EMX Royalty

Investor Relations

Mr. Scott S. Close

Email: sclose@emxroyalty.comPhone: +1 (303) 973-8585

Investor Relations

Mr. Scott S. Close

Email: sclose@emxroyalty.comPhone: +1 (303) 973-8585

https://youtu.be/0IWIxu5ZQYshttps://youtu.be/mVFGvbUDxGk

The following presentation by CEO Tim Johnson of Granite Creek Copper was conducted at the 2020 VRIC via Cambridge House International.

Granite Creek Copper is a Canadian exploration company focused on the 100%-owned Stu Copper-Gold-Silver project which covers 111 square kilometres adjacent to Pembridge Resources’ high-grade Minto Cu-Au-Ag Mine and Copper North’s advanced-stage Carmacks Cu-Au-Ag project in the Minto Copper District of Canada’s Yukon Territory.

(TSX.V: GCX)

Contact Granite Creek Copper:

Phone : 604-235-1982

Email: info@gcxcopper.com

In this exclusive interview, Michael Rowley the CEO and President of Group Ten Metals (TSX.V: PGE | OTC: PGEZF) sits down with Maurice Jackson of Proven and Probable to highlight the company’s flagship Stillwater West Project located in Montana adjacent to Sibanye’s recently acquired Stillwater Project for 2.2 Billion Dollars.

The company just completed its 2019 Drill campaign and the results are confirming the Proof of Concept on the enormous potential for shareholders. Viewers will note: PGE has more than doubled since our last interview in October! We will cover the polymetallic potential of the Stillwater West, and the companies property bank which hosts palladium, platinum, nickel, copper, gold, cobalt, and rhodium.

Proven and Probable Where we deliver Mining Insights & Bullion Sales. I’m a licensed broker for Miles Franklin Precious Metals Investments. Where we provide unlimited options to expand your precious metals portfolio, from physical deliver, offshore depositories, precious metals IRA’s, and private blockchain distributed ledger technology. Call me directly at (855) 505-1900 or you may email maurice@milesfranklin.com.

Proven and Probable provides insights on mining companies, junior miners, gold mining stocks, uranium, silver, platinum, zinc & copper mining stocks, silver and gold bullion in Canada, the US, Australia and beyond.

For more information on Group Ten Metals contact:

Chris Ackerman

Tel: +1 (604) 357-4790

Email: info@grouptenmetals.com

In this exclusive interview, Rick Rule of Sprott USA along with Dr. John-Mark Staude of Riverside Resources sit down with Maurice Jackson of Proven and Probable to discuss what may be the best value proposition in exploration, Prospect Generators. This interview will address the ambiguity that many speculators have regarding the prospect generator business model.

Viewers will gain a valuable insight into why one of the most successful investment minds places a high degree of confidence into the prospect generator business model, has he first defines in his own words to many virtues that prospect generators provide to the Market. We caveat the thesis by introducing Riverside Resources, a prospect generator with generative projects throughout Mexico and Canada.

In addition, Riverside Resources has a highly regarded exploration team with history of discoveries and advancing multiple projects through JVs and strategic partnerships. The company has an extensive project portfolio with diverse commodity exposure with a 75,000+ location database ($20M+ in past investment) Gold-Silver resource project + new discovery drilling in 2020 and new partnerships in 2020, with no debt and tightly held shares.

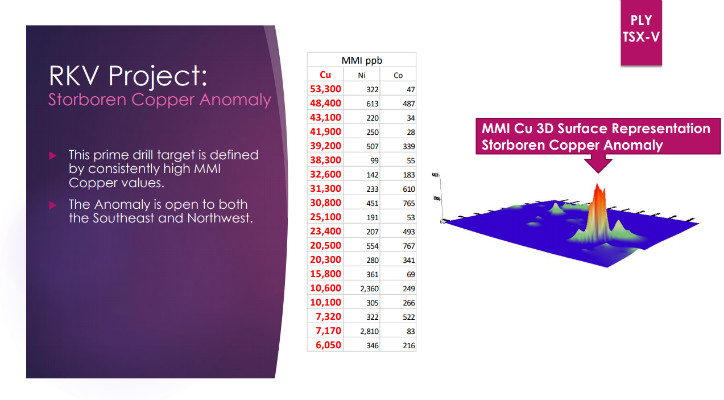

View Playfair Mining’s Corporate Presentation

In the coming days we plan to interview Mr. Donald Moore the CEO of Playfair Mining, to share a very compelling value proposition on their RKV | Storboren Copper Anomaly, located in the friendly mining jurisdiction of Norway. If you see what I see, then you may wish to have a head start on the Market and view the enclosed corporate presentation for Playfair Mining, because this is going to be exciting!

For further information contact:

Donald G. Moore

CEO and Director

Phone: 604-377-9220

Email: dmoore@wascomgt.com

D. Neil Briggs

Director

Phone: 604-562-2578

Email: nbriggs@wascomgt.com

Michael Hudson, Hannan’s CEO, states, “With our first mover advantage cemented and large tracts of ground secured under tenure and now granted, our field teams are now actively exploring multiple trends within 110 kilometres of combined strike for sedimentary-hosted copper-silver mineralization. We are excited to see what our second field season will discover from this newly identified, basin-scale high-grade copper-silver system. Mission critical for Hannan has always been social permitting, and we have been working hard to inform and engage all stakeholders.”

Hannan Metals Limited

Tel: +1 (604) 699 0202 | Email: info@hannanmetals.com

(TSX.V: SYH | OTCQB: SYHBF)

Skyharbour Resources is pleased to announce that its partner company Azincourt Energy Corp. (“Azincourt”) has commenced drilling at the 25,000+ hectare East Preston Uranium Project located 50 km southeast of Patterson Lake in the Western Athabasca Basin, northern Saskatchewan, Canada.

For more details on SHY contact:

Jordan Trimble | CEO

jtrimble@skyharbourltd.com |Telephone: 604-639-3856

Or:

Simon Dyakowski |Corporate Development and Communications

Telephone: 604-639-3850 | Email: info@skyharbourltd.com

CHAKANA COPPER

(TSX.V: PERU : OTC: CHKKF)

“We are pleased to welcome Mr. Wenzel to Chakana’s management team” said David Kelley, CEO of Chakana. “Xavier is bilingual in English and Spanish and with his expertise and experience in financial management, internal controls and corporate governance in various countries we anticipate he will be a great fit to work with our teams in both North America and Peru”.

Investor Relations

Email: info@chakanacopper.com

Website: www.chakanacopper.com

(TSX: NCU | OTC: NEVDF)

We are delighted to announce that Nevada Copper has engaged Tier One mining contractor, Redpath, to handle our ramp up to commercial production at Pumpkin Hollow – which continues to move forward. You will find the news release below. In addition, our lead independent director, Tom Albanese, was interviewed this week by Bloomberg TV. You can find the link to the interview here.

Matt Gili, Chief Executive Officer of Nevada Copper, stated “Nevada Copper made the transition to producer in Q4 2019 and we have developed a clear, straightforward strategy for ramping up our Pumpkin Hollow underground project to full commercial production. Redpath is considered throughout the mining industry as the partner of choice for production ramp up and we are excited to be working with them during this important period of growth.”

Rich Matthews

Phone: (604) 683-8266

Bob Moriarty the founder of the websites 321gold.com and 321energy.com sits down with Maurice Jackson of Proven and Probable to discuss geopolitics, bursting bubbles, and some unique buying opportunities for speculators. Hear from one the most highly regarded minds, as he shares his thoughts on the impeachment trial of President Trump, and the impacts that it may have domestically as well as globally.

We will then shift our focus on Bursting Financial Bubbles that may have a profound impact on the lives of millions of people. We will touch on student debt, The FED, the repo program, real estate, the DOW, and the S&P 500. Bob will also share a valuable insurance tool that very few people implement into their portfolio to offset and or mitigate their losses and has a proven history benefiting its owners from financially calamity.

Finally, Bob will share some unique buying opportunities in the junior mining sector that have his attention and present some very intriguing value propositions that are selling at a discount. This is another action packed interview with lots of insightful gems. Bob Moriarty has proven pedigree of success and is not afraid to share his thoughts candidly.

The Best Video on WHY and WHEN to Buy and Sell Physical Precious Metals:

Proven and Probable

Where we deliver Mining Insights & Bullion Sales. I’m a licensed broker for Miles Franklin Precious Metals Investments, The Only Online Dealer that is Licensed and Bonded (Period)! Where we provide unlimited options to expand your precious metals portfolio, from

Website| www.provenandprobable.com

Call me directly at 855.505.1900 or email: Maurice@MilesFranklin.com

Precious Metals FAQ – https://www.milesfranklin.com/faq-maurice/