TORONTO, Dec. 28, 2022 /CNW/ – Collective Mining Ltd. (TSXV: CNL) (OTCQX: CNLMF) (“Collective” or the “Company”) is pleased to provide an overview of its achievements in 2022 and a preliminary outline of its plans for 2023.

The Company enjoyed an outstanding year exploring in the field as well as building relationships and related sustainability efforts off the field with its employees and stakeholders. Importantly, buy-in by employees of the Company’s health and safety program has resulted in a record low Total Recordable Injury Frequency Rate (“TRIFR”) of 1.44 (Dec. 2021 – Nov. 2022) and as of December 19, 2022, the Company’s employees have gone 333 days without recording a safety incident.

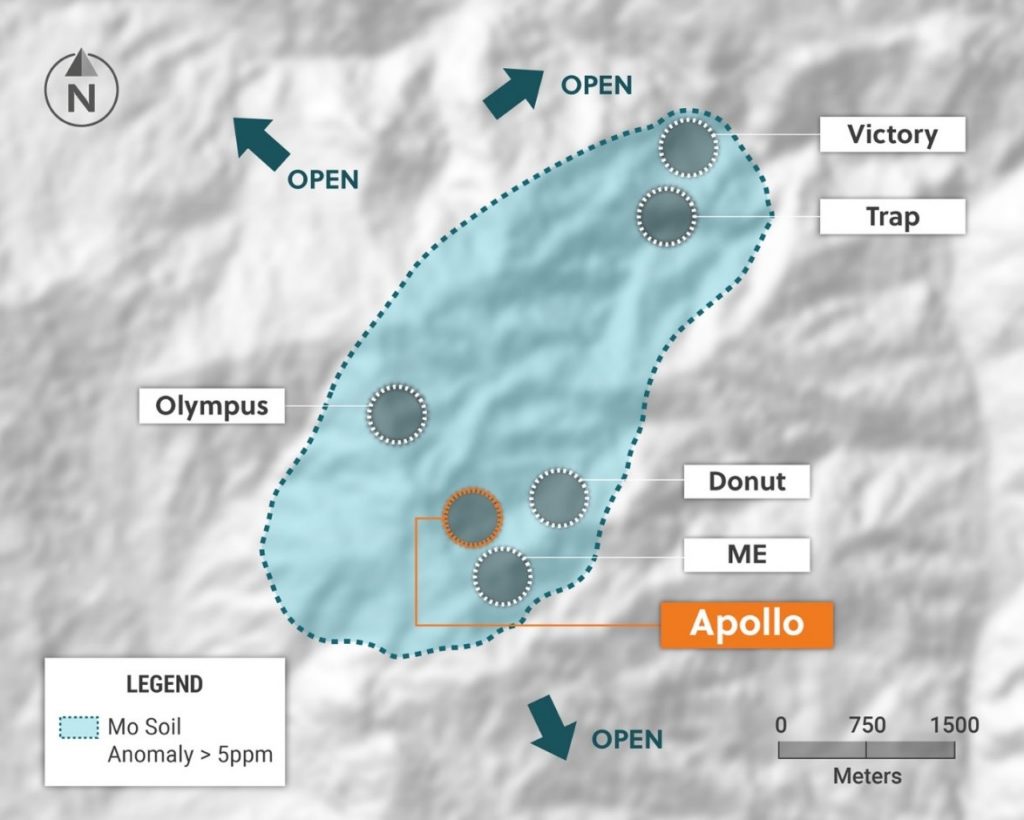

Exploration efforts in 2022 were directed at the Company’s flagship Guayabales project (“Guayabales”) where a major grassroot discovery was drilled at the Apollo target along with two additional earlier stage drilling discoveries at the Olympus and Trap targets. Guayabales is located in an established mining camp with 10 fully permitted and operating mines located within a three-kilometre radius and enjoys excellent infrastructure with abundant labor in close proximity. Additionally, Guayabales is contiguous to the Aris Mining’s multi-million-ounce Marmato project, which was awarded its PTO by the national government of Colombia in November 2022.

2022 Highlights

Guayabales Project

- Drilling: In 2022, the Company drilled a total of 22,907 metres on schedule and on budget, of which 14,975 metres (30 holes) were drilled at the Apollo target.

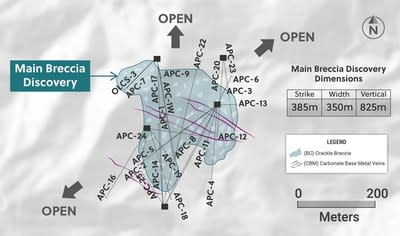

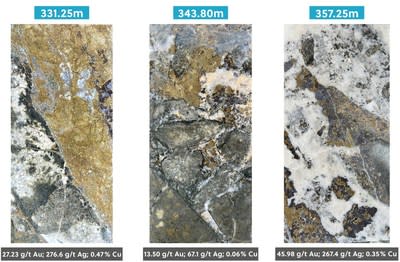

- Discovery 1: Apollo Target Main Breccia Discovery: The Company announced a significant grassroots discovery of a new bulk tonnage and high-grade, copper-silver-gold porphyry-related breccia system named the Main Breccia. The discovery hole for the Main Breccia system was announced on June 22, 2022, and since that time a total of 21 holes have been announced with an additional 9 holes awaiting assay results in the near term. From only a limited number of holes, the maximum known dimensions of the volume of rock, within which the Main Breccia system is hosted, measures 385 metres along strike by 350 metres across by 825 metres vertical. The system remains open for expansion in all directions. Apollo owes its excellent metal endowment to multiple phases of mineralization which include earlier gold-silver-copper breccia matrix mineralization derived from a porphyry source and younger, overprinting, sheeted carbonate base metal vein systems. Highlight assay results for drill holes into the Main Breccia system include:

Table 1: Select Assay Results of Holes Drilled into the Main Breccia Discovery at Apollo

| Hole # | From (m) | To (m) | Intercept (m) | Au (g/t) | Ag (g/t) | Cu% | Zn % | Pb% | Mo % | AuEq (g/t)* | CuEq (%)* |

| APC-2 | 154.75 | 361.90 | 207.15 | 1.46 | 45 | 0.31 | 0.075 | 0.05 | 0.002 | 2.68 | 1.37 |

| Incl | 192.50 | 209.90 | 17.40 | 6.57 | 44 | 0.08 | 0.285 | 0.23 | 0.003 | 7.33 | |

| 270.65 | 291.60 | 20.95 | 3.67 | 68 | 0.41 | 0.034 | 0.03 | 0.002 | 5.21 | ||

| APC-8 | 202.00 | 467.75 | 265.75 | 1.26 | 55 | 0.22 | 0.07 | 0.05 | 0.045 | 2.44 | 1.24 |

| Incl | 202.00 | 215.20 | 13.20 | 3.68 | 27 | 0.03 | 0.32 | 0.24 | 0.238 | 4.29 | |

| 239.05 | 257.50 | 18.45 | 3.48 | 53 | 0.12 | 0.24 | 0.22 | 0.216 | 4.55 | ||

| 279.40 | 307.85 | 28.45 | 3.70 | 24 | 0.16 | 0.03 | 0.02 | 0.016 | 4.18 | ||

| 342.60 | 358.10 | 15.50 | 2.15 | 158 | 0.47 | 0.13 | 0.10 | 0.104 | 5.21 | ||

| APC-12 | 191.35 | 429.05 | 237.7 | 1.15 | 72 | 0.38 | 0.08 | 0.07 | 0.001 | 2.88 | 1.47 |

| Incl | 209.70 | 224.00 | 14.30 | 4.01 | 77 | 0.21 | 0.27 | 0.26 | 0.001 | 5.58 | |

| 339.55 | 361.30 | 21.75 | 3.84 | 210 | 0.68 | 0.37 | 0.45 | 0.001 | 8.27 | ||

| 416.90 | 429.05 | 12.15 | 3.64 | 84 | 0.22 | 0.04 | 0.06 | 0.001 | 5.09 | ||

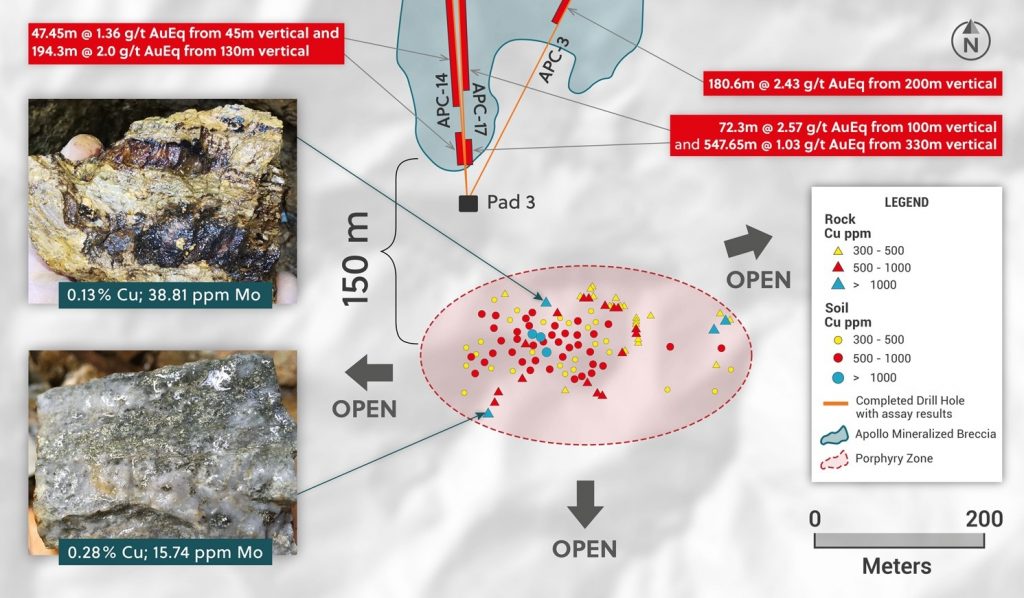

| APC-14 | 84.25 | 131.70 | 47.45 | 0.81 | 13 | 0.20 | 0.01 | 0.00 | 0.003 | 1.36 | 0.7 |

| 197.00 | 391.30 | 194.30 | 0.39 | 56 | 0.44 | 0.03 | 0.01 | 0.002 | 2.00 | 1.02 | |

| APC-18 | 136.05 | 304.65 | 168.60 | 0.98 | 69 | 0.50 | 0.04 | 0.03 | 0.002 | 2.91 | 1.48 |

| Incl | 149.20 | 157.00 | 7.80 | 5.08 | 35 | 0.52 | 0.02 | – | 0.002 | 6.34 | 3.23 |

| 193.20 | 205.10 | 11.90 | 2.18 | 154 | 0.77 | 0.18 | 0.20 | 0.001 | 5.81 | 2.97 | |

| 233.90 | 251.50 | 17.60 | 1.49 | 56 | 0.74 | 0.05 | 0.02 | 0.002 | 3.63 | 1.85 | |

| 291.65 | 297.00 | 5.35 | 3.26 | 10 | 0.11 | 0.01 | – | 0.001 | 3.47 | 1.77 | |

| APC-19 | 199.20 | 497.80 | 298.6 | 0.48 | 34 | 0.31 | 0.04 | 0.02 | 0.002 | 1.54 | 0.79 |

| Incl | 199.20 | 323.50 | 124.30 | 0.62 | 64 | 0.63 | 0.05 | 0.02 | 0.002 | 2.72 | 1.39 |

| 491.30 | 497.80 | 6.50 | 2.33 | 26 | 0.04 | 0.08 | 0.06 | 0.001 | 2.69 | ||

| APC-20 | 298.20 | 400.40 | 102.20 | 2.72 | 28 | 0.08 | 0.21 | 0.15 | 0.001 | 3.38 | |

| Incl | 324.25 | 357.85 | 33.60 | 6.30 | 45 | 0.08 | 0.42 | 0.33 | 0.001 | 7.30 |

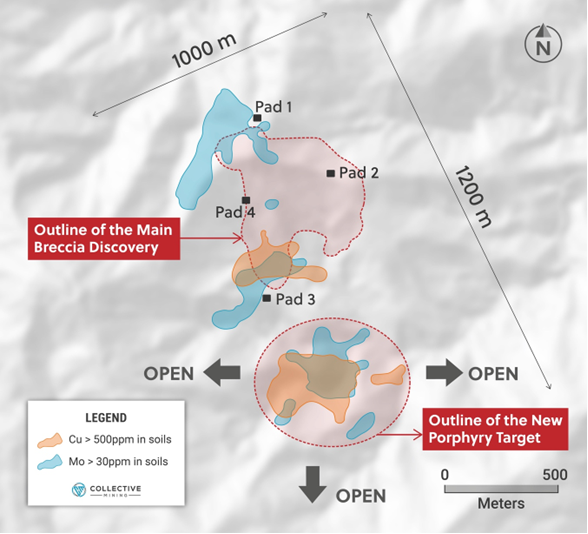

- Apollo Target: New Undrilled Porphyry Target: On December 14, 2022, the Company announced the discovery of a significant high-grade copper and molybdenum soil anomaly located only 150 metres south of the southernmost edge of the Main Breccia discovery. Drilling is planned for early 2023 to test the target, which could be the source of the porphyry copper mineralization found in the Main Breccia system.

- Apollo Target: Metallurgy: The Company successfully completed cyanide leach, bottle-roll test on three representative composite sulphide samples from the Main Breccia discovery. Importantly, the samples covered all major styles of mineralization hosted within the Main Breccia discovery and yielded excellent recovery rates for gold up to 97%.

- Discovery #2: Olympus: The Company made its second grassroots discovery on March 25, 2022, at the Olympus target. The discovery is characterized by broad drilling intercepts of medium grade gold and silver with minor associated base metal credits. The Olympus discovery covers an area measuring 1.0 km by 0.9 km and remains open in most directions. A three-hole, phase II program was recently completed with assay results expected in Q1, 2023. Highlight Phase I assay results for drill holes at Olympus include:

Table 2: Select Assay Results from Drilling at the Olympus Target

| Hole # | From (m) | To (m) | Intercept (m) | Au (g/t) | Ag (g/t) | Cu% | Zn % | Pb% | Mo % | AuEq (g/t)* |

| OLCC-3 | 61.70 | 363.60 | 301.90 | 0.89 | 11.82 | 0.03 | 0.03 | 0.03 | 0.002 | 1.11 |

| OLCC-4 | 73.00 | 289.70 | 216.70 | 0.79 | 13.84 | 0.04 | 0.02 | 0.03 | 0.004 | 1.08 |

- Discovery #3: Trap: The Company announced its third grassroots discovery at the Trap target on September 27, 2022. Trap is a north to northwest trending, structurally controlled corridor with evidence of overprinting porphyry B veins and late-stage carbonate base metals veins. Highlights from the reconnaissance drill program at Trap include:

Table 3: Select Assay Results from Drilling at the Trap Target

| Hole # | From (m) | To (m) | Intercept (m) | Au (g/t) | Ag (g/t) | Cu% | Zn % | Pb% | Mo % | AuEq (g/t)* | CuEq (%)* |

| TRC-1 | 233.8 | 336.0 | 102.20 | 1.26 | 12 | 0.09 | 0.08 | 0.01 | 0.003 | 1.53 | 0.90 |

| VICE-2 | 214.6 | 233.50 | 18.90 | 1.06 | 36 | 0.18 | 0.18 | 0.12 | 0.005 | 1.83 | 1.13 |

Corporate & Sustainability, Strategic Alliances

- Financing: In October, the Company closed a $10.7 million bought deal financing comprised of 4,783,400 units at $2.25 per unit, including one half of one common share purchase warrant at $3.25, excisable until April 25, 2024.

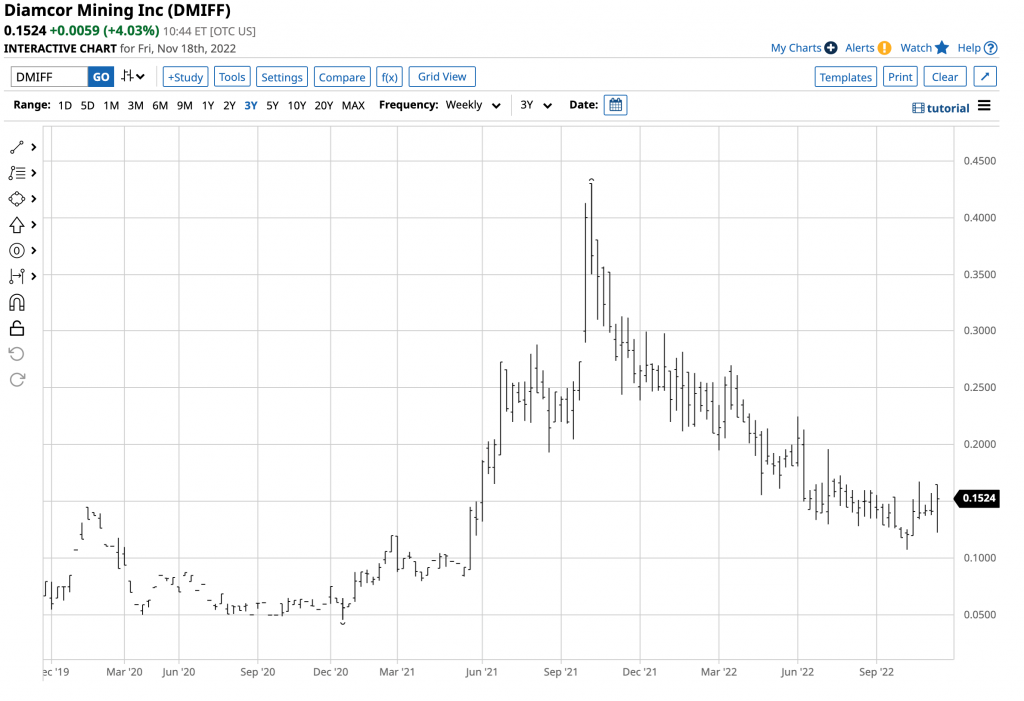

- OTC Listing: The Company upgraded its US-based listing to the OTCQX exchange from the Pink® market, trading under the symbol CNLMF.

- Strategic Alliances:

2023 Preliminary Plans

- Equipped with a strong balance sheet, the Company will continue to actively drill the Apollo target. The program will focus on targeting the high-grade subzones within the Main Breccia system while simultaneously expanding the size of the system. Additionally, the Company will remain aggressive in testing new targets including the newly generated copper and molybdenum porphyry target located 150 metres south of the Main Breccia system. Drilling will resume in early January 2023.

- Assays for the remaining and completed 2022 drill holes at Apollo remain outstanding and will be announced throughout early 2023.

About Collective Mining Ltd.

To see our latest corporate presentation and related information, please visit www.collectivemining.com

Founded by the team that developed and sold Continental Gold Inc. to Zijin Mining for approximately $2 billion in enterprise value, Collective Mining is a copper, silver and gold exploration company based in Canada, with projects in Caldas, Colombia. The Company has options to acquire 100% interests in two projects located directly within an established mining camp with ten fully permitted and operating mines.

The Company’s flagship project, Guayabales, is anchored by the Apollo target, which hosts the large-scale, bulk-tonnage and high-grade copper, silver and gold Main Breccia discovery. The Company’s near-term objective is to continue with expansion drilling of the Main Breccia discovery while increasing confidence in the highest-grade portions of the system.

Management, insiders and close family and friends own nearly 35% of the outstanding shares of the Company and as a result, are fully aligned with shareholders. The Company is listed on the TSXV under the trading symbol “CNL” and on the OTCQX under the trading symbol “CNLMF”.

Qualified Person (QP) and NI43-101 Disclosure

David J Reading is the designated Qualified Person for this news release within the meaning of National Instrument 43-101 (“NI 43-101”) and has reviewed and verified that the technical information contained herein is accurate and approves of the written disclosure of same. Mr. Reading has an MSc in Economic Geology and is a Fellow of the Institute of Materials, Minerals and Mining and of the Society of Economic Geology (SEG).

Technical Information

Rock and core samples have been prepared and analyzed at SGS laboratory facilities in Medellin, Colombia and Lima, Peru. Blanks, duplicates, and certified reference standards are inserted into the sample stream to monitor laboratory performance. Crush rejects and pulps are kept and stored in a secured storage facility for future assay verification. No capping has been applied to sample composites. The Company utilizes a rigorous, industry-standard QA/QC program.

FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including, but not limited to, statements about the drill programs, including timing of results, and Collective’s future and intentions. Wherever possible, words such as “may”, “will”, “should”, “could”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict” or “potential” or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties, and assumptions. Many factors could cause actual results, performance, or achievements to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, Collective cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and Collective assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

SOURCE Collective Mining Ltd.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/December2022/28/c9404.html