In the recent years investors have lost a lot of money in the resource sector. This shouldn’t have been the case had investors paid attention to the work of Bob Moriarty. Exactly when the sector was losing money, Mr. Moriarty was investing in resource stocks—of the likes of Novo Resources and Irving Resources—that made him 10 to 20 times his investment. In some cases, more.

As Warren Buffet says, “People make investing… more difficult than it should be.”

In his book, “Basic Investing in Resource Stocks—the Idiot’s Guide,” Mr. Moriarty provides a common-sense approach to investing in the resource sector.

“You will make mistakes when investing, but make sure you make new ones.”

Those who have focused their investment life in the resource sector, as I have, tend to think that it is full of idiots and liars, or those living a lifestyle using shareholder money. Mr. Moriarty thinks that other sectors are worse.

Referring to the cryptocurrency mania—which he calls “Bitcon”—about which he started writing on 321gold when it was peaking, he says that total value of Bitcon has fallen from $800 billion to $136 billion. I thought that there was a typo. Had he written “billions” instead of “millions?” But his wasn’t an error. A massive amount of money has changed hands, from gullible people to conmen or street-smart traders.

But the biggest con of all is the fiat currency system that surreptitiously steals people’s money and puts the future generation into bondage. This cannot continue. A “great reset” awaits, for there are far too many systemic risks today.

A product of the fiat currency is the derivative business, a boondoggle that poses significant systemic risks.

All debts must be paid, and the world is awash with it. There are far too many black swans for one not to come into the scene. “The Gilets Jaunes movement of France is merely the opening scene,” says Mr Moriarty. That is where protecting oneself from what is another person’s liability is important, making gold (or silver or platinum or palladium or rhodium) one of the ways to preserve one’s wealth.

In the investment space, a lot of wealth is getting destroyed, misallocated or moving into the hands of conmen, private or public, leaving gullible investors high and dry. What one must learn early on is the concept of probabilities before one starts throwing one’s dice.

One, however, cannot depend on the advice of “experts,” which reminds me of “Nobody Knows Anything,” another book by Mr. Moriarty.

Mr. Moriarty advises people to have the courage—once they have studied their homework properly—to have contrarian thinking, even if it goes completely against the emotions of the market.

There is legitimate information in the market and there is noise. Internet should have made it easier for information to flow freely. Alas, it is noise that has grown bigger than the real signal.

“Change your mind when information changes” makes common-sense, except that most people are resistant to changing their views. The end result is that 90% of investors lose money. While Mr. Moriarty advises not to be a part of that 90%, he is happy they exist, to help him make the extra money.

Read the above words of wisdom in his short and sweet book, including the description of the resource industry, and some saucy stories of his investments.

Jayant Bhandari

Author: admin

Vancouver, British Columbia–(Newsfile Corp. – March 11, 2019) – Great Bear Resources (TSXV: GBR) (the “Company” or “Great Bear”), today reported drill results from reconnaissance drilling to the west of the Dixie Hinge Zone (“DHZ”) at its 100% owned Dixie Project in the Red Lake District of Ontario, and acquisition of new district properties covering additional gold mineralization targets.

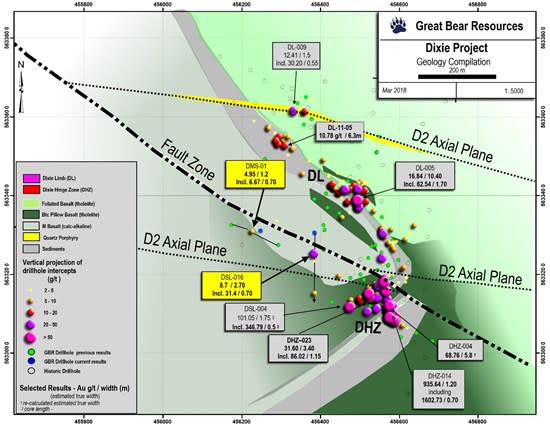

Two exploratory drill fences were completed 150 metres and 400 metres west of the current DHZ drilling, along the D2 fold axis that is interpreted to be a significant gold control, using the recently added second drill rig as shown on Figure 1. All 5 of 5 drill holes intersected gold mineralization. Highlights include:

- 31.40 g/t gold over 0.70 metres within a 2.70 metre interval of 8.70 g/t gold at only 64 metres vertical depth. An image of gold within this new high-grade intercept is provided in Figure 2.

- Multiple gold-bearing veins were intersected in 2 of the 5 drill holes.

- The newly discovered gold veins may comprise significant strike length extensions to the DHZ vein system or may be new gold zones; further drilling is required.

- The second drill rig continues to drill test new targets across the Dixie property.

Table 1: Results of reconnaissance drilling to the west of the Hinge Zone. All widths are drill indicated core length and insufficient data exists to determine true widths and vein orientations at this time.

| Drill Hole | From (m) | To (m) | Width (m) | Gold (g/t) | Vertical Depth (m) | |

| DSL-016 | 83.30 | 86.00 | 2.70 | 8.70 | 64 | |

| including | 83.30 | 84.00 | 0.70 | 31.40 | ||

| DSL-017 | 126.00 | 127.50 | 1.50 | 2.95 | 106 | |

| and | 255.30 | 255.80 | 0.50 | 1.11 | 214 | |

| DSL-018 | 75.30 | 75.80 | 0.50 | 3.84 | 54 | |

| and | 214.65 | 217.15 | 2.50 | 2.68 | 154 | |

| including | 214.65 | 215.15 | 0.50 | 6.32 | ||

| DMS-001 | 35.77 | 39.20 | 3.43 | 2.09 | 29 | |

| including | 38.00 | 39.20 | 1.20 | 4.95 | ||

| and including | 38.00 | 38.70 | 0.70 | 6.67 | ||

| DMS-002 | 47.25 | 50.10 | 2.85 | 2.43 | 43 | |

| including | 47.65 | 48.45 | 0.80 | 4.58 |

Additional drilling has also been completed within the Hinge Zone, results of which have not been received at the time of this release. DHZ drill results will be released once assay results are received and processed.

Chris Taylor, President and CEO of Great Bear said, “In a district where 25 metre step-out drilling is considered aggressive, our new reconnaissance drill holes located 150 metres and 400 metres from the Hinge Zone have yet again shown the extensive footprint of gold mineralization at Dixie, and the apparent importance of major D2 fold axes as regional gold controls. We look forward to further drilling in these areas to determine if these are separate new gold discoveries, or whether the Hinge Zone extends through this entire strike length.”

The Company notes that gold-bearing veins have now been drilled over a strike length of approximately 500 metres from the easternmost Hinge Zone drill holes to the newest drilling to the west. This veining is located on the south side of an ultramafic body and fault that are sub-parallel to the regional D2 fold axis.

Figure 1: Map of reconnaissance drill holes west of the Hinge Zone, adjacent to a D2 fold axis. Drill holes DL-016, 017 and 018 are located 150 metres west of current Hinge zone drilling. Holes DMS-001 and 002 are located 400 metres west of current Hinge Zone drilling.

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/5331/43327_f645824f944a3b76_002full.jpg

The Company also notes that the next interpreted D2 fold axis to the north, also shown on Figure 1, also hosts high grade gold within a quartz feldspar porphyry dike, including 30.20 g/t gold over 0.55 metres, within a wider interval of 12.41 g/t gold over 1.5 metres in hole DL-009, which was drilled by the Company in late 2017. This second fold axis is also an exploration target for future step-out drilling.

Figure 2: Image of newly discovered high-grade gold returning 31.40 g/t gold over 0.70 metres at 64 metres depth, from reconnaissance drill hole DSL-016, located west of the DHZ.

https://orders.newsfilecorp.com/files/5331/43327_f645824f944a3b76_003full.jpg

Great Bear is currently undertaking a fully-funded 30,000 metre, approximately 150 drill hole program that is expected to continue through 2019. A second drill rig was added to the project in February 2019 to accelerate this work and is now drilling additional gold targets.

Property Acquisitions

The Company also reports new low-cost, royalty-free property acquisitionsadding to its strategic land positions in the Red Lake District of Ontario.

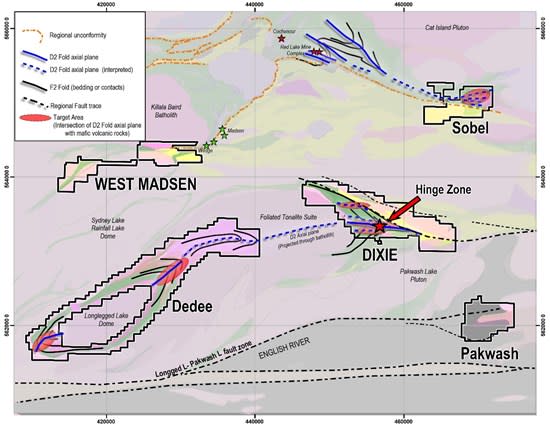

The newly acquired properties will be mapped and prospected in summer 2019, with minimal impact on the Company’s current Dixie property exploration budget and program. A map of the acquired properties is provided in Figure 3.

Chris Taylor continued, “Following our recent drill success at Dixie, the total staked area within the Red Lake district increased by over 150%, constituting the area’s largest staking rush in decades. We have completed a model-driven geological review of the district using the Dixie property’s D2 fold and deep-seated structural gold controls as guides. This work suggests additional prospective areas for gold mineralization, which we have now secured, royalty free. We intend to prospect the new properties in summer 2019.”

Figure 3: Map of newly acquired and optioned properties in the Red Lake district.

To view an enhanced version of Figure 3, please visit:

https://orders.newsfilecorp.com/files/5331/43327_f645824f944a3b76_004full.jpg

Great Bear has not completed sufficient work on the new properties to verify results from historical work.

Dedee Property

Highlights of the Dedee property include:

- Covers the western strike extensions of the major regional D2 fold axial plane that is interpreted as a control of the new high-grade gold discoveries at Great Bear’s flagship Dixie property.

- Two folded greenstone belts are interpreted at Dedee that mimic the geometry of the Dixie folded greenstones.

- Historical drill reports of sulphides similar to the Dixie Limb Zone mineralization that were never assayed for gold.

- Conductive trends similar to the Dixie Limb Zone have also been identified in historic unpublished geophysical surveys; at Dixie, these led Teck Resources to the original gold discovery of the 88-4 zone and associated gold; they are also prospective targets at Dedee.

- 15,300-hectare land area (153 square kilometres)

- Road accessible though logging roads, approximately 20 minutes drive from Red Lake

The Dedee property was acquired in part through staking, and will be acquired in part through an inexpensive royalty-free option agreement with an arm’s length third party. Terms of the option portion of the acquisition are:

(a) $6,000 upon signing the option agreement;

(b) 15,000 shares after receiving acceptance of the Exchange for the issuance of the shares under this agreement;

(c) $10,000 on or before the date that is one year after the Effective Date;

(d) $12,000 on or before the date that is two years after the Effective Date;

(e) $16,000 on or before the date that is three years after the Effective Date; and

(f) $24,000 on or before the date that is four years after the Effective Date.

Pakwash Property

The 3,100-hectare (31 square kilometre) Pakwash property is located southeast of the Dixie property and covers portions a major regional fault structure lying along English River sediments. Historical work has identified gold lake sediment anomalies which are coincident with regional fault zones and gold-in-soil (MMI) anomalies which have not been followed up with detailed exploration.

The Pakwash property will be acquired through an inexpensive royalty-free option agreement with an arm’s length third party. Terms of the option agreement are:

(a) $10,000 upon signing the option agreement;

(b) 25,000 shares within seven (7) business days of receiving acceptance of the Exchange for the issuance of the shares under this agreement;

(c) $8,000 on or before the date that is one year after the Effective Date;

(d) $12,000 on or before the date that is two years after the Effective Date;

(e) $15,000 on or before the date that is three years after the Effective Date; and

(f) $20,000 on or before the date that is four years after the Effective Date.

Sobel Property

The 3,200-hectare (32 square kilometre) Sobel property, is located along the strike extension of the main D2 fold axial plane that is a major interpreted control of gold mineralization at the Red Lake Gold Mine, operated by Goldcorp.

The property overlies prospective Balmer Sequence rocks of the main Red Lake greenstone belt.

The Sobel property will also be acquired through an inexpensive royalty-free option agreement with an arm’s length third party. Terms of the option agreement are:

(a) $10,000 upon signing the option agreement;

(b) 30,000 shares within seven (7) business days of receiving acceptance of the Exchange for the issuance of the shares under this Agreement;

(c) $12,000 on or before the date that is one year after the Effective Date;

(d) $20,000 on or before the date that is two years after the Effective Date; and

(e) $20,000 on or before the date that is three years after the Effective Date.

The Company has elected to buy out all the outstanding royalties on the newly optioned properties for total consideration of 38,500 shares of Great Bear.

The schedule of optional payments for all of the optioned properties can be accelerated at any time at the Company’s discretion in order to achieve full ownership at an earlier date. The options may also be terminated at any time subsequent to the initial cash and share payment.

About Great Bear

Great Bear’s flagship Dixie property is located approximately 15 minutes’ drive along Highway 105 from downtown Red Lake, Ontario. The Red Lake mining district has produced over 30,000,000 ounces of gold and is one of the premier mining districts in Canada, benefitting from major active mining operations including the Red Lake Gold Mine of Goldcorp Inc., plus modern infrastructure and a skilled workforce. The Dixie property covers a drill and geophysically defined 10-kilometre gold mineralized structure similar to that hosting other producing gold mines in the district. In addition, Great Bear is also earning a 100% royalty-free interest in the West Madsen, Pakwash, Dedee and Sobel properties, which cover regionally significant gold-controlling structures and prospective geology. All of Great Bear’s Red Lake projects are accessible year-round through existing roads.

Drill core is logged and sampled in a secure core storage facility located in Red Lake Ontario. Core samples from the program are cut in half, using a diamond cutting saw, and are sent to SGS Canada Inc. in Red Lake, Ontario, and Activation Laboratories in Ancaster Ontario, both of which are accredited mineral analysis laboratories, for analysis. All samples are analysed for gold using standard Fire Assay-AA techniques. Samples returning over 3.0 g/t gold are analysed utilizing standard Fire Assay-Gravimetric methods. Selected samples with visible gold are also analyzed with a standard 1kg metallic screen fire assay. Certified gold reference standards, blanks and field duplicates are routinely inserted into the sample stream, as part of Great Bear’s quality control/quality assurance program (QAQC). No QAQC issues were noted with the results reported herein.

Mr. R. Bob Singh, P.Geo, Director and VP Exploration, and Ms. Andrea Diakow P.Geo, Exploration Manager for Great Bear are the Qualified Persons as defined by National Instrument 43-101 responsible for the accuracy of technical information contained in this news release.

For further information please contact Mr. Chris Taylor, P.Geo, President and CEO at 604-646-8354, or Mr. Knox Henderson, Investor Relations, at 604-551-2360.

ON BEHALF OF THE BOARD

“Chris Taylor”

Chris Taylor, President and CEO

Inquiries:

Tel: 604-646-8354

Fax: 604-646-4526

info@greatbearresources.ca

www.greatbearresources.ca

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This new release may contain forward-looking statements. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statement or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements.

We seek safe harbor

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/43327

![]()

More on Commodity Markets

SPROTT’S THOUGHTS Sprott Media Digest

Excerpts:

To Grow and Protect Your Portfolio… Save the Goose

By Alexander Green, Chief Investment Strategist, The Oxford Club The greatest threat to this long-running bull market is not a tightening Fed, higher valuations or moderating corporate profits… It’s the growing clamor for regulatory and redistributive policies that will reduce innovation, lessen productivity and undermine the economy. Investors are famous for being worrywarts. Day after […]

Read on »

Forward-Looking Statement

This report contains forward-looking statements which reflect the current expectations of management regarding future growth, results of operations, performance and business prospects and opportunities. Wherever possible, words such as “may”, “would”, “could”, “will”, “anticipate”, “believe”, “plan”, “expect”, “intend”, “estimate”, and similar expressions have been used to identify these forward-looking statements. These statements reflect management’s current beliefs with respect to future events and are based on information currently available to management. Forward-looking statements involve significant known and unknown risks, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results, performance or achievements could vary materially from those expressed or implied by the forward-looking statements contained in this document. These factors should be considered carefully and undue reliance should not be placed on these forward-looking statements. Although the forward-looking statements contained in this document are based upon what management currently believes to be reasonable assumptions, there is no assurance that actual results, performance or achievements will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this presentation and Sprott does not assume any obligation to update or revise.

Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any fund or account managed by Sprott. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any fund or account managed by Sprott will be invested.

Past performance does not guarantee future results. The views and opinions expressed herein are those of the author’s as of the date of this commentary, and are subject to change without notice. This information is for information purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination by Sprott Global Resource Investments Ltd. that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice since such advice always requires consideration of individual circumstances. The products discussed herein are not insured by the FDIC or any other governmental agency, are subject to risks, including a possible loss of the principal amount invested.

Generally, natural resources investments are more volatile on a daily basis and have higher headline risk than other sectors as they tend to be more sensitive to economic data, political and regulatory events as well as underlying commodity prices. Natural resource investments are influenced by the price of underlying commodities like oil, gas, metals, coal, etc.; several of which trade on various exchanges and have price fluctuations based on short-term dynamics partly driven by demand/supply and also by investment flows. Natural resource investments tend to react more sensitively to global events and economic data than other sectors, whether it is a natural disaster like an earthquake, political upheaval in the Middle East or release of employment data in the U.S. Low priced securities can be very risky and may result in the loss of part or all of your investment. Because of significant volatility, large dealer spreads and very limited market liquidity, typically you will not be able to sell a low priced security immediately back to the dealer at the same price it sold the stock to you. In some cases, the stock may fall quickly in value. Investing in foreign markets may entail greater risks than those normally associated with domestic markets, such as political, currency, economic and market risks. You should carefully consider whether trading in low priced and international securities is suitable for you in light of your circumstances and financial resources. Past performance is no guarantee of future returns. Sprott Global, entities that it controls, family, friends, employees, associates, and others may hold positions in the securities it recommends to clients, and may sell the same at any time.

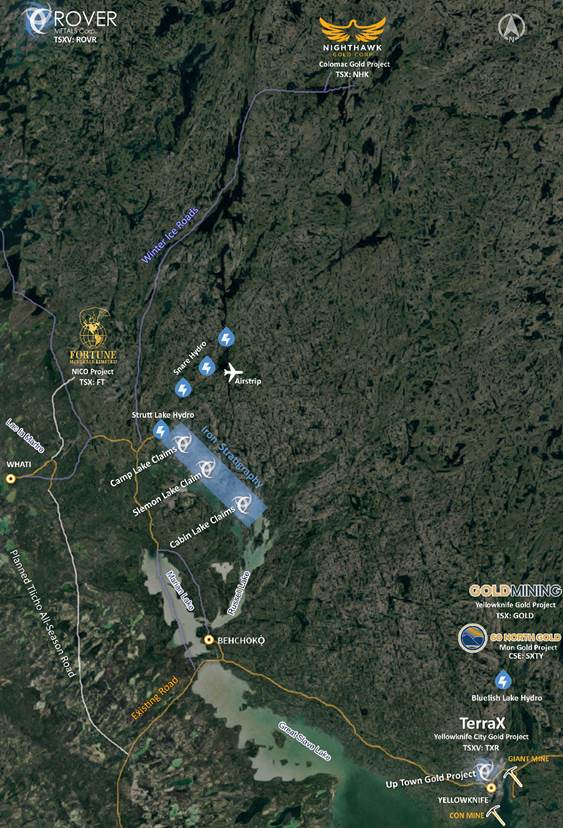

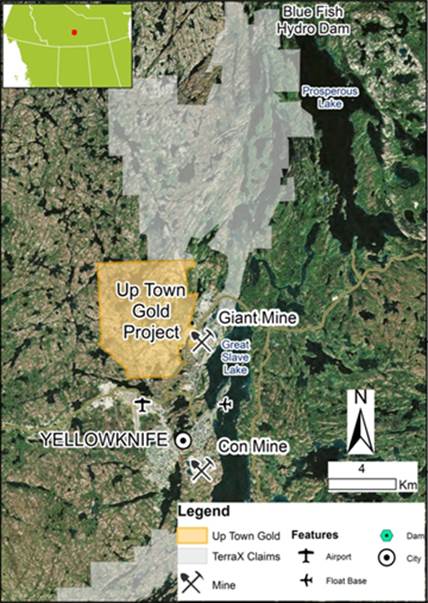

Judson Culter the CEO and Director of Rover Metals (TSX.V: ROVR | OTCQB: ROVMF) sits down with Maurice Jackson of Proven and Probable to discuss the value proposition of the Cabin Lake Property. In this interview Mr. Culter will provide important updates on the Uptown Gold Property, Cabin Lake Project, and Slemon Lake. Rover Metals is a natural resource exploration company specialized in Canadian precious metal resources (specifically gold). In this interview we will discuss the recent accomplishments of Rover Metals. Ranging from IPO and the implementation of a methodical process of building an exploration company that is positioning itself for success from land acquisitions, permit approval, OTC listing, option agreements and completed the first phase of the 2018 exploration program.

VIDEO

AUDIO

TRANSCRIPT

Original Source: https://www.streetwisereports.com/article/2019/03/10/firm-advancing-gold-exploration-in-the-northwest-territories.html

Firm Advancing Gold Exploration in the Northwest Territories Contributed Opinion

Judson Culter, CEO of Rover Metals, speaks with Maurice Jackson of Proven and Probable about historical exploration on his company’s properties, as well as current exploration plans.

Judson Culter: Thanks for having me, Maurice.

Maurice Jackson: Glad to have you back on the program. We last spoke in January of 2018, and since then Rover Metals has completed its IPO and implemented a methodical process of building an exploration company that is positioning itself for success from land acquisitions, permit approval, OTC listing, option agreements and completed the first phase of the 2018 exploration program. But before we begin, Mr. Culter, for first time listeners, who is Rover Metals?

Judson Culter: Rover Metals, we are a precious metal exploration company, specifically gold is our focus currently. We’re co-listed in the United States OTCQB: ROVMF, as well as Canada on the TSX.V ROVR. Our project portfolio is concentrated in and around Yellowknife’s Northwest Territories, one of the most mining friendly jurisdictions in Canada and for North America for that matter. I say that just because that’s where our (Canada’s) diamond mines are. That’s historically where several of our gold mines have been. It’s really the primary employer in the Northwest Territories. Outside of government, mining is it.

Maurice Jackson: Why has Rover Metals received so much interest here of lately?

Judson Culter: I think that’s a two pronged answer. First is just credibility. Going back to 2017 on call with you, Maurice, if one listens to that interview, we talked about how we were going to go public, and how we were going to drill our resources, and how we were going to look to add new resources in the similar area code of Yellowknife.

We’ve successfully accomplished all those tasks. I believe we have strong foundational base in our existing shareholders. We’ve got a lot of credibility with them. We get a lot of word of mouth. I think that goes a long way in a market that can be a little bit over saturated in the junior mining space with which projects or which management teams do you back. I think really that we’ve gotten recognition for that now, which is really helping to drive our current success.

The second prong answer speaks to the projects themselves. Rover has the Cabin Lake Project, which is really what the market is asking for, and that’s why we bought it. When we receive the results from our drilling, we believe we will a high-grade gold historical resource that will contain super high grades that the market wants to see as confirmation that this really could be the next gold mine in the Yellowknife, Northwest Territories.

Not to mention this project itself has all the merits a speculator wants. We have solid infrastructure, the Blue Fish Hydro Dam, roads, all the accessibility and proven area of past producers. The market is beginning to recognize the credibility of the management team and the assets. Also, the awareness that we are near drilling in the not-too-distant future has investors’ attention as well.

Maurice Jackson: Justin, what is the driving thesis for Rover Metals in regards to the Kevin Lake gold project?

Judson Culter: The driving thesis has not changed. It’s the same thesis as in the late 1980s. There’s a project called the Lupin Gold Mine that produced from 1983 to 2003 in the north, which is an iron formation, super high-grade gold. The thought at the time was to go and find another one, and that’s what they thought they had here. This is when Cominco and Freeport McMoRan and then Aber Resources, that’s what they thought they had here. They drove 7,500 meters of at or near-surface iron hosted high-grade gold. The only reason they stopped is because somebody found kimberlites a few years after, and the diamond boom in the Territories began.

This project just kind of sat on the back burner as a result of that. Aber Resources, the owner of the time, of course, went on to find the kimberlites. That’s some historical context on this project and why it’s just now coming back to life.

Maurice Jackson: Talk to us about the business acumen here. When and how was Rover Metals able to acquire the Cabin Lake gold project in such a highly contested and sought out district?

Judson Culter: It wasn’t easy; when we looked at the business case, we figured that with a little bit of just rolling up our sleeves, and getting up there, and meeting the right stakeholders, and just recognizing that this is an area that needs new mines and new projects.

I didn’t think it would be like other areas in British Columbia, for example where BC, trying to get First Nation endorsement can be very difficult. There’s so many competing industries that people can really make a way of life in a jurisdiction like British Columbia, whereas knowing a little bit about the Northwest Territories, mining is a big deal up there. People want to see projects succeed.

When we went into the Cabin Lake project, we knew we had to get a couple of things there to get permits. We knew we had to get our neighbors, Tlicho First Nations, on board. We also did our homework and knew that the Tlicho First Nations had previously worked with Fortune Minerals, as well as Nighthawk Gold. When we got to it, there was a framework in place. There was a government that had been formed.

The Tlicho government and the land use formal plan to work within, for application permits, and applications. So, once we got to it, it ended up only being four months to get it permitted. I think it seemed to keep getting easier for us, and it ended up being a decision that looks like it was the right one to make.

Maurice Jackson: Regarding mineral rights in your project portfolio, are there any reversionary interests?

Judson Culter: There’s a 1.5% NSR that we’ve got viable down to a half percentage point for CA$250,000 per quarter percentage.

Maurice Jackson: And does Rover Metals own the mineral rights outright 100%?

Judson Culter: That’s correct. Yes, not just at Cabin Lake, but at the Cabin Lake group of projects. The claims themselves are 10 kilometers apart; so there’s three of them. For the entire group of projects, yes, we have 100% mineral right interest.

Maurice Jackson: Let’s fast forward to 2018 and discuss your exploration program. What were the results from that program and how has that improved the confidence in the gold project?

Judson Culter: It helped us to better track the iron information. So what we did was we spent the six months from March, when we acquired the project, into October, really to digitize all the historical records. At the time in the 1980s, that was meticulously kept, and it was handwritten. We digitize seven banker boxes of data, as well as three map boxes. Then, we put that in a GPS, and tag the colors and everything else.

Then what we wanted to do to follow on with that data was to run a current, modern-day geophysical program. There were a lot of options to us to do it, but in a really economical manner, but also to do it in a very detailed type formation using a drone. Because the mineralization occurs at or near surface, as well as the iron information itself being at or near surface, it really showed up well on the magnetic survey that we flew over the property. So by interlaying the drill results, as well as the mag survey, our geologist was able to get a better interpretation of the iron formation throughout the project. Really, that really set the stage for where we are going to put the drill when we get to drilling this year in 2019.

Beyond just the iron information, what we also realized about the project is the outcropping on either side is quartz. Historically, the quartz had never been tested for mineralization. So we also did a geochemistry program in October. What that showed us is that the PPM and PPB reading of gold from the quartz outcrop area suggest that it’s also very likely to be a host for gold on this project. It’s never been tested historically. That’s the excitement of 2018 and what’s led into the 2019 drill program, which was always trying to be between March and the end of April. We’re still trying to hold on to that deadline.

We’ve got the collars is ready to go. Right now, we believe what we need to do to start drilling is conduct a small financing that we’ll probably release in the coming week or two here.

Maurice Jackson: So to review the value proposition we had before. This is potentially an open-pitable, early-stage brownfield exploration gold project with historical high-grade resource next to a new cobalt-gold mine, is that correct?

Judson Culter: Yes, and that’s one thing I didn’t touch on is the actual historical resource itself. That’s 85,000 ounces unconfirmed in terms of what our current standards allow us to document as a historical resource. What we’re allowed to document in press releases and everything else is 50,000 ounces of roughly 10 to 12 grams gold per ton. The rest of that 35,000 ounces was never signed off by a Qualified Person, but it is in the NORMIN database in the Northwest Territories. It’s in the areas of the Andrew zone, which we’ve documented. Rover will do the work we need to do under 43-101 standards to take that other 35,000 ounces and get it compliant.

From our side internally, we see it as an 85,000 ounce of resource of 12 grams per ton gold on average. When we talk about it publicly, we have to say, 50,000 from a historical resource perspective, but you’re absolutely right that we’re 20 kilometers away from what’s looking to be Canada’s first cobalt mine. The reason I say that is this project’s been 20 years in the making; it’s at the feasibility stage. I believe they’re really just looking to raise the capital to get to work. It’s an open-pitable cobalt mine. The good news is it’s actually a cobalt gold bismuth. So there is a gold processor that’s going to be built 20 kilometers from us. What better news can you possibly have when you’re developing an at-surface resource?

Maurice Jackson: The location in of itself makes the opportunity quite interesting, but to have open pit to me is icing on the cake. Is the goal to sell the project or develop into a commercial scale mine?

Judson Culter: Definitely the goal is to sell it within the next three years, and so I want to put $10 million in the ground, and let’s get this wrapped up and sold. End of story.

Maurice Jackson: What can you share with us regarding the infrastructure?

Judson Culter: So what you see in Yellowknife right now is what’s going to be coming in the pipeline in the next two to three years in the Pine Point Zinc mine is going back into production and that’s Osisko. Part of that is twining the costs in Taltson Hydro Dam and bringing that into Yellowknife itself, as well as Hay River. There’s going to be federal funding allocated, as well as territorial, to do an environmental study that should be announced through fairly short order this year.

After there is a federally funded environmental study to evaluate the twinning of the Taltson Hydro Dam, a successful outcome will lead into a hydro power upgrade to Yellowknife. When Yellowknife is upgraded, that will free up excess hydro power at the Snare and Strutt Lake hydro dams, located approximately 5km away from Camp Lake, one of our claims that’s part of the Cabin Lake group. That power becomes excess power. All of a sudden that frees up for the future the viability of really selling the project because now you’ve got excess power sitting right there, five kilometers away. How good is that?

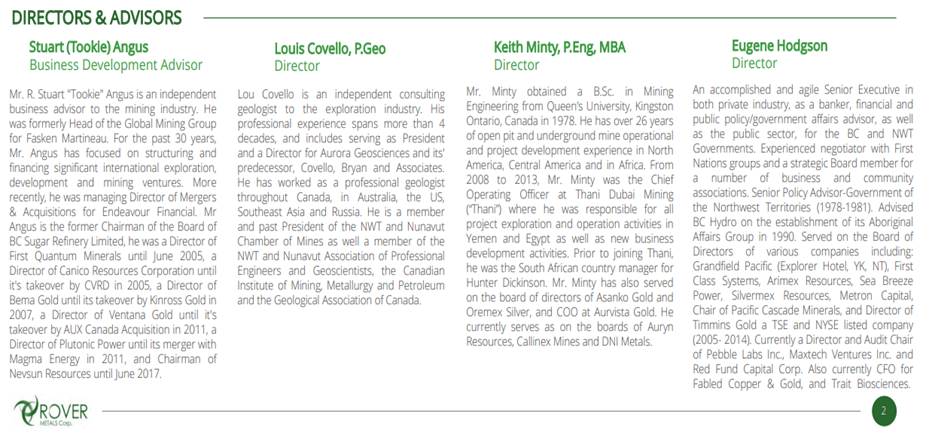

Maurice Jackson: Switching gears. Rover Metals’ board of directors and advisors consists of the following people:

Maurice Jackson: Bios for the management time are below:

Maurice Jackson: Let’s discuss some numbers. Please share your capital structure.

Judson Culter: We’ve got 47 million shares out today. That’s our issued and outstanding common shares. There are warrants out there. We have 10 million warrants at $0.20 cents, and 10 million warrants at $0.25 cents.

Maurice Jackson: How much cash and cash equivalents do you have?

Judson Culter: Treasury is sitting today around CA$450,000. Then, there’s been some prepayments for upcoming work commitments regarding our exploration plans for this year, as well as I mentioned, we’re doing a lot of our growth in terms of our marketing and our shareholder base in the United States. I think our prepaid balance, if you were to look at that today, should be around CA$200,000, just in terms of for events, as well as I mentioned, exploration planning. If you add that back to our cash position, we’re around CA$650,000 in current assets.

Maurice Jackson: What is your burn rate?

Judson Culter: Our burn rate’s about CA$30,000 a month, and that just includes all in. We purposely don’t carry an office in this market. We’re a bootstrap company. We have home offices, and then we’re on the road a lot. We’ve got an exploration office that is free from our exploration partner, Aurora Geosciences. That’s really where a lot of the hard work gets done. Then, there’s just no corporate office. I don’t feel the need for that, so that helps.

Maurice Jackson: How much debt do you have?

Judson Culter: We have some trade payables of, I think it’s roughly CA$40,000 that we’re going to settle in shares. Outside of that, we’ve got CA$25,000 in payables on top of that, that we’re going to pay in cash. That’s just some exploration legacy from last year.

Maurice Jackson: Who is financing the project, and what is their level of commitment?

Judson Culter: Just sophisticated mining investors. It’s been high net worth, accredited investors to this point. That will continue until we become a $10 million market cap company plus, because we’re just still not able to access institutional funds, and that’s fine. If Rover does everything that we hope to accomplish in the next drilling phase, which we hope is in the next 60 to 90 day window here, we should be a $10 million market cap plus company; and well on our way to institutional money.

Maurice Jackson: Who are the major shareholders?

Judson Culter: I’m a major shareholder. I’ve been seeding Rover not just with time, but my own money; since really inception in 2014. Tookie Angus, who is an advisor, is currently our third largest shareholder. Then, it really starts to break down to smaller tranches, but there is a notable name on the list: Ashwath Mehra, the chairman of GT Gold; he’s a relatively large shareholder.

Management, including Ron Woo. Ron’s also seeded this company. I think Ron’s probably fourth largest shareholder. Keith Minty’s a large shareholder; 38% of our outstanding shares are owned by insiders, management, board. That’s a good thing because that means our shares are tied up for three years.

Maurice Jackson: Judson, based on the data available, what type of value proposition do we have in comparing?

Judson Culter: Well, the market price, let’s just say, I think it should be $8.5 million, just on what we set out today. That’s my personal opinion. I think later value that, that’s just the reality of reserve stocks in North America. We’re going to do what we need to do to take that historical resource and bring it up to current standards, as well as to just extend where they stopped drilling, and just show them this really is a multimillion ounce potential asset.

I think we can get there with the drill program that we’re planning. We’re planning roughly a thousand meter program. I think the value proposition is we’re in a $3.5 million market cap today. I think we’re going to take it to $10 to 15 million in the next six months. Hold me to that.

Maurice Jackson: I certainly will, sir. Multi-layered question here: what is the next unanswered question for Rover Metals? When can we expect the response? How much will the response cost? What determines success?

Judson Culter: That’s going to be our Q1 or Q2 exploration drill campaign. I was going to caveat that, that is subject to the future success of our financing effort (click here), which we hope to announce in roughly two weeks’ time.

That will lead into confirmation of the historical high-grade gold results, such as the open-pit economics, expand upon the known mineralization in the iron formation, as well as to prove up a larger area play and this is more Q2/Q3 work, for the Slemon Lake, and Camp Lake claims, which are located 10 kilometers northwest from Cabin Lake, and we’ll fly that with an aerial B10 survey. What that will show is that the drilling we’ve done at Cabin Lake in the iron formation really just, those other two claims, or districts, an extension of the same geology, which everything that we’ve read historically shows us it is.

Maurice Jackson: Mr. Culter, please share the contact details for Rover Metals.

Judson Culter: Please visit our website www.RoverMetals.com. On there, you’ll find our social media links, which are LinkedIn, Twitter, our Facebook page and CEO.ca.

Our social media channels really have daily content. We’re press releasing every couple of weeks, but a lot of our investors like really the daily updates on what’s going on in the Northwest Territory. That’s the best place to stay tuned.

You can also submit to our mailing list. We typically will do an email update every two weeks as well. If you go to the bottom of the homepage on the website, and just submit your email, that subscribes you to our email mailing list.

Maurice Jackson: And last but not least, please visit our website, provenandprobable.com, for mining insights and bullion sales. You may reach us at contact@provenandprobable.com.

Judson Culter of Rover Metals, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Rover Metals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click herefor important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.

|

|

|

|

|

|

|

|

|

|

DNI METALS – Update

TORONTO, ON / ACCESSWIRE / March 6, 2019 / DNI Metals Inc. (DNI: CSE; DNMKF: OTC) (“DNI” or the “Company”) is pleased to provide the following update:

Environmental Licenses

The Public consultation meetings for DNI’s Vohitsara and Marofody projects were held on February 22nd and 23rd.

DNI and the Office National pour l’Environnement Madagascar, (“ONE”), completed two days of technical reviews at Vohitsara and Marofody properties on December 6 and 7.

As per DNI’s press releases on November 8 and 20, 2018 the ONE must complete two site visits, a Technical review, and a Public consultation, both now have been completed.

The ONE group comprised of a panel of four people, from the following government offices;

- ONE coordinator

- Ministry of Mines

- Ministry of Water

- Bureau des Directions Régionales de la Population (DRPPSPF)

Additional government officials that attended the meetings.

- L’Adjoint au Chef District

- Mayor of the Commune

- Two Counsellors

- The President’s of both Marofody and Vohitsara

As part of the technical review, the ONE sent an official letter to DNI, asking for clarity on certain items. DNI has responded to all the technical questions.

DNI has entered into property purchase negotiations with selected Vohitsara land stakeholders required for mine development. Ninety-Nine percent of the people in the area want to see DNI develop a mine.

It was also decided at the public consultation meetings, that a committee would be formed to order to set the land lease prices, the compensation for crops and compensation for any residences that need to be moved. The Committee will be made up of representatives from the local villages, DNI, and government officials from the ministries of Land and agriculture.

Resource Estimate

Micon completed a site visit Jan. 28th through February 2nd, 2019.

During the site visit, it was realized that channel samples taken from trench 3, located approximately 500 metres north-east of the most northernly drilled holes, had never been sent to the laboratory for testing. From February 5th through the 8th, 83 samples from trench 3, and an additional 218 samples that had been misplaced from road cuttings and the drilling were split, and prepped, under the supervision of DNI’s consulting geologist and qualified person (“QP”), Jannie Leeuwner. Dan Weir, DNI’s CEO, and Raymond Borida, DNI’s CSR consultant, prepared all the documents for exportation. The samples were shipped to AGAT Laboratories in Mississauga, Ontario, Canada for assaying on February the 18th. AGAT has completed the testing on a rush basis, and the results are in the process of being compiled, by Jannie and Micon.

This additional data will be used in the Resource estimation.

Surrender of part of Mining Claim in Alberta

A new Biodiversity Stewardship Area (“BSA”)- Wildland Provincial Park, is being created in Alberta. DNI received $500,000 in compensation for the surrendering of part of permit no 930806412. Please see the link below for information on the new park.

DNI owns 5 permits in Alberta, numbers 930806406, 930806407, 930806408, 930806410, and 930806412. Information on the DNI’s Alberta permits can be found at:

https://www.energy.alberta.ca/AU/Services/Pages/InteractiveMaps.aspx

Sale of Utah Gold Royalty

DNI has sold its Utah gold royalty for U$50,000, the money will be wired to DNI shortly.

DNI owned a 0.05% NSR on certain mining claims in Utah, USA.

DNI – CSE

DMNKF – OTC

Issued: 122,398,403

For further information, contact:

DNI Metals Inc. – Dan Weir, CEO 416-595-1195

Also visit www.dnimetals.com

Forward-looking Statements

This press release contains forward-looking statements, including statements that relate to, among other things, the following: (i) the geological characteristics of the projects; (ii) the potential to discover additional mineralization and to extend the area of mineralization; (iii) the potential to raise additional financing; and (iv) the potential to expand and upgrade the resource estimate of the projects. Forward-looking information is subject to the risks, uncertainties and other important factors that could cause the Company’s actual performance to differ materially from that expressed in or implied by such statements. Such factors include, but are not limited to volatility and sensitivity to market metal prices, impact of change in foreign exchange rates, interest rates, imprecision in resource estimates, imprecision in opinions on geology, environmental risks including increased regulatory burdens, unexpected geological conditions, adverse mining conditions, changes in government regulations and policies, including laws and policies; and failure to obtain necessary permits and approvals from government authorities, and other development and operating risks, and can generally be identified by the use of words such as “may”, “will”, “could”, “should”, “would”, “likely”, “possible”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “plan”, “objective”, “hope” and “continue” (or the negative thereof) and words and expressions of similar import. Although DNI believes that the expectations reflected in such forward-looking statements are reasonable, such statements involve risks and uncertainties, and undue reliance should not be placed on such statements. Certain material factors or assumptions are applied in making forward-looking statements, and actual results may differ materially from those expressed or implied in such statements. Additional information about material factors that could cause actual results to differ materially from expectations and about material factors or assumptions applied in making forward-looking statements may be found in the Company’s most recent annual and interim Management’s Discussion and Analysis under “Risk and Uncertainties” as well as in other public disclosure documents filed with Canadian securities regulatory authorities. Forward-looking statements are provided for the purpose of providing information about management’s current expectations and plans relating to the future. Readers are cautioned that such information may not be appropriate for other purposes. The Company does not undertake any obligation to update publicly or to revise any of the forward-looking statements contained in this document, whether as a result of new information, future events or otherwise, except as required by law.

SOURCE: DNI Metals Inc.

View source version on accesswire.com:

https://www.accesswire.com/538192/DNI-Metals–Update

Toronto, Ontario and Vancouver, British Columbia–(Newsfile Corp. – March 5, 2019) – Minera Alamos Inc. (TSXV: MAI) (OTC Pink: MAIFF) (the “Company“) is issuing a correction to its previously disseminated press release dated March 4, 2019 (the “Initial Press Release“). The Initial Press Release announced the closing of the previously announced non-brokered private placement for aggregate proceeds of $4,934,750 through the issuance of 49,347,500 common shares of the Company (“Common Shares“), as well as payment of cash commissions totaling $276,600 and the issuance of 2,862,000 6finder’s warrants exercisable for Common Shares (the “Finder’s Warrants“). In fact, the Company raised aggregate proceeds of $4,994,750 through the issuance of 49,947,500 Common Shares, paid cash commissions of $280,200 and issued 2,898,000 Finder’s Warrants.

The corrected press release follows in full below:

*****

Toronto, Ontario and Vancouver, British Columbia–(March 4, 2019)– Minera Alamos Inc. (TSXV: MAI) (OTC Pink: MAIFF) (the “Company” or “Minera Alamos“) is pleased to announce, further to its press release dated February 26, 2019, that it has closed the non-brokered private placement offering of 49,947,500 common shares of the Company (the “Common Shares“) at a price of $0.10 per Common Share (the “Offering Price“) for aggregate gross proceeds of $4,994,750 (the “Offering“).

The Offering included participation of existing institutional investors. As a result, the Donald Smith Value Fund increased its ownership in the Company to ~9.8% and the Aegis Value Fund increased its ownership to ~4.9%.

“Minera appreciates the ongoing support of both Donald Smith and Aegis as well as the other participants in the Offering as we begin a transformational year leading toward construction decisions at our Santana and Fortuna gold projects” stated Doug Ramshaw, President of Minera Alamos.

Minera Alamos intends to use the net proceeds of the Offering for exploration and development of the Company’s Santana Project in Sonora, Mexico, and for working capital and general corporate purposes.

In connection with the Offering, the Company paid cash finder’s fees of $280,200 and issued 2,898,000 finder’s warrants (the “Finder’s Warrants“). The Finder’s Warrants will each be exercisable for one Common Share at the Offering Price for a period of two years following the closing of the Offering.

All securities issued under the Offering will be subject to a four month hold period from the closing date under applicable Canadian securities laws, in addition to such other restrictions as may apply under applicable securities laws of jurisdictions outside Canada. The Offering is subject to TSX Venture Exchange acceptance of requisite regulatory filings.

The securities offered have not been registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements. This news release shall not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

About Minera Alamos

Minera Alamos is an advanced-stage exploration and development company with a growing portfolio of high-quality Mexican assets, including the La Fortuna open-pit gold project in Durango with positive PEA completed, the Santana open-pit heapleach development project in Sonora with test mining and processing completed and the Guadalupe de Los Reyes open-pit gold-silver project in Sinaloa with mine planning in progress. The Company is awaiting the pending approval of permit applications related to the commercial production of gold at both the Santana and Fortuna projects.

The Company’s strategy is to develop low capex assets while expanding the project resources and pursue complementary strategic acquisitions.

CONTACT INFORMATION:

Minera Alamos Inc.

Doug Ramshaw, President

604-600-4423

dramshaw@mineraalamos.com

www.mineraalamos.com

Caution Regarding Forward-Looking Statements

This news release may contain forward-looking information and Minera Alamos cautions readers that forward-looking information is based on certain assumptions and risk factors that could cause actual results to differ materially from the expectations of Minera Alamos included in this news release. This news release includes certain “forward-looking statements”, which often, but not always, can be identified by the use of words such as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. These statements are based on information currently available to Minera Alamos and Minera Alamos provides no assurance that actual results will meet management’s expectations. Forward-looking statements include estimates and statements with respect to Minera Alamos’ future plans, objectives or goals, to the effect that Minera Alamos or management expects a stated condition or result to occur and the expected timing. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Such statements reflect the Company’s current views with respect to future events based on certain material factors and assumptions and are subject to certain risks and uncertainties, including without limitation, changes in market, competition, governmental or regulatory developments, general economic conditions and other factors set out in the Company’s public disclosure documents. Many factors could cause the Company’s actual results, performance or achievements to vary from those described in this news release, including without limitation those listed above. This list is not exhaustive of the factors that may affect any of Minera Alamos’ forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on Minera Alamos’ forward-looking statements. Minera Alamos does not undertake to update any forward-looking statement that may be made from time to time by Minera Alamos or on its behalf, except in accordance with applicable securities laws.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/43247

Toronto, Ontario and Vancouver, British Columbia–(Newsfile Corp. – March 4, 2019) – Minera Alamos Inc. (TSXV: MAI) (OTC Pink: MAIFF) (the “Company” or “Minera Alamos“) is pleased to announce, further to its press release dated February 26, 2019, that it has closed the non-brokered private placement offering of 49,347,500 common shares of the Company (the “Common Shares“) at a price of $0.10 per Common Share (the “Offering Price“) for aggregate gross proceeds of $4,934,750 (the “Offering“).

The Offering included participation of existing institutional investors. As a result, the Donald Smith Value Fund increased its ownership in the Company to ~9.8% and the Aegis Value Fund increased its ownership to ~4.9%.

“Minera appreciates the ongoing support of both Donald Smith and Aegis as well as the other participants in the Offering as we begin a transformational year leading toward construction decisions at our Santana and Fortuna gold projects” stated Doug Ramshaw, President of Minera Alamos.

Minera Alamos intends to use the net proceeds of the Offering for exploration and development of the Company’s Santana Project in Sonora, Mexico, and for working capital and general corporate purposes.

In connection with the Offering, the Company paid cash finder’s fees of $276,600 and issued 2,862,000 finder’s warrants (the “Finder’s Warrants”). The Finder’s Warrants will each be exercisable for one Share at the Offering Price for a period of two years following the closing of the Offering.

All securities issued under the Offering will be subject to a four month hold period from the closing date under applicable Canadian securities laws, in addition to such other restrictions as may apply under applicable securities laws of jurisdictions outside Canada. The Offering is subject to TSX Venture Exchange acceptance of requisite regulatory filings.

The securities offered have not been registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements. This news release shall not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

About Minera Alamos

Minera Alamos is an advanced-stage exploration and development company with a growing portfolio of high-quality Mexican assets, including the La Fortuna open-pit gold project in Durango with positive PEA completed, the Santana open-pit heapleach development project in Sonora with test mining and processing completed and the Guadalupe de Los Reyes open-pit gold-silver project in Sinaloa with mine planning in progress. The Company is awaiting the pending approval of permit applications related to the commercial production of gold at both the Santana and Fortuna projects.

The Company’s strategy is to develop low capex assets while expanding the project resources and pursue complementary strategic acquisitions.

CONTACT INFORMATION:

Minera Alamos Inc

Doug Ramshaw, President

604-600-4423

dramshaw@mineraalamos.com

Caution Regarding Forward-Looking Statements

This news release may contain forward-looking information and Minera Alamos cautions readers that forward-looking information is based on certain assumptions and risk factors that could cause actual results to differ materially from the expectations of Minera Alamos included in this news release. This news release includes certain “forward-looking statements”, which often, but not always, can be identified by the use of words such as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. These statements are based on information currently available to Minera Alamos and Minera Alamos provides no assurance that actual results will meet management’s expectations. Forward-looking statements include estimates and statements with respect to Minera Alamos’ future plans, objectives or goals, to the effect that Minera Alamos or management expects a stated condition or result to occur and the expected timing. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Such statements reflect the Company’s current views with respect to future events based on certain material factors and assumptions and are subject to certain risks and uncertainties, including without limitation, changes in market, competition, governmental or regulatory developments, general economic conditions and other factors set out in the Company’s public disclosure documents. Many factors could cause the Company’s actual results, performance or achievements to vary from those described in this news release, including without limitation those listed above. This list is not exhaustive of the factors that may affect any of Minera Alamos’ forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on Minera Alamos’ forward-looking statements. Minera Alamos does not undertake to update any forward-looking statement that may be made from time to time by Minera Alamos or on its behalf, except in accordance with applicable securities laws.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/43218

|

|

|

|

|

|

|

MISES INSTITUTE The Great Murray Rothbard

Today would have been Murray Rothbard’s 93nd birthday. He was an unforgettable friend, whose immense knowledge of many different fields was unsurpassed in my experience. In a lecture on the Austrian Theory of the Business Cycle, he mentioned the common objection that the expansion of bank credit might have no effect, if investors anticipated trouble. After the lecture, I asked whether Mises had answered this point. He said, “See his response to Lachmann inEconomica, 1943.” I often went to used bookstores with him, in both Palo Alto and Manhattan, and listened to him as he commented on nearly every book on the shelves. When he was a student at Columbia, he admired the philosopher Ernest Nagel, who he said would always encourage students to do new work. Murray was like this himself. He constantly encouraged students to work on Austrian and libertarian topics. His support for me was never failing, and I owe him everything. If only he were still here now, to guide and instruct us!