VANCOUVER, BC / ACCESSWIRE / July 27, 2022 / Metallic Minerals (TSX.V:MMG)(OTCQB:MMNGF) (“Metallic Minerals“, or the “Company“) is pleased to announce the start of its 2022 exploration and drill campaign at the La Plata silver-gold-copper project, located in southwest Colorado. This is the Company’s second diamond core drill program at La Plata and follows the establishment of a new NI 43-101 compliant mineral resource estimate announced earlier this year (see news release dated April 26, 2022).

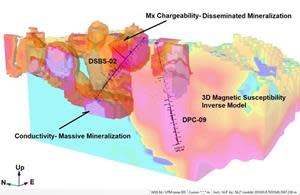

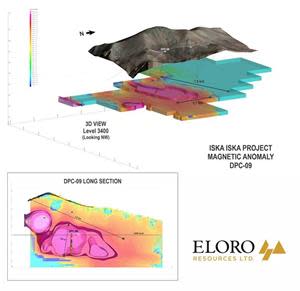

The initial focus of the 2022 drill program is to extend the limits of previously drill-identified mineralization in the Allard resource area, which is expected to form the basis for updated and expanded resource estimate in 2023. The Company is in the process of completing a follow-up ground-based induced polarization geophysical survey designed to support resource expansion drilling, as well as to help refine and prioritize additional copper-silver-gold porphyry targets developed from the Company’s systematic exploration and the application of new technologies on the project.

La Plata Project Highlights

- Inaugural National Instrument 43-101 (“NI 43-101”) compliant inferred mineral resource issued April 2022 for the Allard deposit totals 889 million pounds of copper and 15 million ounces of silver in a constrained model, with 115.7 million tonnes at an average grade of 0.39% copper equivalent (“Cu Eq”) (0.35% Cu and 4.02 g/t Ag) using a 0.25% Cu Eq cut-off grade1.

- Drilling highlights at the Allard porphyry system include 395 m grading 0.57% copper equivalent (0.51% Cu, 6.3 g/t Ag and 0.017 g/t Au) in LP-03, and 854 m at 0.26% Cu, including 254 m grading 0.41% Cu, in drill hole LP-01. Both drill holes started and ended in mineralization.

- Exploration drilling in 2022 is designed to expand limits of known mineralization in the Allard resource area and to test newly developed targets representing potential new copper-silver-gold porphyry mineralization.

Project History

The road accessible La Plata project covers 33 km2 approximately 20 km northeast of Mancos, Colorado within the historic high-grade La Plata mining district located at the southwest end of the prolific Colorado Mineral Belt. Mineralization is related to a large-scale precious metals-rich porphyry copper system with associated high-grade silver and gold epithermal vein and replacement deposits.https://embed.fireplace.yahoo.com/embed?ctrl=Monalixa&m_id=monalixa&m_mode=document&site=sports&os=android&pageContext=%257B%2522ctopid%2522%253A%25221542500%253B1577000%253B1580500%2522%252C%2522hashtag%2522%253A%25221542500%253B1577000%253B1580500%2522%252C%2522wiki_topics%2522%253A%2522La_Plata%253BColorado%253BPorphyry_copper_deposit%253BCompany%253BMancos%252C_Colorado%253BNatural_resource%253BMineral%253BExploration%253BNational_Instrument_43-101%253BBorehole%253BPhelps_Dodge%253BGold_and_Copper%253BCopper%2522%252C%2522lmsid%2522%253A%2522a077000000LnOyOAAV%2522%252C%2522revsp%2522%253A%2522accesswire.ca%2522%252C%2522lpstaid%2522%253A%25226fd0f08e-c132-3ea8-ac39-5f9770e1768b%2522%252C%2522pageContentType%2522%253A%2522story%2522%257D

The La Plata district has a long and rich history of mining with the first silver deposits discovered in the 1700s by Spanish explorers. High-grade silver and gold production has been documented from the 1870s through the early 1940s from vein structures, replacement bodies and breccia zones at over 90 individual mines and prospects3. From the 1950s to 1970s, major miners including Rio Tinto (Bear Creek) and Freeport-McMoRan (Phelps Dodge) explored the district focusing on the significant potential for bulk-tonnage disseminated and stockwork hosted mineralization2. Freeport-McMoRan retained ownership of claims in the district until 2002 when they sold their holdings to the current underlying vendors during the lows of the last metal price cycle.

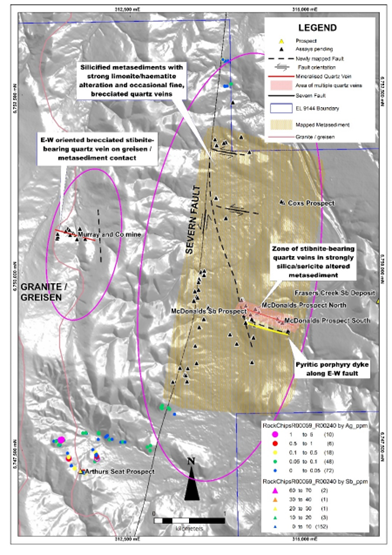

A total of 56 drill holes totaling 15,200 m have been drilled on the property since the 1950s which confirm the presence of large multi-phase porphyry system with significant silver, gold and copper. This large-scale mineralized system is associated with a 10 km2 strongly magnetic signature with intense hydrothermal alteration. Surrounding the central porphyry system is an associated high-grade silver and gold-rich epithermal system measuring at least 8 km by 2 km that hosts 56 identified vein, replacement, and breccia structures. Historical production from some of these high-grade structures included bonanza grades for silver and gold2.

In addition to the development of the inaugural resource estimate, exploration completed by Metallic Minerals at La Plata to date has included confirmation drilling, resampling of historic drill core and underground sampling, surface mapping, and soil sampling. The Company has also completed comprehensive geophysical surveys over the project including airborne resistivity and magnetics, ground-based induced polarization surveys, and analysis of multi-spectral remote sensing data to establish mineralized anomalies and domains for the various styles of mineralization. This work has identified 16 untested potential porphyry centers outside of the main Allard resource area, as well as developed targets with potential for significant high-grade epithermal silver and gold.

Warrant Extension

Metallic further announces that the Company has applied to the TSX Venture Exchange for approval to extend the expiry date on 9,587,500 warrants that were due to expire August 13, 2022 (the “Warrants”) to February 13, 2023. The Warrants were originally issued as part of a financing completed in August 2020 (see news release dated August 13, 2020) led by Canaccord Genuity Corp. on behalf of a syndicate of underwriters including Red Cloud Securities Inc. and Mackie Research Capital Corporation. The warrants entitle the holder to acquire one common share at an exercise price of $0.60.

About Metallic Minerals

Metallic Minerals Corp. is an exploration and development stage company, focused on silver, gold and copper in the high-grade Keno Hill and La Plata mining districts of North America. Our objective is to create shareholder value through a systematic, entrepreneurial approach to making exploration discoveries, growing resources and advancing projects toward development. Metallic Minerals has consolidated the second-largest land position in the historic Keno Hill silver district of Canada’s Yukon Territory, directly adjacent to Alexco Resource Corp’s operations, with more than 300 million ounces of high-grade silver in past production and current M&I resources. Hecla Mining Company, the largest primary silver producer in the USA and fourth largest in the world, announced the acquisition of Alexco in July 2022. Metallic recently announced the inaugural NI 43-101 mineral resource estimate for its La Plata silver-gold-copper project in southwestern Colorado. The Company also continues to add new production royalty leases on its holdings in the Klondike gold district in the Yukon. All three districts have seen significant mineral production and have existing infrastructure, including power and road access. Metallic Minerals is led by a team with a track record of discovery and exploration success on several major precious and base metal deposits, as well as having large-scale development, permitting and project financing expertise.

About the Metallic Group of Companies

The Metallic Group is a collaboration of leading precious and base metals exploration and development companies, with a portfolio of large, brownfields assets in established mining districts adjacent to some of the industry’s highest-grade producers of silver and gold, platinum and palladium, and copper. Member companies include Metallic Minerals in the Yukon’s high-grade Keno Hill silver district and La Plata silver-gold-copper district of Colorado, Granite Creek Copper in the Yukon’s Minto copper district, and Stillwater Critical Minerals in the Stillwater PGE-nickel-copper district of Montana and Kluane district in the Yukon. The founders and team members of the Metallic Group include highly successful explorationists formerly with some of the industry’s leading explorer/developers and major producers. With this expertise, the companies are undertaking a systematic approach to exploration and development using new models and technologies to facilitate discoveries in these proven, but under-explored, mining districts. Members of the Metallic Group have been recognized as recipients of awards for excellence in environmental stewardship demonstrating commitment to responsible resource development and appropriate ESG practices. The Metallic Group is headquartered in Vancouver, BC, Canada, and its member companies are listed on the Toronto Venture, US OTCQB and Frankfurt stock exchanges.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Website: www.mmgsilver.com

Phone: 604-629-7800

Email: cackerman@mmgsilver.com

Toll Free: 1-888-570-4420

Footnotes

1) See Technical Report on the Inaugural Mineral Resource Estimate for the Allard Cu-Ag Porphyry Deposit, La Plata Project, Colorado, USA with an effective date of April 3, 2022. The Mineral Resource has been estimated in conformity with CIM Estimation of Mineral Resource and Mineral Reserve Best Practices Guidelines (2019) and current CIM Definition Standards – For Mineral Resources and Mineral Reserves (2014). The constrained Mineral Resources are reported at a base case cut-off grade of 0.25% CuEq, based on metal prices of $3.60/lb Cu and $22.50/oz Ag, assumed metal recoveries of 90% for Cu and 65% for Ag, a mining cost of US$5.30/t rock and processing and G&A cost of US$11.50/t mineralized material. (1) Cu Eq* calculations are based on 100% recovery of all metals using the same metal prices used for the resource calculation. All figures are rounded to reflect the relative accuracy of the estimate. The current Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability. The quantity and grade of reported Inferred Resources in this Mineral Resource Estimate are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as Indicated or Measured. However, based on the current knowledge of the deposits, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

2) Eckel, USGS Prof Paper 219, Geology and Ore Deposits of the La Plata Mining District, 1949;

3) Bear Creek Mining (now Rio Tinto), Humble Oil (now Exxon) and Phelps Dodge (now Freeport-McMoRan) company reports.

Qualified Persons

The La Plata copper-silver project 2022 mineral resource estimate was prepared by Allan Armitage, P. Geo., of SGS Geological Services, an independent Qualified Person, in accordance with the guidelines of the Canadian Securities Administrators’ National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) with an effective date of October 7, 2021. Jeff Cary, CPG, a qualified person for the purposes of National Instrument 43-101, has reviewed and approved the technical disclosure contained in this news release. Mr. Cary is a Senior Geologist and La Plata Project Manager for Metallic Minerals.

Forward-Looking Statements

This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Metallic Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Group Ten and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Metallic Minerals Corp.

View source version on accesswire.com:

https://www.accesswire.com/709928/Metallic-Minerals-Announces-Start-of-Drilling-at-La-Plata-Silver-Gold-Copper-Project-in-Southwest-Colorado-USA-and-Extends-Warrant-Expiry