Key Take-Aways

- This Phase I drill program represents the first drilling at Cuddy Mountain in over 40 years.

- Scout commenced drilling at Cuddy Mountain in late fall with permits allowing for continued drilling through fall 2026 – with the private placement closed updates can now be issued.

- One internally operated core drill is focused on testing high-priority targets at the Climax zone through winter with two holes completed to target depth and the third ongoing.

- Drilling will progress to the IXL and Railroad targets with additional rigs added as results warrant; assays to be released when enough holes comprise a complete test of the target.

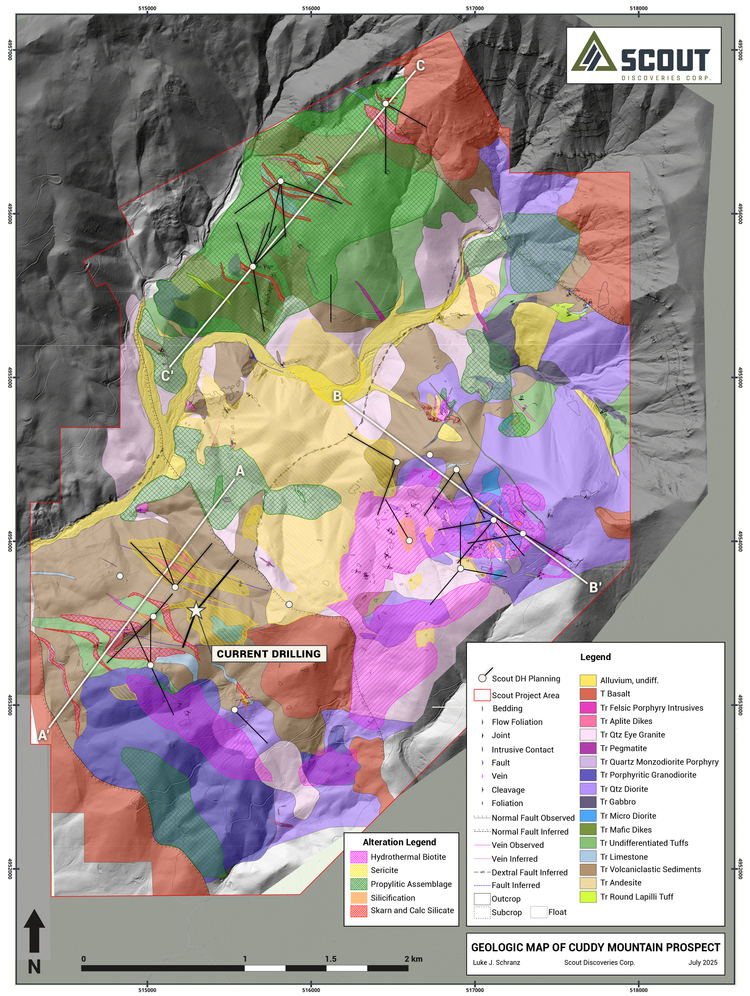

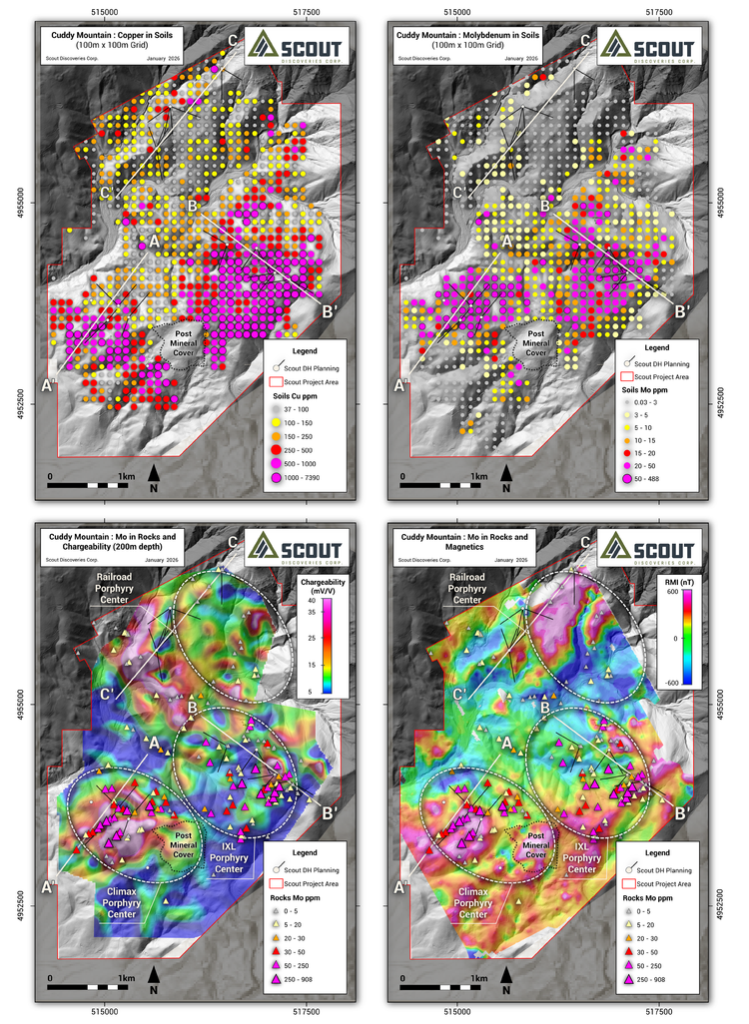

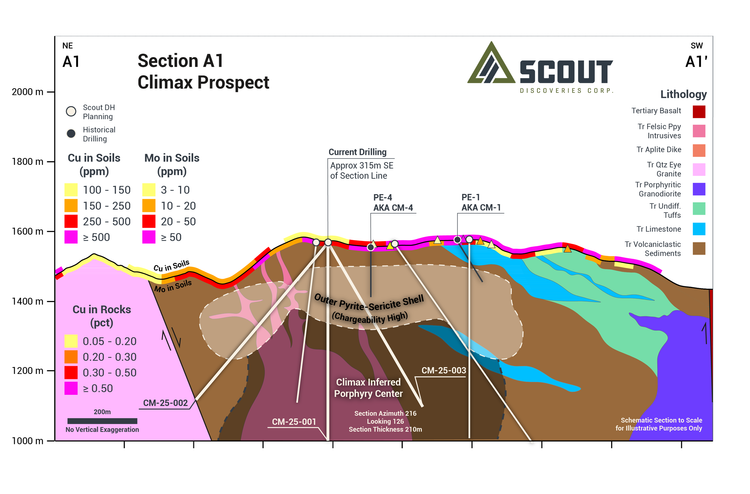

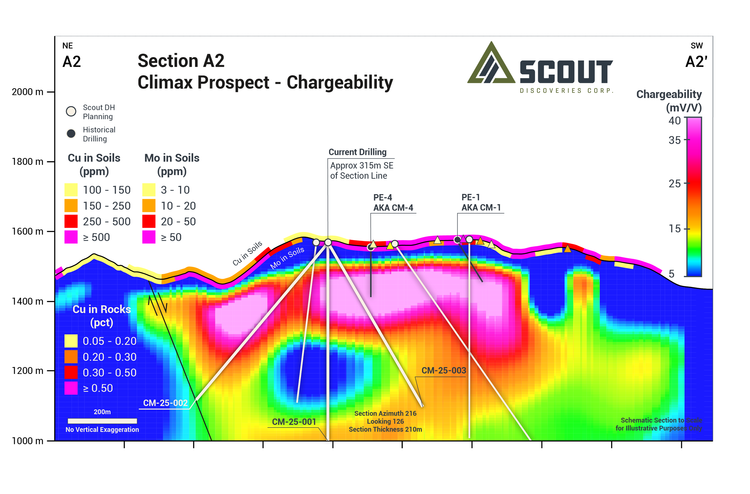

| Coeur d’Alene, Idaho – January 15, 2026 – Scout Discoveries Corp. (“Scout” or the “Company”) is pleased to announce that drilling commenced at the Cuddy Mountain Project in late fall 2025 using one of the Company’s wholly owned drill rigs. This work is part of Scout’s planned Phase I core drilling program of up to 10,000 meters, detailed in the April 9th, 2025 news release. With the recent closing of Scout’s private placement (see January 5th, 2026 news release), the Company is now positioned to provide material updates on the drill program and other corporate developments.The ongoing Phase I drill program marks the first drilling at Cuddy Mountain in over 40 years. Drilling began at the Climax target (Figures 1 & 2) and will continue through the winter. Two completed holes and a third underway beneath the strong molybdenum soil anomaly at Climax shows it is a separate porphyry center from IXL. Assays are pending on both completed holes. Drill core observations reveal multiple porphyry intrusions, high-temperature alteration, and abundant sulfide-rich veins of varying generations ranging from early biotite halo, banded quartz molybdenite, magnetite, and sericite-chlorite-pyrite-(chalcopyrite) veins that are consistent with porphyry copper-molybdenum systems. Drilling will continue through the winter to vector toward inferred higher-temperature mineralization zones based on zoning observed to date.As snow melts in the spring, the Company plans to transition drilling to the IXL and Railroad targets while continuing work at Climax (Figures 1 & 2). Scout retains the flexibility to deploy additional rigs from its fleet of five surface core drills, should results warrant expanded drilling. |

| Curtis Johnson, Scout’s President and CEO commented, “The drill targets at Climax and IXL, including historic intercepts of 177 meters @ 0.34% Cu from surface with 40 meters @ 0.78% Cu, represent some of the most compelling near-surface porphyry targets in the broader Cuddy Mountain-Hercules mineral belt. This belt is emerging as the most significant new porphyry copper district discovered in the United States in well over 50 years. We look forward to utilizing our internally owned drills throughout 2026 to efficiently deploy shareholder capital and understand the full potential of the Cuddy Mountain project.” |

Figure1: Geology and alteration map of Cuddy Mountain with planned hole traces.

Figure 2: Copper in soil (top left), Molybdenum in soil (top right), IP Chargeability (bottom left), reduced to pole ground magnetics (bottom right).

Climax Target – Geologic Summary of Drilling to Date

The Climax area has emerged as one of the most compelling untested targets on the Cuddy Mountain project, having not been identified as a porphyry copper target prior to Scout’s 2024-2025 work programs. The Company utilized systematic geologic mapping, soil and rock geochemistry, and geophysics to guide drill targeting. Climax delivered impressive coincident IP, magnetic, and copper/molybdenum in soil anomalies in an area with newly discovered stockwork quartz-sulfide veining and multiple phases of porphyry dikes (Figures 1, 2, 3, and 4).

Drilling and Geology

Initial drilling of two variably oriented holes with a third ongoing, totaling 1,100 meters focused on testing the highest-magnitude portions of the molybdenum-in-soil anomaly (Figure 2) in multiple orientations. Drilling encountered poor ground conditions in highly faulted and fractured rock that necessitated short drill runs and persistent hole conditioning to maintain recovery and production.

The two completed drill holes (CM-25-001, 002) confirm the occurrence of multiple phases of intermediate to late-mineral quartz-feldspar porphyry dikes (Figure 5) exhibiting diverse degrees of sericite-chlorite alteration. These dikes intrude the adjacent andesitic volcanic, volcaniclastic, and carbonate wall rocks, which display a high abundance of sulfide-rich veins and mineralization with sericite-chlorite, potassic, and skarn alteration (Figure 5A-E). Multiple phases of porphyry intrusions and widespread sulfide-rich veining at Cuddy are consistent with many productive copper deposits. The observation that more high-temperature veins occur in wall rock than in drill-intersected intrusions suggests that early-mineral intrusions linked to copper-molybdenum mineralization are sourced at deeper levels or lateral to areas drilled.

Figure 3: Planned drill section through Climax target showing geology and surface geochemistry.

Figure 4: Planned drill section through Climax target showing IP chargeability, for resistivity click here.

Alteration and Mineralization

Alteration patterns observed in drilling further reinforce the presence of a productive porphyry system at Climax. Magnetite-chlorite-sericite-pyrite alteration is pervasive throughout the volcanic wall rocks, while widespread epidote-garnet-magnetite-(pyrite-chalcopyrite) alteration affects both the volcanics, interbedded limestone, and segments of the porphyry intrusions, indicating strong and extensive hydrothermal fluid flow. Pyrite content ranges between 1-5% (up to 10%) with subordinate chalcopyrite present throughout the volcanics. Sulfide distribution correlates well with the intensity of the chargeability anomaly (Figure 4). Notably, banded quartz-molybdenite veins – hallmark features of porphyry systems – are present in all holes, reaching up to 1% by volume explaining the strong molybdenum soil anomaly (Figure 5A). This is complemented by biotite-selvage (“early halo type”) veins, garnet skarn, sericite selvages around pyrite-quartz veins, and trace to moderate chalcopyrite and native copper on fracture surfaces – all proximal indicators of porphyry systems.

Take-Aways and Future Drilling

Assays have not yet been received from the drilling completed to date, however, interpretation of geologic logging in the initial 1,100 meters of drilling confirms the presence of stockwork quartz veins, early halo veins, minor chalcopyrite with abundant pyrite, and banded quartz-molybdenite veins – classic indicators of proximal portions of a porphyry copper system (Figure 5B, G, H). The identification of molybdenum-rich veins, often found outboard of the high-copper shell in porphyry systems, suggests that current drilling may have intercepted a high-molybdenum shell adjacent to the center of the Climax porphyry system(s). Abundant sericite-chlorite alteration suggests drilling to date tested flanking or upper levels of the system. Increasing chalcopyrite-to-pyrite ratios in core toward areas with the highest-magnitude copper-in-soil (up to 0.2% copper) and molybdenum-in-soil values provide compelling evidence for potentially stronger mineralization in future holes.

| IXL Porphyry Copper System – The Next Target to be DrilledThe IXL target contains a known outcropping of a Triassic porphyry copper-molybdenum system, where historic exploration work at Cuddy Mountain began in the 1950s. Mineralization is dominated by potassic alteration (secondary biotite, K-feldspar) associated with stockwork quartz-chalcopyrite-molybdenite veins and disseminated chalcopyrite, along with local mineralized breccias. A multi-kilometer copper and molybdenum-in-soil anomaly (Figure 2) coupled with strong chargeability highs outline a major porphyry system, which is what the Company believes lies concealed in the Climax target area. Recent detailed geologic mapping by Scout at IXL outlined a much broader area of “shreddy” secondary biotite (potassic) alteration containing copper than was previously recognized due to overprinting low-temperature chlorite alteration of biotite that prior operators interpreted as distal propylitic alteration unrelated to copper mineralization (Figure 1).Approximately 2,500 meters of shallow historical drilling was carried out by multiple operators at IXL in the 1950s to 1970s, with no known drilling completed since. As shown in the sections linked below, the majority of the newly identified soil and chargeability anomalies are poorly tested or untested by previous efforts. Most shallow holes in the IXL region intercepted broad zones of 0.1-0.3% Cu with associated molybdenite and no precious metals assays. The best historic interval is from hole AX-1, which intercepted from surface, 177 meters @ 0.34% Cu including 40 meters @ 0.78% Cu on the margin of a chargeability high. An underground adit was driven to explore this higher-grade sub-interval in the 1960s, which uncovered a mineralized breccia zone coring the potassic alteration with several underground holes identifying strong primary sulfide mineralization including 35 meters @ 1.23% Cu. Scout looks forward to testing these zones to depth and along strike in 2026.Refer to the following links for planned drill sections through the IXL target area showing geology, chargeability, and resistivity: IXL Target Geology, IXL Target Chargeability, IXL Target Resistivity. |

| Railroad Porphyry-Skarn TargetSimilar to the Climax target, the Railroad area has emerged as a compelling concealed target and potential third preserved porphyry center on the project following systematic exploration work by the Scout team. High-grade copper skarn mineralization was previously known in the area; however, detailed mapping has outlined a series of parallel, stacked skarn zones associated with mineralized porphyry dikes offering the potential for bulk tonnage copper mineralization at depth (Figure 1). Strong magnetic and chargeability anomalies at depth (Figure 2) further suggest potential for concealed porphyry style mineralization, which along with near surface skarn mineralization, will be the focus of exploration drilling in the target area in 2026-2027.Refer to the following links for sections through the Railroad target showing geology, chargeability, and resistivity: Railroad Target Geology, Railroad Target Chargeability, Railroad Target Resistivity. |

| About the Cuddy Mountain ProjectThe Cuddy Mountain Project is a porphyry copper-molybdenum (gold) project within the broader western Idaho copper belt. Scout identified the property as having potential in 2020 and acquired it through staking of open ground in 2021, prior to the discovery of the Leviathan porphyry on the adjacent Hercules property in 2023. Since that time, the Company has systematically advanced the large 12 square kilometer outcropping porphyry targets through detailed geologic mapping, surface geochemistry, geophysics and now the phase I drill program described herein. |

| About Scout Discoveries Corp.Scout Discoveries Corp., headquartered in Coeur d’Alene, Idaho, is a private U.S. mineral exploration company with rights to twelve separate precious and base metal projects in the western U.S.A., comprising one of the largest unpatented claim holdings in the region, totaling over 50,000 acres. Scout’s vision is to bring the full discovery process in-house from idea generation through resource drilling, lowering costs and increasing efficiency. With this model, the Company can rapidly advance its project portfolio through discovery by leveraging its five internal core drill rigs and experienced technical teams.For further information, visit: https://www.scoutdiscoveries.com/ |