On behalf of Bob Moriarty, www.321gold.com will be back up and running 5 July 2023. Bob is doing just fine, There was a technical issue with the website,

Category: Uncategorized

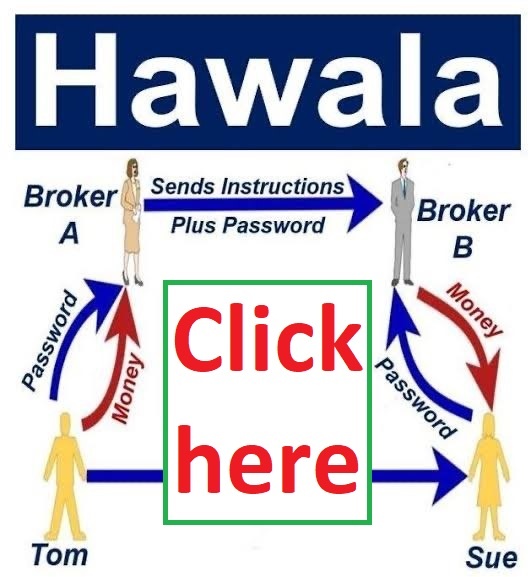

India is imposing a 20% refundable tax on foreign expenses made in INR. While this money will theoretically be refunded in the following tax assessment, you will lose value because of high inflation. Moreover, most people will not claim this money, for they fear audits and harassment by rapacious tax officers. This fear has been a boon for Hawala transactions, which have drained the US dollar from the streets of India. Here are my thoughts:

India is imposing a 20% refundable tax on foreign expenses made in INR. While this money will theoretically be refunded in the following tax assessment, you will lose value because of high inflation. Moreover, most people will not claim this money, for they fear audits and harassment by rapacious tax officers. This fear has been a boon for Hawala transactions, which have drained the US dollar from the streets of India. Here are my thoughts:

As time has passed, corruption has become more blatant in India, and fanaticism is rapidly increasing. Previously, the US used to hold a higher moral ground. However, today, being woke and expedient, it hosts those it once used to ban from entry. Here are my thoughts on Modi’s recent visit to the US:

On Investments

I recently had a conversation with Maurice Jackson about why most people make a horrendous mistake by conflating resource companies with the underlying commodities they represent. We also discussed several coal companies:

Here are some more companies that have my attention:

- Irving Resources (IRV; C$0.72): IRV has three drill rigs, with one operating 24 hours a day at the Omu project in Hokkaido. They have over $7 million in cash. Newmont is increasing its ownership in IRV by financing it at C$1.03 per share, a significant premium to the current share price.

- Maritime Resources (MAE; C$0.04): They are buying the Point Rousee project from Signal Gold. And I wouldn’t be surprised if they bid for the now-defunct Rambler Mines. MAE can create good value if they do this combination right. To protect my downside, I wouldn’t buy it for more than C$0.04.

- Rockcliff Metals (RCLF; C$0.035): RCLF is being acquired by Hudbay. At C$0.035, there would be a 19% arbitrage upside.

- Nameson Holdings (HK:1982; HK$0.47): Nameson is a small knitwear manufacturing company catering to some of the top international brands. My clients and I have been invested in it for several years. The dividend yield is >10%. I expect the next dividend to be much higher.

The next Capitalism & Morality will be held on the 9th of September 2023. If this philosophy seminar interests you, please use the following coupon code to get a 10% discount rate: 1984. The ticket price will go up next week.

Original Source: https://jayantbhandari.com/hawala-rcf-mae-irv/

Jayant Bhandari

Disclaimer: All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, or stock picks, expressed or implied herein, are for informational, entertainment, or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies. The sole purpose of these musings is to show my thinking process when analyzing a stock, not to provide any recommendations. I will not and cannot be held liable for any actions you take resulting from anything you read here. Conduct your due diligence, or consult a licensed financial advisor or broker before making any investment decisions. Any investments, trades, speculations, or decisions made based on any information found on this site, expressed or implied herein, are committed at your own risk, financial or otherwise.

North Vancouver, British Columbia–(Newsfile Corp. – June 28, 2023) – Lion One Metals Limited (TSXV: LIO) (OTCQX: LOMLF) (ASX: LLO) (“Lion One” or the “Company”) is pleased to provide an update on construction progress at its 100% owned Tuvatu Alkaline Gold Project in Fiji.

Highlights:

- Mine construction is approximately 75% complete.

- Earthworks and concrete works are substantially complete, structural steel is 70% complete.

- The project is fully funded and on track for delivery of first gold in Q4 CY 2023.

Figure 1. Tuvatu Gold Mine Under Construction. See below for additional images.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/171562_bb6a2eed54d89a8e_001full.jpg

Mine construction is approximately 75% complete and remains on track for delivery of first gold in Q4 2023. Earthworks and concrete works are substantially complete, with over 3,500 m3 of concrete poured to date. Structural steel is 70% complete and is progressing rapidly. All the components required to commission the processing plant are on site and a team of 350 contractors and employees are working together to bring the project towards completion. Once complete, Lion One plans to operate the processing plant at an initial production capacity of 300 tonnes per day for the first 18 months of operations before increasing the capacity to 500 tonnes per day in mid-2025. Lion One is fully funded to complete mine construction and bring the Tuvatu Alkaline Gold Project into production by the end of the year.

Videos of construction progress can be viewed on the company’s website (www.liononemetals.com). A summary of construction items that are in progress or complete is shown in Table 1 below.

Site Infrastructure

A large portion of the site infrastructure is complete, including the site office, the mine changeroom, the mine workshop, the fresh water supply system, the sewage treatment plant and the waste rock crusher and screener, all of which are commissioned and in use. The construction of the power plant, which consists of six 800 KW generators and one 1,500 KW generator for a total 6.3 MW, is in progress.

Crushing and Conveying

The Lion One processing plant will treat material using a two-stage crushing process, with a primary jaw crusher and a secondary cone crusher. A system of three conveyor belts will transport material between the two crushers and on to the processing plant. The jaw crusher, cone crusher, conveyor belt 1 and conveyor belt 2 are all in place while conveyor belt 3 has been fabricated and needs to be lifted into place. Piping and electrical work remains to be completed. The ROM pad has also been constructed and is in use, with minor upgrades remaining to be completed.

Grinding, Concentrating, Leaching and Recovery

Material from the crushing process will be fed to a two-stage grinding circuit, followed by an integrated two-stage gravity concentration circuit. Some concentrates will then be treated by an intensive cyanide leaching reactor and the remainder of the concentrates will be leached using conventional cyanide Carbon in Leach (CIL) technology. Gold will be recovered from the gold laden carbon using conventional absorption desorption recovery (ADR) technology and smelted on site to produce gold doré bars. Construction is advancing rapidly on the grinding, concentrating, and leaching circuits, as well as on the necessary supporting infrastructure such as warehouses and workshops. Ball Mills 1 and 2 are in place, the leaching tanks are in place, and Reagent Warehouse 1 is nearing completion. All other components of the processing plant are in progress at varying levels of completion. Electrical and piping work remains to be completed.

Tailings Storage Facility (TSF)

Tailings from the processing plant will be treated using the SO2/air process to remove any residual cyanide and will be filtered to produce filtered tailings which will then be transported to the TSF for storage. Stage 1 of the TSF will consist of a dam with a finish level at 115 m elevation, and a pond with enough capacity for 18 months of operation. The tailings dam has currently been built to an elevation of 107 m. TSF construction has been ongoing since June 2022 and the TSF is anticipated to be in operation in Q4 of 2023. Other components of the TSF, such as diversion channels, dam spillway, and liner installation are advancing simultaneously.

Underground Developments

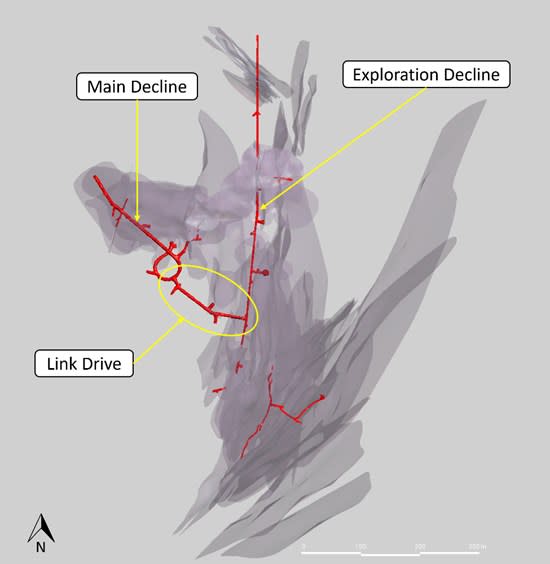

Underground mining of the URA1 , URW1a and URW1b lodes is ongoing. The main decline has reached a vertical depth of 99.4 m below surface and a total length of 344 m from the mine portal. The link drive connecting the main decline to the historical exploration decline has been completed and measures 140 m from the junction with the main decline to the junction with the historical exploration decline. The link decline was driven from the main decline to the exploration decline and broke through the exploration decline on June 21st, 2023.

The completion of the link drive is a major milestone in the development of the mine as it enables the Stage 1 primary ventilation system to be installed. The Stage 1 primary ventilation system consists of four 55KW exhaust fans that are being installed at the entrance to the historical exploration decline, and which will provide ventilation throughout the mine. The Stage 1 primary ventilation system will provide sufficient ventilation to mine all the way down to the 500 zone, which is part of the high-grade feeder zone underlying Tuvatu and which comprises a major component of the mine plan. The completion of the link drive also enables mineralized lodes to be mined both from the historical exploration decline as well as from the main decline, thereby increasing the number of faces available to mine and adding considerable flexibility to the mining operations.

In addition to the link drive and ventilation system, a high voltage power plant and an underground compressor are also being installed to support underground mining operations.

Table 1. Status of Major Mine Components Under Construction.

| Processing Plant | |

| Item | Construction/Installation Progress |

| ROM Pad | Nearing Completion |

| Jaw Crusher | Complete |

| Cone Crusher | Complete |

| Conveyor Belt 1 | Nearing Completion |

| Conveyor Belt 2 | Nearing Completion |

| Conveyor Belt 3 | In Progress |

| Ball Mill 1 | Complete |

| Ball Mill 2 | Complete |

| Gravity Circuit | In Progress |

| Intensive Leaching Circuit | In Progress |

| Leaching Tanks | Nearing Completion |

| Filter Press System | In Progress |

| Reagent Warehouse 1 | Nearing Completion |

| Reagent Warehouse 2 | In Progress |

| Electrowinning and Carbon Regeneration Workshop | In Progress |

| Gold Room | In Progress |

| Main Power Plant | In Progress |

| Supporting Infrastructure | |

| Item | Construction/Installation Progress |

| Mine Changeroom | Complete |

| Mine Workshop | Complete |

| Site Office | Complete |

| Surface Magazine Storage | Complete |

| Mill Maintenance Workshop | Planning |

| Site CCTV and Fibre Optic Cable Installation | Nearing Completion |

| Fresh Water Supply System | Complete |

| Sewage Treatment Plant (STP) | Complete |

| Diesel Generator Power Plant Installation | In Progress |

| Waste Rock Crusher and Screener | In Production |

| Water Retention Pond | Complete |

| Coreshed Expansion | Complete |

| Tailings Storage Facility (TSF) | |

| Item | Construction/Installation Progress |

| Tailings Dam (Stage 1) | In Progress |

| North Diversion Channel | Complete |

| South Diversion Channel | In Progress |

| TSF Basin Excavation | In Progress |

| TSF Dam Spillway | In Progress |

| HDPE Liner Installation | In Progress |

| Underground Developments/Upgrades | |

| Item | Construction/Installation Progress |

| Link Drive Connecting Main and Exploration Declines | Complete |

| HV Power Plant | In Progress |

| UG Compressor Installation | In Progress |

| Stage 1 Primary Ventilation | In Progress |

Images

Figure 2. Oblique aerial view of mine site under construction, June 16, 2023.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/171562_bb6a2eed54d89a8e_002full.jpg

Figure 3. Aerial view of mine portal, ROM pad, and crushing plant, June 16, 2023.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/171562_bb6a2eed54d89a8e_003full.jpg

Figure 4. Aerial view of processing plant.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/171562_bb6a2eed54d89a8e_004full.jpg

Figure 5. Vertical aerial view of mine site under construction, June 16, 2023.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/171562_bb6a2eed54d89a8e_005full.jpg

Figure 6. Aerial view of TSF under construction, June 16, 2023.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/171562_bb6a2eed54d89a8e_006full.jpg

Figure 7. Location of link drive in relation to the main decline and the historical exploration decline. Mineralized lodes are shown in transparent grey. Connecting the main decline to the exploration decline enables the Stage 1 primary ventilation system to be installed and enables mining of the lodes accessed through the exploration decline.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/171562_bb6a2eed54d89a8e_007full.jpg

About Tuvatu

The Tuvatu Alkaline Gold Project is located on the island of Viti Levu in Fiji. The January 2018 mineral resource for Tuvatu as disclosed in the technical report “Technical Report and Preliminary Economic Assessment for the Tuvatu Gold Project, Republic of Fiji”, dated September 25, 2020, and prepared by Mining Associates Pty Ltd of Brisbane Qld, comprises 1,007,000 tonnes indicated at 8.50 g/t Au (274,600 oz. Au) and 1,325,000 tonnes inferred at 9.0 g/t Au (384,000 oz. Au) at a cut-off grade of 3.0 g/t Au. The technical report is available on the Lion One website at www.liononemetals.com and on the SEDAR website at www.sedar.com.

Qualified Person

In accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43- 101”), Patrick Hickey, Chief Operating Officer, is the Qualified Person for the Company and has reviewed and is responsible for the technical and scientific content of this news release.

About Lion One Metals Limited

Lion One’s flagship asset is 100% owned, fully permitted high grade Tuvatu Alkaline Gold Project, located on the island of Viti Levu in Fiji. Lion One envisions a low-cost high-grade underground gold mining operation at Tuvatu coupled with exciting exploration upside inside its tenements covering the entire Navilawa Caldera, an underexplored yet highly prospective 7km diameter alkaline gold system. Lion One’s CEO Walter Berukoff leads an experienced team of explorers and mine builders and has owned or operated over 20 mines in 7 countries. As the founder and former CEO of Miramar Mines, Northern Orion, and La Mancha Resources, Walter is credited with building over $3 billion of value for shareholders.

On behalf of the Board of Directors of

Lion One Metals Limited

“Walter Berukoff“, Chairman and CEO

Contact Investor Relations

Toll Free (North America) Tel: 1-855-805-1250

Email: info@liononemetals.com

Website: www.liononemetals.com

Neither the TSX Venture Exchange nor its Regulation Service Provider accepts responsibility for the adequacy or accuracy of this release

This press release may contain statements that may be deemed to be “forward-looking statements” within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein are forward-looking information. Generally, forward-looking information may be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “proposed”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases, or by the use of words or phrases which state that certain actions, events or results may, could, would, or might occur or be achieved. This forward-looking information reflects Lion One Metals Limited’s current beliefs and is based on information currently available to Lion One Metals Limited and on assumptions Lion One Metals Limited believes are reasonable. These assumptions include, but are not limited to, the actual results of exploration projects being equivalent to or better than estimated results in technical reports, assessment reports, and other geological reports or prior exploration results. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Lion One Metals Limited or its subsidiaries to be materially different from those expressed or implied by such forward-looking information. Such risks and other factors may include, but are not limited to: the stage development of Lion One Metals Limited, general business, economic, competitive, political and social uncertainties; the actual results of current research and development or operational activities; competition; uncertainty as to patent applications and intellectual property rights; product liability and lack of insurance; delay or failure to receive board or regulatory approvals; changes in legislation, including environmental legislation, affecting mining, timing and availability of external financing on acceptable terms; not realizing on the potential benefits of technology; conclusions of economic evaluations; and lack of qualified, skilled labour or loss of key individuals. Although Lion One Metals Limited has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. Lion One Metals Limited does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/171562

Edmonton, Alberta–(Newsfile Corp. – June 23, 2023) – Grizzly Discoveries Inc. (TSXV: GZD) (FSE: G6H) (OTCQB: GZDIF) (“Grizzly” or the “Company”) is pleased to announce that crews have started to mobilize back to the Rock Creek camp to commence work within the Greenwood Precious and Battery Metals Project.

Geological and prospecting crews have mobilized to the Greenwood Project to commence summer field work. Prospecting, rock and soil sampling, geological mapping, and ground geophysical surveys are immediately planned for the Midway and Imperial areas in preparation for drilling later this year. The Company is awaiting land use permits for conducting drilling and trenching at both projects as well as a number of other areas including Sappho and Copper Mountain.

Figure 1: Exploration Targets 2023.

To view an enhanced version of Figure 1, please visit:

https://images.newsfilecorp.com/files/4488/171168_fce32d20f4d22948_002full.jpg

The geological crew has and will be collecting a number of samples for assay. The samples will be submitted for assay and results will be reported when they become available.

The goal is to have a pipeline of high priority Ag-Au and battery metal targets that are all permitted and ready for a long 2023 drilling campaign in order to prioritize these assets into those that can deliver future mineral resources with additional drilling, eventually leading to some form of economic studies and scenarios that might be able to take advantage of local toll treating opportunities that exist in the Greenwood – Republic region.

2023 Exploration Update for Greenwood

- Additional drilling is warranted in 2023 at both the Dayton and Motherlode North target areas in order to follow-up the anomalous results of the 2022 drilling program. In addition, there are other targets at Motherlode North in the vicinity of the Motherlode Pit, the Greyhound Pit and the Great Hopes crown grant that have yet be drill tested.

- Drilling and trenching permit applications have been submitted for the 2023 season for the Midway, Sappho, Copper Mountain and Imperial targets.

- Additional permit applications for drilling at the Crown Point and the Overlander-Mt Attwood areas are in preparation and will be submitted in the near future.

- The Midway area is being targeted for copper-gold skarn and epithermal gold-silver. The Overlander area is being targeted for mesothermal to epithermal gold-silver.

- At Midway, selective rock grab and composite rock grab samples from outcrop collected from the Midway Mine-Picturestone area, with 4 of 7 rock grab samples from outcropping mineralization in the Midway Mine historical pit yielded a range of 12.05 g/t (or 0.351 ounces per ton [oz/t]) Au up to 70.8 g/t (2.065 oz/t) Au (See Company news release dated October17, 2022).

- Three (3) of the 7 selective rock grab samples from the Midway Mine pits yielded from 1,360 g/t Ag (39.7 oz/t Ag) up to 2,140 g/T Ag (62.4 oz/t Ag) (see the Company news release dated October 17, 2022).

- All highly anomalous samples are from outcrop and characterized by the presence of abundant pyrite, arsenopyrite with visible galena and sphalerite in a siliceous chalcedonic host. The mineralization is hosted in polymetallic veins that display the presence of Pb, Zn, Cu, arsenic (As) and antimony (Sb) and are likely epithermal in nature.

- A selective rock grab sample from outcrop 200 m west of the main Midway Mine yielded 15.85 g/t Au (0.462 oz/t Au) and 1,530 g/T Ag (44.6 oz/t Ag), illustrating that there is potential for additional high-grade mineralization in the area.

- The Sappho area is being targeted for copper-gold-PGEs skarn and porphyry type targets associated with an alkalic intrusion and several diorite intrusions south of Greenwood near the US border.

- At least five new showings of copper oxide/sulphide mineralization were found during the 2022 program at the Sappho Target.

- Previous surface sampling and drilling by Grizzly at the Sappho area has yielded significant anomalous copper, gold, silver along with platinum and palladium.

- Numerous rock grab samples have yielded greater than 1% copper, 1 g/t gold, 1 g/t platinum and 1 g/t palladium (see Company news release dated November 3, 2022).

- Historical drilling (by the Company) has yielded up to 0.31% Cu, 0.75 g/t Au, 0.34 g/t Pt, 0.39 g/t Pd and 6.57 g/t Ag over 6.5 m core length in skarn at Sappho in 2010.

Quality Assurance and Control

Rock and soil samples were analyzed at ALS Global Laboratories (Geochemistry Division) in Vancouver, Canada (an ISO/IEC 17025:2017 accredited facility). Gold was assayed using a fire assay with atomic emission spectrometry and gravimetric finish when required (+10 g/t Au). Rock grab and rock chip samples from outcrop/bedrock are selective by nature and may not be representative of the mineralization hosted on the project.

The sampling program was undertaken by Company personnel under the direction of Michael B. Dufresne, M.Sc., P.Geol., P.Geo. A secure chain of custody is maintained in transporting and storing of all samples.

The technical content of this news release and the Company’s technical disclosure has been reviewed and approved by Michael B. Dufresne, M. Sc., P. Geol., P.Geo., who is the Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects.

Director Resigns

Mr. V. Richard Rabbito has resigned from the Company’s Board of Directors. The 500,000 compensation stock options granted to Mr. Rabbito per the Company’s news release dated May 29, 2023 have been cancelled unexercised.

ABOUT GRIZZLY DISCOVERIES INC.

Grizzly is a diversified Canadian mineral exploration company with its primary listing on the TSX Venture Exchange focused on developing its approximately 66,000 ha (approximately 165,000 acres) of precious and base metals properties in southeastern British Columbia. Grizzly is run by a highly experienced junior resource sector management team, who have a track record of advancing exploration projects from early exploration stage through to feasibility stage.

On behalf of the Board,

GRIZZLY DISCOVERIES INC.

Brian Testo, CEO, President

Suite 363-9768 170 Street NW

Edmonton, Alberta T5T 5L4

For further information, please visit our website at www.grizzlydiscoveries.com or contact:

Nancy Massicotte

Corporate Development

Tel: 604-507-3377

Email: nancy@grizzlydiscoveries.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Caution concerning forward-looking information

This press release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable securities laws. This information and statements address future activities, events, plans, developments and projections. All statements, other than statements of historical fact, constitute forward-looking statements or forward-looking information. Such forward-looking information and statements are frequently identified by words such as “may,” “will,” “should,” “anticipate,” “plan,” “expect,” “believe,” “estimate,” “intend” and similar terminology, and reflect assumptions, estimates, opinions and analysis made by management of Grizzly in light of its experience, current conditions, expectations of future developments and other factors which it believes to be reasonable and relevant. Forward-looking information and statements involve known and unknown risks and uncertainties that may cause Grizzly’s actual results, performance and achievements to differ materially from those expressed or implied by the forward-looking information and statements and accordingly, undue reliance should not be placed thereon.

Risks and uncertainties that may cause actual results to vary include but are not limited to the availability of financing; fluctuations in commodity prices; changes to and compliance with applicable laws and regulations, including environmental laws and obtaining requisite permits; political, economic and other risks; as well as other risks and uncertainties which are more fully described in our annual and quarterly Management’s Discussion and Analysis and in other filings made by us with Canadian securities regulatory authorities and available at www.sedar.com. Grizzly disclaims any obligation to update or revise any forward-looking information or statements except as may be required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/171168

VANCOUVER, British Columbia, June 23, 2023 (GLOBE NEWSWIRE) — Rover Metals Corp. (TSXV: ROVR) (OTCQB: ROVMF) (FSE:4XO) (“Rover” or the “Company”) is pleased to announce a non-brokered private placement financing for a minimum of $300,000 and a maximum of $1,250,000. The Company will issue $0.08 units. Each unit is priced at $0.08 and is comprised of one common share and one common share purchase warrant (the “Units”). The warrants on the Units have an exercise price of $0.12 per warrant share, and a life of two and half (2 ½) years. Assuming the financing is fully subscribed, there will be up to 15,625,000 common shares and 15,625,000 common share purchase warrants issued in connection with this financing, plus any finder’s commission warrants.

Further to the above announcement, Rover has received orders for $500,000 and has also received approval from the Toronto Venture Exchange (the “TSXV”) to close the first tranche of the Unit financing for gross proceeds of $500,000 (the “First Closing”). The Company will issue of 6,250,000 common shares and 6,250,000 warrants. Finders’ commissions are being paid in connection with the First Closing in the amount of cash commissions of $30,000 and finders’ warrants of 375,000. The finder’s warrants will have an exercise price of $0.12 and a useful life of two and half (2 ½) years. The shares and warrants issued under the First Closing will bear the minimum four-month regulatory hold period from the date of issuance.

The financing is being led by experienced lithium investors from Europe and Australia.

An updating release will be provided once the Company has completed any future closings of the Unit financing, including receipt of final acceptance from the TSXV for the financing.

Use of Proceeds

The proceeds from the First Closing will be used for Phase 2 Exploration Drilling at the Company’s Let’s Go Lithium project located in Southwest Nevada.

About Rover Metals

Rover is a publicly traded junior mining company that trades on the TSXV under symbol ROVR, on the OTCQB under symbol ROVMF, and on the FSE under symbol 4XO. Rover is currently focussed on the development of a claystone lithium project in southwest Nevada, USA. Plans for 2023 include a reverse circulation drill program at the Let’s Go Lithium project.

You can follow Rover on its social media channels:

Twitter: https://twitter.com/rovermetals

LinkedIn: https://www.linkedin.com/company/rover-metals/

Facebook: https://www.facebook.com/RoverMetals/

for daily company updates and industry news, and

YouTube: https://www.youtube.com/channel/UCJsHsfag1GFyp4aLW5Ye-YQ?view_as=subscriber

for corporate videos.

Website: https://www.rovermetals.com/

ON BEHALF OF THE BOARD OF DIRECTORS

“Judson Culter”

Chief Executive Officer and Director

For further information, please contact:

Email: info@rovermetals.com

Phone: +1 (778) 754-2617

Statement Regarding Forward-Looking Information

This news release contains statements that constitute “forward-looking statements.” Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Rover’s actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur. There can be no assurance that such statements prove to be accurate. Actual results and future events could differ materially from those anticipated in such statements, and readers are cautioned not to place undue reliance on these forward-looking statements. Any factor could cause actual results to differ materially from Rover’s expectations. Rover undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS NEWS RELEASE REPRESENTS THE EXPECTATIONS OF THE COMPANY AS OF THE DATE OF THIS NEWS RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER SUCH DATE. READERS SHOULD NOT PLACE UNDUE IMPORTANCE ON FORWARD-LOOKING INFORMATION AND SHOULD NOT RELY UPON THIS INFORMATION AS OF ANY OTHER DATE. WHILE THE COMPANY MAY ELECT TO, IT DOES NOT UNDERTAKE TO UPDATE THIS INFORMATION AT ANY PARTICULAR TIME EXCEPT AS REQUIRED IN ACCORDANCE WITH APPLICABLE LAWS.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OF THIS RELEASE.

Ottawa, Ontario–(Newsfile Corp. – June 26, 2023) – Gold79 Mines Ltd. (TSXV: AUU) (OTCQB: AUSVF) (“Gold79” or the “Company”) announces that it is extending the final closing date of its non-brokered private placement announced on June 2, 2023. The closing date of the private placement will now be on or before July 26, 2023. All other terms of the private placement remain unchanged. The placement will raise gross proceeds of up to $1,000,000, comprising 33,333,333 units (each a “Unit”), at $0.03 per Unit (the “Offering”). Each Unit consists of one common share of the Company and one whole common share purchase warrant (a “Warrant”). Each Warrant entitles the holder to purchase one common share of the Company at a price of $0.05 per share for a period of 24 months following the date of issuance. Additionally, the Warrants will be callable during the 24-month period, at the option of the Company, in the event that the 20-day volume-weighted average price of the Company’s common shares meets or exceeds $0.08 for ten consecutive trading days based on trades on the TSX Venture Exchange and Alternative Trading Systems. Subscribers will be notified of the call provision being triggered and will have a 30-day period to exercise the warrants.

As announced on June 9, 2023, the Company closed a first tranche of the private placement raising gross proceeds of $210,000 through the issuance of 7,000,000 units.

Any securities issued under the Offering would be subject to a statutory hold period of four months and one day from the date of issuance. This Offering is subject to approval of the TSX Venture Exchange (“TSX-V”).

It is anticipated that approximately 35% of the aggregate proceeds raised under the Offering will be used for exploration expenditures related to the Gold Chain, Arizona project; approximately 30% will be used for land management costs and property payments, approximately 20% will be used for working capital and general corporate purposes, and approximately 15% will be used to pay management fees to Company officers.

Gold79 may pay commissions to qualified finders in Canada in connection with the Offering. Any finder fees paid would be in accordance with TSX-V policies.

The offered securities will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) and may not be offered or sold within the United States or to or for the account or benefit of U.S. persons, except in certain transactions exempt from the registration requirements of the U.S. Securities Act. This press release does not constitute an offer to sell, or the solicitation of an offer to buy, securities of the Company in the United States.

About Gold79 Mines Ltd.

Gold79 Mines Ltd. is a TSX Venture listed company focused on building ounces in the Southwest USA. Gold79 holds 100% earn-in option to purchase agreements on three gold projects: the Jefferson Canyon Gold Project and the Tip Top Gold Project both located in Nevada, USA, and, the Gold Chain Project located in Arizona, USA. In addition, Gold79 holds a 32.3% interest in the Greyhound Project, Nunavut, Canada under JV by Agnico Eagle Mines Limited.

For further information regarding this press release contact:

Derek Macpherson, President & CEO

Phone: 416-294-6713

Email: dm@gold79mines.com

Website: www.gold79mines.com.

Book a 30-minute meeting with our CEO here.

Stay Connected with Us:

Twitter: @Gold79Mines

Facebook: https://www.facebook.com/Gold79Mines

LinkedIn: https://www.linkedin.com/company/gold79-mines-ltd/

FORWARD-LOOKING STATEMENTS:

This press release may contain forward looking statements that are made as of the date hereof and are based on current expectations, forecasts and assumptions which involve risks and uncertainties associated with our business including the proposed private placement or any future private placements, the uncertainty as to whether further exploration will result in the target(s) being delineated as a mineral resource, capital expenditures, operating costs, mineral resources, recovery rates, grades and prices, estimated goals, expansion and growth of the business and operations, plans and references to the Company’s future successes with its business and the economic environment in which the business operates. All such statements are made pursuant to the ‘safe harbour’ provisions of, and are intended to be forward-looking statements under, applicable Canadian securities legislation. Any statements contained herein that are statements of historical facts may be deemed to be forward-looking statements. By their nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties. We caution readers of this news release not to place undue reliance on our forward-looking statements as a number of factors could cause actual results or conditions to differ materially from current expectations. Please refer to the risks set forth in the Company’s most recent annual MD&A and the Company’s continuous disclosure documents that can be found on SEDAR at www.sedar.com. Gold79 does not intend, and disclaims any obligation, except as required by law, to update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

NOT FOR RELEASE OR DISTRIBUTION IN THE UNITED STATES OR

FOR DISSEMINATION TO U.S NEWS WIRE SERVICES

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/171215

VANCOUVER, BC / ACCESSWIRE / June 23, 2023 / Stillwater Critical Minerals Corp. (TSXV:PGE)(OTCQB:PGEZF) (the “Company” or “Stillwater”) announced today that it has executed a definitive agreement for a strategic equity investment by Glencore Canada Corporation, a wholly-owned subsidiary of Glencore plc (“Glencore”) in the form of a non-brokered private placement financing (the “Placement) for exploration and development activities at the Company’s North American nickel projects, as well as for working capital and general and administrative expenses.

Pursuant to the Placement, Glencore has agreed to purchase 19,758,861 units of Stillwater at a price of $0.25 per unit for gross proceeds of $4.94 million, with each unit comprising one common share and 0.70 of a common share purchase warrant. Each full warrant shall entitle Glencore to purchase one common share at an exercise price of $0.375, providing up to approximately $5.2 million additional funding, if exercised in full. The warrants shall be exercisable for three years from the date of issue and contain a customary acceleration provision, which shall be effective if the volume weighted average trading price of the common shares on the TSX-V is greater than $0.5625 for a period of 20 consecutive trading days.

Following closing of the investment, Glencore will have ownership and control of 9.99% of the outstanding common shares of Stillwater on a non-diluted basis and, including the warrants, 15.87% of the outstanding common shares on a partially diluted basis. Glencore does not currently own or control any securities of the Company.

Stillwater Critical Minerals President and CEO, Michael Rowley, stated, “We are very pleased to welcome Glencore, one of the top five largest mining companies in the world, as a major investor. This represents a major step forward for Stillwater as we advance our flagship Stillwater West project with the vision of becoming a large-scale source of battery and precious minerals that are now listed as critical in the US, and elsewhere. There are very few projects globally, and especially located within the United States, that offer the combination of grade and scale in a producing district that we see at Stillwater West. We are now booking drills and crews for our 2023 drill campaign with a focus on expansion of the high-grade nickel-copper sulphides identified in our past campaigns. We look forward to announcing further details in the coming weeks, along with the start of drilling.”

In connection with the Placement, Stillwater and Glencore have agreed to enter into an investor rights agreement, pursuant to which Glencore will be entitled to certain customary rights including participation in future equity issuances and a right to maintain its pro-rata position in Stillwater.

In addition, a technical committee will be formed with representatives from each company.

Net proceeds of the private placement are intended to be used for exploration and development activities at the Company’s North American nickel projects, as well as for working capital and general and administrative expenses.

The Placement is expected to close, subject to customary conditions, upon acceptance by the TSX Venture Exchange. All securities issued pursuant to the Placement will be subject to a four-month hold period from the date of issuance in accordance with applicable securities laws.

This press release is not an offer or a solicitation of an offer of securities for sale in the United States of America. The common shares of Stillwater Critical Minerals have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration.

About Glencore and its Holdings in the Company

Glencore is one of the world’s largest global diversified natural resource companies and a major producer and marketer of more than 60 commodities that advance everyday life. Through a network of assets, customers and suppliers that spans the globe, Glencore produces, processes, recycles, sources, markets and distributes the commodities that support decarbonisation while meeting the energy needs of today.

With around 140,000 employees and contractors and a strong footprint in over 35 countries in both established and emerging regions for natural resources, Glencore’s marketing and industrial activities are supported by a global network of more than 40 offices.

Glencore’s customers are industrial consumers, such as those in the automotive, steel, power generation, battery manufacturing and oil sectors. Glencore also provides financing, logistics and other services to producers and consumers of commodities.

Glencore is proud to be a member of the Voluntary Principles on Security and Human Rights and the International Council on Mining and Metals. Glencore is an active participant in the Extractive Industries Transparency Initiative and is working to decarbonise its operational footprint.

Certain information in this news release is provided by Glencore in satisfaction of the early warning requirements of National Instrument 62-104 – Take-Over Bids and Issuer Bids. Glencore is acquiring the common shares and warrants for investment purposes and will continue to monitor the business, prospects, financial condition and potential capital requirements of the Company. Depending on its evaluation of these and other factors, Glencore may from time to time in the future decrease or increase its direct or indirect ownership, control or direction over securities of the Company through market transactions, private agreements, subscriptions from treasury or otherwise, or may in the future develop plans or intentions relating to any of the other actions listed in (a) through (k) of National Instrument 62-103F1- Required Disclosure Under the Early Warning Requirements.

For the purposes of this press release and early warning disclosure, the number and percentages of outstanding common shares owned and controlled by Glencore following completion of the investment is based on 197,786,398 outstanding common shares following completion of the investment.

Glencore’s address is 100 King Street West, Suite 6900, P.O. Box 403, Toronto, Ontario, Canada, M5X 1E3. Glencore is incorporated under the laws of Ontario. An early warning report in respect of the investment will be filed under the Company’s profile on SEDAR at www.sedar.com. For a copy of the report or for further Glencore information, please contact Peter Fuchs at (416) 305-9273, peter.fuchs@glencore.ca.

About Stillwater Critical Minerals Corp.

Stillwater Critical Minerals (TSX.V: PGE | OTCQB: PGEZF) is a mineral exploration company focused on its flagship Stillwater West Ni-PGE-Cu-Co + Au project in the iconic and famously productive Stillwater mining district in Montana, USA. With the addition of two renowned Bushveld and Platreef geologists to the team, the Company is well positioned to advance the next phase of large-scale critical mineral supply from this world-class American district, building on past production of nickel, copper, and chromium, and the on-going production of platinum group and other metals by neighboring Sibanye-Stillwater. An expanded NI 43-101 mineral resource estimate, released January 2023, delineates a compelling suite of critical minerals contained within five Platreef-style nickel and copper sulphide deposits at Stillwater West, which host a total of 1.6 billion pounds of nickel, copper and cobalt, and 3.8 million ounces of palladium, platinum, rhodium, and gold, and remains open for expansion along trend and at depth.

Stillwater Critical Minerals also holds the high-grade Black Lake-Drayton Gold project adjacent to Treasury Metals’ development-stage Goliath Gold Complex in northwest Ontario, currently under an earn-in agreement with Heritage Mining, and the Kluane PGE-Ni-Cu-Co critical minerals project on trend with Nickel Creek Platinum‘s Wellgreen deposit in Canada‘s Yukon Territory.

The Company’s address is 904, 409 Granville Street, Vancouver, British Columbia, V6C 1T2.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Michael Rowley, President, CEO & Director – Stillwater Critical Minerals

Email: info@criticalminerals.com

Web: http://criticalminerals.com

Phone: (604) 357 4790

Toll Free: (888) 432 0075

Forward-Looking Statements

This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Stillwater believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Stillwater and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Stillwater Critical Minerals

View source version on accesswire.com:

https://www.accesswire.com/763305/Stillwater-Critical-Minerals-Announces-999-Strategic-Investment-by-Glencore

Grizzly Discoveries

Vancouver, British Columbia, June 22, 2023 (GLOBE NEWSWIRE) — Terra Balcanica Resources Corp. (“Terra” or the “Company”) (CSE:TERA; FRA:UB1) is pleased to announce closing of the 2nd tranche of the non-brokered private placement financing (the “Offering”) of units (the ”Units”) and recommences drilling of the 1.2 km wide Brezani porphyry target at its flagship Viogor-Zanik project in Bosnia and Herzegovina.

Second Tranche Private Placement Financing Closed

The Company issued an aggregate of 3,620,564 Units at a price of $0.085 per Unit for gross proceeds of $307,748 pursuant to the Offering announced on April 4th, 2023. Each Unit consists of one common share in the capital of the Company (each, a “Common Share”) and one Common Share purchase warrant (each whole warrant, a “Warrant”). Each Warrant entitles the holder to purchase one Common Share at an exercise price of $0.13 until June 22nd, 2026.

The Company intends to use the net proceeds of the Offering for working capital and to fund the Phase II drilling across its portfolio of properties. Finders’ fees in the amount of $10,465 were paid.

Aleksandar Mišković, President, CEO and a director (the “Insider”), purchased 147,059 Units as part of the Offering. The issuance of the Units to the Insiders constitutes a “related party transaction” as this term is defined in Multilateral Instrument 61-101 – Protection of Minority Securityholders in Special Transactions (“MI 61-101”). The Company is relying on the exemption from valuation requirement and minority approval pursuant to subsection 5.5(a) and 5.7(a) of MI 61-101, respectively, as the securities do not represent more than 25% of the Company’s market capitalization, as determined in accordance with MI 61-101. The participation by an Insider in the Offering was approved by directors of the Company who are independent in connection with such transactions.

Pursuant to applicable Canadian securities laws, all securities issued and issuable in connection with the closing of the Private Placement will be subject to a four (4) month hold period ending October 22nd, 2023.

This news release does not constitute an offer to sell or a solicitation of an offer to sell any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any state securities laws, and may not be offered or sold within the United States, or to or for the account or benefit of any U.S. person or any person in the United States, unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available. “United States” and “U.S. Person” are as defined in Regulation S under the U.S. Securities Act.

Shares for Debt

The Company has agreed to settle outstanding debt in the amount of CDN$50,000 (the “Debt”) owing to a creditor (the “Creditor”) by issuing an aggregate of 588,236 common shares in the capital of the Company (the “Common Shares”) at a price of $0.085 per Common Share (the “Shares for Debt Transaction”). The Creditor is a private company 100% owned by Aleksandar Ilic, a director and shareholder of the Company. The Board of Directors has determined it is in the best interests of the Company to settle the outstanding Debt through the issuance of the Common Shares in order to preserve the Company’s cash for ongoing operations.

The issuance of the Common Shares to the Creditor constitutes a “related party transaction” as this term is defined in Multilateral Instrument 61-101 – Protection of Minority Securityholders in Special Transactions (“MI 61-101”). The Company is relying on the exemption from valuation requirement and minority approval pursuant to subsection 5.5(a) and 5.7(a) of MI 61-101, respectively, as the securities do not represent more than 25% of the Company’s market capitalization, as determined in accordance with MI 61-101.

Closing of the Shares for Debt Transaction is subject to customary closing conditions and intended to close as soon as practicable. The Common Shares to be issued pursuant to the Shares for Debt Transaction will be subject to a hold period of four (4) months and one (1) day from the date of issuance.

Shares for Services

The Company entered into an arm’s length shares for services agreement dated April 18th, 2023 (the “Agreement“) with a company providing drilling services at Terra’s Viogor-Zanik property (the “Service Provider”). For completion of services rendered under the Agreement between April 18th, 2023 and June 19th, 2023 the Company intends to issue (i) 984,378 units of the Company (“Consideration Units”) to the Service Provider, with each Consideration Unit consisting of one common share in the capital of the Company (a “Share”) and one common share purchase warrant (a “Warrant”). Each Warrant will entitle the holder thereof to acquire one additional Share for a period of 36 months from the date of issuance at an exercise of $0.13. Each Consideration Unit will be issued at a deemed price of $0.085.

Closing of the distribution of Consideration Units pursuant to the Agreement is subject to customary closing conditions and intends to close as soon as practicable. The Common Shares to be issued pursuant to the Shares for Debt Transaction will be subject to a hold period of four (4) months and one (1) day from the date of issuance.

Phase II Drilling Starts at Brezani Target

The Company is recommencing diamond core drilling of the Brezani porphyry system to test a > 600 m wide conductivity anomaly at the centre of a 1.2 km wide anomalously magnetic volume of rock overprinted by potassic alteration under a gold-bearing skarn discovered in 2022 (Figure 1). Drilling within this electrically resistive unit returned 88.0 m of 0.61 g/t AuEq from surface (see company news release dated 24th of January 2023).

Concurrently with the Phase 2 Cumavici drilling program at Viogor-Zanik Terra’s geology team has expanded the strike length of calc-silicate hornfels at Brezani to over 800 m NW-SE and 275 m NE-SW thus expanding the volume of gold-bearing rock to drill test. Sulphide content and grain size increases to the south of the trend, indicating a possible proximity indicator to intrusive contact. The package of calc silicates is interpreted as a mineralized shoulder to the porphyry intrusion.

Figure 1. Conductivity profile of the Brezani target with >95th percentile magnetic anomaly. BREDD002 tested the resistive volume above an abrupt change into coincident high magnetic and elevated electrical conductivity response below 300 m depth which culminates at >60 mS/m at 450 m of depth. Dashed line represents distance from the end of BREDD002 to the top of conductor. (Click here to view image)

Moving 700 m NE from the centre of the calc-silicates, pervasive argillic alteration of a granodioritic unit crops out over 600 m strike length representing the shallowest part of the porphyry system. Within this argillic alteration newly recognized massive specular hematite veining is present, indicative of oxidized hydrothermal fluids, adjacent to gold-bearing hydrothermal breccias. The alteration consists of a silicified groundmass and clay or vugs present after plagioclase feldspar destruction. Secondary, euhedral quartz and arsenopyrite-pyrite-galena-sphalerite can be seen infilling these vugs, offering yet another style of mineralization at the Brezani target.

Qualified Person

Dr. Aleksandar Mišković, P.Geo, is the Company’s designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure of Mineral Projects (“NI 43-101”) and has reviewed and validated that the information contained in this news release as accurate.

About the Company

Terra Balcanica is a polymetallic exploration company targeting large-scale mineral systems in the Balkans of southeastern Europe. The Company has 90% interest in the Viogor-Zanik Project in eastern Bosnia and Herzegovina, 100% of the Kaludra and Ceovishte mineral exploration licences in southern Serbia. The Company emphasizes responsible engagement with local communities and stakeholders. It is committed to proactively implementing Good International Industry Practice (GIIP) and sustainable health, safety, and environmental management.

ON BEHALF OF THE BOARD OF DIRECTORS

Terra Balcanica Resources Corp.

“Aleksandar Mišković”

Aleksandar Mišković

President and CEO

For further information, please contact Alex Mišković at amiskovic@terrabresources.com, or visit our website at www.terrabresources.com.

Cautionary Statement

This news release contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). The use of any of the words “will”, “intends” and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Such forward-looking statements should not be unduly relied upon. Actual results achieved may vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors. The Company believes the expectations reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct. The Company does not undertake to update these forward-looking statements, except as required by law.