I don’ t agree with the financial terms, but the overall message is correct.

I don’ t agree with the financial terms, but the overall message is correct.

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

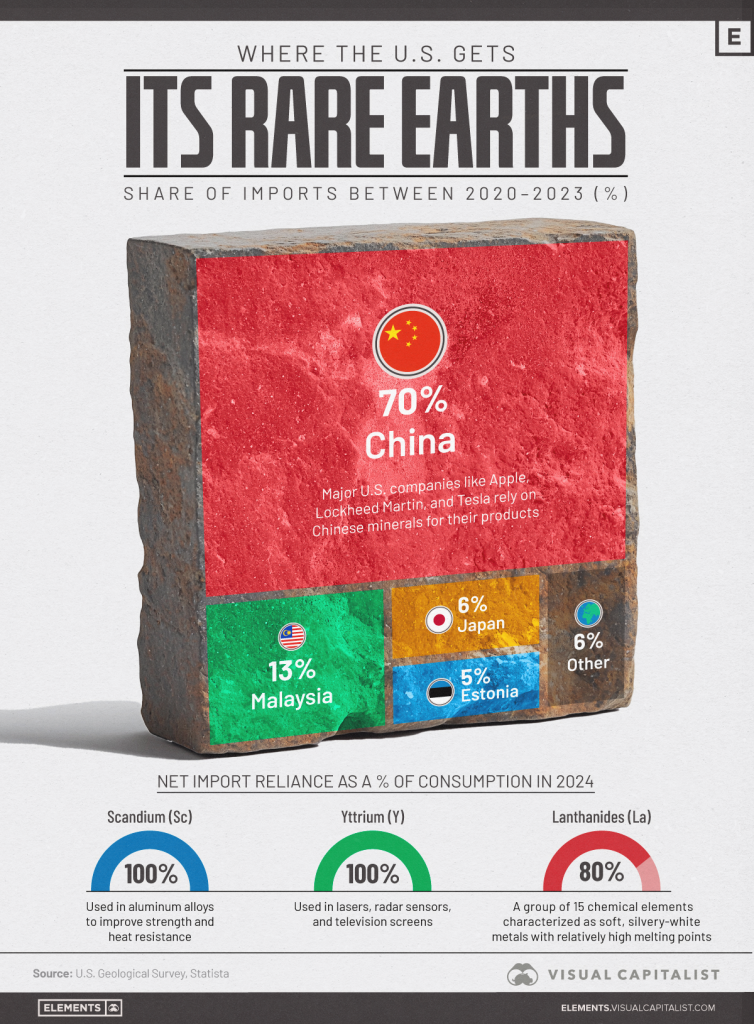

China dominates the global supply of rare earth elements (REEs)—a group of 17 minerals vital to everything from smartphones and electric vehicles to guided missiles and satellites.

Between 2020 and 2023, China accounted for 70% of U.S. rare earth imports, making it by far the country’s top supplier. Malaysia, Japan, and Estonia round out the top four.

| Country | Share of U.S. Imports |

|---|---|

China China | 70% |

Malaysia Malaysia | 13% |

Japan Japan | 6% |

Estonia Estonia | 5% |

| 🌐 Others | 6% |

This chart breaks down America’s rare earth import sources. The data comes from the U.S. Geological Survey, Mineral Commodity Summaries, as of January 2025, and Statista.

Despite their name, rare earths are relatively abundant in the Earth’s crust. The challenge lies in finding them in high enough concentrations—and processing them economically and sustainably.

China produces around 90% of the world’s refined rare earths and is home to the largest capacity for separation and purification, giving it a chokehold on global supply chains.

Take yttrium, for example—used in radar systems, lasers, and television screens. Between 2020 and 2023, 93% of all yttrium compounds imported into the U.S. came from China.

Other critical rare earths affected by this supply concentration include:

Many of these elements are essential in military applications, electric motors, and next-gen electronics. Companies like Lockheed Martin, Tesla, and Apple rely on these materials in their core products.

As part of its response to Donald Trump’s new tariffs on Chinese goods, China recently expanded export restrictions on seven rare earth elements, temporarily suspending overseas shipments of the minerals.

The U.S. currently has only one rare earth mine: the Mountain Pass mine in California. While it’s one of the richest rare earth deposits globally, nearly all of the ore extracted there is still shipped to China for final processing.

To diversify away from Chinese dependence, the U.S. has been actively seeking new supply partnerships. One potential opportunity is in Ukraine, which holds Europe’s largest recoverable rare earth reserves. Currently, the Trump administration is working to close a deal to secure access to these untapped resources.

Source: https://elements.visualcapitalist.com/charted-where-the-u-s-gets-its-rare-earths-from/

From the offices of Jayant Bhandari:

The program for the next seminar on 23rd August 2025 is linked here.

This is a friendly reminder that seats for Friday dinner with Albert Lu are limited. Only the first eighty people who register will be invited. Of course, the price of the ticket will increase as the event date approaches.

If you are already registered, I will email you in two weeks to ask if you will be attending the Friday dinner with Albert Lu.

You may use coupon code PPC2025 for a 10% discount.

While I quite liked our usual room for the seminar, we had audio problems there. So, the new location will be a couple of blocks away. Please make a note of the seminar room location from the webpage.

The playlists of all the past Capitalism & Morality seminars are linked here.

Regards,

Jayant Bhandari

www.jayantbhandari.com

Skype: jayantbh (voicemail)

Telephone: +1-206-317-1236 (voicemail)

email: contact@jayantbhandari.com

Subscribe to my free musings here

(Bloomberg) — Platinum surged to its highest level since 2014 as supply concerns and a wave of speculative buying jolted the market.

The precious metal surged as much as 4.6%, while palladium was up more than 5% at one point. Gold edged higher as investors waited for clearer signs that Israel-Iran tensions won’t spill over again, and for more certainty on the Federal Reserve’s interest rate path.

“The recent surge in Chinese investment and jewelry replacement is shining a spotlight on platinum’s supply deficit,” said Justin Lin, an analyst at Global X ETFs. “Palladium and platinum are intrinsically linked as they can be substituted for one another for use in autocatalysts depending on relative prices, so we can expect some positive momentum in palladium off of platinum’s rally.”

The dominant platinum spot market in London and Zurich has shown signs of tightness for months, after approximately half a million ounces surged into US warehouses, spurred by a lucrative arbitrage and fear of tariffs.

Forward prices for platinum are now trading well below spot, a situation known as backwardation, which indicates tight market conditions. The implied cost of borrowing the metal is also still high, at an annualized rate of roughly 13% for a one-month lease, well above the usual rate of close to zero.

Platinum surged 3.4% to $1,400.75 an ounce as of 11:25 a.m. in London and palladium jumped 2.4% to $1,093.46. Gold rose 0.2% to $3,339.20 and silver added 1%. The Bloomberg Dollar Spot Index declined 0.5%.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.

Vancouver, British Columbia–(Newsfile Corp. – June 24, 2025) – Questcorp Mining Inc. (CSE: QQQ) (OTCQB: QQCMF) (FSE: D910) (the “Company” or “Questcorp“) is pleased to announce the commencement of the first phase work program at its La Union carbonate replacement deposit (CRD) project, located in Sonora, Mexico. Questcorp is earning a 100% interest from Riverside Resources Inc. in the 2,520 ha (25 km sq) property by making a series of cash payments and share issuance and completing a series of exploration expenditures.

The initial stages of phase one will concentrate on finalizing the location of drill targets and drill pads for the upcoming drill program. Field activities are underway and include:

“We are extremely pleased to initiate the fully funded first phase work program at La Union,” commented Questcorp President & CEO Saf Dhillon. “We are first concentrating on de-risking the upcoming 1,500 metre drill program scheduled for mid to late Q3 through alteration mapping and IP geophysics,” he continued. “Under the technical expertise of John-Mark Staude and the Riverside team we are confident we are maximizing every exploration dollar being invested at La Union,” he concluded.

Riverside Resources Inc. President & CEO John-Mark Staude stated “The work program is going well, I have been in the field this past week with the exploration team and pleased to see the safe, high quality focus of good work and diving into careful review of the planned drill sites and now the IP program is underway. It is great to work with Saf, Tim and the entire Questcorp organization.”

The La Union Project

The La Union Project is a carbonate replacement deposit (“CRD“) project hosted by Neoproterozoic sedimentary rocks (limestones, dolomites, and siliciclastic sediments) overlying crystalline Paleoproterozoic rocks of the Caborca Terrane. The structural setting features high-angle normal faults and low-to-medium-angle thrust faults that sometimes served as mineralization conduits. Mineralization occurs as polymetallic veins, replacement zones (mantos, chimneys), and shear zones with high-grade metal content, as shown in highlight grades of 59.4 grams per metric tonne (g/t) gold, 833 g/t silver, 11% zinc, 5.5% lead, 2.2% copper, along with significant hematite and manganese oxides, consistent with a CRD model (see the technical report entitled “NI 43-101 Technical Report on the Union Project, State of Sonora, Mexico” dated effective May 6, 2025 available under Questcorp’s SEDAR+ profile). These targets also demonstrate intriguing potential for large gold discoveries potentially above an even larger porphyry Cu district potential as the Company’s target concept at this time.

Questcorp cautions investors grab samples are selective by nature and not necessarily indicative of similar mineralization on the property.

Riverside, the operator of the La Union Project, is currently lining up the various geophysical contractors to immediately undertake orientation surveys and follow up detailed survey to confirm and enhance the drill targets.

The technical and scientific information in this news release has been reviewed and approved by R. Tim Henneberry, P. Geo (BC), a director of the Company and a “qualified person” under National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Questcorp Mining Inc.

Questcorp Mining Inc. is engaged in the business of the acquisition and exploration of mineral properties in North America, with the objective of locating and developing economic precious and base metals properties of merit. The Company holds an option to acquire an undivided 100% interest in and to mineral claims totaling 1,168.09 hectares comprising the North Island Copper Property, on Vancouver Island, British Columbia, subject to a royalty obligation. The Company also holds an option to acquire an undivided 100% interest in and to mineral claims totaling 2,520.2 hectares comprising the La Union Project located in Sonora, Mexico, subject to a royalty obligation.

Contact Information

Questcorp Mining Corp.

Saf Dhillon, President & CEO

Email: saf@questcorpmining.ca

Telephone: (604) 484-3031

This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements with respect to Riverside’s arrangements with geophysical contractors to undertake orientation surveys and follow up detailed survey to confirm and enhance the drill targets. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: the ability of Riverside to secure geophysical contractors to undertake orientation surveys and follow up detailed survey to confirm and enhance the drill targets as contemplated or at all, general business, economic, competitive, political and social uncertainties, uncertain capital markets; and delay or failure to receive board or regulatory approvals. There can be no assurance that the geophysical surveys will be completed as contemplated or at all and that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/256556

Central banks around the world have dumped $48 billion in Treasuries since late March alone. At the same time, central banks keep buying gold, continuing a trend that began years earlier.

A recent survey from the World Gold Council found that geopolitical instability and potential trade conflicts are chief reasons why central banks in emerging economies are shifting toward gold at a much faster rate than those in advanced economies.

BofA estimated the central banks’ gold holdings are now equivalent to just under 18% of outstanding U.S. public debt, up from 13% a decade ago.

“That tally should be a warning for US policymakers. Ongoing apprehension over trade and US fiscal deficits may well divert more central bank purchases away from US Treasuries to gold,” analysts warned.

Meanwhile, the market still doesn’t appear to be overexposed to gold. BofA estimated that investors have allocated just 3.5% of their portfolios to gold.

And regardless of how Congress ends up rewriting the budget bill, analysts said deficits will remain elevated.

“Therefore, market concerns over fiscal sustainability are unlikely to fade no matter the result of Senate negotiations,” BofA predicted. “Rates volatility and a weaker USD should then keep gold supported, especially if the US Treasury or the Fed are ultimately forced to step in and support markets.”

This story was originally featured on Fortune.com

North Vancouver, British Columbia–(Newsfile Corp. – June 9, 2025) – Lion One Metals Limited (TSXV: LIO) (OTCQX: LOMLF) (“Lion One” or the “Company“) is pleased to announce the appointment of Edward (Ned) Collery to the Board of Directors.

Mr. Collery is the founder and President of Pelham Investment Partners LP, a private investment partnership based in New York. Prior to founding Pelham Investment Partners, Mr. Collery worked as a research analyst and partner in the investment management industry, including as a partner at private investment firm SC Fundamental, and an analyst at private New York-based investment firm Arbiter Partners. Mr. Collery has over a decade of investment experience in the natural resource sector and mining space and is also currently a director of the TSX-V listed nickel producer Nickel 28 Capital Corp. Mr. Collery holds a B.A. in Economics from Vanderbilt University with a minor in Financial Economics.

“We are excited to welcome Ned Collery to our Board of Directors, and we are confident his expertise will contribute to the future success of Lion One”, said Lion One Chairman and President Walter Berukoff.

About Lion One Metals Limited

Lion One Metals is an emerging Canadian gold producer headquartered in North Vancouver BC, with new operations established in late 2023 at its 100% owned Tuvatu Alkaline Gold Project in Fiji. The Tuvatu project comprises the high-grade Tuvatu Alkaline Gold Deposit, the Underground Gold Mine, the Pilot Plant, and the Assay Lab. The Company also has an extensive exploration license covering the entire Navilawa Caldera, which is host to multiple mineralized zones and highly prospective exploration targets.

On behalf of the Board of Directors,

Walter Berukoff, Chairman & President

Contact Information

Email: info@liononemetals.com

Phone: 1-855-805-1250 (toll free North America)

Website: www.liononemetals.com

Neither the TSX-V nor its Regulation Service Provider accepts responsibility or the adequacy or accuracy of this release

This press release may contain statements that may be deemed to be “forward-looking statements” within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein are forward-looking information. Generally, forward-looking information may be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “proposed”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases, or by the use of words or phrases which state that certain actions, events or results may, could, would, or might occur or be achieved. This forward-looking information reflects Lion One Metals Limited’s current beliefs and is based on information currently available to Lion One Metals Limited and on assumptions Lion One Metals Limited believes are reasonable. These assumptions include, but are not limited to, the actual results of exploration projects being equivalent to or better than estimated results in technical reports, assessment reports, and other geological reports or prior exploration results. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance, or achievements of Lion One Metals Limited or its subsidiaries to be materially different from those expressed or implied by such forward-looking information. Such risks and other factors may include, but are not limited to: the stage development of Lion One Metals Limited, general business, economic, competitive, political and social uncertainties; the actual results of current research and development or operational activities; competition; uncertainty as to patent applications and intellectual property rights; product liability and lack of insurance; delay or failure to receive board or regulatory approvals; changes in legislation, including environmental legislation, affecting mining, timing and availability of external financing on acceptable terms; not realizing on the potential benefits of technology; conclusions of economic evaluations; and lack of qualified, skilled labor or loss of key individuals. Although Lion One Metals Limited has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Accordingly, readers should not place undue reliance on forward-looking information. Lion One Metals Limited does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/254954