Tag: proven and probable

Click to Open Press Release

https://wcsecure.weblink.com.au/pdf/WWI/02461931.pdf

ABOUT WEST WITS MINING LIMITED

West Wits Mining Limited (ASX: WWI) is focused on the exploration, development and production of high value precious and base metals for the benefit of shareholders, communities and environments in which it operates. Witwatersrand Basin Project, located in the proven gold region of Central Rand Goldfield of South Africa, boasts a 4.28Moz gold project at 4.58 g/t Au. The Witwatersrand Basin is a largely underground geological formation which surfaces in the Witwatersrand. It holds the world’s largest known gold reserves and has produced over 1.5 billion ounces (over 40,000 metric tons), which represents about 22% of all the gold accounted for above the surface7. In Western Australia, WWI is exploring for gold and copper at the Mt Cecilia Project in a district that supports several world-class projects such as Woodie Woodie manganese mine, Nifty copper and Telfer

gold/copper/silver mines.

For further information contact:

Australia

Victoria Humphries / Peter Taylor

Investor Relations

victoria@nwrcommunciations.com.au /

peter@nwrcommunications.com.au

North America, Canada and UK

Jody Kane / Jonathan Paterson

jody.kane@harboraccessllc.com /

jonathan.paterson@harboraccessllc.com

General info@westwitsmining.com

www.westwitsmining.com

Toronto, Ontario, Dec. 01, 2021 (GLOBE NEWSWIRE) —

Silver Bullet Mines Corp. (TSXV: SBMI) (“Silver Bullet” or the “Company”), formerly Pinehurst Capital I Inc., is pleased to announce that the Company has closed its qualifying transaction (the “Transaction”) previously announced in the Company’s comprehensive press releases dated November 12, 2020 and June 28, 2021 and more particularly set out in its filing statement dated September 27, 2021 (the “Filing Statement”) which is available under the Company’s profile at www.sedar.com, subject to final approval of the TSX Venture Exchange (the “TSXV”). The Company’s shares, which had traded on the TSXV, were halted on August 27, 2020, at the Company’s request pending completion of the Transaction and receipt of final approval of the TSXV. The Company’s common shares will commence trading on the TSXV as a Tier 2 mining issuer under the symbol “SBMI” on or about December 6, 2021.

The Transaction

Pursuant to an amalgamation agreement, Pinehurst I Acquisition Corp., a wholly owned subsidiary of the Company, and an entity formerly named Silver Bullet Mines Inc. amalgamated under the Canada Business Corporations Act (the “Amalgamation”) to form Silver Bullet Mining Inc. As a result of the Amalgamation, (i) all common shares of Pinehurst Capital I Inc. were consolidated on the basis of one (1) post-consolidation common share for every 2.1428 pre-consolidation common shares (the “Consolidation”); and (ii) in exchange for each (1) security held in the capital of Silver Bullet Mining Inc., each securityholder received one (1) security in the capital of the Company. Concurrently with the closing of the Transaction, the Company changed its name to Silver Bullet Mines Corp.

Outstanding Share Capital and Escrow

Following the closing of the Transaction, the Company has a total of 55,458,038 common shares issued and outstanding. An aggregate 24,071,668 common shares and 2,605,763 stock options held by the principals of the Company are subject to Tier 2 Surplus Security Escrow and will be released from escrow as follows: five percent (5%) of the escrowed shares will be released from escrow on the issuance of the final exchange bulletin confirming the completion of the Transaction by the TSXV (the “Final Exchange Bulletin”), five percent (5%) will be released 6 months thereafter, ten percent (10%) will be released 12 months and 18 months following the issue of the Final Exchange Bulletin, fifteen percent (15%) will be released 24 months and 30 months following the issue of the Final Exchange Bulletin, and the balance of forty percent (40%) will be released 36 months after the issue of the Final Exchange Bulletin. An additional 6,000,000 shares and 428,571 stock options held by non-principals of the Company are subject to Tier 2 Value Security Escrow and will be released from escrow as follows: ten percent (10%) of the escrowed shares will be released from escrow on the issuance of the Final Exchange Bulletin, fifteen percent (15%) will be released on each of the 6 months, 12 months, 18 months, 24 months, 30 months and 36 months thereafter.

New Board and Management

On closing of the Transaction, David Rosenkrantz, Daniel Tobon, Ilana Prussky, John A. Leja, Maurice Kagan and Shael Soberano resigned as the directors and officers of the Company.

On closing, the following individuals were appointed as directors and officers of the Company:

John Carter – CEO and Director

Ron Wortel – President and Director

Ron Murphy – Vice President Mining and Director

Eric Balog – Director

J. Birks Bovaird – Director

Peter Clausi – Vice President Capital Markets and Director

Jon Wiesblatt – Director

Brian Crawford – Chief Financial Officer and Corporate Secretary

The incoming board of directors would like to thank Messrs. Rosenkrantz, Tobon, Leja, Kagan and Soberano and Ms. Prussky for their contributions and service to the Company.

For further information, please contact:

John Carter

Silver Bullet Mines Corp.

e: info@silverbulletmines.com

p: 905-302-3843

Neither the Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

The securities referenced herein have not been, nor will be, registered under the United States Securities Act of 1933, as amended, and may not be offered or sold within the United States or to, or for the account or benefit of, U.S. persons absent U.S. registration or an applicable exemption from U.S. registration requirements. This release does not constitute an offer for sale of securities in the United States.

Investors are cautioned that, except as disclosed in the Filing Statement, any information released or received with respect to the Transaction may not be accurate or complete and should not be relied upon.

VANCOUVER, BC / ACCESSWIRE / December 1, 2021 / Granite Creek Copper Ltd. (TSXV:GCX)(OTCQB:GCXXF) (“Granite Creek” or the “Company“) is pleased to announce the results of work completed by Sedgman Canada and Mining Plus on the Company’s Carmacks copper-gold-silver deposit in the Minto Copper Belt located in central Yukon, Canada. The Company has received a final report on studies that include review of alternate leach technologies, mine planning, ore sorting and other key elements which are expected to be highly influential on the updated preliminary economic assessment (“PEA”) planned for H1 2022.

Highlights include:

- Excellent results from initial metallurgical testing on sulfide material;

- Confirmation of in tank leaching as the preferred method of extraction of both copper and precious metals from oxide ores;

- Identification of conventional flotation as the preferred method of producing a copper concentrate from sulfide ores;

- Development of a draft underground mine plan, with sub-level block cave as the preferred underground mining method at Carmacks;

Granite Creek President & CEO, Tim Johnson, stated, “We are extraordinarily pleased with the results provided by Sedgman and Mining Plus and the degree of efficiency, expertise and professionalism they have demonstrated since Granite Creek initially engaged them in May of this year. The studies have provided a great deal of new insight and clarity on the best path forward as we continue to advance Carmacks toward updated economics and, ultimately, production. We are very confident that these elements of mine planning and optimization, combined with the updated 43-101 mineral resource estimate we anticipate in Q1, will form the basis of a robust new PEA. The Yukon is an exceptional mining jurisdiction, the Minto belt has excellent infrastructure and robust mineralization currently being mined by Minto Metals Corp. just to the north of us who are now publicly traded on the Venture Exchange. We look forward to additional announcements soon as the pieces continue to fall into place at Carmacks.”

Virtual Investor Conference – OTC Markets Group

Granite Creek will be presenting at the upcoming Mining & Metals Virtual Investor Conference hosted by OTC Markets Group on Wednesday, December 8th at 11:30 AM PT / 2:30 PM ET. Topics of discussion will include the Company’s 2021 drilling campaign, the mine planning and mineral processing results described herein, and implications for the expected updates to both the existing 43-101 mineral resource estimate and PEA. To register, click here.

Sedgman / Mining Plus Report Discussion

An initial review of geotechnical studies as referenced in the 2017 PEA1,2, has indicated that a sub-level block cave is likely the most cost-effective method of underground mining of Zone 1 at the Carmacks Deposit. Based on this, Granite Creek will now move to initiate costing studies to support an updated PEA that includes potential underground resources not only in Zone 1 but other adjacent zones. In addition, the Company will launch pit design and optimization efforts on mineralized zones that lie outside of the pit contemplated in the 2017 PEA. Specifically, Zones 2000S and 13 will see pit optimization scenarios that will determine how much material could potentially be mined via open pit and what portion of the resources will be extracted by underground mining methods.

Metallurgical testing of sulfide mineralization to determine recovery of copper minerals using conventional flotation technology to create a copper concentrate was highly successful, achieving copper recoveries of up to 95%. Further testing is planned to confirm these recovery rates and to add gold and silver to a concentrate scenario. This work will be used identify the correct sizing of a copper-gold-silver concentrator circuit and the associated economics.

Previous economic assessments did not consider the potential value from processing of the high-grade sulphide material at Carmacks, despite a defined sulfide resource. In conducting a comprehensive review of the Carmacks deposit and the Carmacks North target area, the presence of significant sulfide mineralization became immediately apparent and Granite Creek felt it prudent to examine its potential inclusion as a means to expand the overall resource, extend mine life and improve economics. The majority of the Company’s 2021 drilling campaign focused on delineating and expanding sulfide resources with both near surface and deeper targets explored. Both oxide and sulphide mineralized zones remain open to expansion, with a significant expansion of the sulphide resource anticipated in the upcoming resource estimate update in Q1 2022. The updated PEA will incorporate this expanded resource and will include review of the mining sequence including an assessment of whether any sulfide resources may be mined via open pit and the optimal sequence for sulfide flotation and oxide leaching.

Table 1. Current Mineral Resource Estimate on the Carmacks Copper Project1,2

| Category | Tonnes (000) | Cu (%) | Au (g/t) | Ag (g/t) | |

| Oxide & Transition Mineralization | Measured | 6,484 | 0.86 | 0.41 | 4.24 |

| Indicated | 9,206 | 0.97 | 0.36 | 3.80 | |

| M&I | 15,690 | 0.94 | 0.38 | 3.97 | |

| Inferred | 913 | 0.45 | 0.12 | 1.90 | |

| Sulphide Mineralization | Measured | 1,381 | 0.64 | 0.19 | 2.17 |

| Indicated | 6,687 | 0.69 | 0.17 | 2.34 | |

| M&I | 8,068 | 0.68 | 0.18 | 2.33 | |

| Inferred | 8,407 | 0.63 | 0.15 | 1.99 |

[1] JDS Energy and Mining. Feb 9, 2017. NI 43-101 Preliminary Economic Assessment Technical Report on the Carmacks Project, Yukon, Canada. Contained metal based on 23.76 million tonnes of NI 43-101 compliant resources in the Measured and Indicated categories grading 0.85% Cu, 0.31 g/t Au, 3.14 g/t Ag.

[2] Arseneau Consulting Services, 2016 Independent Technical Report on the Carmacks Copper Project, Yukon, Canada.

About Granite Creek Copper

Granite Creek, a member of the Metallic Group of Companies, is a Canadian exploration company focused on the 176 square kilometer Carmacks project in the Minto copper district of Canada’s Yukon Territory. The project is on trend with the high-grade Minto copper-gold mine, operated by Minto Metals Corp., to the north, and features excellent access to infrastructure with the nearby paved Yukon Highway 2, along with grid power within 12 km. More information about Granite Creek Copper can be viewed on the Company’s website at www.gcxcopper.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

Timothy Johnson, President & CEO

Telephone: 1 (604) 235-1982

Toll-Free: 1 (888) 361-3494

E-mail: info@gcxcopper.com

Website: www.gcxcopper.com

Metallic Group: www.metallicgroup.ca

Twitter: @yukoncopper

Qualified Person

Ms. Debbie James, P.Geo., a qualified person for the purposes of National Instrument 43-101, has reviewed and approved the technical disclosure contained in this news release.

Forward-Looking Statements

This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Granite Creek Copper believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Granite Creek Copper and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Granite Creek Copper Ltd.

View source version on accesswire.com:

https://www.accesswire.com/675433/Granite-Creek-Copper-Announces-Results-of-Mine-Planning-Mineral-Processing-Work-Conducted-on-the-Carmacks-Copper-Gold-Project-by-Sedgman-and-Mining-Plus

VANCOUVER, BC / ACCESSWIRE / December 1, 2021 / Noram Lithium Corp. (“Noram” or the “Company”) (TSX.V:NRM)(Frankfurt:N7R)(OTCQB:NRVTF) today announced the appointment of Peter A. Ball as President and Chief Operating Officer. The addition of Mr. Ball strengthens Noram’s Senior Management team as its 100%-owned Zeus Lithium Project in Nevada continues to transition from an advanced exploration project to a potential company-making development-stage asset with the imminent completion of its Preliminary Economic Assessment (“PEA”).

“We are excited to have Mr. Ball join our team as we transition from explorer to developer,” stated Mr. Sandy MacDougall, CEO of Noram Lithium. “Peter is an experienced capital markets executive and brings with him field experience from years in the mining sector. Peter adds considerable strength to our management team as we advance our Zeus Lithium Project toward production.”

“I am thrilled to join the exceptional team at Noram Lithium at this key transformational period of the Company’s advancement of its 100% owned high-grade Zeus Lithium Project,”commented Mr. Peter A. Ball, Noram’s new President and COO.“I appreciate the opportunity to be a part of Noram’s lithium development story and leverage the current global battery metals bull market. At Noram, we are executing an aggressive and focused resource development strategy to fully understand the economics of the Zeus Lithium Project. We believe the upcoming PEA, which is anticipated to be completed before the end of 2021, will clearly highlight to the market and global lithium and battery metal investors that the Zeus Project has the potential to not only reach the production stage, but significantly assist battery metal end-users tackle the demand/supply crunch clearly evident over the next decade and beyond. The Zeus Project’s resource model indicates a high-grade shallow lithium deposit located in Nevada, one of the top mining jurisdictions globally, and is also immediately adjacent to the only Lithium producer in United States. I look forward to contributing to what will be Noram’s biggest year ahead as we focus on aggressively elevating the Zeus Lithium Project amongst our peers and rewarding our supportive shareholders.”

Mr. Ball brings a progressive track record of proven leadership experience covering more than thirty years in the mining and finance sectors. He has demonstrated competencies in the resource industry on an international level, leveraging senior executive management roles in business, engineering, finance, and securities. Mr. Ball has served in various management and senior executive roles for numerous companies most recently in Nevada at NV Gold Corp., and including Redstar Gold Corp., Columbus Gold Corp., Hudson Bay Mining & Smelting, Echo Bay Mines Ltd., RBC Dominion Securities and Eldorado Gold Corp. Mr. Ball is a graduate of the Haileybury School of Mines, Georgian Business College and is a member of CIMM.

Noram has granted 1,000,000 incentive stock options to an officer and consultant of the Company. The Options are exercisable at a price of $0.77 per share for a period of ten (10) years, expiring on November 30, 2031. All options granted are in accordance with the Company’s 10% Rolling Stock Option Plan, and subject to TSX Venture acceptance.

About Noram Lithium Corp.

Noram Lithium Corp (TSX.V:NRM)(Frankfurt:N7R)(OTCQB:NRVTF) is a Canadian based advanced Lithium exploration stage company. Noram is aggressively advancing its 100%-owned Zeus Lithium Project in Nevada from the current advanced resource stage to the development-stage level through the completion of its Preliminary Economic Assessment by the end of 2021. The Company’s flagship asset is the Zeus Lithium Project (“Zeus”), located in Clayton Valley, Nevada. The Zeus Project contains a current 43-101 measured and indicated resource estimate of 363 million tonnes grading 923 ppm lithium, and an inferred resource of 827 million tonnes grading 884 ppm lithium utilizing a 400 ppm Li cut-off.

Noram’s long term strategy is to become a leader in the development of lithium deposits, become a low-cost producer and supplier, and sell lithium into the markets of Europe, North America and Asia.

Please visit our web site for further information: www.noramlithiumcorp.com.

ON BEHALF OF THE BOARD OF DIRECTORS

Sandy MacDougall

CEO and Director

Investor Relations Contact:

Rich Matthews

Managing Partner

Integrous Communications

rmatthews@integcom.us

+1 604 757 7179

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking information which is not comprised of historical facts. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes statements regarding, among other things, the completion transactions completed in the Agreement. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, regulatory approval processes. Although Noram believes that the assumptions used in preparing the forward-looking information in this news release are reasonable, including that all necessary regulatory approvals will be obtained in a timely manner, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Noram disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by applicable securities laws.

SOURCE: Noram Lithium Corp.

View source version on accesswire.com:

https://www.accesswire.com/675431/Noram-Announces-Appointment-of-President-and-Chief-Operating-Officer

YERINGTON, Nev., Nov. 30, 2021 (GLOBE NEWSWIRE) — Nevada Copper Corp. (TSX: NCU) (OTC: NEVDF) (FSE: ZYTA) (“Nevada Copper” or the “Company”) today provided an update on its operations, including advances at the Company’s underground mine at its Pumpkin Hollow Project (the “Underground Mine”) and an update on its 2022 development plan.

Underground Mine Operations Highlights

- Lateral Development Rates Continue to Rise. The Company has advanced approximately 760 lateral equivalent feet in the past 30 days, a 20% increase in average daily footage from the previous 30 days. Lateral development continues on multiple headings, providing access to ore mining zones in the East South orebody and advancing development towards the East North orebody.

- Sugar Cube to be Blasted Shortly. The high-grade Sugar Cube zone is planned to be drilled in December and mining is expected to commence in early Q1 2022. This will be the first stope mined in the East North orebody, which is expected to have higher quality ground conditions and significantly larger stope sizes.

- Processing Plant Operating Well. The mill continues to run at design specifications with the grinding, flotation, thickening, and concentrate filtration circuits performing well mechanically. The Company anticipates increased production and recovery rates with the addition of the Sugar Cube zone to the processing plant’s ore feed in Q1 2022.

- Surface Ventilation Fans on Schedule. The surface ventilation fans are on schedule to arrive on site in approximately 3 weeks with installation and commissioning expected to be completed on time in line with the demands of the mine plan.

2022 Development Plan Update

- Open Pit Drilling and Progressing. With additional funding received from the Company’s recent public equity offering, the Company intends to undertake an infill drilling campaign and to update its open pit studies to reflect opportunities for increased scale, larger resource and other optimization workstreams. Further updates on the Company’s 2022 development plan will be released shortly.

“I am pleased with the operational advances we have achieved this month, as we build on the progress from Q3,” stated Randy Buffington, President and Chief Executive Officer. “Our development rates continue to increase on a weekly basis and will soon provide access to the larger high-grade stopes, which is expected to result in increased ore feed delivered to our fully operational processing plant for a step further in our ramp-up progression.”

Qualified Persons

The technical information and data in this news release was reviewed by Greg French, C.P.G., VP Head of Exploration of Nevada Copper, and Neil Schunke, P.Eng., a consultant to Nevada Copper, who are non-independent Qualified Persons within the meaning of NI 43-101.

About Nevada Copper

Nevada Copper (TSX: NCU) is a copper producer and owner of the Pumpkin Hollow copper project. Located in Nevada, USA, Pumpkin Hollow has substantial reserves and resources including copper, gold and silver. Its two fully permitted projects include the high-grade Underground Mine and processing facility, which is now in the production stage, and a large-scale open pit project, which is advancing towards feasibility status.

NEVADA COPPER CORP.

www.nevadacopper.com

Randy Buffington, President and CEO

For further information contact:

Rich Matthews, Investor Relations

Integrous Communications

rmatthews@integcom.us

+1 604 757 7179

Cautionary Language

This news release includes certain statements and information that constitute forward-looking information within the meaning of applicable Canadian securities laws. All statements in this news release, other than statements of historical facts are forward-looking statements. Such forward-looking statements and forward-looking information specifically include, but are not limited to, statements that relate to mine development, production and ramp-up objectives, equipment installation, drilling programs and the completion of a new feasibility study.

Forward-looking statements and information include statements regarding the expectations and beliefs of management. Often, but not always, forward-looking statements and forward-looking information can be identified by the use of words such as “plans”, “expects”, “potential”, “is expected”, “anticipated”, “is targeted”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the negatives thereof or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements or information should not be read as guarantees of future performance and results. They are subject to known and unknown risks, uncertainties and other factors which may cause the actual results and events to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information.

Such risks and uncertainties include, without limitation, those relating to: the ability of the Company to complete the ramp-up of the Underground Mine within the expected cost estimates and timeframe; requirements for additional capital and no assurance can be given regarding the availability thereof; the impact of the COVID-19 pandemic on the business and operations of the Company; the state of financial markets; history of losses; dilution; adverse events relating to milling operations, construction, development and ramp-up, including the ability of the Company to address underground development and process plant issues; ground conditions; cost overruns relating to development, construction and ramp-up of the Underground Mine; loss of material properties; interest rates increase; global economy; limited history of production; future metals price fluctuations; speculative nature of exploration activities; periodic interruptions to exploration, development and mining activities; environmental hazards and liability; industrial accidents; failure of processing and mining equipment to perform as expected; labor disputes; supply problems; uncertainty of production and cost estimates; the interpretation of drill results and the estimation of mineral resources and reserves; changes in project parameters as plans continue to be refined; possible variations in ore reserves, grade of mineralization or recovery rates from management’s expectations and the difference may be material; legal and regulatory proceedings and community actions; accidents; title matters; regulatory approvals and restrictions; increased costs and physical risks relating to climate change, including extreme weather events, and new or revised regulations relating to climate change; permitting and licensing; volatility of the market price of the Company’s securities; insurance; competition; hedging activities; currency fluctuations; loss of key employees; other risks of the mining industry as well as those risks discussed in the Company’s Management’s Discussion and Analysis in respect of the year ended December 31, 2020 and in the section entitled “Risk Factors” in the Company’s Annual Information Form dated March 18, 2021. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements or information. The forward-looking information or statements are stated as of the date hereof. Nevada Copper disclaims any intent or obligation to update forward-looking statements or information except as required by law. Readers are referred to the additional information regarding Nevada Copper’s business contained in Nevada Copper’s reports filed with the securities regulatory authorities in Canada. Although the Company has attempted to identify important factors that could cause actual actions, events, or results to differ materially from those described in forward-looking statements, there may be other factors that could cause actions, events or results not to be as anticipated, estimated or intended. For more information on Nevada Copper and the risks and challenges of its business, investors should review Nevada Copper’s filings that are available at www.sedar.com.

Nevada Copper provides no assurance that forward-looking statements and information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements or information. Accordingly, readers should not place undue reliance on forward-looking statements or information.

HIGHLIGHTS

- Novo’s extensive greenfields exploration program has recently identified and advanced a series Ni-Cu-Co targets adjacent to Azure Minerals Limited’s (“ Azure ”) (ASX: AZS) Andover VC-07 Ni-Cu-Co massive sulphide discovery (“ Andover ”) and Artemis Resources Limited’s (“ Artemis ”) (ASX: ARV) Carlow Castle Au-Cu-Co discovery (“ Carlow Castle ”)

- Novo’s 100%-owned exploration licence 47/1745 contains several airborne electromagnetic (“ VTEM ”) anomalies (previously defined in 2007 by Legend Mining Limited (“ Legend ”) (ASX: LEG)) which have not been drill tested, along with large high order soil geochemical anomalies (including Cu, Ni and Co) associated with the VTEM conductors, including the Southcourt and Milburn prospects

- Novo is now progressing ground electromagnetic (“ EM ”) geophysical surveys in the near-term to advance these discoveries

- This work is consistent with Novo’s accelerated exploration strategy targeted at growing the Company’s portfolio of gold and battery metals prospects in the Pilbara region of Western Australia

VANCOUVER, British Columbia, Nov. 30, 2021 (GLOBE NEWSWIRE) — Novo Resources Corp. ( “Novo” or the “Company” ) (TSX: NVO, NVO.WT & NVO.WT.A) (OTCQX: NSRPF) is pleased to advise that it has recently identified and advanced a series of Au-Cu and Ni-Cu-Co targets on EL47/1745, adjacent to Andover 1 and Carlow Castle 2 in the West Pilbara region of Western Australia, although there is no certainty that EL47/1745 contains the same levels of mineralization as either of these discoveries.

The general area has benefited from a renewed exploration interest since Azure announced its drilling success on Andover in November 2020 1 with 3.9m @ 2.85% Ni and 0.47% Cu from 94.5m in their maiden drill hole ANDD001, subsequent to success by the Creasy Group, in 2018, who intersected 7m @ 2.62% Ni and 0.65% Cu in ADRC002 3 .

Recent geochemical sampling by Novo over previously defined VTEM conductors on EL47/1745 (weak conductors within airborne electro-magnetic surveys by Legend 4 , 5 ) has defined several large high-order Cu, Ni and Co anomalies relating to the VTEM targets.

Results and technical information referred to in this news release from Azure, Legend, Artemis, Westfield Minerals Ltd (“ Westfield ”) and AMAX Exploration (“ AMAX ”) are not necessarily representative of mineralization throughout the district. This historical data was disclosed in ASX announcements, other public disclosure documents, and annual exploration reports filed on the Western Australian Department of Mines, Industry Regulation and Safety’s (“ DMIRS ”) website (collectively, “ Disclosure ”) issued by Azure, Legend, Artemis, Westfield, and AMAX. The technical information contained herein has been extracted from this Disclosure. Reference should be made to the relevant Disclosure which is available online at the links provided in various footnotes throughout this news release.

A qualified person has not verified the technical information contained in the Disclosure, and Novo is unaware of the existence of any technical report prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects or the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves in connection with the technical information contained in the Disclosure. Novo is unable to comment on the reliability of the technical information contained in the Disclosure and therefore, reliance should not be placed on such technical information.

https://www.globenewswire.com/NewsRoom/AttachmentNg/639bed66-5cfe-4d58-ac4f-9ead23808126

( Figure 1 – EL47/1745 location and priority targets, in relation to Andover and Carlow Castle.)

Southcourt Anomalies

Three weak VTEM conductors 3km WNW of Andover are present in a zone of complex geology within the Andover intrusion at Novo’s Southcourt prospect ( Figure 1 ), including layered gabbro and ultramafic intrusive rocks.

Detailed 20 x 20 m to 20 x 40 m spaced soil sampling undertaken by Novo utilizing a Niton XL5 pXRF has defined a high-order 500 m long Cu anomaly flanking the western two VTEM conductors ( Figure 2 ). Co and Ni partially overlap the broad copper anomaly ( Figure 3 ). Peak pXRF soil values include 1,456 ppm Cu, 1,521 ppm Ni, and 1,938 ppm Co. Peak rock chip results utilizing the pXRF for spot assaying on sulphide minerals or Cu-Ni oxide minerals yielded up to 19.6% Cu, 0.13% Co and 2.07% Ni. These results are not necessarily representative of mineralization throughout the entire district. Novo interprets the broad anomaly to be a zone of disseminated sulphide ( Figure 5a ) on the margin of potentially more substantial sulphide bodies at depth (VTEM target). Additional assay results are pending.

Milburn Anomaly

One high intensity VTEM anomaly is present at Milburn, 1.4km ESE from the east end of Carlow Castle. Previous work by Legend 6 included eight lines of ground EM which identified a single conductor modelled to a dip of 45 o west at a depth of 35 m. The EM anomaly was followed up by Legend 5 , 7 , 8 with 17 -2 mm soil samples which returned peak values of 36 and 33 ppb Au and previous rock chip sampling yielded values of 4.83% Cu, 0.15 g/t Au and 0.21% Ni. The anomaly was not drilled by Legend.

In 1967, Westfields Minerals 9 defined a 1 km long induced polarization (“ IP ”) anomaly (Fig. 3) to the south of the EM conductor and completed shallow vertical percussion holes with a best result of 6m @ 0.22% Ni and 0.15% Cu (BH31) (Fig. 3). Subsequent drilling in 1971 by AMAX 10 intersected a sequence of mafic and ultramafic rocks with 1 to 10% disseminated sulfides (pyrite, pyrrhotite and rare chalcopyrite) with best results from PDH20A (Fig. 3) of 3.66 m @ 0.23% Ni and 0.17% Cu. These results are not necessarily representative of mineralization throughout the entire district. Importantly, Au, Co and PGE minerals were not analyzed.

Detailed 20 x 20m spaced soil sampling undertaken by Novo utilizing a Niton XL5 pXRF has defined a high-order 450 m long Cu anomaly flanking the eastern side of the VTEM conductor ( Figure 4 ). Peak pXRF soil values include 1,677 ppm Cu, 1,131 ppm Ni, and 238 ppm Co. Peak rock chip results utilizing the pXRF for spot assaying on sulphide minerals or Cu-NI oxide minerals yielded up to 15.2% Cu, 92 ppm Co and 0.33% Ni. These results are not necessarily representative of mineralization throughout the entire district. Figure 5b highlights a copper rich siliceous altered mafic rock from the trend. Additional assay results are pending.

https://www.globenewswire.com/NewsRoom/AttachmentNg/d4efe865-748e-4f4f-9a3c-e129a140dd07

( Figure 2 – Southcourt Cu soil geochemistry (pXRF) with overlapping Co anomaly and VTEM conductors (white dashed circles).)

https://www.globenewswire.com/NewsRoom/AttachmentNg/18c3576f-1fd3-4dc7-8356-f69f9583be31

( Figure 3 – Southcourt Ni soil geochemistry (pXRF) with overlapping Cu anomaly Co anomaly (white shapes) and VTEM conductors (white dashed circles.))

https://www.globenewswire.com/NewsRoom/AttachmentNg/19312c11-f490-4c79-afbe-5d01f9ab6588

( Figure 4 – Milburn Cu soil geochemistry (pXRF) and VTEM conductors (white dashed circles) and the location of Westfields IP anomaly and drillholes in the general area.)

Other significant targets ( Figure 1 ) on EL47/1745 include:

Anna Valley , which is in the SW corner of EL47/1745. This VTEM anomaly defined by Legend 4 , 5 was followed up with a ground fixed loop transient EM (“ FLTEM ”) survey 6 defining a strong conductor dipping between 35 – 55°to the northwest with a modelled depths of 30 to 35 m. The target was thought to relate to a chert body which outcrops to the west, but the target is under thick alluvial and colluvial cover.

Fortune South #1 and #2 , which are part of a 2 km long shear zone with several historic workings and a number of metal detector pits where sheared gabbro and anastomosing quartz veins are present. Previous sampling has assayed up to 8.51 g/t Au and 0.134% Cu on EL47/1745 8 . pXRF rock chip samples at Fortune South #2 into banded and sheared Cu-rich gossan ( Figure 5d ) yielded peak values of 60% Cu and 802 ppm Ni. These target types (shear-related Au-Cu) are not highlighted by VTEM.

Thorpe East , which is part of a 2 km long shear corridor with several historic workings and peak assay results of 3.11 ppm Au 8 . Novo has identified significant gossanous zones ( Figure 5c ) associated with quartz veining, yielding up to 676 ppm As, 3.5% Cu, 0.15% Ni, and 48.6 ppm Mo. These target types (shear-related Au-Cu) are not highlighted by VTEM.

Carlow Castle Extension , on which Artemis 2 have reported a soil geochemical anomaly and favourable stratigraphy along strike and to the east of Carlow Castle, on EL47/1745, directly north of Milburn. Novo has not yet conducted any work on this 1.7 km long zone of potential. This orogenic Au-Cu-Co target type is not highlighted by VTEM.

The foregoing results at Anna Valley, Fortune South #1 and #2, and Thorpe East are not necessarily representative of mineralization throughout the entire district.

Exploration planned for EL47/1745 by Novo in early 2022 includes ground FLTEM surveys to better define the EM conductors, possible induced polarization lines across the identified target zones pending results of EM, and drilling into the main target areas, including the Milburn, Southcourt and Anna Valley prospects. Drill holes will be surveyed using downhole EM techniques to locate off-hole conductors. Extensive first pass reconnaissance soil sampling, regional to detailed mapping, and rock chip sampling will be conducted across highly prospective EL47/1745.

https://www.globenewswire.com/NewsRoom/AttachmentNg/bdab9da9-60a8-46a9-b9fa-cc9b7af6d6e3

( Figure 5a, 5b, 5c, 5d – Milburn Cu soil geochemistry (pXRF) and VTEM conductors (white dashed circles).)

Analytic Methodology

The pXRF assay technique utilized a Niton XL5 handheld XRF machine. The Niton is calibrated daily, with 4 QAQC standards (fit for purpose including certified Ni, Cu and Co values) run concurrently, with an additional 2 standards checked per 100 readings and 4 QAQC standard assayed before the machine is shut down. pXRF is utilized as a preliminary exploration technique for base metals. Soil samples are unprepared and analysed for 30 seconds using two machine filters and rock chip samples are point analysed for 90 seconds using 4 machine filters. The pXRF is a spot reading device and has diminished precision due to grainsize effect, especially on rock samples where peak results represent a window of < 10mm field of view.

QP STATEMENT

Dr. Quinton Hennigh (P.Geo.) is the qualified person, as defined under National Instrument 43-101 Standards of Disclosure for Mineral Projects , responsible for, and having reviewed and approved, the technical information contained in this news release other than the technical information extracted from the Disclosure. Dr. Hennigh is the non-executive co-chairman and a director of Novo.

ABOUT NOVO

Novo operates its flagship Beatons Creek gold project while exploring and developing its prospective land package covering approximately 13,250 square kilometres in the Pilbara region of Western Australia. In addition to the Company’s primary focus, Novo seeks to leverage its internal geological expertise to deliver value-accretive opportunities to its shareholders. For more information, please contact Leo Karabelas at (416) 543-3120 or e-mail leo@novoresources.com .

On Behalf of the Board of Directors,

Novo Resources Corp.

“ Michael Spreadborough ”

Michael Spreadborough

Executive Co-Chairman

Forward-looking information

Some statements in this news release contain forward-looking information (within the meaning of Canadian securities legislation) including, without limitation, planned exploration activities. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, without limitation, customary risks of the resource industry and the risk factors identified in Novo’s management’s discussion and analysis for the nine-month period ended September 30, 2021, which is available under Novo’s profile on SEDAR at www.sedar.com. Forward-looking statements speak only as of the date those statements are made. Except as required by applicable law, Novo assumes no obligation to update or to publicly announce the results of any change to any forward-looking statement contained or incorporated by reference herein to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements. If Novo updates any forward-looking statement(s), no inference should be drawn that the Company will make additional updates with respect to those or other forward-looking statements.

______________________________

1 Refer to Azure’s ASX announcement dated November 9, 2020 .

2 Refer to Artemis’ ASX announcement dated November 20, 2019 .

3 Refer to Azure’s ASX announcement dated August 6, 2020 .

4 Refer to Legend’s ASX announcement dated July 23, 2007 .

5 Refer to Legend’s Annual Report 2009 – WAMEX Open File Data Rept. A82043

6 Refer to Legend’s ASX announcement dated October 02, 2007 .

7 Refer to Legend’s ASX announcement dated January 24, 2008 .

8 Refer to Legend’s Annual Report 2009 – WAMEX Open File Data Rept. A69000

9 Refer to Westfields Final Report 1967 – WAMEX Open File Data Rept. A982

10 Refer to AMAX Final Report 1972 – WAMEX Open File Data Rept. A3472

North Vancouver, British Columbia–(Newsfile Corp. – November 30, 2021) – Lion One Metals Limited (TSXV: LIO) (OTCQX: LOMLF) (ASX: LLO) (“Lion One” or the “Company”) is pleased to announce results from the infill drill and re-sampling program undertaken in the near-surface portion of the Tuvatu deposit. This program was designed to further strengthen the database in the portion of the deposit earmarked for earliest production, from the Company’s 100% owned Tuvatu gold project in Fiji.

- 5,615m of infill drilling completed in 30 holes (~70% of the proposed program)

- 600 additional data points generated from infill resampling of 12 historic holes

Highlights from near-surface infill drilling and re-sampling include:

20.61 g/t Au over 7.50m inc. 89.03 g/t Au over 1.50m, and 227.3 g/t Au over 0.30m from TUDDH545

21.34 g/t Au over 2.50m inc. 38.25 g/t Au over 1.30m, and 52.27 g/t Au over 0.30m from TUDDH548

33.52 g/t Au over 2.40m inc. 185.60 g/t Au over 0.40m from TUDDH553

9.13 g/t Au over 2.59m inc. 74.58 g/t Au over 0.30m from resampling of historic hole TUDDH362

TUDDH541

- 4.61 g/t Au over 4.23m from 112.6-116.83m, including

- 14.35 g/t Au over 1.20m from 115.63-116.83, which includes

- 33.85 g/t Au over 0.30m from 116.23-116.53m

- 7.09 g/t Au over 0.60m from 124.63-125.23m, including

- 12.82 g/t Au over 0.30m from 124.93-125.23m

TUDDH544

- 8.27 g/t Au over 0.30m from 24.65-24.95m

- 5.46 g/t Au over 2.90m from 34.6-37.5m, including

- 16.75 g/t Au over 0.50m from 34.9-35.4m, and

- 7.83 g/t Au over 0.60m from 36.6-37.2m

- 9.21 g/t Au over 0.30m from 50.85-51.15m

- 18.62 g/t Au over 0.30m from 65.93-66.23m

- 9.44 g/t Au over 0.60m from 68.32-68.92m, including

- 13.45 g/t Au over 0.30m from 68.32-68.62

- 11.21 g/t Au over 0.30m from 147.23-147.53

TUDDH545

- 20.61 g/t Au over 7.50m from 123.6-131.1m, including

- 7.97 g/t Au over 1.00m from 123.6-124.6m, and

- 8.97 g/t Au over 0.90m from 125.6-126.5m, and

- 89.03 g/t Au over 1.50m from 128.3-129.8m, which includes

- 227.30 g/t Au over 0.30m from 128.3-128.6m, and

- 10.48 g/t Au over 0.30m from 128.6-128.9, and

- 39.01 g/t Au over 0.30m from 128.9-129.2m, and

- 99.42 g/t Au over 0.30m from 129.2-129.5m, and

- 68.95 g/t Au over 0.30m from 129.5-129.8m

- 9.88 g/t Au over 0.30m from 130.8-131.1m

- 9.38 g/t Au over 1.00m from 137.6-138.6m

TUDDH546

- 10.16 g/t Au over 1.20 from 104.2-105.4m, including

- 39.33 g/t Au over 0.30m from 104.2-104.5m

TUDDH547

- 13.47 g/t Au over 0.30 from 104.5-104.8m

TUDDH548

- 9.82 g/t Au over 0.30 from 82.6-82.9m

- 18.74 g/t Au over 0.30m from 101.6-101.9m

- 6.41 g/t Au over 1.50m from 106.2-107.7m, including

- 26.34 g/t Au over 0.30m from 106.2-106.5m

- 15.37 g/t Au over 0.30m from 110.4-110.7m

- 21.34 g/t Au over 2.50m from 120.85-123.35m, including

- 38.25 g/t Au over 1.30m from 121.75-123.05m, which includes

- 52.27 g/t Au over 0.30m from 121.75-122.05m, and

- 21.13 g/t Au over 0.30m from 122.05-122.35m, and

- 53.82 g/t Au over 0.30m from 122.35-122.75m, and

- 20.58 g/t Au over 0.30m from 122.75-123.05m

TUDDH553

- 7.84 g/t Au over 0.90m from 26.0-26.9m

- 33.52 g/t Au over 2.40m from 173.4-175.8m, including

- 185.60 g/t Au over 0.40m from 174.5-174.9m

Highlights from infill resampling of historic drilling include:

- 6.78 g/t Au over 3.50m from 91.1-94.6m, including

- 8.43 g/t Au over 2.70m from 91.1-93.8m, including

- 10.98 g/t Au over 0.90m from 91.1-92.0m in TUDDH225

- 9.13 g/t Au over 2.59m from 84.81-87.4m, including

- 74.58 g/t Au over 0.30m from 86.31-86.61m in TUDDH362

- 1.81 g/t Au over 0.60m from 118.2-118.8m in TUDDH410

- 6.88 g/t Au over 0.60m from 131.1-131.7m in TUDDH539

Infill Drilling and Resampling Program

In addition to the recently reported expansion of the high-grade 500 Zone underlying the Tuvatu resource, several bonanza-grade intercepts have also been returned from the ongoing near-surface infill/definition drill program. The ~8000m infill drill program was initiated in June of 2021 with the aim of infilling areas of low data density within parts of the resource currently categorized as Inferred. To date, a total of 5,615m of diamond drilling over 30 holes have been completed, with ~30% of the proposed program remaining. Concurrently, a program of resampling of unsampled intervals from historic drill holes in has been initiated with the resampling of 12 holes completed to date (23 holes planned), representing ~50% of the planned resampling program, and thus far generating ~600 additional samples in areas where data was considered sparse. The additional data generated was generated in Lion One’s own assay laboratory in Nadi and will add significant new high-grade intercepts to the resource earmarked for early production.

Final results received to date from holes drilled as part of the infill program are for 7 holes only (TUDDH541-553). All results for holes TUDDH554-562 remain pending. Figure 3 shows some of the coarse visible gold intersected as part of the infill drilling program. Photographs shown are from drill holes for which analytical results are still pending. A complete set of results for all previously unreported drill holes which form part of the infill drill program is included as Table 1.

The Company is currently undertaking two tiers of drilling: 1) the completion of shallow resource infill drilling from surface and underground, 2) deep exploration drilling from surface and underground targeting lode extensions and additional feeders under the Tuvatu resource. With the wet season starting in Fiji, the regional drill program requiring access to remote parts of the Navilawa caldera has seen a planned interruption, and is scheduled to resume in early 2022.

Deep Feeder Zone 500 – additional update

An update of results obtained from the ongoing deep drilling of the high-grade 500 Zone feeder zone is also provided at this time. Additional results, as yet unreported, from ongoing drilling of the 500 Zone include: 17.43 g/t Au over 1.5m from downhole depth of 643.1-644.6m from hole TUDDH544-W1.

There are currently 3 drill holes targeting the 500 Zone. Results of these will be reported as they become available.

Sergio Cattalani, Lion One’s Senior Vice President Exploration, commented, “High grade mineralization continues to be defined both in the near-surface portion of the deposit, as well as in the expanding deep feeder Zone 500. The additional data generated by the infill drilling and resampling programs will greatly enhance our understanding of the geometry of the veins, and raise the level of confidence needed, ahead of Lion One’s near-term underground development at Tuvatu. Our objective remains to work toward a near-term modest production start, concomitant with an aggressive exploration program aimed at the continued expansion of deep bonanza-grade resources for the eventual scaled-up development of a larger and richer resource base.”

Figure 1: Left) schematic cross-section across the northern part of Tuvatu showing the location of some infill drill holes, with selected results. Right) Plan view of Tuvatu orebody as a block model, showing the trace of the Tuvatu decline and the location of the vertical section on the left. The different colors represent ore blocks of different grade forming the various lodes.

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/2178/105778_35fc524c74ba88bc_001full.jpg

Figure 2: Left) schematic cross-section across the northern part of Tuvatu showing the location of some of the drill holes that have been resampled, with selected results. Right) Plan view of Tuvatu orebody as a block model, showing the trace of the Tuvatu decline and the location of the vertical section on the left. The different colors represent ore blocks of different grade forming the various lodes.

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/2178/105778_35fc524c74ba88bc_002full.jpg

Table 1: Drilling Intervals Reported (intervals greater than 3.0 g/t Au cutoff are bolded)

| Drill Hole | From (m) | To (m) | Interval (m) | Au (g/t) |

| TUDDH541 | 52.54 | 54.55 | 2.01 | 1.12 |

| 59.00 | 59.40 | 0.40 | 2.24 | |

| 63.40 | 63.70 | 0.30 | 1.32 | |

| 69.00 | 70.78 | 1.78 | 1.06 | |

| 109.95 | 110.25 | 0.30 | 2.50 | |

| 112.60 | 116.83 | 4.23 | 4.61 | |

| including | 115.63 | 116.83 | 1.20 | 14.35 |

| including | 116.23 | 116.53 | 0.30 | 33.85 |

| 118.30 | 118.60 | 0.30 | 1.02 | |

| 120.00 | 123.50 | 3.80 | 3.27 | |

| including | 122.30 | 123.50 | 1.20 | 5.71 |

| 124.63 | 125.23 | 0.60 | 7.09 | |

| including | 124.93 | 125.23 | 0.30 | 12.82 |

| 127.20 | 130.20 | 3.00 | 0.87 | |

| including | 129.90 | 130.20 | 0.30 | 6.69 |

| TUDDH-542 | 73.00 | 73.60 | 0.60 | 0.75 |

| 78.10 | 78.40 | 0.30 | 0.73 | |

| 79.80 | 81.50 | 1.70 | 1.65 | |

| 83.60 | 83.90 | 0.30 | 0.87 | |

| 91.90 | 94.70 | 2.80 | 1.36 | |

| TUDDH-545 | 74.60 | 75.60 | 1.00 | 3.38 |

| 79.60 | 80.20 | 0.60 | 3.23 | |

| 81.60 | 83.60 | 2.00 | 1.4 | |

| 108.10 | 108.40 | 0.30 | 5.36 | |

| 123.60 | 131.10 | 7.50 | 20.61 | |

| including | 123.60 | 124.60 | 1.00 | 7.97 |

| and | 125.60 | 126.50 | 0.90 | 8.97 |

| and | 128.30 | 129.80 | 1.50 | 89.03 |

| including | 128.30 | 128.60 | 0.30 | 227.3 |

| and | 128.60 | 128.90 | 0.30 | 10.48 |

| and | 128.90 | 129.20 | 0.30 | 39.01 |

| and | 129.20 | 129.50 | 0.30 | 99.42 |

| and | 129.50 | 129.80 | 0.30 | 68.95 |

| and | 130.80 | 131.11 | 0.30 | 9.88 |

| 137.60 | 138.60 | 1.00 | 9.38 | |

| TUDDH-546 | 80.50 | 81.70 | 1.20 | 2.53 |

| 97.80 | 99.60 | 1.80 | 1.64 | |

| 104.20 | 105.40 | 1.20 | 10.16 | |

| including | 104.20 | 104.50 | 0.30 | 39.33 |

| 109.20 | 109.50 | 0.30 | 3.76 | |

| 113.20 | 113.50 | 0.30 | 0.92 | |

| 115.90 | 117.40 | 1.50 | 1.04 | |

| 120.50 | 123.30 | 2.80 | 0.85 | |

| including | 123.00 | 123.30 | 0.30 | 3.93 |

| 60.20 | 60.50 | 0.30 | 1.61 | |

| 66.60 | 67.20 | 0.60 | 1.3 | |

| 68.40 | 69.00 | 0.60 | 1.35 | |

| TUDDH-547 | 70.40 | 71.00 | 0.60 | 2.67 |

| 76.30 | 77.20 | 0.90 | 1 | |

| 87.10 | 88.90 | 1.80 | 1.13 | |

| 91.60 | 92.50 | 0.90 | 1.59 | |

| 94.30 | 99.70 | 5.40 | 1.96 | |

| including | 94.30 | 95.20 | 0.90 | 5.19 |

| 97.00 | 99.70 | 2.70 | 1.08 | |

| 104.50 | 104.80 | 0.30 | 13.47 | |

| 107.00 | 107.90 | 0.90 | 3.96 | |

| 110.30 | 111.20 | 0.90 | 0.52 | |

| 115.70 | 118.10 | 2.40 | 0.72 | |

| TUDDH-548 | 82.60 | 82.90 | 0.30 | 9.82 |

| 99.20 | 100.40 | 1.20 | 1.15 | |

| 101.60 | 101.90 | 0.30 | 18.74 | |

| 106.20 | 107.70 | 1.50 | 6.41 | |

| including | 106.20 | 106.50 | 0.30 | 26.34 |

| 110.40 | 110.70 | 0.30 | 15.37 | |

| 113.90 | 115.30 | 1.40 | 1.16 | |

| 118.45 | 118.75 | 0.30 | 4.31 | |

| 120.85 | 123.35 | 2.50 | 21.34 | |

| including | 121.75 | 123.05 | 1.30 | 38.25 |

| including | 121.75 | 122.05 | 0.30 | 52.27 |

| and | 122.05 | 122.35 | 0.30 | 21.13 |

| and | 122.35 | 122.75 | 0.40 | 53.82 |

| and | 122.75 | 123.05 | 0.30 | 20.58 |

| 74.10 | 74.40 | 0.30 | 4.69 | |

| TUDDH-553 | 26.00 | 26.90 | 0.90 | 7.84 |

| 108.50 | 109.50 | 1.00 | 0.79 | |

| 115.80 | 120.10 | 4.30 | 1.42 | |

| 173.40 | 175.80 | 2.40 | 33.5 | |

| including | 174.50 | 174.90 | 0.40 | 185.6 |

| 179.90 | 180.50 | 0.60 | 1.91 | |

| TUDDH544W1 (500 Zone) | 643.10 | 644.60 | 1.50 | 17.43 |

| including | 643.10 | 643.40 | 0.30 | 5.10 |

| and | 643.40 | 643.70 | 0.30 | 75.55 |

| and | 643.70 | 644.00 | 0.30 | 4.05 |

Table 2: Survey details of diamond drill holes referenced in this release not previously reported

| Hole No | Coordinates (Fiji map grid) | RL | final depth | dip | azimuth | |

| N | E | m | (TN) | |||

| TUDDH544, 544W1 | 3920795.6 | 1876350.7 | 209.7 | 758.5 | -65.0° | 132° |

| TUDDH541 | 3920733.6 | 1876296.8 | 225.1 | 165.6 | -49.0° | 002° |

| TUDDH542 | 3920845.3 | 1876170.4 | 166.6 | 150.5 | -7.0° | 139° |

| TUDDH545 | 3920732.5 | 1876296.8 | 225.1 | 191.6 | -80° | 10° |

| TUDDH546 | 3920734.1 | 1876298.1 | 225.1 | 170.5 | -49° | 13° |

| TUDDH547 | 3920733.8 | 1876298.0 | 225.1 | 173.5 | -61° | 17° |

| TUDDH548 | 3920733.4 | 1876297.9 | 225.2 | 200.7 | -73° | 15° |

| TUDDH553 | 3920724.8 | 1876385.5 | 237.0 | 206.4 | -74° | 274° |

| TUDDH562 | 3920723.3 | 1876385.5 | 237.0 | 244.2 | -70° | 248° |

| TUDDH563 | 3920796.3 | 1876351.1 | 209.7 | in progress | -63° | 121° |

Figure 3: A) Photo of a portion of uncut drill core from TUDDH563, one of the infill drill holes, showing coarse visible goldat 13.60m depth. Analytical results pending. B) Photo of a portion of uncut drill core from TUDDH562, one of the infill drill holes, showing coarse visible goldat 165.0m depth. C) Same interval as B after cutting. Analytical results pending.

To view an enhanced version of Figure 3, please visit:

https://orders.newsfilecorp.com/files/2178/105778_35fc524c74ba88bc_003full.jpgABC

Drilling and Assay Processes and Procedures

The Company is utilizing its own diamond drill rig, using PQ, HQ and ultimately NQ sized drill core rods. Drill core is logged by Company geologists and then is sawn in half and sampled by Lion One staff.

Samples are analyzed at the Company’s own geochemical laboratory in Fiji, whilst pulp duplicates of all samples with results >0.5g/t Au are re-assayed, as well as sent to ALS Global Laboratories in Australia for check assay determinations. All samples for all high-grade intercepts reported here are will be sent to ALS Global Laboratories for check assays shortly. All samples are pulverized to 80% passing through 75 microns. Gold analysis is carried out using fire assay with an AA finish. Samples that have returned grades greater than 10g/t Au are then re-analyzed by gravimetric method. For certain high-grade samples for which results for duplicate assay are within 10% of the initial results, the average of duplicate runs is presented. Lion One’s laboratory can also assay for a range of 71 other elements through Inductively Coupled Plasma Optical Emission Spectrometry (ICP-OES), but currently focuses on a suite of 9 important pathfinder elements. All duplicate anomalous samples sent to ALS Townsville, Queensland, Australia are analyzed by the same methods (Au-AA26, and also Au-GRA22 where applicable). ALS also analyze for 33 pathfinder elements by HF-HNO3-HClO4 acid digestion, HCl leach and ICP-AES. (method ME-ICP61).

Qualified Person

The scientific and technical content of this news release has been reviewed, prepared, and approved by Mr. Sergio Cattalani, P. Geo, who is a qualified person pursuant to National Instrument 43-101 – Standards of disclosure for Mineral Projects (“NI-43-101).

About Tuvatu

The Tuvatu gold deposit is located on the island of Viti Levu in the South Pacific island nation of Fiji. The mineral resource for Tuvatu as disclosed in the technical report “Tuvatu Gold Project PEA”, dated June 1, 2015, and prepared by Mining Associates Pty Ltd of Brisbane Qld, comprises 1,120,000 tonnes indicated at 8.17 g/t Au (294,000 oz. Au) and 1,300,000 tonnes inferred at 10.60 g/t Au (445,000 oz. Au) at a cut-off grade of 3 g/t Au. The technical report is available on the Lion One website at www.liononemetals.com and on the SEDAR website at www.sedar.com.

About Lion One Metals Limited

Lion One’s flagship asset is 100% owned, fully permitted high grade Tuvatu Alkaline Gold Project, located on the island of Viti Levu in Fiji. Lion One envisions a low-cost high-grade underground gold mining operation at Tuvatu coupled with exciting exploration upside inside its tenements covering the entire Navilawa Caldera, an underexplored yet highly prospective 7km diameter alkaline gold system. Lion One’s CEO Walter Berukoff leads an experienced team of explorers and mine builders and has owned or operated over 20 mines in 7 countries. As the founder and former CEO of Miramar Mines, Northern Orion, and La Mancha Resources, Walter is credited with building over $3 billion of value for shareholders.

On behalf of the Board of Directors of

Lion One Metals Limited

“Walter Berukoff“

Chairman and CEO

For further information

Contact Investor Relations

Toll Free (North America) Tel: 1-855-805-1250

Email: info@liononemetals.com

Website: www.liononemetals.com

Neither the TSX Venture Exchange nor its Regulation Service Provider

accepts responsibility for the adequacy or accuracy of this release.

This press release may contain statements that may be deemed to be “forward-looking statements” within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein are forward-looking information. Generally, forward-looking information may be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “proposed”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases, or by the use of words or phrases which state that certain actions, events or results may, could, would, or might occur or be achieved. This forward-looking information reflects Lion One Metals Limited’s current beliefs and is based on information currently available to Lion One Metals Limited and on assumptions Lion One Metals Limited believes are reasonable. These assumptions include, but are not limited to, the actual results of exploration projects being equivalent to or better than estimated results in technical reports, assessment reports, and other geological reports or prior exploration results. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Lion One Metals Limited or its subsidiaries to be materially different from those expressed or implied by such forward-looking information. Such risks and other factors may include, but are not limited to: the stage development of Lion One Metals Limited, general business, economic, competitive, political and social uncertainties; the actual results of current research and development or operational activities; competition; uncertainty as to patent applications and intellectual property rights; product liability and lack of insurance; delay or failure to receive board or regulatory approvals; changes in legislation, including environmental legislation, affecting mining, timing and availability of external financing on acceptable terms; not realizing on the potential benefits of technology; conclusions of economic evaluations; and lack of qualified, skilled labour or loss of key individuals. Although Lion One Metals Limited has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. Lion One Metals Limited does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Sign up for Alerts

Sign up to receive news releases by email for Lion One Metals Limited or all companies belonging to the Mining and Metals, Precious Metals industries.

Recent News

- Lion One Reports Additional High-Grade Intercepts from Infill Drilling at Tuvatu Gold Project, Fiji

2021-11-30 3:01 AM EST - Lion One Reports New High-Grade Intercepts to Expand Deep Feeder Zone 500 at Tuvatu, Fiji

2021-11-02 3:01 AM EDT - Lion One Adds Numerous High-Grade Intercepts near Surface and Expands Deep Feeder Zone 500, Tuvatu, Fiji

2021-09-07 3:01 AM EDT

Hashtags

GoldJuniorMiningMiningMiningStocksPreciousMetalsDrillResultsMetalsOTCOTCMarketsOTCStocksSmallCapsTSXVInvesting

Similar Stories

Tell Us Your Story

Vancouver

380 – 1100 Melville Street

Vancouver, BC, Canada

V6E 4A6

Phone: 604-609-0244

Calgary

2500 – 500 4th Ave SW

Calgary, AB, Canada

T2P 2V6

Phone: 403-806-0664

Toronto

601 – 15 Toronto Street

Toronto, ON, Canada

M5C 2E3

Phone: 416-806-1750

New York

5881 – 99 Wall Street

New York, NY, USA

10005

Phone: 646-609-8767

Terms of Use

Anti-Spam Policy

Privacy Policy

Copyright 2021 Newsfile Corp. All rights reserved.

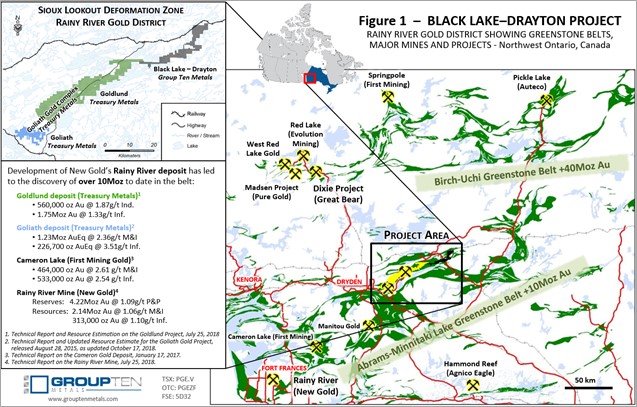

November 29, 2021 – Vancouver, BC – Group Ten Metals Inc. (TSX.V: PGE | OTCQB: PGEZF; FSE: 5D32) (the “Company” or “>Group Ten”) is pleased to announce that it has signed a Definitive Agreement (the “Agreement”) with Heritage Mining Ltd. (“Heritage”) per the binding Letter of Intent (the “LOI”) announced August 26, 2021. By the terms of the Agreement, and subject to the earn-in requirements specified therein, Heritage can acquire up to a 90% interest in Group Ten’s Black Lake-Drayton gold project (the “Property”) in Ontario, Canada.

Group Ten also announces that it has initiated the exploration program required by the Agreement, with a focus on advancing and refining existing targets identified in past campaigns, as well as advancing new targets. To this end, the 2021 program includes re-sampling of core from 1996-2002 drill campaigns programs at the Moretti, Dragfold, and Bonanza targets, focused prospecting in areas of interest identified by the 2017 geophysical modelling and interpretation report, and a basal till sampling program intended to expand upon successful 2018 and 2020 programs.

Group Ten President and CEO, Michael Rowley stated, “We are pleased to announce the successful conclusion of the first in what we expect will ultimately become a series of deals whereby Group Ten begins to realize value for our non-core assets. Black Lake-Drayton, like our Kluane Ni-Cu-PGE project, is a high-quality brownfields project that is district-scale in size and 100%-owned by the Company. The Agreement with Heritage Mining provides Group Ten with significant exposure to the gold market while allowing us to focus on our 100%-owned Stillwater West project in Montana, where we see terrific potential to expand our recent inaugural resource estimates of first-world nickel, copper, palladium, platinum, rhodium, gold and cobalt. Core from 2021 resource expansion drilling at Stillwater West is progressing through the assay lab and we look forward to a series of news releases announcing results starting in the coming weeks, as well as updates on other initiatives including our work in carbon sequestration.”

Heritage Mining’s CEO, Peter Schloo stated, “It is rare that a project of this size and quality becomes available, and we appreciate Group Ten’s faith in our ability to add significant shareholder value in a timely manner. We are very excited about the Black Lake-Drayton project and look forward to developing the property in a systematic manner. This is a pivotal point in Heritage Mining’s path, and we look forward to the future. We anticipate a go-public listing shortly, pending market conditions.”

Upcoming Events

Live Webinar – Amvest Capital

Group Ten Metals President and CEO, Michael Rowley, will provide an overview and update on the Company and our flagship Stillwater West battery metals and platinum group elements project during a live webinar event hosted by Amvest Capital on Monday, November 29th at 13:05 PT / 16:05 ET. To register, click here.

Virtual Investor Conference – OTC Markets Group

Group Ten has been invited to present at the upcoming Mining & Metals Virtual Investor Conference hosted by OTC Markets Group on Wednesday, December 8th at 12:00 PM PT / 3:00 PM ET. Topics of discussion will include the Company’s recently announced NI 43-101 mineral resource estimate, the 2021 expansion drill campaign, and upcoming, near-term catalysts. To register, click here.

Terms of the Heritage Mining Definitive Agreement

Under the terms of the Agreement, Heritage may acquire a 90% undivided interest in the Property by making payments totaling 7.2 million shares and CAD $300,000 in cash to Group Ten, completing exploration and development work totaling CAD $5 million on the Property, granting Group Ten a 10% carried interest in the Property through completion of a feasibility study, and completing other requirements including potential success-based discovery payments, as detailed below:

- Heritage shall issue 2,800,000 shares to Group Ten within ten (10) business days of obtaining a public listing on a specified exchange.

- Heritage may earn a 51% interest (the “First Option”) in the Property by completing the following on or before the third anniversary of the “Agreement:

- Issuing an additional 3.3 million shares to Group Ten;

- Completing cash payments totaling CAD $300,000; and

- Completing exploration work totaling CAD $2.5 million.

- Upon completion of the First Option, Heritage may earn an additional 39% ownership interest in the Property (the “Second Option”) for a cumulative 90% interest by completion of the following on or before the fourth anniversary of the Agreement:

- Issuing an additional 1.1 million shares to Group Ten; and

- Completing additional exploration work totaling CAD $2.5 million.

In addition, the LOI provides the following:

- A discovery payment of $1.00 per ounce of gold or gold equivalent shall be made on mineral resource estimates as filed from time-to-time on the Property and shall, in Heritage’s discretion, be paid in cash or shares (or a combination thereof), capped at a maximum of $10 million.

- Upon completion of the Second Option, Group Ten will retain a 10% free carried interest in the Project, with Heritage being responsible for all Property costs until completion by Heritage of a positive feasibility study supported by a technical report prepared in accordance with NI 43-101 on the Property (the “FS”).

- The Agreement provides for the formation of a Joint Venture (“JV”) based on the then legal and beneficial ownership levels in the Property following completion of the FS. A JV may also be formed in the event Heritage does not complete the requirements of the Second Option.

- Heritage will be required to maintain minimum exploration and development expenditures of CAD $500,000 per annum until the completion of the FS in order to maintain status as operator of the JV. Group Ten maintains certain back-in rights in the event Heritage does not meet minimum expenditure requirements.

- Group Ten is required to complete CAD $300,000 of exploration work on the Property within the first year of the Agreement.

Black Lake – Drayton Gold Project Overview

The 100%-owned Black Lake–Drayton project consists of 137 square kilometers in the Abrams‐Minnitaki Lake Archean greenstone belt, along the northern margin of the Wabigoon sub-province in Ontario, Canada. The Property has significant exploration potential with demonstrated high-grade gold in drill results and bulk samples across more than 30 kilometers of underexplored strike in a geologic setting that is shared with Treasury Metals’ development-stage Goliath Gold Complex project in a highly active gold belt that also hosts Rainy River’s New Gold mine and other deposits. The geological models and exploration methods that have successfully proven up over 14 million ounces of gold at Treasury, New Gold, and other projects in the region since the 1990s have yet to be systematically applied at Black Lake – Drayton. Access and infrastructure are excellent on the Property, which features direct road access, and proximity to rail and power.

About Heritage Mining

Heritage Mining Ltd. is a private, well-capitalized company focused on acquiring Tier-1, advanced stage precious and base metal exploration projects and/or the junior/micro-producer project stage. Heritage’s board and management Team have a proven track record of shareholder value creation with over 100 years of combined experience in the mining and exploration sector. For more information, visit the Heritage Mining website.

About Group Ten Metals Inc.

Group Ten Metals Inc. is a TSX-V-listed Canadian mineral exploration company focused on the development of high-quality platinum, palladium, nickel, copper, cobalt, and gold exploration assets in top North American mining jurisdictions. The Company is focused on its 100%-owned, flagship Stillwater West battery metals and platinum group elements project in Montana, USA, adjacent to the high-grade PGE mines operated by Sibanye-Stillwater. In October 2021, the Company announced its inaugural NI 43-101 mineral resource estimate, with an update expected in Q1 2022 subject to results from an expansion drill campaign in 2021 from which assays are pending.

Group Ten also holds two additional district-scale brownfields assets including the high-grade Black Lake-Drayton Gold project adjacent to Treasury Metals’ development-stage Goliath Gold Complex in northwest Ontario (now subject to an earn-in by Heritage Mining), and the Kluane PGE-Ni-Cu-Co project on trend with Nickel Creek Platinum‘s Wellgreen deposit in Canada‘s Yukon Territory.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Michael Rowley, President, CEO & Director

Email: info@grouptenmetals.com Phone: (604) 357 4790

Web: http://grouptenmetals.com Toll Free: (888) 432 0075

Forward-Looking Statements

Forward Looking Statements: This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding the execution of a definitive agreement, the completion of the proposed transaction and the receipt of any cash or share payments therefrom, future exploration and development expenditures, the sale of non-core assets, potential mineralization, the realization of mineral resource estimates, the timing and success of exploration activities generally or the completion of a feasibility study, the timing and results of future resource estimates, future driling activities, and future plans and objectives of the Company are forward-looking statements that involve various risks and uncertainties. Although Group Ten believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals (including board and stock exchange approvals), the failure to negotiate and execute the Agreement on the terms currently contemplated or at all, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Group Ten and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.