Rumble: https://rumble.com/v74c700-chris-temple-interview-gold-silver-and-what-comes-next.html

Key Points

Silver, often nicknamed the ‘Devil’s metal’ because of its volatility, has reached record highs this year and still has further to run despite a supply crunch, according to experts.

The metal’s growth value has been running alongside gold’s, which has seen its own rally with the price surging past $4,000 an ounce this year.

Silver prices reached a historic peak of $54.47 per troy ounce in mid October, marking a 71% rise year-on-year. They’ve since pared back gains somewhat, but are now growing again, despite low supply levels.

“Some people were having to transport silver by plane rather than on cargo ships to meet delivery demand,” Paul Syms, head of EMEA ETF Fixed Income and commodity product management at Invesco, told CNBC.

“While we’ve seen the spike up, we’ve seen the price come down a little bit. Longer term, there’s a different dynamic this time that could keep silver at reasonably high prices and maybe continuing to go up for some time to come,” he added.

October was only the third time in the past 50 years where silver prices peaked. Other silver price highs include January 1980, when the Hunt brothers amassed a third of the world’s supply as they attempted to corner the market, as well as 2011, following the U.S. debt ceiling crisis when silver and gold were embraced as safe haven assets.

“Silver is only about a tenth the size of the gold market, and that short squeeze, obviously, sort of caught a few investors by surprise,” said Syms.

Unlike the previous investment waves, silver’s boom in 2025 relied on a mix of low supply and high demand from India as well as industrial needs and tariffs.

“After Liberation Day, the gold price spiked, but silver actually went down a little bit. And the gold-silver ratio spiked to above 100,” said Syms, referring to the gold-silver ratio which reflects how many ounces of silver are needed to buy one ounce of gold.

A low ratio means gold is relatively cheap, while a high ratio indicates silver is undervalued and likely to rise. In April, the ratio reached a historic high.

“The risk managers in financial and industrial entities did not want to let any metal go out of the States for fear that it might come back in at 35% higher for example,” said Rhona O’Connell, head of market analysis EMEA and Asia at Stone X.

Fast forward to the Autumn and silver entered its peak demand, especially as India’s monsoon and harvest seasons came to an end.

“Farmers don’t really like the banks very much, so gold and latterly, silver, tend to be the first port of call when they’ve got the harvest in,” said O’Connell.

India is also the world’s largest consumer of silver, with about 4,000 metric tons used every year, mostly for jewelry, utensils and ornaments.

The silver appeal this Autumn also coincided with Diwali, a five-day ‘Festival of Lights’ celebrating prosperity and good fortune and also India’s biggest public holiday.

While gold is traditionally a favorite, this year silver — an affordable investment option in a country where about 55% of the population depends on agriculture for their livelihood — outshined other metals.

On Oct. 17, the price of silver in India rose sharply, reaching a record high of 170,415 rupees a kilogram — an 85% rise since the start of the year.

However, 80% of India’s silver supply is imported. The UAE and China are increasingly supporting that demand, but the U.K. is traditionally India’s largest silver supplier.

Yet, London’s vaults have been emptying rapidly for the past few years. In June 2022, the London Bullion Market Association held 31,023 metric tons of silver. By March 2025, volumes had fallen by around a third to 22,126 metric tons — its lowest point in years.

“What isn’t necessarily so visible to people is what’s happening in the vaults,” said O’Connell. “And that had reached a point where there was basically there was no available metal left in London.”

In October, the squeeze was such that traders had to pay much higher borrowing costs – or lease rates – to close their positions.

“At one stage, to borrow overnight was costing 200% on an annualized basis, so a lot of people were very stressed to put it mildly,” said O’Connell.

Supply is a constant issue for silver, as for other precious and rare metals. The Silver Institute’s 2025′s World Silver Survey estimates that mine production has been decreasing over the past 10 years, especially in Central and South America.

“Over the course of the past twelve months or so, the underlying surplus has started to turn into a deficit for three reasons: the impact of the electrification of the vehicle fleet, artificial intelligence, and photovoltaics,” said O’Connell.

Register Here: New Orleans Investment Conference

🔗 Connect with Apollo Silver Corp.:

APOLLO SILVER: TSX.V: APGO | OTCQB: APGOD

Website: https://apollosilver.com/

Phone: 1 (604) 428-6128

Info: info@apollosilver.com

Corporate Deck: http://bit.ly/42ekw60

Calico 43-101: http://bit.ly/3IFBxiM

Ciinco De Mayo 43-101: http://bit.ly/42KNhHE

Apollo Silver – https://apollosilver.com/

TSX.V: APCO | OTCQB: APGOF | Frankfurt: 6ZF0

Now, I’ve seen a thing or two in my time, from the muddy banks of the Mississippi to the wild, woolly, and mostly-full-of-lies silver rushes out West. The talk of riches—it’s like a siren’s song, ain’t it? It’ll make a man forget his grammar, his good sense, and sometimes his very trousers. The world is full of fellows who’d sell you a gold brick made of brass, and another sort who’ll show you a hole in the ground and swear it’s a direct-to-Heaven express line for your pocketbook.

And so it is, that a body must approach a matter of finance with a mind as clear as a bottle of good whiskey before the cork’s been pulled. And I’ve been looking at this Apollo Silver business, and it’s a curious thing, a right proper puzzle for a man who’s seen a few. It ain’t about the grand promises of a bonanza that’ll make you the next Rockefeller, a-building libraries and a-dressing in finery. No sir. That kind of talk is for the greenhorns and the giddy.

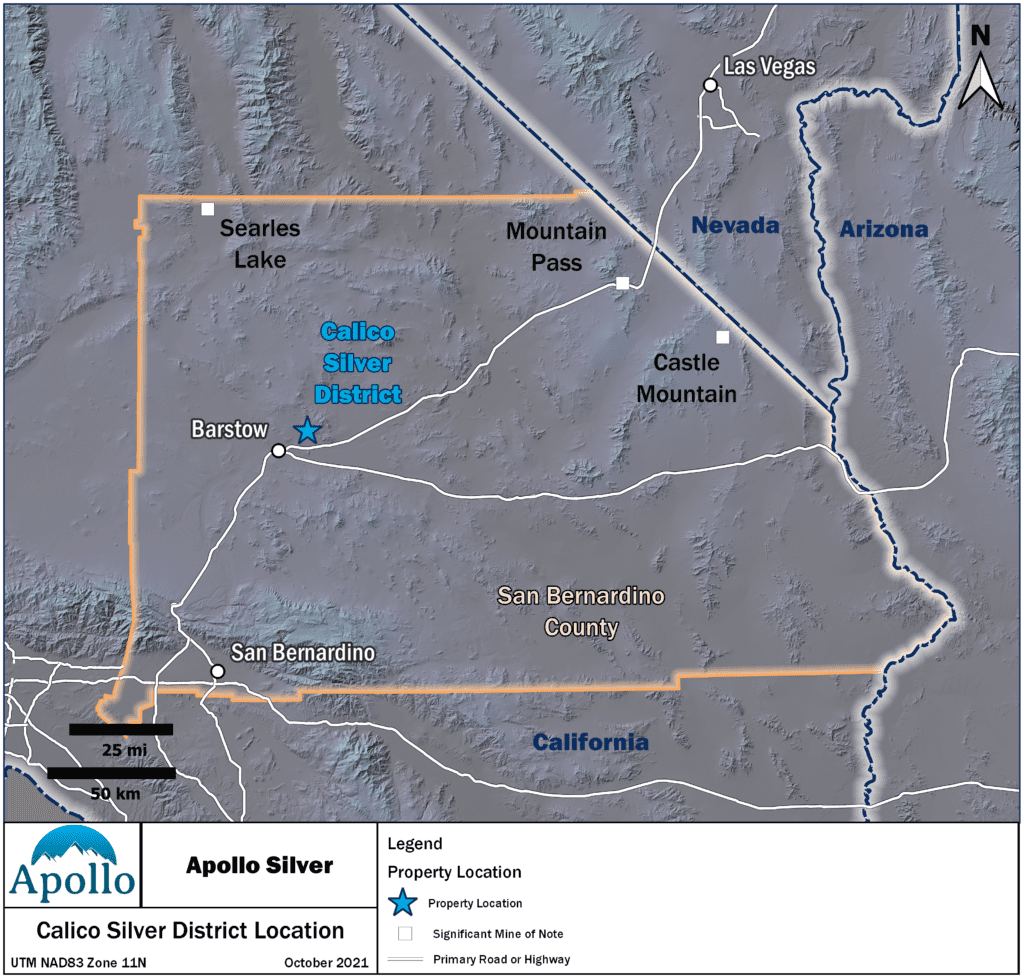

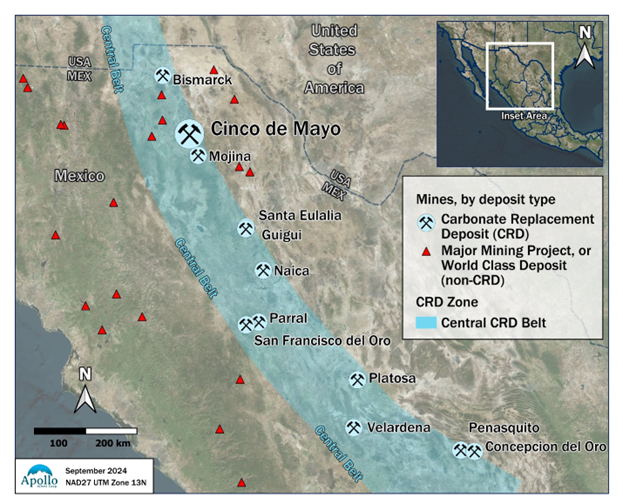

What’s to be said for Apollo is a different tune entirely. It’s a calm, measured sort of melody, like a riverboat gliding on a Sunday afternoon. You see, they’ve got this Calico project out in California, and another one, Cinco de Mayo, down in Mexico. And when they speak of it, they ain’t waving their arms about or using words too big for their boots. They’re talking about a mineral resource. And not just a vague promise, but numbers that have been “measured,” “indicated,” and “inferred.” That’s the part that sticks to a man’s ribs like a good meal.

And there’s history to back it up, too. The Calico district ain’t some new-fangled idea; it’s a place where they’ve been pulling silver from the earth for a long spell. Back in 1881, after a big discovery, Calico became a real humdinger of a town. It was a place that produced millions of dollars in silver over a dozen years, a wild and colorful place that drew in folks from all over the globe, a town with a name that came right from the “calico-colored” mountains themselves. A fella by the name of Walter Knott, who had a berry farm and a fondness for history, even went and restored the old place after it became a ghost town. So, the ground there, it’s got a reputation.

And in that reputable ground, they’ve got a proper accounting. The Calico project is said to hold a mighty 110 million ounces of silver in the “Measured and Indicated” category, which is a powerful lot of the shiny stuff. And on top of that, there’s another 51 million ounces of silver in the “Inferred” category. That’s a sum a body can get his head around.

Now, as for the Cinco de Mayo project down in Chihuahua, Mexico, well, that region is a whole other book of stories. Mexico’s got a history with silver that goes back centuries, and a fella who knows a thing or two about rocks will tell you that the very geology of the area is famous for these “carbonate replacement deposits,” the kind that have been responsible for a good 40% of all the silver ever pulled out of the ground in that country. And while their report on this project is of a historical nature, it still speaks to a substantial resource, with a historical estimate of 52.7 million ounces of silver in the “Inferred” category. It’s a testament to the region’s long-standing character.

Now, I’ve seen men go bust on a whim, throwing their money at some fly-by-night scheme with a map that had more flourishes than truth. But this here, this is a matter of geography and common sense. It’s in places where they’ve been digging silver for a hundred years, and where the land itself seems to say, “Why yes, there’s more where that came from.” And the folks in charge—they’ve got a long-standing acquaintance with the business of pulling wealth from the earth, not just from the pockets of others.

So, a man must ask himself, what’s the virtue in this? The virtue is in the lack of fancy. It’s a bet on what’s already there, not what might be. It’s the difference between a high-stakes poker game where you might lose your shirt, and a man walking into a store to buy a new one. It ain’t a get-rich-quick scheme. It’s a slow, deliberate trundle down the road of reason. And in a world where every huckster with a shovel has a story to tell, a story about a resource measured and counted is a mighty comfortable thing to rest your hat on.

(Please note: Apollo Silver is a sponsor of Proven And Probable, and we are biased.)

In this episode of ‘Proven and Probable,’ we engage with Bob Moriarty, a distinguished commentator on geopolitical and economic affairs. Bob’s extensive experience includes serving as a Marine F-4B pilot during the Vietnam War, where he flew over 820 combat missions and became one of the most highly decorated pilots of the conflict.

We delve into the recent tragic collision between an American Airlines plane and a military helicopter near Washington, D.C., exploring Bob’s insights on the incident, the National Transportation Safety Board’s investigative approach, and media coverage.

The discussion also covers U.S. tariff policies, international responses, and the current state of gold and precious metals, providing a comprehensive analysis of these pressing issues.

Join us for an in-depth conversation that offers clarity and depth on these complex topics.