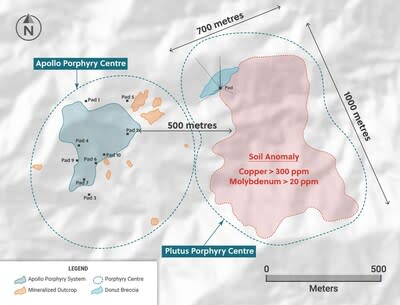

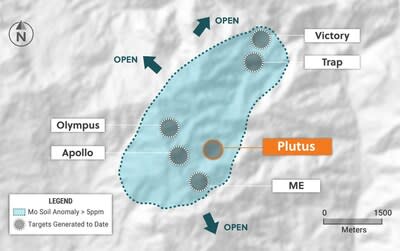

- Exploration fieldwork has discovered a new porphyry target located five hundred metres east of the high-grade Apollo Porphyry Deposit and referred to as the Plutus Porphyry Centre (“Plutus”).

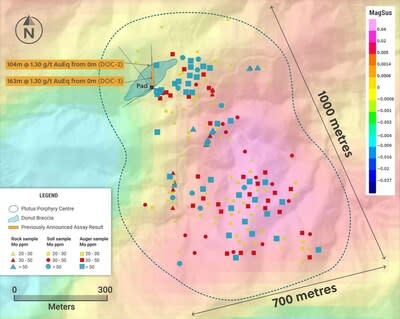

- To date, Plutus covers 1,000 metres by 720 metres in area and hosts multiple mineralization styles including porphyry veining, porphyry related breccia mineralization and late-stage carbonate base metal (‘CBM”) veins.

- Within Plutus are two areas of interest:

- Reconnaissance rock chip and shallow auger sampling of oxidized (leached) surface material at Plutus has yielded the following results:

- Drilling is expected to commence at Plutus in August 2023. Four rigs are now operating at the project with eleven holes currently in the lab for analysis. Additional assay results are expected in the near term from further drilling at Apollo and surrounding targets.

Ari Sussman, Executive Chairman commented: “The Guayabales project continues to demonstrate its remarkable geological endowment. Hard work by the technical team has outlined the Plutus Porphyry Centre, which is the largest target outlined to date at the project. Given the sheer scale of Plutus, three pads are being constructed ahead of drilling which is expected to commence in mid to late August. We will be aggressive in testing Plutus and are hopeful of making another discovery to rival the Apollo porphyry system.”

TORONTO, July 18, 2023 /CNW/ – Collective Mining Ltd. (TSXV: CNL) (OTCQX: CNLMF) (“Collective” or the “Company”) is pleased to announce assay results and field observations from recent reconnaissance exploration work undertaken in the new Plutus Porphyry Centre (“Plutus”), located 500 metres east of the Apollo porphyry system (“Apollo”) at the Guayabales project located in Caldas, Colombia.

Apollo is a high-grade, bulk tonnage copper-silver-gold system, which owes its excellent metal endowment to an older copper-silver and gold porphyry system being overprinted by younger precious metal rich, carbonate base metal vein systems (intermediate sulphidation porphyry veins) within a magmatic, hydrothermal inter-mineral breccia and diorite porphyry bodies currently measuring 455 metres x 395 metres x 915 metres and open for expansion.

To watch a short video of Richard Tosdal, renowned porphyry expert and Special Advisor to Collective Mining, review the Plutus discovery please click here.

Details (See Figures 1-3)

This press release outlines results from surface reconnaissance exploration work undertaken at the newly discovered Plutus Porphyry Centre (“Plutus”). Plutus is located 500 metres to the east of the Apollo Porphyry in an area with very sparse outcrop due to landslide and ash cover. Results and observations from Plutus are summarized below.

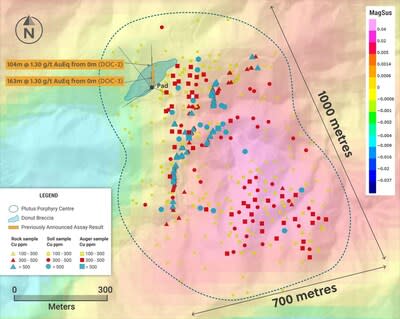

The Plutus porphyry centre measures 1,000 metres by 720 metres in area and is defined by a large porphyry intrusive in contact with breccia to its north-west. The intrusive body is outlined by soil anomalies of copper, molybdenum, gold, tungsten, tin and bismuth which are coincident with a magnetic susceptibility high. Soil copper values greater than 500 parts per million (“ppm”) and 30 ppm molybdenum with highest values up to 1,482 ppm copper and 127 ppm molybdenum define a 650-metre diameter area outlining the porphyry body. Surface geochemical soil, auger and rock sampling assay results from Plutus displays the following ranges of results:

Rock Chip

- Gold rock chip values up to 4.90 g/t (range of 0.03 g/t to 4.90 g/t);

- Silver rock chip values up to 100 g/t (range of 0.10 g/t to 100 g/t);

- Copper rock chip values up to 1,290 ppm (56 ppm to 1,290 ppm);

- Molybdenum rock chip values up to 102 ppm (0.2 ppm to 102 ppm).

Soil

- Gold soil values up to 4.80 g/t (range of 0.03 g/t to 4.80 g/t);

- Silver soil values up to 364 g/t (range of 0.10 g/t to 364 g/t);

- Copper soil values up to 835 ppm (0.3 ppm to 835 ppm);

- Molybdenum soil values up to 127 ppm (0.5 ppm to 127 ppm).

Auger

- Gold auger values up to 3.72 g/t (range of 0.03 g/t to 3.72 g/t);

- Silver auger values up to 56 g/t (range of 0.02 g/t to 56 g/t);

- Copper auger values up to 1,482 ppm (69 ppm to 1,482 ppm);

- Molybdenum auger values up to 113 ppm (1 ppm to 113 ppm).

The amount of rock and weathered exposures in the Plutus target area is limited to a few sparse outcrops due to vegetation, historical landslides, and volcanic ash cover.

Observations from surface mapping of the sparse outcrops and logging of auger drilling chips highlights the presence of porphyry-related mineralization, including magnetite veins as well as pyrite, chalcopyrite and molybdenite sulphide and quartz A, B, EB, and D type porphyry veins. The quartz diorite porphyry exhibits both potassic and sericite alteration.

A north-western breccia area with multiple outcrops is located contiguous with the porphyry intrusive body and includes the Donut Breccia discovery where previous drilling intercepts included 163 metres @ 1.3 g/t AuEq from surface in DOC-3 and 104 metres @ 1.3 g/t AuEq from surface in DOC-2 (see press release dated November 15, 2021 and October 18, 2021, respectfully). Follow up work in the breccia area has identified additional outcrops located to the west and east of the area previously drill tested with assay results pending from channel sampling of limited available exposures.

One rig will be mobilized to Plutus with drilling expected to commence in August 2023.

Apollo Drill Program Outline and Assay Update

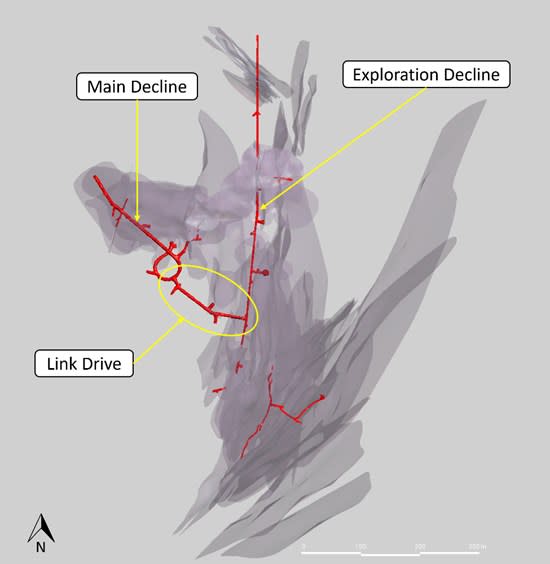

The 2023 Phase II drilling program is advancing on schedule with 24 holes completed and results announced with an additional eleven holes awaiting assay results from the lab. The objective of the 2023 drilling program is to define high-grade near surface mineralization of the Apollo porphyry system, expand the size of the system through step-out and directional drilling and drill test multiple new targets generated through grassroots exploration. Since the announcement of the discovery hole at Apollo in June 2022, a total of 55 drill holes (approximately 23,907 metres) has been completed and assayed.

About Collective Mining Ltd.

To see our latest corporate presentation and related information, please visit www.collectivemining.com

Founded by the team that developed and sold Continental Gold Inc. to Zijin Mining for approximately $2 billion in enterprise value, Collective Mining is a copper, silver, and gold exploration company with projects in Caldas, Colombia. The Company has options to acquire 100% interests in two projects located directly within an established mining camp with ten fully permitted and operating mines.

The Company’s flagship project, Guayabales, is anchored by the Apollo target, which hosts the large-scale, bulk-tonnage and high-grade copper-silver-gold Apollo porphyry system. The Company’s near-term objective is to drill the shallow portion of the porphyry system, continue to expand the overall dimensions of the system through step out and direction drilling, which remains open in most directions and drill test multiple new targets generated through grassroots exploration.

Management, insiders and close family and friends own nearly 45% of the outstanding shares of the Company and as a result, are fully aligned with shareholders. The Company is listed on the TSXV under the trading symbol “CNL” and on the OTCQX under the trading symbol “CNLMF”.

Qualified Person (QP) and NI43-101 Disclosure

David J Reading is the designated Qualified Person for this news release within the meaning of National Instrument 43-101 (“NI 43-101”) and has reviewed and verified that the technical information contained herein is accurate and approves of the written disclosure of same. Mr. Reading has an MSc in Economic Geology and is a Fellow of the Institute of Materials, Minerals and Mining and of the Society of Economic Geology (SEG).

Technical Information

Rock, soils and core samples have been prepared and analyzed at SGS laboratory facilities in Medellin, Colombia and Lima, Peru. Blanks, duplicates, and certified reference standards are inserted into the sample stream to monitor laboratory performance. Crush rejects and pulps are kept and stored in a secured storage facility for future assay verification. No capping has been applied to sample composites. The Company utilizes a rigorous, industry-standard QA/QC program.

Information Contact:

Follow Executive Chairman Ari Sussman (@Ariski73) and Collective Mining (@CollectiveMini1) on Twitter.

FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including, but not limited to, statements about the drill programs, including timing of results, and Collective’s future and intentions. Wherever possible, words such as “may”, “will”, “should”, “could”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict” or “potential” or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties, and assumptions. Many factors could cause actual results, performance, or achievements to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, Collective cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and Collective assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

SOURCE Collective Mining Ltd.