Vancouver, British Columbia–(Newsfile Corp. – August 12, 2024) – EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the “Company” or “EMX”) is pleased to report results for the three and six months ended June 30, 2024 (in U.S. dollars unless otherwise noted).

In Q2 2024, EMX continued on a strong uptrend in revenue due to robust royalty production and strong metal prices. Strong performance during the quarter was marked from Timok, Gediktepe, and Leeville. EMX continued to invest capital generating and acquiring royalties around the world while our partners invested significant capital to expand operations at existing mines, advance towards the development of new mines, and explore for new opportunities.

Summary of Financial Highlights for the Quarter Ended June 30, 2024 and 2023:1

| Three months ended June 30, | Six months ended June 30, | |||||||||||

| (In thousands of dollars) | 2024 | 2023 | 2024 | 2023 | ||||||||

| Statement of Loss | ||||||||||||

| Revenue and other income | $ | 6,005 | $ | 3,408 | $ | 12,245 | $ | 6,150 | ||||

| General and administrative costs | (1,694 | ) | (1,576 | ) | (3,842 | ) | (3,298 | ) | ||||

| Royalty generation and project evaluation costs, net | (2,907 | ) | (2,200 | ) | (5,841 | ) | (5,022 | ) | ||||

| Net loss | $ | (4,022 | ) | $ | (4,722 | ) | $ | (6,249 | ) | $ | (8,448 | ) |

| Statement of Cash Flows | ||||||||||||

| Cash flows from operating activities | $ | (514 | ) | $ | (1,002 | ) | $ | 513 | $ | (4,335 | ) | |

| Non-IFRS Financial Measures1 | ||||||||||||

| Adjusted revenue and other income | $ | 8,758 | $ | 6,614 | $ | 17,051 | $ | 11,582 | ||||

| Adjusted royalty revenue | $ | 7,836 | $ | 5,265 | $ | 15,493 | $ | 9,208 | ||||

| GEOs sold | 3,352 | 2,662 | 7,047 | 4,750 | ||||||||

| Adjusted cash flows from operating activities | $ | 1,341 | $ | 1,452 | $ | 4,002 | $ | (983 | ) | |||

| Adjusted EBITDA | $ | 4,639 | $ | 2,848 | $ | 7,862 | $ | 3,222 | ||||

| Strong Revenue Growth Adjusted revenue and other income1 increased by 32% compared to Q2 2023•Adjusted royalty revenue1 increased by 49% compared to Q2 2023 | Development of Flagship Assets Significant investment by Zijin Mining Group at Timok through continued development of upper and lower zonesLundin Mining increased its ownership percentage in Caserones to 70% |

| Record Quarterly Revenue from Flagship Asset Timok generated royalty revenue of $1,586,000 in Q2 2024 for a second consecutive quarter of record production from the upper zone | Consistent and Steady Cash Flows Fifth consecutive quarter with positive adjusted cash flows from operating activities1 |

Outlook

The Company is maintaining its 2024 guidance of GEOs sales of 11,000 to 14,000, adjusted royalty revenue of $22,000,000 to $27,500,000 and option and other property income of $2,000,000 to $3,000,000. The Company is currently on pace to achieve the upper end of its annual guidance for GEOs sold and adjusted royalty revenue, while aiming for the lower end of our option and other property income guidance.

The Company is excited about the prospect for continued growth in the portfolio for 2024 and the coming years. The driver for near and long term growth in cash flow will come from the large deposits of Caserones in Chile and Timok in Serbia. At Caserones, Lundin has initiated an exploration program which is intended to expand mineral resources and mineral reserves while at the same time looking to increase throughput at the plant. At Timok, Zijin Mining Group Co. continues to increase its production rates in the upper zone copper-gold deposit while developing the lower zone, which we believe will be one of the more important block cave development projects in the world.

In terms of other production royalty assets, the Company expects Gediktepe, Leeville, and Gold Bar South to mirror what occurred in 2023. In Türkiye, Gediktepe continues to perform well and is ahead of its production forecast for 2024 (as of the end of Q2) and production rates and grades at Balya North ramped up again in Q2. We are also excited about the advancement of Diablillos in Argentina by AbraSilver Resource Corp. where the company continues to expand the mineral resource.

The Company will continue to evaluate and work to acquire mineral rights and royalties in 2024. The Company expects it will invest similar amounts as in 2023 towards the royalty generation business. As in previous years, producing royalties will continue to be supplemented by option, advance royalty, and other pre-production payments from partnered projects across the global asset portfolio. Efforts and programs are underway to optimize and control costs as the Company continues to grow. EMX believes it is well positioned to identify and pursue new royalty and investment opportunities, while further filling a pipeline of royalty generation properties that provide opportunities for additional cash flow, as well as exploration, development, and production success.

As part of the Company’s effort to continue to strengthen its balance sheet, subsequent to the end of the period, the Company has closed the refinancing of its outstanding debt with Sprott Private Resource Lending II of $34,660,000, with a new $35,000,000 credit agreement with Franco-Nevada Corporation (“Franco”), previously announced on June 20, 2024. This refinancing extends the maturity date of the Company’s debt facility from December 31, 2024 to July 1, 2029.

Second Quarter Results for 2024

In Q2 2024, the Company recognized $8,758,000 and $7,836,000 in adjusted revenue and other income1 and adjusted royalty revenue1, respectively, which represented a 32% and 49% increase, respectively, compared to Q2 2023. The significant increase is due to the commencement of royalty payments in Q3 2023 from the Timok royalty property, as well as a 54% increase in royalty revenue from Gediktepe and a 79% increase in royalty revenue from Leeville when compared to Q2 2023.

The following table is a summary of GEOs1 sold and adjusted royalty revenue1 for the three months ended June 30, 2024 and 2023:

| 2024 | 2023 | ||||||||||

| GEOs Sold | Revenue (in thousands) | GEOs Sold | Revenue (in thousands) | ||||||||

| Caserones | 1,178 | $ | 2,753 | 1,621 | $ | 3,206 | |||||

| Timok | 678 | 1,586 | – | – | |||||||

| Gediktepe | 772 | 1,806 | 594 | 1,175 | |||||||

| Leeville | 508 | 1,187 | 336 | 664 | |||||||

| Balya | 133 | 311 | 5 | 9 | |||||||

| Gold Bar South | 71 | 167 | 68 | 134 | |||||||

| Advanced royalty payments | 11 | 26 | 39 | 77 | |||||||

| Adjusted royalty revenue | 3,352 | $ | 7,836 | 2,662 | $ | 5,265 | |||||

Included in the quarterly revenue for Caserones was a true up of $493,000 (Q2 2023 – $1,153,000) due to a higher than expected revenue in the prior quarter. The true up in the current period was mainly driven by higher than anticipated copper and molybdenum sales in Q1 2024.

The following table is a summary of GEOs1 sold and adjusted royalty revenue1 for the six months ended June 30, 2024 and 2023:

| 2024 | 2023 | ||||||||||

| GEOs Sold | Revenue (in thousands) | GEOs Sold | Revenue (in thousands) | ||||||||

| Caserones | 2,168 | $ | 4,806 | 2,800 | $ | 5,432 | |||||

| Timok | 1,290 | 2,853 | – | – | |||||||

| Gediktepe | 2,216 | 4,796 | 1,084 | 2,101 | |||||||

| Leeville | 925 | 2,051 | 618 | 1,198 | |||||||

| Balya | 228 | 508 | 86 | 162 | |||||||

| Gold Bar South | 108 | 242 | 68 | 134 | |||||||

| Advanced royalty payments | 113 | 237 | 94 | 181 | |||||||

| Adjusted royalty revenue | 7,047 | $ | 15,493 | 4,750 | $ | 9,208 | |||||

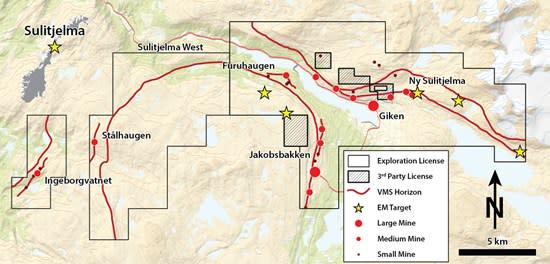

Net royalty generation and project evaluation costs increased from $2,200,000 in Q2 2023 to $2,907,000 in Q2 2024. Royalty generation costs include exploration related activities, technical services, project marketing, land and legal costs, as well as third party due diligence for acquisitions. The increase in net royalty generation and project evaluation costs was predominately attributable to the timing of the 2024 and 2023 annual share-based compensation grants. The 2024 annual grant occurred in Q2 2024 while the 2023 grant occurred in Q3 2023. This timing difference generated a $472,000 increase in costs when compared to Q2 2023. The remaining increase can be attributed to an increase in property costs in Fennoscandia and South America, a decrease in recoveries in Fennoscandia and an increase in overall costs in Eastern Europe and Morocco.

These cost increases were offset by a $203,000 decrease in net expenditures in the USA. The decrease was primarily related to drilling costs that were incurred in 2023, through a former subsidiary of the Company, Scout Drilling LLC., in exchange for future royalty opportunities.

Not inclusive of the net royalty generation and project evaluation cost, EMX earned $555,000 in royalty generation revenue in Q2 2024 (Q2 2023 – $1,088,000).

Second Quarter Corporate Updates

Appointment of Two New Members to the Board of Directors

In Q2 2024, the Company announced the appointment of Dawson Brisco and Chris Wright to the Board of Directors.

Credit Agreement with Franco-Nevada Corporation

In June 2024, the Company announced that it had entered into a $35,000,000 credit agreement with Franco-Nevada Corporation with a maturity date of July 1, 2029. Once received, the Company will use the proceeds of the loan to repay the outstanding balance of the Sprott Credit Facility and for general working capital purposes. Subsequent to the end of the period, the Company closed its credit agreement with Franco.

Inaugural Sustainability Report

The Company is also pleased to announce the publication of its inaugural Sustainability Report for 2023. This report marks a milestone in the Company’s journey with respect to its sustainable and ethical business practices and sets a foundational baseline for the Company’s Environmental, Social and Governance (ESG) efforts moving forward. The report provides information on the Company’s key ESG initiatives, reviews performance metrics, identifies improvement areas, and sets future targets.

Commencement of Normal Course Issuer Bid

During the three months ended June 30, 2024 (“Q2 2024”) the Company purchased 106,276 common shares at a cost of $206,000 which were returned to treasury pursuant to the Company’s Normal Course Issuer Bid. Subsequent the period end, the Company repurchased 167,199 shares for a total cost of $305,000.

Cyber Event Update

In April 2024, the Company became aware that one of the Company’s subsidiaries in Türkiye was the subject of a cyber event resulting in a potential loss of up to $2,326,000. The Company has launched a full investigation of the event which remains ongoing and is pursuing recovery of its funds through all legally available means as appropriate, in order to mitigate the loss amount to the fullest extent possible. A criminal complaint has been filed with the public prosecutor’s office in Türkiye which is the first step to recovery whether it be through a criminal or civil process, or both. EMX is also working with its attorneys in Mexico and is currently preparing a civil complaint in the jurisdiction in which the funds were received and withdrawn. An extensive investigation by a reputable third party security firm yielded that there was no intrusion into EMX systems nor its network in its findings. EMX continues to vigorously pursue all remedies available to it in pursuit of recovery all or a part of the funds.

Qualified Persons

Michael P. Sheehan, CPG, a Qualified Person as defined by NI 43-101 and employee of the Company, has reviewed, verified, and approved the above technical disclosure on North America and Latin America, except for Caserones. Consulting Chief Mining Engineer Mark S. Ramirez, SME Registered Member #04039495, a Qualified Person as defined by NI 43-101 and consultant to the Company, has reviewed, verified and approved the above technical disclosure with respect to the Caserones Mine. Eric P. Jensen, CPG, a Qualified Person as defined by NI 43-101 and employee of the Company, has reviewed, verified, and approved the above technical disclosure on Europe, Türkiye and Australia.

Shareholder Information – The Company’s filings for the year are available on SEDAR+ at www.sedarplus.ca, on the U.S. Securities and Exchange Commission’s EDGAR website at www.sec.gov, and on EMX’s website at www.EMXroyalty.com. Financial results were prepared in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board.

About EMX – EMX is a precious, and base metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and TSX Venture Exchange under the symbol “EMX”. Please see www.EMXroyalty.com for more information.

For further information contact:

David M. Cole

President and CEO

Phone: (303) 973-8585

Dave@EMXroyalty.com

Isabel Belger

Investor Relations

Phone: +49 178 4909039

IBelger@EMXroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange accepts responsibility for the adequacy or accuracy of this release

Forward-Looking Statements

This news release may contain “forward looking information” or “forward looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding the future price of copper, gold and other metals, the estimation of mineral reserves and resources, realization of mineral reserve estimates, the timing and amount of estimated future production, the Company’s growth strategy and expectations regarding the guidance for 2024 and future outlook, including revenue and GEO estimates, refinancing outstanding debt and the timing thereof, the acquisition of additional royalty interests and partnerships, the purchase of securities pursuant to the Company’s NCIB or other statements that are not statements of fact. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, identified by words or phrases such as “expects,” “anticipates,” “believes,” “plans,” “projects,” “estimates,” “assumes,” “intends,” “strategy,” “goals,” “objectives,” “potential,” “possible” or variations thereof or stating that certain actions, events, conditions or results “may”, “could”, “would”, “should”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements are based on a number of material assumptions, including those listed below, which could prove to be significantly incorrect, including disruption to production at any of the mineral properties in which the Company has a royalty, or other interest; estimated capital costs, operating costs, production and economic returns; estimated metal pricing (including the estimates from the CIBC Global Mining Group’s Consensus Commodity Price Forecasts published on January 2, 2024), metallurgy, mineability, marketability and operating and capital costs, together with other assumptions underlying the Company’s resource and reserve estimates; the expected ability of any of the properties in which the Company holds a royalty, or other interest to develop adequate infrastructure at a reasonable cost; assumptions that all necessary permits and governmental approvals will remain in effect or be obtained as required to operate, develop or explore the various properties in which the Company holds an interest; and the activities on any on the properties in which the Company holds a royalty, or other interest will not be adversely disrupted or impeded by development, operating or regulatory risks or any other government actions.

Certain important factors that could cause actual results, performances or achievements to differ materially from those in the forward-looking statements include, amongst others, failure to maintain or receive necessary approvals, changes in business plans and strategies, market conditions, share price, best use of available cash, copper, gold and other commodity price volatility, discrepancies between actual and estimated production, mineral reserves and resources and metallurgical recoveries, mining operational and development risks relating to the parties which produce the gold or other commodity the Company will purchase, regulatory restrictions, activities by governmental authorities (including changes in taxation), currency fluctuations, the global economic climate, dilution, share price volatility and competition.

Forward-looking statements are subject to known and unknown risks, uncertainties and other important factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: the impact of general business and economic conditions, the absence of control over mining operations from which the Company will receive royalties from, and risks related to those mining operations, including risks related to international operations, government and environmental regulation, actual results of current exploration activities, conclusions of economic evaluations and changes in project parameters as plans continue to be refined, risks in the marketability of minerals, fluctuations in the price of gold and other commodities, fluctuation in foreign exchange rates and interest rates, stock market volatility, as well as those factors discussed in the Company’s MD&A for the quarter ended June 30, 2024, and the most recently filed Annual Information Form (“AIF”) for the year ended December 31, 2023, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR+ at www.sedarplus.ca and on the SEC’s EDGAR website at www.sec.gov. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company does not undertake to update any forward-looking statements that are contained or incorporated by reference, except in accordance with applicable securities laws.

Future-Oriented Financial Information

This news release may contain future-oriented financial information (“FOFI”) within the meaning of Canadian securities legislation, about prospective results of operations, financial position, GEOs and anticipated royalty payments based on assumptions about future economic conditions and courses of action, which FOFI is not presented in the format of a historical balance sheet, income statement or cash flow statement. The FOFI has been prepared by management to provide an outlook of the Company’s activities and results and has been prepared based on a number of assumptions including the assumptions discussed under the headings above entitled “2024 Guidance”, “Outlook” and “Forward-Looking Statements” and assumptions with respect to the future metal prices, the estimation of mineral reserves and resources, realization of mineral reserve estimates and the timing and amount of estimated future production. Management does not have, or may not have had at the relevant date, or other financial assumptions which may have been used to prepare the FOFI or assurance that such operating results will be achieved and, accordingly, the complete financial effects are not, or may not have been at the relevant date of the FOFI, objectively determinable.

Importantly, the FOFI contained in this news release are, or may be, based upon certain additional assumptions that management believes to be reasonable based on the information currently available to management, including, but not limited to, assumptions about: (i) the future pricing of metals, (ii) the future market demand and trends within the jurisdictions in which the Company or the mining operators operate, and (iii) the operating cost and effect on the production of the Company’s royalty partners. The FOFI or financial outlook contained in this news release do not purport to present the Company’s financial condition in accordance with IFRS, and there can be no assurance that the assumptions made in preparing the FOFI will prove accurate. The actual results of operations of the Company and the resulting financial results will likely vary from the amounts set forth in the analysis presented in any such document, and such variation may be material (including due to the occurrence of unforeseen events occurring subsequent to the preparation of the FOFI). The Company and management believe that the FOFI has been prepared on a reasonable basis, reflecting management’s best estimates and judgments as at the applicable date. However, because this information is highly subjective and subject to numerous risks including the risks discussed under the heading above entitled “Forward-Looking Statements” and under the heading “Risk Factors” in the Company’s public disclosures, FOFI or financial outlook within this news release should not be relied on as necessarily indicative of future results.

Non-IFRS Financial Measures

The Company has included certain non-IFRS financial measures in this press release, as discussed below. EMX believes that these measures, in addition to conventional measures prepared in accordance with IFRS, provide investors an improved ability to evaluate the underlying performance of the Company. These non-IFRS financial measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. These financial measures do not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers.

Non-IFRS financial measures are defined in National Instrument 52-112 – Non-GAAP and Other Financial Measures Disclosure (“NI 52-112”) as a financial measure disclosed that (a) depicts the historical or expected future financial performance, financial position or cash flow of an entity, (b) with respect to its composition, excludes an amount that is included in, or includes an amount that is excluded from, the composition of the most directly comparable financial measure disclosed in the primary financial statements of the entity, (c) is not disclosed in the financial statements of the entity, and (d) is not a ratio, fraction, percentage or similar representation. A non-IFRS ratio is defined by NI 52-112 as a financial measure disclosed that (a) is in the form of a ratio, fraction, percentage or similar representation, (b) has a non-IFRS financial measure as one or more of its components, and (c) is not disclosed in the financial statements.

The following table outlines the non-IFRS financial measures, their definitions, the most directly comparable IFRS measures and why the Company use these measures.

| Non-IFRS financial measure | Definition | Most directly comparable IFRS measure | Why we use the measure and why it is useful to investors | |||

| Adjusted revenue and other income | Defined as revenue and other income including the Company’s share of royalty revenue related to the Company’s effective royalty on Caserones. | Revenue and other income | The Company believes these measures more accurately depict the Company’s revenue related to operations as the adjustment is to account for revenue from a material asset | |||

| Adjusted royalty revenue | Defined as royalty revenue including the Company’s share of royalty revenue related to the Company’s effective royalty on Caserones. | Royalty revenue | ||||

| Adjusted cash flows from operating activities | Defined as cash flows from operating activities plus the cash distributions related to the Company’s effective royalty on Caserones. | Cash flows from operating activities | The Company believes this measure more accurately depicts the Company’s cash flows from operations as the adjustment is to account for cash flows from a material asset. | |||

| Gold equivalent ounces (GEOs) | GEOs is a non-IFRS measure that is based on royalty interests and calculated on a quarterly basis by dividing adjusted royalty revenue by the average gold price during such quarter. The gold price is determined based on the LBMA PM fix. For periods longer than one quarter, GEOs are summed for each quarter in the period. | Royalty revenue | The Company uses this measure internally to evaluate our underlying operating performance across the royalty portfolio for the reporting periods presented and to assist with the planning and forecasting of future operating results. | |||

| Earnings before interest, taxes, depreciation and amortization (EBITDA) and adjusted EBITDA | EBITDA represents net earnings or loss for the period before income tax expense or recovery, depreciation and amortization, finance costs. Adjusted EBITDA adds all revenue from the Caserones Royalty less any equity income from the equity investment in the Caserones Royalty. Additionally, it removes the effects of items that do not reflect our underlying operating performance and are not necessarily indicative of future operating results. These may include: share based payments expense; unrealized and realized gains and losses on investments; write-downs of assets; impairments or reversals of impairments; foreign exchange gains or losses; and other non-cash or non-recurring expenses or recoveries. | Earnings or loss before income tax | The Company believes EBITDA and adjusted EBITDA are widely used by investors and analysts as useful indicators of our operating performance, our ability to invest in capital expenditures, our ability to incur and service debt and also as a valuation metric. |

Reconciliation of Adjusted Revenue and Other Income and Adjusted Royalty Revenue:

During the three months ended June 30, 2024 and 2023, the Company had the following sources of revenue and other income:

| (In thousands of dollars) | Three months ended June 30, | Six months ended June 30, | ||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||

| Royalty revenue | $ | 5,083 | $ | 2,059 | $ | 10,687 | $ | 3,776 | ||||

| Option and other property income | 492 | 1,011 | 680 | 1,700 | ||||||||

| Interest income | 430 | 338 | 878 | 674 | ||||||||

| Total revenue and other income | $ | 6,005 | $ | 3,408 | $ | 12,245 | $ | 6,150 | ||||

The following is the reconciliation of adjusted revenue and other income and adjusted royalty revenue:

| Three months ended June 30, | Six months ended June 30, | |||||||||||

| (In thousands of dollars) | 2024 | 2023 | 2024 | 2023 | ||||||||

| Revenue and other income | $ | 6,005 | $ | 3,408 | $ | 12,245 | $ | 6,150 | ||||

| SLM California royalty revenue | $ | 6,442 | $ | 7,685 | $ | 11,247 | $ | 13,584 | ||||

| The Company’s ownership % | 42.7 | 40.0 | 42.7 | 40.0 | ||||||||

| The Company’s share of royalty revenue | $ | 2,753 | $ | 3,206 | $ | 4,806 | $ | 5,432 | ||||

| Adjusted revenue and other income | $ | 8,758 | $ | 6,614 | $ | 17,051 | $ | 11,582 | ||||

| Royalty Revenue | $ | 5,083 | $ | 2,059 | $ | 10,687 | $ | 3,776 | ||||

| The Company’s share of royalty revenue | 2,753 | 3,206 | 4,806 | 5,432 | ||||||||

| Adjusted royalty revenue | $ | 7,836 | $ | 5,265 | $ | 15,493 | $ | 9,208 | ||||

Reconciliation of GEOs:

| Three months ended June 30, | Six months ended June 30, | |||||||||||

| (In thousands of dollars) | 2024 | 2023 | 2024 | 2023 | ||||||||

| Adjusted Royalty Revenue | $ | 7,836 | $ | 5,265 | $ | 15,493 | $ | 9,208 | ||||

| Average gold price per ounce | $ | 2,338 | $ | 1,978 | $ | 2,198 | $ | 1,939 | ||||

| Total GEOs | 3,352 | 2,662 | 7,047 | 4,750 | ||||||||

Reconciliation of Adjusted Cash Flows from Operating Activities:

| Three months ended June 30, | Six months ended June 30, | |||||||||||

| (In thousands of dollars) | 2024 | 2023 | 2024 | 2023 | ||||||||

| Cash provided by operating activities | $ | (514 | ) | $ | (1,002 | ) | $ | 513 | $ | (4,335 | ) | |

| Caserones royalty distributions | 1,855 | 2,454 | 3,489 | 3,352 | ||||||||

| Adjusted cash flows from operating activities | $ | 1,341 | $ | 1,452 | $ | 4,002 | $ | (983 | ) | |||

Reconciliation of EBITDA and Adjusted EBITDA:

| Three months ended June 30, | Six months ended June 30, | |||||||||||

| (In thousands of dollars) | 2024 | 2023 | 2024 | 2023 | ||||||||

| Income (loss) before income taxes | $ | (3,430 | ) | $ | (3,095 | ) | $ | (5,665 | ) | $ | (6,740 | ) |

| Finance expense | 1,080 | 1,270 | 2,145 | 2,511 | ||||||||

| Depletion, depreciation, and direct royalty taxes | 1,369 | 790 | 3,788 | 1,642 | ||||||||

| EBITDA | $ | (981 | ) | $ | (1,035 | ) | $ | 268 | $ | (2,587 | ) | |

| Attributable revenue from Caserones royalty | 2,753 | 3,206 | 4,806 | 5,432 | ||||||||

| Equity income from investment in Caserones royalty | (1,411 | ) | (1,340 | ) | (2,208 | ) | (2,255 | ) | ||||

| Share-based payments | 1,354 | 132 | 1,543 | 225 | ||||||||

| Loss (gain) on revaluation of investments | (1,142 | ) | 1,383 | (1,226 | ) | 709 | ||||||

| Loss (gain) on sale of marketable securities | 1,535 | 17 | 1,946 | 459 | ||||||||

| Foreign exchange loss (gain) | 139 | 797 | 255 | 965 | ||||||||

| Gain on revaluation of derivative liabilities | 66 | (188 | ) | 107 | 398 | |||||||

| Loss on revaluation of receivables | – | (124 | ) | – | (124 | ) | ||||||

| Other losses | 2,326 | – | 2,326 | – | ||||||||

| Impairment | – | – | 45 | – | ||||||||

| Adjusted EBITDA | $ | 4,639 | $ | 2,848 | $ | 7,862 | $ | 3,222 | ||||

1 Refer to the “Non-IFRS financial measures” section below or on page 29 of the Q2 2024 MD&A for more information on each non-IFRS financial measure. These financial measures do not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers.

2 Refer to the “Non-IFRS financial measures” section below and on page 29 of the Q2 2024 MD&A for more information on each non-IFRS financial measure.

3 Refer to the “Non-IFRS financial measures” section below and on page 29 of the Q2 2024 MD&A for more information on each non-IFRS financial measure.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/219519