📢 Exciting Update from EMX Royalty! 🌟

At Proven and Probable, we dive deep into the latest developments shaping the world of mining, royalties, and resource investments. 📈 Here’s what’s making headlines at EMX Royalty Corporation:

🔹 Strong Financial Results: EMX’s latest financial update showcases robust performance and strategic fiscal management.

🔹 Share Buyback Completion: The successful conclusion of their $5 million share buyback program underscores their commitment to enhancing shareholder value.

🔹 Strategic Divestment: EMX has executed an agreement to sell four projects in the western USA to Pacific Ridge Exploration, streamlining their portfolio.

🔹 Armenia Expansion: The acquisition of royalty interests in Hayasa’s Urasar Project further solidifies EMX’s position in the region.

🔹 Peruvian Opportunity: EMX’s purchase of a royalty on the Chapi Copper Mine highlights their continued focus on high-potential assets globally.

This is a pivotal moment for EMX Royalty, showcasing their strategic approach to growth, value creation, and global asset diversification.

Website: https://emxroyalty.com/

Ticker: NYSE: EMX | TSX.V: EMX

A conversation with Maurice Jackson of ‘Proven and Probable’ and David Cole of EMX Royalty, the Royalty Generator – NYSE: EMX | TSX.V: EMX

Maurice: EMX Royalty is off to a strong start in 2025. For readers, could you briefly introduce EMX Royalty and its unique investment proposition?

David: Certainly. I’ll start by saying royalties are phenomenal financial instruments embedded with huge optionality, and you want to be exposed to a lot of royalties. My fundamental thesis is that the value of mineral rights is only going to go up over time, as it has throughout our lifetimes. The best way to be exposed to mineral rights is through royalty ownership.

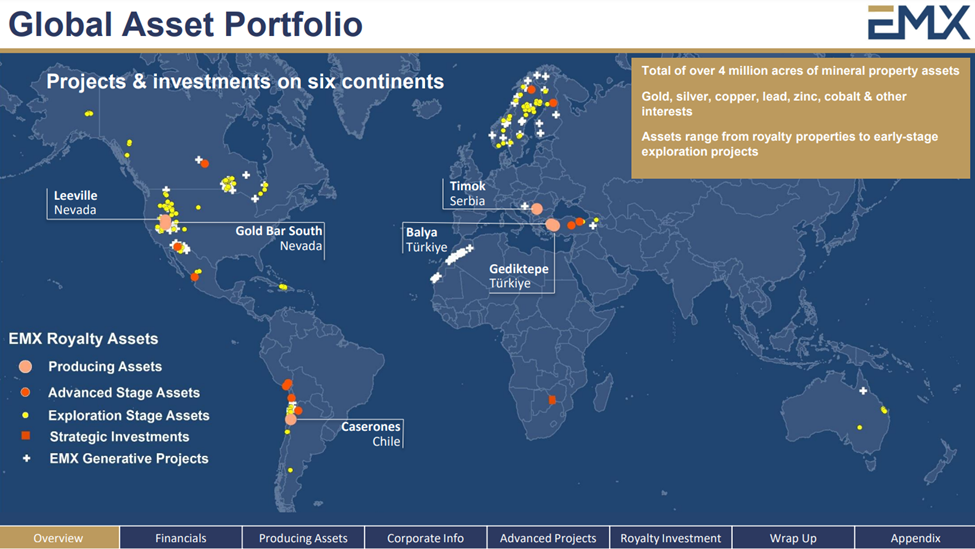

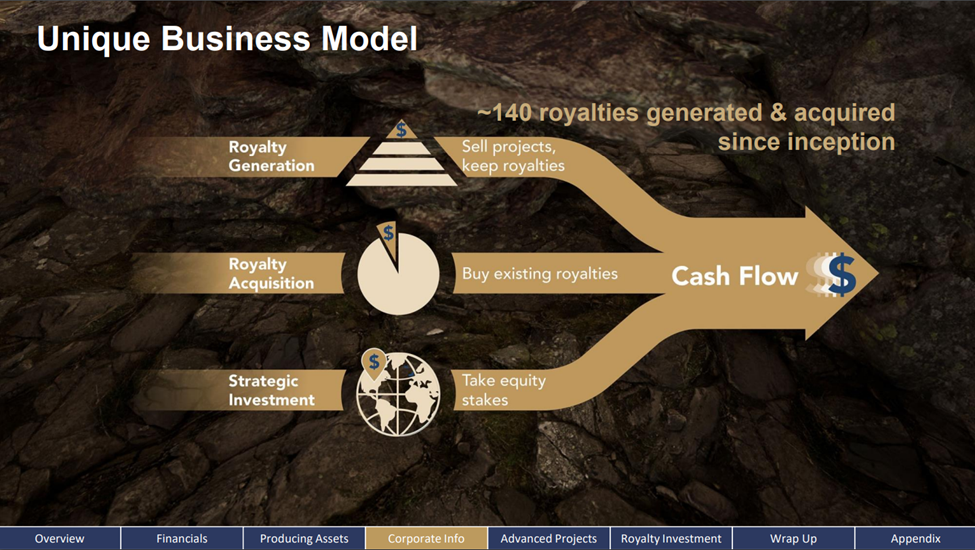

We accumulate royalties around the world, spanning 14 countries, and have built a portfolio of over 150 royalties. We do this through two primary mechanisms: acquiring royalties and generating royalties ourselves by acquiring mineral rights, adding value through geological data, selling assets, and retaining royalties.

Additionally, we make strategic investments along the way, which have been quite profitable. By integrating these three aspects into a synergistic business model, we have built a significant portfolio over the past two decades.

Maurice: You just referenced optionality. Could you expand on that term for someone who might be new to it?

David: That’s a fair question, Maurice, and I get asked about optionality often. It’s a common term within the industry. Essentially, optionality refers to the potential for outcomes—both good and bad—associated with an asset over time. There’s value that can be attributed to this potential.

The most significant aspect of optionality, in our view, is the potential for new discoveries. For example, if we generate or acquire a royalty on a project with a known resource—let’s say, a million ounces of gold in reserve with a 1% royalty—and during production, the geologists discover another half a million or even a million ounces, that additional discovery was not factored into our original acquisition price. That’s discovery optionality.

Other aspects of optionality include commodity prices, which can fluctuate. Over the course of my career, I’ve seen prices generally increase. Over time, as geological understanding improves, infrastructure is developed, and engineering and metallurgical techniques advance, the likelihood of additional discoveries and improved project economics increases.

A great example is the Goldstrike Royalty, which Pierre Lassonde of Franco Nevada acquired for $2 million Canadian dollars. Thanks to discovery optionality and other factors, that royalty has now generated over a billion dollars in cash flow and is still paying. It’s a tremendous example of how optionality can create extraordinary returns. Not every royalty turns out that way, of course, but the potential for these outcomes is what makes royalties so compelling.

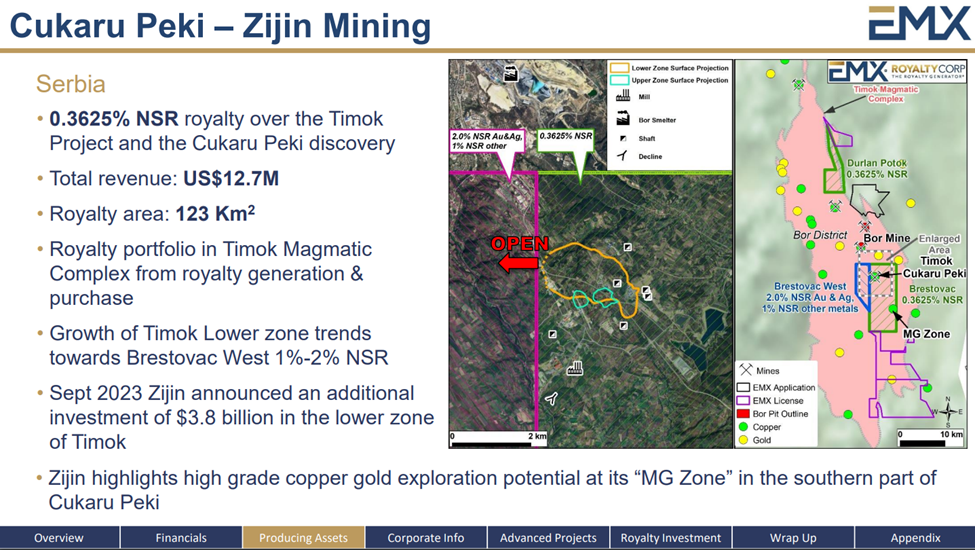

Maurice: Within your portfolio, you have the Timok investment—$200,000 initially, I believe. I don’t want to steal your thunder, so can you share the numbers with us?

David: Certainly. So far, Timok has paid about $7 million to us. But that’s just the beginning—there’s potentially half a billion dollars or more coming to us over time based on the existing, known resource.

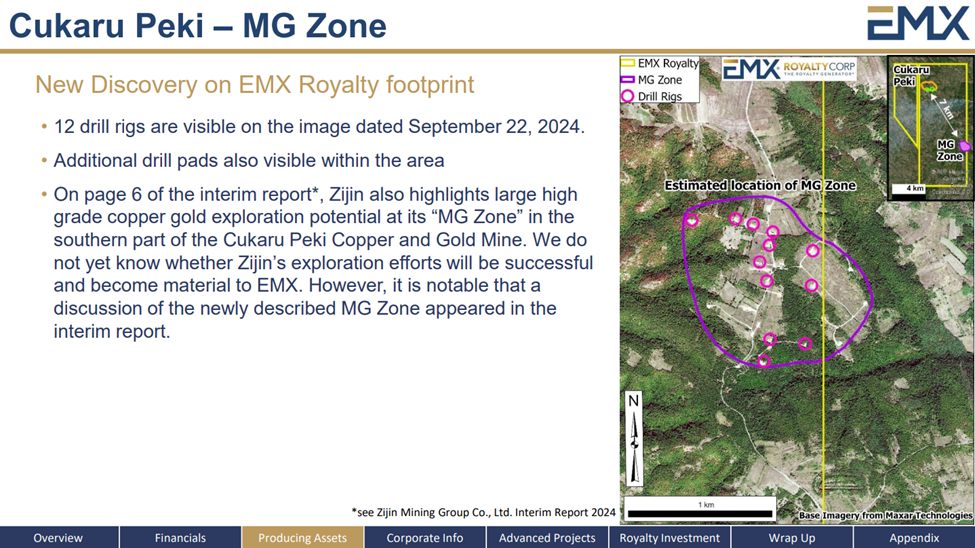

And that’s before we fully account for the new MG Discovery. Zijin Mining recently announced in their last quarterly report that they’ve made a significant, high-grade copper-gold discovery within our royalty footprint. This new discovery is called the MG Zone.

We’ve been able to see its location through satellite imagery, but Zijin hasn’t disclosed the tonnage and grade yet. They’ve indicated they’ll provide more details in their next reporting period. We expect their annual report to be released toward the end of the first quarter or early second quarter.

Maurice: That’s a fantastic example. You mentioned commodity price optionality and the cost to shareholders. Could you explain how royalties mitigate those risks and costs?

David: Absolutely. The beauty of a royalty is that we get paid on the top-line revenue of a mine. Most of our royalties are net smelter return (NSR) royalties, which means we earn a percentage—commonly 1%-4%—of the revenue the mine receives from the smelter.

As royalty holders, we don’t pay for the mine’s capital expenditures, exploration costs, or reclamation expenses. We simply receive our royalty payment based on production revenue. This structure exposes us to the upside potential of a project—like discoveries or commodity price increases—without the operational risks and costs borne by the mining company.

Maurice: That’s an profitable value proposition. Let’s transition to EMX’s recent developments. The company recently reported $27 million in cash and cash equivalents and $35 million in long-term debt maturing in 2029. How does this financial standing influence your strategic decisions for 2025 and beyond?

David: Capital allocation is one of the most critical decisions we make to benefit our shareholders. With our shares trading at a discount to price-to-net-asset value (PNAV), we’ve focused on buying back stock. Over the past year, we’ve purchased 5 million shares, fully utilizing the allotment permitted by the TSX exchange. We’ll likely apply for approval to buy back more in the coming year. We’re also incrementally paying down debt and acquiring royalties, all while generating cash flow from top assets like Timok, Caserones in Chile, and Carlin Trend in Nevada.

In addition to share buybacks, we plan to incrementally pay down debt, which, by the way, is held by Franco-Nevada—our capital partner and a significant shareholder. They’ve been a great partner in various royalty acquisitions.

Maurice: For shareholders who may not fully understand, how does the share buyback program impact EMX’s financial health?

David: By reducing the number of outstanding shares, we increase each shareholder’s proportional ownership in the company. When shares are trading below NAV, buybacks effectively create value for shareholders. It’s a tax-efficient alternative to dividends and reflects our confidence in the company’s intrinsic value.

Of course, we’re also growing the portfolio organically and through strategic acquisitions, as you’ve seen with recent transactions.

Maurice: Speaking of transactions, let’s start with Armenia, where EMX acquired a royalty interest in the Urasar gold-copper project. What motivated this acquisition, and what potential do you see in the project?

David: This acquisition was motivated by two factors: the geology of Armenia and our trust in the project’s steward, Dennis Moore. Dennis has a proven track record of world-class discoveries, and his involvement gives us confidence.

Geologically, Armenia offers excellent mineral potential, which aligns with our strategy of acquiring assets with strong long-term discovery potential. This royalty adds to the base of our portfolio, exposing us to future upside at minimal upfront cost.

Maurice: How does this transaction align with EMX’s broader strategy and portfolio?

David: This fits perfectly with our early-stage royalty acquisition strategy, where we aim to augment the foundation of our portfolio with assets that offer significant long-term potential.

This deal was part of our joint venture with Franco-Nevada, where they provide a premium for royalties we identify and acquire. This partnership not only validates our due diligence but also allows us to achieve a financial “lift” on the transaction.

Maurice: Let’s move to South America, where EMX recently acquired a royalty on the Chapi copper mine in Peru. Could you elaborate on the significance of this acquisition?

David: Certainly. The Chapi copper mine is located in a region with world-class copper endowment. This acquisition gives us exposure to a proven project with immediate cash-flow potential and substantial long-term discovery potential.

This project is being restarted by a team with a solid track record of copper production, and we anticipate cash flow within a couple of years. Beyond the restart, the exploration upside is what excites us most—it’s a classic example of how optionality can transform a royalty into a company-making asset.

Maurice: The optionality in the Chapi copper mine acquisition seems consistent with EMX’s strategy. Can you expand on the timing and significance of securing cash-flowing assets like this?

David: Acquiring cash-flowing or near-term cash-flowing assets is a deliberate part of our strategy. While we excel at generating royalties organically, the reality is that acquiring royalties on producing or development-stage assets can accelerate the financial returns to our shareholders.

The Chapi royalty exemplifies this. It strengthens our portfolio’s cash flow potential while maintaining long-term upside through exploration. By securing a mix of cash-flowing and earlier-stage royalties, we achieve a balanced portfolio that supports near-term financial health and long-term growth.

Maurice: Sticking in Peru, where EMX received an early property payment from Aftermath Silver. Aftermath Silver made an early $2.9 million property payment for the Berenguela project in Peru. How does this early payment impact EMX’s cash flow and plans for similar agreements?

David: EMX is fully supportive of what Aftermath Silver is doing on the ground there. They’re advancing a very interesting manganese and silver deposit, with some copper exploration on the property as well. We’re quite interested in that long-term copper optionality; there’s potential for the discovery of new copper deposits. But the manganese and silver deposit is particularly compelling.

The manganese, of course, is an important metal in the battery business, and this deposit has the potential to be a key source of manganese for batteries. That said, we’ll let them work on that. For us, a nice aspect is that we’re just sitting back here as a royalty holder. There are specific payments that have to be made to us over time. We’ve allowed them some flexibility—one payment was made a little late in exchange for an interest fee, and another was made a little early for a small reduction. We’re supportive of them advancing this asset. I believe it’s being managed by some very capable people.

Maurice: A good symbiotic relationship there. Now, let’s visit the U.S., where EMX announced the sale of four projects to Pacific Ridge Exploration. What benefits does this transaction bring to EMX, and how does it align with your growth strategy?

David: This is right down the alley of EMX’s bread-and-butter royalty generation business. We go out, acquire prospective mineral rights—commonly very inexpensively—consolidate data, collect additional field data, and illustrate prospectivity by building geological models. These models demonstrate the potential for significant gold or copper deposits.

We then sell the projects on, often to junior companies, for a combination of commercial terms. These typically include share payments, incremental payments over time, and always a royalty at the end of the day.

This transaction with Pacific Ridge is just another example of what we do repeatedly—roughly 20 projects a year, and we might exceed that this year. These deals build long-term discovery optionality at the base of our portfolio pyramid. At the top, we have producing royalties; at the base, we have exploration assets being advanced using other people’s expertise and money, with EMX as the long-term beneficiary.

Maurice: Diversification seems to be a recurring theme in EMX’s strategy. How does the company ensure that its acquisitions align with its broader objectives?

David: Diversification is indeed one of our core principles. When evaluating acquisitions, we focus on several key criteria: the quality of the underlying asset, the jurisdiction, the operator’s track record, and the potential for long-term upside.

Our acquisitions span various geographies, commodities, and stages of development to reduce risk and enhance returns. For example, our portfolio includes royalties on gold, copper, and polymetallic projects in North and South America, Europe, Asia, and Australia. This global reach allows us to capitalize on opportunities in different markets while mitigating exposure to regional risks.

Maurice: It’s clear that EMX has been strategic in its acquisitions. As we wrap up, what’s next for the company in 2025 and beyond?

David: We’re fortunate to be in a strong position with positive cash flow for seven consecutive quarters. We anticipate this continuing for some time, driven by key assets like our Caserones royalty in Chile, operated by Lundin Mining Corporation. That’s performing nicely, with significant exploration work ongoing.

Zijin Mining is also producing at Timok in Serbia, generating handsome payments. Additionally, our royalty on the Carlin Trend in Nevada—advanced and produced by Barrick as part of their joint venture with Newmont—is generating over $4 million annually.

With these assets delivering robust returns, our focus is on astute capital allocation. This includes paying down debt, buying back shares while undervalued, and pursuing incremental acquisitions like the one at the Chapi Mine in Peru.

Maurice: Has EMX considered changing its logo to a cow surrounded by cash? EMX is quite literally becoming a cash cow.

David: I’ve said for years we’d become one, and we have! We’re thrilled to be in this position, allocating cash strategically to grow the portfolio, buy more royalties, and repurchase shares when the price is low. Managing long-term debt and driving shareholder value remains our priority.

Maurice: You’ve touched on this, but how do you plan to navigate potential challenges in the current market environment?

David: The money is coming in, and our royalties are performing exceptionally well. While metal prices are strong, the natural resource capital markets have been tough. It’s an intriguing bifurcation, but we’re capitalizing on our strengths.

By buying back stock at a discount to our net asset value, we maximize value. Once rectified, we’ll allocate more capital to expand the royalty portfolio. It’s about understanding and deploying our capital effectively in any market.

Our portfolio also boasts exciting developments. For instance, Zijin’s MG Zone in Serbia, with 12 drill rigs on-site, is remarkable. South 32’s Peak Discovery in Arizona could be a game-changer with promising copper-zinc-silver drill results. These discoveries reinforce why owning royalties is so valuable.

Maurice: Absolutely! In closing, what did I forget to ask?

David: Nothing comes to mind, Maurice. Insider buying, share buybacks, strong cash flow, and global discoveries—all make EMX a company worth following.

Maurice: If someone wants to learn more about EMX Royalty, where can they go?

David: Visit our website at emxroyalty.com.

Maurice: Thank you, Mr. Cole, for sharing your insights.