Akiko Fujita · Host

Sun, October 27, 2024

Small modular reactors (SMRs) have long held the promise of cheaper, more efficient nuclear energy. Their smaller, standardized designs were expected to usher in a new era for an industry historically plagued by cost overruns and safety concerns.

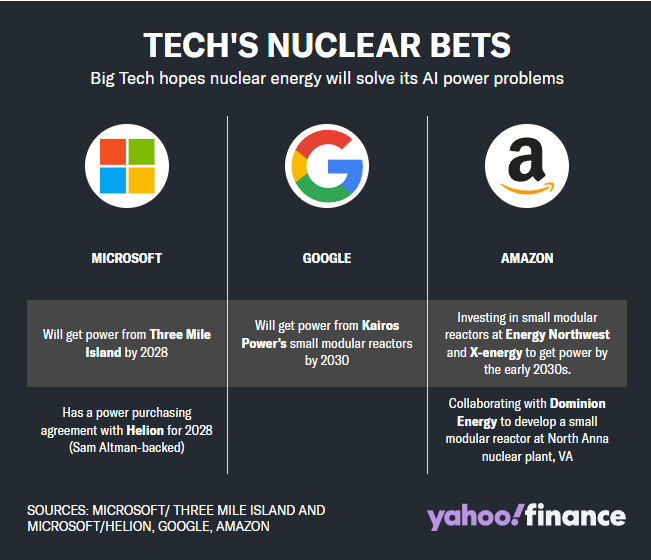

But as major tech firms, including Google (GOOG) and Amazon (AMZN), turn to advanced technologies in hopes of powering their AI ambitions with a low carbon footprint, skeptics are raising questions about their viability, largely because no commercial SMR has been built in the US yet.

Despite the talk of a simplified process, there are only three SMRs operational worldwide — two in Russia and one in China.

“Nobody knows how long they’re going to take to build,” said David Schlissel, an analyst at the Institute for Energy Economics and Financial Analysis who has been critical of SMRs. “Nobody knows how expensive they’re going to be to build. We don’t know how effective they will be in addressing climate change because it may take them 10 to 15 years to build them.”

Nuclear power has received renewed interest because of the global push to move away from fossil fuels to reduce harmful emissions driving climate change. Although wind and solar power offer prevalent, low-cost energy options, nuclear remains an attractive clean alternative, in large part because it can run 24/7 in any season and has a smaller footprint.

SMRs have offered the most promise. Unlike traditional nuclear plants that have been costly and time-consuming, modular reactors are one-third the size, with a power capacity of 300 megawatts or less. The nuclear industry has touted their efficiency and cost savings, as SMRs are built in factories and assembled on-site.

“It reduces the risk associated with the project,” said Jacopo Buongiorno, a professor of nuclear engineering at MIT. “For an investor, … you may recover your investment quicker and with fewer uncertainties in terms of project execution.”

‘The technology is evolving’

Yet, in many ways, the hurdles facing this new generation of reactors have mirrored the old. Advanced reactor designs have taken longer than projected. Those delays have added to cost overruns.

Oregon-based NuScale (SMR) became the first company to get approval from the Nuclear Regulatory Commission to build SMRs in 2022, but the company canceled plans to deploy six reactors in Idaho last year. The announcement came after costs for the project, scheduled for completion in 2030, ballooned from $5 billion to $9 billion.

Buongiorno said the buildout has been complicated by the array of technologies tested within individual projects. While all SMRs utilize uranium as fuel, its form and application within reactors differ depending on the company and its technology. That’s dramatically different from existing nuclear power plants, which all use uranium dioxide, he said.

“The technology is evolving. We expect the performance of these reactors to be different. But the big question marks are … what’s going to be the reliability? How reliable this technology is going to be, given that we don’t have a lot of experience?” Buongiorno said. “Equally, if not more important, what’s going to be the cost?”

AI a ‘game changer’

X-energy CEO Clay Sell said demand has been part of the problem until now.

Artificial intelligence has changed that calculation, largely because of the energy needs associated with powering data centers that drive AI models, Sell said. Goldman Sachs estimates the advanced technology will contribute to a 160% increase in data center power demand by 2030.

Earlier this month, Amazon announced a $500 million investment in the development of SMRs, including funding for X-energy. That funding will help X-energy complete the design of its standard plant and construct the first facility that will manufacture the fuel used in those plants, Sell said, calling the investment a “game changer.”

“A significant portion of the increased electricity demand in the United States for the next 25 years is going to come from AI,” Sell said. “It could be as high as 10%, 20%.”

Kairos Power CEO Mike Laufer, who inked a purchase agreement deal with Google, said his company is still in the process of pursuing non-nuclear demonstrations of the technology. Any “cost certainty” would hinge on a successful demonstration and the company’s ability to manufacture in-house, he said.

“[Cost certainty] has been very elusive in this space,” he said.

There are other challenges beyond cost, including a lengthy regulatory approval process and what to do with all of the nuclear waste.

While nuclear companies maintaining a smaller footprint will mean less waste, a study by Stanford University found that SMRs would increase the volume of nuclear waste “by factors of 2 to 30.”

Schlissel argues that all of the money spent on small reactors should instead go to wind and solar power and battery storage, which are proven to reduce carbon emissions and cost less to produce.

Buongiorno countered that nuclear reactors have a longer shelf life. While the upfront costs may be higher, reactors have a lifespan of 60 to 100 years, he said. With the smaller footprint, SMRs can also be built closer to data centers, minimizing infrastructure costs, he added.

The Department of Energy says nuclear energy is critical to transitioning the country away from fossil fuels. The agency has set aside $900 million in funding for the development of SMRs.

The Energy Department estimates the US will need approximately 700-900 GW of additional clean, firm power generation capacity to reach net-zero emissions by 2050, adding that nuclear energy already provides nearly half of carbon-free electricity in the country.