Vancouver, British Columbia–(Newsfile Corp. – March 8, 2023) – EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the “Company” or “EMX”) is pleased to announce the execution, by its wholly-owned subsidiary Bronco Creek Exploration Inc. (“BCE”), of a Letter of Intent (“LOI”) to sell its a) portfolio of 14 precious and base metal projects in Idaho (the “Portfolio”) acquired via staking between 2018-2022, b) Idaho Business Unit, and c) wholly-owned core drilling subsidiary, Scout Drilling LLC, to Scout Discoveries Corp. (“Scout”). Scout is a U.S. private corporation headquartered in Coeur d’Alene, Idaho and will be led by Dr. Curtis Johnson, as president and CEO along with several members of the BCE team who generated, acquired, and advanced the Portfolio which represents the largest unpatented claim holdings in the state.

EMX was an early mover in the modern era of exploration in Idaho by recognizing the geologic potential for tier one precious and base metal systems coupled with the ability to acquire contiguous district-scale land positions where limited exploration has taken place in over 30 years. Numerous projects in the Portfolio were advanced by previous EMX partners between 2018-2022. The work invested in the Portfolio has resulted in a diverse pipeline of early-stage projects through fully vetted, drill-ready targets with several historical resources open for expansion (Figure 1).

This proposed transaction is a unique example of the organic royalty generation component of EMX’s business model that provides an asset base substantial enough to form a new company around. The terms of the LOI provide EMX with an equity interest, a retained 3.25% net smelter return (“NSR”) royalty interest, annual advance royalty (“AAR”) payments, and certain milestone payments as the Portfolio of 14 projects is advanced.

Commercial Terms Overview. Pursuant to the LOI, Scout will purchase a 100% interest in the Portfolio by (all dollar amounts in USD):

- Issuance of shares equal to 19.9% of Scout to EMX.

- Raising a minimum of $3,000,000 in exploration capital coincident with the closing of the transfer of the Portfolio.

Upon the successful completion of the above:

- EMX will be granted a 3.25% NSR royalty on each of the 14 projects in the Portfolio, as well as AAR and milestone payments divided into two tiers:

- Tier 1, Advanced-stage Exploration Projects: Erickson Ridge, South Orogrande, Lehman Butte, Jacknife, Moose Ridge, and Century.

- Tier 2, Early-stage Exploration Projects: Timber Butte, Muldoon, Independence, Valve House, Cuddy Mountain, Scout, Silverback, and Cartwright Canyon.

Ongoing Scout obligations to the Company, on a per project basis, will include:

- EMX will receive AAR payments for Tier 1 projects beginning on the second anniversary and Tier 2 projects beginning on the fourth anniversary of the LOI starting at $10,000/year and increasing $10,000/year to a cap of $75,000/year.

- EMX will receive milestone payments of $500,000 for Tier 1 and $200,000 for Tier 2 projects upon completion of a preliminary economic analysis (“PEA”), $1,000,000 for Tier 1 and $750,000 for Tier 2 projects upon completion of a pre-feasibility study (“PFS”), and $1,000,000 for both Tier 1 and Tier 2 projects upon completion of a feasibility study (“FS”).

EMX will maintain a 19.9% non-dilution right up to $10,000,000 of capital raises and a preemptive right to participate in future financings to maintain a 9.9% interest, so long as it holds at least 5% of the issued and outstanding shares of Scout.

Scout may purchase 0.5% of a given NSR royalty for the USD equivalent of 600 ounces of gold by the eighth anniversary of the LOI, and an additional 0.5% NSR for the USD equivalent of 1,800 ounces of gold before commercial production on each property.

In addition to the 14 property interests, Scout will purchase a 100% interest of EMX’s wholly-owned drilling subsidiary, Scout Drilling LLC, by completing $10,000 monthly payments for 12 months, a $500,000 payment by the first anniversary (firm commitments), and 12 additional monthly payments of $10,000 and a final $1,000,000 payment, with the 24 monthly payments creditable, by the second anniversary of the LOI.

The LOI contemplates EMX and Scout entering into a definitive agreement by March 31st and closing the transaction by May 1st, 2023.

Scout Discoveries Overview. With the completion of the LOI, Scout will be 100%-focused on advancing the Idaho Portfolio to discovery. Combining the Portfolio with EMX’s low impact Hydracore HC2000 core drill and experienced team, Scout will be structured to internally advance projects from initial target definition, through drill testing and resource delineation. This represents a unique, cost-effective business model to advance the Portfolio, which includes the following key projects:

- Erickson Ridge: The Erickson Ridge project covers the northern extension of the Orogrande Shear Zone (“OSZ”) in the Elk City mining district, and hosts multiple historical shear-hosted gold resources (Figure 2), including a 1980s-era historical resource. Historical drill intercepts from the 1980s include 33.5 meters @ 4.1 g/t gold (ER-84-13 from 16.8m to 50.3 m) and 21.3 meters @ 3.15 g/t gold (ER-84-23 from 77.7 to 99.0 m) (disseminated-style mineralization, true thicknesses unknown)[1].

Historical exploration was focused on shallow oxide gold mineralization, with drill holes typically less than 100 meters in depth. Previous soil sampling programs by EMX and partners identified a 0.5 x 1.5 km gold-in-soil anomaly that extends mineralization more than one kilometer (km) along strike beyond the historical resource footprint[2]. The project is now permitted for drilling to follow-up on these targets.

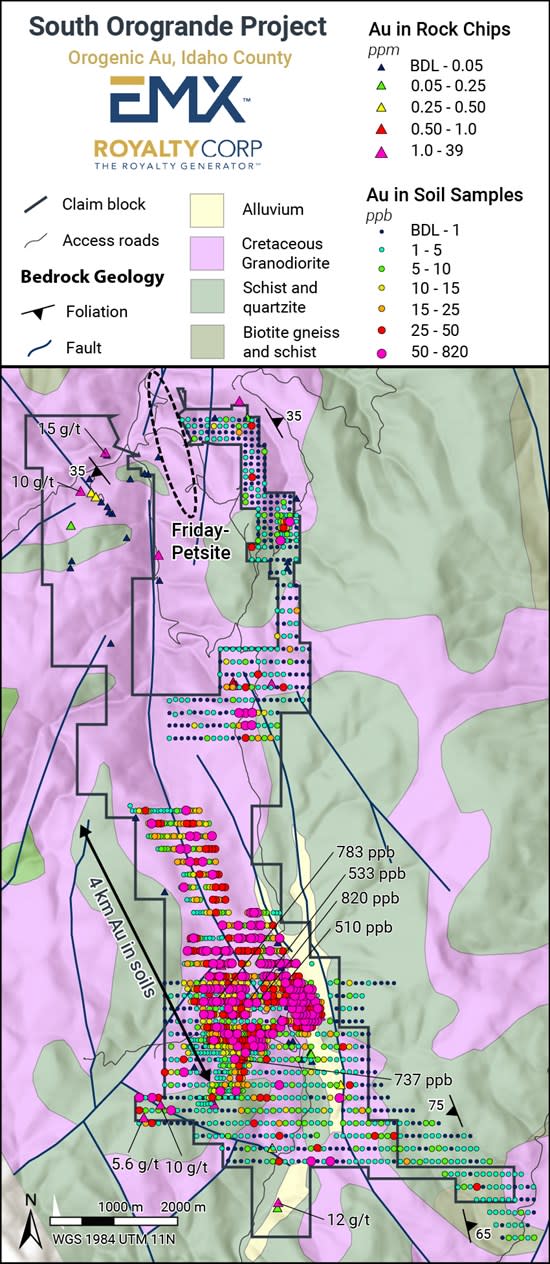

- South Orogrande: The project lies 16 km south of Erickson Ridge and covers approximately 11.5 km of strike length along the OSZ (Figure 3). South Orogrande is adjacent to, and along strike, of Endomines Inc’s Friday deposit which has historical open pit constrained mineral resources[3]. At South Orogrande, modern surface exploration (2018-2021) identified multiple km-scale, cohesive gold-in-soil anomalies (2×5 km and 1.5×3 km) with coincident geophysical anomalies in areas of minimal outcrop and widespread placer gold[4].

The only modern drilling is a single hole in 2021 that was lost at 269m, which intersected increasing intensities of disseminated quartz-sericite-pyrite alteration that assayed 0.78 g/t Au over 1.5m within a consistent zone of 72m @ 0.15 g/t Au (from 197m to 269m) at the bottom of the hole[5]. This drilling has not been followed up, and the project is permitted for 50 new drill pads within the gold-in-soil anomalies.

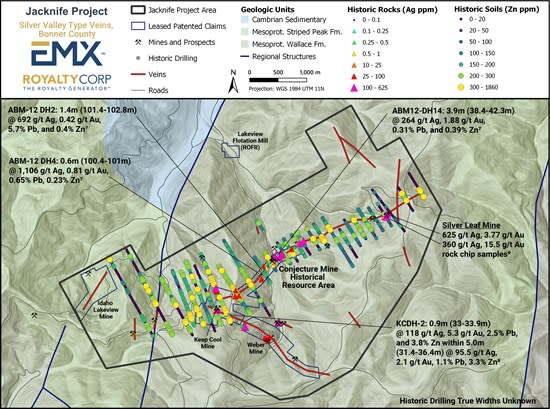

- Jacknife: The Jacknife project encompasses the entirety of the Lakeview Ag-Pb-Zn district, including 335 acres of leased patented claims, approximately 40 km northwest of the Silver Valley, Idaho (Figure 4). The project is centered on a seven-km swarm of 0.5 to 5-meter-thick carbonate-quartz-sulfide veins hosted in regional shear zones within Mesoproterozoic Belt Basin sedimentary units, predominantly the Wallace, St. Regis, and Revett Formations – key host units in the Silver Valley. In the 1960s a 610 meter (m) vertical exploration shaft was sunk, with exploration drifting completed to explore the vein system to depth and define an historical resource[6]. Only minor surface exploration and small-scale production has occurred in the district since.

In 2012, limited shallow drilling was completed in the historical resource area, with highlight intercepts of 1.4m (101.4-102.8m) @ 692 g/t Ag, 5.7% Pb, 0.4% Zn, and 0.42 g/t Au (ABM-12-DH2) and 0.6m (100.4-101m) @ 1,106 g/t Ag, 0.65% Pb, 0.23% Zn, 0.81 g/t Au (ABM-12-DH4) (true thicknesses unknown)[7]. In 2021-2022, EMX leased the patented claims at Lakeview, and staked the surrounding open ground, marking the first time the district has been consolidated since initial discovery in the late 1800s.

- Lehman Butte: The Lehman Butte project, located in central Idaho, contains widespread low sulfidation epithermal veining and quartz-clay-adularia alteration in intermediate volcanic rocks, as well as jasperoid replacing underlying Mississippian limestone (Figure 5). Work by EMX and previous partners has outlined a cohesive 1.5 x 3 km gold-in-soil anomaly with rock chip samples that include 3.1 g/t Au and 19.8 g/t Ag (n=214, avg. 0.145 g/t Au and 4.8 g/t Ag), indicating bulk-tonnage style mineralization, cored by a zone of banded quartz-adularia feeder veins up to 2.5m in width and mapped across 3 km of strike. Coincident magnetic, chargeability, and resistivity anomalies corroborate the targets outlined by surface sampling and mapping. The project is permitted for drilling and the primary target is a bulk-tonnage Au-Ag deposit hosted within permeable volcanics, as well as high-grade bonanza-style epithermal veins at depth.

- Pipeline Projects: The Portfolio includes an additional 10 district-scale, earlier stage projects with Carlin-type Au, low sulfidation epithermal Au-Ag, porphyry and intrusion-related Au-Cu, carbonate replacement Ag-Pb-Zn (Au-Cu), Silver Valley-type Ag-Pb-Zn, and orogenic Au targets. Scout will advance these projects systematically through detailed target definition as the four highlighted projects are drill-tested.

The Scout Discoveries team will be led by Dr. Curtis Johnson as President and CEO, and will be comprised of a core group of youthful, but seasoned explorationists that will shift from BCE to Scout on a 100% basis. These acomplished geologists have been responsible for assembling and building value in Scout’s Idaho Portfolio. Further value will be provided by integrating Scout Drilling LLC into the new company, which will provide Scout Discoveries with a unique competitive advantage to quickly and cost effectively evaluate mineral project upside through drilling. Idaho is a highly prospective terrane for developing new precious, base and battery metals resources, and EMX is confident that Scout Discoveries will be a leader in exploration discovery and entrepreneurial success.

More information on Scout Discoveries Corp. and the Portfolio can be found at: www.scoutdiscoveries.com.

Comments on Sampling, Assays, and QA/QC. EMX and its project partners’ exploration samples were collected in accordance with accepted industry standards and best practices. EMX samples were submitted to ALS Laboratories in Reno for sample preparation and analysis. Gold was analyzed by Au-ICP21 fire assay and ICP-AES (30 g nominal sample weight) method, and multi-element analyses were performed by an ME-MS61m method combining a four-acid digestion with ICP-MS finish. As standard procedure, the Company conducts routine QA/QC analysis on all assay results, including the systematic utilization of certified reference materials, blanks, and field duplicates.

Comments on Historical Exploration Results and Nearby Deposits & Mines. The historical data in this disclosure (including maps) is related to historical drilling and surface sampling results. EMX and its partners have conducted independent field assessment, including geologic mapping, surface sampling, and in some cases reconnaissance drilling. From this independent work, the Company considers that the historical results are reliable and relevant for guiding and planning follow-up exploration work.

The nearby deposits and mines referenced provide geologic context for EMX’s projects, but this is not necessarily indicative that the projects host similar tonnages or grades of mineralization.

Qualified Person. Michael P. Sheehan, CPG, a Qualified Person as defined by National Instrument 43-101 and employee of the Company, has reviewed, verified and approved the disclosure of the technical information contained in this news release.

About EMX. EMX is a precious, base and battery metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and TSX Venture Exchange under the symbol “EMX”, and also trade on the Frankfurt exchange under the symbol “6E9”. Please see www.EMXroyalty.com for more information.

For further information contact:

David M. Cole

President and CEO

Phone: (303) 973-8585

Dave@EMXroyalty.com

Scott Close

Director of Investor Relations

Phone: (303) 973-8585

SClose@EMXroyalty.com

Isabel Belger

Investor Relations (Europe)

Phone: +49 178 4909039

IBelger@EMXroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

Forward-Looking Statements

This news release may contain “forward looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended September 30, 2022 (the “MD&A”), and the most recently filed Annual Information Form (“AIF”) for the year ended December 31, 2021, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedar.com and on the SEC’s EDGAR website at www.sec.gov.

Figure 1: Overview map of project locations.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1508/157665_f56b66eb34ab4ada_002full.jpg

Figure 2: Erickson Ridge project map.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1508/157665_f56b66eb34ab4ada_003full.jpg

Figure 3: South Orogrande project map.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1508/157665_f56b66eb34ab4ada_004full.jpg

Figure 4: Jacknife project map[8],[9].

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1508/157665_f56b66eb34ab4ada_005full.jpg

Figure 5: Lehman Butte project map.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1508/157665_f56b66eb34ab4ada_006full.jpg

[1] From “Erickson Reef Project, Idaho County, Idaho”, 1985 internal report for United Gold Corp.

[2] Gold Lion Resources news release dated February 1, 2022.

[3] “NI 43-101: Technical Report, Idaho Gold Project” dated April 8, 2013 prepared by Geosim for Premium Exploration Inc.

[4] Gold Lion Resources news release dated November 10, 2020.

[5] Gold Lion Resources news release dated January 28, 2022.

[6] “Reserve Estimate – Conjecture Mine Project, Lakeview Mining District, Bonner County, Idaho”, 1981 internal report for Mines Management.

[7] Black Mountain Resources, news release dated October 17, 2012.

[8] Shoshone Silver, 2008. Lakeview Project Drilling. Internal report.

[9] Duval Corporation, 1965. Conjecture Mine Area, Geochemical Surface Sampling Map. Internal Map.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/157665