a mineralized system within the diatreme that appears open to the northeast, east and southeast under an area of post-mineral cover. The eastern margin of the diatreme lies approximately 600 m beyond the end of these two holes, leaving considerable room for further exploration. A large, sub-surface magnetic feature situated approximately 400 m northeast of hole CH-009 may be an intrusion, potentially related to mineralization.

- Holes CH-001, CH-002 and CH-003 in the Stockwork Zone encountered narrow intervals of anomalous mineralization. Miramont sees limited potential for broader zones of mineralization in this area. Similar short intervals of anomalous mineralization were encountered in holes CH-007 and CH-008 targeting the Carbonate Replacement Zone, indicating limited potential in this area.

- Miramont is currently undertaking a thorough review of results from drilling at Cerro Hermoso with the intent of determining the best path forward.

Dr. Quinton Hennigh, Miramont’s Chairman said: “First pass drilling has confirmed the presence of a large mineralized system at Cerro Hermoso. Mineralization within the Central Breccia Zone appears open to the northeast, east and southeast as well as at depth. A nearby magnetic anomaly suggests the system is driven by a buried intrusion. Over the coming weeks we plan to compile, review and interpret all data from the latest program.”

The table below presents anomalous intercepts in all nine diamond drill holes completed at Cerro Hermoso. Some intercepts from holes CH-001 through CH-006 were previously reported in a news release dated March 28, 2019.

*End of hole

Au eq calculated using 81.25 gpt Ag = 1 gpt Au, 1.4237% Zn = 1 gpt Au, 2.1518% Pb = 1 gpt Au, 0.6485% Cu = 1 gpt Au)

Analytic Protocols and QA/QC

Assays were completed first by SGS and then by ALS Laboratories in Peru. Future samples will be analyzed by ALS as primary laboratory. Miramont follows rigorous sampling and analytical protocols that meet industry standards. Core samples are stored in a secured area until transport in batches to either SGS or ALS prep labs in Arequipa, Peru. Sample batches include certified reference materials, blanks, and duplicate samples are then processed under the control of ALS or SGS. ALS samples are analyzed using the ME-ICP61 (a technique that provides a comprehensive multi-element overview of the rock geochemistry), while gold is analyzed by AA24 and GRA22 when values exceed 10 gpt. Over limit silver, copper, lead and zinc are analyzed using the OG-62 procedure. SGS samples are analyzed using the ICP 40B method while gold is analyzed by FAA515. Over limit silver, copper, lead and zinc are analyzed using the AAS41B procedure.

National Instrument 43-101 Disclosure

The technical content of this news release has been reviewed and approved by Dr. Quinton Hennigh, P.Geo., Chairman of Miramont and a Qualified Person as defined by National Instrument 43-101.

About Miramont Resources Corp.

Miramont is a Canadian based exploration company with a focus on acquiring and developing mineral prospects within world-class belts of South America. Miramont’s two key projects are Cerro Hermoso and Lukkacha, both located in southern Peru. Cerro Hermoso is a diatreme-hosted copper dominant polymetallic prospect. Lukkacha is a classic copper-porphyry prospect.

On behalf of the Board of Directors,

MIRAMONT RESOURCES CORP.

“Quinton Hennigh”

Quinton Hennigh, Chairman

For more information, please contact the Company at:

Telephone: (604) 398-4493

Facsimile: (604) 815-0770

info@miramontresources.com

www.miramontresources.com

Reader Advisory

This news release may contain statements which constitute “forward-looking information”, including statements regarding the plans, intentions, beliefs and current expectations of the Company, its directors, or its officers with respect to the future business activities of the Company. The words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” and similar expressions, as they relate to the Company, or its management, are intended to identify such forward-looking statements. Investors are cautioned that any such forward-looking statements are not guarantees of future business activities and involve risks and uncertainties, and that the Company’s future business activities may differ materially from those in the forward-looking statements as a result of various factors, including, but not limited to, fluctuations in market prices, successes of the operations of the Company, continued availability of capital and financing and general economic, market or business conditions. There can be no assurances that such information will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. The Company does not assume any obligation to update any forward-looking information except as required under the applicable securities laws.

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Map 1

To View an enhanced version of this Map, please visit: https://orders.newsfilecorp.com/files/5945/44047_1341a750b4c22a72_002full.jpg

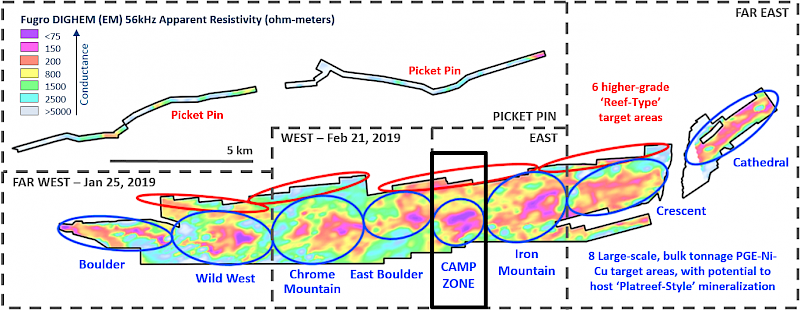

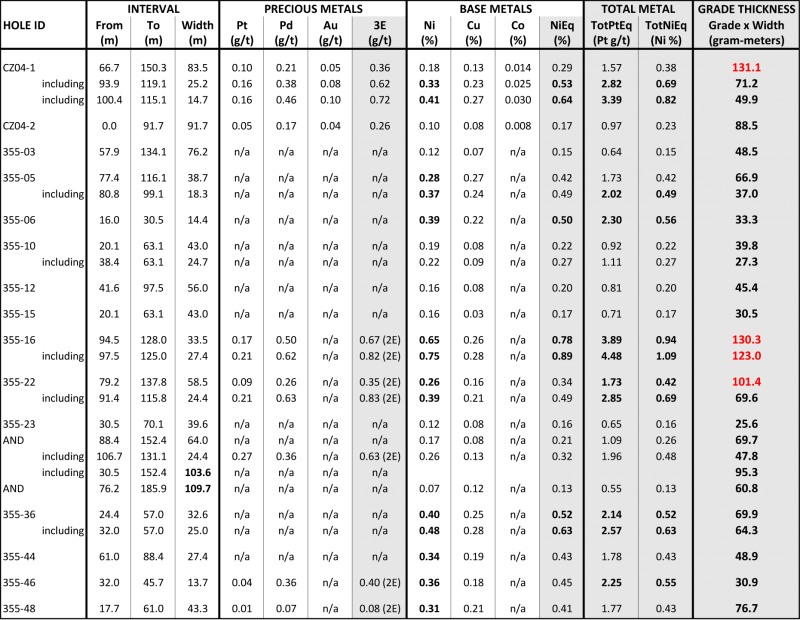

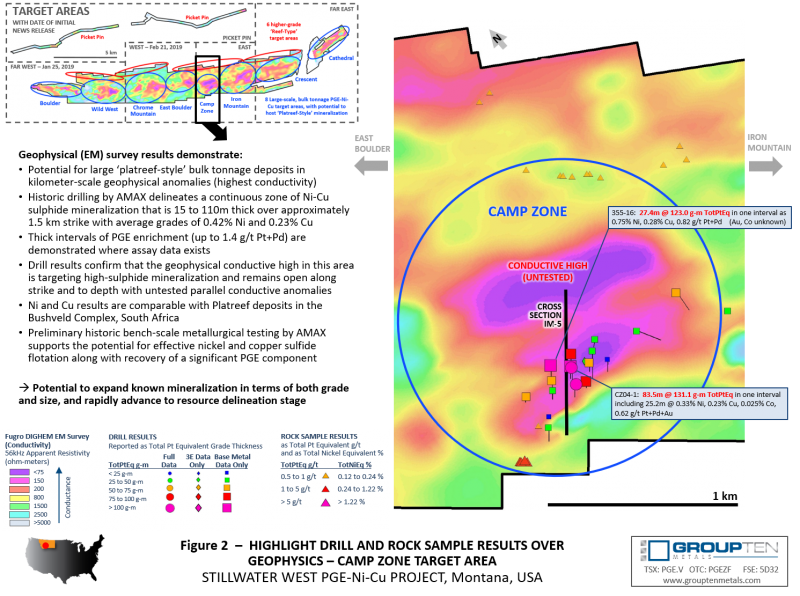

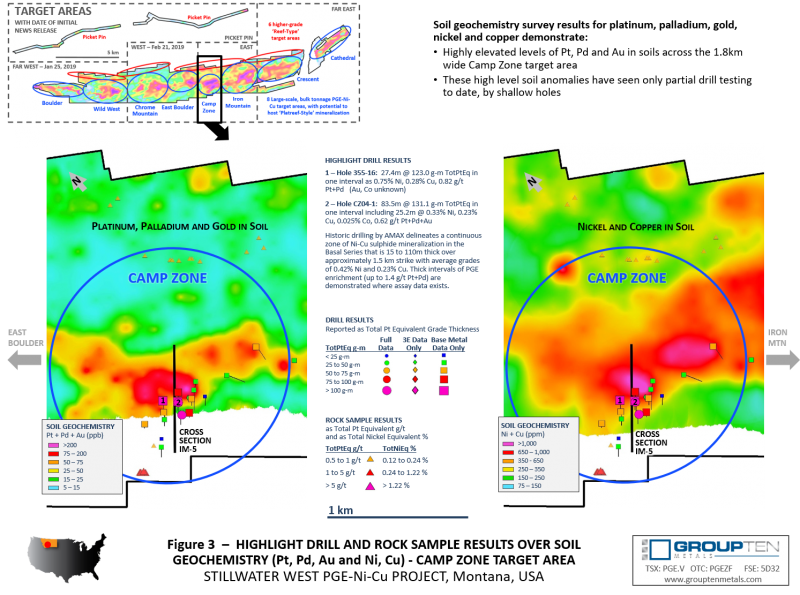

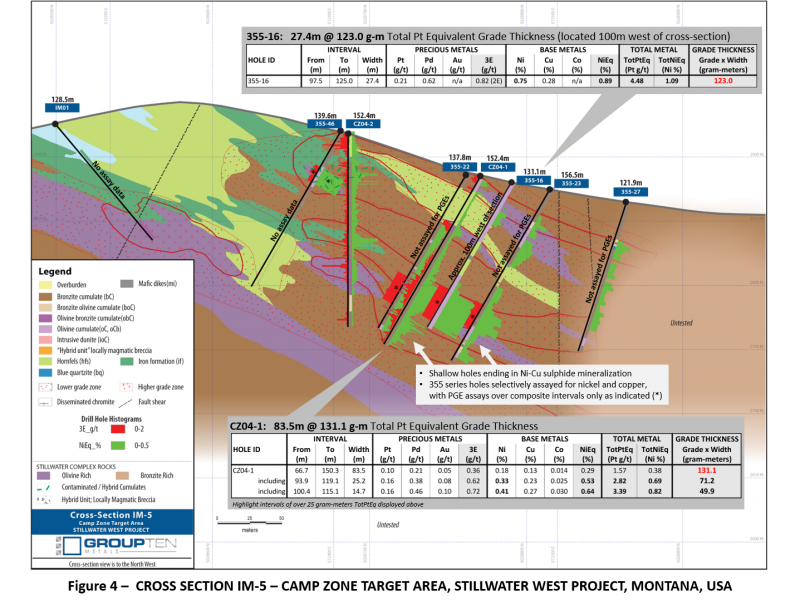

Vancouver, BC – Group Ten Metals Inc. (TSX.V: PGE; US OTC: PGEZF; FSE: 5D32) (the “Company” or “Group Ten”) announces results from the Camp Zone target area on the east side of the Stillwater West Project in Montana, USA. This is the third in a series of planned news releases to report results of 2018 exploration programs and on-going data synthesis and modeling work at the Company’s flagship platinum group element-nickel-copper (“PGE-Ni-Cu”) project adjacent to Sibanye-Stillwater’s high-grade PGE mines in the Stillwater Igneous Complex. Highlights include:

- Drilling by AMAX in the late 1960s and early 1970s includes nine holes which delineate a continuous zone of nickel-copper sulphide mineralization in the Basal Series ranging from 15 to 110 meters in thickness over approximately 1.5 kilometers strike with average grades of 0.42% nickel and 0.23% copper. Platinum and palladium assays, completed as composite samples over select intervals only, demonstrate thick intervals of enrichment, confirming the potential for Platreef-style deposits in the lower Stillwater Complex.

- Nickel and copper grades in these drill holes are comparable to those in the Platreef deposits. Limited data is available for platinum and palladium although select intervals were composited with intercepts of up to 1.4 g/t Pt+Pd. Additional drilling will be needed to better define PGE content.

- These drill holes confirm that the geophysical conductive high in this area is targeting high-sulphide mineralization which remains open along strike and to depth with untested parallel conductive anomalies.

- Initial bench-scale metallurgical results from the Camp Zone completed by AMAX are very encouraging and demonstrate that, though Stillwater West is still an exploration stage asset with a lot of room to grow, preliminary testing supports the potential for effective nickel and copper sulphide flotation along with recovery of a significant PGE component.