Website| https://provenandprobable.com/

Call Me |855.505.1900 or email: Maurice@MilesFranklin.com

Precious Metals – https://www.milesfranklin.com/

Website| https://provenandprobable.com/

Call Me |855.505.1900 or email: Maurice@MilesFranklin.com

Precious Metals – https://www.milesfranklin.com/

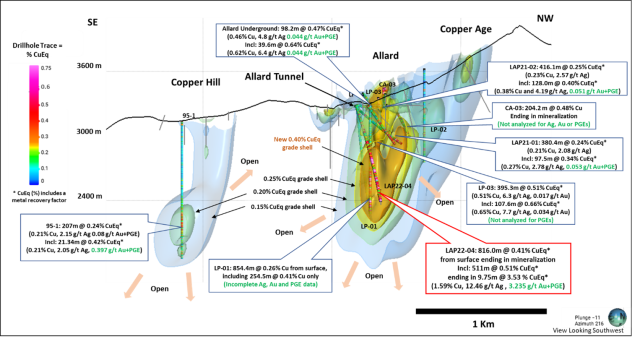

Hot Chili Limited (ASX: HCH) (TSXV: HCH) (OTCQX: HHLKF) (“Hot Chili” or the “Company”) is pleased to announce that drilling has re-commenced across the western extension of the Cortadera porphyry resource, part of the Company’s Costa Fuego Copper-Gold Project (“Costa Fuego” or “the Project”) located 600 km north of Santiago, at low elevation (<1,000 m) in the coastal range of the Atacama Region, Chile.

Drilling operations have been underway for five days with one reverse circulation rig in operation and further diamond drill rigs to be added as the Company ramps up its fully-funded 30,000m expansion drilling programme across Costa Fuego.

Given the Company’s significant advance on its Pre-Feasibility Study for Costa Fuego (over 80% complete) and high Indicated categorisation of the current Mineral Resource (82% Indicated), the majority of planned drilling is being directed toward exploration and mineral resource growth.

A mineral resource update for Costa Fuego is planned to be completed in H2 2023 and will include drilling from the current 30,000m programme as well as significant drilling undertaken across Costa Fuego since the beginning of 2022.

The Company is well funded with approximately A$26 million in treasury following closing of its recent investment agreement with Osisko Gold Royalties for US$15 million (as announced 26th July 2023).

A PEA technical report prepared in accordance with NI 43-101 (as defined below) will be filed on SEDAR+ by 11th August 2023.

The Company looks forward to providing further updates on results from drilling activities and ongoing development study workstreams.

To access the announcement please click on the link below.

Vancouver, British Columbia–(Newsfile Corp. – August 1, 2023) – EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the “Company” or “EMX”) is pleased to announce the execution of a binding term sheet with Franco-Nevada Corporation (“Franco-Nevada”) for the joint acquisition of newly created precious metals and copper royalties sourced by EMX (the “Agreement”). Franco-Nevada will contribute 55% (up to US$5.5 million) and EMX will contribute 45% (up to US$4.5 million) towards the royalty acquisitions, with the resulting royalty interests equally split (i.e. 50/50). The initial term is for three years from the signing date, or until the maximum contributions totaling US$10 million from both companies have been met, and may be extended if mutually agreed by both companies.

EMX and Franco-Nevada believe that royalty financing capital is sorely needed in an exploration sector where equity capital is difficult to source. The Agreement allows EMX to direct a large amount of capital towards the royalty generation aspect of its business model, and Franco-Nevada to participate in exploration stage royalty financing opportunities identified by EMX. Franco-Nevada is already an EMX shareholder (6.1% fully diluted), having made a $10 million private placement to facilitate the Company’s purchase of additional royalty interests in the Caserones copper (molybdenum) mine in Chile last year (see EMX news release dated April 14, 2022). In parallel with EMX’s royalty acquisition, Franco-Nevada also purchased a royalty interest in Caserones.

Commercial Terms Overview. Pursuant to the terms of the Agreement dated June 27, 2023, EMX will source newly created precious metals royalties (“Precious Metals Royalties”) and/or copper royalties (“Copper Royalties”, and together with Precious Metals Royalties, “Royalties” and each a “Royalty”) exclusively for the benefit of EMX and Franco-Nevada (jointly the “Parties”). The Royalties will be for all minerals from mining projects having primary economic metal(s) that are precious metals or copper, but the Agreement will not apply to the purchase of existing third-party royalty interests or exploration lands.

The material Agreement terms are (all dollar amounts are in U.S. dollars (USD)):

Discussion. The Agreement with Franco-Nevada is expected to accelerate the growth of the Company’s royalty portfolio by allowing EMX to direct a larger amount of capital towards new royalty acquisitions through exploration royalty financing or other entrepreneurial means. EMX’s assets currently include over 250 exploration and early stage royalty generation projects, in addition to six producing and eleven advanced royalty properties. The Company has active programs and important assets in North America (the western U.S., Canada, and Mexico), South America (Chile, Peru, and Argentina), Europe (Fennoscandia, Serbia and the other Balkans), western Asia (Turkey), Africa (Morocco and Botswana), and Australia. From these countries and regions, the Company manages its portfolio utilizing in-country or in-region exploration teams, consultants, and advisers. EMX’s search for new royalty opportunities will be led in the western hemisphere by Chief Geologist, Dr. David Johnson, in the eastern hemisphere by General Manager of Exploration, Dr. Eric Jensen, and globally by General Manager of Corporate Development, Thomas Mair.

The precious metals and copper focused search for new royalties leverages EMX’s experience in assessing opportunities for these commodities. The Company’s portfolio is principally comprised of gold (59%) and copper (21%) assets, with battery (e.g., cobalt, nickel, etc.) and other metals (e.g., lead, zinc, etc.) accounting for the remaining 20%. The Company’s current portfolio provides a strong base from which to source new royalties for both companies.

EMX is well positioned to source new royalty opportunities under the Agreement. In particular, the EMX – Franco-Nevada initiative well-suited for the acquisition of new royalties from companies that have promising precious metals or copper projects, but are confronted by the current challenging environment for exploration funding. Interested third parties are encouraged to see www.EMXroyalty.com for more information regarding key management contacts, as well as the Company’s portfolio and business strategy.

Qualified Person. Michael P. Sheehan, CPG, a Qualified Person as defined by National Instrument 43-101 and employee of the Company, has reviewed, verified and approved the disclosure of the technical information contained in this news release.

About EMX. EMX is a precious, base and battery metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and TSX Venture Exchange under the symbol “EMX”, and also trade on the Frankfurt exchange under the symbol “6E9”. Please see www.EMXroyalty.com for more information.

About Franco-Nevada. Franco-Nevada Corporation is the leading gold-focused royalty and streaming company with the largest and most diversified portfolio of cash-flow producing assets. Its business model provides investors with gold price and exploration optionality while limiting exposure to cost inflation. Franco-Nevada uses its free cash flow to expand its portfolio and pay dividends. It trades under the symbol FNV on both the Toronto and New York stock exchanges.

For further information contact:

David M. Cole

President and Chief Executive Officer

Phone: (303) 973-8585

Dave@emxroyalty.com

Scott Close

Director of Investor Relations

Phone: (303) 973-8585

SClose@emxroyalty.com

Isabel Belger

Investor Relations (Europe)

Phone: +49 178 4909039

IBelger@EMXroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

Forward-Looking Statements

This news release may contain “forward-looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended March 31, 2023 (the “MD&A”), and the most recently filed Annual Information Form (“AIF”) for the year ended December 31, 2022, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedarplus.ca and on the SEC’s EDGAR website at www.sec.gov.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/175578

Edmonton, Alberta–(Newsfile Corp. – July 31, 2023) – Grizzly Discoveries Inc. (TSXV: GZD) (FSE: G6H) (OTCQB: GZDIF) (“Grizzly” or the “Company”) is pleased to announce that crews have been mobilized to the Rock Creek camp and have commenced work at Midway, Copper Mountain and the Imperial target areas within the Greenwood Precious and Battery Metals Project.

Geological and prospecting crews have commenced prospecting, geological mapping, rock and soil sampling within the Greenwood Project. The intent is to prepare these target areas for drilling later this year. The Company is awaiting land use permits for conducting drilling and trenching at the Midway Mine area as well as drilling at Copper Mountain, Imperial and potentially the Sappho target areas (Figure 1).

Figure 1: Exploration Targets 2023.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4488/175436_7ecbab4574189b01_002full.jpg

The geological and prospecting crew has made a new discovery of sulphide in a quartz vein zone on an extension to the Mabel Jenny structural zone in the Copper Mountain project area. Figures 2 and 3 outline a new road cut from which a rock grab sample collected in 2022 returned 7.5 grams per tonne gold (g/t Au), 54 g/t silver (Ag), 2.04% zinc (Zn) and 0.067% Cu. The new logging road cut has been dug out and cleaned up with a number of new samples collected (Figure 2). The road cut is approximately 150 m northwest of the Mabel Jenny historical workings (Figure 3). Another 2022 rock grab sample collected about 100 m further northwest yielded 1.01 g/t Au.

Figure 2: New discovery of a quartz vein breccia zone with sulphide about 150 m northwest of Mabel Jenny. Click here for video clip: Quartz vein breccia zone with sulphide

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4488/175436_7ecbab4574189b01_003full.jpg

A single drillhole in the area of the Mabel Jenny workings intersected a propylitic to argillic altered quartz diorite with pervasive pyrite, quartz veining and localized breccia zones. The 178 m hole returned up to 0.21 g/t Au over 42.8 m with a core of 0.4 g/t Au across 18.2 m core length, but more importantly every sample was anomalous with gold, with not a single sample returning less than detection background gold.

The geological crews have collected approximately 1,200 soil samples and 200 rock samples from the Midway and Copper Mountain areas to date. Assays results will be reported as they become available.

Figure 3: Samples and drillholes on backdrop of HLEM and Geology.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4488/175436_7ecbab4574189b01_004full.jpg

The goal of the current fieldwork is to improve the targeting for the late summer – fall drilling campaigns at a number of precious metal and battery metal targets across the property and continue to develop a pipeline of high priority precious metal and battery metal targets that are all permitted and ready for a long 2023 drilling campaign in order to prioritize these assets into those that can deliver future mineral resources with additional drilling, eventually leading to some form of economic studies and scenarios that might be able to take advantage of local toll treating opportunities that exist in the Greenwood – Republic region.

Brian Testo, President and CEO of Grizzly Discoveries stated, “We are extremely excited with the progress that our prospecting team has made to date. The new discovery of a quartz vein breccia zone near the Mable Jenny target is an excellent start to the 2023 exploration season. Grizzly plans to pursue this and a number of high grade gold – silver showings and historical mines within our current 160,000+ acre land holdings in the Greenwood District. We have numerous prospective zones that could potentially result in additional new discoveries along with the multiple historical mining production showings that Grizzly intends to drill and advance.”

2023 Exploration Update for Greenwood

in the Midway Mine historical pit yielded a range of 12.05 g/t (or 0.351 ounces per ton [oz/t]) Au up to 70.8 g/t (2.065 oz/t) Au (See Company news release dated October17, 2022).

Quality Assurance and Control

Rock and soil samples were analyzed at ALS Global Laboratories (Geochemistry Division) in Vancouver, Canada (an ISO/IEC 17025:2017 accredited facility). Gold was assayed using a fire assay with atomic emission spectrometry and gravimetric finish when required (+10 g/t Au). Rock grab and rock chip samples from outcrop/bedrock are selective by nature and may not be representative of the mineralization hosted on the project.

The sampling program was undertaken by Company personnel under the direction of Michael B. Dufresne, M.Sc., P.Geol., P.Geo. A secure chain of custody is maintained in transporting and storing of all samples.

The technical content of this news release and the Company’s technical disclosure has been reviewed and approved by Michael B. Dufresne, M. Sc., P. Geol., P.Geo., who is the Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects.

ABOUT GRIZZLY DISCOVERIES INC.

Grizzly is a diversified Canadian mineral exploration company with its primary listing on the TSX Venture Exchange focused on developing its approximately 66,000 ha (approximately 165,000 acres) of precious and base metals properties in southeastern British Columbia. Grizzly is run by a highly experienced junior resource sector management team, who have a track record of advancing exploration projects from early exploration stage through to feasibility stage.

On behalf of the Board,

GRIZZLY DISCOVERIES INC.

Brian Testo, CEO, President

Suite 363-9768 170 Street NW

Edmonton, Alberta T5T 5L4

For further information, please visit our website at www.grizzlydiscoveries.com or contact:

Nancy Massicotte

Corporate Development

Tel: 604-507-3377

Email: nancy@grizzlydiscoveries.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Caution concerning forward-looking information

This press release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable securities laws. This information and statements address future activities, events, plans, developments and projections. All statements, other than statements of historical fact, constitute forward-looking statements or forward-looking information. Such forward-looking information and statements are frequently identified by words such as “may,” “will,” “should,” “anticipate,” “plan,” “expect,” “believe,” “estimate,” “intend” and similar terminology, and reflect assumptions, estimates, opinions and analysis made by management of Grizzly in light of its experience, current conditions, expectations of future developments and other factors which it believes to be reasonable and relevant. Forward-looking information and statements involve known and unknown risks and uncertainties that may cause Grizzly’s actual results, performance and achievements to differ materially from those expressed or implied by the forward-looking information and statements and accordingly, undue reliance should not be placed thereon.

Risks and uncertainties that may cause actual results to vary include but are not limited to the availability of financing; fluctuations in commodity prices; changes to and compliance with applicable laws and regulations, including environmental laws and obtaining requisite permits; political, economic and other risks; as well as other risks and uncertainties which are more fully described in our annual and quarterly Management’s Discussion and Analysis and in other filings made by us with Canadian securities regulatory authorities and available at www.sedar.com. Grizzly disclaims any obligation to update or revise any forward-looking information or statements except as may be required by law.

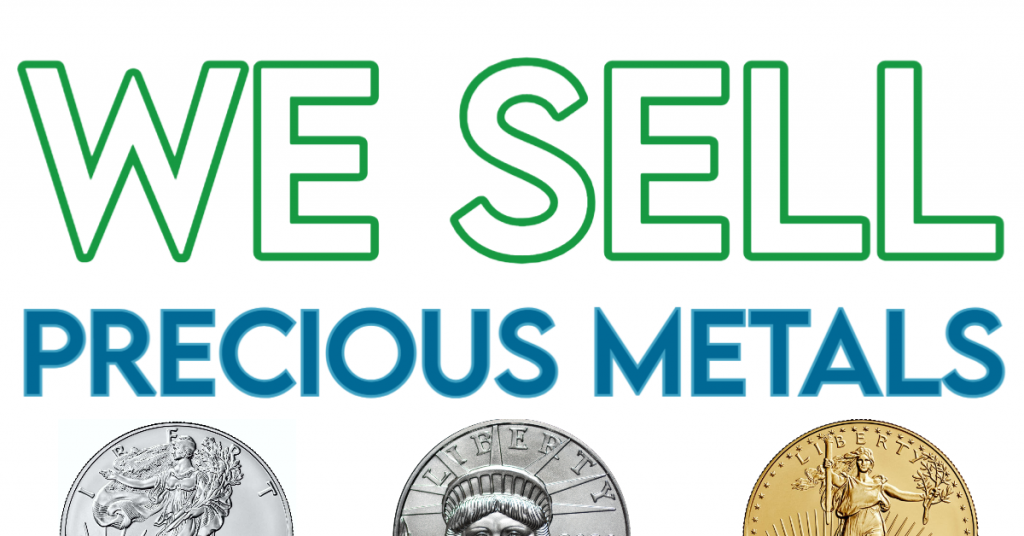

VANCOUVER, BC / ACCESSWIRE / July 31, 2023 / Metallic Minerals Corp. (TSX.V:MMG)(OTCQB:MMNGF) (“Metallic Minerals” or the “Company”) is pleased to announce an updated National Instrument 43-101 Mineral Resource Estimate representing a 25% increase in contained metal based on an additional 1,730 meters of diamond drilling completed at its La Plata project in 2022. Inferred mineral resources at the Allard deposit now total 1,211 million pounds of copper (“Mlbs”) and 17.6 million ounces (“Moz”) of silver in a constrained model with 147.3 million tonnes at an average grade of 0.41% Copper Equivalent (“CuEq”) (0.37% Cu and 3.72 g/t Ag) using a 0.25% CuEq cut-off grade (See Table 1 notes).

The expansion from the inaugural resource to the current 1,317 Mlbs CuEq is largely driven by the major discovery in drill hole LAP22-04 (drilled in 2022), which intersected 816 meters of 0.41% CuEq recovered (0.30% Cu, 2.47 g/t Ag, 0.038 g/t Au, 0.055 g/t Pd and 0.093 g/t Pd) bottoming in 5.39% CuEq recovered over 5.2 m (2.44% Cu, 18.7 g/t Ag, 5.0 g/t Au+PGE). Follow-up drilling is currently underway to test the extent of this newly discovered high-grade mineralization, and at the time of this news release, the first offset drill hole was drilling in porphyry mineralization and had reached approximately 500 m depth.

The Allard deposit resource remains completely open to expansion laterally and to depth. Future mineral resource estimates will add gold, platinum and palladium to the copper and silver resource with additional drilling. These metals were not previously assayed for in historic drilling but add significant value to the recent drill intercepts. Furthermore, the greater La Plata copper-silver-gold-PGE project remains underexplored and open to new discoveries of both additional copper porphyry centers, as well as high-grade epithermal silver, gold and telluride mineralization that were the focus of historic mining in the district.

Highlights

An NI 43-101-compliant technical report on the 2023 La Plata Resource will be filed on Sedar.com within 45 days.

Scott Petsel, Metallic Minerals’ President, states, “The current expansion of the La Plata resource is an early first step in realizing the true potential of the project and the fact that we were able to achieve a 25% increase over the inaugural resource with a modest amount of drilling in 2022 speaks to the well mineralized yet underexplored nature of the project. Hole LAP22-04 resulted in the discovery of new, extremely rich mineralization that is unconstrained to the east, north and at depth and clearly requires follow-up drilling to understand the true size and nature of the Allard resource. Metallic Minerals in collaboration with our strategic investor Newcrest Mining is excited to pursue expansion on this discovery in 2023 and have secured a drill capable of penetrating well beyond the current resource extent. The continuity of mineralization starting from surface, coupled with the very high grades at depth, represent significant upside to both scale and grade in future resource updates. We expect considerable expansion of the contained precious metals and copper with subsequent drilling and envision the potential scale for a Tier 1 asset. In addition, numerous high-priority untested targets have been identified outside of the resource area that we hope to begin testing in 2023.”

Table 1 – 2023 Updated La Plata Inferred Mineral Resource Estimate at a Base Case Cut-off Grade of 0.25% CuEq with Grade and Contained Metal Sensitivity Analysis at Various CuEq Cut-off Grades.

| Class | CuEq (%) | Tonnes | Cu | Ag | CuEq (%) | |||

| Cut-off | Grade (%) | Mlbs | Grade (g/t) | Ounces | Grade (%) | Mlbs | ||

| Inferred | 0.15 | 212,243,000 | 0.32 | 1,480 | 3.24 | 22,131,000 | 0.34 | 1,613 |

| Inferred | 0.20 | 187,173,000 | 0.34 | 1,391 | 3.42 | 20,597,000 | 0.37 | 1,515 |

| Inferred | 0.25 | 147,344,000 | 0.37 | 1,211 | 3.72 | 17,604,000 | 0.41 | 1,317 |

| Inferred | 0.30 | 116,438,000 | 0.41 | 1,041 | 3.95 | 14,783,000 | 0.44 | 1,130 |

| Inferred | 0.35 | 87,871,000 | 0.44 | 854 | 4.20 | 11,861,000 | 0.48 | 925 |

La Plata Property Overview

Metallic Minerals’ La Plata project covers 44 square kilometers 20 km north of Mancos, Colorado, within the historic La Plata mining district, that is in the southwest portion of the prolific Colorado Mineral Belt. The La Plata project is easily accessible by highways and improved gravel roads and is near significant power transmission lines.

The La Plata district has a long and rich history of mining with the first silver deposits discovered in the 1700s by Spanish explorers. High-grade silver and gold production has been documented from the 1870s through the early 1940s from mineralized deposits at over 90 individual mines and prospects1. From the 1950s to 1970s, major miners, including Rio Tinto (Bear Creek) and Freeport-McMoRan (Phelps Dodge), explored the district focusing on the significant potential for bulk-tonnage disseminated and stockwork hosted mineralization2. Freeport-McMoRan retained ownership of claims in the district until 2002 when they sold their holdings to the current underlying vendors during the lows of the last metal price cycle.

A total of 17,215 meters in 59 drill holes has been drilled on the property from the 1950s to present, this drilling has demonstrated the presence of a large multi-phase porphyry system with copper, silver, gold with more recent discoveries highlighting the potential for significant PGEs, rare earth minerals and tellurium. This large-scale mineralized system is associated with a 10 km2 strongly magnetic signature with intense hydrothermal alteration. Surrounding the central porphyry system is an associated high-grade silver and gold-rich epithermal system measuring at least 8 km by 2 km that hosts 56 identified mineralized veins, replacement, and breccia structures. Historical production from some of these high-grade structures included bonanza grades for silver and gold.

Copper mineralization with associated silver, gold, platinum, and palladium is hosted by a large-scale, Late Mesozoic age, alkalic porphyry system with related silver, gold, telluride epithermal vein, breccia and replacement deposits hosted in adjacent sedimentary rocks. Porphyry copper systems are some of the largest sources of copper and precious metals production worldwide and are frequently cornerstone Tier 1 assets for the major mining companies. The sub-type of porphyry systems, known as alkalic porphyry deposits, commonly contain higher-grade precious metal content like at La Plata and can demonstrate significant scale.

Figure 1 – La Plata Cross Section with Significant Drill Intervals and Mineralized Grade Shells

Critical Minerals

The Allard deposit at La Plata is a significant potential source of copper and silver, both important industrial metals used for modern technologies broadly and particularly in renewable and clean energy applications. Recent and historical work has also demonstrated that the broader La Plata district is also a potential source of other critical minerals identified by the U.S. Government as requirements for economic and national security3. Drilling by Metallic Minerals in 2022 returned multi-gram intervals of platinum group elements with individual grades up to 5 g/t platinum and palladium, as well as critical minerals such as vanadium, and rare earth elements. Tellurium, another element on the critical mineral list, was a by-product of historic high-grade gold and silver production in the district. The potential for these critical minerals to add additional economic value to the La Plata project will be evaluated as part of ongoing exploration efforts.

U.S. Geological Survey Earth Mapping Resources Initiative

The U.S. Geological Survey (“USGS”) is funding the Colorado Geological Survey for geological studies in the La Plata Mountains as part of the Earth Mapping Resources Initiative. The work to be carried out by the Colorado Geological Survey includes geologic mapping as well as geochemical and mineralogical studies in the La Plata Mining District to generate a greater understanding of the area’s potential to host critical minerals. See USGS news release dated January 25, 2023.

About SGS Geological Services

SGS Geological Services has an experienced and respected mining team focused on the domestic and international mining industry. The team has considerable experience in estimation and modeling of deposits of all types and practical and theoretical experience having realized hundreds of assessments for clients. The SGS team consists of a multi-disciplinary group of qualified persons with a strong understanding of the disclosure requirements for Mineral Resources set out in the NI 43-101 Standards of Disclosure for Mineral Projects (2016), CIM Definition Standards for Mineral Resources and Mineral Reserves (2014) and a strong understanding of the CIM Estimation of Mineral Resources & Mineral Reserves Best Practice Guidelines 2019.

About Metallic Minerals

Metallic Minerals Corp. is a leading exploration and development stage company focused on copper, silver, gold, and other critical minerals in the La Plata mining district in Colorado, and silver and gold in the high-grade Keno Hill and Klondike districts of the Yukon. Our objective is to create shareholder value through a systematic, entrepreneurial approach to making exploration discoveries, growing resources, and advancing projects toward development.

At the Company’s La Plata project in southwestern Colorado, the new 2023 NI 43-101 mineral resource estimate identifies a significant porphyry copper-silver resource containing 1,211 Mlbs copper and 17.6 Moz of silver. Results from 2022 expansion drilling providing the basis for the updated resource, included the longest and highest-grade interval ever encountered at La Plata and one of the top intersections for any North American copper project in the past several years. In May 2023, the Company announced a 9.5% strategic investment by Newcrest Mining Limited to accelerate the advancement of the Company’s La Plata project. In the 2023 Fraser Institute’s Annual Survey of Mining Companies, Colorado ranked 5th globally for investment attractiveness and 2nd in the USA.

In Canada’s Yukon Territory, Metallic Minerals has consolidated the second-largest land position in the historic high-grade Keno Hill silver district, directly adjacent to Hecla Mining Company’s (“Hecla”) operations, with more than 300 Moz of high-grade silver in past production and current M&I resources. Hecla, the largest primary silver producer in the USA and third largest in the world, completed the acquisition of Alexco Resource Corp and its Keno Hill operations in September 2022. Hecla is targeting to start production at the Keno Hill operations by Q3 2023. Metallic Minerals is anticipating the announcement of inaugural mineral resource estimate at Keno Silver in the second half of 2023.

The Company is also one of the largest holders of alluvial gold claims in the Yukon and is building a production royalty business by partnering with experienced mining operators, including Parker Schnabel of Little Flake Mining from the hit television show, Gold Rush, on the Discovery Channel.

All of the districts in which Metallic Minerals operates have seen significant mineral production and have existing infrastructure, including power and road access. Metallic Minerals is led by a team with a track record of discovery and exploration success on several major precious and base metal deposits in the region, as well as having large-scale development, permitting and project financing expertise. The Metallic Minerals team has been recognized for its environmental stewardship practices and is committed to responsible and sustainable resource development.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Website: www.mmgsilver.com Phone: 604-629-7800

Email: cackerman@mmgsilver.com Toll Free: 1-888-570-4420

Footnotes:

Qualified Persons

The La Plata copper-silver project 2023 mineral resource estimate was prepared by Allan Armitage, P. Geo., of SGS Geological Services, an independent Qualified Person, in accordance with the guidelines of the Canadian Securities Administrators’ National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) with an effective date of July 10, 2023. Armitage conducted a site visit to the property on August 13, 2021, and again on April 18 and 19, 2023. Jeff Cary, CPG, a qualified person for the purposes of National Instrument 43-101, has reviewed and approved the technical disclosure not pertaining to the resource estimate contained in this news release. Mr. Cary is a Senior Geologist and La Plata Project Manager for Metallic Minerals.

Forward-Looking Statements

This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, statements about expected results of operations, royalties, cash flows, financial position and future dividends as well as financial position, prospects, and future plans and objectives of the Company are forward-looking statements that involve various risks and uncertainties. Although Metallic Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, unsuccessful operations, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration, development of mines and mining operations is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Metallic Minerals and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Metallic Minerals Corp.

View source version on accesswire.com:

https://www.accesswire.com/771165/Metallic-Minerals-Expands-Resource-at-La-Plata-Copper-Silver-Gold-PGE-Project-in-Southwestern-Colorado-USA

CORPORATE PRESENTATION: CLICK HERE

Vancouver, British Columbia–(Newsfile Corp. – July 24, 2023) – Ridgeline Minerals Corp. (TSXV: RDG) (OTCQB: RDGMF) (FSE: 0GC0) (“Ridgeline” or the “Company”) is pleased to announce the commencement of the Company’s diamond core drill program at the Selena project (“Selena”). Selena is host to a silver (“Ag”) – gold (“Au”) – lead (“Pb”) – zinc (“Zn”) carbonate replacement (“CRD”) style discovery located in White Pine County, Nevada (Figure 1).

The drill program has been designed to follow-up on bonanza grade CRD intercepts drilled at the Chinchilla zone in 2022, with highlights including 6.1 meters (“m”) grading 480 grams per tonne (“g/t”) Ag, 12.0% Pb, 6.4% Zn, and 0.1 g/t Au in SE22-045 and 0.5 m grading 1,793 g/t Ag, 2.2% tungsten (“W”) and 0.5% copper (“Cu”) in SE22-039 (see January 24, 2023 press release HERE). The program will complete up to six (6) core holes for a total of 3,000 m with results to be released as they are received (Figure 2).

Mike Harp, Vice President, Exploration commented, “Last year’s program delivered the best intercepts in the project’s history. It also confirmed our theory that core drilling would significantly upgrade historical reverse circulation assay results, indicating substantial upside as we convert historically drilled RC intercepts to core. Our 2023 program will build off that success and focus on expanding the high-grade mineralization at two known “chimney” or feeder structures that make up the core of the Chinchilla Zone. We will also drill the lower half of the Guilmette Limestone host rocks, which we believe have potential to host multiple stacked CRD horizons adjacent to known chimney structures.”

Selena Project

Selena is located in White Pine County, Nevada, approximately 64 kilometers (“km”) north of the town of Ely, NV. The project shares a property boundary with the Butte Valley project, a US $33M earn-in agreement between Freeport-McMoRan and Falcon Butte Minerals. The 100% owned project is comprised of 39 square kms of highly prospective exploration ground including Ridgeline’s shallow-oxide Ag-Au-Pb-Zn Chinchilla discovery. Subsequent drilling has continued to highlight the potential for high-grade CRD type mineralization (Ag-Au-Pb-Zn ±Cu) between Chinchilla and the Butte Valley Cu-Au-Ag porphyry located directly west of the property. (View the Selena VRIFY Deck Here)

Figure 1: Plan view map showing location of the Selena project which sits directly adjacent to the Butte Valley Porphyry, a US $33M earn-in exploration agreement between Freeport-McMoRan and Falcon Butte Minerals

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7298/174606_1663e979340e3b14_002full.jpg

Figure 2: X-Section C-C’ with scaled plan view map showing past Chinchilla zone intercepts and proposed chimney and manto targets to be tested beneath known high-grade CRD intercepts

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7298/174606_1663e979340e3b14_003full.jpg

QAQC Procedures

Samples are submitted to American Assay Laboratories (AAL) of Sparks, Nevada, which is a certified and accredited laboratory, independent of the Company. Samples are prepared using industry-standard prep methods and analysed using FA-PB30-ICP (Au; 30 g fire assay) and ICP-5AM48 (48 element Suite; 0.5 g 5-acid digestion/ICP-MS) methods. AAL also undertakes its own internal coarse and pulp duplicate analysis to ensure proper sample preparation and equipment calibration. Ridgeline’s QA/QC program includes regular insertion of CRM standards, duplicates, and blanks into the sample stream with a stringent review of all results completed by the Company’s Qualified Person, Michael T. Harp, Vice President, Exploration.

Technical information contained in this news release has been reviewed and approved by Michael T. Harp, CPG. the Company’s Vice President, Exploration, who is Ridgeline’s Qualified Person under National Instrument 43-101 and responsible for technical matters of this release.

About Ridgeline Minerals Corp.

Ridgeline is a discovery focused gold-silver explorer with a proven management team and a 192 km² exploration portfolio across six projects in Nevada and Idaho, USA. More information about Ridgeline can be found at www.RidgelineMinerals.com.

On behalf of the Board

“Chad Peters”

President & CEO

Further Information:

Chad Peters, P.Geo.

President & CEO

Ridgeline Minerals Corp.

(775) 304-9773 | info@ridgelineminerals.com

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Cautionary Note regarding Forward-Looking Statements

Statements contained in this press release that are not historical facts are “forward-looking information” or “forward-looking statements” (collectively, “Forward-Looking Information”) within the meaning of applicable Canadian securities legislation and the United States Private Securities Litigation Reform Act of 1995. Forward-Looking Information includes, but is not limited to, the anticipated benefits of the Earn-In Agreement and the transaction contemplated thereby. The words “potential”, “anticipate”, “meaningful”, “discovery”, “forecast”, “believe”, “estimate”, “expect”, “may”, “will”, “project”, “plan”, “historical”, “historic” and similar expressions are intended to be among the statements that identify Forward-Looking Information. Forward-Looking Information involves known and unknown risks, uncertainties and other factors which may cause the actual results to be materially different from any future results expressed or implied by the Forward-Looking Information. In preparing the Forward-Looking Information in this news release, Ridgeline has applied several material assumptions, including, but not limited to, assumptions that TSX Venture Exchange approval will be granted in a timely manner subject only to standard conditions; the current objectives concerning the Project can be achieved and that its other corporate activities will proceed as expected; that general business and economic conditions will not change in a materially adverse manner; and that all requisite information will be available in a timely manner. Forward-Looking Information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of Ridgeline to be materially different from any future results, performance or achievements expressed or implied by the Forward-Looking Information. Such risks and other factors include, among others, risks related to dependence on key personnel; risks related to unforeseen delays; risks related to historical data that has not been verified by the Company; as well as those factors discussed in Ridgeline’s public disclosure record. Although Ridgeline has attempted to identify important factors that could affect Ridgeline and may cause actual actions, events, or results to differ materially from those described in Forward-Looking Information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that Forward-Looking Information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on Forward-Looking Information. Except as required by law, Ridgeline does not assume any obligation to release publicly any revisions to Forward-Looking Information contained in this news release to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/174606

VANCOUVER, BC / ACCESSWIRE / July 28, 2023 / Blackwolf Copper and Gold Ltd. (“Blackwolf”, or the “Company”) (TSXV:BWCG)(OTC PINK:BWCGF) is pleased to announce the launch of the maiden drill program at the Cantoo Mountain Project (“Cantoo”) in Southwest Alaska. The Cantoo Property is located adjacent to the Canadian border and the historic Premier Gold Mine that is currently in redevelopment. Initial drill holes could be in excess of 700 meters to test the multiple structures. This marks the first modern exploration effort at Cantoo since the 1920s and the first ever diamond drill program testing Multiple stacked shallow-dipping vein structures and breccia, including a 30m (100ft) wide vein. During preliminary sampling, Blackwolf uncovered a significant 30-meter (100ft) vein exhibiting high-grade results of up to 30.4g/t Gold, 2860 g/t Silver, and 5.8% Copper outcropping at surface. The initial drill program is planned to cover up to 2000 meters in 4 drill holes over a 1.5 month period with Initial results expected early September.

Morgan Lekstrom, CEO and Director of Blackwolf, commented, “We are proud to commence this drill program, a testament to our commitment to unlocking the potential of this promising location. Cantoo stands out as one of the most compelling untested drill targets in the Golden Triangle. Notably, it lies just approximately 600 meters away from the Premier Mine on the Canadian side of the border. As we know, geology transcends boundaries and borders, and in this prolific region, which is also home to the renowned Brucejack Mine (acquired in 2021 for $2.8 Billion) and numerous other significant mining endeavors, we are poised to unveil the hidden treasures that lie beneath its surface.”

Figure 1: Sampling Results and Drill Plan

Photo 1: Drill pad under construction

Market Making Agreement

Blackwolf is also pleased to announce that it has retained PI Financial Corp. (“PI”) to trade the securities of Blackwolf on the TSX‐V for the purposes of maintaining an orderly market. In consideration of the services provided by PI, the Company will pay PI a monthly cash fee of $5,000 for a minimum term of six months and renewable thereafter. Blackwolf and PI are unrelated and unaffiliated entities. PI will not receive shares or options as compensation. The capital used for market making will be provided by PI.

QA/QC AND QUALIFIED PERSON

The analytical work on the Hyder project will be performed by MSALABS a certified, analytical services provider, at its laboratory in Langley, British Columbia. All samples will be prepared using procedure PRP-910 (dry, crush to 70% passing 2mm, riffle split off 250g, pulverize split to better than 85% passing 75 microns) and analyzed by method FAS-111 (30g fire assay with AAS finish) and IMS-130 (0.5g, aqua regia digestion and ICP-AES/MS analysis). Any samples containing >10g/t Au were reanalyzed using method FAS-415 (30g Fire Assay with gravimetric finish). Samples containing >100 ppm Ag and/or >1% Cu, Pb, & Zn are reanalyzed using method ICF-6 (0.2g, 4-acid digest and ore grade ICP-AES analysis). Samples containing >1000 g/t Ag were reanalyzed using method FAS-418 (30g fire assay with AAS finish) and samples containing >20% Pb were reanalyzed using method STI-8Pb (volumetric titration).

The reported work was completed using industry standard procedures, including a quality assurance/quality control (“QA/QC”) program consisting of the insertion of certified standard, blanks and duplicates into the sample stream. The Qualified Person has reviewed the data and detected no significant QA/QC issues.

Andrew Hamilton, P.Geo., Consultant to the Company, is a Qualified People under NI 43-101, will oversee the 2023 Program and has reviewed and approved the scientific and technical content of this release.

About Blackwolf Copper & Gold Ltd.

The Company holds a 100% interest in the high-grade Niblack copper-gold-zinc-silver VMS project, located adjacent to tidewater in southeast Alaska as well as five Hyder Area gold-silver and VMS properties in southeast Alaska and northwest British Columbia in the Golden Triangle, including the high-priority wide gold-silver veins at the Cantoo Property. Blackwolf’s founding vision is to be an industry leader in transparency, inclusion and innovation. Guided by our Vision and through collaboration with local and Indigenous communities and stakeholders, Blackwolf builds shareholder value through our technical expertise in mineral exploration, engineering and permitting. For more information on Blackwolf, please visit the Company’s website at www.blackwolfcopperandgold.com.

On behalf of the Board of Directors of Blackwolf Copper & Gold Ltd.

“Morgan Lekstrom”

CEO and Director

For more information, contact:

| Morgan Lekstrom 250-574-7350 (Mobile) 604-343-2997 (Office) rm@bwcg.ca | Liam Morrison 604-897-9952 (Mobile) 604-343-2997 (Office lm@bwcg.ca |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

All statements, trend analysis and other information contained in this press release about anticipated future events or results constitute forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “expect” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions. All statements, other than statements of historical fact, included herein, including, without limitation, statements regarding anticipated benefits of the Transaction, the closing of the Transaction, the Company’s position in the Golden Triangle and the Company bringing greater awareness to the Company and engaging with current and future shareholders are forward-looking statements. Although Blackwolf believes that the expectations reflected in such forward-looking statements and/or information are reasonable, undue reliance should not be placed on forward-looking statements since Blackwolf can give no assurance that such expectations will prove to be correct. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements, including the risks, uncertainties and other factors identified in Blackwolf’s periodic filings with Canadian securities regulators, and assumptions made with regard to: the ability of Blackwolf and Optimum (the “Companies”) to complete the Transaction; the Companies’ ability to secure the necessary shareholder, securityholder, legal and regulatory approvals required to complete the Transaction; and the Companies’ ability to achieve the synergies expected as a result of the Transaction. Forward-looking statements are subject to business and economic risks and uncertainties and other factors that could cause actual results of operations to differ materially from those contained in the forward-looking statements. Important factors that could cause actual results to differ materially from Blackwolf’s expectations include risks associated with the business of the Companies; risks related to the satisfaction or waiver of certain conditions to the closing of the Transaction; non-completion of the Transaction; risks related to reliance on technical information provided by the Companies; risks related to exploration and potential development of the Companies’ projects; business and economic conditions in the mining industry generally; fluctuations in commodity prices and currency exchange rates; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; the need for cooperation of government agencies and native groups in the exploration and development of properties and the issuance of required permits; the need to obtain additional financing to develop properties and uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs and uncertainty of meeting anticipated program milestones; uncertainty as to timely availability of permits and other governmental approvals; and other risk factors as detailed from time to time and additional risks identified in the Companies’ filings with Canadian securities regulators on SEDAR in Canada (available at www.sedar.com). Forward-looking statements are based on estimates and opinions of management at the date the statements are made. The Company does not undertake any obligation to update forward-looking statements except as required by applicable securities laws. Investors should not place undue reliance on forward-looking statements.

SOURCE: Blackwolf Copper and Gold Ltd

View source version on accesswire.com:

https://www.accesswire.com/770826/Blackwolf-Commences-Drilling-at-the-Cantoo-Project-in-Alaskas-Golden-Triangle

PERTH, Australia, July 28, 2023 /PRNewswire/ –

Highlights

Costa Fuego Copper-Gold Project Preliminary Economic Assessment (PEA)1 Outlines One of World’s Lowest Capital Intensity, Major Copper Developments

US$15 Million Investment Agreement with Osisko Gold Royalties

30,000 m drilling program across multiple targets to commence shortly

Single, Large Pit Scenario for Cortadera being studied in H2 2023

Strong Cash balance of $26 million

| __________________________ |

| 1 The PEA is preliminary in nature and includes 3% of production feed from Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorised as Mineral Reserves (NI 43-101) or Ore Reserves (JORC 2012), and there is no certainty that the PEA will be realised. Mineral Resources that are not Mineral Reserves or Ore Reserves do not have demonstrated economic viability. References to “Mineral Reserves” in this announcement include Ore Reserves (JORC 2012). See page 39 for additional cautionary language. 2 The copper-equivalent (CuEq) annual production rate was based on the combined processing feed (across all sources) and used long-term commodity prices of: Copper US$3.85/lb, Gold US$1,750/oz, Molybdenum US$17/lb, and Silver US$21/oz; and estimated metallurgical recoveries for the production feed to the following processes: Concentrator (87% Cu, 56% Au, 37% Ag, 58% Mo), Oxide Leach (55% Cu only), & Low-grade Sulphide Leach (40% Cu only). 3 See page 16 for full non-IFRS measures disclaimer. |

Hot Chili’s Managing Director and Chief Executive Officer Mr Christian Easterday is responsible for this announcement and has provided sign-off for release to the ASX and TSXV.

For more information please contact:

| Christian EasterdayManaging Director – Hot Chili | Tel: +61 8 9315 9009Email: admin@hotchili.net.au | |

| Penelope BeattieCompany Secretary – Hot Chili | Tel: +61 8 9315 9009Email: admin@hotchili.net.au | |

| Harbor AccessInvestor & Public Relations (Canada) | Email: Graham.Farrell@harbor-access.comEmail: jonathan.paterson@harbor-access.com |

or visit Hot Chili’s website at www.hotchili.net.au

Cautionary Statement – JORC Code (2012)

| The Preliminary Economic Assessment referred to in this report is equivalent to a Scoping Study under JORC Code (2012) reporting guidelines. It has been undertaken for the purpose of initial evaluation of a potential development of the Costa Fuego Copper Project in Chile. It is a preliminary technical and economic study of the potential viability of the Costa Fuego Copper Project. The PEA outcomes, production target and forecast financial information referred to in the report are based on low level technical and economic assessments that are insufficient to support estimation of Ore Reserves. The PEA is presented in US dollars to an accuracy level of +/- 35%. While each of the modifying factors was considered and applied, there is no certainty of eventual conversion to Ore Reserves or that the production target itself will be realised. Further exploration and evaluation and appropriate studies are required before Hot Chili will be in a position to estimate any Ore Reserves or to provide any assurance of any economic development case. Given the uncertainties involved, investors should not make any investment decisions based solely on the results of the PEA. Of the Mineral Resources scheduled for extraction in the PEA production plan, approximately 97% are classified as Indicated and 3% as Inferred during the 18-year evaluation period. The Company has concluded that it has reasonable grounds for disclosing a production target which includes a small amount of Inferred Mineral Resources. There is a low level of geological confidence associated with Inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of Indicated Mineral Resources or that the production target itself will be realised. Inferred Mineral Resources comprise 2.5% of the production schedule in the first four years of operation. The viability of the development scenario envisaged in the PEA does not depend on the inclusion of Inferred Mineral Resources. The Mineral Resources underpinning the production target in the PEA have been prepared by a competent person in accordance with the requirements of the JORC 2012. For full details on the Mineral Resource estimate, please refer to the ASX announcement of 31 March 2022. Hot Chili confirms that it is not aware of any new information or data that materially affects the information included in that release and that all material assumptions and technical parameters underpinning the estimate continue to apply and have not been changed. To achieve the outcomes indicated in the PEA, including reaching Definitive Feasibility Study (“DFS”) stage, funding in the order of US$1.10 Billion will be required, including pre-production and working capital and assumed financing charges. Investors should note that that there is no certainty that Hot Chili will be able to raise that amount of funding when needed. One of the key assumptions is that the funding for the Project will be available when required. It is also possible that such funding may only be available on terms that may be dilutive to or otherwise affect the value of Hot Chili’s existing shares. It is also possible that Hot Chili could pursue other value realisation strategies such as debt financing, a sale or partial sale of its interest in the Costa Fuego Copper Project, sale of further royalties and/or streaming rights, sale of non-committed offtake rights, and sale of non-core assets. This report contains forward-looking statements. Hot Chili has concluded that it has a reasonable basis for providing these forward-looking statements and believes it has a reasonable basis to expect it will be able to fund development of the Costa Fuego Copper Project. However, a number of factors could cause actual results or expectations to differ materially from the results expressed or implied in the forward-looking statements. Given the uncertainties involved, investors should not make any investment decisions based solely of the results of the PEA. |

SUMMARY OF OPERATIONAL ACTIVITIES

Costa Fuego Copper-Gold Project Preliminary Economic Assessment (PEA)1 Outlines One of World’s Lowest Capital Intensity, Major Copper Developments

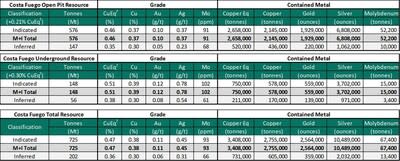

The Costa Fuego PEA has been prepared by Wood Australia Pty. Ltd. as an update to the historical Productora 2016 Pre-Feasibility Study (the “2016 PFS”). It follows significant regional consolidation and a near quadrupling of the Company’s resource inventory with the addition of the Cortadera porphyry resource, and the San Antonio high-grade satellite resource. The expanded resource base provided the opportunity to lift the scale of development for a combined development hub (Costa Fuego) and optimise infrastructure required to transport these resources to a proposed centralised processing plant at Productora. The PEA therefore presents a materially different project to that contemplated in the 2016 PFS.

The Costa Fuego PEA presents the largest copper development project listed on the Australian Securities Exchange (ASX). Already the ASX’s largest copper development resource, the PEA confirms Costa Fuego as having the largest potential copper production in the exchange’s development pipeline, (refer to ASX Announcement “Costa Fuego PEA Presentation”, released 28th June 2023, slide 51 “New Material Copper Supply”) at a time when the ASX is losing its significant copper-players, with Oz Minerals taken over by diversified-miner BHP and Newcrest under takeover by US-based Newmont.

The strong economics of Costa Fuego are described below in Table 1, using financial assumptions of an 8% discount rate and long-term metal price assumptions for the base case of US$3.85/lb copper (Cu) and US$1,750/oz gold (Au).

| __________________________ |

| 1 The PEA is preliminary in nature and includes 3% of production feed from Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorised as Mineral Reserves (NI 43-101) or Ore Reserves (JORC 2012), and there is no certainty that the PEA will be realised. Mineral Resources that are not Mineral Reserves or Ore Reserves do not have demonstrated economic viability. References to “Mineral Reserves” in this announcement include Ore Reserves (JORC 2012). See page 19 for additional cautionary language. |

Table 1. Copper Price Ranges: Lower-, Base-, and Upper-Case Scenarios1,2

| Project Metric | Units | Copper Price | |||

| Lower(US$3.50/lb) | Base(US$3.85/lb) | Upper(US$4.20/lb) | |||

| Pre-Tax | NPV8% | US$M | 1,046 | 1,540 | 2,029 |

| IRR | % | 19 % | 24 % | 29 % | |

| Post-Tax | NPV8% | US$M | 733 | 1,100 | 1,463 |

| IRR | % | 17 % | 21 % | 25 % | |

| Annual Average Revenue | US$M | 779 | 845 | 911 | |

| Annual Average EBITDA | US$M | 384 | 445 | 506 | |

| Annual Average Free Cash Flow | US$M | 226 | 271 | 315 | |

| Payback period (From First Production) | years | 4.25 | 3.50 | 3.25 | |

| Post-Tax NPV8% /Start-up Capital | 0.7 | 1.1 | 1.4 | ||

Within the base-case scenario of the PEA, the positive economics shown in Table 2 outline a project that leverages its low-elevation advantage to achieve low start-up capital costs and consequently one of the lowest capital intensities of global copper development projects at this scale. Annual average revenue of around US$845 Million allow the project to achieve a fast 3.5-year payback on the back of initial open pit mining that fully funds the project expansion and development of underground bulk mining.

| ______________________________ |

| 1 Certain terms of measurement used in this news release are not performance measures reported in accordance with International Financial Reporting Standards (“IFRS”). Non-IFRS terms measures used such as “Cash Cost”, “All-in Sustaining Costs”, “C1”, “Expansion Costs”, “Free Cashflow” and “All-in costs” are included because these statistics are measures that management uses internally to evaluate performance, to assess how the Project ranks against its peer projects and to assess the overall effectiveness and efficiency of the contemplated mining operations. These performance measures do not have a meaning within IFRS and, therefore, amounts presented may not be comparable to similar data presented by other mining companies. These performance measures should not be considered in isolation as a substitute for measures of performance in accordance with IFRS. |

| 2 The PEA is preliminary in nature and includes 3% of production feed from Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorised as Mineral Reserves, and there is no certainty that the PEA will be realised. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. See page 19 for additional cautionary language. |

Table 2: Costa Fuego PEA1 Economic Highlights2– Base Case

| Project Metric | Units | Estimated Value | ||

| Financial Measures | ||||

| Pre-tax | Cu US$3.85/lb | NPV8% | US$M | 1,540 |

| IRR | % | 24 | ||

| Post-tax | Cu US$3.85/lb | NPV8% | US$M | 1,100 |

| IRR | % | 21 | ||

| Payback period (from start of operations) | years | 3.5 | ||

| Open Pit Strip Ratio | W/P | 1.8 | ||

| Post-tax NPV/Start-up Capex | Ratio | 1.1 | ||

| Capital Costs Costs2 | ||||

| Total Pre-production Capital Expenditure | US$M | 1,046 | ||

| Expansion | US$M | 708 | ||

| Sustaining | US$M | 1,014 | ||

| Total | US$M | 2,768 | ||

| Operating Costs2 | ||||

| C1 | $/lb Cu | 1.33 | ||

| Total Cash Cost (net by-products and including royalties) | $/lb Cu | 1.43 | ||

| All-in-Sustaining Cost | $/lb Cu | 1.74 | ||

| All-In Cost LOM | $/lb Cu | 2.31 | ||

| Mine Life & Metal Production | ||||

| Primary Mine Production Including Ramp-up | years | 14 | ||

| Mine Life (Life of Mine Processing) | years | 16 | ||

| Primary Mine Production – Average Annual Copper Equivalent Metal[9] | kt | 112 | ||

| Primary Mine Production – Average Annual Copper Metal | kt | 95 | ||

| Primary Mine Production – Average Annual Gold Metal | koz | 49 | ||

Following the pre-production Capital Cost of around US$1.05 Billion, operations are expanded to access the remaining deposits at an estimated Capital Cost of US$708 Million, with Sustaining Capital Costs bringing the total project Capital Cost to around US$2.77 Billion. Capital Cost incorporated a 20% contingency, with further contingency applied to the mining pit shells, which were developed using a copper price of US$3.30/lb to hedge against downside price risk impacting the production feed inventory.

Operating costs for Costa Fuego average (estimated net of by-products) a C1 Cash Cost of US$1.33/lb of copper, with an approximate average production rate of 112 ktpa CuEq4: Including 95 kt Cu and 49 koz Au during primary production (first 14 years).

| __________________________ |

| 1 The PEA is preliminary in nature and includes 3% of production feed from Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorised as Mineral Reserves, and there is no certainty that the PEA will be realised. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. See page 39 for additional cautionary language. |

| 2 Certain terms of measurement used in this news release are not performance measures reported in accordance with International Financial Reporting Standards (“IFRS”). See page 40 for full non-IFRS measures disclaimer. |

| 3 Includes Payability |

| 4 The copper-equivalent (CuEq) annual production rate was based on the combined processing feed (across all sources) and used long-term commodity prices of: Copper US$3.85/lb, Gold US$1,750/oz, Molybdenum US$17/lb, and Silver US$21/oz; and estimated metallurgical recoveries for the production feed to the following processes: Concentrator (87% Cu, 56% Au, 37% Ag, 58% Mo), Oxide Leach (55% Cu only), & Low-grade Sulphide Leach (40% Cu only). |

The Costa Fuego life-of-mine processing runs for 16-years, producing an estimated 1.41 Mt of copper and 718 koz of gold (plus 22 kt of molybdenum and 1.7 Moz of silver) for total revenue of approximately US$13.52 Billion and total free cash flow of approximately US$3.28 Billion (post-tax, after operating costs, capital costs, and royalties)

Revenues from the PEA metal payload are described in Table 3 below, with 85% of revenue deriving from copper. Costa Fuego is highly leveraged to the copper price, with analysis identifying that for every US$0.10/lb increase above US$ 3.85/lb Cu price, US$100 Million (approximately) is added in post-tax NPV8%

Table 3: Costa Fuego Revenue Breakdown1

| LOM Revenue Contribution | Revenue (US$M) | % of Total |

| Copper in Concentrate | 10,342 | 76 % |

| Copper Cathode | 1,218 | 9 % |

| Gold | 1,132 | 8 % |

| Molybdenum | 799 | 6 % |

| Silver | 32 | 0.2 % |

| Total | 13,523 | 100 % |

Hot Chili has been systematic in its approach to de-risking the project with over a decade of work in consolidating the deposits and securing infrastructure easements and surface rights. Costa Fuego is one of the very few projects globally that holds a granted water permit, approval for power connection to the national grid and the necessary easement corridors for water and power infrastructure that would support the advancement of the project to construction.

30,000 m drilling program across multiple targets to commence shortly

The Company plans to rapidly begin drilling high priority growth targets proximal to the current resource. Drilling will also test promising greenfield targets as shown in Figure 1. Further strategic regional consolidation options are concurrently being pursued, with mineral resource estimate upgrades expected in Q4 2023 and H1 2025.

| _________________________________ |

| 1 Includes Payability |

Figure 1. Exploration Growth Targets Across the Costa Fuego Project

Figure 2. Cortadera Porphyry Expansion Targets1

| ______________________________________ |

| 1 Refer to announcement dated 28th August 2019 for further information regarding Induced Polarisation (IP/MT– MIMDAS) Survey. * Resource Copper Equivalent (CuEq) considers assumed commodity prices and average metallurgical recoveries for the Mineral Resource from testwork. See Page 43 for complete Mineral Resource disclosure of Costa Fuego. |

Single, Large Pit Scenario for Cortadera being studied in H2 2023

The Company is investigating a large single open pit scenario for Cortadera (no underground block cave) with the potential to materially increase processing feed inventory and mine-life.

This scenario would necessitate a second PEA, studied while refining of the model inputs for metallurgy, geotechnical engineering and hydrogeology, to be incorporated into the Pre-feasibility. Once both PEA scenarios are assessed, the Company would select a single scenario to complete the final stages of its PFS for Costa Fuego, which is expected to be completed by H2 2024.

SUMMARY OF CORPORATE ACTIVITIES

US$15 Million Investment Agreement with Osisko Gold Royalties

The significant investment by Osisko provides strong endorsement from one of North America’s leading royalty-streaming groups. The key elements of the royalty agreement, which closed in late July, are:

Development and Growth Funding

The Investment by Osisko has strengthened the Company’s cash position to approximately A$26 million and the project is now fully funded for the next 12 to 18 months to deliver the next steps in its growth and development plan, (refer Figure 3) including:

| ____________________________ |

| 1 CuEq considers assumed commodity prices and average metallurgical recoveries from test work. See qualifying statements on page 19. |

Figure 3. Costa Fuego Project Roadmap1

Figure 4. Location of the Costa Fuego Project Regionally in Relation to Key Infrastructure

| ______________________________ |

| 1 The Mining Project delivery schedule mentioned herein is subject to various risks inherent to the mining industry, and external factors beyond the control of the project stakeholders, including but not limited to, geological and processing challenges, government policies, permits, or regulations, fluctuations in commodity prices, or market conditions. These external factors can impact the Project timeline and potentially result in delays. The delivery schedule provided is based on the best estimates and assumptions available at the time of its creation, and the Project team is committed to minimising disruptions and implementing mitigation measures to the best of their abilities. However, the effectiveness of these measures in avoiding delays cannot be guaranteed. |

Drill Results Reported for Costa Fuego in Quarter 2 2023

No further drilling has been completed in Q2, subsequently there are no details to report.

Additional ASX Disclosure Information

ASX Listing Rule 5.3.2: There was no substantive mining production and development activities during the quarter.

ASX Listing Rule 5.3.3 – Schedule of Mineral Tenements as at 30 June 2023

The schedule of Mineral Tenements and changes in interests is appended at the end of this activities report.

ASX Listing Rule 5.3.4: Reporting under a use of funds statement in a Prospectus does not apply to the Company currently.

ASX Listing Rule 5.3.5: Payments to related parties of the Company and their associates during the quarter per Section 6.1 of the Appendix 5B totaled $151,667. This is comprised of directors’ salaries and superannuation of $151,667.

Health, Safety, Environment and Quality

Field operations during the period included geological reconnaissance activities, core-testing and logging, field mapping, and sampling exercises across the Cortadera, El Fuego and Productora landholdings. El Fuego field activities are run from the Cortadera operations centre and safety statistics are combined for reporting.

No safety incidents were recorded during the quarter. The Company’s HSEQ quarterly performance is summarised in Table 3 below.

Hot Chili’s sustainability framework ensures an emphasis on business processes that target long-term economic, environmental and social value. The Company is dedicated to continual monitoring and improvement of health, safety and the environmental systems. There is no greater importance than ensuring the safety of our people and their families.

Table 3 HSEQ Quarter 1 2023 Performance and Statistics

| Deposit | Productora | Cortadera | Las Cañas | |||

| Timeframe | Q2 2023 | Cum. | Q2 2023 | Cum. | Q2 2023 | Cum. |

| LTI events | 0 | 0 | 0 | 6 | 0 | 1 |

| NLTI events | 0 | 2 | 0 | 5 | 0 | 1 |

| Days lost | 0 | 0 | 0 | 152 | 0 | 23 |

| LTIFR index | 0 | 0 | 0 | 24 | 0 | 170 |

| ISR index | 0 | 0 | 0 | 596 | 0 | 3,898 |

| IFR Index | 0 | 39 | 0 | 43 | 0 | 339 |

| Thousands of manhours¹ | 2.1 | 51.2 | 7.9 | 257 | 0 | 5.9 |

| Incidents on materials and assets | 0 | 0 | 0 | 0 | 0 | 0 |

| Environmental incidents | 0 | 0 | 0 | 0 | 0 | 0 |

| Headcount² | 4 | 11 | 15 | 37 | 0 | 21 |

| Notes: HSEQ is the acronym for Health, Safety, Environment and Quality. LTIFR per million-manhours. Safety performance is reported on a monthly basis to the National Mine Safety Authority on a standard E-100 form; (1) manhours; (2) Average monthly headcount (3) Cumulative statistics since April 2019. |

Tenement Changes During the Quarter

During the Quarter, the Company has renewed the mining exploration concessions Porfiada I (replaces Porfiada I, which expired on June, 14th, 2023), Porfiada II (replaces Porfiada II, which expired on July, 5th, 2023), Porfiada III (replaces Porfiada III, which expired on June, 15th, 2023) and Porfiada IV (replaces Porfiada IV, which expired on July, 5th, 2023).

The Company’s existing tenements are detailed in the table below.

Table 4. Current Tenement (Patente) Holdings in Chile as at 30 June 2023

Cortadera Project

| License ID | HCH % Held | HCH % Earning | Area (ha) | Agreement Details |

| MAGDALENITA 1/20 | 100% Frontera SpA | 100 | ||

| ATACAMITA 1/82 | 100% Frontera SpA | 82 | ||

| AMALIA 942 A 1/6 | 100% Frontera SpA | 53 | ||

| PAULINA 10 B 1/16 | 100% Frontera SpA | 136 | ||

| PAULINA 11 B 1/30 | 100% Frontera SpA | 249 | ||

| PAULINA 12 B 1/30 | 100% Frontera SpA | 294 | ||

| PAULINA 13 B 1/30 | 100% Frontera SpA | 264 | ||

| PAULINA 14 B 1/30 | 100% Frontera SpA | 265 | ||

| PAULINA 15 B 1/30 | 100% Frontera SpA | 200 | ||

| PAULINA 22 A 1/30 | 100% Frontera SpA | 300 | ||

| PAULINA 24 1/24 | 100% Frontera SpA | 183 | ||

| PAULINA 25 A 1/19 | 100% Frontera SpA | 156 | ||

| PAULINA 26 A 1/30 | 100% Frontera SpA | 294 | ||

| PAULINA 27A 1/30 | 100% Frontera SpA | 300 | ||

| CORTADERA 1 1/200 | 100% Frontera SpA | 200 | ||

| CORTADERA 2 1/200 | 100% Frontera SpA | 200 | ||

| CORTADERA 41 | 100% Frontera SpA | 1 | ||

| CORTADERA 42 | 100% Frontera SpA | 1 | ||

| LAS CANAS 16 | 100% Frontera SpA | 1 | ||

| LAS CANAS 1/15 | 100% Frontera SpA | 146 | ||

| CORTADERA 1/40 | 100% Frontera SpA | 374 | ||

| LAS CANAS ESTE 2003 1/30 | 100% Frontera SpA | 300 | ||

| CORROTEO 1 1/260 | 100% Frontera SpA | 260 | ||

| CORROTEO 5 1/261 | 100% Frontera SpA | 261 | ||

| ROMERO 1 AL 31 | 100% Frontera SpA | 31 | ||

| PURISIMA | 100% Frontera SpA | 20 | NSR 1.5% |

| Note. Frontera SpA is a 100% owned subsidiary company of Hot Chili Limited |

Productora Project

| License ID | HCH % Held | HCH % Earning | Area (ha) | Agreement Details |

| FRAN 1, 1-60 | 80% SMEA SpA | 220 | ||

| FRAN 2, 1-20 | 80% SMEA SpA | 100 | ||

| FRAN 3, 1-20 | 80% SMEA SpA | 100 | ||

| FRAN 4, 1-20 | 80% SMEA SpA | 100 | ||

| FRAN 5, 1-20 | 80% SMEA SpA | 100 | ||

| FRAN 6, 1-26 | 80% SMEA SpA | 130 | ||

| FRAN 7, 1-37 | 80% SMEA SpA | 176 | ||

| FRAN 8, 1-30 | 80% SMEA SpA | 120 | ||

| FRAN 12, 1-40 | 80% SMEA SpA | 200 | ||

| FRAN 13, 1-40 | 80% SMEA SpA | 200 | ||

| FRAN 14, 1-40 | 80% SMEA SpA | 200 | ||

| FRAN 15, 1-60 | 80% SMEA SpA | 300 | ||

| FRAN 18, 1-60 | 80% SMEA SpA | 273 | ||

| FRAN 21, 1-46 | 80% SMEA SpA | 226 | ||

| ALGA 7A, 1-32 | 80% SMEA SpA | 89 | ||

| ALGA VI, 5-24 | 80% SMEA SpA | 66 | ||

| MONTOSA 1-4 | 80% SMEA SpA | 35 | NSR 3% | |

| CHICA | 80% SMEA SpA | 1 | ||

| ESPERANZA 1-5 | 80% SMEA SpA | 11 | ||

| LEONA 2A 1-4 | 80% SMEA SpA | 10 | ||

| CARMEN I, 1-50 | 80% SMEA SpA | 222 | ||

| CARMEN II, 1-60 | 80% SMEA SpA | 274 | ||

| ZAPA 1, 1-10 | 80% SMEA SpA | 100 | ||

| ZAPA 3, 1-23 | 80% SMEA SpA | 92 | ||

| ZAPA 5A, 1-16 | 80% SMEA SpA | 80 | ||

| ZAPA 7, 1-24 | 80% SMEA SpA | 120 | ||

| CABRITO, CABRITO 1-9 | 80% SMEA SpA | 50 | ||

| CUENCA A, 1-51 | 80% SMEA SpA | 255 | ||

| CUENCA B, 1-28 | 80% SMEA SpA | 139 | ||

| CUENCA C, 1-51 | 80% SMEA SpA | 255 | ||

| CUENCA D | 80% SMEA SpA | 3 | ||

| CUENCA E | 80% SMEA SpA | 1 | ||

| CHOAPA 1-10 | 80% SMEA SpA | 50 | ||

| ELQUI 1-14 | 80% SMEA SpA | 61 | ||

| LIMARÍ 1-15 | 80% SMEA SpA | 66 | ||

| LOA 1-6 | 80% SMEA SpA | 30 | ||

| MAIPO 1-10 | 80% SMEA SpA | 50 | ||

| TOLTÉN 1-14 | 80% SMEA SpA | 70 | ||

| CACHIYUYITO 1, 1-20 | 80% SMEA SpA | 100 | ||

| CACHIYUYITO 2, 1-60 | 80% SMEA SpA | 300 | ||

| CACHIYUYITO 3, 1-60 | 80% SMEA SpA | 300 | ||

| LA PRODUCTORA 1-16 | 80% SMEA SpA | 75 | ||

| ORO INDIO 1A, 1-20 | 80% SMEA SpA | 82 | ||

| AURO HUASCO I, 1-8 | 80% SMEA SpA | 35 | ||

| URANIO, 1-70 | 0 % | 0 % | 350 | 25-year Lease AgreementUS$250,000 per year (average for the 25 year term); plus 2% NSR all but gold; 4% NSR gold; 5% NSR non-metallic |

| JULI 9, 1-60 | 80% SMEA SpA | 300 | ||

| JULI 10, 1-60 | 80% SMEA SpA | 300 | ||

| JULI 11 1/60 | 80% SMEA SpA | 300 | ||

| JULI 12 1/42 | 80% SMEA SpA | 210 | ||

| JULI 13 1/20 | 80% SMEA SpA | 100 | ||

| JULI 14 1/50 | 80% SMEA SpA | 250 | ||

| JULI 15 1/55 | 80% SMEA SpA | 275 | ||

| JULI 16, 1-60 | 80% SMEA SpA | 300 | ||

| JULI 17, 1-20 | 80% SMEA SpA | 100 | ||

| JULI 19 | 80% SMEA SpA | 300 | ||