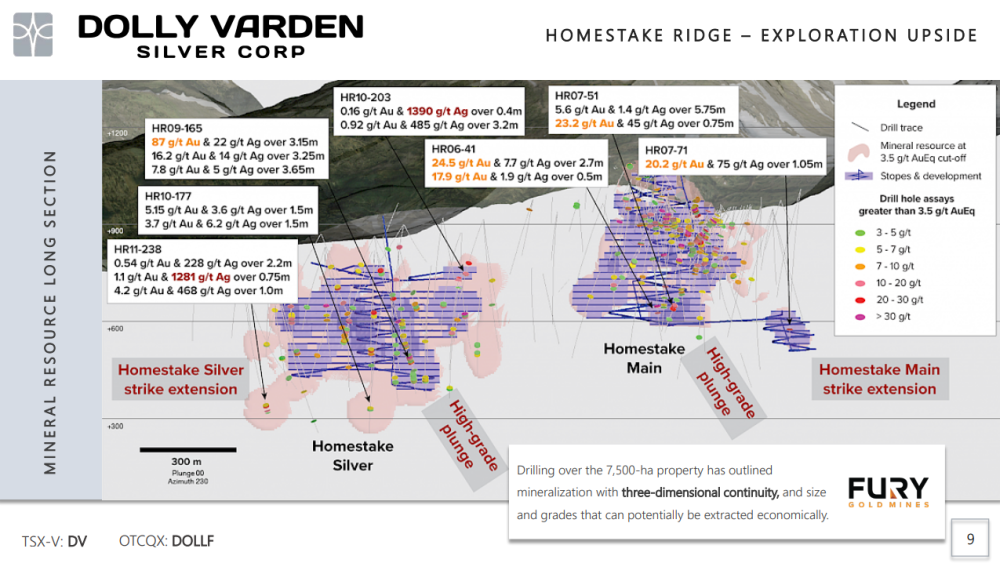

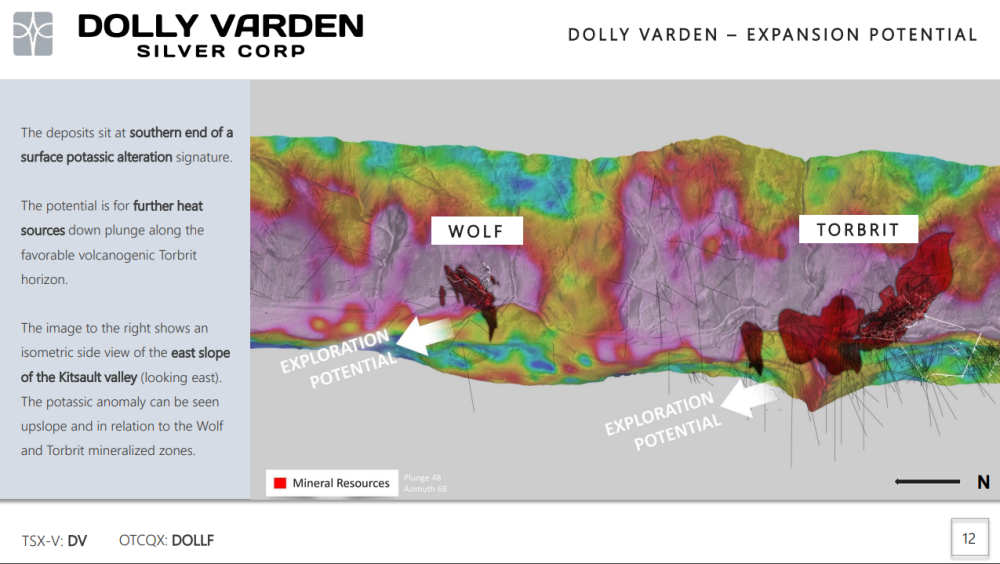

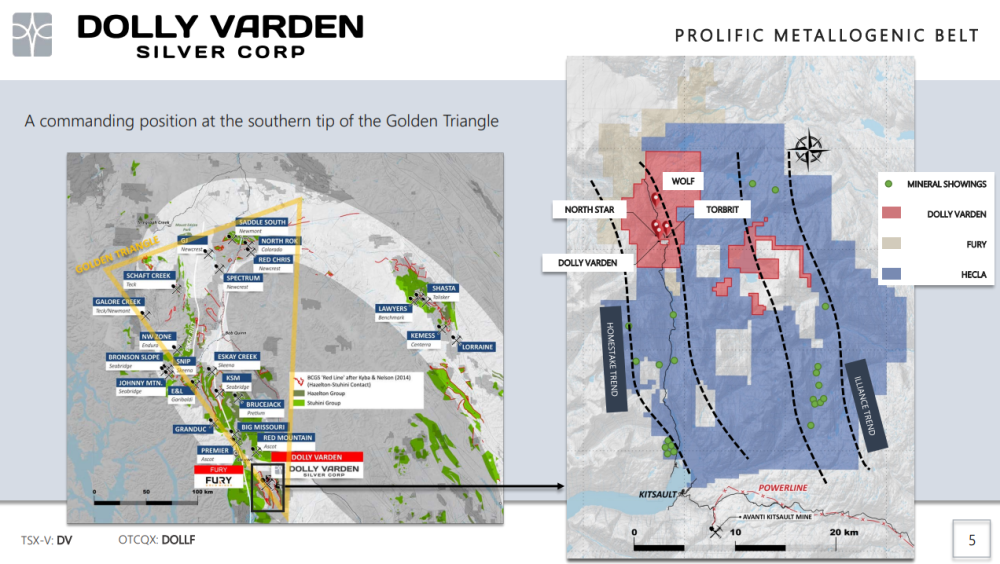

Figure 1

Long section showing mined out stopes and highlighted intercepts

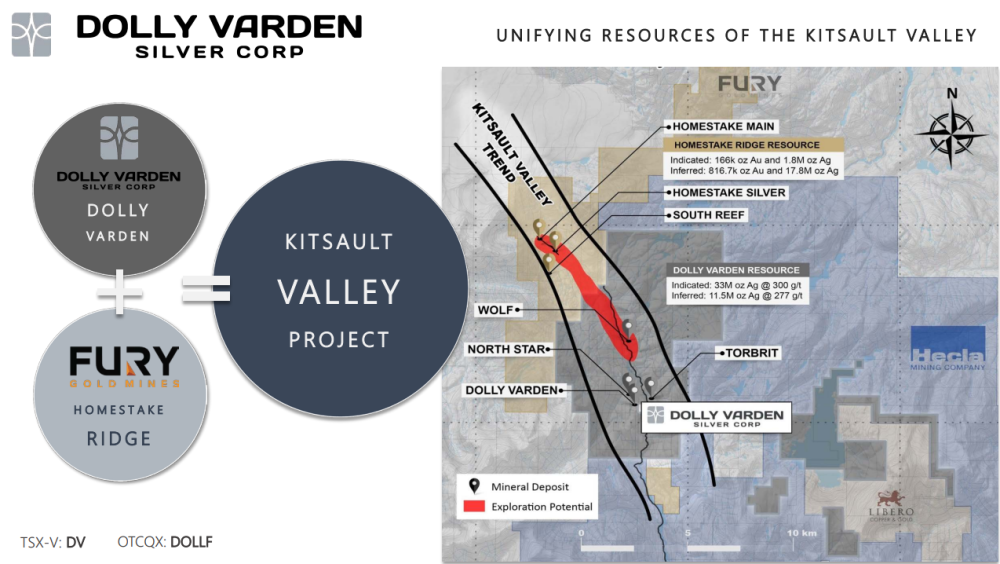

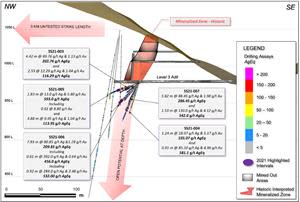

Figure 2

Oblique cross section highlighting 2021 assay results

VANCOUVER, British Columbia, Dec. 14, 2021 (GLOBE NEWSWIRE) — Silver Hammer Mining Corp. (CSE: HAMR / OTCQB: HAMRF) (“Silver Hammer” or the “Company”) is pleased to report results from the Company’s recently completed initial Phase I drill campaign at the past-producing Silver Strand Mine located in Idaho, USA. Historical records at Silver Strand indicate the potential for both significant gold (“Au”) and silver (“Ag”) mineralization within the upper part of the system, directly below the lowest surface level. All six drillholes (first drilling in ~20 years at Silver Strand) cut through a 25 metre (m) wide zone of intensely silicified quartzite with locally higher-grade Au-Ag mineralization and confirmed the Company’s thesis that the mineralized body extends beneath the old mine workings.

Highlights:

- SS21-003: 1.13 g/t Au and 89.76 g/t Ag over 4.57 m (202.76 g/t Silver Equivalent) (“AgEq”) (AgEq silver:gold ratio 100:1) shown for reference purposes

- SS21-004: 5.17 g/t Au and 18.07 g/t Ag over 1.24 m (535.07 g/t AgEq), followed by 4.96 g/t Au and 85.10 g/t Ag over 0.91 m (581.10 g/t AgEq)

- SS21-005: 5.80 g/t Au and 13 g/t Ag over 1.83 m (593.93 g/t AgEq)

- SS21-006: 1.29 g/t Au and 80.85 g/t Ag over 7.93M (209.85 g/t AgEq), Including 0.61 g/t Au and 392.00 g/t Ag over 0.61 m (456.00 g/t AgEq) and 2.48 g/t Au and 284.00 g/t Ag over 0.92 m (532.00 g/t AgEq)

- SS21-007: 4.12 g/t Au and 130.00 g/t Ag over 1.53 m (542.00 g/t AgEq)

“We are very encouraged that all six drillholes from our initial drill campaign at Silver Strand cut significant Au-Ag mineralization. Quickly and cost effectively rehabilitating and utilizing the existing underground allowed us to create a new drilling station accessed from the surface level 3 portal,” stated President and CEO, Morgan Lekstrom.

Lekstrom added, “Other large high-grade silver mines in the same Revett Formation rocks within the Coeur d’Alene district extend to 1,800 m or greater, often with the highest silver grades starting 100’s of metres below surface. Our shallow confirmatory drilling has successfully delivered proof-of-concept and we look forward to testing the system at greater depth and targeting potential additional high-grade chutes along strike in 2022.”

Figure 1: Long section showing mined out stopes and highlighted intercepts

https://www.globenewswire.com/NewsRoom/AttachmentNg/d0f03e87-c4b2-494c-bbad-d80a01476417

The Company recently completed mine rehabilitation work within the level 3 portal (see Figure 1 above and press release September 1, 2021) and established a new underground drill station stepped out from the old mine workings. This station is on the same plane as surface and will allow for an expedited, focused, and cost-effective way to continue drilling at greater depths and along strike.

Table 1: Summary of significant gold (Au) and silver (Ag) assay results

| Hole_ID | From (m) | To (m) | INTVL (m) | Au_g/t | Ag_g/t | AgEq_g/t* |

| SS21-003 | 19.66 | 24.08 | 4.42 | 1.13 | 89.76 | 202.76 |

| 24.08 | 25.21 | 1.13 | No samples obtained | |||

| and | 25.21 | 27.74 | 2.53 | 1.04 | 12.29 | 116.29 |

| SS21-004 | 41.76 | 43.01 | 1.25 | 5.17 | 18.07 | 535.07 |

| 43.01 | 46.33 | 3.32 | Post mineral Dyke | |||

| and | 46.33 | 47.24 | 0.91 | 4.96 | 85.10 | 581.10 |

| SS21-005 | 26.21 | 28.04 | 1.83 | 5.80 | 13.93 | 593.93 |

| Including | 26.21 | 27.13 | 0.92 | 8.80 | <3 | 880.00 |

| And | 31.39 | 36.27 | 4.88 | 1.04 | 9.95 | 113.95 |

| SS21-006 | 35.05 | 42.98 | 7.93 | 1.29 | 80.85 | 209.85 |

| Including | 38.71 | 39.32 | 0.61 | 0.64 | 392.00 | 456.00 |

| Including | 40.84 | 41.76 | 0.92 | 2.48 | 284.00 | 532.00 |

| SS21-007 | 29.57 | 31.39 | 1.82 | 1.98 | 88.45 | 286.45 |

| Including | 30.48 | 31.39 | 0.91 | 2.36 | 111.00 | 347.00 |

| and | 34.44 | 35.97 | 1.53 | 4.12 | 130.00 | 542.00 |

| SS21-008 | 15.54 | 17.78 | 2.24 | 0.47 | 84.40 | 131.40 |

*Notes: All reported assays are downhole core lengths, uncapped and calculated using a 110 g/t Ag cut-off grade. AgEq_g/t = Ag_g/t + Au_g/t*100; True thickness unknown. One hundred percent recovery utilized. AgEq shown for reference purposes.

Background and Interpretation of Results

The Company’s initial targeted pierce points would have required approximately 3,000 m of drilling from surface as well as a more extensive surface permitting process, but by utilizing an underground drill method, the equivalent drilling was completed with only ~290 m in six core holes. Drillholes were positioned to evaluate presumed extensions of mineralization beneath the lowest production level of the mine (see Figure 2 below).

Figure 2: Oblique cross section highlighting 2021 assay results

https://www.globenewswire.com/NewsRoom/AttachmentNg/1737c57e-f045-4011-a7e4-1219a894a84a

The six drillholes completed from the underground drilling all passed through a 25 m wide zone of intensely silicified quartzite with extensive, highly fractured quartz veining which hosts at its core the Au-Ag mineralization being reported (see Table 1 above). This zone of pervasive hydrothermal alteration and lower grade halo precious metal mineralization (e.g. SS21-005 cut 1.36 g/t Au over 15.5 m and SS21-007 cut 1.38 g/t Au over 9.41 m) is also intruded by a post-mineral mafic dyke, as noted for drillhole SS21-004. The extent and intensity of the silica alteration supports the Company’s view that the Silver Strand project represents a compelling exploration target with potential for increased gold-silver values across broader intervals at greater depths and along strike.

Confirming the association of the quartz to the mafic dyke, allows the Company to extend its exploration plans not only underground, but to understand the UAV MAG survey anomalies with potential for exploration surface drilling as well.

Quality Assurance, Quality Control

Sample Security

The following measures were taken to ensure sample security: samples were submitted to the American Analytical Services (AAS) by company personnel following the guidelines and procedures of Silver Hammer Mining Company; only authorized personnel have attended the samples; core was logged at the Silver Hammer core processing facility and then transferred to the AAS lab in Osburn, Idaho.

Analysis Suite

All drill core samples were analyzed by AAS using conventional assay methods involving the fire assaying of 30 gram charges of pulverized sample material for gold and silver, with ICP finishing. Gravimetric analyses were to be applied to any samples that yielded Au values greater than 10 g/t Au and 10 g/t Ag. In addition, pulverized charges were collected for all core samples and were entirely dissolved using 4-acid digestion, with the final solution being analyzed for 35 elements using the ICP-MS method.

Audits or reviews

Internal review of sampling techniques, data, and drilling results by the Company’s management is routinely done through the course of the project.

Standards, Blanks and Duplicates

For quality assurance/quality control purposes, the batches of core samples sent to AAS for assaying and ICP analyses were regularly infused with ‘duplicate’, ‘standard’ and ‘blank’ samples. So-called ‘standard’ samples consisted of certified reference material (OREAS 611) of pulverized rock obtained from OREAS, a company that provides certified reference materials. The ‘blank’ samples consisted of barren landscaping gravel, while the ‘duplicates’ were in fact laboratory duplicates created during sample preparation at the labs of AAS. The laboratory also provided analytical results for their own reference samples for further a QA/QC check. The standards and blanks were inserted into the assay stream by Silver Hammer geologists.

Qualified Person

Technical aspects of this press release have been reviewed and approved by Philip Mulholland, P.Geo., the designated Qualified Person (QP) under National Instrument 43-101.

About Silver Hammer Mining Corp.

Silver Hammer Mining Corp. is a junior resource company exploring mineral claims covering the past-producing Silver Strand Mine in the Coeur d’Alene Mining District in Idaho, USA as well as the Eliza Silver Project and the Silverton Silver Mine, both located in Nevada, one of the world’s most prolific mining jurisdictions, and the Lacy Gold Project in British Columbia, Canada. The Company recently completed its initial drill program at Silver Strand that was designed to test for silver and gold mineralization immediately below the mine’s lowest level some 90 metres below surface. Silver Hammer strives to become a multi-mine silver producer and will focus near-term exploration and drilling programs at its Idaho and Nevada silver-gold assets.

*Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

On Behalf of the Board of Silver Hammer Mining Corp.

Morgan Lekstrom, President and CEO

Corporate Office: 551 Howe Street, Vancouver, British Columbia V6C 2C2, Canada

For further information contact:

Kristina Pillon, President, High Tide Consulting Corp.

T: 604.908.1695

E: investors@silverhammermining.com

For media inquiries, contact: Adam Bello, Primoris Group Inc.

T: 416.489.0092

E: media@primorisgroup.com

The CSE does not accept responsibility for the adequacy or accuracy of this release.

The Canadian Securities Exchange has neither approved nor disapproved the contents of this press release.

Shawn Khunkhun:

Shawn Khunkhun: Shawn Khunkhun:

Shawn Khunkhun: