Author: admin

Register Here:

Rule Symposium: https://bit.ly/458dgJr

Capitalism & Morality: http://bit.ly/4od95Vl

New Orleans Investment Conference: http://bit.ly/45lwjAm

Battle Bank: https://battlebank.com/

Battle Bank Finance Opportunity: https://battlebank.com/battle-financial-inc-invest/

Tekoa Da Silva shares his profound insights on “Security Analysis” by Benjamin Graham and David Dodd, hailing it as “The Best Book Ever Written on Stock Investing.”

In this must-watch discussion, Tekoa explains how this foundational text empowers investors to become self-sufficient in understanding financial statements, debunks the myth that a professional background is needed for stock investing, and reveals how the book helps recognize market patterns.

Whether you’re a seasoned investor or just starting, this book offers invaluable tutorials on key financial concepts like P/E ratios, dividend yield, and balance sheet analysis.

Watch the full conversation and get inspired to deepen your investment knowledge: 🔗 https://youtu.be/sQ8GfI0dCF8?si=n-PtM1A1YSiPkCL6

#StockMarket #Investing #ValueInvesting #SecurityAnalysis #FinancialLiteracy #TekoaDaSilva #InvestmentBooks #ProvenAndProbable #FinancialEducation

NYMEX platinum futures posted a 32.12% gain in Q2 and were 49.22% higher over the first six months of 2025. After years of lagging gold, platinum posted the most significant gain in the precious metals sector and the commodities asset class in Q2 and the first half of 2025.

I concluded my Q2 Barchart report on precious metals with:

Silver, platinum, and palladium formed powerful bullish formations in Q2, with each metal falling below its Q1 low and closing the quarter above the previous quarter’s peak. The bullish key reversal patterns could indicate that the bullish trend in the precious and industrial metals will continue over the coming months and quarters, as silver, platinum, and palladium catch up with gold.

Platinum closed Q2 at $1,334 per ounce on the nearby NYMEX futures contract. The price continued to appreciate in July 2025.

A bullish key reversal leads to more gains

In Q2 2025, NYMEX platinum futures fell to a slightly lower low than in Q1 2025 before closing the second quarter above the first quarter’s high, forming a bullish key reversal on the long-term chart.

The quarterly continuous futures chart highlights platinum’s bullish technical price action that caused the rare precious metal to move substantially above the $1,000 pivot point that had dominated price action from 2015 through Q1 2025. In early Q3, platinum futures continued their ascent, rising to over $1,500 per ounce, the highest price since Q3 2014. Nearby platinum futures were around the $1,425 level on July 28.

Approaching the next upside target

Platinum futures are closing on the next technical resistance level at the Q3 2014 high.

The monthly continuous contract chart illustrates that platinum’s next upside target is $1,523.80 per ounce, the high from July 2014. Above there, the February 2013 high of $1,774.50, the August 2011 high of $1,918.50, and the March 2008 record peak of $2,308.80 are technical resistance levels and upside targets.

Platinum was once “rich person’s gold”

In March 2008, when platinum reached its record $2,308.80 high, gold’s peak was $1,033.90 per ounce. Platinum commanded a nearly $1,275 premium over gold. Platinum is a rarer precious metal, with approximately 170 tons of annual production. Most platinum output comes from South Africa and Russia. In South Africa, production is primary, while in Russia, platinum is a byproduct of nickel production in Siberia’s Norilsk region.

Annual gold production is approximately 3,600 tons. While China and Russia lead the world in gold output, Australia, Canada, the United States, Kazakhstan, Mexico, Indonesia, South Africa, Uzbekistan, Peru, and many other countries are leading gold producers, making gold output far more ubiquitous than platinum production.

Meanwhile, in 2008 and for many years prior, platinum traded at a premium to gold, earning it the nickname “rich person’s gold.” However, since 2008, platinum’s price took a backseat to gold as the golden bull has taken the yellow precious metal to a series of higher record highs, leading to the latest 2025 peak at the $3,500 per ounce level.

Platinum’s liquidity could mean a parabolic move is on the horizon- Fundamentals in a dangerous world support more gains

As highlights, annual output of 170 metric tons of platinum compared to approximately 3,600 tons of gold makes platinum a far less liquid market. Moreover, the data from the futures arena highlights platinum’s illiquidity compared to gold. Open interest is the total number of open long and short positions in a futures market. While gold trades on the CME’s COMEX division, platinum futures trade on the CME’s NYMEX division. A gold futures contract contains 100 ounces of gold, while a platinum futures contract contains 50 ounces of platinum.

As of July 25, 2025:

- COMEX gold futures open interest was 466,174 contracts or 46,617,400 ounces. At $3,310 per ounce, the total value was over $154.304 billion.

- NYMEX platinum open interest was 88,775 or 4,438,750 ounces. At $1,425 per ounce, the total value was $6.325 billion.

The platinum market is far smaller than the gold market. Lower liquidity often leads to higher volatility. In platinum’s case, a herd of buying can exacerbate price action as we have seen over the first half of 2025, with platinum’s over 29% gain. At the current price, platinum could have a long way to go on the upside before challenging the 2008 all-time high of $2,308.80 per ounce.

PPLT and PLTM are platinum ETF products

The most direct route for an investment or trading position in platinum is the physical market for bars and coins. Platinum futures on the CME’s NYMEX division are a secondary route, as they offer a physical delivery mechanism. Two of the dedicated ETF products that hold physical platinum, trade on the NYSE Arca, and track the metal’s price action are:

- The Aberdeen Physical Platinum ETF (PPLT) is the most liquid platinum ETF product. At $127.05 per share, PPLT had over $1.663 billion in assets. PPLT trades an average of nearly 398,000 shares daily and charges a 0.60% management fee.

- The GraniteShares Platinum Shares ETF (PLTM) provides exposure to platinum. At $13.45 per share, PLTM had over $89.288 million in assets. PPLT trades an average of nearly 450,000 shares daily and charges a 0.50% management fee.

Platinum remains in a bullish trend, with plenty of upside room before it approaches the 2008 all-time high. Given gold’s ascent over the past years and platinum’s liquidity constraints, platinum could head back to its former position as “rich person’s gold.”

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. This article was originally published on Barchart.com

KELOWNA, BC / ACCESS Newswire / July 29, 2025 / Diamcor Mining Inc. (TSX-V.DMI), (the “Company“) announces that due to ongoing delays in completing its funding objectives and associated operational and audit related delays, the Company will be unable to file its audited financial statements and corresponding management’s discussion and analysis for the year ended March 31, 2025 (collectively, the “Financial Disclosure“) on or before the prescribed filing deadline of July 29, 2025 as required by National Instrument 51-102 – Continuous Disclosure Obligations. The Company’s South African auditor, PricewaterhouseCoopers, and its Canadian auditor, MNP LLP, require more time to complete the preparation, reviews and audit in respect of the Financial Disclosure. The delay has been caused by the inability of the Company to complete its funding objectives underway and the associated funding transactions due to the well documented industry wide supply chain disruptions and the resulting uncertainty surrounding the impact of US imposed tariffs, compounded by the recent actions undertaken by a major creditor, Tiffany & Co. Canada (“Tiffany”), to enforce its security against all of the Company’s present and after acquired personal propertyand all shares held by the Company in the capital of its subsidiary DMI Diamonds South Africa (Pty) Ltd., as previously announced in the Company’s news release on June 13, 2025. These issues have disrupted the Company’s South African operations, which has also contributed to the delays in completing the South Africa portion of the Company’s annual audit work.

The Company is working to complete the financing objectives underway, provide the additional submissions and related items to its auditors and to complete the audit of the financial statements for the year ended March 31, 2025. In this regard, the Company has formulated the following remediation plan:

- Finalize arrangements with Tiffany to defer any formal insolvency proceedings in order to enable the Company to complete its funding objectives (target completion: August 15, 2025);

- Complete funding objectives (target completion August 29, 2025);

- Complete delivery of required submissions and related items to the Company’s South African and Canadian auditors (target completion: September 2, 2025);

- Complete draft Annual Filings for review and approval by the Company (target completion: September 23, 2025);

- Complete final approval and filing of Annual Filing (target completion: September 26, 2025).

Based on the foregoing, the Company anticipates that it will be in a position to file its Financial Disclosure before September 29, 2025. The Company confirms that it will comply with the alternative information guidelines included in National Policy 12-203 – Management Cease Trade Orders, for so long as it remains in default of a specified requirement.

The Company has filed an application with the British Columbia Securities Commission and the Alberta Securities Commission requesting that they issue a management cease trade order against the Company’s Directors, Officers and/or Insiders instead of a cease trade order against the Company and all of its securityholders.

About Diamcor Mining Inc.

Diamcor Mining Inc. is a fully reporting publicly traded junior diamond mining company which is listed on the TSX Venture Exchange under the symbol V.DMI. The Company has a well-established operational and production history in South Africa and extensive prior experience supplying rough diamonds to the world market.

On behalf of the Board of Directors

Mr. Dean H. Taylor

President & CEO Diamcor Mining Inc.

DTaylor@diamcormining.com

Tel (250) 864-3326

www.diamcormining.com

Statement Regarding Forward-Looking Information

This news release contains statements that constitute “forward-looking statements.” Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur.

Forward-looking statements in this document include statements concerning the Company’s intent to file the Financial Disclosure before September 29, 2025, and all other statements that are not statements of historical fact.

Although the Company believes the forward-looking information contained in this news release is reasonable based on information available on the date hereof, by their nature forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. By their nature, these statements involve a variety of assumptions, known and unknown risks and uncertainties and other factors, which may cause actual results, levels of activity and achievements to differ materially from those expressed or implied by such statements.

Examples of such assumptions, risks and uncertainties include, without limitation, assumptions, risks and uncertainties associated with adverse industry events; future legislative and regulatory developments; and other assumptions, risks and uncertainties.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS NEWS RELEASE REPRESENTS THE EXPECTATIONS OF THE COMPANY AS OF THE DATE OF THIS NEWS RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER SUCH DATE. READERS SHOULD NOT PLACE UNDUE IMPORTANCE ON FORWARD-LOOKING INFORMATION AND SHOULD NOT RELY UPON THIS INFORMATION AS OF ANY OTHER DATE. WHILE THE COMPANY MAY ELECT TO, IT DOES NOT UNDERTAKE TO UPDATE THIS INFORMATION AT ANY PARTICULAR TIME EXCEPT AS REQUIRED IN ACCORDANCE WITH APPLICABLE LAWS.

WE SEEK SAFE HARBOUR

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Diamcor Mining Inc.

View the original press release on ACCESS Newswire

Don’t Miss “A Generational Opportunity” at the New Orleans Investment Conference 2025! 🚀

This is your chance to gain unparalleled insights and strategic knowledge from leading figures in the financial and natural resource sectors. The New Orleans Investment Conference, November 2-5, 2025, is truly The World’s Greatest Investment Event.

We’re excited to invite you to join us and learn from the best in the business. This conference is crucial for anyone looking to navigate today’s complex markets and identify future growth opportunities.

Secure your registration today via our dedicated link: 👇 🔗 https://www.eventbrite.com/e/2025-new-orleans-investment-conference-tickets-1073141658589?aff=pp

#NOIC2025 #Investment #FinancialMarkets #NaturalResources #PreciousMetals #GenerationalOpportunity #MarketOutlook #EconomicInsights #Networking #ProvenAndProbable #WealthManagement #Conference

Vancouver, British Columbia–(Newsfile Corp. – July 24, 2025) – EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (“EMX” or the “Company”) congratulates Talga Group Ltd (“Talga”; ASX:TLG) on its progress in advancing the Vittangi graphite project in northern Sweden. EMX controls a 2% NSR royalty on all mineral production from the Vittangi project, which recently concluded an appeals review process for the issuance of an Exploitation Concession, a key step in the mine permitting process in Sweden. According to Talga’s ASX News Release dated June 12, 2025: “all major permits are now in force for [Talga’s] 100% owned Nunasvaara South Mine, which is part of Europe’s largest and highest grade JORC classified natural graphite resource”.

The Nunasvaara South mine at Vittangi is part of a vertically integrated development-stage project that will produce high performance battery graphite anode materials for the electrical vehicle, battery storage and defense industries. Graphite is classified as a strategic element by the European Union and United States and is vital to various battery technologies and a critical component to many defense-sector applications. At present, almost all commercial processing of graphite is controlled by China, with very little production capacity located in Europe and in the Americas. As such, the Vittangi project stands out in terms of its robust resource grades and tonnages as well as Talga’s ability to produce a strategic product from its fully permitted downstream refinery and anode plant that will be constructed in Luleå, Sweden.

Talga has also recently received funding support via grants from the EU Innovation Fund and has been designated as a Strategic Project under the European Commission’s Critical Raw Materials Act (“CRMA”) and Net-Zero Industry Act. Under such designations, Talga will utilize EU support and innovative technologies to produce natural graphite anode materials with a remarkably low emissions footprint.

Much of current graphite production is utilized in the refractory/steel-making industries, but demand is forecasted to increase dramatically in the coming years due to increased production of lithium-ion batteries. The Vittangi royalty interest and the current high levels of interest surrounding this project underscore the deep optionality that exists within EMX’s global royalty portfolio.

EMX Royalty. EMX acquired its 2% NSR royalty via its acquisition of Phelps Dodge Exploration Sweden AB (“PDES”) in July, 2010, from Freeport-McMoRan Copper & Gold Inc. (see EMX News Release dated August 5, 2010). PDES had previously entered into a royalty agreement with TCL Sweden Ltd, a wholly owned subsidiary of Teck Resources Ltd (“Teck”), which covered the Vittangi project exploration permits. Teck subsequently sold TCL Sweden Ltd to Talga in February 2012. The EMX royalty covers all mineral production from the Vittangi nr 2, Nunasvaara nr 2 and Kallokajärvi nr 1 exploration permits and “any renewal thereof and any other form of successor or substitute title” to those permits.

Vittangi Graphite Deposit. The Vittangi deposit lies within the Palaeoproterozoic greenstone sequence of northern Sweden, consisting of metasedimentary and metavolcanic rocks. The graphite mineralization occurs in graphitic schists hosted in the Nunasvaara Formation, which is part of a highly metamorphosed volcanic-sedimentary sequence.

The Vittangi Project consists of several mineralized zones, with the Nunasvaara South deposit being the most significant. A detailed feasibility study, published in 2021, defined a Probable Reserve on Nunasvaara South of 2.3 million tonnes at 24.1% graphite (%Cg) as shown below1. Talga has also defined an Indicated Mineral Resource of 26.7 million tonnes at 24.3% graphite (%Cg)2. Further upside comes from considerable exploration potential elsewhere on the Vittangi property.

| Mineral Reserves as reported by Talga Group Ltd; see ASX News Released Dated July 1, 20211 | ||||

| Deposit | Reserve Category | Tonnage (t) | Graphite (%Cg) | Contained Graphite (t) |

| Nunasvaara South | Probable | 2,260,140 | 24.1 | 544,693 |

| Mineral Resources as reported by Talga Group Ltd; see ASX News Released Dated October 6, 20232 | ||||

| Deposit | Resource Category | Tonnage (t) | Graphite (%Cg) | Contained Graphite (t) |

| Vittangi (all deposits) | Indicated | 26,691,000 | 24.3 | 6,482,000 |

| Vittangi (all deposits) | Inferred | 8,329,000 | 22.1 | 1,844,000 |

1Notes on Mineral Reserves. The Nunasvaara Mineral Reserve was disclosed by Talga in their ASX News Release dated July 1, 2021, in accordance with the 2012 JORC Code reporting guidelines, which is an acceptable foreign code under Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). The Mineral Reserve is based upon a previously disclosed Mineral Resource estimate for Nunasvaara South (See Talga Group Ltd ASX News Release dated September 17, 2020). The Mineral Reserve Statement utilized a graphite price of US$4,000/t and cut-off grade of 11% Cg. Only Indicted Resources within optimized Whittle pit shells were used for the conversion to Probable Reserves. Totals may not sum correctly due to rounding. As reported by Talga, the Competent Person as defined by the JORC Code who supervised the Mineral Reserve Statement was Mr. John Walker. At the time of disclosure, Mr. Walker was a sub-contractor with Golder Associates Ltd. and a Professional Member of the Institute of Materials, Minerals and Mining (Membership No.451845).

2Notes on Mineral Resources. The Vittangi Mineral Resources were disclosed by Talga in their ASX News Release dated October 6, 2023. All Mineral Resources have been reported in accordance with the 2012 JORC Code reporting guidelines, which is an acceptable foreign code under NI 43-101. Indicated Mineral Resources are reported within preliminary pit shells and above a cut-off grade of 12.5% Cg and using a graphite price of US$5,000/t. Reported resources are inclusive of reserves. Totals may not sum correctly due to rounding. As reported by Talga, the qualified person who supervised the Mineral Resource Estimate was Ms. Katharine Masun (HBSc Geology, MSc Geology, MSA Spatial Analysis), who at the time of disclosure was a Principal Geologist at SLR Consulting (Canada) Limited. Also, at the time of disclosure, Ms. Masun was registered as a Professional Geologist in the Northwest Territories and Nunavut, Provinces of Ontario, Newfoundland and Labrador, and Saskatchewan, Canada, and a Competent Person as defined by the JORC Code.

Note that NI 43-101 and JORC (2012) both comply with the CRIRSCO reporting protocols, utilizing equivalent categories of Inferred and Indicated Resources and Probable Reserves.

More information on the Vittangi project can be found at www.EMXroyalty.com.

Dr. Eric P. Jensen, CPG, a Qualified Person as defined by NI 43-101 and employee of the Company, has reviewed, verified and approved the disclosure of the technical information contained in this news release.

About EMX. EMX is a precious and base metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and TSX Venture Exchange under the symbol “EMX”. Please see www.EMXroyalty.com for more information.

For further information contact:

| David M. Cole President and CEO Phone: (303) 973-8585 Dave@EMXroyalty.com | Stefan Wenger Chief Financial Officer Phone: (303) 973-8585 SWenger@EMXroyalty.com | Isabel Belger Investor Relations Phone: +49 178 4909039 IBelger@EMXroyalty.com |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

Forward-Looking Statements

This news release may contain “forward looking statements” and “forward looking information” (together “forward-looking statements”) that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, expectations related to Vittangi graphite project, mineral reserves and resource estimates, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include but are not limited to unavailability of failure to identify commercially viable mineral reserves, delays in the advancement and production at the Vittangi graphite project, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended March 31, 2025 (the “MD&A”), and the most recently filed Annual Information Form (“AIF”) for the year ended December 31, 2024, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedarplus.ca and on the SEC’s EDGAR website at www.sec.gov. EMX does not undertake to update any forward-looking statements, except in accordance with applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/259816

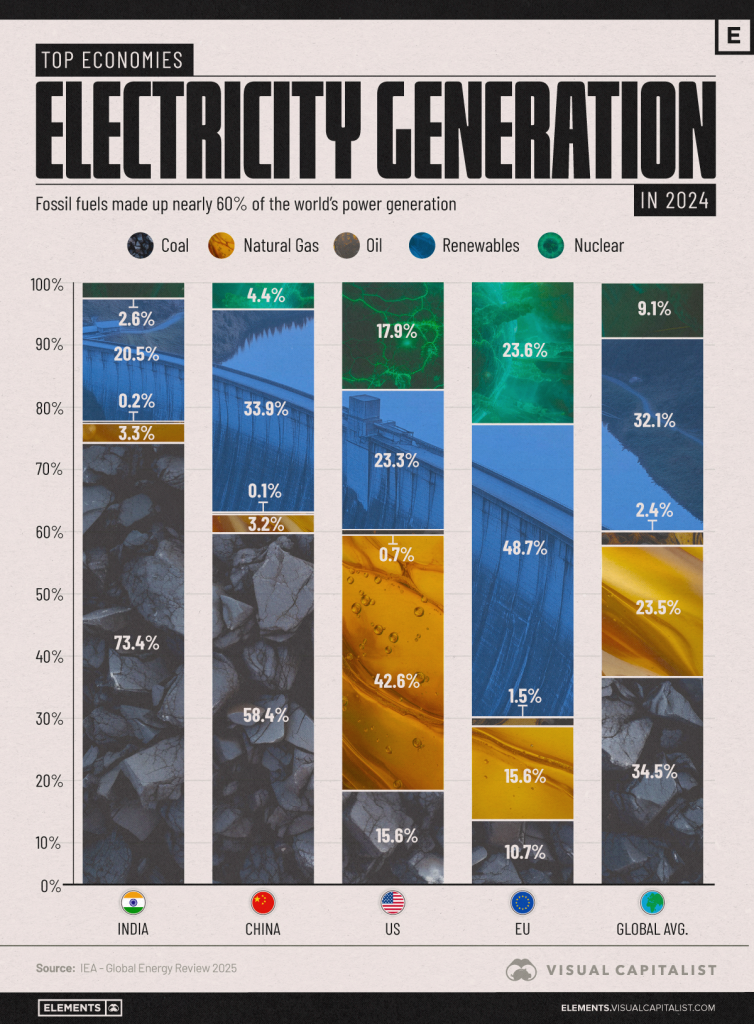

Charted: Coal Still Dominates Global Electricity Generation

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- Fossil fuels made up nearly 60% of 2024 electricity generation.

- Coal accounts for 35% of total power generation.

Fossil Fuels Still Power Most of the World

Global energy demand grew faster than average in 2024, driven by rising electricity use across sectors. The power sector led the surge, with demand growing nearly twice as fast as overall energy use—fueled by increased cooling needs, industrial activity, transport electrification, and the expansion of data centers and AI.

Despite a growing push toward cleaner energy sources, coal remains the leading source of electricity generation worldwide. In 2024, fossil fuels accounted for nearly 60% of global power generation, with coal alone contributing 35%, according to the International Energy Agency.

While renewable energy continues to expand, making up about one-third of total electricity production, the global energy mix still leans heavily on traditional sources.

| Country | Coal | Natural Gas | Oil | Renewables | Nuclear |

|---|---|---|---|---|---|

India India | 73.4% | 3.3% | 0.2% | 20.5% | 2.6% |

China China | 58.4% | 3.2% | 0.1% | 33.9% | 4.4% |

U.S. U.S. | 15.6% | 42.6% | 0.7% | 23.3% | 17.9% |

EU EU | 10.7% | 15.6% | 1.5% | 48.7% | 23.6% |

| 🌍 Global | 34.5% | 21.8% | 2.4% | 32.1% | 9.1% |

In emerging markets and developing economies, coal continues to be the backbone of power systems. China, the world’s largest energy consumer, generated nearly 60% of its electricity from coal. In India, coal’s dominance is even more pronounced, providing close to three-quarters of all electricity produced.

In contrast, advanced economies are increasingly relying on cleaner sources. In 2024, the European Union made significant strides in renewable energy adoption—nearly half of its electricity came from renewables, far exceeding the global average.

In the United States, natural gas led the power mix, accounting for over 40% of electricity generation in 2024. President Trump’s pro-coal policies and the surge in energy demand from AI innovation are expected to boost coal production in the U.S. over the next few years.

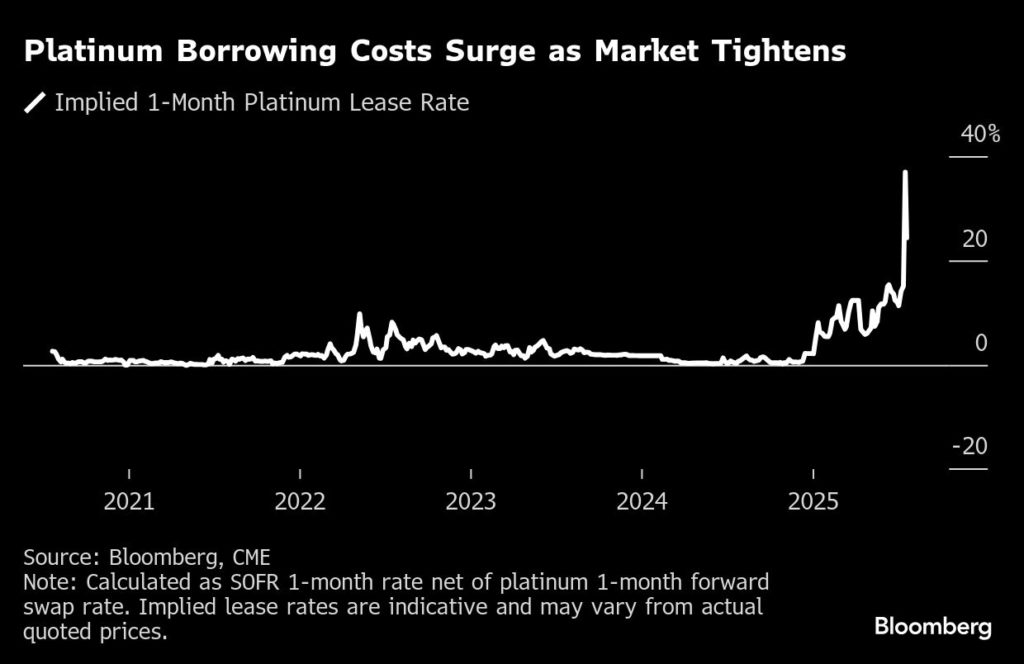

The platinum market has tightened to unprecedented levels in the past few days as tariff fears and speculative buying pull metal from the key London and Zurich markets into warehouses in the US and China.

Following a record rally last month, spot prices have soared to fresh all-time highs and the implied cost of borrowing the metal for one month has hit the steepest level in data going back to 2002. The inflow of platinum into facilities linked to the New York Mercantile Exchange on Thursday was the second-highest on record.

US President Donald Trump’s erratic trade threats led more than half a million ounces of platinum to flow into US warehouses earlier this year to capture premium prices driven by tariff fears — a surge of shipments similar to the one seen in markets for industrial metals such as copper.

Though no figures exist for how low inventories are in London and Zurich, stocks have also been drawn down by record Chinese imports of 36 tons in the second quarter.

Spot prices have surged almost 60% this year, and platinum’s unusual scarcity in the dominant over-the-counter spot market in London has led the precious metal’s annualized one-month borrowing costs to spiral close to 40%. Most of the time that rate is close to zero.

While prices retreated slightly on Tuesday, there’s little sign that the market tightness is easing. The price structure known as backwardation — with buyers paying more for the closest deliveries than for longer-dated contracts to secure supplies — only intensified this month, Jonathan Butler, head of business development at Mitsubishi International in London, wrote in a note.

“A combination of tariff-related dislocation, physical buying in Asia and speculative interest led to extreme market tightness,” he said. “The difference now is that the backwardation is deeper and more widespread across the curve than at any time in more than 20 years.”

Lease rates might also in part have been driven higher by platinum users’ skepticism about the steep price rally, according to Trevor Raymond, chief of industry body World Platinum Investment Council.

“Because the metal has been rangebound between $950 and $1100 an ounce for years, many market participants didn’t see the rally as sustainable, they said ‘we don’t need to react, we can lease the metal,’” he said. Given the now prohibitive cost of borrowing platinum, some of those borrowers may soon end up buying metal to end those leases, rather than rolling over the loans.

Spot platinum edged 0.8% lower on Tuesday, to $1,439.15 an ounce as of 1:57 p.m. in New York.

Stocks in American warehouses had began to decline in April once platinum was exempted from Washington’s first batch of tariffs, bringing US prices back in line with London and Zurich. But US premiums surged once again after Trump unexpectedly announced a 50% tariff on copper.

Although platinum is still exempt, the copper levy has “upped tariff risk in the white metals significantly,” Nicky Shiels, head of metals strategy at MKS Pamp SA said in a note.

In addition to investment demand, platinum is used in catalytic converters and laboratory equipment. The WPIC estimates a supply deficit of almost 1 million ounces this year, further eroding dwindling above-ground stocks.

(By Jack Ryan)

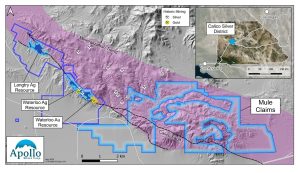

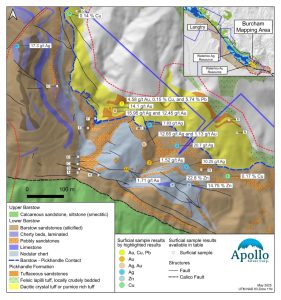

Vancouver, British Columbia, May 20, 2025 – Apollo Silver Corp. (“Apollo” or the “Company”) (TSX.V: APGO, OTCQB: APGOF, Frankfurt: 6ZF0) is pleased to announce it has acquired 2,215 hectares (“ha”) of highly prospective claims contiguous to its Waterloo property at its Calico Silver Project (“Calico” or “Calico Project”). The newly acquired claims herein referred to as the Mule claims comprise 415 lode mining claims, and have been acquired from LAC Exploration LLC (“LAC”), a wholly-owned subsidiary of Lithium Americas Corp. (TSX: LAC; NYSE: LAC), who were the previous operators of the property. Preliminary mapping and sampling conducted by the prior operator of the Mule claims identified several high-grade silver targets, which will be evaluated as part of Apollo’s future exploration planning.

In addition, a mapping and sampling program was recently completed at the Burcham gold prospect area in the southwest region of the Waterloo property (see news release dated February 12, 2025). This program confirmed the importance of the Calico fault system with respect to controls on the silver (“Ag)” and gold (“Au”) mineralization in the area and has identified the potential for copper (“Cu”), zinc (“Zn”) and lead (“Pb”) mineralization associated with stratabound and mantos lenses.

Highlights:

- Mule claims expand the Calico Project land package by over 285%, from 1,194 ha to 3,409 ha of contiguous claims.

- Mule claims trend along the mineralized Calico Fault System responsible for mineralization seen at Calico.

- Reports from the prior operator indicate that there are several strongly anomalous silver values on the property, which Apollo will attempt to ground-truth in the coming exploration programs.

- Sampling done across the Mule claims by previous operator has identified a large Ag anomaly associated with the same suite of host rocks at the Waterloo property.

- Exploration at the Burcham prospect at Waterloo included assays from 27 surface samples:

- Assay peaks up to 14.10 g/t Au, 20.70 g/t Ag, 0.17% Cu, 22.80% Zn and 5.74 % Pb from various samples (see Table 1).

- Identification of strata-bound lenses and mantos that show strong potential for Cu, Zn and Pb mineralization.

Ross McElroy, President and CEO of Apollo, commented, “The addition of the Mule claims substantially enhances the Calico Project. Calico already hosts 3 discrete drill delineated zones with resource estimates along a 4km long trend, along the Calico fault zone. The Mule claims increase the overall land area of the Calico project by more than 2.5x. The new claims are strategically located to the east along the very prolific Calico mineralized corridor and represent a great opportunity for further discoveries. Apollo is committed to continuing to unlock value in California for our shareholders.”

Mule Claims Acquisition

The Mule claims are composed of 415 lode mining claims administered by the Bureau of Land Management. Mapping and sampling conducted by the previous operators across the Mule claims has identified a continuation of the mineralized Calico Fault System. The sedimentary rocks of the Barstow formation which hosts the Waterloo silver deposit, as well as the volcanic Pickhandle formation are pronounced all over the acquired claims. The contact between the Barstow and Pickhandle formation has demonstrated potential for gold mineralization as is seen at Waterloo. Sampling across the Mule claims has identified several strong Ag and Au anomalies. Apollo plans to conduct its own follow up exploration program on the Mule claims to better develop its own exploration targets and delineate where this highly prospective contact is exposed.

Details of the Transaction

The Mule claims were acquired by Apollo’s wholly owned U.S. subsidiary, Stronghold Silver USA Corp. (“Stronghold”), from LAC. As consideration for the acquisition, Apollo paid US$250,000 in cash, and LAC retains a 2.0% net smelter return royalty (the “Royalty”) on the Mule claims.

Apollo, through Stronghold, retains the right to buy back 1.0% of the Royalty at any time on or before the date that is thirty (30) days from the date of commencement of commercial production, for a payment of US$1,000,000.

Figure 1: Map of Calico Project in San Bernardino, California

2025 Burcham Exploration Program

The Company has completed its previously announced surface exploration work at its Burcham prospect (see news release dated February 12, 2025). The work completed consisted of detailed mapping, sample collection and target generation, with the aim to follow up with future drilling.

The exploration team has completed some of the most detailed mapping to date at the Calico Project, including previous programs at Langtry and Waterloo. Structures dominating at Burcham are similar to those at Waterloo with the system being dominated by the Calico Fault, a sinuous moderately plunging reverse fault that dips steeply to the north. Potential for Au mineralization is strong along the contact of the Burcham and Pickhandle formations. Previously unrecognised, stratiform mantos and lenses occupying fold flexures show strong potential for Cu mineralization. This type of mantos have been historically mined on the north side of the Waterloo deposit, and occur near the contact between the Pickhandle Formation and the overlying Barstow Formation. Historic mining on the North side of Waterloo Deposit targeted a manto about 1.5 m thick. Copper mineralization is associated with strong hydrothermal alteration which is seen to diminish as you move eastward along the property. Assays of the sample results are presented in Table 1.

Figure 2: Summary Map of Burcham Exploration Program

Table 1: Location and Assay Results of Samples Collected

Sampling and Quality Assurance/Quality Control

Grab samples were collected in the field and a 2 kg representative sample was sent for analysis. Rock samples are catalogued and securely stored in a warehouse facility in Barstow, California until they are ready for secure shipment to ALS Global Geochemistry in Reno, Nevada (“ALS Reno”) for sample preparation and gold analysis. After preparation, splits of prepared pulps are securely shipped to ALS Vancouver, British Columbia for analysis.

Samples were prepared at ALS Reno (Prep-31 package) with each sample crushed to better than 70% passing a 2 mm (Tyler 9 mesh, U.S. Std. No. 10) screen. A split of 250 g is taken and pulverized to better than 85% passing a 75-micron (Tyler 200 mesh, U.S Std. No 200) screen. Surface samples were analyzed using complete characterization via the CCP-PK05 methods, which include whole rock analysis (ME-ICP06), ME-MS61, single element trace method using aqua regia digestion and ICP-MS (ME-MS42) and rare earth elements using the method ME-ME81, which consists of lithium borate fusion followed by ICP-MS. All surface samples were submitted for gold analysis by fire assay (Au-AA23). Over-range samples analyzed for copper, lead and zinc were re-submitted for analysis using a four-acid digestion and ICP-AES finish (method OG62) with a range of 0.001-50% for copper, 0.001-20% for lead, and 0.001-30% for zinc. Gold was analyzed by fire assay with atomic absorption finish (method Au-AA25) with a reportable range of 0.01-100 ppm Au. All analyses were completed at ALS Vancouver except for gold by fire assay, which was completed at ALS Reno.

Apollo’s QA/QC program includes ongoing auditing of all results from the laboratories. The Company’s Qualified Person is of the opinion that the sample preparation, analytical, and security procedures followed are sufficient and reliable. The Company is not aware of any sampling issues or other factors that could materially affect the accuracy or reliability of the data reported herein.

2025 Marketing Initiatives

The Company also announces that it has engaged Creative Direct Marketing Group, Inc. (“CDMG”), an arm’s-length service provider, to provide creative services in accordance with the policies of the TSX Venture Exchange (“TSXV”) and applicable securities laws. Based in Nashville, Tennessee, CDMG specializes in marketing, advertising, and public awareness across various sectors, including mining and metals.

Pursuant to a work order dated May 16, 2025 (the “Agreement”), the Company has retained CDMG’s for a one-time fee of approximately US$129,800. The Agreement represents a creative budget for marketing and advertising services (the “Services”), enabling CDMG to begin preparing content that may be used in future campaigns. No specific marketing campaign has been prepared, approved, or scheduled at this time. The engagement is subject to the approval of the TSX Venture Exchange.

Qualified Person

The scientific and technical data contained in this news release was reviewed and approved by Isabelle Lépine, M.Sc., P.Geo., Apollo’s Director, Mineral Resources. Ms. Lépine is a registered professional geologist in British Columbia and a QP as defined by NI 43-101 and is not an independent of the Company.

About Apollo Silver

Apollo Silver has assembled an experienced and technically strong leadership team who have joined to advance quality precious metals projects in sought after jurisdictions. The Company is focused on advancing its portfolio of two prospective silver exploration and resource development projects, the Calico Project, in San Bernardino County, California and the Cinco de Mayo Project, in Chihuahua, Mexico.

Please visit www.apollosilver.com for further information.

ON BEHALF OF THE BOARD OF DIRECTORS

Ross McElroy, President and CEO

For further information, please contact:

Amandip Singh, VP Corporate Development

Telephone: +1 (604) 428-6128

Email: info@apollosilver.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding “Forward-Looking” Information

This news release includes “forward-looking statements” and “forward-looking information” within the meaning of Canadian securities legislation. All statements included in this news release, other than statements of historical fact, are forward-looking statements including, without limitation the expected benefits and strategic rationale of the Mule claims acquisition; the timing, scope, and success of planned exploration activities, including mapping, sampling, and drilling at the Burcham prospect; the potential for silver, gold, and copper mineralization; and the Company’s ability to advance, develop, and permit the Calico Project. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, “potential”, “target”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof.

Forward-looking statements are based on the reasonable assumptions, estimates, analysis, and opinions of the management of the Company made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management of the Company believes to be relevant and reasonable in the circumstances at the date that such statements are made. Forward-looking information is based on reasonable assumptions that have been made by the Company as at the date of such information and is subject to known and unknown risks, uncertainties and other factors that may have caused actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks associated with mineral exploration and development; metal and mineral prices; availability of capital; accuracy of the Company’s projections and estimates; realization of mineral resource estimates, interest and exchange rates; competition; stock price fluctuations; availability of drilling equipment and access; actual results of current exploration activities; government regulation; political or economic developments; environmental risks; insurance risks; capital expenditures; operating or technical difficulties in connection with development activities; personnel relations; and changes in Project parameters as plans continue to be refined. Forward-looking statements are based on assumptions management believes to be reasonable, including but not limited to the price of silver, gold and Ba; the demand for silver, gold and Ba; the ability to carry on exploration and development activities; the timely receipt of any required approvals; the ability to obtain qualified personnel, equipment and services in a timely and cost-efficient manner; the ability to operate in a safe, efficient and effective matter; and the regulatory framework regarding environmental matters, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward looking information contained herein, except in accordance with applicable securities laws. The forward-looking information contained herein is presented for the purpose of assisting investors in understanding the Company’s expected financial and operational performance and the Company’s plans and objectives and may not be appropriate for other purposes. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.