Highlights include 58.8m @ 2.11g/t PGM+Au, and 19.8m @ 2.68g/t PGM+Au

VANCOUVER, BC, Nov. 2, 2022 /CNW/ – Bravo Mining Corp. (TSXV: BRVO) (OTCQX: BRVMF), (“Bravo” or the “Company“) today announced that it has received assay results from an additional nine infill diamond drill holes (“DDH”) from its Luanga palladium + platinum + rhodium + gold + nickel (3PGM+Au+Ni) project (“Luanga” or “Luanga PGM+Au+Ni“), located in the Carajás Mineral Province, state of Pará, Brazil.

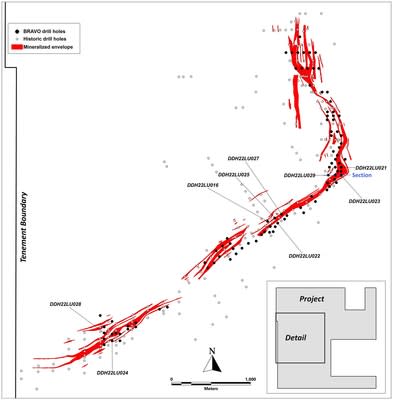

“Drill hole DDH22LU029, which intersected 58.8m @ 2.11g/t 3PGM+Au from 9.7m, is one of the broadest zones of 3PGM+Au mineralization intersected at Luanga to date. This drill hole also demonstrates that multiple stacked 3PGM+Au+Ni zones exist stratigraphically above (see section attached) and below the previously defined mineralized horizons. This increases our confidence in both the overall 3PGM+Au+Ni potential of Luanga, and the potential for higher-grade nickel sulphide mineralization given the 39.4m @ 0.16% Ni intersected from 29.1m,” said Luis Azevedo, Chairman and CEO of Bravo. “Furthermore, DDH22LU029 intersected a zone of nickel-rich disseminated sulphides below the main mineralized horizons (see section attached), yet still within the same orthopyroxenite host stratigraphy, again opening the possibility for new as yet unseen styles of nickel sulphide mineralization at depth.”

Highlights

- The infill drilling campaign continues to advance rapidly, while results compare well with, or exceed, the intercepts in historic drill holes on nearby drill sections, in both tenor and mineralized thicknesses.

- Highlights of Bravo’s recent intercepts are tabulated below, with details attached:

| HOLE-ID | From(m) | To(m) | Thickness (m) | Pd(g/t) | Pt(g/t) | Rh(g/t) | Au (g/t) | PGM + Au (g/t) | Ni (% Sulphide) | TYPE |

| DDH22LU029 | 9.7 | 68.5 | 58.8 | 1.33 | 0.64 | 0.09 | 0.06 | 2.11 | NA | Ox/FR |

| Including | 29.1 | 68.5 | 39.4 | 1.12 | 0.48 | 0.07 | 0.07 | 1.74 | 0.16 | FR |

| And | 108.4 | 117.1 | 8.7 | 2.12 | 1.70 | 0.24* | 0.03 | 4.09* | 0.05 | FR |

| And | 158.5 | 165.0 | 6.5 | 0.33 | 0.14 | 0.01 | 0.01 | 0.50 | 0.43 | FR |

| DDH22LU016 | 55.5 | 75.3 | 19.8 | 0.48 | 1.94 | 0.26 | 0.01 | 2.68 | 0.06 | FR/LS |

| DDH22LU022 | 81.2 | 101.0 | 19.8 | 1.27 | 0.77 | 0.12 | 0.05 | 2.21 | 0.23 | FR |

| Notes: All ‘From’, ‘To’ depths, and ‘Thicknesses’ are downhole. |

| Given the orientation of the hole and the mineralization, the intercept is estimated to be 80% to 90% of true thickness. |

| Type: Ox = Oxide. LS = Low Sulphur. FR = Fresh Rock. Recovery methods and results will differ based on the type of mineralization. |

| NA: Not Applicable as intercept is oxide or a mix of oxide and fresh rock mineralization. |

| * = Includes Rh >1.00g/t result. Overlimit analyses pending. |

- In addition, two diamond drill holes were completed on two drill sections, 50m north and south of DDH22LU047, the hole that intercepted massive sulphides (see August 16th, 2022 news release). All four step out drill holes have intersected varying amounts of semi-massive sulphides. Assay results are pending.

- Downhole Electromagnetic surveys (“EM”) on these 4 drill holes, and surface fixed loop EM over the Luanga deposit, have commenced.

- 102 drill holes have been completed, for a total of 17,337 metres (or 68% of Phase 1 Drilling Program), including 6 twin holes and 6 metallurgical holes.

- 17,689 samples submitted for assay to date including 3,216 re-assay samples from historic drill core.

- 6 drill rigs operating onsite.

Luanga Drill Program

The Phase 1 diamond drill program continues as planned at Luanga. Six drill rigs are on site, with drilling progressing in various locations along the entire 8.1km strike length of the known Luanga mineralized envelope. To date, 102 drill holes have been completed, for a total of 17,337 metres (or 68%) of the planned 25,500 metre Phase 1 drill program.

Complete Table of Intercepts

| HOLE-ID | From(m) | To(m) | Thickness (m) | Pd(g/t) | Pt(g/t) | Rh(g/t) | Au (g/t) | 3PGM + Au (g/t) | Ni (% Sulphide) | TYPE |

| DDH22LU016 | 55.5 | 75.3 | 19.8 | 0.48 | 1.94 | 0.26 | 0.01 | 2.68 | 0.06 | FR/LS |

| DDH22LU021 | 8.0 | 13,0 | 5.0 | 0.29 | 0.24 | <0.01 | 0.01 | 0.54 | NA | Ox |

| DDH22LU022 | 81.2 | 101.0 | 19.8 | 1.27 | 0.77 | 0.12 | 0.05 | 2.21 | 0.23 | FR |

| DDH22LU023 | 0.0 | 7.0 | 7.0 | 0.38 | 0.30 | <0.01 | 0.03 | 0.62 | NA | Ox |

| DDH22LU024 | 66.6 | 76.0 | 9.4 | 0.77 | 0.29 | 0.12 | 0.05 | 1.24 | 0.22 | FR |

| DDH22LU025 | 28.5 | 37.5 | 9.0 | 0.85 | 0.55 | 0.15 | 0.02 | 1.57 | 0.17 | FR |

| DDH22LU027 | 88.1 | 91.1 | 3.0 | 0.42 | 0.27 | 0.03 | 0.01 | 0.73 | 0.01 | FR |

| And | 95.6 | 103.6 | 8.0 | 0.26 | 0.09 | 0.05 | 0.01 | 0.40 | 0.01 | FR/LS |

| DDH22LU028 | 0.0 | 24.0 | 24.0 | 0.25 | 0.26 | <0.01 | 0.01 | 0.52 | NA | FR |

| DDH22LU029 | 9.7 | 68.5 | 58.8 | 1.33 | 0.64 | 0.09 | 0.06 | 2.11 | NA | Ox/FR |

| Including | 29.1 | 68.5 | 39.4 | 1.12 | 0.48 | 0.07 | 0.07 | 1.74 | 0.16 | FR |

| And | 108.4 | 117.1 | 8.7 | 2.12 | 1.70 | 0.24* | 0.03 | 4.09* | 0.05 | FR |

| And | 158.5 | 165.0 | 6.5 | 0.33 | 0.14 | 0.01 | 0.01 | 0.50 | 0.43 | FR |

| Notes: All ‘From’, ‘To’ depths, and ‘Thicknesses’ are downhole. |

| Given the orientation of the hole and the mineralization, the intercept is estimated to be 80% to 90% of true thickness. |

| Type: Ox = Oxide. LS = Low Sulphur. FR + Fresh Rock. Recovery methods and results will differ based on the type of mineralization. |

| NA: Not Applicable as intercept is oxide or a mix of oxide and fresh rock mineralization. |

| * = Includes Rh >1.00g/t result. Overlimit analyses pending. |

About Bravo Mining Corp.

Bravo is a Canada and Brazil-based mineral exploration and development company focused on advancing its Luanga 3PGM + Au + Ni Project in the world-class Carajás Mineral Province of Brazil.

The Luanga Project benefits from being in a location close to operating mines, with excellent access and proximity to existing infrastructure, including road, rail and clean and renewable hydro grid power. The project area was previously de-forested for agricultural grazing land. Bravo’s current Environmental, Social and Governance activities includes replanting trees in the project area, hiring and contracting locally, and ensuring protection of the environment during its exploration activities.

Technical Disclosure

Technical information in this news release has been reviewed and approved by Simon Mottram, F.AusIMM (Fellow Australia Institute of Mining and Metallurgy), President of Bravo Mining Corp. who serves as the Company’s “qualified person”, as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101“). Mr. Mottram has verified the technical data and opinions contained in this news release.

Forward Looking Statements

This news release contains forward-looking information which is not comprised of historical facts. Forward-looking information is characterized by words such as “Exceptional”, “High-Grade”, “Highlights”, “broadest”, “multiple”, “confidence”, “potential”, “rich”, “possibility”, “as yet unseen”, “continues”, “compare well”, “exceed”, “highlights”, and other similar words, phrases or statements that certain events or conditions “should”, or “will” occur. In particular, this news release contains forward-looking information pertaining to the Company’s ongoing re-assay and drill programs and the results thereof; the expected completion of geophysical surveys and the results of such surveys; the potential for the definition o new styles of mineralization and extensions to depth and the Company’s plans in respect thereof. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, and opportunities to differ materially from those expressed or implied by such forward-looking information. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, changes in the state of equity and debt markets, fluctuations in commodity prices, delays in obtaining required regulatory or governmental approvals, environmental risks, limitations on insurance coverage; and other risks and uncertainties involved in the mineral exploration and development industry. Forward-looking information in this news release is based on the opinions and assumptions of management considered reasonable as of the date hereof, including, but not limited to, the assumption that the assay results confirm the interpreted mineralization contains significant values of nickel, copper and also contain PGMs and Au; final drill and assay results will be in line with management’s expectations; that activities will not be adversely disrupted or impeded by regulatory, political, community, economic, environmental and/or healthy and safety risks; that the Luanga Project will not be materially affected by potential supply chain disruptions; and general business and economic conditions will not change in a materially adverse manner. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information. The Company disclaims any intention or obligation to update or revise any forward-looking information, other than as required by applicable securities laws.

Schedule 1: Drill Hole Collar Details

| HOLE-ID | Company | East (m) | North (m) | RL (m) | Datum | Depth (m) | Azimuth | Dip | |

| DDH22LU016 | Bravo | 659067.99 | 9341140.05 | 231.20 | SIRGAS2000 UTM22S | 199.05 | 90.00 | -60.00 | |

| DDH22LU021 | Bravo | 660000.70 | 9341825.04 | 256.77 | SIRGAS2000 UTM22S | 250.00 | 90.00 | -60.00 | |

| DDH22LU022 | Bravo | 659195.85 | 9341118.15 | 227.84 | SIRGAS2000 UTM22S | 150.30 | 330.00 | -60.00 | |

| DDH22LU023 | Bravo | 660000.02 | 9341721.99 | 241.36 | SIRGAS2000 UTM22S | 250.05 | 90.00 | -60.00 | |

| DDH22LU024 | Bravo | 657100.06 | 9339629.97 | 259.19 | SIRGAS2000 UTM22S | 170.00 | 360.00 | -60.00 | |

| DDH22LU025 | Bravo | 659158.01 | 9341182.98 | 225.69 | SIRGAS2000 UTM22S | 150.35 | 330.00 | -60.00 | |

| DDH22LU027 | Bravo | 659245.18 | 9341231.67 | 229.00 | SIRGAS2000 UTM22S | 150.35 | 330.00 | -60.00 | |

| DDH22LU028 | Bravo | 657000.01 | 9339729.10 | 296.06 | SIRGAS2000 UTM22S | 170.40 | 360.00 | -60.00 | |

| DDH22LU029 | Bravo | 659836.03 | 9341725.05 | 243.28 | SIRGAS2000 UTM22S | 183.75 | 90.00 | -60.00 |

Schedule 2: Assay Methodologies and QAQC

Samples follow a chain of custody between collection, processing and delivery to the ALS laboratory in Parauapebas, state of Pará, Brazil. The drill core is delivered to the core shack at Bravo’s Luanga site facilities and processed by geologists who insert certified reference materials, blanks and duplicates into the sampling sequence. Drill core is half cut and placed in secured polyurethane bags, then in security-sealed sacks before being delivered directly from the Luanga site facilities to the Parauapebas ALS laboratory by Bravo staff. Additional information about the methodology can be found on the ALS global website (ALS) in the analytical guides.

Quality Assurance and Quality Control (“QAQC“) is maintained internally at the lab through rigorous use of internal certified reference materials, blanks, and duplicates. An additional QAQC program is administered by Bravo using certified reference materials, duplicate samples and blank samples that are blindly inserted into the sample batch. If a QAQC sample returns an unacceptable value an investigation into the results is triggered and when deemed necessary, the samples that were tested in the batch with the failed QAQC sample are re-tested.

| Bravo ALS | |||||

| Preparation | Method | Method | Method | Method | |

| For All Elements | Pt, Pd, Au | Rh | Ni-Sulphide | Trace Elements | |

| PREP-31B | PGM-ICP27 | Rh-MS25 | Ni-ICP05 | ME-ICP61 |

SOURCE Bravo Mining Corp.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2022/02/c5677.html