Spotify:https://open.spotify.com/episode/09FO0OzuguyQF0PKbYl1Pz

Category: Precious Metals

Vancouver, British Columbia–(Newsfile Corp. – December 21, 2021) – EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the “Company“, or “EMX“) is pleased to announce the execution, by its wholly-owned subsidiary Bronco Creek Exploration Inc., of exploration and option agreements (the “Agreements”) for four precious-metals projects (the “Projects” or individually a “Project”) located in Idaho and Nevada to Hochschild Mining PLC (LSE: HOC) (“Hochschild”). The Agreements provide EMX with work commitments and cash payments during Hochschild’s earn-in period, and upon earn-in for a given project, a 4% net smelter return (“NSR”) royalty, annual advance royalty payments, and milestone payments. Prior to final execution of the agreements, EMX and Hochschild agreed to, and commenced, initial exploration programs on all four Projects.

The three Idaho Projects, Valve House, Timber Butte, and Lehman Butte are located in southern and south-central Idaho (see Figure 1). Valve House and Timber Butte host Carlin-style gold mineralization in prospective carbonate-rich lithologies. Lehman Butte hosts epithermal style veins in Eocene volcanic rocks and jasperoids in older Paleozoic carbonate rocks. The Speed Goat Project hosts an intrusion-related gold-copper target located in the greater Battle Mountain-Eureka gold belt of north-central Nevada.

The Projects were recently acquired by staking prospective open ground during EMX’s ongoing regional scale, field-oriented royalty generation gold program. The Agreements with Hochschild serve as an example of the Company’s successful execution of the royalty generation aspect of its business model. Part and parcel to EMX’s business model, the Projects are now advancing with funding from a quality international mining company with EMX receiving pre-production payments while retaining upside optionality with retained NSR royalty interests.

Commercial Terms Overview. Pursuant to the Agreements, Hochschild can earn a 100% interest in a Project by (all dollar amounts in USD): (a) making option payments totaling $600,000, (b) completing $1,500,000 in exploration expenditures before the fifth anniversary of a given Agreement, and (c) reimbursing EMX the previous year’s holding costs. For clarity, the above terms are per individual Agreement covering an individual Project.

Upon an option exercise, EMX will retain a 4% NSR royalty on a Project. Hochschild may buyback up to a total of 1.5% of the royalty by first completing an initial 0.5% royalty buyback for a payment of 300 ounces of gold (or the cash equivalent) to the Company prior to the third anniversary of the option exercise. If the first buyback is completed, then the remaining 1% of the royalty buyback can be purchased anytime thereafter for a payment of 1,700 ounces of gold (or the cash equivalent) to the Company. Hochschild will also make annual advance royalty (“AAR”) payments of $50,000 that increase to $100,000 upon completion of a Preliminary Economic Assessment (“PEA”). The AAR payments for a Project cease upon commencement of production. In addition, Hochschild will make Project milestone payments consisting of: (a) $500,000 upon completion of a PEA, (b) $1,000,000 upon completion of a Prefeasibility Study, and (c) $1,000,000 upon completion of a Feasibility Study.

Project Overviews and 2021 Work Programs. The Projects optioned to Hochschild represent diverse styles of precious metals mineralization within, and along extensions of, key mineral belts in Idaho and Nevada.

Valve House, Idaho. Valve House is located approximately 25 kilometers southeast of Pocatello, Idaho. The Project covers 9.5 square kilometers of Carlin-style alteration and mineralization hosted within lower Paleozoic silty carbonate units. Gold mineralization is both structurally and stratigraphically controlled. The last noteworthy exploration, conducted in the 1980’s, identified three separate areas of gold mineralization and jasperoid replacement in limestone lithologies. Historical drill intercepts from this work included 42.7 meters averaging 0.87 g/t gold (from 10.7 to 53.4 m, true width unknown) and 21.3 meters averaging 0.71 g/t gold (from 0 to 21.3 m, true width unknown)1. Mineralization remains open for expansion.

To date, Hochschild has conducted additional reconnaissance mapping and rock chip sampling, a property-wide soil survey and an induced polarization (“IP”) geophysical survey. As well, Hochschild expanded the property position by staking additional claims. Hochschild’s exploration results are pending.

Timber Butte, Idaho. Timber Butte is located approximately 15 kilometers northeast of Carey, Idaho. The Project is a Carlin-style target characterized by anomalous gold mineralization associated with jasperoid and decalcified carbonate bearing rocks along north-northwest oriented structures cutting Roberts Mountains Formation, a key host to Carlin-style mineralization in Nevada. Cordex explored a portion of Timber Butte in the 1970’s and completed three rotary holes that intersected anomalous gold mineralization. EMX’s work has extended beyond the historical target area with additional targets identified along trend and under shallow colluvial cover. EMX’s rock chip sampling of altered outcrops on the main structural trend returned assay results including 1.25 g/t gold (n=19, avg. 0.1 g/t Au) along a strike length of approximately 3.2 kilometers.

After completing additional reconnaissance mapping and rock chip sampling, Hochschild expanded the land position, completed soil sampling geochemical surveys over key target areas, and collected stream sediment samples. An IP survey is planned for the first part of 2022 while awaiting assay results from the geochemical sampling programs.

Lehman Butte, Idaho. Lehman Butte is located in south-central Idaho, approximately 15 kilometers west-northwest of Mackay. The target at Lehman Butte is low sulfidation epithermal precious metals mineralization in quartz-sulfide veins cutting Eocene lavas and tuffs which overlie Paleozoic carbonate units. The quartz-sulfide veins are commonly greater than one meter wide and associated with widespread quartz-clay-adularia alteration in intermediate volcanic rocks, as well as with jasperoid alteration in the underlying Mississippian age limestone. The Project was identified from an EMX regional stream sediment geochemical program. Follow-up reconnaissance work included a rock chip sample of 3.1 g/t gold and 19.8 g/t silver (n=35, avg. 0.185 g/t Au and 6.7 g/t Ag) coincident with silicified zones and quartz-pyrite feeder veins. EMX and Hochschild are targeting bulk-tonnage precious metals mineralization hosted within permeable tuffaceous units.

Hochschild’s recently completed work program entailed property-wide geologic mapping and rock chip sampling along with an 800-sample soil survey and ground magnetic geophysical program. Results are pending. An IP survey together with an initial drill test is planned for the spring of 2022.

Speed Goat, Nevada. Speed Goat is located within the Battle Mountain-Eureka Trend, approximately 30 kilometers northwest of the Phoenix-Fortitude intrusion-related skarn system in north-central Nevada. EMX identified gold-copper mineralization composed of sheeted quartz-iron oxide after sulfide veins cutting Jurassic granodiorite. Mineralization appears to be related to a series of north-south striking porphyry dikes. Reconnaissance soil sampling by EMX outlined a 0.6 by 1 kilometer gold-in-soil anomaly (n=73, avg. 82 ppb Au) coincident with rock chip assays from outcrop that included 5.1 g/t gold (n=20, avg. 0.67 g/t Au). The mineralization is also anomalous in pathfinder geochemical elements (e.g., Bi-As-Sb-Cu), consistent with other intrusion-related gold systems in the nearby Battle Mountain district.

At Speed Goat, Hochschild completed additional geologic mapping and select channel sampling across the target zone in addition to ground magnetic and IP geophysical surveys in preparation for an initial drill test.

Comments on Sampling, Assaying, QA/QC, and Historical Exploration Results. EMX’s exploration samples were collected in accordance with industry standard best practices. The samples were submitted to ALS laboratories in Reno, Nevada and Vancouver, Canada (ISO 9001:2017 and ISO/IEC 17025:2017 accredited) for sample preparation and analysis. Gold assays were performed by fire assay with an ICP/AES finish. EMX conducts routine QA/QC analysis on its exploration samples, including the utilization of certified reference materials, blanks, and duplicate samples. Gold assays were performed by fire assay with an ICP/AES finish. Silver and other elements were analyzed by four acid digestion with ICP-AES or AAS finish.

From EMX’s independent field work, including geological mapping and geochemical sampling, the historical drill results referenced from Meridian and Cordex are judged to be representative and relevant.

Michael P. Sheehan, CPG, a Qualified Person as defined by National Instrument 43-101 and an employee of the Company, has reviewed, verified, and approved the disclosure of the technical information contained in this news release.

About EMX. EMX is a precious, base and battery metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and TSX Venture Exchange under the symbol EMX, as well as on the Frankfurt Exchange under the symbol “6E9”. Please see www.EMXroyalty.com for more information.

For further information contact:

David M. Cole

President and Chief Executive Officer

Phone: (303) 973-8585

Dave@EMXroyalty.com

Scott Close

Director of Investor Relations

Phone: (303) 973-8585

SClose@EMXroyalty.com

Isabel Belger

Investor Relations (Europe)

Phone: +49 178 4909039

Ibelger@EMXroyalty.com

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release may contain “forward looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to: unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended September 30, 2021 and the year ended December 31, 2020 (the “MD&A”), and the most recently filed Revised Annual Information Form (the “AIF”) for the year ended December 31, 2020, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedar.com and on the SEC’s EDGAR website at www.sec.gov.

Figure 1: Locations of the EMX Projects optioned to Hochschild

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/1508/108153_6b64df24a4b0f9a6_002full.jpg

____________________________

1 Meridian Gold and Cordex Exploration, 1984-1991. Unpublished internal company data.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/108153

VANCOUVER, BC / ACCESSWIRE / December 20, 2021 / Group Ten Metals Inc. (TSX.V:PGE)(OTCQB:PGEZF)(FSE:5D32) (the “Company” or “Group Ten”) today reports partial results from the first two drill holes of the 14-hole resource expansion campaign completed in 2021 at the Company’s flagship Stillwater West PGE-Ni-Cu-Co + Au project in Montana, USA. Results are expected to form the basis of an updated resource estimate in 2022.

2021 Drill Highlights:

- CZ2021-01 returned the widest high-grade intercept to date on the project being 63.7 meters of 0.92% Nickel Equivalent (“NiEq”), equal to 2.46 g/t Palladium Equivalent (“PdEq”), with 0.47% Ni, 0.42 g/t Pd, 0.27% Cu, and 0.04% Co as well as significant Pt and Au values, within 367.6 meters of continuous mineralization at 0.31% NiEq (or 0.83 g/t PdEq). See Table 1 for details.

- CM2021-01 returned the longest mineralized intercept ever recorded in the Stillwater district with 728 meters of continuous sulphide mineralization at 0.27% NiEq, or 0.73 g/t PdEq, including contained intervals of successively higher grades:

- 352.9 meters of 0.39% NiEq (or 1.04 g/t PdEq) with 0.52 g/t 3E (Pd, Pt, and Au), and 0.17% Ni, plus significant Cu and Co values;

- 159.2 meters of 0.48% NiEq (or 1.29 g/t PdEq) with 0.77 g/t 3E, 0.18% Ni, plus significant Cu and Co values;

- 50.2 meters of 0.54% NiEq (or 1.45 g/t PdEq) with 1.0 g/t 3E, 0.19% Ni, plus significant Cu and Co values; and

- Shorter intervals of high-grade mineralization including 7.2 meters of 1.33 g/t Pd, 0.93 g/t Pt, and 0.24% Ni, plus significant Au, Cu, and Co values, for 1.02% NiEq (or 2.72 g/t PdEq).

- Both holes are step-outs completed with the objective of expanding deposits delineated by the 2021 Mineral Resource Estimate announced on October 21, 2021:

- CM2021-01 was one of six holes drilled in 2021 in the area between the DR and Hybrid deposits to step out from high-grade nickel sulphide-PGE mineralization identified in hole CM2020-04;

- CZ2021-01 is one of two holes drilled in 2021 to step-out on the CZ deposit in the area of wide, high-grade mineralization returned in hole CZ2019-01.

- Mineralization starts at or near surface in both holes.

- Assay results are pending from the lowest portion of CZ2021-01, and from the remaining 12 holes drilled in 2021. Rhodium results are also pending on all holes.

Michael Rowley, President and CEO, commented, “These initial results from the first two holes of our 2021 resource expansion drill campaign provide the strongest demonstration to date of our ability to target highly mineralized zones at Stillwater West, with significant wide intervals reaching more than five times the cut-off grade used in our recent resource estimate. This is very clear evidence that our predictive geologic model, utilizing tools like deep penetrating induced polarization geophysics, is accurately and effectively guiding us to drill wide zones of higher-grade nickel-copper-cobalt sulphide mineralization (battery metals), enriched in palladium, platinum, rhodium (platinum group elements), and gold. In addition to driving increased size and grade in our planned resource update, our ability to target effectively as we step-out from known mineralization in a large magmatic system is delivering incredibly low discovery costs as we advance the project.”

“Our work to date has demonstrated the exceptional scale and potential of the mineralized system in the lower Stillwater Complex. These results confirm and refine that understanding with Chrome Mountain hole CM2021-01 returning nearly three-quarters of a kilometer of continuous mineralization from a site that is over seven kilometers west of the HGR deposit in the Iron Mountain area, where hole IM2019-03 previously held the record for highest grade-thickness. Both areas have additional very high grade-thickness intervals in drill results, as does the CZ deposit located between the two. All of this confirms our observation that the lower Stillwater Complex has an immense endowment of contained metal and yet is surprisingly underexplored, despite its location in a famously productive and well-mineralized American mining district. Our systematic approach to exploration has quickly delineated five resource-stage deposits that are open for expansion across the nine-kilometer core of the Stillwater West project and we will continue to focus on their expansion while also advancing earlier stage targets that continue across the 32 kilometers of prospective magmatic stratigraphy covered by the property. We look forward to announcing results from the remaining drill holes along with results of our 2021 IP expansion survey in the near term as they become available.”

Table 1 – Highlight Results from 2021 Expansion Drill Campaigns at the DR, Hybrid, and CZ Deposit Areas

Assays pending for rhodium and certain intervals denoted by *. Highlighted significant intercepts with grade-thickness values over 20 gram-meter PdEq are presented above. Grade thickness values cover significant mineralized intervals with total palladium and nickel equivalent grade-thickness determined by multiplying the thickness of continuous mineralization (in meters) by the palladium equivalent grade (in grams/tonne) to provide gram-meter values (g-m) or by multiplying the nickel equivalent grade (in percent) to provide percent-meter values as shown. Total nickel and palladium equivalent calculations reflect total gross metal content using metals prices as follows (all USD): $7.00/lb nickel (Ni), $3.50/lb copper (Cu), $20.00/lb cobalt (Co), $1,000/oz platinum (Pt), $1,800/oz palladium (Pd), and $1,600/oz gold (Au). Equivalent values have not been adjusted to reflect metallurgical recoveries. Total metal equivalent values include both base and precious metals. In terms of dollar value, 0.20% nickel equates to a copper value of 0.40%, or a palladium value of 0.53 g/t, using the above metal values. Intervals are reported as drilled widths and are believed to be representative of the actual width of mineralization.

Grade-Thickness

Grade-thickness values of the mineralized intervals continue to demonstrate the remarkable metal endowment of the lower Stillwater Complex, with both holes reported here being well above 100 gram-meter (“g-m”) palladium equivalent grade-thickness. CM2021-01 returned 530 g-m PdEq grade-thickness, which is a record high for the Stillwater Complex. For comparison, this equates to 596 g-m gold equivalent, 954 g-m platinum equivalent, or 199 %-meter nickel equivalent. Grade-thickness values are an exploration tool used for comparing the intensity of mineralization across different mineralized widths. A grade-thickness value of 10 gram-meter Pd is equivalent to 1 g/t Pd over 10 meters, or 10 g/t Pd over 1 meter and is considered economically significant. The adjacent J-M Reef deposit now mined by Sibanye-Stillwater averages approximately 34 gram-meter Pd and Pt1,2. Values over 100 g-m PdEq are considered exceptional, highlighting the strength of the mineralized system, and values of more than 250 g-m PdEq (or 281 g-m AuEq) are rare across the industry. To date, the Stillwater West project has returned 31 drill holes with over 50 g-m PdEq grade-thickness, including five with more than 250 g-m PdEq.

Upcoming News and Events

Group Ten is pleased to confirm that it will participate in the upcoming Vancouver Resource Investment, AME Roundup, and Prospectors and Developers Association conferences in Q1 2022.

About Stillwater West

Group Ten is rapidly advancing the Stillwater West PGE-Ni-Cu-Co + Au project towards becoming a world-class source of low-carbon, sulphide-hosted nickel, copper, and cobalt, critical to the electrification movement, as well as key catalytic metals including platinum, palladium and rhodium used in catalytic converters, fuel cells, and the production of green hydrogen. Stillwater West positions Group Ten as the second-largest landholder in the Stillwater Complex, with a 100%-owned position adjoining and adjacent to Sibanye-Stillwater’s PGE mines in south-central Montana, USA1. The Stillwater Complex is recognized as one of the top regions in the world for PGE-Ni-Cu-Co mineralization, alongside the Bushveld Complex and Great Dyke in southern Africa, which are similar layered intrusions. The J-M Reef, and other PGE-enriched sulphide horizons in the Stillwater Complex, share many similarities with the highly prolific Merensky and UG2 Reefs in the Bushveld Complex. Group Ten’s work in the lower Stillwater Complex has demonstrated the presence of large-scale disseminated and high-sulphide battery metals and PGE mineralization, similar to the Platreef in the Bushveld Complex2. Drill campaigns by the Company, complemented by a substantial historic drill database, have delineated five deposits of Platreef-style mineralization across a core 9.2-kilometer span of the project, all of which are open for expansion into adjacent targets. Multiple earlier-stage Platreef-style and reef-type targets are also being advanced across the remainder of the 32-kilometer length of the project based on strong correlations seen in soil and rock geochemistry, geophysical surveys, geologic mapping, and drilling.

About Group Ten Metals Inc.

Group Ten Metals Inc. is a TSX-V-listed Canadian mineral exploration company focused on the development of high-quality platinum, palladium, nickel, copper, cobalt, and gold exploration assets in top North American mining jurisdictions. The Company’s core asset is the Stillwater West PGE-Ni-Cu-Co + Au project adjacent to Sibanye-Stillwater’s high-grade PGE mines in Montana, USA. Group Ten also holds the high-grade Black Lake-Drayton Gold project adjacent to Treasury Metals’ development-stage Goliath Gold Complex in northwest Ontario, and the Kluane PGE-Ni-Cu-Co project on trend with Nickel Creek Platinum‘s Wellgreen deposit in Canada‘s Yukon Territory.

About the Metallic Group of Companies

The Metallic Group is a collaboration of leading precious and base metals exploration companies, with a portfolio of large, brownfield assets in established mining districts adjacent to some of the industry’s highest-grade producers of silver and gold, platinum and palladium, and copper. Member companies include Metallic Minerals in the Yukon’s high-grade Keno Hill silver district and La Plata silver-gold-copper district of Colorado, Group Ten Metals in the Stillwater PGM-nickel-copper district of Montana, and Granite Creek Copper in the Yukon’s Minto copper district. The founders and team members of the Metallic Group include highly successful explorationists formerly with some of the industry’s leading explorers/developers and major producers. With this expertise, the companies are undertaking a systematic approach to exploration using new models and technologies to facilitate discoveries in these proven, but under-explored, mining districts. The Metallic Group is headquartered in Vancouver, BC, Canada, and its member companies are listed on the Toronto Venture, US OTC, and Frankfurt stock exchanges.

Note 1: References to adjoining properties are for illustrative purposes only and are not necessarily indicative of the exploration potential, extent or nature of mineralization or potential future results of the Company’s projects.

Note 2: Magmatic Ore Deposits in Layered Intrusions-Descriptive Model for Reef-Type PGE and Contact-Type Cu-Ni-PGE Deposits, Michael Zientek, USGS Open-File Report 2012-1010.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Michael Rowley, President, CEO & Director

Email: info@grouptenmetals.com Phone: (604) 357 4790

Web: http://grouptenmetals.com Toll Free: (888) 432 0075

Quality Control and Quality Assurance

2021 drill core samples were analyzed by ACT Labs in Vancouver, B.C. Sample preparation: crush (< 7 kg) up to 80% passing 2 mm, riffle split (250 g) and pulverize (mild steel) to 95% passing 105 µm included cleaner sand. Gold, platinum, and palladium were analyzed by fire assay (1C-OES) with ICP finish. Selected major and trace elements were analyzed by peroxide fusion with 8-Peroxide ICP-OES finish to insure complete dissolution of resistate minerals. Following industry QA/QC standards, blanks, duplicate samples, and certified standards were also assayed.

Mr. Mike Ostenson, P.Geo., is the qualified person for the purposes of National Instrument 43-101, and he has reviewed and approved the technical disclosure contained in this news release.

Forward-Looking Statements

Forward Looking Statements: This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Group Ten believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Group Ten and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Figure 1 – 2021 Resource Expansion Drill Holes with Deposit Outlines over Drill Data and Geophysics (Conductivity)

Figure 2 – 2021 Resource Expansion Drill Holes with Deposit Outlines and Drill Data over Precious and Base Metals in Soils

Figure 3 – 2021 Mineral Resource Estimate over 9 KM Core Project Area with 3d Model of Ip Survey Results

SOURCE: Group Ten Metals Inc.

View source version on accesswire.com:

https://www.accesswire.com/678533/Group-Ten-Reports-Highest-Grade-and-Widest-Mineralized-Intercepts-to-Date-at-the-Stillwater-West-Battery-Metals-and-Platinum-Group-Elements-Project-in-Montana-USA-Including-637-Meters-of-092-Nickel-Equivalent-Mineralization-246-gt-Palladium-Equivalent

VANCOUVER, BC, Dec. 20, 2021 /PRNewswire/ – Dolly Varden Silver Corporation (“Dolly Varden” or the “Company“) (TSXV: DV) (OTC: DOLLF), is pleased to announce drill results from regional exploration and reconnaissance drilling at its 100%-owned Dolly Varden Project located near tidewater in northwestern British Columbia, with particularly encouraging results from the Wolf Vein, as well as the identification of large, new porphyry related copper-gold system.

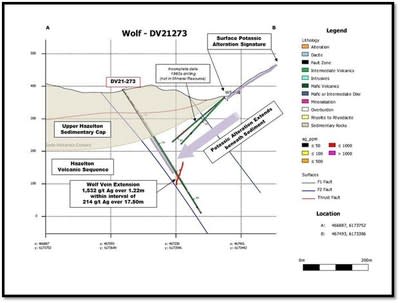

At the Wolf Deposit, drill hole DV21-273 tested the southwest projection of the Wolf Vein, 94m down plunge from the current Mineral Resources, intersecting 1,532 g/t Ag, 0.44 g/t Au, 2.11 % Pb and 1.07% Zn over 1.22m core length within a brecciated sulphide-rich quartz vein hosted within a broader pyrite stockwork breccia zone of 17.50m averaging 214 g/t Ag and 0.47% Pb. The current NI 43-101 Mineral Resource Estimate hosts 3.83 million ounces of silver at 296 g/t in the Indicated category at Wolf. It is located approximately two kilometers northwest of the 25.0 million ounces of silver in the Indicated Category and additional 10.5 million ounces of silver in the Inferred category at Dolly Varden’s Torbrit Deposit.

In other regional exploration drilling, Dolly Varden’s technical team is highly encouraged by long intervals of stockwork quartz with strongly anomalous gold (>100 ppb) over wide intervals (up to 303 meters) along with silver and copper at the Western Gold Belt Area. Hosted within early Jurassic volcanic rocks, this style of stockwork and alteration is analogous to numerous alkalic gold-copper deposits and mines in British Columbia. The Company plans appropriate geophysical surveys for porphyry-style mineralization and subsequent follow-up drilling in this area.

“This high-grade silver intercept at Wolf demonstrates the excellent exploration and resource expansion potential on the Property. The next phase of exploration drilling will prioritize connecting our historic mines and current deposits of the Dolly Varden Trend with the deposits at Homestake 5.4km to the northwest along the Kitsault Valley Trend that comprise the recently announced proposed acquisition from Fury Gold Mines,” said Shawn Khunkhun, CEO of Dolly Varden Silver. “Additionally, the strong indicator of porphyry related gold-copper-silver style indicators potentially the most significant exploration breakthrough on the Property in years”.

A total of 10,506m in 31 diamond drill holes were completed at Dolly Varden during the 2021 field season. Results have been received for 10 holes that tested five regional exploration targets on the Property including the Wolf Vein extension and Western Gold-Copper Belt. Assays will be announced in the near future for the 21 holes completed at the high-grade Torbrit and Kitsol Silver Deposits. The 21 near-Resource holes were drilled as part of a two phase program with the objective of expanding Resources as well as upgrading current Inferred Resources to Measured and Indicated Classification.

The 2021 drilling at Dolly Varden initiated the Company’s two-year strategy to aggressively expand and upgrade the Torbrit Silver Deposit and multiple satellite zones with the objective of advancing Dolly Varden to be the next high-grade silver mine in British Columbia.

| Hole ID | From (m) | To (m) | Length (m) | Ag (g/t) | Au (g/t) | Pb (%) | Zn (%) |

| DV21-273 | 302.00 | 319.50 | 17.50 | 214 | 0.47 | 0.06 | |

| including | 303.18 | 304.40 | 1.22 | 1532 | 0.44 | 2.11 | 1.07 |

| including | 311.85 | 315.80 | 3.95 | 328 | 0.12 | 0.52 | 0.83 |

| *true width is estimated at 85% of core length, using angle to core from oriented core data. |

Table 1: Wolf Extension Exploration drilling results

Hole DV21-273 is also significant as it tested the prospective Hazelton volcanic rock that underlies the sedimentary units of the Upper Hazelton for the Wolf Vein extension. Discovering that the strong potassic alteration associated with silver mineralization within the volcanogenic Torbrit Deposit continues beneath the sediment suggests that the mineralizing system continues to the west of the 4.5 km long surface alteration anomaly. This opens up exploration potential of the entire bottom of the Kitsault valley north of Wolf towards the Property boundary and onto Homestake Ridge.

“Intercepting silver mineralization associated with potassic alteration in the older volcanic rocks underneath the sediment package within the fold axis of a regional syncline gives our team further reason to drill test several geophysical anomalies identified along the northerly trend towards the deposits at Homestake Ridge”, explained Rob van Egmond, Chief Geologist for Dolly Varden Silver.

Wolf is the northernmost deposit that comprises the current Mineral Resources at the Dolly Varden Project. Modelling of the epithermal vein style deposit indicates a stepped vein system, offset by steep faults. The hanging wall of the deposit has strong barium signature and the veins contain barite and quartz. There are historic underground drifts at Wolf but no historic production was reported.

Western Gold-Copper Belt

On the Western side of the Kitsault Valley, three holes (DV21-267, 268 and 269) tested the Red Point target with structures related to a gold in soil anomaly within the southern end of the Western Gold belt quartz, sericite, pyrite (QSP) alteration zone. Drilling intercepted wide zones of stockwork veins with strongly anomalous gold, silver and copper mineralization within Hazelton volcanic rocks. Proximal to intrusive rocks, this wide zone mineralization is analogous to other alkalic copper-gold porphyry related systems in British Columbia. In the Golden Triangle, these deposits include KSM, Treaty Creek, Saddle (GT Gold), Red Chris and Snowfield.

This Western Gold Belt is located on the west side of the Kitsault valley and trends from near the Dolly Varden Mine northward for several kilometers towards Homestake Ridge. Intrusive-related QSP alteration is associated with zones of increased silica stockwork and multi-phased breccias with pyritic matrix. This style of alteration, mineralization and brecciation is also common at other higher grade deposits in the Golden Triangle, including Homestake Ridge and Ascot’s past-producing Premier and Big Missouri mines, as well as Goliath Resource’s recent discoveries west of Dolly Varden. Results are as follows:

| Hole ID | From (m) | To (m) | Length (m) | Au (g/t) | Ag (g/t) | Cu (%) |

| DV21-267 | 1.55 | 170.10 | 168.55 | 0.13 | ||

| DV21-267 | 26.00 | 26.65 | 0.65 | 0.35 | 13 | |

| including | 79.00 | 80.00 | 1.00 | 1.15 | 24 | |

| including | 81.80 | 83.00 | 1.20 | 0.95 | 5 | 0.07 |

| including | 168.00 | 170.10 | 2.10 | 0.33 | 10 | 0.41 |

| DV21-268 | 2.36 | 186.80 | 184.44 | 0.17 | ||

| including | 66.00 | 72.00 | 6.00 | 0.57 | 6 | |

| and | 192.06 | 192.56 | 0.50 | 128 | 0.94 | |

| DV21-269 | 2.65 | 85.00 | 82.35 | 0.17 | ||

| DV21-269 | 127.00 | 430.00 | 303.00 | 0.15 | ||

| including | 289.00 | 290.12 | 1.12 | 1.1 | ||

| including | 316.00 | 317.00 | 1.00 | 1.12 |

| *true width has not been determined as there is insufficient drilling to model the orientation of the broad mineralization and alteration zone |

Table 2: Red Point – Combination, Western Gold Belt results

Medallion

Three holes were completed at the Medallion Prospect (DV21-264, 265 and 266) located at the southern end of the Project. Historic trenches and small adits explored narrow zones of veining within weakly altered volcanic rocks hosting silver, copper lead and zinc mineralization. No significant results were returned.

Syndicate

Diamond drill holes DV21-270 and 271 were drilled from the same setup as Medallion to test the Syndicate Target. A near-surface vein in DV21-270 returned 126 g/t Ag and 1.31 g/t Au over a core length of 1.10m.

| Target | Hole ID | From | To | Core Length (m) | Ag (g/t) | Au (g/t) |

| Syndicate | DV21-270 | 52.4 | 53.5 | 1.10 | 126 | 1.31 |

| Syndicate | DV21-271 | No significant results |

| *true width has been estimated at between 80% to 90% of core length based on limited drilling for geometry modelling |

Table 3: Syndicate results

Silver Horde

One drill hole tested the potassic alteration zone at Silver Horde, approximately 900m north of Wolf. It was collared in sediment cap rocks to test the volcanic units down plunge of previously encouraging drill results. Hole DV21-272 intersected two zones where diffuse sheeted veinlets were found carrying dark silver sulphosalts. The structure returned 9.0 meters core length averaging 126.7 g/t Ag within the volcanic host, plunging towards the axis of the valley syncline.

| Target | Hole ID | From | To | Core Length (m) | Ag (g/t) |

| Silver Horde | DV21-272 | 41 | 50 | 9.0 | 126.75 |

| including | 41 | 42.5 | 1.5 | 256 | |

| Silver Horde | DV21-272 | 202.5 | 203 | 0.5 | 249 |

| *true width has not been determined as there is insufficient drilling to model the orientation of the diffuse sheeted veins |

Table 4: Silver Horde results

| Hole ID | Area | Easting NAD 83 | Northing NAD 83 | Elevation (m) | Azimuth | Dip | Depth |

| DV21-264 | Medallion | 467181 | 6168686 | 514 | 210 | -50 | 203 |

| DV21-265 | Medallion | 467199 | 6168813 | 457 | 193 | -46 | 341 |

| DV21-266 | Medallion | 467220 | 6169100 | 444 | 193 | -50 | 501 |

| DV21-267 | Red Point | 466637 | 6172476 | 735 | 56 | -50 | 356 |

| DV21-268 | Red Point | 466637 | 6172476 | 735 | 56 | -75 | 425 |

| DV21-269 | Red Point | 466637 | 6172476 | 735 | 236 | -50 | 430 |

| DV21-270 | Syndicate | 466196 | 6176721 | 453 | 80 | -47 | 493 |

| DV21-271 | Syndicate | 466196 | 6176721 | 453 | 80 | -80 | 107 |

| DV21-272 | Silver Horde | 466760 | 6174562 | 377 | 55 | -50 | 365 |

| DV21-273 | Wolf | 467093 | 6173630 | 387 | 120 | -55 | 449 |

Table 5: Exploration portion of 2021 program: drill hole location data

Quality Assurance and Quality Control

The Company adheres to CIM Best Practices Guidelines for exploration related activities conducted on its Project. Quality Assurance and Quality Control (QA/QC) procedures are overseen by the Qualified Person.

Dolly Varden QA/QC protocols are maintained through the insertion of certified reference material (standards), blanks and field duplicates within the sample stream. Drill core is cut in-half with a diamond saw, with one-half placed in sealed bags and shipped to the laboratory and the other half retained on site. Third party laboratory checks on 5% of the samples are carried out as well. Chain of custody is maintained from the drill to the submittal into the laboratory preparation facility.

Analytical testing was performed by ALS Canada Ltd. in North Vancouver, British Columbia. The entire sample is crushed and a 500 gram split is pulverized to minus 200mesh. Multi-element analyses were determined by Inductively–Coupled Plasma Mass Spectrometry (ICP-MS) for 48 elements following a 4-acid digestion process. High grade silver testing was determined by Fire Assay with either an atomic absorption, or a gravimetric finish, depending on grade range. Au is determined by Fire Assay on a 30g split.

Qualified Person

Rob van Egmond, P.Geo., Chief Geologist for Dolly Varden Silver, the “Qualified Person” as defined by NI43-101 has reviewed, validated and approved the scientific and technical information contained in this news release and supervises the ongoing exploration program at the Dolly Varden Project.

About Dolly Varden Silver Corporation

Dolly Varden Silver Corporation is a mineral exploration company focused on exploration in northwestern British Columbia. The Dolly Varden Project consists of the namesake Dolly Varden silver property that hosts a unique pure silver mineral resource as well as the nearby Big Bulk copper-gold porphyry property. The Dolly Varden Project is considered to be highly prospective for hosting high-grade precious metal deposits, since it comprises the same structural and stratigraphic setting that host numerous other high-grade deposits (Eskay Creek, Brucejack).

Dolly Varden has recently entered into an agreement with Fury Gold Mines to acquire the Homestake Ridge Project adjacent to the current Dolly Varden property to consolidate the Kitsault Valley Gold-Silver mineralization trend into one large, high-grade precious metals project with further exploration upside potential. The Big Bulk property is prospective for porphyry and skarn style copper and gold mineralization similar to other such deposits in the region (Red Mountain, KSM, Red Chris).

Forward Looking Statements

This release may contain forward-looking statements or forward-looking information under applicable Canadian securities legislation that may not be based on historical fact, including, without limitation, statements containing the words “believe”, “may”, “plan”, “will”, “estimate”, “continue”, “anticipate”, “intend”, “expect”, “potential” and similar expressions. Forward-looking statements involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of Dolly Varden to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. Forward looking statements or information relates to, among other things, completion of the Offering, Exchange approval of the Offering, the use of proceeds with respect to the Offerings, the results of previous field work and programs and the continued operations of the current exploration program, interpretation of the nature of the mineralization at the project and that that the mineralization on the project is similar to Eskay and Brucejack, results of the mineral resource estimate on the project, the potential to grow the project, the potential to expand the mineralization, the planning for further exploration work, the ability to de-risk the potential exploration targets, and our beliefs about the unexplored portion of the property. These forward-looking statements are based on management’s current expectations and beliefs but given the uncertainties, assumptions and risks, readers are cautioned not to place undue reliance on such forward-looking statements or information. The Company disclaims any obligation to update, or to publicly announce, any such statements, events or developments except as required by law.

For additional information on risks and uncertainties, see the Company’s most recently filed annual management discussion & analysis (“MD&A”), which is available on SEDAR at www.sedar.com. The risk factors identified in the MD&A are not intended to represent a complete list of factors that could affect the Company.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this news release.

View original content to download multimedia:https://www.prnewswire.com/news-releases/dolly-varden-silver-intersects-1-532-gt-silver-over-1-22-meters-at-wolf-vein-94-meters-down-dip-301448005.html

SOURCE Dolly Varden Silver Corp.

Vancouver, British Columbia–(Newsfile Corp. – December 17, 2021) – EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the “Company“, or “EMX“) reports that it will deliver a Notice of Arbitration to Zijin Mining Group Ltd. (“Zijin”) and its wholly owned subsidiary, Nevsun Resources Ltd. (“Nevsun”) pursuant to the Net Smelter Returns Royalty Agreement dated March 16, 2010 by and between Reservoir Capital Corp. (of which Nevsun is a successor in interest), and Euromax Resources Ltd. (of which EMX is the acquirer of Euromax Resources Ltd’s royalty interest) (“Royalty Agreement”).

The rate of the royalty on the Timok Project in Serbia on the Brestovac East and Durian Potok Licences which cover the Cukaru Peki deposit is stated to be 0.5% (“Royalty Rate”) under the Royalty Agreement. The decision to initiate arbitration arose from recent communication between parties where Zijin indicated to EMX that the Royalty Rate of 0.5% had been reduced to 0.125% and Zijin’s failure to respond to our correspondence challenging this assertion and seeking clarification. Arbitration will be conducted in accordance with the commercial arbitration rules of the Commercial Arbitration Act (British Columbia), in British Columbia, and in accordance with British Columbia law.

The Royalty Agreement contains a provision for the reduction of the Royalty Rate under certain express and specific circumstances, namely, the acquisition by Freeport McMoRan Copper & Gold Inc. or any affiliate of a direct, undivided, ownership interest in the properties that are the subject of the Royalty Agreement, solely by directly incurring certain types of expenditures on the properties. EMX does not believe that the circumstances which would have triggered the reduction of the Royalty Rate have occurred and therefore the Royalty Rate remains at 0.5%. The Royalty Agreement also expressly outlined the circumstances under which the Royalty Rate could not be reduced. The Royalty Agreement has been filed by EMX as a material contract of EMX on www.sedar.com (“SEDAR”).

As it is EMX’s understanding that production has commenced, the Notice of Arbitration is necessary in order to preserve EMX’s rights with respect to its royalty interests. EMX continues to believe that a dialogue and amicable discussions may allow the parties to reach a mutually acceptable outcome prior to the start of arbitral proceedings. The timing and outcome of any such discussions or arbitral proceedings with Zijin are not known at this time. The Company intends to take all necessary steps to protect its interests under the Royalty Agreement and will consider any other actions necessary to ensure its rights are preserved.

Timok Project Overview. The Timok Project’s Cukaru Peki deposit consists of a higher level body of high-grade, epithermal-style copper-gold mineralization referred to as the Upper Zone project, and a deeper body of porphyry-style copper-gold mineralization known as the Lower Zone project. Prior to its acquisition by Zijin, a Pre-Feasibility Study (“PFS”) of the Upper Zone and resource estimate of the Lower Zone was completed by previous owner Nevsun, which was filed in August 2018 under Nevsun’s profile on SEDAR. EMX used the aforementioned PFS as the basis for its NI 43-101 Technical Report – Timok Copper-Gold Project Royalty, Serbia dated July 30, 2021 and EMX is unaware of any new, publicly available material scientific or technical information that would make Nevsun’s previous disclosures regarding the PFS inaccurate or misleading.

Eric P. Jensen, CPG, a Qualified Person as defined by National Instrument 43-101 and an employee of the Company, has reviewed, verified, and approved the disclosure of the technical information contained in this news release.

About EMX. EMX is a precious, base and battery metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and TSX Venture Exchange under the symbol EMX, as well as on the Frankfurt exchange under the symbol “6E9”. Please see www.EMXroyalty.com for more information.

For further information contact:

David M. Cole

President and Chief Executive Officer

Phone: (303) 973-8585

Dave@EMXroyalty.com

Scott Close

Director of Investor Relations

Phone: (303) 973-8585

SClose@EMXroyalty.com

Isabel Belger

Investor Relations (Europe)

Phone: +49 178 4909039

Ibelger@EMXroyalty.com

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release may contain “forward looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements include statements regarding the payment of the royalty under the Royalty Agreement, the Royalty Rate, the outcome of any discussions, dispute or arbitral proceedings between EMX and Zijin and any other steps or actions taken by EMX to protect its rights, perceived merits of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential”, “upside” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to: unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. We are under no obligation to update any forward-looking statements except as required under applicable securities laws. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended September 30, 2021 (the “MD&A”), and the most recently filed Revised Annual Information Form (the “AIF”) for the year ended December 31, 2020, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedar.com and on the SEC’s EDGAR website at www.sec.gov.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/107930

Vancouver, British Columbia–(Newsfile Corp. – December 16, 2021) – StrikePoint Gold Inc. (TSXV: SKP) (OTCQB: STKXF) (“StrikePoint” or the “Company”) is pleased to announce the results from surface channel sampling as well as reconnaissance grab samples collected during the 2021 exploration program at the 100%-owned Willoughby gold-silver property, located east of the community of Stewart in British Columbia’s prolific Golden Triangle. The purpose of the channel samples is to provide quality surface assay data over the surface expression of mineralized zones that could potentially be used for a NI43-101 Mineral Resource Estimate for the property.

These results are from seven continuous series of channel samples in steep terrain at the Icefall Zone, collected by experienced climbing geologists and technicians using a hydraulic chisel, from well-exposed bedrock hosting disseminated to massive sulphides, primarily pyrite and pyrrhotite. The samples cover approximately 55 metres of strike and 80 metres of vertical relief along a steep exposure. These samples, along with pending results at other zones on the property, will provide representative assay data for surface expressions projected up-dip from previous and current drilling. Results are pending for channel sampling from the Edge and North zones at Willoughby. Highlights of the channel samples from the Icefall Zone include:

- 2.94 g/t Au and 31.04 g/t Ag or 3.38 g/t AuEq over 15.0 metres, which includes 11.545 g/t Au and 69.4 g/t Ag or 12.53 g/t AuEq over 2.0 metres (WH21-CH004)

- 3.21 g/t Au and 16.61 g/t Ag or 3.45 g/t AuEq over 12.0 metres, which includes 4.46 g/t Au over 5.0 metres and 31.23 g/t Ag or 4.82 g/t AuEq over 3.0 metres (WH21-CH007)

- 1.83g/t Au and 32.62 g/t Ag 0r 2.30 g/t AuEq over 13.0 metres, which includes 8.68g/t Au and 265.0g/t Ag or 12.47 g/t AuEq over 1.0 metre (WH21-CH002)

- 2.9 g/t Au and 21.42 g/t Ag or 3.21 g/t AuEq over 10.0 metres, which includes 15.45 g/t Au and 74.5g/t Ag or 16.51 g/t AuEq over 1.0 metre (WH21-CH001)

*AuEq calculated using a 70:1 silver to gold ratio.

StrikePoint’s CEO, Shawn Khunkhun, states, “These results provide excellent surface data for modelling of our multiple mineralized zones at Willoughby. Our objective during this year’s program at the Willoughby gold-silver and Porter silver properties was to significantly expand the gold-silver mineralization down-dip and along strike and to test new targets. We are pleased with the quality of work completed and expect the remainder of results before the end of 2021 or in January 2022.“

2021 Willoughby Channel Sampling

Channel sampling at the Upper and Lower Icefall Zones confirmed continuous gold and silver mineralization along all seven channel sample lines. Due to the steep terrain, the channel sample locations are oriented at a variety of oblique angles to the orientation of the Icefall Zone and do not represent true widths. The gold-silver mineralization is hosted in semi-massive to replacement style sulphides, primarily pyrite and pyrrhotite with lesser sphalerite and galena within Jurassic volcanic rocks. Pervasive sericite alteration was consistently observed throughout all channel samples at Icefall, all of which returned intervals of gold and silver mineralization as displayed in Table 1. The 67 channel samples collected average 2.46 g/t Au and 23.28 g/t Ag and range between 0.041 to 15.45 g/t Au and 1.1 to 265.0 g/t Ag, respectively. Results are as follows:

Table 1: Channel sample results showing >1 g/t Au and >10 g/t Ag composite intervals

| Channel Sample Line ID | From (m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) | AuEq (g/t) |

| W21-CH-001 | 0.00 | 10.00 | 10.00 | 2.90 | 21.42 | 3.21 |

| Incl. | 0.00 | 7.00 | 7.00 | 3.87 | 23.97 | 4.21 |

| Incl. | 6.00 | 7.00 | 1.00 | 15.45 | 74.50 | 16.51 |

| W21-CH-002 | 0.00 | 13.00 | 13.00 | 1.83 | 32.62 | 2.30 |

| Incl. | 7.00 | 11.00 | 4.00 | 3.49 | 82.72 | 4.67 |

| Incl. | 9.00 | 10.00 | 1.00 | 8.68 | 265.00 | 12.47 |

| W21-CH-003 | 0.00 | 2.00 | 2.00 | 1.33 | 18.10 | 1.59 |

| W21-CH-004 | 0.00 | 15.00 | 15.00 | 2.94 | 31.04 | 3.38 |

| Incl. | 0.00 | 2.00 | 2.00 | 11.54 | 69.40 | 12.53 |

| W21-CH-005 | 0.00 | 10.00 | 10.00 | 1.85 | 7.81 | 1.96 |

| Incl. | 0.00 | 5.00 | 5.00 | 2.73 | 10.04 | 2.87 |

| W21-CH-006 | 0.00 | 5.00 | 5.00 | 1.69 | 28.50 | 2.10 |

| W21-CH-007 | 0.00 | 12.00 | 12.00 | 3.21 | 16.61 | 3.45 |

| Incl. | 0.00 | 5.00 | 5.00 | 4.46 | 25.18 | 4.82 |

*AuEq calculated using a 70:1 silver to gold ratio.

Figure 1: 2021 Channel sample locations within the Icefall Zone showing gold equivalent values (AuEq g/t). Reference lines (1-7) represent stations (WH-21-CH001 to WH-21-CH007). Select anomalous gold samples are highlighted with annotated texts.

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/5044/107796_cb777fb514a3a892_002full.jpg

Results were also received from select grab samples collected at the Icefall Zone during the 2021 season. The nine grabs at Icefall average 5.12g/t Au and 32.64g/t Ag, ranging from trace to 23.69g/t Au and 0.25 to 107.0g/t Ag, respectively.

Figure 3: 2021 select grab samples within the Icefall Zone showing gold equivalent values (AuEq g/t). Select anomalous gold assays are highlighted by annotated texts.

To view an enhanced version of Figure 3, please visit:

https://orders.newsfilecorp.com/files/5044/107796_cb777fb514a3a892_003full.jpg

Willoughby Project

The project occurs along the eastern margin of the Cambria Icefield, approximately seven kilometers east of the advanced-stage Red Mountain Deposit owned by Ascot Resources. Upper Triassic Stuhini rocks and Lower Jurassic Hazelton volcano-sedimentary rocks underlay the property, subsequently intruded by an early Jurassic-aged hornblende-feldspar porphyry, like and potentially comagmatic with the Goldslide Intrusive suite at Red Mountain. Intrusive-related mineralized zones consist of primary pyrite with lesser pyrrhotite, sphalerite, galena, chalcopyrite, and native gold. Eight gold and silver mineralized zones have been identified to-date over a one-kilometer strike-length mineralized trend.

QA/QC

Using a hydraulic chisel, an approximate 2 by 2-centimetre channel was sampled continuously along 1 metre sample stations. If the hydraulic chisel was incapable of retrieving a chip from a specific location, a hand chisel was used to assist with the chipping within the limits of the 1 metre station. Samples were placed directly into a marked polyurethane bag. Chip observation data was recorded and digitized in the field using MX Deposit.

Surface samples for the 2021 exploration program were labeled and shipped with chain of custody controls to the laboratory. The company implements a rigorous Quality Control/Quality Assurance program, including the insertion of Standards, Blanks, and Duplicates at regular intervals in the sample stream to monitor laboratory performance.

Samples were submitted to ALS Laboratory facility located in North Vancouver, British Columbia, for preparation and analysis. The ALS facility is accredited to the ISO/IEC 17025 standard for gold assays, and all analytical methods include quality control materials at set frequencies with established data acceptance criteria. The entire sample is crushed, split into representative sub-samples using a riffle splitter and subsequently, 250g is pulverized. Multi-element analyses were determined by ICP-AES for 33 elements following a 4-acid digestion process. Analysis for gold is by 30g fire assay with atomic absorption (AAS) finish. Samples that returned with gold assays greater than 10 g/t were re-analyzed using a 30g fire assay with a gravimetric finish.. Samples with silver assays higher than 100 g/t are re-analyzed using a fire assay with gravimetric finish.

Qualified Person

The Qualified Person for this news release for National Instrument 43-101 is Andrew Hamilton, P. Geo, technical advisor to Strikepoint. He has read and approved the scientific and technical information that forms the basis for the disclosure contained in this news release.

About StrikePoint

StrikePoint Gold is a gold exploration company focused on building high-grade precious metals resources in Canada. The company controls two advanced stage exploration assets in BC’s Golden Triangle. The past-producing high-grade silver Porter Project and the high-grade gold property Willoughby, which is adjacent to Red Mountain. The company also owns a portfolio of gold properties in the Yukon.

ON BEHALF OF THE BOARD OF DIRECTORS OF

STRIKEPOINT GOLD INC.

“Shawn Khunkhun”

Shawn Khunkhun

Chief Executive Officer and Director

For more information, please contact:

StrikePoint Gold Inc.

Shawn Khunkhun, CEO and Director

T: (604) 602-1440

E: sk@strikepointgold.com

W: www.strikepointgold.com

Statements in this release that are forward-looking statements are subject to various risks and uncertainties concerning the specific factors disclosed under the heading “Risk Factors” and elsewhere in the Company’s filings with Canadian securities regulators. Such information contained herein represents management’s best judgment as of the date hereof based on information currently available. The Company does not assume any obligation to update any forward-looking statements, save and except as may be required by applicable securities laws.

Neither the TSX Venture Exchange nor it’s Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/107796

Figure 1

Track mounted diamond drill rig on site at the Malmsbury Project – 14/12/2021.

Figure 2

Malmsbury Project location and major targets in the north of the project area, with geology and historic workings.

Figure 3a

Unidirectional solidification textures (USTs) in the Missing Link Monzogranite on the Malmsbury project

Figure 3b

Unidirectional solidification textures (USTs) in the Missing Link Monzogranite overprinted by gold bearing stockwork quartz veins on the Malmsbury project

Figure 4

soil geochemistry overlying geology.

Figure 5

FALCON® vertical gravity gradient image highlighting the gravity low associated with outcrop of gold mineralized granite. The Leven Star deposit is parallel to and lies on the edge of a major gravity gradient.

HIGHLIGHTS

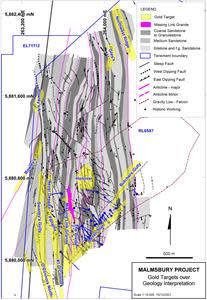

- Commencement of >2,000 m diamond drilling program, testing multiple high-order gold targets at the 50%-owned Malmsbury Gold Project (“Malmsbury Project”), 50 km SSW of the high-grade Fosterville gold mine in Victoria, Australia

- Drill targets defined through systematic exploration in 2021 including mapping with alteration vectoring, grid soil and rock chip sampling, historic drill core review/re-sampling and historic data compilation with 3D modelling

- The Malmsbury Project is under-explored and highly structurally complex, with multiple orientations of high-grade gold mineralization and in excess of 1,500 historic workings and old trenching

- Several target styles are present, including “Fosterville-type” anticline-fault related targets, large scale planar faults and fault breccias, “Woods Point-A1 style” intrusion-hosted orogenic gold targets and an intrusion-related gold (“IRG”) system

- Drilling will target a shoot on the Leven Star trend where historic reverse circulation (RC) drilling intersected 7 m @ 4.84 g/t Au (LSCR014) including 3m @ 9.38 g/t Au from 54 m and 4.1 m @ 13.1 g/t Au from 66.3 m (LSDDH08)1. These historical results are not necessarily representative of mineralization throughout the Malmsbury Project

- Within the most complex part of the system, drilling will also target a highly altered gold-mineralized Devonian monzogranite which is rare in Victoria and outcrops over 340 m strike and 40 m width

- Forward work program includes a further second phase of drilling in 2022, 2D/3D induced polarization (“IP”) to define disseminated sulphide haloes around various gold targets, further expansion of systematic soil geochemistry, mapping, and rock chip sampling

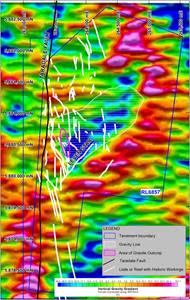

VANCOUVER, British Columbia, Dec. 16, 2021 (GLOBE NEWSWIRE) — Novo Resources Corp. (“Novo” or the “Company”) (TSX: NVO, NVO.WT & NVO.WT.A) (OTCQX: NSRPF) is pleased to advise that drilling has recently commenced (Figure 1) on a number of high-priority gold targets (Figure 2) at the Malmsbury Project (RL6587), approximately 50 km SSW of the high-grade Fosterville gold mine. Targeting has relied on significant exploration work conducted by the Novo/GBM team throughout 2021, including detailed 1:500 scale mapping, rock chip and grid soil sampling, 3D modelling and an airborne FALCON® gravity survey.

Novo acquired a 50% interest in the Malmsbury Project from ASX-listed GBM Resources Limited (ASX: GBZ) (“GBM”) in May 2021 and has the initial right to earn up to an additional 10% interest by incurring A$5 million in exploration expenditure over a four-year period2. GBM are currently managing the project.

The historical results and technical information referred to in this news release, published by AuStar Gold Limited (ASX: AUL) (“AuStar”) and included in geologic reports filed on the GeoVIC Earth Resources website, are not necessarily representative of mineralization throughout the Malmsbury Project. This historical data was disclosed in ASX announcements, other public disclosure documents, and exploration reports filed on the GeoVIC Earth Resources website (collectively, “Disclosure”) issued by AuStar and others, as identified in the GeoVIC Earth Resources filings. Certain of the technical information contained in this news release has been extracted from this Disclosure. Reference should be made to the relevant Disclosure which is available online at the links provided in various footnotes throughout this news release.

A qualified person has not verified the technical information contained in the Disclosure for Novo, and Novo is unaware of the existence of any current technical report prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects or the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves in connection with the technical information contained in the Disclosure. Novo is unable to comment on the reliability of the technical information contained in the Disclosure and therefore, reliance should not be placed on such technical information.

https://www.globenewswire.com/NewsRoom/AttachmentNg/a13c2709-16da-4aa7-ad3c-1ab1ed3ce7d8

(Figure 1 – Track mounted diamond drill rig on site at the Malmsbury Project – 14/12/2021.)

Exploration Results and Summary from 2021

Mapping and Petrology – Detailed 1:500 scale mapping was conducted by Novo staff in the first half of 2021, aiding in defining the deep-seated regional Taradale Fault in the west of the Malmsbury Project, four main anticlinal structures trending the length of the project, zones of intense silicification, sulphidation and stockwork quartz veining, and the broad structural framework of the project area. Mapping (Figure 2) has highlighted significant anticlines and mineralized west dipping fault zones similar to the setting of the high-grade Fosterville deposit and extended the Leven Star mineralized trend to the SW of its previous known extent.

Coupled with mapping, historic workings (>1,000) and historic exploration costeans (>500) were field verified (GPS located) and accurately mapped with the aid of high-resolution LIDAR imagery acquired in 2020. Rock chip sampling also relied on mapping and historic workings location for selection criteria.

Importantly, mapping also defined a porphyritic monzogranite intrusion in the Belltopper Hill area with an outcrop expression over 340 m strike and up to 40 m width. The central portion of the granite, known as the Missing Link Granite, has incredible unidirectional solidification textures (“UST”) (Figure 3) typical in the carapace of IRG systems3 and these are overprinted by gold mineralized sheeted to stockwork quartz veins (Figure 3) and intense greisen style alteration defined by petrological studies. The intrusion will be targeted as an IRG system but also as a brittle host to orogenic vein style mineralization, similar to historic deposits including the Morning Star-Woods Point diorite-hosted ladder vein deposit owned by AuStar which produced over 800,000 oz of gold at 26.5 g/t Au tonne4.

One historic diamond drill hole (DDHMA3)5 intersected the Missing Link Granite, which was not recognized. Assaying of the hole by Novo/GBM, which was collared near the contact of the granite (top 18 m of hole missing as roller bit was used) yielded 23 m @ 0.46 g/t Au (at 0.1 g/t Au cut-off) from 18 m. Surface sampling yielded assay results up to 9.74 g/t Au from quartz veins within the granite.

Rock Chip Sampling – Results for 413 rock chip samples were received throughout the year, providing critical information on gold endowment and multielement associations and providing a useful targeting parameter. Over 17% of the samples assayed >1g/t Au with peak assay results of 27.1 g/t Au and 14.2 g/t Au on the Leven Star trend (Table 1).

Soil Sampling – Results for 474 grid soil samples taken in 2021 were recently received, with a further 150 results pending. Sampling was aimed at infilling older soils grids and expanding coverage across the RL. Approximately 11% of the samples assayed >100 ppb Au with a peak assay of 1.47 g/t Au and 89 ppm Sb. Soil sampling has provided an excellent vector for drill targeting with strong Au, As and Sb anomalies defining key targets (Figure 4). Soil sampling has also defined zoned multielement patterns around the Missing Link Granite with intrusion-related geochemical signatures, including a strong Mo core (Figure 4) zoning outward to Sn, Bi and W and potentially Sb and Au,

The aforementioned results are not necessarily representative of mineralization throughout the Malmsbury Project.

https://www.globenewswire.com/NewsRoom/AttachmentNg/b20c54dc-9cea-4f52-a352-4e871b90c062

(Figure 2 – Malmsbury Project location and major targets in the north of the project area, with geology and historic workings.)

https://www.globenewswire.com/NewsRoom/AttachmentNg/416bea9d-3362-4d6f-9371-bd5c29f0bce0

https://www.globenewswire.com/NewsRoom/AttachmentNg/a39a04c7-c910-40fb-9c4c-ddf11f58277b

(Figure 3 – Unidirectional solidification textures (USTs) in the Missing Link Monzogranite overprinted by gold bearing stockwork quartz veins on the Malmsbury Project.)

FALCON® Gravity – A FALCON® airborne gravity gradiometer and aeromagnetic survey was flown in May 2021, totalling 537.6 line kilometres. The gravity survey identified a large gravity low (1.5 x 0.8 km) potentially related to the monzogranite intrusion which crops out in the western edge of the gravity low feature. The Leven Star Lode lies on the edge of and is parallel to the gravity low (Figure 5).

Drilling Program 2021 – 2022

A minimum of 2,000 m of diamond drilling is planned during late 2021 and the first quarter of 2022 to test multiple high-ranking targets (Figure 2).

- Drilling will target a shoot on the Leven Star Lode where historic reverse circulation (“RC”) drilling intersected 7 m @ 4.84 g/t Au (LSCR014) including 3 m @ 9.38 g/t Au from 54 m1. Drilling will also test up and down dip positions adjacent to high-grade intersections on the main Leven Star Lode for deposit extension and metallurgical test work purposes.

- As a preliminary test, one 350 m drill hole will extend west along the Leven Star Lode to intersect the junction of a number of mineralized trends including Leven Star, Panama South and Missing Link (Figure 2). Surface mapping and soil and rock chip sampling have highlighted strong gold and multielement geochemistry and intense sheeted quartz veining and silica alteration are present at surface.

- The newly discovered Missing Link Granite, including Missing Link and Hanover West historic reefs (Figure 2) will be drill tested with one 400 m drill hole as an initial scout to identify the geometry and gold endowment of the monzogranite at depth. As stated above, the intrusion will be targeted as an IRG system but also as a brittle host to orogenic vein style mineralization.

- The Never Despair historic workings are centred on a convergence of four separate reefs. Rock chip sampling from waste rock spoils yielded consistent grades averaging 1.96 g/t Au and 260ppm Sb and peak results of 5.66 g/t Au. Drilling will aim to intersect the target down plunge at depth

- Drilling of two holes initially will test beneath the Queens-Egyptian and O’Connor’s Historic reefs to test down dip continuity of high-grade historic reefs.

The aforementioned results are not necessarily representative of mineralization throughout the Malmsbury Project.

https://www.globenewswire.com/NewsRoom/AttachmentNg/7162289e-e591-4047-82bd-724424e75ea1

(Figure 4– soil geochemistry overlying geology.)

https://www.globenewswire.com/NewsRoom/AttachmentNg/555055d9-6fb4-49b7-b3f1-924bebabd4cd

(Figure 5 – FALCON® vertical gravity gradient image highlighting the gravity low associated with outcrop of gold mineralized granite. The Leven Star deposit is parallel to and lies on the edge of a major gravity gradient.)

Forward Work Program 2022

Subsequent to the 2,000 m drilling program, future work programs include a further second phase of drilling in late 2022, IP to define disseminated sulphide haloes around various gold targets including potential IRG mineralization, further expansion of systematic soil geochemistry, mapping and rock chip sampling.

Analytic Methodology

Soil sampling is 20 to 60 cm depth B horizon sampling sieved to -80 mesh at the lab and analysed at ALS Brisbane for Au using four acid digest 30g charge fire assay with ICPAES finish (method Au-ICP21) and multielements using four acid digest Super Trace Lowest detection limit ICPMS (method ME-MS61L).

Rock chip samples and drill core is assayed at ALS Brisbane using the using four acid digest ore grade 30g charge fire assay with AA finish (method Au-AA25) and multielements using four acid digest ICPMS (method ME-MS61) after pulverization.

QAQC for soil samples is completed at the rate of 4 field duplicates, 2 standards and 2 blanks per 100 samples. QAQC for rock chip samples and drill core was completed at the rate of 3 standards and 3 blanks per hundred samples.

To date, there have been no limitations to the verification process and all relevant data has been verified by a qualified person as defined in NI 43-101 by reviewing analytical procedures undertaken by the various laboratories.

QP STATEMENT

Dr. Quinton Hennigh (P.Geo.) is the qualified person, as defined under National Instrument 43-101 Standards of Disclosure for Mineral Projects, responsible for, and having reviewed and approved, the technical information contained in this news release other than the technical information extracted from the Disclosure. Dr. Hennigh is the non-executive co-chairman and a director of Novo.

ABOUT NOVO

Novo operates its flagship Beatons Creek gold project while exploring and developing its prospective land package covering approximately 13,250 square kilometres in the Pilbara region of Western Australia. In addition to the Company’s primary focus, Novo seeks to leverage its internal geological expertise to deliver value-accretive opportunities to its shareholders. For more information, please contact Leo Karabelas at (416) 543-3120 or e-mail leo@novoresources.com.

On Behalf of the Board of Directors,

Novo Resources Corp.

“Michael Spreadborough”

Michael Spreadborough

Executive Co-Chairman

Forward-looking information

Some statements in this news release contain forward-looking information (within the meaning of Canadian securities legislation) including, without limitation, that the drilling and future work programs described in the news release will be undertaken at the Malmsbury Project. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, without limitation, customary risks of the resource industry and the risk factors identified in Novo’s management’s discussion and analysis for the nine-month period ended September 30, 2021, which is available under Novo’s profile on SEDAR at www.sedar.com. Forward-looking statements speak only as of the date those statements are made. Except as required by applicable law, Novo assumes no obligation to update or to publicly announce the results of any change to any forward-looking statement contained or incorporated by reference herein to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements. If Novo updates any forward-looking statement(s), no inference should be drawn that the Company will make additional updates with respect to those or other forward-looking statements.

Table 1 – 2021 exploration program rock chip assay results >1 g/t Au

| Sample | North GDA94 Z55 | East GDA94 Z55 | Au ppm | Ag ppm | As ppm | Bi ppm | Mo ppm | Sb ppm | W ppm |

| MR0483 | 5880458 | 264166 | 27.1 | 1.69 | 14350 | 23.5 | 7 | 5610 | 1 |

| MR0784 | 5880804 | 263840 | 16.7 | 0.63 | 563 | 553 | 14 | 35 | 43 |

| MR0435 | 5879965 | 263401 | 14.65 | 1.03 | 2630 | 1.56 | 1 | 14 | 31 |

| MR0762 | 5880283 | 263920 | 14.55 | 0.25 | 2000 | 0.5 | 1 | 8510 | 3 |

| MR0814 | 5880075 | 263757 | 14.2 | 0.2 | 4380 | 19.7 | 3 | 80 | 111 |

| MR0450 | 5880626 | 263665 | 9.74 | 0.04 | 1660 | 78.2 | 112 | 220 | 69 |

| MR0804 | 5880359 | 263718 | 9.53 | 0.49 | 931 | 212 | 41 | 30 | 16 |

| MR0811 | 5880184 | 263360 | 8.35 | 1.76 | 3840 | 52.6 | 3 | 649 | 32 |

| MR0725 | 5880489 | 263374 | 6.89 | 0.2 | 2510 | 4.71 | 1 | 121 | 57 |

| MR0761 | 5880296 | 263932 | 6.06 | 0.07 | 1255 | 15.3 | 1 | 122 | 22 |

| MR0505 | 5880975 | 263544 | 5.49 | 0.1 | 2100 | 4.87 | 1 | 22 | 12 |

| MR0793 | 5880724 | 263887 | 5.41 | 0.04 | 1840 | 70.6 | 19 | 206 | 169 |

| MR0695 | 5880751 | 263491 | 5.01 | 0.15 | 1415 | 5.38 | 1 | 52 | 33 |

| MR0521 | 5880053 | 263604 | 4.83 | 5.71 | 48.1 | 1100 | 4 | 58 | 73 |

| MR0737 | 5880570 | 264026 | 4.82 | 0.33 | 245 | 704 | 38 | 379 | 450 |

| MR0428 | 5880842 | 263471 | 4.55 | 0.16 | 2890 | 8.97 | 2 | 8 | 15 |